Quick commerce feels the need for speed

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, we’ll tell you why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and watch the videos on YouTube. You can also watch The Daily Brief in Hindi.

In today’s edition of The Daily Brief:

The rapidly-changing gears of quick commerce

A golden quarter for India’s jewellery companies

The rapidly-changing gears of quick commerce

The quick commerce industry is moving, well, quicker than you might have imagined. It’s worth taking a step back to see just how much has changed in the last few months.

Zepto raised fresh capital and is rumoured to be inching toward an IPO. Reliance Retail’s management declared that they re-pivoted their quick commerce model to 30-minute delivery, and they’re simply riding on top of an existing store base that covers most of urban India. Swiggy is raising funds after insisting not long ago that it didn’t need external capital. Blinkit, deep into a major shift in its operating model, is accelerating store additions in its strongest markets. The list is endless.

We aren’t really interested in the debate on whether the space is overvalued or undervalued. What is in our scope is breaking down what the 2 big players, Swiggy and Zomato Eternal, actually said and actually did this quarter. This is a sector we’ve followed very closely, and the landscape changes so quickly that each quarter feels like a new chapter.

So, let’s take a ride through quick-commerce results this quarter.

Quick look at the broad numbers

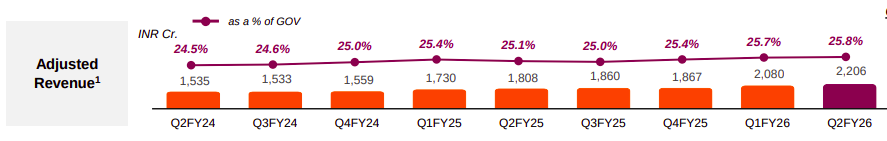

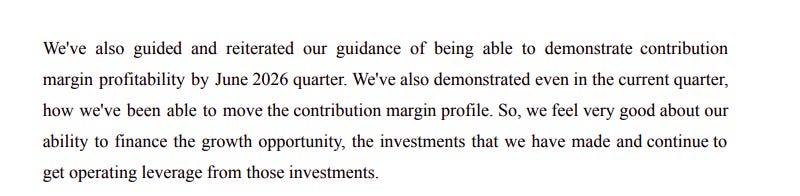

Swiggy’s adjusted revenue this quarter was ₹2,206 crore, up 22% from last year.

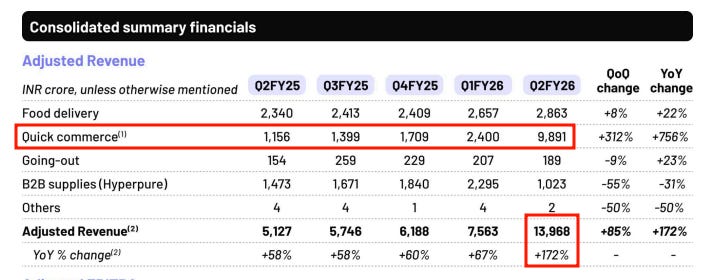

Eternal’s adjusted revenue was massive at ₹13,968 crore, growing 172% year-on-year. On the face of it, that kind of growth looks extraordinary. And most of it came from quick commerce — compared to last quarter, Blinkit’s revenue jumped over 3x, which sounds unbelievable at first glance.

But there’s an important catch. Over time, Blinkit has been shifting from a marketplace model to an inventory-led model (or 1P) — which means it directly owns and buys the stock it sells instead of relying on marketplace sellers. This shift makes comparisons against past years or quarters much less useful. Their 3x quarterly jump is mostly an accounting effect, not a sudden explosion in the underlying business.

If you look at the real operating metric — which is net order value (NOV) — the fog gets clearer. NOV is simply the total value of all customer orders placed on the platform by removing the discounts. On that basis, Blinkit still grew at roughly 100% year-on-year, which is genuinely strong and far more representative of the scale the business added over the past year.

If the revenues are to be believed, both companies seem to be growing well. But in this sector, where everyone seems to be growing at breakneck pace, revenue is gradually becoming less useful as a metric of judgment. What may be more useful is to look elsewhere: in the costs, the cash burn, and the choices made about where to slow down and where to push harder.

