Why Oil Prices Suddenly Crashed

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and watch the videos on YouTube. You can also watch The Daily Brief in Hindi.

In today’s edition of The Daily Brief:

OPEC's surprise move sends oil prices tumbling

Intel Just Got an Upgrade—Thanks to TSMC

OPEC's surprise move sends oil prices tumbling

Yesterday, OPEC+ announced a surprising acceleration of their production. Oil markets were caught completely off guard. It doesn’t help that this comes right when markets were already jittery from the new tariffs announced by the Trump administration: a new cherry atop the bad news-cake. Of course investors took it badly.

So what exactly happened? And why does it matter? Let's break it down.

How OPEC+ plays with the oil market

First, some context.

If there’s one thing you know about the OPEC+, it’s that it’s an international cartel of oil producers, which tries to manipulate the global price of oil. For the past couple of years, OPEC+ has been carefully managing global oil supply through a series of production cuts. After all, when there’s less oil for people to buy, you can get more money for whatever oil you do sell.

These cuts began in late 2022 when the alliance announced a substantial reduction — 2 million barrels per day — amid concerns about a global economic slowdown. But they didn't stop there; in April 2023, they tightened supply even further, with additional voluntary cuts of over 1.65 million barrels per day. Later, they doubled down, with another 2.2 million barrels per day in additional voluntary cuts.

By the beginning of this year, in all, OPEC+ had removed a staggering 5.8 million barrels per day from the market. That's nearly 6% of global oil demand, for context. These cuts were essentially organized in three layers:

About 2 million barrels in baseline cuts by all member countries

Roughly 1.6 million barrels in voluntary cuts by nine members

An additional 2.2 million barrels in voluntary cuts by eight members.

What’s happening now

That brings us to April 2025.

OPEC+ had announced plans to begin gradually unwinding some of these cuts. Specifically, they started reversing the 2.2 million barrels per day of voluntary cuts over an 18-month period running through September 2026. The plan was to increase production by about 135,000 barrels per day each month.

But here's where things got interesting: instead of ramping up production slowly, they did it all at once.

Yesterday, in a surprise move, eight key OPEC+ producers — Saudi Arabia, Russia, Iraq, UAE, Kuwait, Kazakhstan, Algeria, and Oman — announced that they're accelerating this timeline. Instead of increasing production by the scheduled 135,000 barrels per day in May, they're now planning to boost output by a whopping 411,000 barrels per day.

Essentially, they’re cramming three months' worth of increases into a single month.

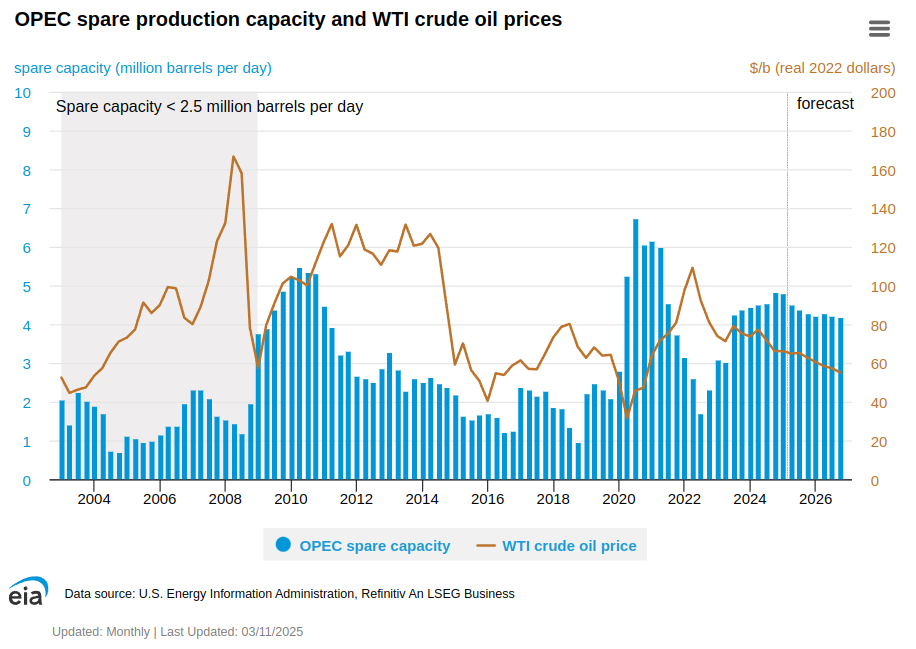

Markets reacted immediately and dramatically. Oil prices plummeted about 10% since the announcement. Brent crude fell to around $67 per barrel. WTI dropped to about $65 per barrel. If you’re wondering how significant that is, just look at this chart:

