What’s Powering the Cement Boom?

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and watch the videos on YouTube. You can also watch The Daily Brief in Hindi.

In today’s edition of The Daily Brief:

Cement sees a resilient quarter

India’s quiet commodities windfall: and why it might not last

Cement sees a resilient quarter

The results of the 2 biggest players in the cement sector in India are out: Ultratech and Adani Cement.

Now, cement may just look like a dull grey powder. But in India, it is one of the surest pulse-checks on growth: every kilometre of highway, every metro viaduct, every apartment tower and warehouse drinks it by the truck-load.

As always, we’ll do a complete run-down of their results. But, before that, let’s give you a picture of the entire sector, based on what we hear from the management of the two companies.

UltraTech’s management came out with a nice run-down of the construction work happening across the country. They pointed to strong activity in states like Andhra Pradesh and Bihar, where road-building and infrastructure spending are picking up. At the same time, they acknowledged a temporary slowdown in urban real estate. In their words:

With infrastructure growth already sluggish and the heat setting in, the company flagged a seasonal lull kicking in, as construction activity slows:

That’s one of the many under-appreciated ways in which climatic conditions can impact the fates of businesses. Heat waves can literally stop construction in its tracks — workers can’t pour concrete or work outdoors safely in extreme temperatures, so projects pause.

Meanwhile, Ambuja Cement’s management is quite bullish:

All in all, both companies are optimistic about the future. They see demand holding up — and possibly accelerating — at least once we get past this scorching summer and head into cooler, building-friendly months.

With that, let’s look at how the companies individually fared.

Ultratech Cement

UltraTech, owned by the Aditya Birla Group, is leading the expansion of India’s cement industry. After buying India Cements and Kesoram, it can now churn out 184 million tonnes of cement a year. In fact, over the last year, 57% of India’s new cement capacity was added by Ultratech alone.

In the March quarter, the company shipped 41 million tonnes of cement — a 17% increase from last year.

And the company’s seeing robust growth at the moment. That’s not just because of its acquisition activity, by the way. Even if you exclude its newly acquired plants, its core business still grew 10%. That’s a lot more cement – not just because of its new factories, but because of stronger demand. The company’s revenue rose to ₹22,788 crore, up 14% year-on-year.

And this growth in volumes translates directly into higher earnings. The company’s EBITDA, i.e. the operating cash profit it makes before you factor in costs like taxes and loan payments, came to ₹4,721 crore. That is up 11% from last year.

Ultratech even managed to pull India Cements into the black. From losses in the March quarter last year, India Cements became profitable at an operating level this March.

Behind Ultratech’s healthy quarter was a broad-based improvement in how it handled their expenses, ensuring that they spent less for every bag of cement they made. How did they manage it? Let’s break it down.

Fuel savings

You see, cement is made by heating limestone and other minerals in a massive oven called a kiln. A kiln needs to hit about 1,450°C — hot enough to melt steel. Naturally, keeping that kiln blazing takes a lot of fuel. For this, UltraTech buys a fuel called petroleum coke (pet-coke), a coal-like byproduct from oil refining.

This quarter, pet-coke cost them $122 a tonne — 20% cheaper than last year. That made it much cheaper to run their plants.

But there’s more. They also relied more heavily on ‘captive coal’ i.e. coal from their own mines or contracts. By blending in more alternative fuels—like waste plastic—along with sourcing more coal from their own mines, they pushed fuel costs down even further. Essentially, the amount they spent per unit of heat came down, with this push.

In simple terms: UltraTech’s kilns are consuming cheaper fuel this year, and that is money saved for every ton of cement they produce.

Power savings

Now a cement plant doesn’t just need heat; it also hogs electricity. The machines that crush rocks, spin kilns, and run conveyors use mountains of electricity. Buying that power from the grid is expensive.

So UltraTech began creating its own electricity. It built its own ‘waste-heat recovery plants’: mini power plants that capture the hot air leaving the kilns and turn it into electricity. They also relied more heavily on captive solar and wind farms. Today, around a third of UltraTech’s electricity comes from these home-grown sources.

Why does that matter? Because self-made power is cheaper than buying from the grid. Thanks to this, UltraTech’s electricity bill fell 10% compared to last year.

Freight savings

After cement is made, it still has to travel hundreds of kilometres to customers. Cement is both heavy, and cheap on a per-kilo basis — so it costs a lot to move it, and your margins are so fine that you can’t move it too far before it becomes uneconomical. That’s why cement companies try to put factories close to demand hubs or optimize delivery routes.

This is a problem UltraTech is trying to solve. It improved its freight network and logistics efficiency. The average trip distances it shipments had to make came down to 384 km, from 400 km last year. That brought down the company’s diesel requirements considerably.

