The off-shore casinos that want your life’s savings

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and watch the videos on YouTube. You can also watch The Daily Brief in Hindi.

In today’s edition of The Daily Brief:

SEBI shuts down OctaFX India

Is Tesla too late for India?

SEBI shuts down OctaFX India

Last week, SEBI passed a settlement order which, on the surface, might look routine. But once you look closely, it reveals a lot about how shady forex platforms have been exploiting regular Indians — and how regulators are finally starting to crack down.

The case involves a company called Tauga Private Limited. But even if that doesn’t ring a bell, you might remember the other name this company went by: OctaFX India Private Limited. You’ve probably seen their ads. It has cricket players telling you how easy it is to make money trading forex. They showcase expensive cars, foreign vacations, and people claiming they turned a few thousand rupees into lakhs overnight — all by trading currency from their phones.

Sounds tempting? Well, that’s what makes this story important.

The regulatory switch-a-roo

OctaFX India, on paper, was a SEBI-registered stock broker.

At the same time, though, it was also linked to an unauthorized forex trading platform — OctaFX.com — and its associated trading app. Its SEBI license, in other words, was a cover to find clients for an entirely different business; one that SEBI didn’t even govern in theory.

To understand how wrong that is, imagine a certified dentist taking using their license and degree to secretly refer their clients to an unlicensed neurosurgery practice. They had a licence, and that gave them credibility — but they used that credibility to do something they just weren’t allowed to do.

The SEBI proceedings

Back in 2022, SEBI had asked BSE to dig through OctaFX’s online trading platform. BSE looked into the matter, and what it saw seemed unusual. So, in March 2022, BSE wrote to SEBI, flagging what looked like illegal activity. SEBI then dug further, and things just seemed impossible to ignore: OctaFX India was promoting illegal forex trading.

When prodded, initially, OctaFX India tried denying any relationship with the unauthorized platform. But eventually, it agreed to settle. It paid ₹32 lakh in settlement charges, surrendered their broker licence, and accepted a one-year ban from accessing the securities market. They’re also barred from applying for any SEBI registration for the next five years.

In other words, SEBI basically shut them down. But that’s just one part of the story.

Forex trading

To really understand what happened, you need to know how forex trading is regulated in India.

All foreign exchange trading by Indian residents is primarily regulated by the Reserve Bank of India (RBI). If you’re exchanging currencies while in India, you’re doing so under RBI’s rules. SEBI looks over some forex derivative trading, but even there, the RBI sets the limits of what you can do.

Now, the RBI doesn’t control what happens in the rest of the world, so offshore forex platforms don’t come under the regulator. But it can still ban Indians from going there. That’s why the RBI maintains a public list of unauthorized forex trading platforms that Indians should avoid. Indian residents trading on such platforms, it clarifies, are violating the Foreign Exchange Management Act, or FEMA.

OctaFX has been on that list since 2021.

That hasn’t stopped such platforms from going after Indian customers, of course. They would regularly run prime-time ads, using Bollywood celebrities and cricket stars to promote their apps. That would draw many to these illegal platforms in the hope of making a quick buck.

If anything, these platforms have become more attractive than ever, off late.

Until recently, retail investors could earlier trade currency futures and options on NSE and BSE. They could speculate on currency pairs like USD-INR or EUR-INR without needing a specific reason. But that changed in January 2024, when the RBI issued a circular which completely altered things.

These new rules said: you can only trade currency derivatives if you have a genuine underlying exposure. That is, these markets were only open to those that were hedging themselves against a bigger risk. This market was open, for instance, to an exporter that wanted to hedge their business against rupee depreciation, or an importer worried about rising dollar costs. But it wasn’t open to anyone that just wanted to make money.

In short, speculation, even on this regulated platform, was banned. This was only a market for those with real, business-related needs.

The effect was immediate. Volumes on NSE and BSE’s currency derivative segments dropped sharply. Retail forex trading — at least the legal kind — became practically non-existent overnight.

But while the RBI was clamping down on speculation in the regulated ecosystem, these offshore platforms were doing the exact opposite. They were taking in any customer they could get. They aggressively promoted wild speculation, and the sheer scale of leverage they offered was unheard of.

Contracts for difference

All of this was based on something called CFDs — or ‘Contracts for Difference’.

