What Trump's tariffs mean for India

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and videos on YouTube. You can also watch The Daily Brief in Hindi.

In today’s edition of The Daily Brief:

What Trump's tariffs mean for India

Paint Sector: shades of red, with a splash of green

What Trump's tariffs mean for India

Thus far, in this newsletter, we’ve looked at America’s new obsession with tariffs from various angles. We’ve given you our version of how these might play out, and what these mean for the global trading system, speaking broadly. But for us Indian investors, the most important question remains: what would an escalation of tariffs mean for India?

Trump’s threat to India is fairly simple: reciprocal tariffs. If there’s any country in the world that has higher tariffs than the United States, he intends to match them with his own tariffs. India is particularly vulnerable in such a tit-for-tat battle. And so, as Prime Minister Modi visits the United States, Trump’s threats will linger over everything they discuss.

So, what’s at stake? What are the options that India has? And if things don’t go our way, what scenarios should we be prepared for? That’s what we’re going to explore today.

India’s vulnerability to US tariffs

India is particularly vulnerable to American tariffs. We have always been in Trump’s cross-hairs. In his first term, he called India a “big abuser” of trade ties, and christened us the world’s “Tariff King”.

But if he had problems then, he’s probably going to be much less happy now — because India-US trade has evolved significantly in the four years since his first term as President. In the Biden years, India’s exports to the United States rose sharply. In fact, in FY 2023, America pushed past China to become the biggest export destination for Indian firms. Around 15% of everything India exports lands up in America.

In FY 2023, India exported ~$78.5 billion worth of goods to the United States, Meanwhile, our imports from America were far lower. In all, India currently enjoys a trade surplus of around $45 billion with the US. This is an obvious target if Trump seeks to "correct" this asymmetry in trade.

India has a long history with tariffs. As recently as 1991, one-third of Indian government revenues came from import duties. While we have left those days far behind, in many sectors, we still see hangovers from that era.

In fact, across the board, India places far higher tariffs on American goods than the other way around.

Among the world’s major economies, we arguably have one of the highest tariff rates in the world:

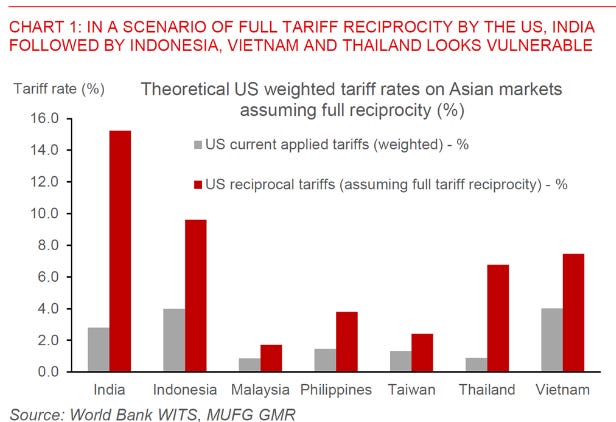

So, when Donald Trump threatens ‘reciprocal tariffs’ against countries that treat the United States unfairly, what he leaves unsaid — but you should know — is that India is one of the main countries he’s thinking of. If he goes ahead with them, the tariff hit India will take shall probably be far worse than our rival emerging economies, like Vietnam or Indonesia.

What makes us especially vulnerable is our asymmetrical trade relationship with the United States. If the U.S. decides to inflict economic pain on India, there’s little we can do to return the favor. While America accounts for nearly one-sixth of India’s exports, India is a minor player in the American economy, purchasing just ~2% of U.S. exports.

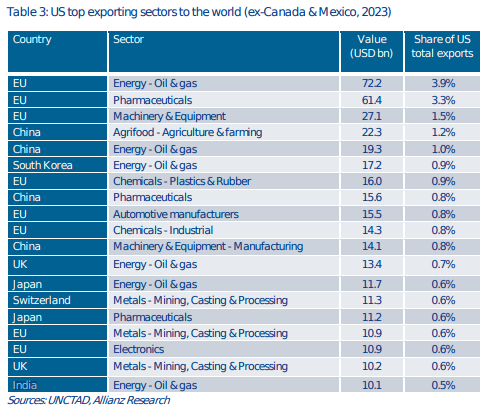

In case a trade war breaks out, we really only have one pressure point — we’re a big importer of American energy. We import ~$10 billion of American oil and gas per annum, which we can threaten to stop:

That just makes for 0.5% of American exports, however, and beyond this, there’s little we can do. This gives America a lot of leverage in any trade confrontation with India.