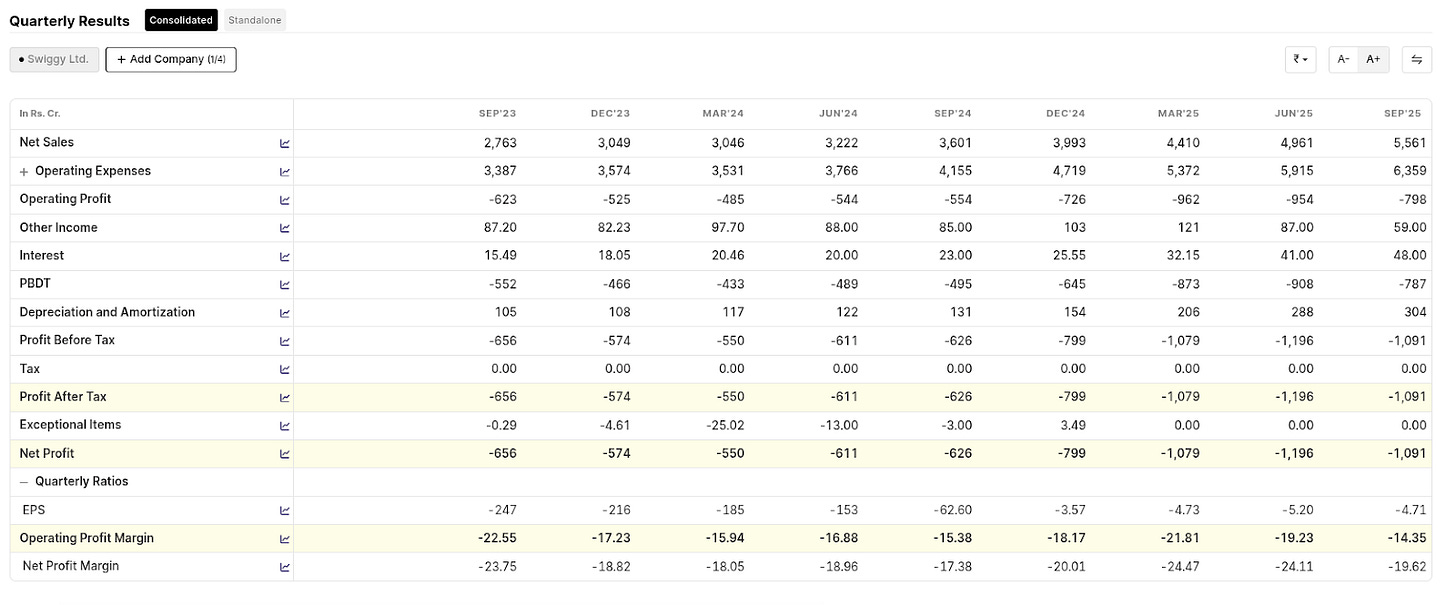

Look no further than Swiggy’s situation right now to see why this is important. Its losses came around to ~₹1,100 crore — almost double what they were a year ago.

Without saying it explicitly, Swiggy finally admitted that Instamart’s journey to breaking even isn’t coming to a fruitful end anytime soon. Earlier, management said they expected Instamart to reach contribution-margin (or CM) breakeven sometime between Dec 2025 and June 2026. This quarter, they stopped mentioning the earlier Dec 2025 date and only repeated the outer limit.

Eternal, as a whole, remained profitable, with adjusted EBITDA of ~₹224 crore this quarter. Blinkit’s adjusted EBITDA margin improved slightly, but the company is still losing money in absolute terms, as marketing spend jumped sharply and they added more than 270 new stores. Eternal’s food delivery business continues to make money, but a good chunk of those profits now effectively subsidises Blinkit’s growth.

Food delivery reaches a stable equilibrium

How did food delivery — which was once the founding cornerstone of Swiggy and Eternal — perform? Turns out, food delivery has evolved from the chaotic, rapidly-growing market it was a few years ago, to a more slow, steady, dependable line of business.