So why did OPEC+ make this move? Why rush all that oil to the market? There are several factors that might have pushed them to accelerate their production increases.

First, there's the possibility of pressure from the Trump administration. President Trump has been simultaneously championing higher U.S. oil output, which could potentially influence OPEC's market calculations. Only, American oil is considerably more expensive to produce than oil elsewhere in the world. A price cut hurts major oil suppliers, but it makes American oil entirely uncompetitive.

Second, there's the sanctions factor. The U.S. has recently tightened sanctions on Iran and Venezuela. According to analysts at RBC Capital Markets, these stricter sanctions could take significant volumes of oil off the market, potentially creating an opportunity for OPEC+ to fill that gap by increasing their own production.

Third, there's some discussion of internal compliance issues within OPEC+. That’s a fundamental challenge in running such a cartel — if a bunch of countries collaborate to cut supply and run up prices, any country that breaks ranks and supplies more oil suddenly earns a huge windfall from those high prices. As Helima Croft RBC noted, that’s precisely what’s happening. Kazakhstan, for example, has reportedly been producing well above its targets. By suddenly increasing production quotas, OPEC+ might be attempting to discipline such countries.

Finally, there's the simple issue of market share. While OPEC+ has been capping its output, other producers have been boosting production. This dynamic may have created internal pressure from some members to reclaim market share.

It's worth noting that this meeting was the first one attended by Kazakhstan's new energy minister, which adds an interesting subplot to the decision. And despite OPEC citing "healthy market fundamentals" and a "positive market outlook" as the official rationale for the increase, the timing – just as Trump announced sweeping new tariffs – has raised eyebrows among market analysts.

Analysts from SAXO Bank noted that, as a result of these developments, Brent crude could head towards $65, while WTI moves towards $60 in the near term.

So, will OPEC just stop cutting production now?

Nah.

