Trump’s New Tariffs, Big Consequences!

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and videos on YouTube. You can also watch The Daily Brief in Hindi.

In today’s edition of The Daily Brief:

Trump’s wrecking ball to the world economy

This is one of the biggest things in the budget

Trump’s wrecking ball to the world economy

Throughout Donald Trump’s electoral campaign, one economic promise stood out over all others — tariffs. Two weeks into his presidency, he's already delivering on that promise.

Why does he want tariffs? His reasons aren’t obvious, but there are two possibilities: one, that he wants leverage, and two, he wants to correct past wrongs.

The first is straightforward. The American market, with its seemingly endless appetite for consumption, is a global cash cow for export-oriented economies. This, to Trump, is an enormous point of leverage. By threatening to cut off access to this market through tariffs, Trump believes he can force countries to bend to his will on all sorts of issues — ranging from trade balances to immigration and drug enforcement.

Beyond this, however, Trump perhaps believes that America’s trade deficits come from historical injustices. Many countries export more goods and services to America than it exports to them. There are many reasons behind this, of course — from simple economic laws to the Dollar’s status as the world’s reserve currency. In Trump’s worldview, however, other countries duped America while it quietly stood by, and he’s out to reverse this imbalance.

Either way, Trump came in with a track record for tariffs — after all, in his first term, he famously launched a trade war against China. Even so, given how deeply the United States economy was linked to the rest of the world, people weren’t quite sure of how far he could go.

We didn’t have to wait long to find out. He’s already fired the first shots in his new trade wars:

He placed 25% tariffs on imports from Mexico and Canada (with smaller tariffs of 10% on Canadian energy imports). In theory, these are meant to pressure them into keeping illegal immigrants and drugs like Fentanyl from entering the United States.

In addition, he also placed an extra 10% tariff on all imports from China. Through his campaign, he’d promised tariffs as high as 60%, so these might go up further.

These tariffs are on top of all the other tariffs that were already in place.

Trump has also bandied the threat of tariffs in smaller, isolated cases. When Colombia refused to accept deportees from the United States, for instance, he threatened massive tariffs and visa sanctions. Colombia folded within an hour.

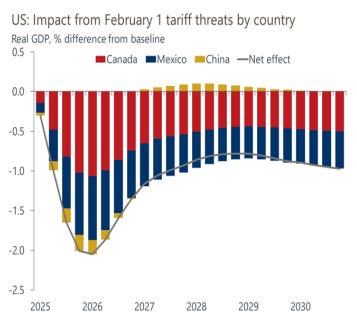

Cumulatively, these new tariffs cover 43% of the United States’ imports — or approximately $1.3 trillion worth of goods. That’s unprecedented. According to Deutsche Bank, the average increase in American tariffs over the last few days is five times as much as the total increase in his first term. And this is only the beginning. He’s also threatened tariffs against the EU and BRICS nations — including India.

Though Trump telegraphed these measures well before he became the President, people initially thought it was all bluster. They were wrong. Many were caught off-guard by how quickly he went for tariffs, and how aggressive they are.

The markets responded violently. There was a global sell-off across the board, with sharp moves across equities and currencies. Although the Dollar grew stronger (paradoxically hurting Trump’s ambitions), American index futures fell:

Now that these tariffs are in play, however, how should one assess them? What might their impact be? While this is enormously complicated, here are five facets we’re interested in:

One, what are the immediate effects on American consumers?

Tariffs cause inflation. According to Morgan Stanley, you should expect the tariffs to cause an inflationary spike of 2.9%-3.2% in the United States, potentially reducing its growth by as much as 1%.

The full impact, however, depends on complex market dynamics. A tariff functions quite like a tax. It’s an additional sum that consumers must pay on imports – much like the GST you might pay on a packet of biscuits. But its impact on prices can be complicated. When a tariff hits a product, three main scenarios can unfold:

One, alternative suppliers from non-tariffed countries step in. The United States keeps importing that product but from elsewhere. While the old exporters have to cut costs to survive, all in all, America continues to run a deficit.

Two, American companies that sell or use imported products pay more for imports but don’t have the leeway to increase prices. In this case, American importers absorb the costs of a tariff by reducing their margins.

