Reliance takes big swings this quarter

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, we’ll tell you why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and watch the videos on YouTube. You can also watch The Daily Brief in Hindi.

In today’s edition of The Daily Brief:

How did Reliance do this quarter?

Major changes are coming for mutual funds

How did Reliance do this quarter?

There are very few companies in India that touch as many corners of our daily life as Reliance does.

From the fuel that powers our cars to the internet that powers our phones, from the food in our kitchens to the clothes we wear: Reliance is everywhere. Which is why, its quarterly results aren’t just about itself — to a degree, it also tells us how the Indian economy itself is moving.

Reliance recently announced its results for the second quarter of FY26. This has been another good quarter for the giant, reporting a consolidated revenue of roughly ₹2,80,000 crore, up 10% from a year ago. The quarter’s PAT stood at ₹22,092 crore, a rise of 14.3% year-on-year.

But Reliance shouldn’t be looked at as a single business. It’s a machine made up of many cogs, each moving with its own rhythm and responding to very different forces. To really understand what’s going on, it’s looking under the hood to see each cog.

With that, let’s start with the cog that (still) brings in the lion’s share of revenue: the old but critical Oil-to-Chemicals (O2C) business.

Oil-to-Chemicals (O2C)

This is where crude oil comes in, and is turned into everything else: like fuel for vehicles, or plastics, or even the materials for textiles and detergents. The O2C business runs one of the world’s largest refineries in Jamnagar, turning it into petrol and diesel that it sells through Jio-bp stations across India.

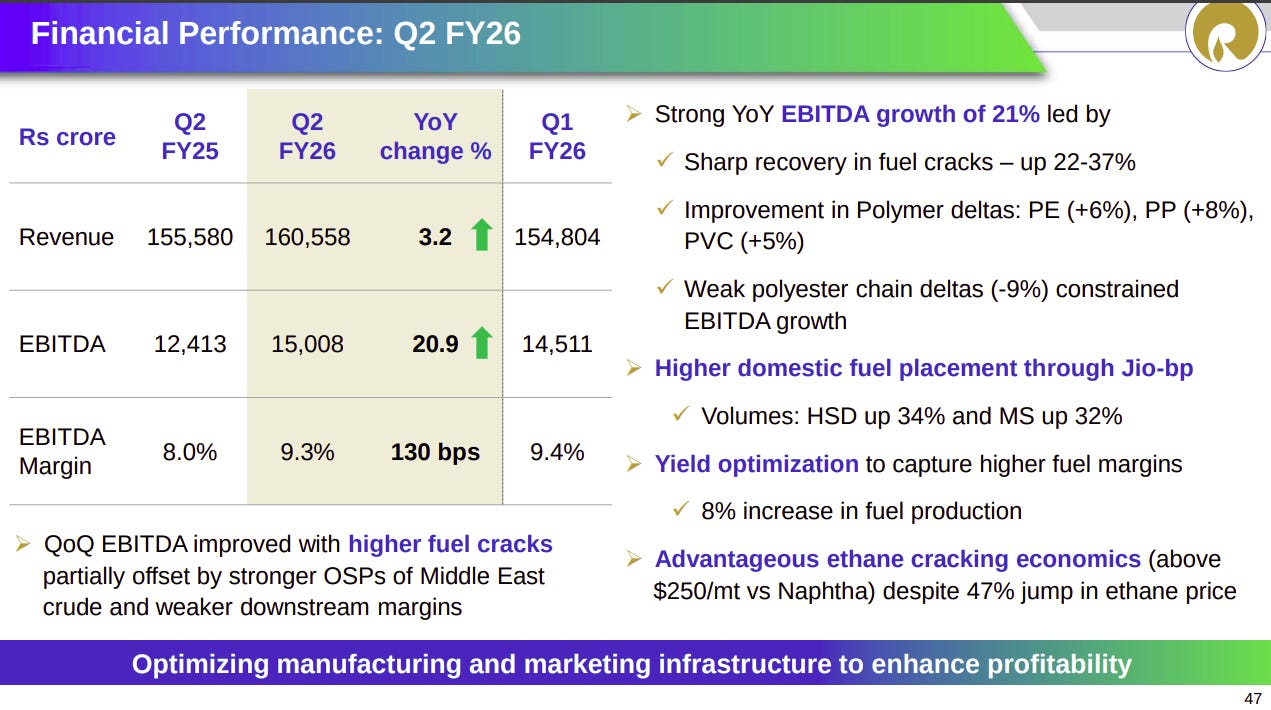

This quarter, O2C’s revenue stood at about ₹1.6 lakh crore, up 3.2% from last year. Its EBITDA, however, grew by a whopping ~21% as margins on gasoline, diesel, and jet fuel rose sharply. These margins rose because globally, oil supply stayed tight while demand stayed strong.

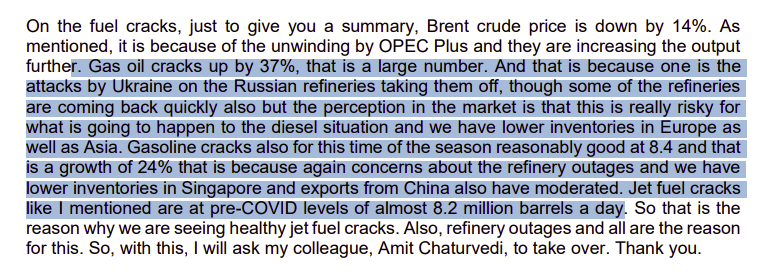

That dynamic, actually, should tell you the state of global oil trade today, which is buzzing with activity. Disruptions at Russian refineries pushed down the world’s diesel exports, China trimmed its own product shipments, and European diesel inventories ran low. Even as crude oil got cheaper, refiners were making more money per barrel of product, lifting margins everywhere.

