The part of the electronics puzzle no one's talking about

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how, too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and watch the videos on YouTube. You can also watch The Daily Brief in Hindi.

In today’s edition of The Daily Brief:

How printed circuit boards are re-wiring the global chessboard

Industrial gases: the backbone of all industrial production

How printed circuit boards are re-wiring the global chessboard

When we talk about the future of technology, semiconductors dominate the headlines, be it geopolitical or financial. We’ve also covered them twice (here and here).

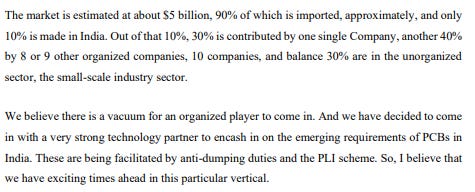

But there's another piece of the electronics puzzle that's just as essential yet rarely gets attention: Printed Circuit Boards (PCBs). From smartphones to televisions to game consoles, there is at least one PCB in every device you use today.

Yet, somehow PCBs are actually getting far more attention than ever. Turns out, ignoring them in the era of AI, clean energy and EVs is not an option for any country that wants to make headway in those industries. And, much like for chips, PCB production has upped the geopolitical stakes, undergoing a massive supply chain shift.

We’ll be looking at what goes into a PCB, who makes them, why the supply chain is shifting, and what India is doing about them. This is a very technical industry that we are hardly experts in But we’ll do our best to break down the basics of how you should think about PCBs.

Let’s dive in.

The director of power and signals

Before we get into the intricacies of PCBs: what do PCBs even do?

Let’s put it this way: a chip, no matter how powerful, is fundamentally useless without a PCB. To function, a chip must be mounted on a circuit board that connects it to power sources, other chips, and input/output interfaces. The PCB carries logic signals and distributes power between chips and other electronic components.

In other words, PCBs are the city infrastructure of the electronics world—they provide the roads, power lines, and connections that allow electronic components (including chips) to work together. It works both as a communication network and a power grid.

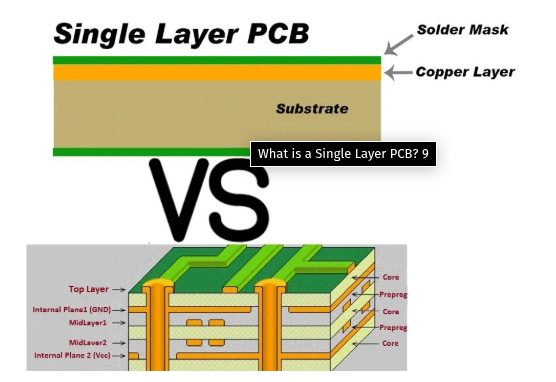

We know only too well that chips are evolving rapidly, but PCBs are keeping up too. The most advanced electronic devices now rely on something called IC substrates—miniature, ultra-precision PCBs that sit between a chip and the main PCB. These substrates are insane engineering marvels, often containing 10-20 copper layers that are thinner than human hair (a few micrometers). Hence, they’re much harder to make than normal PCBs.

Here’s an example of how important substrates are. In 2021, the world faced a massive chip shortage, and not necessarily because there wasn’t enough silicon—there weren’t enough high-end substrates. Even if chip fabs produced enough processors, there weren't enough substrates to package them. As a result, production of chips slowed, prices jumped 30-40%, and the entire electronics industry—from NVIDIA to LG—was in a chokehold.

Today, beyond consumer electronics, a lot of new-age industries require PCBs. AI chips, for instance, cannot do without high-end PCBs. Clean energy is yet another industry that needs them — in battery management systems, solar power inverters, and even the lithium-ion batteries in EVs. 5G infrastructure is another example, as the high-frequency 5G signals can only be transmitted through special substrates.

The art of cooking

Now, how is a PCB made?

Well, it’s an extremely complex process that honestly, even we don’t fully understand. But we’ll try to break down the parts of it that are key to the PCB supply chain.

A PCB basically contains a lot of copper foil — ultra-thin copper wires through which the PCB directs power. This foil is placed on a copper-clad laminate (CCL) which is the canvas of the PCB. The CCL is made up of fiberglass (that keeps the foil robustly tied to the PCB) and resin (to insulate areas from shocks).