Swiggy’s food delivery vertical continued to grow steadily, while margins improved to ~3% this quarter. Swiggy didn’t break out numbers for their 10-minute food delivery, Bolt. However, in previous quarters, they’ve mentioned that Bolt makes up a meaningful share of food orders, and these users tend to retain better than the average Swiggy customer.

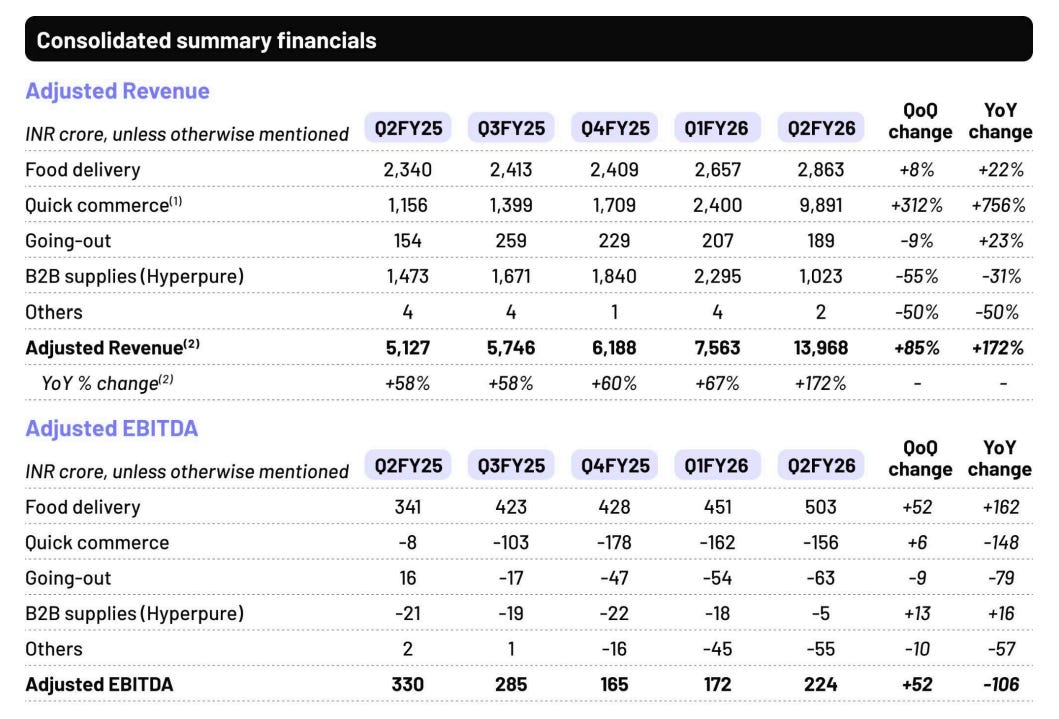

Eternal’s food delivery business, while also similarly stable, is telling a slightly different story.

Growth has slowed to around 15%, which management openly acknowledged. Margins did improve, but mainly because the company raised its platform fee midway through the quarter — right after competitors raised theirs.

Eternal also offered some rationales for the slower growth. For one, people have cut back a little on discretionary spending. Secondly, there’s been a shortage of delivery partners because quick commerce companies are hiring aggressively. And lastly, some customers now choose to buy packaged food from Blinkit instead of ordering from restaurants.

Eternal still believes food delivery can grow faster in the long run. But, at this moment, its momentum is far slower (and predictable).

The 10-minute delivery

If food delivery is how Swiggy and Eternal began, quick commerce is where both firms are pouring most of their energy and money today.