Why does this matter? Freight can account for 25-30% of a cement company’s production and distribution cost. That’s a huge chunk, and makes every saved kilometre count. Even a small saving in kilometres makes a big dent in costs.

The bottom line

Put it all together, and UltraTech is now running its operations more cheaply: it’s spending less on the fuel to fire kilns up, less on the power to keep its factories running, and less on the trucks to haul their output. That’s how they managed to keep ₹1,270 of cash profit per tonne—and that’s why their EBITDA looks strong.

Adani Cement

When the Adani Group bought Ambuja and ACC just three years ago, in 2022, the pair had 66 million tonnes of capacity. Fast forward to today: with new acquisitions (Sanghi, Penna, Orient) and various expansions, they’ve grown to over 100 million tonnes. In other words, in less than half a decade, they’ve become a player to reckon with.

In the March quarter, they shipped 18.7 million tonnes of cement — up 13% year-on-year. As volumes went up, their revenue, too, rose to ₹9,889 crore, up 11%. Its EBITDA followed, reaching ₹1,868 crore — up 10% year-on-year.

But because costs went up — including higher spending on branding, consultancy, and purchased clinker — the EBITDA margin slipped slightly to 18.9% from 19.1% a year ago.

But there was a surprise. The company’s PAT actually fell by 16% — to ₹1,282 crore. Somehow, the company became less profitable, despite doing good business. But why?

They scrapped some 40-year-old kilns at Barchasa, booking a ₹200-crore impairment charge. This is like writing off old equipment that’s no longer useful — a one-time expense on its books, but one that doesn’t point to any deterioration in its business fundamentals.

In the same quarter last year, the company received a ₹826-crore government subsidy, which boosted its income artificially. There’s no such subsidy this time, so the comparison looks weaker.

If you remove these quirks, though, their core business is actually improving. Just like UltraTech, Ambuja has been working on costs:

Its fuel cost fell 14%. Like Ultratech, that’s thanks to more captive coal, and cheaper pet-coke sourced via Adani’s trading network.

Its freight cost eased 2%. For Adani Cements too, average trip lengths were 15 km shorter than last year. In fact, more than half of their trucks now deliver directly from plant to dealer — instead of idling time at depots in between — which saves them both time and diesel.

Green power now covers 26% of its electricity needs, thanks to a new 300-megawatt captive wind-solar park. They plan to double down on this. Their target is to hit 60% green power by FY28.

But Adani Cement has another ace up its sleeve. Not only is it trying to push costs down, it’s also trying to boost its earnings per bad. The company is trying to capture more premium, higher-margin segments. Premium cement brands now make up 29% of its retail sales, up from 24% last year. These specialty cements fetch ₹200-300 extra per bag, lifting its margins, and helping it become more profitable.

A cleaner balance sheet

Unlike UltraTech, Ambuja has no net debt. In fact, it’s sitting on ₹10,125 crore of cash. That money will fund their expansion to 118 million tonnes by FY26, and 140 million tonnes by FY28 — all without needing any new debt. In essence, a rapidly growing enterprise has ambitions of scaling even faster.

At the same time, its past growth hasn’t come easy — especially given how much of it has been inorganic. The company has acquired a series of smaller cement players over the years. Integrating all these acquisitions isn’t simple. Each company comes with its own IT systems, factory processes, different raw materials. Merging them all together takes time and effort.

Management says the early synergies in all its acquisitions are “encouraging”. But as investors, it’s worth watching closely to see if costs keep falling in future quarters.

A harder fought future

Zooming out, there are two things to keep in mind, if you’re looking at the cement industry.

One, both UltraTech and Adani Cement are aggressively expanding capacity — which means that India will soon have the ability to supply a lot more cement.

Two, the industry’s concentration is tightening. Its top five cement players together control more than 50% of the market.

Will there be enough space for all these players to thrive? That depends on how fast demand grows — and how far players are willing to go to protect their turf. If we see a construction boom that absorbs all this excess supply, all these players will have enough space to co-exist. But that boom isn’t guaranteed. With excess capacity looming and market power consolidating, the next phase of India’s cement story may just be shaped by an era of cutthroat rivalry.

India’s quiet commodities windfall: and why it might not last

Over the last few years, we’ve all been learning to adjust to a world that’s grown used to volatility — from war and weather, to trade wars and tariff tantrums. With so much confusion all around, the World Bank’s Commodity Markets Outlook for April 2025 almost feels soothing.