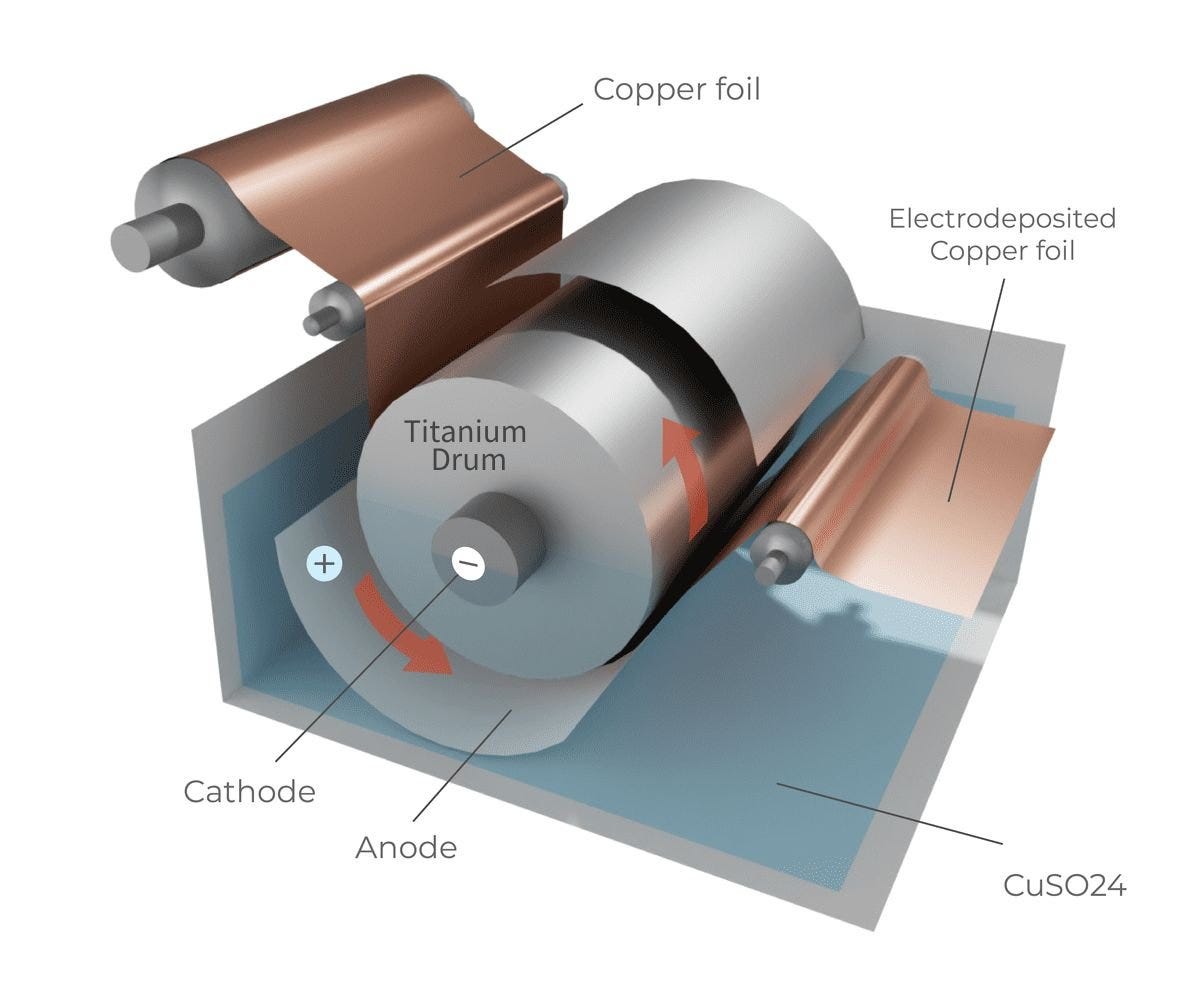

But here’s what you should know: making the copper foil alone is tough, and is not the same as dealing with raw copper metal. In fact, PCB makers don’t deal with raw copper, but with specific players who specialize in copper foil manufacturing — which involves special equipment and a keen understanding of chemistry.

CCLs (~30%) and copper foil (~9%) together make up the biggest chunk of raw material costs of manufacturing PCBs. Raw material in total makes up close to 60% of the costs.

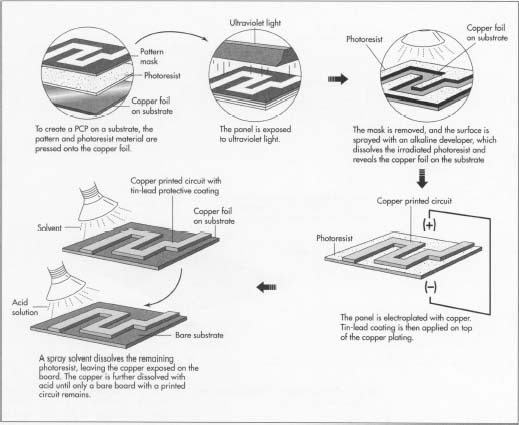

After this comes creating the circuit patterns on the board, which is done using a process called photo-lithography. In simple terms, it involves directing lasers of UV light on the CCL, like a stencil. Certain areas of the PCB need more light and others need less — a protective layer ensures that. Then, the excess copper on the CCL is removed using a process called etching, after which only the copper "roads" remain.