It’s important not to overstate America’s control over us either, however. While the United States can severely hurt our exports, overall, our economy isn’t very reliant on exports. This becomes clear if you consider other emerging markets: Vietnam, for instance, relies heavily on international trade — with exports adding up to almost 90% of its GDP. In contrast, India’s exports hover around 20% of our GDP, and most of our economic output comes from what Indians themselves consume. This held us back in the era of hyper-globalization, but if global trade breaks down, it might turn into a layer of insulation.

How India is trying to pre-empt tariffs

Trump’s threats have clearly left a mark on the Indian government. We have been trying to get on his good side as quickly as possible:

Pre-emptive Tariff Cuts: In the run-up to Prime Minister Modi’s US trip, India has itself been cutting down tariffs. For instance, in his last term, Trump decried Indian tariffs on heavy American motorcycles, like Harley Davidson. This time around, India slashed tariffs on such motorcycles before Trump even brought them up.

Increased U.S. Imports: India is signaling a willingness to buy more from the United States, particularly in sectors like energy and defence. For instance, Indian oil giants are currently in talks to import American liquefied natural gas (LNG).

Immigration Concessions: India is also playing along with America’s anti-immigration push. Recently, it cooperated with American attempts to deport Indian nationals, possibly as a goodwill gesture. (India did, however, protest the poor treatment they received.)

At the same time, India’s trying to find ways of diversifying its international trade — just in case things still fall apart. For instance, after dragging its feet on free trade agreements (or FTAs) for years, India has suddenly changed track. It’s now on a spree, aggressively negotiating small-scale FTAs with countries ranging from the UK to Oman. This could open up alternate markets in case our trade with America takes a hit.

The three possible scenarios

Ultimately, if things escalate, what’s at stake are ~$80 billion of Indian exports — that’s roughly ₹7 lakh crore. But there are three potential ways in which things could actually play out

The optimistic case: “Chaos is a ladder”, as the famous Littlefinger line goes. Donald Trump has always been enthusiastic about "striking deals." If India can manage that — negotiating exemptions from the worst of America’s tariffs — this could give India a relative advantage over other emerging markets. This could become very handy. If global supply chains are hit by Trump’s tariffs, particularly as he targets China, India could capitalize and grab onto some of them.

The base case: While an exemption from tariffs may be too optimistic, India could get by relatively unscathed if the tariffs imposed on us are in line with other emerging markets. The damage to Indian exports will stay manageable — and perhaps could be nullified if the Rupee is allowed to depreciate. India could simultaneously diversify its trade relationships to compensate for any losses in the U.S. market. In this case, India's economy remains largely stable, though some industries—particularly those reliant on the U.S. market—might struggle.

The pessimistic case: If Trump brings back his old rhetoric about India being the "tariff king," things could take a turn for the worse. A trade war with the U.S. would create massive uncertainty for Indian businesses. Companies reliant on the U.S. market would need to scramble for alternatives, either by shifting supply chains, restructuring operations, or abandoning American markets altogether.

It’s important to remember, however, that global trade is complex. These tariffs will have unpredictable second-order effects. For example, during the previous US-China trade war, Beijing responded by devaluing its currency. While this helped Chinese exporters cope with tariffs, it also flooded the Indian market with cheap Chinese goods, hurting domestic manufacturers. As more countries are dragged into the chaos, India should expect the unpredictable, once again.

The worst-case scenario:

While we hope that things remain relatively normal, in case the worst of these scenarios does play out, it’s worth asking where our biggest weaknesses lie.

India’s major exports to the United States include the following:

Precious Stones and Jewelry: India is a leading exporter of cut and polished diamonds and gold jewelry. In fact, in 2022, cut diamonds alone accounted for nearly $10 billion of India’s exports to the U.S..

Pharmaceuticals: The U.S. is the largest market for Indian generic drugs and medical formulations. The U.S. now buys almost one-third of India’s total pharma exports.