This isn’t like trading stocks or even currency pairs. In a CFD, you’re not actually buying any asset. You’re purely betting on whether the price of something will go up or down.

What’s worse? This doesn’t work like a market at all. While these platforms look like legitimate trading interfaces, the whole deal is structured like a casino. In fact, your trade never even goes to an exchange. They might show you charts, order flows, and even "order executed" notifications, but none of it is real. The platform doesn’t pair you with someone taking the opposite position as you. There’s no counterparty except the platform itself.

Like any casino, the house always wins. Most retail traders, as you probably know, lose money. So, when they make a bet, the platform quietly takes the other side of the bet. If you lose, they win.

They pull you in through leverage. On some of these platforms, they offer 500x or even 1000x leverage. That means for every ₹1 you put in, you can trade as if you had ₹500 or ₹1000. But that also means a 0.1% market move against you can wipe out your entire position. One bad move and you lose everything.

These platforms know that. So they sweeten the deal by giving you “bonus” or “seed” money — often $1,000 or more — to start trading. You can’t withdraw this money, but you can use it to place trades. With that kind of leverage, even a small win hits like a drug. It feels like you’re making money out of nothing.

That’s what gets you to start investing your own money. And that’s when the losses begin.

Only, once the money’s gone, there’s nothing you can do. There’s no one to call, no real grievance mechanism, and no regulatory oversight.

The danger of unregulated platforms

In 2020, our founder, Nithin Kamath, wrote a blog post breaking all of this down. Many such platforms, he wrote, had approached Zerodha to offer CFDs as well. He refused — ultimately, when customers lose, the platform profits. It could make us money, but that’s not who we wanted to be.

Elsewhere, though, it’s happening at scale. Teachers, IT professionals, students — all sorts of people invest their life’s savings, hoping to see them multiply — only to end up with nothing. Your life’s work can literally disappear within seconds.

These platforms even drew the attention of the Enforcement Directorate. They’ve raided offices and frozen accounts — but there’s a limit to what they can do. These platforms are often based in jurisdictions like Cyprus or Malta. By the time any action is taken, the money has already moved overseas, beyond the reach of Indian regulators.

Amidst this, the OctaFX case is a rare victory for Indian law. It shows that even a SEBI-registered broker isn’t immune. If you’re helping promote or enable these unauthorized platforms, you’ll be held accountable. The ₹32 lakh fine, the five-year registration ban, the shutdown of OctaFX India — all of this sends a clear message to other brokers: don’t mess around.

Ultimately, though, these platforms are slippery. They’re built to evade the law, and they’ll keep coming up again. The only real protection is awareness.

Remember, if someone offers you a trade that’s too good to be true, it probably is.

Tesla enters India… but is it too late?

Last week, one of India’s richest areas — Mumbai’s Bandra-Kurla Complex — welcomed a new resident: Tesla.

After a long wait, Tesla opened its first showroom in India, and began taking in orders for its “Model Y”. But more than the car, the focus was on its price tag — a whopping ₹60 lakh. This was, clearly, only meant for India’s most affluent.

Behind its entry, though, is a long story.

Consider this: the Indian subsidiary of Tesla was officially launched in 2021. But over the last few years, it has been locked into a tough negotiation with our country. They lobbied for lower prices. We asked for Tesla cars made within our borders. Tesla’s entry, now, signals a detente between the two sides.

But this story isn’t just about Tesla. It’s equally about India’s car buyers, foreign automakers, and our ambitions to build a robust car industry.

Building Indian auto with foreign help

Importing a foreign car has always been hard in India. Compared globally, India has generally levied some of the world’s highest import tariffs on cars — even going as high as 110%.

Why? Industrial policy, of course.

One sector that’s always been at the heart of Indian industrial policy — before and after liberalisation — is automotives. Our government always wanted to keep foreign auto manufacturers from capturing our massive market before our own carmakers could catch up. Instead, we tried getting them to bring their expertise to India. With import tariffs, we created incentives for foreign carmakers to invest in Indian factories. That was the only way they could escape those duties. To sweeten the pot, we would also give them lots of subsidies and tax breaks.

That is how carmakers that we practically consider Indian, like Maruti Suzuki, first set up shop here.