If you’ve read our earlier pieces, you may recall that photo-lithography is central to how chips are made. The process in chips is far more complex and technical, but the principle is similar — use a fine source of light to make patterns. Photo-lithography is a very high-stakes process. If it gets messed up, then the PCB (or chip) won’t be effective.

This is just one layer. Complex electronics like smartphones involve PCBs with multiple layers. They use pre-preg sheets—thin fiberglass infused with half-cured resin—to bond multiple copper layers together under extreme heat and pressure.

Now, imagine getting 6 or 12 layers perfectly aligned with the right circuit patterns. It would make the photolithography part even harder. Even small mistakes—layers misaligned by a hair's breadth—can make circuits fail completely.

Then comes drilling—thousands of tiny holes called vias that connect different layers. These holes are then plated with copper to link the layers. Think of it like dipping a cookie in chocolate, except you're coating the inside of microscopic holes with copper.

All these steps make PCB manufacturing a capital and machine-intensive process. But it’s also about the knowledge needed to master—and execute at scale—a high-tech baking process.

Yet another (big) supply chain shift

Now that we’re done with the hard part, let’s talk supply chains.

For a long time, PCB production was primarily located in East Asia — Japan, Taiwan, South Korea and China (which commands ~50% of global volume). These countries themselves became stronger in making PCBs because Western companies shifted there to chase lower manufacturing costs.

However, there’s a catch: while China dominates volume, it doesn’t necessarily capture value. The cutting-edge substrates for the high-performance chips used in AI, 5G and clean energy remain largely controlled by companies from Taiwan, Japan, and South Korea. Companies like Taiwan's Unimicron and Kinsus, Japan's Ibiden and Shinko, and South Korea's Samsung Electro-Mechanics have decades of R&D in advanced materials and ultra-fine processing. China is investing heavily to catch up, but remains behind as of now.

Now, the entire supply chain is experiencing another shift due to 2 simple, but powerful forces: geopolitics and economics.

The Geopolitical Push

The U.S.-China trade war has slapped high tariffs on Chinese-made goods, and PCBs were no exception. This has lowered the cost advantage for companies located there. Additionally, the US is re-prioritizing domestic PCB production with the “Protecting Circuit Boards and Substrates Act”.

Additionally, broader concerns about over-reliance on China has pushed companies toward diversifying production. This is particularly true for companies from Taiwan, which faces intense hostility from China. They will need to find an outlet before both of them go to war.

The Economic Reality

On the economic side, Chinese PCB makers expanded so aggressively that an over-supply emerged in low-to-mid-tier boards. Like in other industries in China, this led to an all-out price war, creating razor-thin margins. Meanwhile, labor costs in China rose and environmental regulations tightened modestly, eroding some cost advantages.

So, companies are looking elsewhere where labor costs are comparatively lower, the infrastructure is solid, and the threat of US tariffs is more muted.