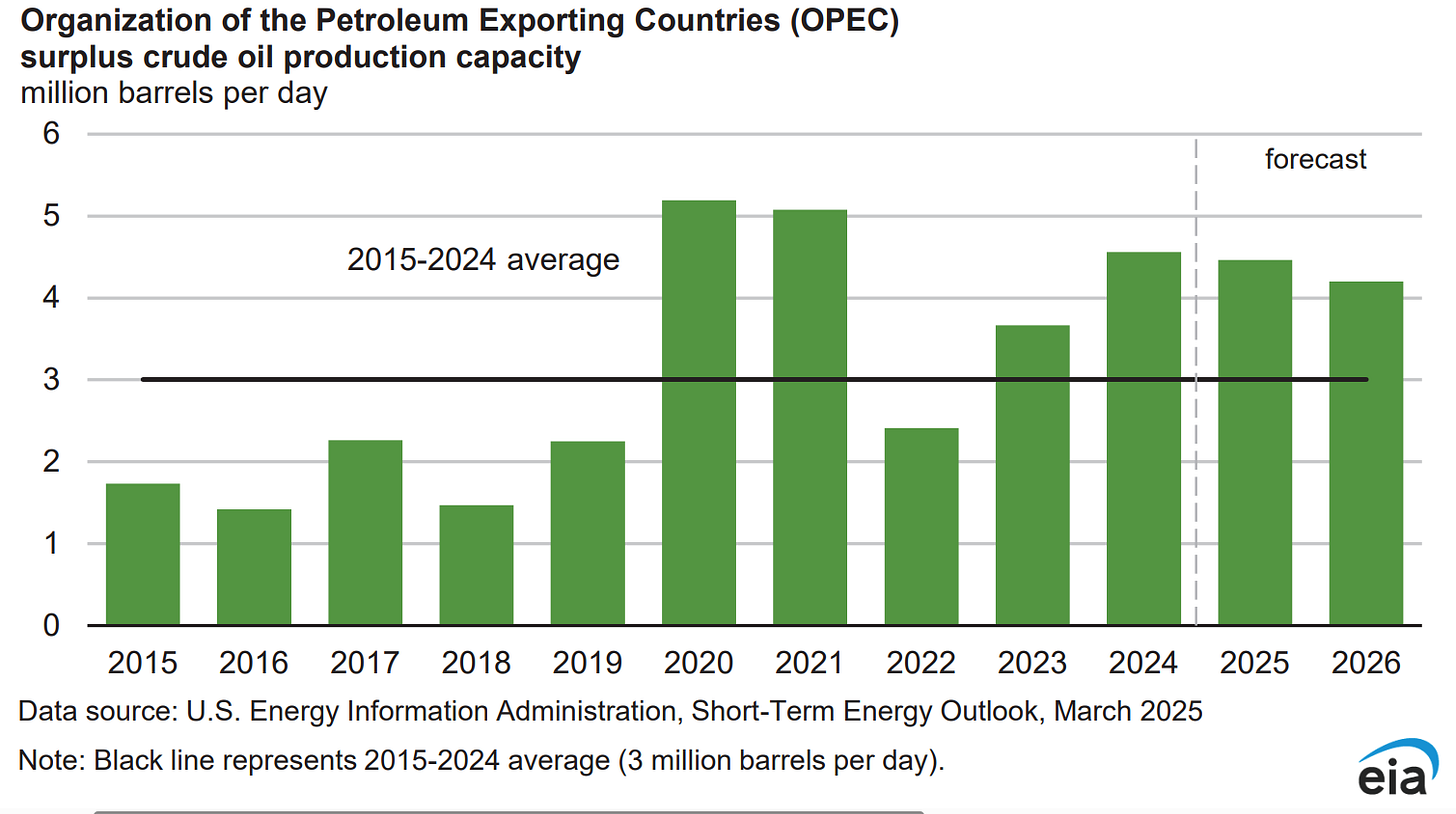

Despite this acceleration, OPEC+ still has significant supply restraints in place. Even after this increase, approximately 3.65 million barrels per day remain offline through the end of 2026. This isn’t a complete change in strategy. While they're turning the tap on a bit more, they're still holding back a substantial amount of production. If the OPEC+ really wanted it, oil prices could be much, much lower.