After the 1991 market reforms, although the government aggressively courted foreign investment into India, we still kept auto tariffs high. We made it easier for them to come in. We removed various limits for investors to pour in money — firms faced far fewer rules to source auto parts locally, the maximum cap on foreign equity was gradually upped to 100%, tax breaks and so on. But it was always clear: India wanted its own auto manufacturing industry.

And global automakers came thronging to set up shop. They would often import parts from outside, and assemble the final car in India. These industries all clustered in a few parts of India. Chennai, in fact, was likened to Detroit at its peak.

Despite the more favorable investment climate however, sometimes, our laws were just too restrictive. Many car companies that came in suffered high-profile failures, causing them to exit their India business entirely.

India’s graveyard of foreign cars

Consider Ford.

In 1995, Ford entered India, spinning off its own subsidiary by 1998. However, their entry was based on a faulty assumption: that the Indian consumer would buy what they already sold; that there was no need to change their cars.

That wasn’t what India wanted, however. In the 2000s, we flocked to buy smaller cars. We wanted a lot of bang for our buck, and we wanted to know that we could sell our cars second-hand. And most importantly, those cars needed to be suited to Indian roads.

Ford neglected this, and hit many bumps in their journey to sell in India. It entered with the Ford Escort, a large, expensive sedan that was built for driving on the right side of the road. It didn’t fare well. Eventually, Ford embraced smaller, India-specific models like the Ikon. But it was still too expensive to maintain, with pricey spare parts that were rarely available. Their competitors, like Maruti-Suzuki and Hyundai, had wider, cheaper product lines.

Eventually, Ford ran out of steam, and in 2021, it made its exit. This left thousands of workers jobless, and plenty of car dealers unhappy with how these exits spoiled their own investments.

This is just one story. General Motors, Fiat, Daewoo, Mitsubishi — there’s a long list of companies that failed to make the slightest dent in our tough, highly-competitive market.

An unbroken deadlock

Where all these have failed, can Tesla do any better?

If anything, Tesla has entered India at a much more significant disadvantage compared to companies like Ford. The Model Y has been slapped with a whopping 70% import tariff. That’s why the retail price is so high.

Tesla, of course, has been lobbying for lower import duties, so that it can prove that there’s a market for its cars in India. Elon Musk has even expressed his unhappiness at our tariffs before.

But that isn’t easy; India is committed to its industrial policy. The only way Tesla’s cars get cheaper is if it starts manufacturing in India. That’s the base condition for any tariff cuts. The Indian government promises much lower import duties — 15% — to all foreign EV manufacturers. But in exchange, they must fulfil 3 major conditions:

Invest at least $500 million in India within 3 years.

Achieve 25% domestic value-addition by year 3 of operations, and 50% by year 5.

Post a bank guarantee equivalent to the total duties foregone over 5 years (or $500M, whichever is lower), which can be seized on non-compliance.

These conditions, if anything, are certainly stricter than anything Ford had to face. They mark a shift in how India has decided to approach foreign carmakers. Earlier, incentives were offered to encourage foreign auto-makers to achieve targets. But now, the script has flipped on its head — incentives will only be provided if those targets are met.

Will Tesla agree to these terms? That seems unlikely. Union Minister HD Kumaraswamy said, last month, that Tesla is still unwilling to set up a manufacturing unit in India.

So far, Tesla’s playbook seems like that of Ford from two decades ago. Tesla is using global designs for its India entry. It hasn’t made India-specific modifications — perhaps because they don’t have an Indian manufacturing unit. It is also making only one model available in India right now, while generally sporting a limited portfolio of models.

But can Tesla succeed where Ford didn’t?

A luxury market play

Tesla has one thing that Ford did not. It’s betting on India’s growing population of millionaires. India now has a constituency for luxury cars that just didn’t exist before.

Luxury car sales in India crossed 50,000 units last year, growing at 20% — double the pace of mainstream cars in 2023. That same year, Mercedes-Benz India recorded its highest annual sales in India. And they still seem to have pricing power. In fact, the average selling price of their cars, in India, has gone up from ₹57 lakh to ₹88 lakh since 2020.

And within the luxury segment itself, EVs are doing pretty well. Between January and May 2025, luxury EV sales surged by 66%, accounting for 11% of all luxury car sales. This growth is happening despite import duties — which are much higher for luxury cars than mainstream ones.

This is the wave Tesla thinks it can ride. They’re so confident, in fact, that they’re willing to build their own EV charging stations in tier-1 Indian cities, promising 4 in Mumbai.