South-East Asia Rising

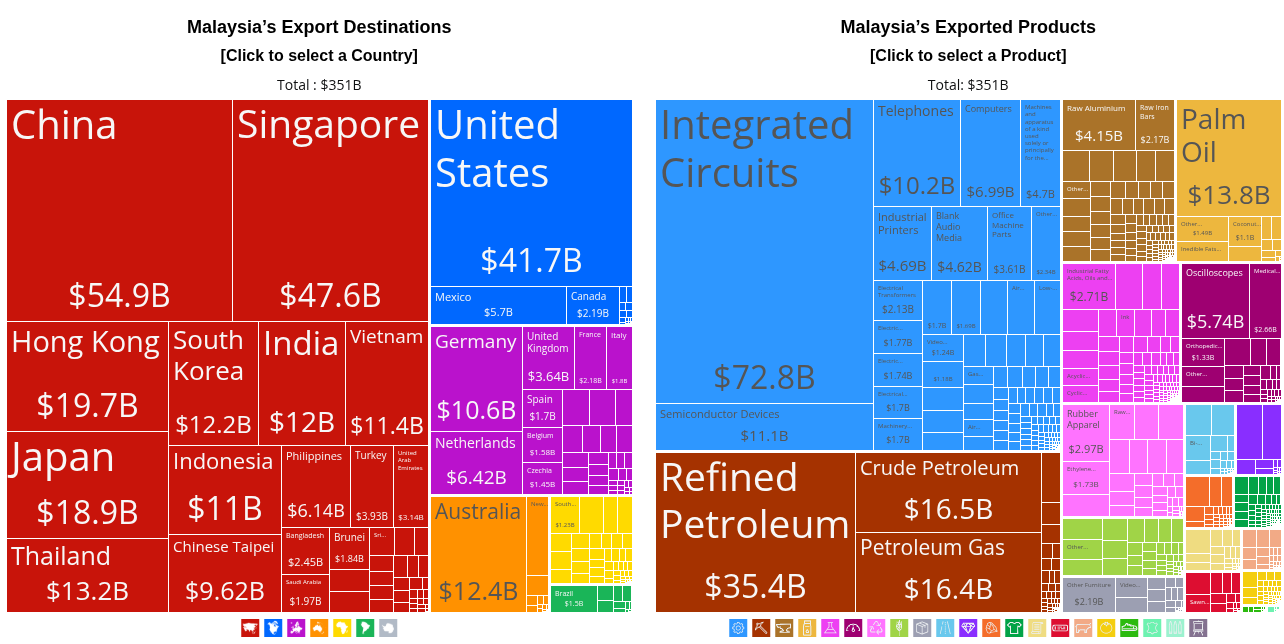

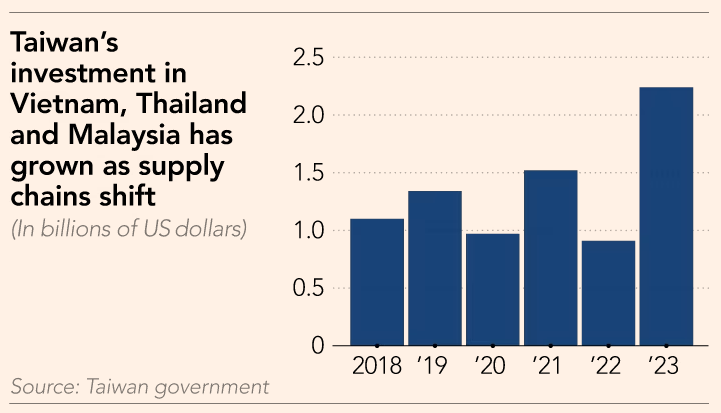

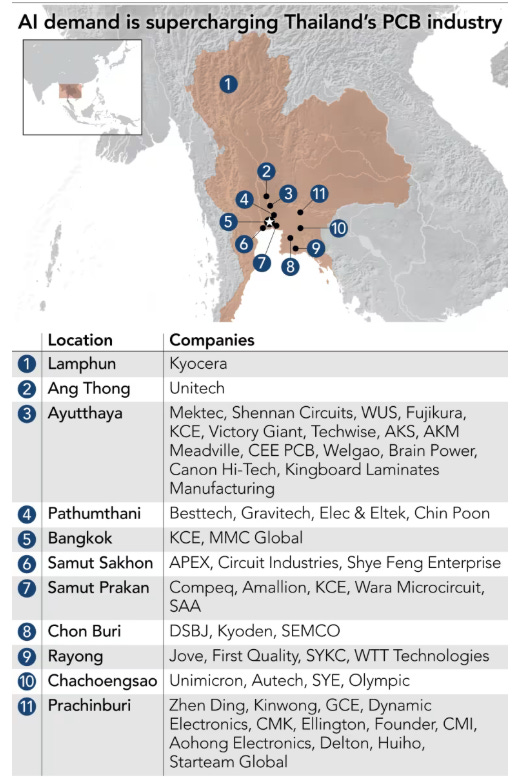

Three countries in South-East Asia (SEA) are emerging as the biggest winners of this shift: Thailand, Vietnam, and Malaysia.

Thailand offers the stability that electronics manufacturers crave. Reliable power and water supply—crucial for 24/7 PCB plating operations—combined with skilled labor from its electronics assembly history. The government sweetened the deal with EV incentives and free-trade zones. And unlike China, Thailand faces a much smaller tariff penalty.

Vietnam leverages its position as an electronics exporting giant. With giants like Foxconn operating major facilities there, a built-in demand for PCBs exists locally — Taiwanese PCB companies have already opened branches there to supply Apple's partners. Competitive labor costs and extensive trade agreements make exports attractive.