Yet, Reliance benefited much more by playing it smart. Instead of chasing exports, the company channelled more of its fuels into India, where demand was strong and margins steadier. It could avoid export taxes and cut shipping costs while exposing the company to a market that was still growing fast and was willing to pay for energy. Its diesel sales were up 34% while petrol was up 32%, helped by the Jio-bp network.

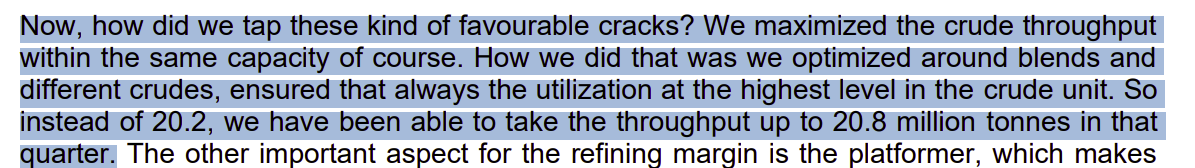

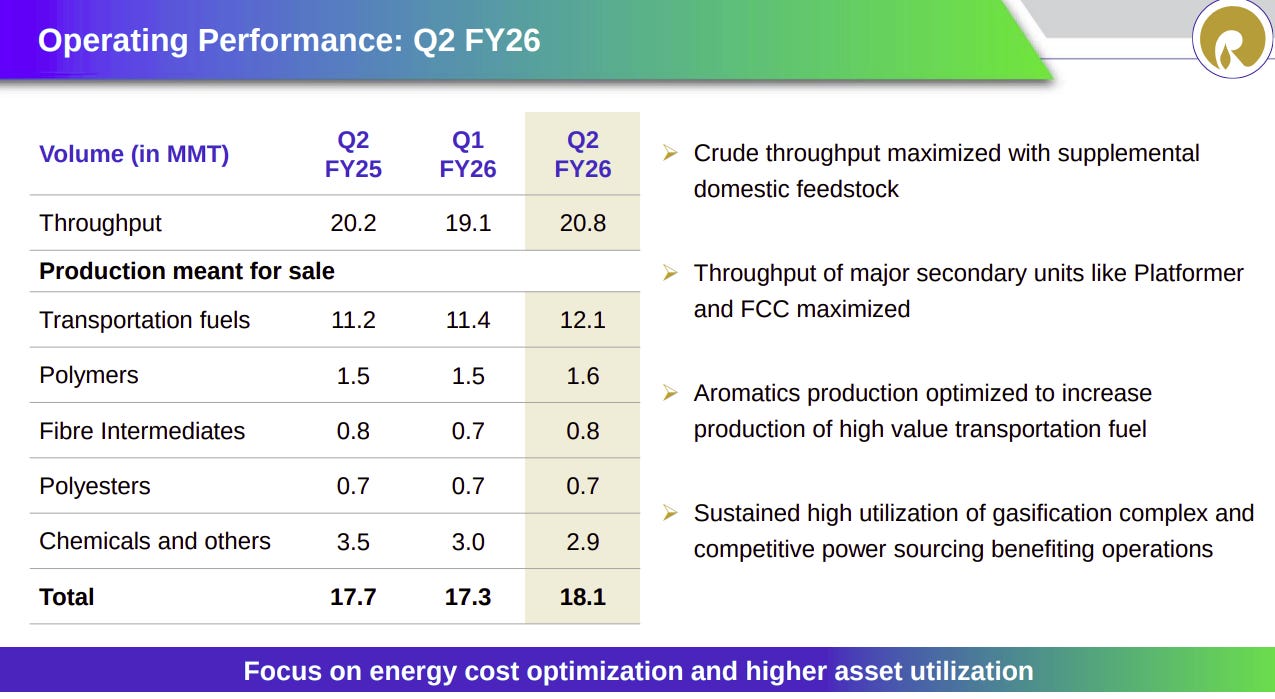

Reliance also ran its refinery more efficiently this quarter. It processed a little more crude — 20.8 million tonnes against 20.2 a year ago — by tweaking the mix to get a higher yield of petrol and diesel. Here’s what the management said:

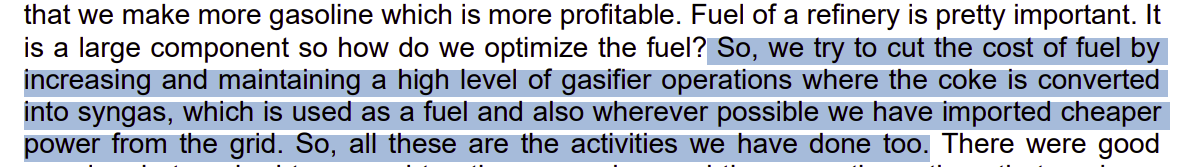

The idea was simple: turn more of each barrel into the fuels that were making the most money. It also found ways to cut costs of running the refinery by using gas made from refinery waste, as well as buying cheaper power from the power grid.

That said, there were parts of its petrochemicals business that didn’t hold up as well. The polyester side of the business, in particular, stayed weak as global textile demand remained soft. Better polymer margins, however, helped make up for the low volumes.

All-in-all, however, O2C is a stable, mature business. The more interesting business line, however, was retail.