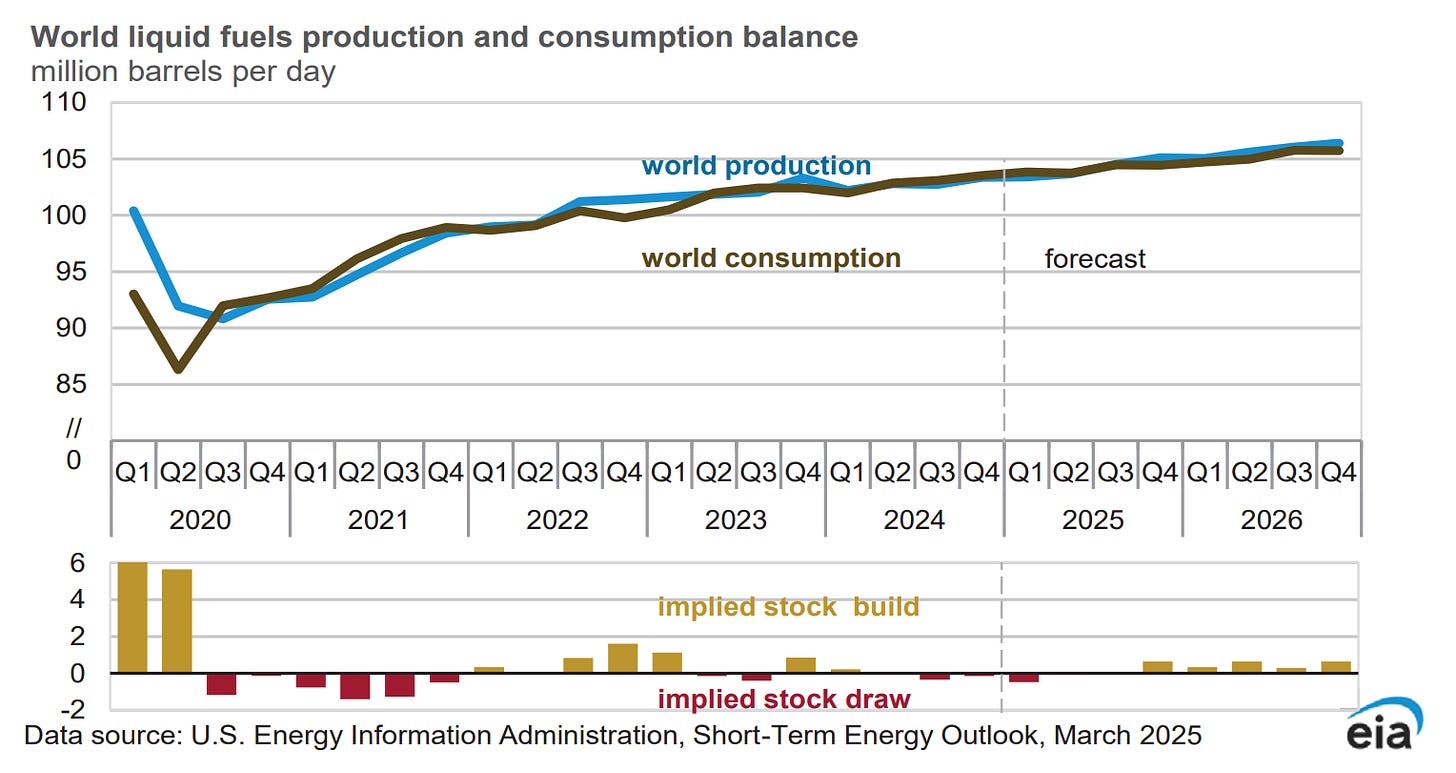

The Energy Information Administration's latest Short-Term Energy Outlook gives us some interesting perspective for what might come ahead. The EIA projects that global oil markets will remain relatively tight through the middle of 2025 — that is, there won’t be a lot of spare oil in the market. By mid-year, though, countries will shift to building up their inventories later this year. That’ll take some of the demand off the market.

However, that won’t be the case forever. They expect global oil inventories to fall again in the second quarter of 2025, because Iran and Venezuela will have to cut down their production by then. Things will look tight towards the September quarter.

But then, things will change yet again. Countries’ oil inventories will build up again towards the end of this year. And so, once again, there will be downward pressure on crude oil prices in late 2025 and through 2026. OPEC+ will unwind production cuts at the same time. As a result, they forecast the Brent crude oil price will fall to an average of $68 per barrel in 2026.

Interestingly, one other key ingredient in this decline in prices, according to the EIA, is a jump up in production from countries outside OPEC+. They expect the United States, Canada, Brazil, and Guyana to all drive production growth in the coming year. Meanwhile, global oil consumption growth continues to be less than the pre-pandemic trend, with forecast increases of 1.3 million barrels per day in 2025 and 1.2 million barrels per day in 2026.

Look, we know that’s a lot to process. But here’s the one thing you should take away from this, if nothing else: OPEC+ is essentially trying to thread a very delicate needle. They're attempting to respond to market dynamics, potentially reclaim some market share, and maintain price stability — even as much of their attention is going into dealing with a deeply uncertain world, and navigating dissent in its own ranks.

But that’s their headache. What does it mean for you?

For consumers, this could mean some relief at the pump in the short term. For investors and traders, it signals a potentially more volatile oil market ahead as OPEC+ adjusts its strategy. And for the broader economy, lower oil prices could help ease inflation pressures at a time when they're very much needed.

One thing is clear: OPEC+'s willingness to suddenly accelerate production increases shows they're ready to be more flexible with their market management strategy. The big question now is whether they'll stick with this new plan, or reverse course if prices fall too far.