Malaysia has a long history in semiconductor assembly and testing — we recommend reading Noah Smith’s piece on how Malaysia got there. About 13% of global chip packaging happens in Malaysia, with many multinational chip companies present. It was only obvious that PCB makers set up shop there.

The momentum is clear. SEA's PCB export growth has been extremely high — in 2023, Taiwan’s investment in these 3 countries increased by 146% over the previous year to $2.2 billion. Even though China continues to be the leader in making PCBs, it’s clear that the supply chain will soon have a new power node in SEA.

But the real question is — how is India adapting to this shift?

India's PCB awakening

India presents an intriguing case study. We are a massive consumer of electronics but have played little-to-no role in making PCBs. Most of the PCBs we use—even the most basic ones—are imported mostly from China. At a measly 0.5%, India's share of global PCB production is basically negligible. This is a strategic vulnerability.

Why is that?

The biggest reason for our PCB situation goes back to how PCBs are made. Remember, CCLs and copper foil make up the biggest cost of making PCBs. Not coincidentally, the manufacturing of copper foil is also concentrated in the same East Asian countries.

However, nearly all the CCLs used by Indian PCB manufacturers are imported. This is despite the fact that we have copper reserves of our own and are expanding our mining operations further. Making copper foils is a whole different ballgame from simple copper metal.

The second reason is that PCB manufacturing requires a lot of power and water throughout the extremely-delicate operations behind making PCBs. Unfortunately, unlike our SEA peers, Indian firms—especially small ones—don’t enjoy such consistency. It’s also likely that with how often we face power outages and droughts, we might not be able to afford supplying PCB makers with a lot of power.

The third reason has to do with trade agreements. For one, India is not part of the RCEP, which includes Thailand, Vietnam and Malaysia. This prevents us from having the kind of preferential access in exports that they have. Additionally, our membership in the WTO IT Agreement mandated zero import duties on PCBs, making local manufacturing harder.

Because of these reasons, Indian PCB makers can't yet compete on cost. But this is changing.

India tries to adapt

The government has recognized PCBs as crucial infrastructure, making them eligible under the PLI scheme. Specifically, the SPECS program reimburses up to 25% of capital expenditure for electronics manufacturing.

Across the PCB supply chain, major Indian investments are now materializing. In September 2025, Syrma SGS announced India's largest PCB manufacturing facility in Andhra Pradesh—a ₹1,593 crore project targeting everything from single-layer to high-density interconnect boards. This also aligns with AP’s targeted industrial policy in electronics — something we covered recently. Syrma also entered a joint venture with South Korean firm Shinhyup Electronics to make both PCBs and CCLs.

Additionally, Wipro has also invested ₹500 crores in a large-scale CCL factory in Karnataka, aiming to start production by 2026.

In India’s PLI scheme, electronics has been a notable success. We have created multiple successful electronics hubs which should attract PCB makers in time. Indian electronics assembler Kaynes has already taken a leap here by building its own PCB factory.

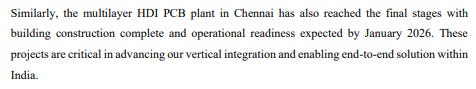

There’s a huge market for domestic PCBs waiting to be tapped. Here’s a comment from Syrma on the same:

Existing players aren’t sitting silently, either. Domestic players Genus Electrotech and Sahasra were among the approved companies under PLI 2.0.

Conclusion

The global landscape of PCBs is just like the PCB itself: complex and distributed. With a supply chain shift, existing players are being challenged, while new countries move up the ladder. With regular developments in AI, solar energy, and EVs, the PCB will only evolve further to meet the needs of these new industries.

At the same time, we want a piece of it, especially to complement our rising electronics sector. Only time will tell if India manages to catch up.

The future of the humble PCB has probably never been more exciting.

Industrial gases: the backbone of all industrial production

We’ve never looked at the industrial gases industry before; frankly, we didn't realize how important it is. But once you know where to look, you’ll see it everywhere.

Hospitals, steel plants, refineries, food packaging, even semiconductors — all of them run on a constant supply of gases. It’s one of those hidden systems of the economy: quiet, technical, and taken for granted. Which makes it all the more interesting to unpack.

We’ve been learning on-the-go through reports, articles, and videos, and are hardly experts on it. But for now, we’ll do our best on giving you a tour of this strange, invisible business.

Why does this industry even exist?

In your science class at school, you must have learnt a key fact about the natural state of air: it’s 78% nitrogen and 21% oxygen.

But this composition of air is useless to any industrial process. A blast steel furnace, for instance, needs 99.5% pure oxygen, delivered at high pressure, 24x7. A semiconductor fab doesn’t want mere “normal” nitrogen — its supply should be free of every trace of moisture and dust. Even a cola bottler doesn’t want “random” carbon dioxide; it wants sterilized, beverage-grade CO₂.