Reliance Retail

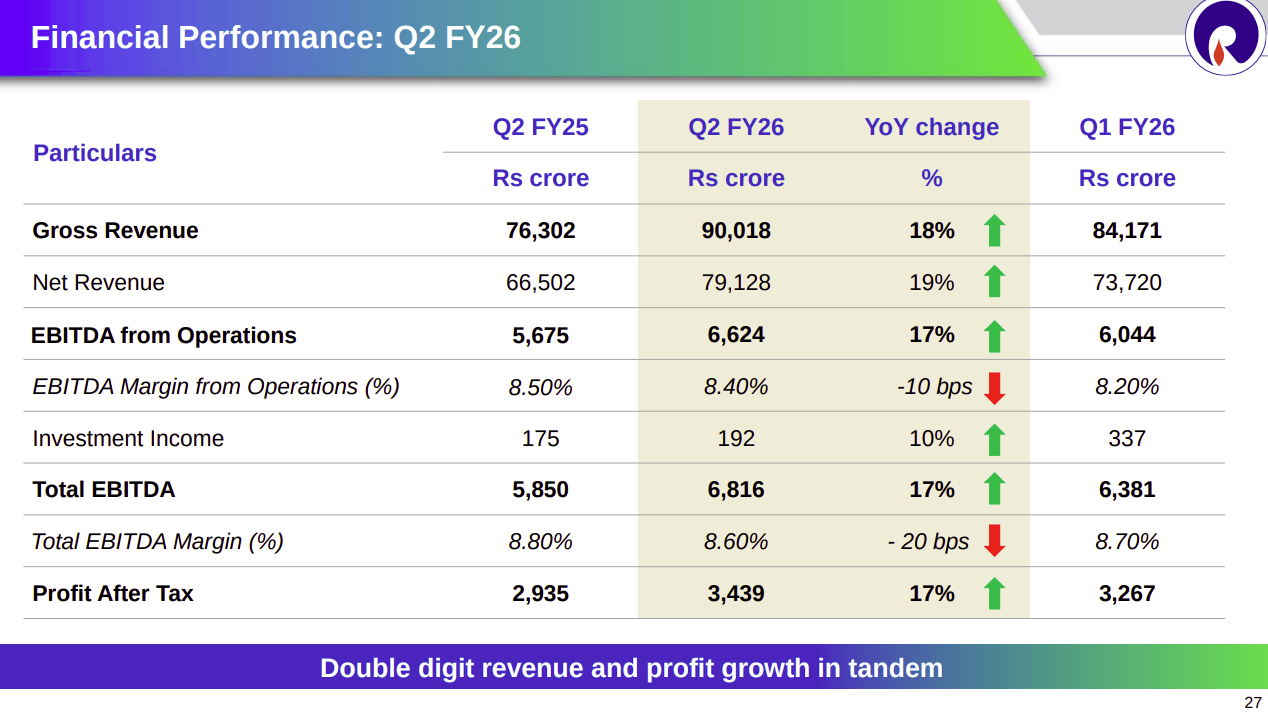

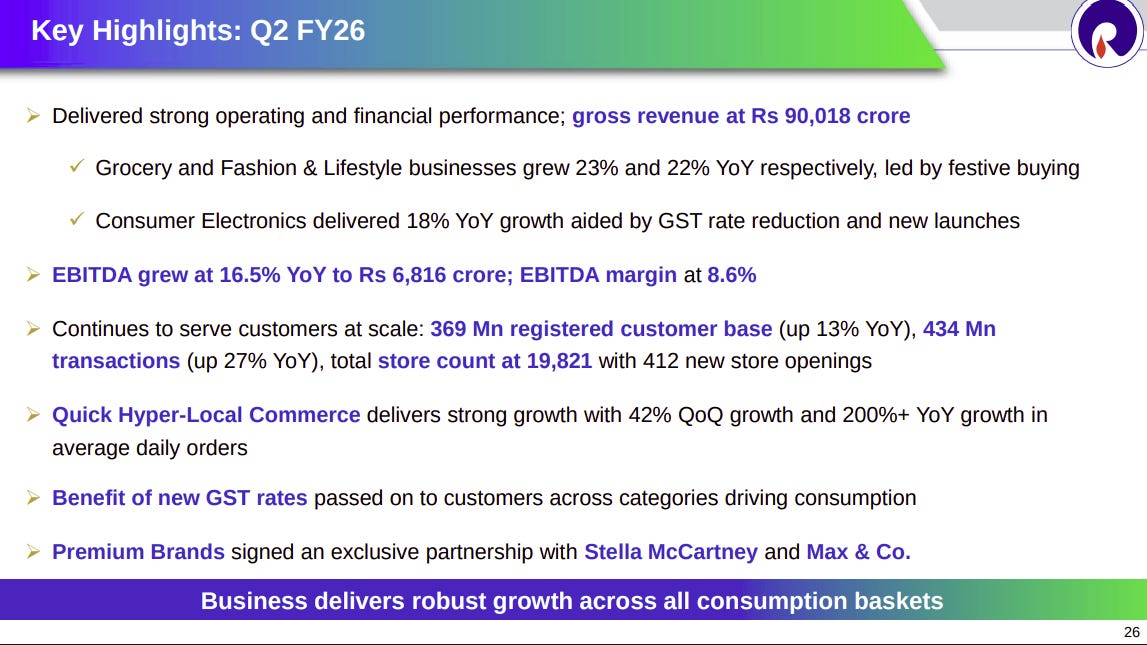

This is one segment that everyone likes to keep an eye on because of how interesting it is. This quarter, Reliance Retail clocked around ₹90,000 crore in gross revenue (i.e., revenue before discounts, returns) up 18% year on year. PAT came in at around ₹3,400 crore, up 17% from last year.

It’s hard to appreciate just how massive and sprawling this vertical of Reliance is. For context, it has 19,000+ stores across the country. Through these, Reliance sells everything from vegetables to jewellery.