For now, they’re keeping their cards close to the chest. As OPEC indicated in their statement, these "gradual increases may be paused or reversed subject to evolving market conditions."

Intel just got an upgrade—Thanks to TSMC

Here’s some big news from the chip world: TSMC, the world’s gold standard in chipmaking, will soon team up with Intel, the struggling has-been of the semiconductor world.

The two are forming a joint venture, with which TSMC will take a 20% stake in Intel’s chipmaking unit. What’s it paying for this investment, though? Nothing. TSMC isn’t putting in a single dollar in this JV. They’re just bringing the know-how. No capex. No fab. Just vibes.

Anyway, why are we talking about a random joint venture? Especially one where no money changes hands? See, this story is way bigger than a couple of businesses. It might look like a mere tech partnership on the surface. But beneath it? This is a huge geopolitical move dressed up as a corporate handshake. There are two big angles here—and both are dripping with historic context and political urgency.

But before we get into all that, let’s talk about why this matters.

You’ve probably heard this a lot, but it bears repeating: chips run the world. Phones, laptops, cars, fighter jets, washing machines, and TikTok algorithms — all are powered by semiconductors. You can’t have anything resembling our modern world without chips. When this much is at stake, things stop becoming mere products. This deal isn’t just about some piece of technology; it’s a matter of national security. If you control chip supply, you practically control the future.

That’s why this is important. With that, let’s dive in.

How Intel went from GOAT to Ghost

Intel was once the Michael Jordan of the world’s chip landscape. It invented the microprocessor in 1971. It defined the personal computing era.

But somewhere along the way, it lost the plot. We’ve talked about this before, but here’s a quick recap:

It missed the mobile revolution, limiting its focus on traditional PC and server processors while the computing world increasingly shifted to smartphones and tablets. And while they looked away, Qualcomm ate their lunch.

Intel’s business model — of fabricating all its chips in house — began to fail it. While it was once an unbeatable competitive moat, over time, it became a drain on its attention. Chip design and fabrication are both bleeding edge tech businesses, and running two such businesses under the same roof became impossible.

It missed the AI revolution. While Nvidia was generating approximately $20 billion per quarter from AI chips by 2024, Intel's AI revenue remained a mere $500 million annually, highlighting the vast discrepancy in how the two companies approached this transformative technology.

In fact, Intel even missed investing in OpenAI when it had the chance. Oof. Intel had the opportunity to purchase a 15% stake in OpenAAI Takeover: Qualcomm's Push to Acquire Intel and Shape the Future of Tech | YourStoryI for $1 billion in cash. However, then-CEO Bob Swan ultimately decided against the deal, believing that generative AI models would not reach the market soon enough to justify the investment.

Essentially, while everyone else was betting on the future, Intel bet on staying the same. Spoiler alert: it didn’t work. By 2024, Intel was bleeding. It saw a $18.8 billion net loss, its stock price fell by 60%, and its prospects looked bleak — it was struggling to manufacture 7nm chips, which TSMC had mastered in 2018.

The company was a full six years behind its competitors and barely relevant in AI. While a five to six-year gap might appear relatively modest, the implications are substantial. The scavengers started appearing on the horizon. For instance, Qualcomm — once insignificant before Intel’s might — even considered buying Intel. Imagine the humiliation.

Logically, Intel should’ve died a slow, boring corporate death. But here it is, still kicking. Why?

Because of the second angle. The one where geopolitics decides who gets to live.

The US-China chip war is real (And getting weird)

This whole saga really starts in 2020, when the U.S. told chipmakers, “Hey, you can’t do business with Huawei if you're using any American tech.” That was the first cannonball in what’s now a full-blown semiconductor war between the U.S. and China.

Why does America want to throttle China’s access to chips? At least officially, here’s why: China has a ‘Military-Civil Fusion’ strategy. That means every tech breakthrough can double as a weapon. One could give China video game chips, only to find that they’re guiding missiles. And so, the U.S. wasn’t about to let Huawei or any other Chinese company get their hands on bleeding-edge chips.