Now, enter the industrial gases industry.

Its job is to take ordinary air or chemical by-products, strip them down, purify them, separate them, and deliver them in the exact form each industry needs. It is the invisible plumbing of modern industry: never noticed by the end consumer but impossible to replace.

How does the industry actually work?

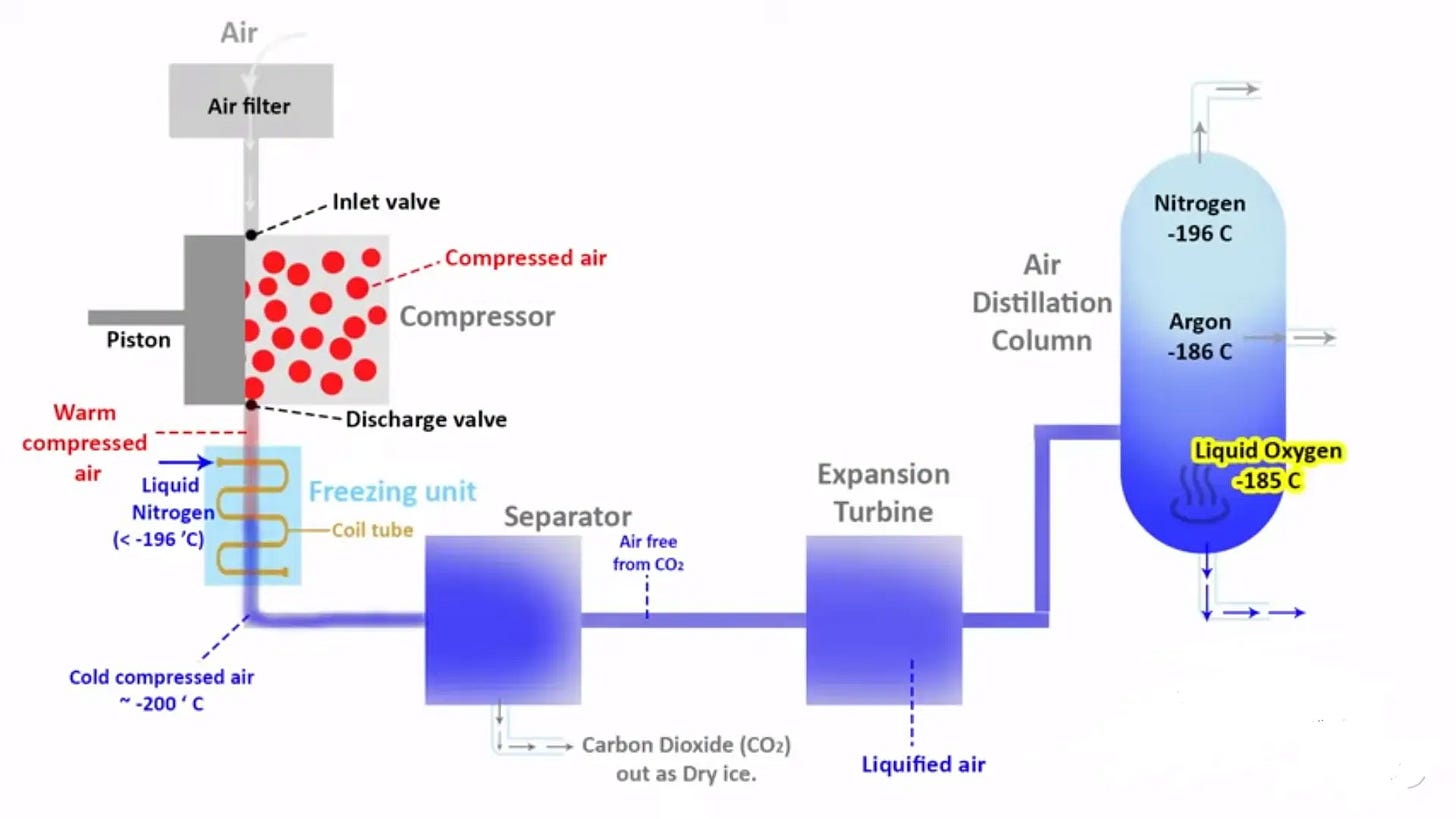

The backbone of the business is the air separation unit (ASU). Think of it as a factory that takes in air, chills it to extremely cold sub-zero temperatures, and then distills it into liquid oxygen, nitrogen, and argon.