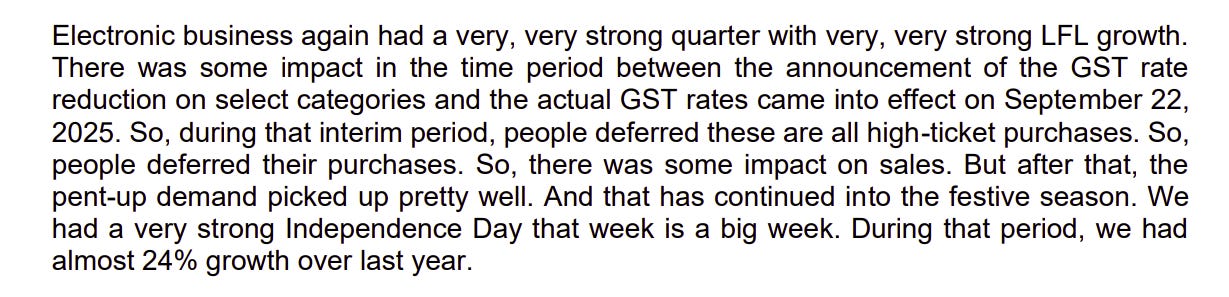

Across segments, the company’s retail business performed exceptionally well. Its grocery arm grew 23% and fashion and lifestyle 22%, lifted by an early festive season and better footfalls. Electronics jumped 18%, helped by the GST rate cut on some appliances and a wave of deferred purchases.

Much of this serves pent up demand. Reliance’s management says that many customers who had held off big buys in the summer came back for upgrades and new launches once discounts and festivals began.

Within grocery, Reliance’s own-label consumer products (like Campa Cola and Independence) have done an impressive ₹5000+ crores in gross revenue this quarter. The products benefited from Reliance’s own distribution network in JioMart and kirana partnerships. Reliance is also trying out premium formats of grocery stores through the Freshpik brand.

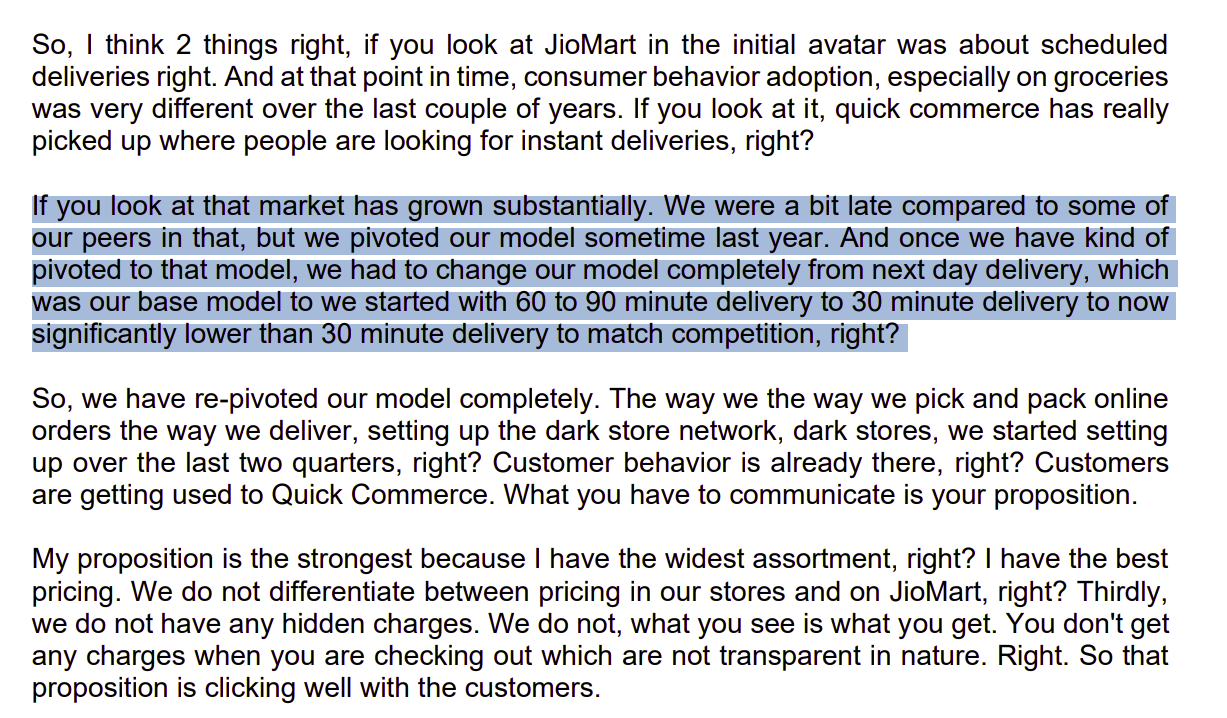

At the other end, Reliance is in the process of re-pivoting JioMart into a full quick-commerce model. From delivering groceries in an hour or more, the service has been rebuilt for sub-30-minute delivery. The management called this a “structural shift” in the grocery model — a permanent change in how it fulfils orders.

We wrote in much more detail about the quick commerce side of Reliance’s business in our Saturday show: Who Said What. Do check it out!

The jewellery business also stood out. Reliance reported steady performance despite sky-rocketing gold prices, with the average bill value up 52 % year-on-year. The jump wasn’t from people buying heavier jewelry — it was mostly the price of gold itself. With prices up sharply, the average bill got bigger even though volumes fell, and many customers simply exchanged old gold instead of buying new.