Three, there are no cost-effective alternatives available, and pricing power remains in the hands of exporters. Consumers bear the full burden of the tariffs.

Of course, in reality, it won’t just be one of these three. Instead, you’re likely to see some combination of the three outcomes in every industry. The result will be mixed — some things will go up in price, some won’t, and the demand for some goods might fall.

Two, how will forex markets digest this news?

Tariffs aren’t the only thing that determines the price of an import. The exchange rate is equally important, and there are many ways it can play out.

For instance, investors, anticipating these tariffs, may start putting their money in the United States. This might push the US Dollar up in value. In fact, we’re already seeing this play out — the Mexican Peso and the Canadian Dollar have both fallen dramatically against the United States ever since Trump announced the tariffs:

A change in forex rates can mitigate the effect of a tariff. If the currency of an exporting country falls against the Dollar, you’ll have to pay exporters fewer Dollars for each product. While tariffs will artificially inflate the rate of these products, forex rates will pull them down. All in all, in such a case, they’ll blunt some of the effects that tariffs might have on these countries.

At the same time, countries that rely heavily on imports, such as India, might try to defend their currencies from such a fall. In order to do so, these countries — often emerging market economies — might sell off their forex reserves. This could push down the price of US Dollar assets.

These things will happen simultaneously, creating a complicated push-pull dynamic around the Dollar. Where it goes is anyone’s guess, but you should expect greater volatility going ahead.

Three, how will other countries react?

The world outside America, of course, won’t quietly sit by for America to do as it pleases. They’ll react to the tariffs, in ways that may well be inconvenient.

In all, there are three main options that any country has when faced with tariffs:

One, as Trump no doubt hopes, they might appease America and "strike a deal".

Two, they might morph supply chains to circumvent sanctions. To get around the sanctions Trump placed in his first term, for instance, China routed many goods through countries like Vietnam. This can push America into a game of whack-a-mole, constantly plugging one loophole after another.

Three, in a worst-case scenario, they fight back.

America exports goods as well, and its exporters are at the mercy of other countries. When America threatens exports from those countries, they might push back by hurting American exports. This locks the world in a “trade war” — one run on the principle of an eye for an eye. Instead of trying to improve the lives of their people, countries get wrapped in a competition to cause economic pain to each other.

Canada has already chosen the third path. It announced immediate 25% tariffs on CAD 30 billion worth of American imports, with plans to expand to another CAD 125 billion after a 21-day adjustment period. Individual provinces are taking additional measures. British Columbia, for instance, is specifically targeting Trump voters, banning alcohol imports from "Red states".

While Mexico and China have been more restrained so far, they’re also thinking of counter-measures.

Of course, there’s no guarantee that things stop here. Trump’s tariff order already says that the United States will ramp its tariffs up in the case of a retaliation. You might soon see countries go tit-for-tat, locked in a race to the bottom as tariffs spiral out of control. This will help nobody while causing pain for businesses across the world.

By some estimates, if this were to play out, global GDP might fall by up to 2%. The worst impact will be felt by countries relying heavily on imports.

Four, can the United States re-shore manufacturing?

One of Trump's key objectives in this trade war is to bring manufacturing jobs back to the United States. Unfortunately for him, the feasibility of this goal is complex and multifaceted.

First, international trade works in weird, counter-intuitive ways. For instance, there's something called Lerner's Symmetry Theorem — which holds that a country's imports are often directly proportional to its exports. The reasons for this are subtle and complex — and entirely beyond our scope today — but there’s enough international economic evidence for this case. The trade war may, in cutting imports, inadvertently hurt American export-oriented industries as well.

Second, these tariffs disrupt existing American supply chains and can hurt American manufacturing. U.S. refineries, for instance, are specifically designed to process the thick, viscous Canadian crude oil. They can't easily switch to American alternatives. Only, Canadian crude oil has just been hit by tariffs, making life harder for these refineries.

Expect similar disruption across industries like automobiles, pharmaceuticals, and agriculture — all of which currently have complex, multinational supply chains.

Third, whether America wants to return to routine manufacturing jobs is an open question. There are two perspectives on this. There’s a possibility that American manufacturing declined because of its addiction to free trade policies. In that case, reversing those policies will, over time, bring back manufacturing jobs.