Is this hope justified?

At its current price point, not only is Tesla not competing with Indian EVs, it’s also steering clear of other foreign mass EV-makers like BYD. The Sealion 7, BYD’s most expensive offering in India, is still 6 lakh lower than Tesla’s cheapest offering, while the price of the best version of Tata Harrier falls within 30 lakh.

Industry experts believe that Tesla is relying on its brand name rather than its features to do the heavy-lifting. Elon Musk’s name, it bets, can draw a crowd. Moreover, Indian consumers are uncomfortable buying Chinese cars — Tesla’s biggest rivals — due to tensions between both countries. Tesla is betting that these will, together, allow it to fetch a premium.

But with such a strategy, it’s essentially focusing on an extremely small population of India. And it’s arguably not catering to their needs either. It’s yet to build service centers in India. Meanwhile, getting to the larger market of middle-class Indians is a different ballgame, which it isn’t even trying to play.

Tesla’s biggest hope….India?

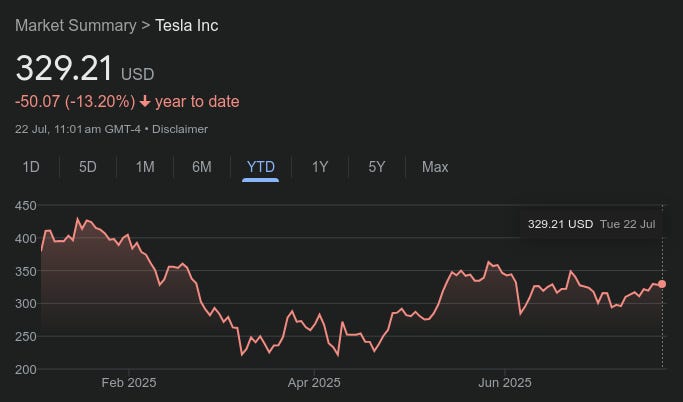

Outside India, a storm threatens to engulf Tesla.

The company’s share of global EV sales has been falling rapidly. Even in its home country, the US, its electric vehicle market share has fallen from 75% in 2022 to 50% in 2024. This year, it recorded one of the biggest sales declines in the company’s entire history, while marking its first-ever decline in back-to-back years. Profits have crashed by a scary 71% since last year, as Chinese EV companies fight tooth-and-nail by cutting costs and starting price wars globally. Tesla’s inventory, in fact, is full of unsold cars.

At one point, its stock fell so severely that JPMorgan said that it can’t find a similar instance in the entire history of cars.

Tesla needs to tap into a new, big market, and fast. After China, India is probably its only hope. If anything, Tesla is probably more dependent on India than the other way round.

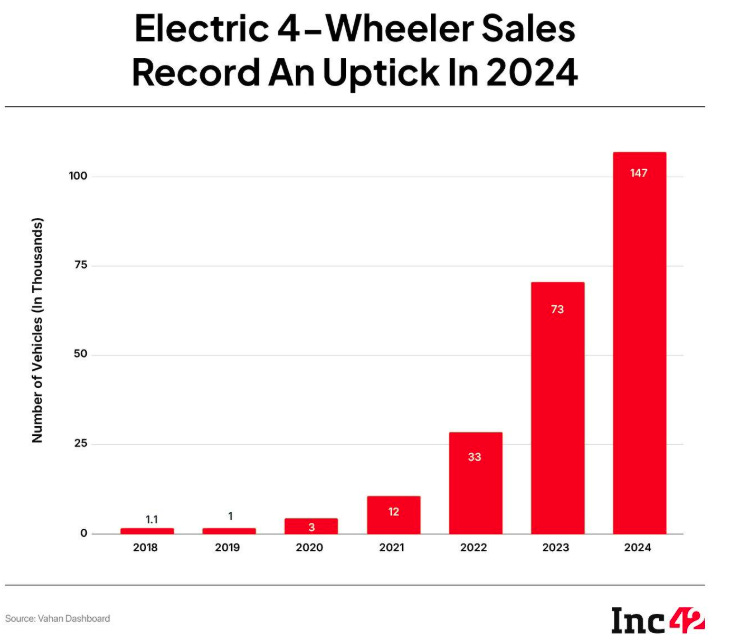

Meanwhile, India’s policy towards EVs has been working well. Earlier, we covered India’s FAME scheme for homegrown EVs, which have contributed to a 2x jump to nearly 1.5 lakh four-wheeler units sold. Companies like Tata and Mahindra were big beneficiaries of this scheme, and are now major players in the space. Meanwhile, a company like JSW-MG Motors practically emerged as another key player from nowhere.