That surge came from customers trading up to heavier, higher-value pieces even as overall volumes softened. The company said its old-gold exchange share rose to 32.5 % from 21.9 % a year ago — meaning more shoppers are swapping older jewellery for new designs.

Jio Platforms

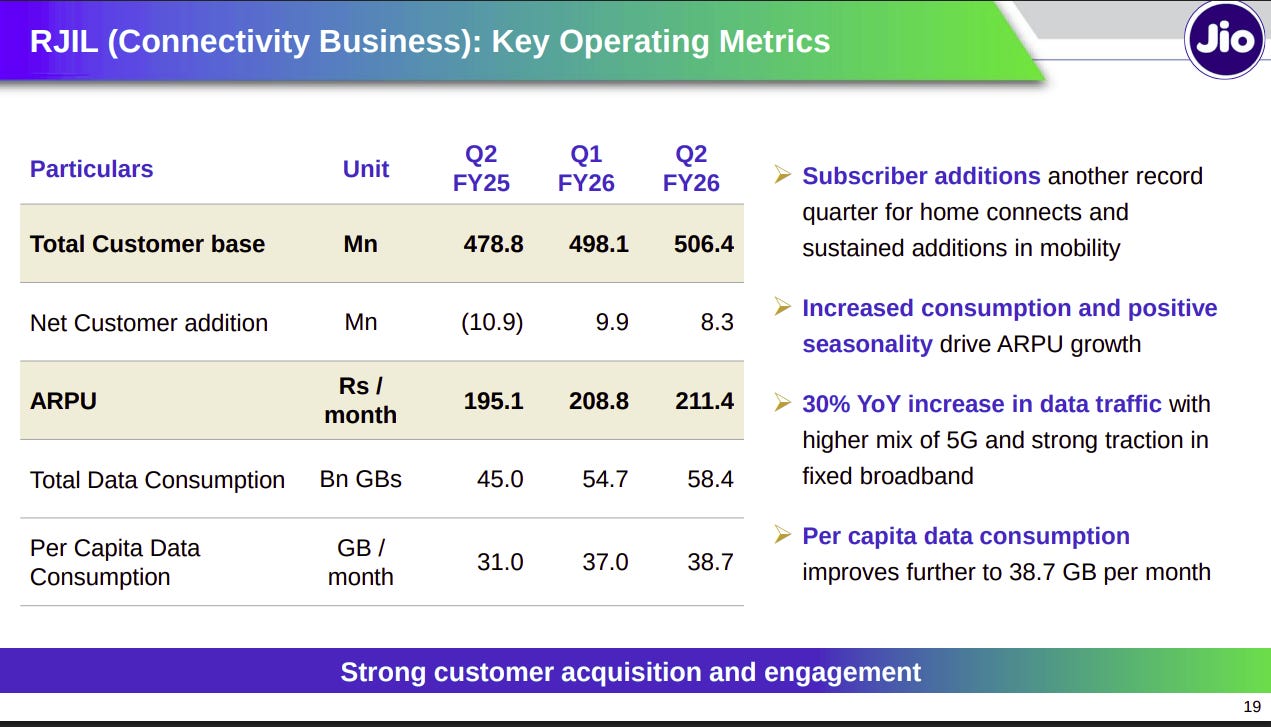

Now, let’s look at the telecom side. Jio Platforms’ operating revenue for this quarter came in at ₹36,332 crore, up 14.6% year on year, while net profit stood at ₹7,375 crore, up 12.8%.

This surge in revenue comes from two factors. One, the company has added 8.3 million new subscribers this quarter, taking its total base to 506 million. But secondly, each customer is also paying more, as Reliance increased its average revenue per user (ARPU) to ₹211.4, from ₹195.1 last year.

In return, people are using Jio’s network more than ever. Data traffic jumped nearly 30% year-on-year. Per-capita data consumption hit 38.7 GB per month — the highest in India’s telecom market. And this is hardly limited to just urban areas; rural data traffic has also grown 2.2× year-on-year.