Here’s the headline takeaway: global commodity prices are, at long last, expected to fall. After years of wild swings — crude oil crashing to $20 and then soar to nearly $100, cocoa prices spiking well beyond recognition, and base metals yo-yo-ing like stocks — the World Bank forecasts a 12% drop in global commodity prices this year, followed by another 5% decline in 2026.

Don’t mistake this for a return to stability, though. It’s a mirage. Behind those declining averages lies a commodity world that’s growing more erratic. And India, with its vast appetite for imports, its outsized role in global rice and steel markets, and its rapidly shifting energy ambitions, will be hit from all sides. What we’re seeing is a broad-based global movement. The pulse of global commodity cycles is changing, as power and pressure points re-align.

Let’s dive in.

A shorter cycle, with a sharper edge

Before we get to the specifics, let’s pause on the World Bank report’s most important meta-observation: one that should shape how you see everything else it says: the commodity cycle itself has changed.

See, commodities markets move in cycles. There are always periods of heightened demand, followed by times where demand slumps. The time period over which these cycles play out, though, is changing.

For decades, world commodity markets swung in long arcs. A full boom-to-bust cycle used to take nearly eight years. But now? It’s dropped to less than four. According to the Bank’s data, since 2020, price cycles have halved in duration. Booms now rise faster, while we recover from busts more slowly.

As a result, we’re increasingly caught in a state of constant economic whiplash. Entities of all sorts — from farmers, to refineries, to governments — have less information to base their decisions on. An expense or investment that makes sense based on today’s prices could fall apart tomorrow, as one finds themselves in a completely different world by the time that decision actually bears fruit.

Why is there so much uncertainty now?

This shortening of cycles is partly structural. In the post-COVID world, we’re seeing many overlapping shocks converge. We’ve essentially hit some sort of polycrisis, where we’re facing climate disasters, wars, pandemic aftershocks, the green transition, and an uptick in protectionism — all at the same time. All these factors have their own impact on commodities markets. As a result, even as the world exits its latest price peaks, possibly because of a fall in overall demand, the volatility hasn’t eased. Unexpected events are simply too frequent.

This is something to keep in mind, as we get a breather in the prices of what we import. We aren’t entering a ‘new normal’ of lower prices. This is a narrow, fast-closing window, which we should use to prepare for the next turn.

With that, lets turn to individual commodities

The price of oil falls

We start with oil.

Brent crude is forecast to average $64 per barrel this year, a substantial fall from around $81 in 2024. At its heart, this stems from a global oil surplus. The world’s supply of crude oil is expected to grow by 1.2 mb/d. Oil consumption, meanwhile, will probably not keep pace. Demand is expected to rise only 0.7 mb/d — or half the average rate from 2015–19. We’ve talked about this before.

This weak demand reflects two trends: one, that the world’s economic growth is slowing, and two, that the world is moving towards electric vehicles.

For us in India, this is a relief. India imports over 80% of the crude it consumes. As a broad thumb-rule, every $10 drop in oil prices saves us roughly 0.3% of our GDP, in import costs. In total, if we keep buying oil at current volumes, this slide in prices could add up to a haircut of nearly ₹2 trillion from our import bill.

But things might not look rosy forever. There are severe geopolitical tensions, especially in the Middle East, which might suddenly hurt oil and gas supplies. If that happens, Brent could quickly bounce back toward $80. On the other hand, if the world economy settles into a lower rhythm, prices could even fall further.

India bucks the trend on coal

Coal prices are slated to fall in the coming years. The world bank estimates that the price of Australian coal will fall by 27% in 2025, followed by another 5% drop in 2026.

India is in a unique position here. We’re the world’s biggest beneficiary of this decline. All over the world, the demand for coal is either declining or stagnant. China, for instance, is expected to cut down on how much coal it uses this year. India, though, is the world’s largest source of demand. According to the World Bank, India alone will account for the entire net increase in global coal consumption between now and 2026.

The reason for this is straightforward. Our electricity demand is booming, and though we’re building out renewable sources of power, we can’t do so quickly enough.

This is, however, a temporary reprieve. Over the long term, the world is producing less coal as well — a trend that will probably continue into the future. And if we don’t unwind our dependence on coal soon, our import bills will soon start picking up.

The strange trends in your grocery basket

When it comes to food, price trends are a mass of contradictions, all of which directly hit your plate.

First, the good news: global prices for staples are declining. Rice, wheat, and maize all recently saw great harvests. India’s own easing of rice export restrictions has added to the global availability of food.

Meanwhile, the price of edible oils, which form a big chunk of India’s food imports, is falling sharply. It’s projected to drop between 6% and 17% this year. Given that we import more than half our oil needs, that’s fantastic news.