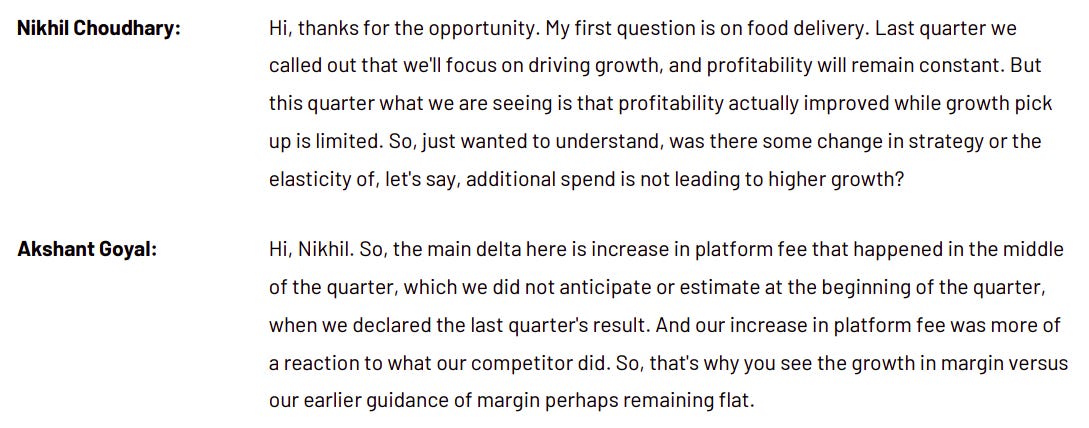

Swiggy took a slower, steadier approach. It added only ~40 new Instamart stores in the quarter. That’s a huge slowdown compared to the earlier financial year, when store additions were in the hundreds.

But they explained why. A lot of their existing stores still have room to double the orders they handle, so the company wants to get the most out of its existing facilities before rushing to open more. Right now, only ~25% of Instamart stores are CM-positive, meaning they make money after direct costs. The rest, though, still have some road left before they turn CM-positive. Swiggy is being cautious with how it expands, hoping to reach breakeven without stretching the network too quickly.

Blinkit, in contrast, aggressively expanded their network. It added 270+ stores this quarter, pushing its total close to 1,800. And it still wants to reach 3,000 stores by March 2027.

But the real insight isn’t the number of stores — it’s where they’re being added. Eternal said that 70–75% of new stores are coming in the top 10 cities. They’re not really expanding across India, but instead saturating the biggest, richest, most frequently ordering cities — because that’s where the economics of quick commerce work best. A store in South Delhi or Mumbai, for example, can do multiple times the order volume of a store in a small city. Blinkit wants to flood the strongest markets before worrying about which stores to shut down.

But the more interesting part of Blinkit’s strategy is the shift to the 1P inventory model that we mentioned earlier. This is a huge operational change, and they said they’re 80% through the transition.

Owning inventory gives Blinkit more control over what’s available, and the ability to negotiate directly with brands — which can potentially translate to better margins. But it also brings new costs — like the first-mile cost, which they now have to pay because sellers aren’t delivering goods to stores anymore. Blinkit said the full margin benefit of this shift will take 4–6 quarters to show up.

Zepto is also trying to move toward an inventory-led model, but there’s a structural roadblock. To run a full 1P model under India’s FDI rules, the company needs to be majority-owned by domestic capital. Zepto’s current ownership structure doesn’t meet that requirement yet: which is why investors like Motilal have been actively increasing their stake.

Quick commerce is still growing at a pace that neither company fully expected. Blinkit said they expect order volume to grow 100%+ for at least the next one to two years. With that kind of growth, they feel it makes more sense to chase market share today and worry about margins later. We wrote this in detail in our weekend show: Who said what?

More problems, more money

And, of course, Swiggy and Eternal need more money.

Swiggy also announced a massive ₹11,000-crore QIP this quarter. This stood out because just a few months ago, the CFO had said the company had a comfortable cash balance and didn’t see the need to raise money. Now they’re saying the new funds are meant to create a “strategic reserve” and support growth. In simple terms, Swiggy wants a war chest.

Blinkit raised capital last year for the same reason, when it was still in the middle of its turnaround. And Zepto raised money recently, too, which it is using to expand stores and push harder on customer acquisition.

You can also see the competitive heat in the way Swiggy and Zepto have now dropped most of the fees — surge fees, handling fees, and other add-ons. Removing these fees is a clear sign that companies want to stay aggressive on pricing and keep customer friction low, so that they can grab more market share before the space gets too crowded.

The bottom line

The real action has clearly shifted to quick commerce. That is where both companies are spending, where competition is rising, and where the long-term bets are being made. Food delivery, which once drove the story for both companies, has settled into a steady, profitable business. It isn’t growing as fast as before, but it works, and it throws off cash.