Each gas is tapped off, purified, stored in tanks, and sent on its way. Large ASUs are massive power guzzlers — a single one can draw 50 to 100 megawatts of electricity. That makes energy cost one of the biggest levers in the entire industry.

Building one ASU can cost hundreds of crores upfront, with payback spread over 10–15 years. Ideally, you can only build an ASU if you have a long-term contract in hand. Which is why they’re often financed against 15–20 year take-or-pay deals with fixed minimum fees.

Once you’ve made the gases, the next question is: how do you get them to the customer?

Here, the industry works on three models:

On-site (tonnage): If the customer is huge, let’s say, a steel plant, the gas company just builds a plant on the customer’s premises, connects it by pipeline, and runs it for decades. The long contracts mean that even if the customer’s offtake falls, they still pay a minimum fee. For the gas company, this is annuity-like revenue. For the customer, it means they never worry about supply.

Merchant (bulk liquid by tanker): For mid-sized users, the gas is liquefied, stored in large cryogenic tanks, and shipped by road in insulated tankers. Customers store it in satellite tanks and vaporise it into gas as needed.

Packaged (cylinders): For small customers — workshops, small hospitals, labs — gases are delivered in cylinders. This is the most operationally intense segment, with the highest working capital and safety requirements, but also the highest per-unit revenue.

What the business model depends on

Clearly, geography is a massive factor in the industry’s business model. Cryogenic tankers can only travel so far before the economics stop making sense. If your plant is in a region with dense industrial demand — like the steel cluster in eastern India — every trip is efficient. If you’re serving scattered customers across long distances, your trucks spend more time on the highway than unloading. The denser your network, the lower your per-unit logistics cost, and the better your margins. In gases, density is destiny.

Utilization also matters in this industry. An ASU breaks even at around 65–70% capacity, while the profits are really good above 80%. This is why gas companies chase new tonnage contracts i.e. every on-site plant not only secures annuity revenue, but also generates extra liquid product that can be sold in the merchant market. That “liquid pool” is where margins are made or lost. Additionally, tonnage contracts can be really sticky. Once a gas company builds a plant on your site and lays pipelines into your process, switching is near impossible.

Then there’s the India-specific handicap: power and logistics. Power costs are higher and more volatile than in Europe or the US. Roads are congested, distances are long, and cryogenic tanker fleets are limited. Which means Indian players work harder to keep margins in the same 25–30% EBITDA range that global peers achieve more easily.

Lastly, safety is critical. In fact, it’s a business moat in this industry. Purity certifications, PESO licences, cylinder testing, and BIS standards are what separate a credible supplier from a risky one. Customers will not really switch for weak reasons, unless a single mishap halts production or — worse — endangers lives.

Who are the players?

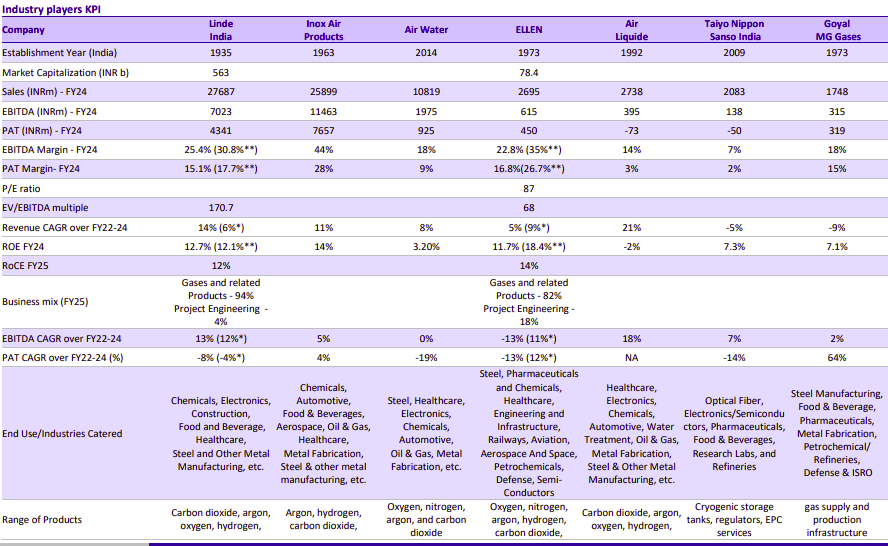

Globally, three names dominate: Linde, Air Liquide, and Air Products. Add Taiyo Nippon Sanso which specializes in gases for the electronics industry specifically, and you have the global oligopoly. In India, Linde India is the largest listed player, with a presence in steel, healthcare, and now semiconductors.