But there’s also another possibility — that America’s economy may simply have evolved beyond factory jobs. Manufacturing traditionally thrives in countries with large pools of low-wage workers willing to do repetitive work. This description may no longer fit the American workforce.

If that’s the case — if Americans genuinely don't want manufacturing jobs, Trump’s plank might fail. If anything, we might instead see accelerated automation in the manufacturing sector.

Five, what does this mean for American soft power?

Perhaps the most significant impact of these tariffs lies in how they affect the world’s perception of America. While America is no stranger to foreign policy misadventures, its historical adherence to a ‘rules-based economic order’ has been a cornerstone of its global influence. There’s a general sense of trust, across the world, that America stands by its treaty commitments — making countries more willing to enter into arrangements with the United States.

This is an under-appreciated source of power for America. For instance, during the Asian Financial Crisis, many countries accepted the United States’ leadership in crafting IMF responses, because it was perceived as being a principled player that followed international rules and procedures. Such trust is deeply important to America’s global leadership, and its ability to dictate global rules of engagement.

This trust may, however, be eroding. Trump’s new tariffs, for instance, violate his own signature US-Mexico-Canada Agreement (or ‘USMCA’). The implication is clear — you can no longer trust what America says. As trade relationships fundamentally rely on trust, such an erosion of confidence could have far-reaching implications — not just for America, but for global commerce as a whole.

This is one of the biggest things in the budget

In the recent budget announcement, India took a big step toward opening up its nuclear power sector. The government plans to amend two key laws—the Atomic Energy Act of 1962 and the Civil Liability for Nuclear Damage Act (CLNDA) of 2010. These changes will allow private companies and foreign investors to take part in the nuclear power industry, which has been strictly controlled by the government for over 60 years.

Finance Minister Nirmala Sitharaman, in her budget speech, highlighted that this move is crucial for India's long-term energy plans, especially its goal to generate 100 gigawatts (GW) of nuclear power by 2047. To support this, the government will launch a Nuclear Energy Mission with an initial budget of ₹20,000 crore ($2.31 billion). The funds will be used to build new reactors, including Small Modular Reactors (SMRs).

This announcement might seem like just another policy change, but it’s actually a huge deal. Let’s take a step back to understand why this matters and why we should be paying close attention.

The Road to 2006

To see why this is so important, we need to go back to the Cold War era when global powers tightly controlled nuclear technology and weapons. In 1968, the Nuclear Non-Proliferation Treaty (NPT) was signed by the United States, Russia (then the Soviet Union), China, France, and the United Kingdom. These five countries were officially recognized as nuclear powers, while other nations were expected to give up nuclear weapons in exchange for access to peaceful nuclear technology.

India, however, refused to sign the NPT, seeing it as unfair. The treaty allowed only a few countries to have nuclear weapons while restricting others. India faced real security threats—China tested its first nuclear weapon in 1964, and Pakistan became a nuclear power in the 1990s. Determined to stay independent, India developed its own nuclear program and conducted its first nuclear test in Pokhran in 1974. This led to global sanctions. Things got even worse after the Pokhran-II tests in 1998, when US President Bill Clinton imposed strict sanctions, cutting off economic and military aid, freezing loans, and banning exports of American aerospace technology and uranium.

But by the early 2000s, the global political landscape started changing. The US began to see India as a key player in countering China's growing influence in Asia. This shift led to the landmark India-US Civil Nuclear Agreement in 2008. The deal was historic—despite India not signing the NPT, the US and other countries agreed to lift restrictions on nuclear trade. In return, India agreed to separate its civilian and military nuclear programs and allow the International Atomic Energy Agency (IAEA) to inspect its civilian reactors. This was a major diplomatic win, strengthening US-India relations and giving India access to the global nuclear market.

The 2006 deal sparked excitement in the nuclear industry. Major companies like Areva (France), Westinghouse (US), and Hitachi (Japan) showed interest in building large-scale reactors in India. For India, these partnerships were essential. We didn’t have enough high-quality uranium reserves, so working with international players was crucial for securing fuel and advanced reactor technology. Several big projects were planned, including six reactors in Jaitapur (Maharashtra) with Areva and reactors in Andhra Pradesh with Westinghouse.