Whether q-com eventually becomes a stable, profitable business is still unclear. But for now, it’s the part of the business that is shaping almost every major decision they make.

A golden quarter for India’s jewellery companies

We’re in the middle of a fascinating period for India’s jewellery market.

Gold prices have skyrocketed over the last year. On average, over the September quarter, gold was ~43% more expensive than it was last year. This April, prices for 10g of gold breached the six figure mark for the first time. But they didn’t stop there — they kept climbing steadily, only peaking around Diwali, midway through October.

What does a moment like this mean for companies that consider gold as their primary raw material? How does a gold-crazed nation like ours behave at a moment like this? Do people hold back on buying? Do they buy even more, in anticipation of further prices? Or do they change their behavior in other ways?

And what does this all mean for the industry’s fortunes?

Today, we’re looking at the results of three jewellery majors for answers to these questions. At the premium end is Titan Company, whose flagship Tanishq is India’s strongest jewellery brand. Alongside, is its most ambitious challenger, Kalyan Jewellers, which is blitz-scaling beyond its Southern base with dozens of new stores every quarter, in India and abroad. Finally, we’re looking at Senco Gold, a rising force in East India’s tier-2 and tier-3 cities.

Underneath the latest earnings

There are some peculiarities to keep in mind when you’re looking at this quarter’s results. The biggest is this year’s early navratri — which began late in September, rather than the first half of October, when it arrives most years. This is a time that’s always marked by a spike in gold purchases. But unlike most years, when that spike shows up in the third quarter, this year, it arrived in the second quarter itself.

That’s why this quarter’s results are, in a sense, boosted by sales “pulled forward” from an event that would ordinarily have come next quarter. That simple fact pollutes any year-on-year comparison.

That said, last year’s September quarter was hardly ordinary either. Back then, the government had slashed its customs duty on gold imports to the lowest level in a decade, which unleashed a buying frenzy. Any quarter that followed those massive volumes would look subdued in comparison. This, too, makes year-on-year comparisons difficult, but in the opposite manner.

Titan Company

Titan Company had a stellar second quarter. Despite the sheer scale of its operations, its total income still grew by 21% over last year, to ₹16,407 crore. In some quarters, this growth came exceptionally fast. For instance, Titan’s tech-enabled, youth-oriented arm, CaratLane, reported a 32% jump in sales from last year.

As impressive as this may be, however, this was a quarter where total revenues were bound to go up — everything they sold was more expensive as a simple outcome of the remarkable surge in gold prices. More impressively, however, the company actually managed to push its margins to 12.1% — more than 2% above where they were a year ago. This led to a dramatic 59% expansion in the company’s bottomline from last year.

The company is now looking at markets outside India for future growth. In just the last year, its international sales went up by 92%, led by a massive surge in North America and the Middle East. And it’s only doubling down on its outward push. For instance, the company recently announced that it would take a controlling stake in the UAE-based Damas Jewellery.

Kalyan Jewellers

Even Titan’s impressive showing, however, doesn’t come close to the explosive pace of Kalyan’s growth.

The company’s quarterly revenues, at ₹7,856 crore, surged over 30% from last year, while it also pushed costs down. That’s why its net profit — ₹261 crore — was more than twice as high as it was in the same quarter last year.

Where does that growth come from? While Kalyan’s same store sales grew by a healthy 16% from last year, it’s hardly as though those stores were flooded with new business. Those higher revenues, it appears, came from its rapid expansion, as Kalyan added 32 new stores this quarter alone. It expanded its network by more than 7% in just the space of three months. And it has been expanding at this pace for a while.

This expansion drive has fundamentally altered Kalyan’s customer base. For a company that was identified primarily as a South Indian player, 54% of its revenues now come from outside the south.

How is Kalyan sustaining this pace of growth? The company isn’t letting new stores weigh down its balance sheet. Instead, it has adopted the asset-light “FOCO” model — or franchise-owned, company-operated. In this setup, franchisees fund any capital expenditure a store needs, while the company focuses purely on running the operations. This lets it expand without tying its capital up in real estate. In fact, Kalyan is actively selling off the real estate it already owns.