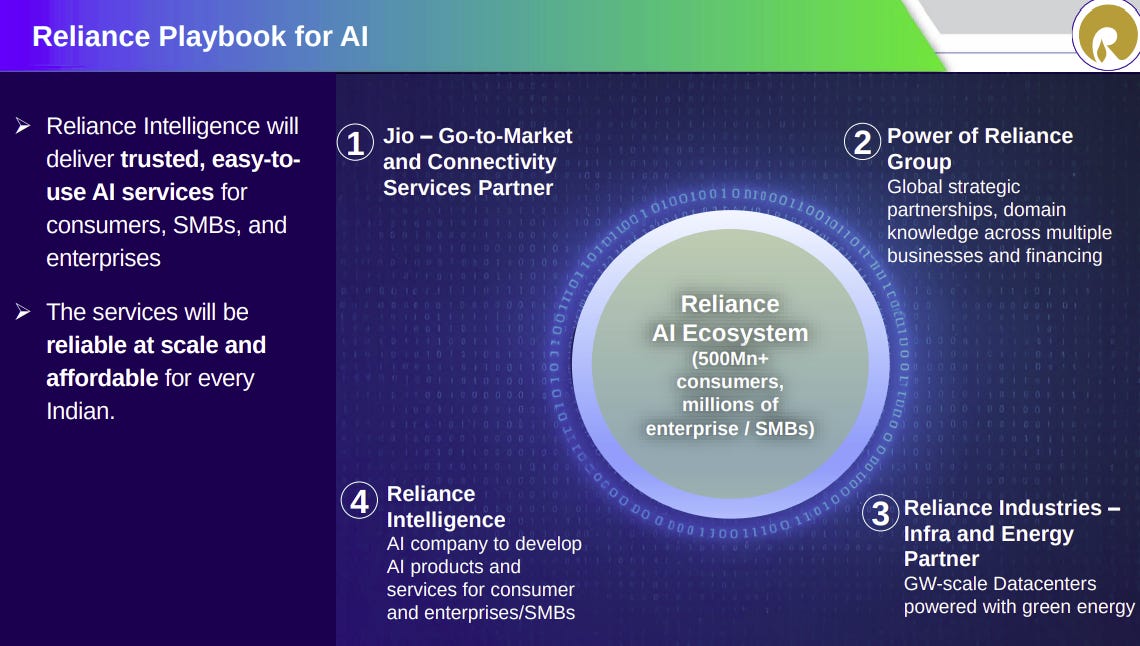

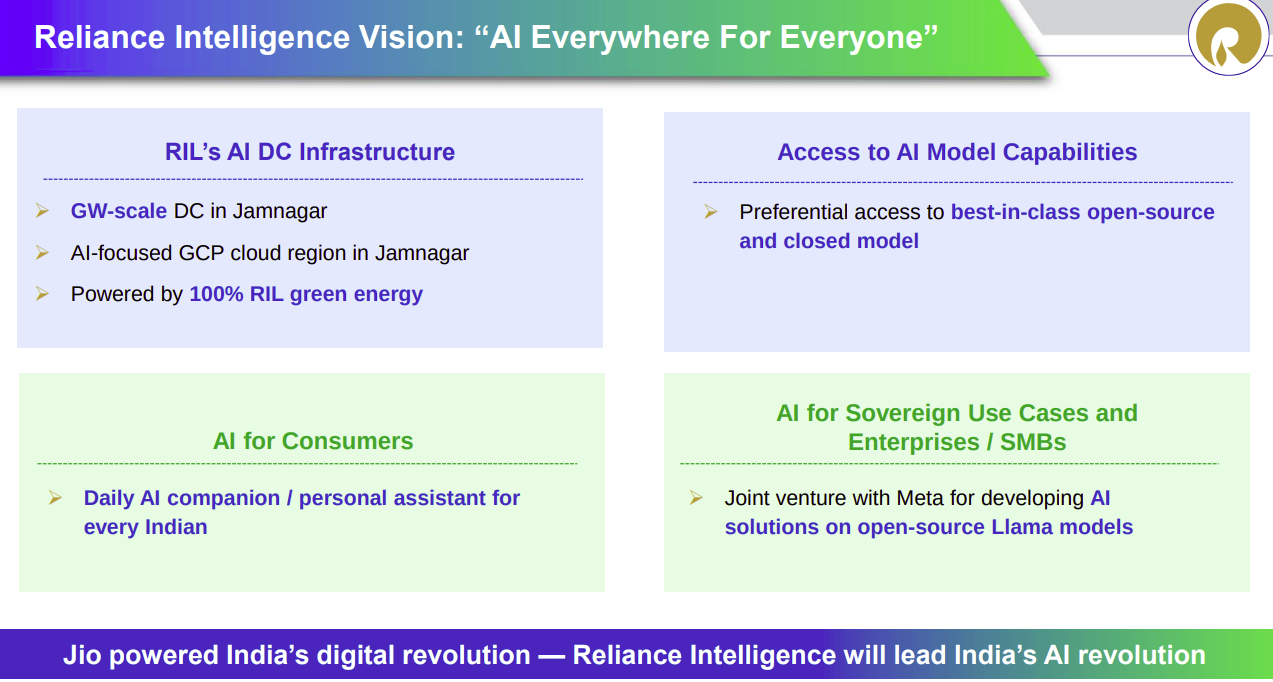

But the company is adding a new feather to its cap, with a new AI division called Reliance Intelligence. It will cater to all things AI and the data infrastructure behind it. Reliance is already building huge data centers in Jamnagar powered entirely by its own green energy. It also aims to develop its own AI products and tools while partnering with OpenAI, Google, and Microsoft.

As Reliance Intelligence focuses on creating AI infrastructure, Jio shall act as the face of the business, delivering those AI tools to customers through its huge network. Meanwhile, Reliance Intelligence might also sell its capacity and software both across the group and to outside clients (like hyperscalers).

New Energy

Meanwhile, Reliance has been making giant moves when it comes to renewable energy. In fact, it hopes to make the New Energy vertical just as big as the O2C business, and this quarter, we got a glimpse of how serious they are about that goal.

At Jamnagar, Reliance is building a solar gigafactory called the Dhirubhai Ambani Green Energy Giga Complex. The factory has already commissioned four module lines, and its first solar cell line will go live soon.

But that is not the only gigafactory — let alone normal-sized factory — Reliance is building. It has been moving fast on a gigafactory for battery energy storage systems (or BESS), which is planned to host 40 GWh of power capacity. That’s enough to store several hours of India’s daily power demand. These batteries will feed both grid storage and other renewable projects.

That’s not all. 400 kilometres away from Jamnagar, in Kutch, Reliance is also developing what could be one of the world’s largest clean-energy sites — a 5.5 lakh-acre stretch of desert land that’s being cleared for solar and wind installations. The company claims to begin solar power generation from the site in the first half of next year for captive requirements.

Reliance is also trying to produce green hydrogen on a commercial scale. We’ve covered how hard it is to mass-produce green hydrogen, but that, it seems, hasn’t stopped Reliance from trying. It has begun pilot production of electrolyser stacks — machines that split water into hydrogen and oxygen.

Unlike the other segments of the conglomerate, the New Energy business doesn’t move the numbers yet. But given the scale of its installations this quarter alone, it’s clear that Reliance thinks that the landscape of Indian energy will massively change in the coming years.