Fertiliser prices have risen 10% over the past year — largely because China clamped down on phosphate exports. Since much of the world’s fertilisers comes from heavily sanctioned countries like Russia and Belarus, the market is horribly complex, with all kinds of sanctions and barriers distorting supply. All in all, though, supply had kept pace with demand, ensuring a degree of stability.

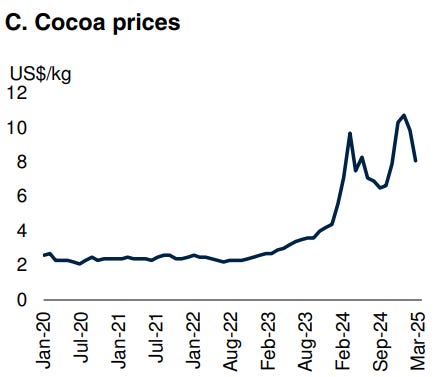

But not everything is easing. Beverages, in particular, are racing in the other direction. The overall beverage price sub-index is set to rise 19% in 2025: as coffee and chocolate shoot up in price. A combination of poor West African harvests, hot weather in Brazil, and fungal disease has caused a global shortfall for both products. Cocoa prices have risen nearly 70% year-on-year. Coffee — especially arabica — has risen more than 50% in price.

This will probably continue. The World Bank projects its beverages sub-index to rise nearly 20% this year, even as overall food prices stay flat.

Over the long term, food prices are a function of overall climatic conditions. An episode of extreme weather could suddenly slash agricultural output. Everything from poor monsoons, to droughts, to untimely rains could disrupt rice or oilseed production. If that happens, price spikes will follow.

Metals face downward pressure, with some surprises

A big reason for the fall in global commodity prices is a steady slide in the price of industrial metals. The World Bank expects copper, aluminum, lead, and nickel to all trend lower this year, pulling the overall metals index down by 10%. Next year will probably see a further 3% slide.

With China’s property sector collapsing, iron ore prices, too, are expected to fall by 13% in 2025.

Nickel is particularly interesting. Despite being a darling of the energy transition narrative, it has fallen 35% in the past two years and is forecast to fall another 6% this year. The culprit? Indonesia has suddenly flooded the market with supply. Chinese-backed smelters are expanding rapidly in the country, and global nickel markets are now awash with material. While cheaper nickel helps lower input costs for green industries, like EV manufacturing, this sudden concentration is a risk of its own. Indonesia now controls over 60% of global nickel output, and has started using quotas and levies to stabilise prices.

The EV manufacturing boom of the last few years has hit the prices of metals in all sorts of ways. Critical minerals like lithium and copper, for instance, are seeing sustained demand. If this is combined with trade barriers, prices could suddenly climb up. On the other hand, other metals are losing relevance. The demand for lead, for instance, is fading. Two-thirds of its demand previously came from internal combustion engine batteries. As EV penetration rises, however, lead prices are set to decline gently year after year. This is the flip side of the clean energy story: as new metals become strategic, old ones fade into irrelevance.

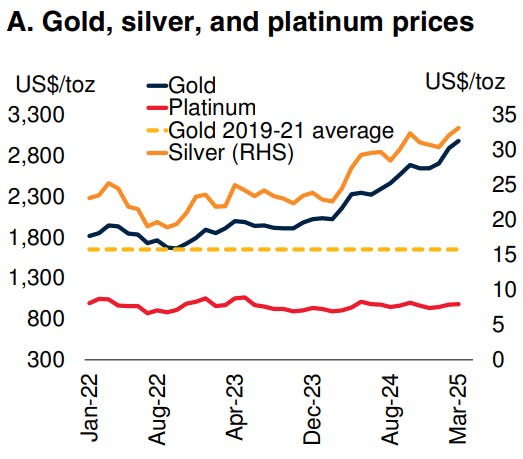

Precious metals buck the broader trend of falling prices. Gold, as you probably already know, has slammed through several all-time highs. As long as global uncertainty sticks around, its prices will probably only rise.

Trade walls

The report spends a lot of time on something that isn’t about prices at all: the growing fragmentation of global trade.

Over the past three years, commodity-specific trade restrictions have risen to more than ten times their pre-COVID average. Governments are increasingly willing to ban, hoard, or tax their commodity exports in response to domestic pressures. This can distort prices. Not only can it affect global price movements, such barriers decouple regional prices from those in the rest of the world. For instance, if China places tariffs on American soybeans, American prices may decline, while alternate suppliers raise prices.

The economics of these distortions is complex. More than anything, it creates severe volatility as different actors react to these price differentials, making it much harder to plan ahead.