49% of its stores have already shifted to the FOCO model. While this shift might impact its margins, it frees the company to focus on what it does best — selling jewellery — without getting bogged down by fixed assets. It also lets the company clean out its debt.

Senco Gold

Senco seemed to have a more muted quarter than its larger peers, as revenues grew by a modest 2% over last year — partly because business was poor in its East India stronghold. Yet, remarkably, Senco tripled its profits to ~₹48.8 crore over the past year (albeit from a low base).

How did it achieve such a dramatic increase in margins? A bunch of reasons: from better prices for diamonds, to a hike in making charges, to a better product mix in favor of studded jewelry.

Another interesting reason was that so far in FY26, the company has been hedging less than it usually does. Usually, Senco hedges 80-90% of their gold inventory against the gold price volatility. But though gold prices have been too wild, they couldn’t hedge enough due to liquidity constraints. As gold prices went up, their unhedged gold they already held as inventory became more “valuable”. This isn’t real profit — it’s profit on paper.

And Senco warns that these margins will come down: in fact, profit in Q2 took a steep dip from Q1 — which saw most of the gains from lower hedging.

The company has an interesting strategy for its future. It’s avoiding the wealthier markets of West and South India, where larger brands dominate. Instead, it’s attacking underserved markets that others might ignore. Already, 60-65% of its stores are in East India, while many of the rest are in North India. It’s doubling down on these markets, with 80% of its new stores opening there. It’s also expanding its presence in the North-East at a clip of 25-30% a year.

Surviving high gold prices

These results paper over one crucial bit of variance: across the board, jewellery companies started the quarter slow, and accelerated towards the end. As Titan’s management noted, early in the quarter, customers had been scared off by the meteoric rise in prices. Eventually, however, they realised that this was perhaps the new normal. Those prices were unlikely to come back down any time soon.

So, right at the end of the quarter, many “fence-sitters” took to the market, especially as the festive season came around. This gave these companies an exceptionally strong finish to the quarter.

But it’s not just timing. In this era of higher prices, customers’ purchasing decisions are changing as well. Here are some of the nuances we picked up:

A shift in jewellery choices

One way of getting around those high prices is to sell pieces where gold makes a smaller component of the overall price.

Many customers didn’t increase their budgets for jewellery purchases, even though gold prices had gone up. Instead, they traded down to lighter designs or lower carats, so that each piece had less gold in it. Senco, for instance, reported a 10-12% reduction in the average weight of the pieces its customers bought, even though they were spending the same amount. Titan also suggested that it was looking to double down on its 18 carat portfolio.

If you sold to customers that were willing to pay, however, studded jewellery became an attractive option. By adding precious stones, a company can earn between 2-4x the margins it does on plain gold pieces. These are harder to make, and simply look prettier, letting you charge a premium. So, if high gold prices are putting your margins under pressure, selling more studded pieces to the mix can give you some breathing room.

Titan and Kalyan already have big bets on studded jewellery, with such pieces making up roughly a third of their sales. While Senco has been late to this game, it has made a conscious effort to change that recently. It slowly pushed its share of studded pieces up to 12% of sales — ~30% higher than last year — and aims to go even further.

Many customers, meanwhile, are shifting to jewellery that uses other metals entirely. Senco, for instance, reported a 54% year-on-year growth in the sales of its silver jewellery.