Petroleum Products: India exports refined petroleum (such as diesel, and gasoline) to the U.S., leveraging its large refining capacity.

Engineering and Machinery: Over the last few years, India has become increasingly entwined in American supply chains. As a result, engineering goods – including industrial machinery, automotive parts, and equipment – form a significant share of India’s US exports.

Textiles & Apparel: The U.S. is a major buyer of Indian garments, home textiles, and cotton yarn. Roughly one-third of India’s apparel exports go to the U.S., especially as Bangladesh has taken a back seat following its political troubles.

Here are the absolute numbers:

Will these sectors be hit the worst, in case tariffs rise? We’re not sure yet. There are many ways in which things can play out.

In relative terms, our biggest export sectors are the very sectors where our tariffs are low. If, in placing ‘reciprocal tariffs’, America simply matches India’s tariff rates, these sectors might not take too bad a hit.

On the other hand, if the United States really tries to amp up the pressure, it could specifically target these sectors with massive tariffs. This could lead to a lot of grief ahead.

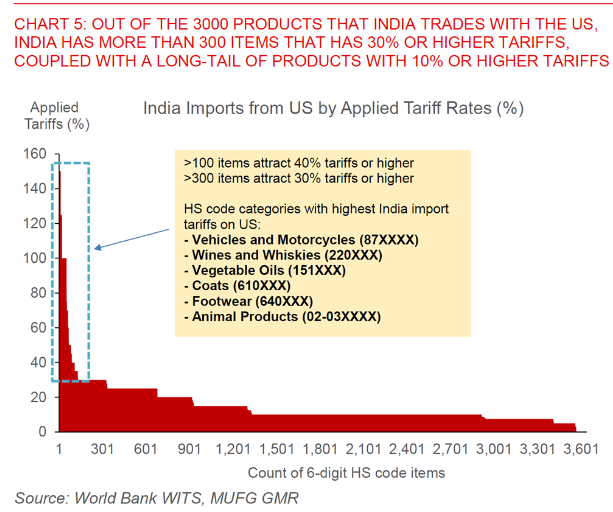

On the other hand, there are ~300 items where India has particularly high tariffs — of 30+%. These might soon come under major scrutiny, although their impact on our exports will be relatively muted:

Beyond goods, India is also a major services exporter to the United States. For instance, 60% of the revenue of Indian IT firms comes from North America. Traditionally, services like IT aren’t subject to tariffs. But if tensions escalate, America could bring all sorts of policies that can squeeze Indian services. For instance, given how dependent Indian IT companies are on US corporate clients, the United States could clamp down on the visas their employees get. Such measures would seriously jeopardize what these companies can offer their clients.

The Bottom Line

As Prime Minister Modi meets his US counterpart, a lot is at stake. India is walking a fine line. It’s trying to secure a “deal” with Trump while also preparing contingency plans if the worst plays out. What might happen next is anyone’s guess. If India can successfully negotiate concessions, we may emerge as a relative winner in Trump’s trade war. But if things take a turn for the worse, we could face economic disruptions that completely upend our export strategy. Either way, you should brace for volatility in key sectors as the India-US trade agenda unfolds.

Paint Sector: shades of red, with a splash of green

The quarterly results for India’s biggest paint companies are out.

While paints aren’t the biggest driver of our economy, they sit at an interesting intersection of multiple economic trends. Think about it: paints are linked to real estate and construction, and tell us how home demand is shaping up. They also depend on globally traded commodities like crude oil-based chemicals, bringing insights into input cost pressures and global trends. And re-painting one’s house is an entirely discretionary expense — which reflects how confident people feel about spending on things like home renovations. All of this makes the paint sector a great proxy for understanding broader economic shifts.

In this story, we’ll take a quick look at how each major paint company performed, looking at their revenue, margins, and growth trends. We’ll then turn to four big-picture takeaways from the latest paint sector earnings, and what they reveal about the economy.

Let’s begin.

How are individual companies doing?

Asian Paints.