The bottomline

These are the major engines of Reliance today — oil, retail, telecom, and renewable energy. Each sits at a different point in its life cycle: O2C is mature and steady, while Retail is expanding, and AI and New Energy still have a long way to go.

Naturally, there’s a lot more beneath the surface in a huge business like Reliance. However, with the latest results, what we gather is that they’re leveraging their existing strengths and capacity to try and swing big in new, rising sectors.

And they’re well positioned to ride these winds of change. We’re seeing them make early bets in renewable energy, which should power their existing industrial capacity. They also expect their AI bets to benefit from their own telecom network.

If nothing else, these bets are indeed extremely ambitious. It will be really interesting to see how they pan out for Reliance.

Major changes are coming for mutual funds

In a perfect world, mutual funds would be loss-less machines for pooling and investing capital.

You would put your money into the fund’s pool, and all of it would go straight to the markets — with no spillage or friction. Every rupee you invest would buy you a claim on the portfolio’s assets. Nothing would be lost in between.

But, we don’t live in a perfect world. Mutual funds have to pay managers, compliance departments, distributors, brokers, and more. Each of these take a tiny nibble out of your portfolio. Together, these can shave off a good part of the returns you get.

Some of these costs are sensible; they’re the friction inherent to managing and investing large pools of money. Some are not. But to a lay investor, it may not always be clear what these are, let alone if they make sense.

That’s why SEBI constantly looks over these funds’ shoulders. And recently, the regulator proposed sweeping changes to the mutual fund business, the expenses that funds can charge, and what they must tell you. Now, these are mere suggestions; nothing’s in place just yet. But they point to how SEBI is thinking, and the changes it could soon bring in.

There’s a lot we haven’t been able to cover in this piece — we recommend taking a look at the consultation paper for the whole picture. But we’ll cover the changes that matter to you, the investor, the most.

Let’s dive in.

Many changes to TERs

Every mutual fund scheme charges a small amount — like a percentage of your holdings — to manage your money for you. Some of this stays with the AMC itself, as its fee. Some goes into the other expenses it incurs, like registrar charges or overheads. Collectively, this amount is called the fund’s “Total Expense Ratio”, or “TER”.

Fund houses have some incentive to keep these expenses low. Investors compare the expense ratios that different funds charge while considering an investment, pushing funds to compete on how low they can keep them. At the same time, SEBI polices these charges as well, capping the maximum TER a fund can take.

It’s here that SEBI proposes the most far-reaching changes.

For one, SEBI’s asking fund houses to clearly itemise the many extra costs you might incur — expenses, brokerage, exchange fees, and so on. Until now, investors would just be given a partial figure at the outset, with other costs coming as a surprise. These changes, however, could bring more clarity.

But beyond that, there are more significant tweaks in the works.

The statutory payments conundrum

There are some expenses that fund houses have no control over. Some charges go directly to the government through taxes and levies, like GST payments and Securities Transaction Taxes (STT).

Naturally, clubbing these under a fund’s TER makes little sense. The whole idea of a TER cap is to stop AMCs from over-charging investors, not to limit what the government can tax. If a big part of that “expense” is a statutory payment, it confuses things. Suppose the government raises STT — under the old rules, funds had to absorb the extra tax within the same cap, even though the AMC earned no more. And if the government cut STT, there was no clear way to pass savings back to investors.

SEBI sort of acknowledges the issue already. The GST payable on fund management fees, for instance, already lies outside the cap. All other statutory levies, though, are still inside the cap.

But now, SEBI wants to take the next logical step — keeping all statutory levies outside the TER cap. If the proposals go through, investors will soon have a clear idea of what expenses the fund house is actually charging, and what gets paid out to the government.

However, this exclusion doesn’t mean fund houses will get to charge higher expenses. To keep things fair, SEBI also plans to reduce the expense ratio cap slightly. As an investor, going ahead, you should expect to pay roughly the same amount, but you’ll also know better where your money is really going.

Brokerage gets a haircut

Perhaps the most significant change for the industry, however, has to do with brokerage fees — which are charged over-and-above these expense ratios. The scope of those fees is soon slated to come down.

See, whenever a mutual fund buys or sells a stock, it has to pay a small percentage of the transaction value as brokerage fee to the broker that executes the trade. The fund passes on this cost to investors. Under SEBI’s current rules, mutual funds can charge up to 0.12% of every cash-market trade and 0.05% of every derivatives trade to investors, over and above the scheme’s TER.

While studying these, however, SEBI found something odd. Somehow, different sorts of funds were paying wildly different brokerage rates, even though they all had access to institutional brokerage rates.

Take arbitrage funds, that track the prices of the same instruments in different markets — say, between different exchanges, or between the spot and futures markets. When they spot a difference, they mechanically buy it for cheap and sell it higher. These funds were making transactions in bulk, and for those, were paying brokerages of barely 0.01–0.013%.

Other equity funds, meanwhile, were paying five to ten times as much — 0.05-0.12%.

Why the difference? After all, executing a trade took the same amount of money, no matter what your strategy was. SEBI figured that those funds weren’t actually paying to just have their trades executed. They were also paying for all the add-on services that their brokers bundled in — like research reports or analysis.

That’s hardly fair for an investor. After all, why you pay an active manager their fee is precisely because they’re supposed to do all that analysis for you. If the same fund pays a broker for that research, and passes those costs to you, they’re basically charging you twice for the same service.

And so, SEBI proposes to slash the cap on brokerage fees considerably — from 0.12% to 0.02% for equity, and from 0.05% to 0.01% for derivatives. These are the only “brokerage” costs a fund house is allowed to pass to an investor, over and above its own expenses.