Things could get far worse if the world’s economic growth falls. The Bank’s stress test finds that if the world were to see negative per capita GDP growth — a mild global recession, essentially — commodity prices would plummet, falling by 25% in less than nine months. That could crater export revenues for developing countries like India, although import costs will fall as well.

A forecast on edge

In all, the Commodity Markets Outlook paints the picture of a cooling market. But this isn’t a moment to get comfortable. This forecast teeters on a knife’s edge. Shorter cycles, now completing in 45 months, mean price swings are more frequent. Trade restrictions, tenfold higher than pre-COVID, distort markets. Climate and geopolitical risks threaten supply.

At the moment, India is in a good position. Falling oil prices, stable food costs, and cheaper metals mean lower inflation, a narrower current account deficit, and better fiscal optics. But behind this is an ocean of volatility. The benefits of today’s soft prices could be undone in a quarter or two.

This calls for a shift in mindset. This is no longer a world where you can just plan for lower prices — you must constantly prepare for the next shock.

Tidbits

IHCL Q4 Profit Jumps 25% on Strong Revenue Growth

Source: Business Standard

Indian Hotels Company Limited (IHCL), the Tata Group’s hospitality arm and parent of Taj Hotels, reported a 25% rise in consolidated net profit to ₹522.3 crore for the January–March quarter of FY25, compared to ₹417.7 crore a year earlier. Revenue from operations grew 27% year-on-year to ₹2,425 crore, up from ₹1,905.3 crore. For the full year FY25, IHCL posted a 23% increase in revenue to ₹8,334.5 crore, while net profit surged 52% to ₹1,908 crore. Management fees rose 20% year-on-year to ₹562 crore. The company recorded 74 new hotel signings and 26 openings in FY25, with over 95% of signings under capital-light arrangements. Its Ginger brand crossed the 100-hotel milestone, while Vivanta surpassed 50 hotels. Looking ahead, IHCL expects double-digit growth in FY26, supported by same-store performance, new business momentum, and 30 planned hotel openings, including a 127-key Vivanta and a 151-key Ginger in Ekta Nagar, Gujarat.

India Offers Zero-Tariff Access to US for Steel, Auto Parts, Pharma in Trade Talks

Source: Bloomberg

India has proposed a zero-tariff offer on steel, auto components, and pharmaceuticals to the US, but only up to a specific import threshold, beyond which normal duties would apply. The offer was made during trade negotiations in Washington as both countries aim to finalize a bilateral trade deal by this fall. The talks are part of efforts to reach agreements before the end of the 90-day pause on US President Donald Trump’s retaliatory tariffs. Trump has suggested that some trade deals could be wrapped up as early as this week, providing possible relief to trading partners. Asian countries like South Korea, Japan, and India are among those actively pushing for interim agreements with the US. Meanwhile, the US has asked India to address concerns over mandatory Quality Control Orders, which it sees as non-transparent non-tariff barriers. The proposed deal focuses on specific sectors seen as priority areas by both nations. Neither country has officially commented, and the Indian Ministry of Commerce and Industry did not respond to email queries.

India’s Auto Retail Sales Rise 2.95% in April 2025, Driven by Festivals and Rural Demand

Source: Business Standard

India’s overall automobile retail sales rose 2.95% in April 2025 to 22.8 lakh units compared to 22.2 lakh units in April 2024, according to the Federation of Automobile Dealers Associations (FADA). Two-wheeler sales increased by 2.25% year-on-year to 16.8 lakh units, while passenger vehicle sales grew 1.55% to 3.4 lakh units. Tractor sales showed a stronger rise of 7.5%, supported by post-rabi harvest demand, and three-wheelers recorded a 24.5% increase. However, commercial vehicle sales slipped by 1% year-on-year. The month-on-month rise in two-wheeler sales was notable at 11.84%, reflecting the impact of seasonal festivals like Chaitra Navratri, Akshay Tritiya, Baisakhi, Vishu, and others. Overall, the data points to steady consumer activity across key auto segments despite some category-level differences.

- This edition of the newsletter was written by Pranav and Krishna.

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, even the smaller logistics firms—and copy the full transcripts. Then we bin the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

🌱Have you checked out One Thing We Learned?

It's a new side-project by our writing team, and even if we say so ourselves, it's fascinating in a weird but wonderful way. Every day, we chase a random fascination of ours and write about it. That's all. It's chaotic, it's unpolished - but it's honest.

So far, we've written about everything from India's state capacity to bathroom singing to protein, to Russian Gulags, to whether AI will kill us all. Check it out if you're looking for a fascinating new rabbit hole to go down!

Subscribe to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Thank you for reading. Do share this with your friends and make them as smart as you are 😉

hello

thats very nice