Asian Paints had yet another bad quarter. It reported a 6% YoY revenue decline. This is its fourth consecutive drop in revenues. Volume growth was muted — at just 1.6%. Sale prices have also declined — the company’s value growth fell by 7.8%, year-on-year. Urban demand remains weak, and customers are switching to cheaper products, worsening value growth.

As costs grew, customers down-graded and discounts were ramped up, the company’s margins took a severe hit. Its EBITDA margin fell 344 basis points year-on-year, to 19.1% — even though raw material costs fell slightly, improving its gross margins from the last quarter.

While the company is generally trying to expand into home décor, it saw sales declines in key verticals in this segment. For instance, its revenue for the quarter from White Teak, its lighting studio, fell 23% compared to last year, while revenues from Weatherseal, its foray into windows, fell by 14%.

Over the last year, the meteoric rise of Birla Opus, a division of Grasim Industries, had shaken up the entire sector. Its impact continued to play out last quarter. Its entry has intensified competition, forcing higher marketing spends and impacting profitability.

Berger Paints.

While Berger Paints’ performance wasn’t dominant, it outperformed its peers in the sector. Their market share now exceeds 20%.

Berger Paints saw 7.4% YoY volume growth. Its value growth, however, lagged at just 0.4% — due to earlier price cuts (4-5%) and higher sales of lower-value products like texture paints and tile adhesives.

Grasim’s entry (~3.5% market share YTD) hasn’t significantly impacted Berger yet — with its premium and exterior focus helping mitigate risks. It expects double-digit volume growth in the current quarter, with the gap in growth of volumes and value narrowing, as price cuts fade. For this, it’s banking on more government spending on infrastructure and a recovery in urban demand.

Birla Opus.

Grasim’s Birla Opus paints division is scaling rapidly, capturing market share in an industry that is flat, or maybe has even declined slightly (-1%).

The company’s paint sales surged from ₹400-₹450 crore to ₹650-₹700 crore this quarter. The company has expanded into 5,500+ towns, and it has launched 1,000+ SKUs, targeting 50,000 dealers by the end of this financial year.

At the moment, this growth is expensive. The company saw an EBITDA loss of ₹320 crore in Q3FY25, improving slightly from ₹350 crore in the previous quarter. Its standalone net debt rose to ₹8,270 crore, because of its heavy capital expenditure. This is expected to peak by FY27 as the company becomes profitable and self-finances its future growth.

The company has backed this rapid expansion with marketing efforts like “Naye Zamane ka Naya Paint”, boosting brand visibility. In response, Asian Paints also increased their marketing budget.

Birla Opus is on track to become much, much bigger. Grasim is confident of hitting ₹10,000 crore in revenue for Paints by FY28. The company plans to spend ₹10,000 crore in capex, with six plants operational by FY26. 90% of this target has already been completed.

A new plant in Mahad will commence operations in the current quarter, while another in Kharagpur will begin trial production in the next quarter. All of this will make Grasim India’s second-largest decorative paint manufacturer by capacity, behind only Asian Paints.

What does the industry tell you about the wider economy?

Commodity costs and crude impact

Crude oil is a key raw material in paint production, making up 25-30% of the sector’s total raw material cost. So paint companies keep a close eye on crude prices.

Asian Paints mentioned that raw material prices have declined ~2% this quarter. However, this was nullified by the Rupee’s depreciation against the Dollar, which offset some cost benefits. Berger highlighted future volatility in crude prices as a concern, too, noting that it could lead to a minor contraction in margins.

Overall, despite some softening in crude and deflation in raw material prices, the industry was much too competitive for companies to meaningful hike prices — owing largely to the entry of Birla Opus. Over the last nine months, the only company to announce a price hike was Asian Paints — which managed a meagre ~1.6% increase. That’s quite low, given its historical dominance.

Consumption trends and demand slowdown

The paint industry’s struggles confirm a larger slowdown in people’s discretionary spending. Industry volumes dipped by ~1% in Q3, with festive demand remaining weak. Interestingly, rural markets performed better than urban ones, much like what we saw in FMCG and auto sales.

It’s clear that this isn’t just about paints — there’s a wider consumption slowdown through our economy, which has affected companies across the board. We’ve seen muted demand in a variety of industries — from apparel to electronics. However, the paints sector is seeing particularly tough days, as the emergence of Birla Opus has taken incumbents by storm.