Since then, the U.S. has:

Blocked ASML from selling cutting-edge lithography machines to China. These machines are what makes it possible for companies like TSMC to make high tech microchips.

Banned Nvidia’s best AI chips from being exported there.

Rolled out the $52 billion CHIPS Act to boost domestic manufacturing.

Meanwhile, China has been trying to play catch-up with $96 billion in subsidies—but that isn’t enough to close the gap with the United States. It’s still six to ten years behind in chip manufacturing. If six years doesn’t sound like a lot to you, consider this. Given how computing technology has more-or-less followed Moore's Law, which predicts that the number of transistors on a microchip doubles approximately every two years, TSMC's cutting-edge products can compute about eight times more efficiently than their Chinese counterparts. That’s a massive gap.

So, what does China do? It smuggles chips. Literally. Like it pays kids to fly home with Nvidia GPUs stuffed in their suitcases. It sets up fake shell companies in Taiwan to poach engineers. It’s proper spy-movie-level stuff.

Intel + TSMC = A match made in Trump’s office

This is where it all comes together.

If there’s a chip war, Intel is America’s last hope for independence. TSMC may be the best chipmaker, but it’s Taiwanese—and Taiwan is, well, one Chinese invasion away from becoming a war zone.

That’s why the U.S. wanted to set up a $65 billion TSMC fab in Arizona. But while there’s been some progress on that front, it’s been painfully slow. The project has been plagued with delays and cost overruns. So now, the government (read: Trump) has nudged TSMC to go help Intel too.

That’s the rationale behind the deal. TSMC’s money isn’t very important to America. But this is about national security. Intel gets TSMC’s chipmaking knowledge, no capex needed. In exchange, the U.S. shores up its domestic manufacturing muscle without relying entirely on a foreign company. So in summary, with this deal:

Intel wins—it finally gets the technical chops it couldn’t build on its own.

The U.S. kinda wins—because now, even if Taiwan falls, its chip-making knowledge won’t.

China definitely loses—because TSMC’s crown jewels just got shared with their mortal adversary.

Final thoughts

Let’s be honest: Intel had no business surviving in today’s chip game. But politics has a way of keeping zombies alive when it’s convenient. And when the chip war becomes a national security issue, even has-beens get second chances.

Will this new joint venture work? Who knows. Intel still has to deal with tech debt, integration issues, and its own bureaucracy. But if there’s one thing this deal proves, it’s this: in the world of chips, business isn’t just business any more. Standard economic logic no longer applies. Countries treat their chip-makers as strategic assets. There’s a new sort of company, now, that’s too big to fail.

Tidbits

India's two-wheeler market closed FY25 on a strong note, with total sales across key brands rising by 7.3% year-on-year to 20,029,530 units, up from 18,671,443 units in FY24. According to company data, TVS recorded 4.33 million units sold in FY25, up 12%, while Hero MotoCorp reached 5.48 million units, a 5.51% increase.

India’s residential real estate market reported 88,274 primary home sales in Q1CY25, marking a modest 2% year-on-year growth, according to Knight Frank India

India's Parliament has passed the Protection of Interests in Aircraft Objects Bill, aligning the country’s laws with the Cape Town Convention and Protocol to safeguard aircraft leasing rights. The move comes after a 2023 dispute where lessors, including SMBC Aviation, failed to repossess over 50 Airbus aircraft from the bankrupt airline Go First.

- This edition of the newsletter was written by Bhuvan and Kashish

📚Join our book club

We've recently started a book club where we meet each week in Bangalore to read and talk about books we find fascinating.

If you'd like to join us, we'd love to have you along! Join in here.

🌱Have you checked out One Thing We Learned?

It's a new side-project by our writing team, and even if we say so ourselves, it's fascinating in a weird but wonderful way. Every day, we chase a random fascination of ours and write about it. That's all. It's chaotic, it's unpolished - but it's honest.

So far, we've written about everything from India's state capacity to bathroom singing to protein, to Russian Gulags, to whether AI will kill us all. Check it out if you're looking for a fascinating new rabbit hole to go down!

Subscribe to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Thank you for reading. Do share this with your friends and make them as smart as you are 😉