But that’s just the gases — the infrastructure that supports the gases is a different story. INOX India is the leader in making the cryogenic tanks and storage equipment that the whole industry depends on. It’s a reminder that there are companies who dig for gold, and then there are companies who build the shovels needed to dig the gold.

Together, these 3–4 companies control about 70–75% of India’s industrial gases market. The rest is fragmented among smaller Indian firms. Ellenbarrie Industrial Gases is the biggest of these, listed and fully Indian-owned, with around 2–3% share. SICGIL and Goyal MG specialise in carbon dioxide for beverages, food, and dry ice.

Where does the demand come from?

Start with steel. It is by far the largest consumer of oxygen. Blast furnaces need oxygen to enrich combustion and basic oxygen furnaces use it to refine molten iron. Every steel expansion in Odisha or Jharkhand translates directly into new oxygen demand.

There’s refining and petrochemicals. Refineries need hydrogen and syngas, produced on site in huge complexes. They also need nitrogen for purging and blanketing. Air Products has built massive hydrogen and nitrogen supply systems for IOCL and BPCL refineries. With India expanding its refining and petrochemical capacity, this demand will only grow.

Then comes healthcare. Oxygen is the obvious story, but hospitals also use nitrous oxide, medical CO₂, and liquid nitrogen for cryotherapy and storage.

Food and beverages rely on CO₂ for carbonation and nitrogen for packaging. Dry ice is used in cold chains and blasting. Glass and cement use oxygen to boost combustion efficiency. Fabrication and welding use mixtures of argon and CO₂.

And finally, the new frontier: semiconductors. A fab consumes enormous volumes of ultra-pure nitrogen, plus a cocktail of specialty gases for etching and deposition. It’s extremely tough to run a fab without having a dedicated onsite gas system.

Why this matters

Industrial gases are hardly glamorous. You don’t see ads for them. You don’t buy them off the shelf. But without them, steel doesn’t flow, chips don’t print, hospitals don’t function, colas don’t fizz, and many other industries will simply shut down.

The next time you see a cryogenic tanker on the highway, you’ll know it’s not just a truck. It’s a piece of the hidden plumbing that keeps the economy alive.

Tidbits

Apple’s iPhone 17 launch is historic — all U.S.-bound models are now made in India, showing how Apple is reworking its supply chain amid U.S.–China tensions. Experts say India is emerging as a key hub, though tariffs and costs remain challenges. We’ve covered this before here and here

Source: https://restofworld.org/2025/is-apples-iphone-17-launch-a-win-for-india-we-asked-experts/

India is unlikely to introduce a full crypto law, a government document shows, fearing regulation would grant legitimacy and create systemic risks. Instead, it will maintain partial oversight, relying on taxes and existing rules to deter speculation. Officials also worry stablecoins could undermine UPI and fragment the payments system.

IDBI Bank has once again moved the NCLT against Zee Entertainment, seeking insolvency proceedings over a ₹225 crore default linked to Siti Networks. ZEEL has called the plea “malicious” and noted that earlier applications were dismissed by both NCLT and NCLAT. We’ve already covered the entire Zee saga in detail here.

- This edition of the newsletter was written by Manie and Krishna

Have you checked out Points and Figures?

Points and Figures is our new way of cutting through the noise of corporate slideshows. Instead of drowning in 50-page investor decks, we pull out the charts and data points that actually matter—and explain what they really signal about a company’s growth, margins, risks, or future bets.

Think of it as a visual extension of The Chatter. While The Chatter tracks what management says on earnings calls, Points and Figures digs into what companies are showing investors—and soon, even what they quietly bury in annual reports.

We go through every major investor presentation so you don’t have to, surfacing the sharpest takeaways that reveal not just the story a company wants to tell, but the reality behind it.

You can check it out here.

Introducing In The Money by Zerodha

This newsletter and YouTube channel aren’t about hot tips or chasing the next big trade. It’s about understanding the markets, what’s happening, why it’s happening, and how to sidestep the mistakes that derail most traders. Clear explanations, practical insights, and a simple goal: to help you navigate the markets smarter.

Check out “Who Said What? “

Every Saturday, we pick the most interesting and juiciest comments from business leaders, fund managers, and the like, and contextualise things around them.

📚Join our book club

We've started a book club where we meet each week in JP Nagar, Bangalore to read and talk about books we find fascinating.

If you think you’d be serious about this and would like to join us, we'd love to have you along! Join in here.

Subscribe to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Thank you for reading. Do share this with your friends and make them as smart as you are 😉

Your exploded pie chart -3D looks no nice. Which library do you use?