A major concern for the industry is ‘downtrading’ — consumers who previously bought premium paints are now opting for mid-range or budget alternatives. For instance, while Berger reported 7.4% volume growth, its value growth was just 0.4% — indicating that lower-end products are driving sales. Margins, accordingly, are falling. Overall, this reflects growing consumer caution. While people aren’t cutting their spending entirely, they’re becoming more price-conscious, especially on discretionary purchases.

There’s one silver lining to this grey cloud, however: B2B and project sales are performing better than retail decorative sales. It seems like while people are cutting back, the demand from large construction projects remains stable.

Real estate cycle and the demand for new homes

While 75% of paint demand comes from repainting, the rest depends on new real estate activity. This is why the paints sector hints at wider trends in home construction.

Paint companies report steady demand from builders and government projects. Evidently, we’re seeing strong institutional activity. However, mass-market decorative paint sales are slowing, which suggests some weakness in the demand for affordable housing. We witnessed similar trends in the housing finance sector.

In contrast, there have been record housing sales in premium markets. This, however, isn’t reflected in the paints sector’s results. We aren’t sure why. Perhaps buyers are delaying interior work after making purchases, as painting isn’t an immediate priority.

Stable industrial sales

The paints industry has two key segments — decorative paints, which are used in homes, and industrial paints, which are used to coat automotives, machinery, and infrastructure.

We’ve looked at the muted growth in decorative paints over this story. But interestingly, companies like Akzo Nobel and Kansai Nerolac — who have a larger share in industrial paints — saw stable but mixed growth. Demand remained strong in infrastructure, power, and mining, while automotive coatings benefited from steady vehicle sales — a stark contrast to the slowdown in decorative paints. However, global weakness hit their exports, and commercial vehicle and tractor coatings saw selective slowdowns.

The wider picture that emerges, then, is that India’s manufacturing and infrastructure sectors remain resilient, backed by government-led capex, though uncertainties in foreign trade pose risks.

Tidbits

ONGC NTPC Green or ONGPL has signed a ₹19,500 crore or $2.3 billion deal to acquire Ayana Renewable Power, marking its first major acquisition since its formation in November 2024. Ayana, established in 2018, has a portfolio of 4.1 GW in operational and under-construction renewable energy assets. This acquisition aligns with ONGC’s and NTPC’s net-zero targets for 2038 and 2050, respectively.

India’s retail inflation dropped to 4.31% in January 2025, down from 5.22% in December, driven by a sharp decline in food inflation to 6.02% from 8.39%. Vegetable price inflation cooled to 11.35% YoY, a sharp fall from 26.60% in December. The RBI projects inflation to average 4.8% in FY25, with expectations of 4.2% next year, supporting prospects for further rate cuts after February’s easing. However, core inflation rose slightly to 3.7%, indicating sticky domestic demand. Risks remain from warmer March temperatures impacting wheat production and rupee depreciation to ₹87.95 per USD, which could push up import costs.

Ahmedabad-based Torrent Group has acquired a 67% stake in Gujarat Titans from CVC Capital Partners for ₹5,000 crore, valuing the IPL franchise at ₹7,453 crore. CVC will retain a 33% stake, while the deal awaits BCCI approval. This move aligns with IPL’s rising financial strength, evident from its ₹48,390 crore media rights deal for the period of 2023 to 2027.

- This edition of the newsletter was written by Pranav and Kashish

🌱Have you checked out One Thing We Learned?

It's a new side-project by our writing team, and even if we say so ourselves, it's fascinating in a weird but wonderful way. Every day, we chase a random fascination of ours and write about it. That's all. It's chaotic, it's unpolished - but it's honest.

So far, we've written about everything from India's state capacity to bathroom singing to protein, to Russian Gulags, to whether AI will kill us all. Check it out if you're looking for a fascinating new rabbit hole to go down!

Subscribe to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Thank you for reading. Do share this with your friends and make them as smart as you are 😉 Join the discussion on today’s edition here.

What abt software services? Does that come under tariffs? And what% is it of overall exports

If what U.S sells to India, constitutes only 2% of total U.S exports — in that case at an absolute level, US wouldn’t be too bothered about India would they?