Our EV scheme has since evolved to allow more foreign competition. But while Tesla hasn’t taken advantage of it yet, other foreign companies are doing exactly that. There’s a lot of interest from companies like Skoda, Volkswagen, Hyundai and Kia. Many of them also enjoy strong customer loyalty, with a strong track record in our mass-consumer market.

Does Tesla risk being late to India’s EV gold rush? This could well be one of the most important questions for the company’s survival.

Tidbits

China’s rare earth squeeze just got worse.

Foxconn’s AirPods plant in Telangana is facing production disruptions — and the culprit is dysprosium. Dysprosium, one of the seven rare earth elements now under China’s export control, is a key component in the magnets used inside AirPods.

While Foxconn has downplayed the disruption, reports say the company has flagged the issue to the Telangana government and sought help securing End User Certificates (EUCs) — the paperwork China now demands for approving rare earth exports.

Source: Business StandardIndia’s clean energy surge is real — but so is the coal reality.

In a bright spot, India added a record 22 GW of renewable capacity in the first half of 2025 — up 56% from last year. That’s brought India’s total non-fossil energy capacity above fossil fuels for the first time. It’s a major milestone for a country trying to hit 500 GW of clean capacity by 2030.

But before we celebrate, here’s the catch: capacity is not generation. Despite the optics, coal still powers nearly 75% of India’s electricity. That dominance will remain unless there’s massive, urgent investment in energy storage and grid upgrades to handle intermittent solar and wind.

Source: BloombergPutting a pause on the Jane Street saga (for now):

SEBI has lifted trading restrictions on U.S. firm Jane Street after the company deposited $567 million into an escrow account. The firm is now allowed to resume trading, excluding options, while SEBI continues its investigation into alleged market manipulation.

Source: ReutersWe love talking about industrial policies here.

Delhi's government has unveiled a draft industrial policy for 2025–35, aiming to boost the service sector through a ₹400 crore venture capital fund and capital investment reimbursements. The policy targets frontier tech, R&D, and hospitality, offering incentives like GST reimbursement and subsidies to promote a business-friendly environment.

Source: Times of India

- This edition of the newsletter was written by Anurag, Bhuvan & Manie

📚Join our book club

We've started a book club where we meet each week in JP Nagar, Bangalore to read and talk about books we find fascinating.

If you think you’d be serious about this and would like to join us, we'd love to have you along! Join in here.

🧑🏻💻Have you checked out The Chatter?

Every week we listen to the big Indian earnings calls—Reliance, HDFC Bank, even the smaller logistics firms—and copy the full transcripts. Then we bin the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

“What the hell is happening?”

We've been thinking a lot about how to make sense of a world that feels increasingly unhinged - where everything seems to be happening at once and our usual frameworks for understanding reality feel completely inadequate. This week, we dove deep into three massive shifts reshaping our world, using what historian Adam Tooze calls "polycrisis" thinking to connect the dots.

Frames for a Fractured Reality - We're struggling to understand the present not from ignorance, but from poverty of frames - the mental shortcuts we use to make sense of chaos. Historian Adam Tooze's "polycrisis" concept captures our moment of multiple interlocking crises better than traditional analytical frameworks.

The Hidden Financial System - A $113 trillion FX swap market operates off-balance-sheet, creating systemic risks regulators barely understand. Currency hedging by global insurers has fundamentally changed how financial crises spread worldwide.

AI and Human Identity - We're facing humanity's most profound identity crisis as AI matches our cognitive abilities. Using "disruption by default" as a frame, we assume AI reshapes everything rather than living in denial about job displacement that's already happening.

Subscribe to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Thank you for reading. Do share this with your friends and make them as smart as you are 😉

Musk is certainly late in entering India. I remember Daewoo cars in early 2000's. If possible can you analyze its business and write why did it burst its business? His owner had very humble beginnings like Hyundai, still failed. Thanks

Excellent... Den do you have a substack for topics covered in hindi ??