This proposal doesn’t mean a fund can’t pay a broker higher rates. But if it does, any additional amount it charges will come under its TER caps. Those extra charges won’t be counted as “brokerage”. For all intents and purposes, brokerage fees will now be limited to not more than the execution costs.

Expect this to hit the bottom lines of brokers with margin institutional businesses. Since every extra rupee above those lower caps will directly eat into their own fee pool, fund houses are likely to press brokerages for better rates. And unless brokerages offer exceptional research, their add-ons might cease to be a major source of revenue.

Performance-based fees

With all these SEBI-mandated caps on fees, you might wonder: what if there’s a fund-house that can legitimately command a bigger fee? What if it has higher expenses, but those translate into better returns? Should they not be compensated fairly?

Well, SEBI wants to open up that option.

Right now, SEBI controls what a fund can charge through a fixed cap. No matter how a fund performs, its manager earns the same fee within that cap. But now, SEBI has proposed a “differential expense ratio”, which will work like a performance-linked fee. This isn’t mandatory; a fund can stick to the old system. But it can also choose to charge investors depending on how well it performs.

This could align the fund’s incentives to those of the investor. If a fund thinks it can beat the expense caps SEBI proposes, it simply has to beat the benchmark. If it succeeds, it gets to charge a bit more. But doing so entails risks — do worse, and you’ll have to be content with lower fees.

That said, this is a tricky system to pull off. What benchmarks should one use to measure “outperformance”? Countries that use similar systems, such as the US, have found that the success of such systems depends heavily on the specifics. If your benchmark is too low, investors might pay extra for nothing. If it’s too high, fund managers may take outsized risks while chasing those benchmarks. The benchmarks need to be just right.

For now, this proposal is best read as SEBI testing the waters. It hasn’t yet fleshed out the details — those will be finalised in a later consultation.

No add-on for exit loads

On top of their normal expenses, many mutual funds also charge an “exit load”. Exit too early, and you might have to pay the AMC a small penalty (like 1%) to compensate them.

Before 2012, the AMC would pocket all this money. Some of it would be used to off-set all the commissions and marketing costs it spent on you. But much of it would simply go to the fund house. In effect, it turned early exits into a revenue stream.

While it arguably made sense to penalise investors for too quick an exit, it created weird incentives. Fund houses would then want to push people out too early. So, SEBI decided to correct this by saying that if a fund charged an exit load, it had to use it to reward others for staying with the fund. The fund itself couldn’t pocket exit loads anymore.

But, there was one exception to this rule. If you left early, the funds would be left short of the marketing costs and commissions it incurred on your account. And so, funds were allowed to take an additional amount — an extra 20 basis points — to meet those expenses.

This was always meant to be a transitory provision. In 2018, SEBI clipped this add-on down from 20 basis points to 5 basis points. But now, it plans to remove that add-on amount completely. To make fund houses whole, it might permit such funds to revise their TERs upwards by 5 basis points.

The bottomline

On the surface, SEBI’s proposals might seem like small tweaks to the plumbing of the mutual fund business. They are, after all, changes of a fraction of a percentage, here and there. But together, these could rewire large parts of the industry, and push it to rethink every rupee it charges.

To a great extent, the regulator is trying to get there by pushing for much more transparency. It wants investors to be able to see, line by line, where exactly their money is going, and to who. That visibility, in itself, could re-shape how the industry behaves.

Tidbits

India’s industrial growth up 4% in September

India’s industrial output rose 4% year-on-year in September, led by strong manufacturing (up 4.8%) and capital goods (up 4.7%). Consumer durables jumped 10.2%, while mining slipped slightly. Growth for April–September stood at 3%, showing steady industrial recovery despite uneven sectoral performance.

Source: ReutersL&T plans entry into electronics manufacturing

Larsen & Toubro is exploring entry into the electronics manufacturing services (EMS) sector, with talks for a 200-acre facility near Chennai. The $17 billion group aims to build end-to-end capabilities, focusing on industrial, defence, and aerospace electronics — similar to Tata’s integrated manufacturing model.

Source: Economic TimesInvestors seize control of Bira’s Beer Cafe

Bira 91’s main backer Kirin Holdings and lender Anicut Capital have taken control of The Beer Cafe, citing Bira’s worsening cash crunch and losses. B9 Beverages, Bira’s parent, reported a ₹748 crore loss in FY24 and faces mounting debt. The move is meant to protect Beer Cafe assets as Bira contests the action in court.

Source: Economic Times

- This edition of the newsletter was written by Krishna and Pranav

We’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

Check out “Who Said What? “

Every Saturday, we pick the most interesting and juiciest comments from business leaders, fund managers, and the like, and contextualise things around them.

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, even the smaller logistics firms—and copy the full transcripts. Then we bin the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

Subscribe to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Thank you for reading. Do share this with your friends and make them as smart as you are 😉

Completely agree... what’s remarkable is how Reliance has turned diversification into vertical integration rather than dispersion. Each arm, O2C, Retail, Jio, or New Energy, seems to reinforce the others, creating a feedback loop of scale, data, and capital efficiency. Do you think Reliance’s diversification adds long-term resilience, or could it start diluting focus across too many verticals?

Just brilliant.

Reliance continues to prove why it’s more of an ecosystem than a company — seamlessly balancing legacy strength in O2C with futuristic bets like AI, data centres, and quick-commerce.

What stands out this quarter is not just the double-digit growth across all verticals, but the strategic agility — re-pivoting JioMart, scaling own-label FMCG, and leveraging India’s consumption rebound.

A true reflection of how India’s growth story and Reliance’s evolution are moving in sync.