Don’t purchase, exchange

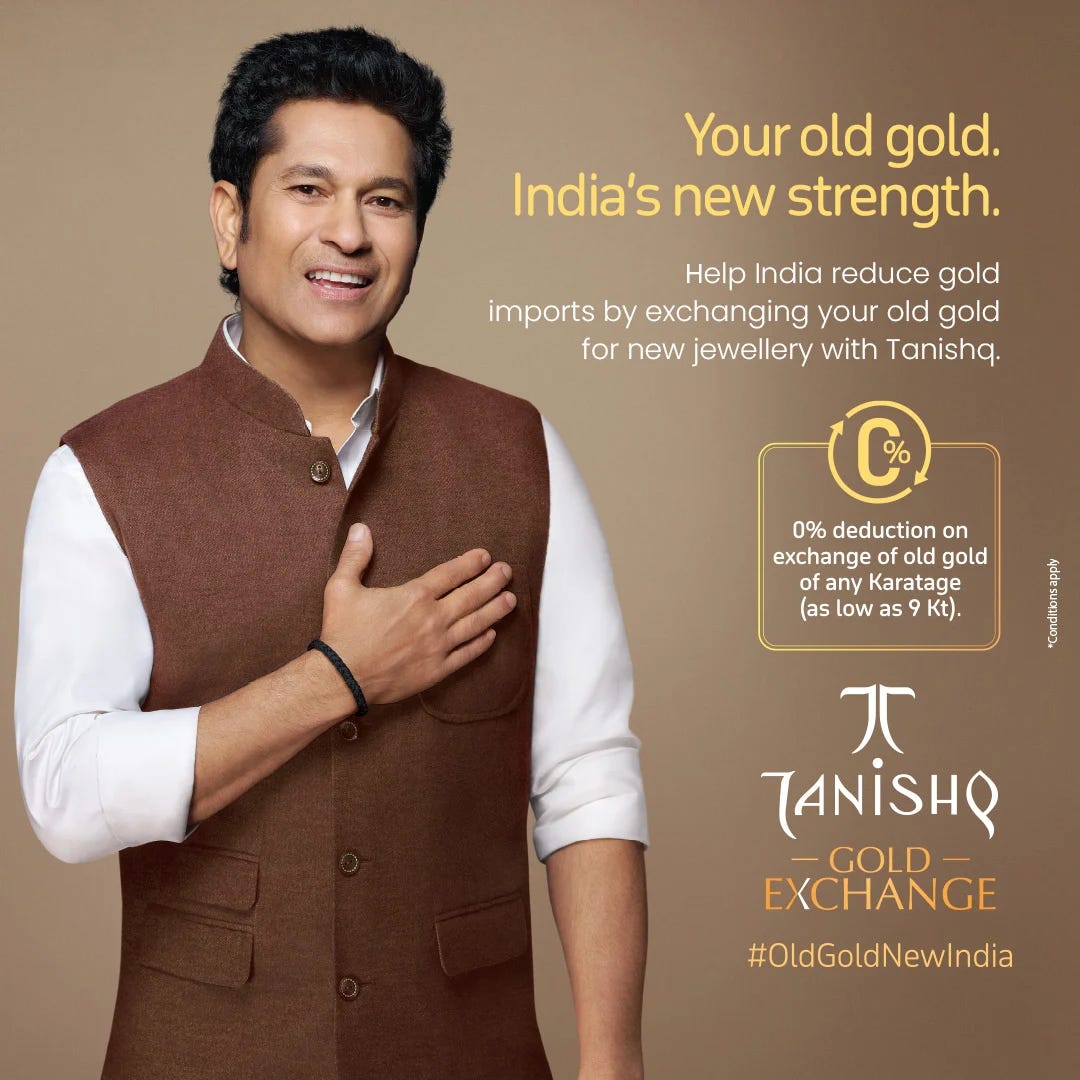

If you didn’t want to compromise on the amount of gold you were buying, however, there was another option: exchange your old gold for a new piece of jewellery.

Titan, for instance, ran a high-profile gold exchange campaign, fronted by Sachin Tendulkar — which linked gold exchange to a national duty. The campaign, as the company’s management confirmed, was a “game-changer”. In bringing in their existing gold, customers were able to purchase new pieces without the sticker shock of the prevailing prices.

This became a major driver of Tanishq’s business. But equally, according to the company’s management, this almost worked like a customer acquisition drive. The sheer ease of exchanging their gold, the company believes, makes customers more likely to come back.

But it wasn’t just Titan that saw such exchange drive volumes. Senco, too, saw 40% of its transactions come from old gold exchange programs, up from 25% a couple of years ago.

A rise in investment demand

But all of that’s for just one sort of customer. See, the jewellery market actually has two cohorts of customers: those that are seeking an ornament, and those who’re looking for an investment.

To the former, the high prices were a deterrent that made one think twice about a purchase. To the latter, however, this was the mother-of-all-bull-runs in a cherished commodity. As prices spiked, the demand for gold coins went up drastically. Titan, for instance, reported a 65% year-on-year increase in demand for gold coins. While these are plain products that can push margins down, they’re an easy ticket to high volumes.