It looked like India's nuclear future was finally taking off.

Just when it seemed like India’s nuclear ambitions were about to take off, the Civil Liability for Nuclear Damage Act (CLNDA) of 2010 brought everything to a halt.

Indian lawmakers introduced a liability law that held all parties—including suppliers of nuclear technology and materials—responsible for damages in case of an accident. The most controversial part of the law was Clause 17(b), which allowed NPCIL, the state-owned nuclear operator, to sue suppliers for compensation if their equipment was found to have caused an accident.

This was unusual. Around the world, nuclear liability is placed only on the operator, not the supplier. Suppliers provide technology, equipment, and fuel but don’t control daily operations or safety measures. Accidents—like those at Chernobyl or Fukushima—often result from a mix of system failures and human error, not just faulty parts. Because of this, major nuclear companies like Areva and Westinghouse refused to take on projects in India. They feared that Indian courts could hold them responsible for billions in damages, making the risk too high.

The law faced strong criticism. Experts argued that it went against international agreements, like the Convention on Supplementary Compensation for Nuclear Damage (CSC), which India had signed. The government tried to ease concerns in 2015 by issuing clarifications, stating that suppliers would only have limited liability. But these statements weren’t legally binding and didn’t do much to attract foreign investors. As a result, India’s nuclear sector stayed stagnant for over a decade.

The Slowdown (2010-2025)

Between 2010 and 2025, India struggled to expand its nuclear capacity. Projects with Areva, Westinghouse, and Hitachi faced delays or were canceled. Even domestic companies like Larsen & Toubro (L&T) and Walchandnagar Industries, which had supplied equipment for earlier reactors, pulled back due to liability concerns. India's nuclear energy output remained stuck at around 8 GW, far below what was needed to meet rising energy demands and climate goals.

A Fresh Start: The New Budget

The recent budget aims to change this story. By amending both the Atomic Energy Act and the Civil Liability Act, the government wants to clear the roadblocks holding back private and foreign investment.

For the first time in India’s history, private companies will be allowed to build and operate nuclear reactors. The focus will also be on Small Modular Reactors (SMRs), which are cheaper, safer, and faster to build than large reactors. The government plans to have at least five SMRs up and running by 2033.

This move is important not just for India's energy needs but also for its climate goals. Nuclear power can provide steady, low-carbon electricity, working alongside solar and wind energy. Experts say that reaching 100 GW of nuclear capacity by 2047 is a big challenge, but it's possible—if these changes are put into action the right way.

Tidbits

Nearly five years after being banned over data security concerns, Shein is making a comeback in India. Reliance Retail has reintroduced the fashion brand through a new standalone app, setting it apart from brands like Superdry and Gap, which are integrated into Reliance’s Ajio platform. This move highlights Shein’s strong growth potential in the Indian market.

The Indian government has approved ₹5,597 crore for Phase II of the Indian Strategic Petroleum Reserves Ltd (ISPRL) project. This phase includes building a new 4-million-metric-ton (mmt) reserve in Chandikhol and expanding the existing Padur reserve by 2.5 mmt. India currently holds 5.33 mmt of crude reserves across Visakhapatnam (1.33 mmt), Mangalore (1.5 mmt), and Padur (2.5 mmt), covering about 9.5 days of the country’s oil demand. The expansion aims to enhance India’s energy security.

The US has imposed steep tariffs—25% on imports from Canada and Mexico and 10% on Chinese goods. In response, Canada has slapped 25% tariffs on $106 billion worth of US imports, while Mexico and China have announced countermeasures. China has also escalated the dispute by filing a complaint at the WTO.

- This edition of the newsletter was written by Pranav and Krishna

🌱One thing we learned today

Every day, each team member shares something they've learned, not limited to finance. It's our way of trying to be a little less dumb every day. Check it out here

This website won't have a newsletter. However, if you want to be notified about new posts, you can subscribe to the site's RSS feed and read it on apps like Feedly. Even the Substack app supports external RSS feeds and you can read One Thing We Learned Today along with all your other newsletters.

Subscribe to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Thank you for reading. Do share this with your friends and make them as smart as you are 😉 Join the discussion on today’s edition here.