Growth? Or cannibalisation?

This quarter was a stress test for India’s jewellery sector, with many assumptions that were baked into the business going haywire in an environment of wild price swings. If anything, however, India’s listed jewellery giants thrived over this period. What does this mean?

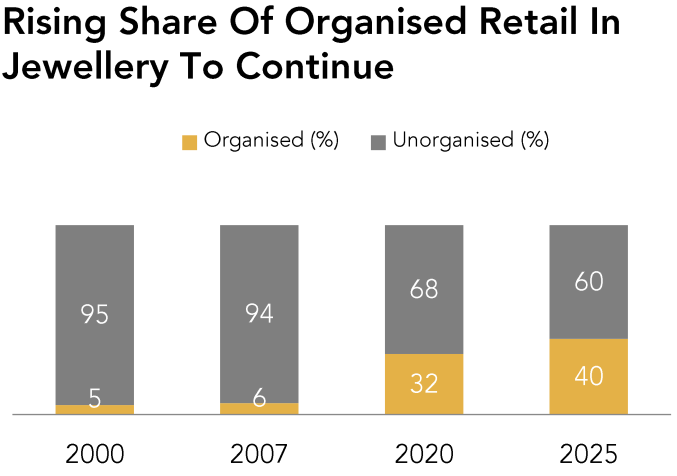

Here’s one possibility: India’s jewellery market is in the midst of a massive structural shift. The incredible growth rates of these formal players isn’t a simple outcome of India’s growing economy, or a booming jewellery industry. It’s a story of a migration of market share — from the fragmented, unorganized sector to branded players.

This is a process that has been playing out for many years. But the volatility of the last couple of years — with changing regulation, new tax structures, ballooning prices, and more — seems to have accelerated this trend. It may not have created this shift, but it has nudged it along.

If that’s the case, this isn’t the story of India’s jewellery sector at all, but of the outliers that are shifting its centre of gravity.

Tidbits

NTPC plans 5–10 MTPA coal-to-gas unit

NTPC is planning a 5–10 million tonne per year coal-to-synthetic natural gas (SNG) facility using high-ash coal from captive mines to produce cleaner fuel for internal use and sale. The fuel’s production cost is estimated at $10–12 per mmbtu, and project work is likely to start next year.

Source: Economic Times

Biocon mulls merging Biocon Biologics in $4.5 bn deal

Biocon is considering merging its biosimilars arm Biocon Biologics with the parent company in a $4.5 billion deal, evaluating both IPO and share-swap options. The move aims to cut $1.2 billion acquisition debt from its Viatris deal. Morgan Stanley is advising on value creation strategies.

Source: Economic Times\Mid-tier IT firms to outpace Big Five in hiring

Midcap IT companies like LTIMindtree, Coforge, and Mphasis are expected to hire about 16,000 employees this fiscal, outpacing TCS, Infosys, and Wipro. Agile projects, BFSI demand, and AI-driven roles are fueling this growth. Large IT firms, meanwhile, are focusing more on reskilling and productivity.

Source: Mint

- This edition of the newsletter was written by Krishna and Pranav.

We’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

Have you checked out Points and Figures?

Points and Figures is our new way of cutting through the noise of corporate slideshows. Instead of drowning in 50-page investor decks, we pull out the charts and data points that actually matter—and explain what they really signal about a company’s growth, margins, risks, or future bets.

Think of it as a visual extension of The Chatter. While The Chatter tracks what management says on earnings calls, Points and Figures digs into what companies are showing investors—and soon, even what they quietly bury in annual reports.

We go through every major investor presentation so you don’t have to, surfacing the sharpest takeaways that reveal not just the story a company wants to tell, but the reality behind it.

You can check it out here.

Introducing In The Money by Zerodha

This newsletter and YouTube channel aren’t about hot tips or chasing the next big trade. It’s about understanding the markets, what’s happening, why it’s happening, and how to sidestep the mistakes that derail most traders. Clear explanations, practical insights, and a simple goal: to help you navigate the markets smarter.

Subscribe to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Thank you for reading. Do share this with your friends and make them as smart as you are 😉