India’s inflation is NOT slowing down!

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and videos on YouTube. You can also watch The Daily Brief in Hindi.

This post might break in your email. You can read the full post in the web browser of your device by clicking here.

In today’s edition of The Daily Brief:

India’s inflation is NOT slowing down!

Why isn’t Swiggy making money?

A clash of Titans (and Kalyan)

India’s inflation is NOT slowing down!

The Reserve Bank of India (RBI) conducts a series of ‘forward-looking surveys,’ which captures how people see our economy pan out in the near future.

One of these is its bi-monthly ‘Inflation Expectations Survey of Households’ (IESH), which captures how Indian households perceive inflation today, and where they think prices are headed in the next three months, and one year. They do this by talking to 6,000+ households across 19 cities.

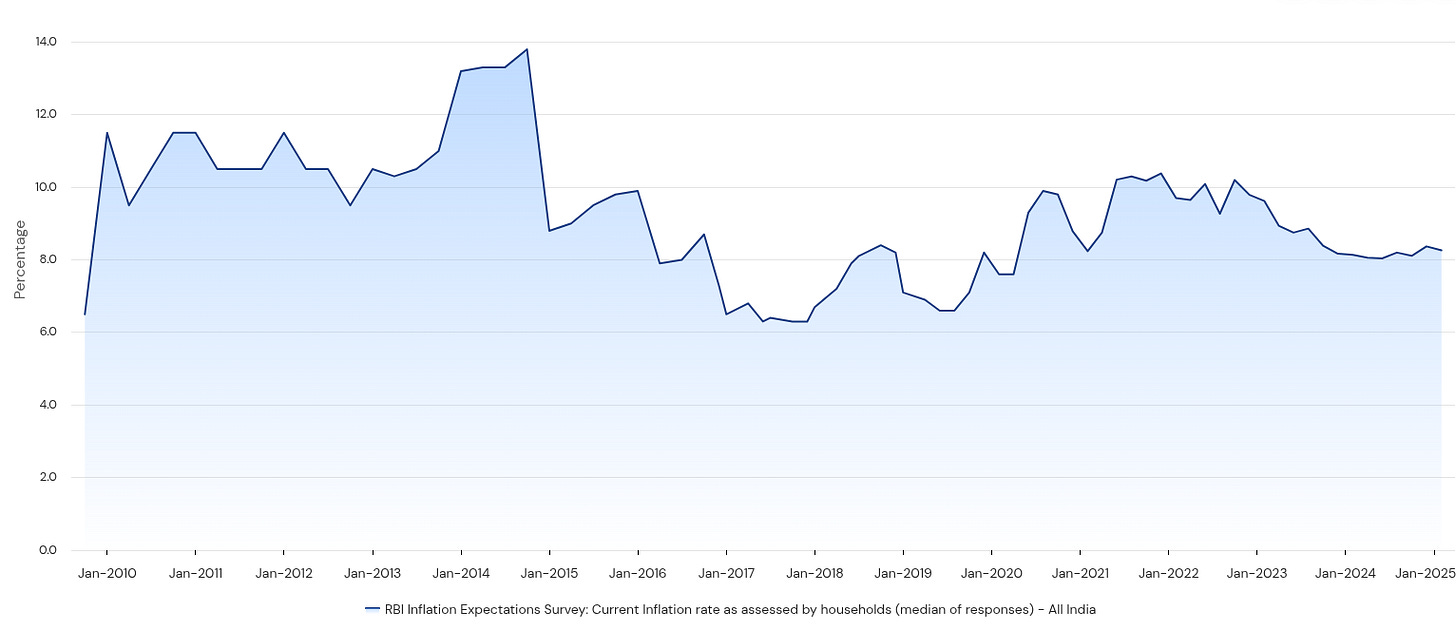

While these expectations don’t always match actual inflation data, they offer crucial insight into people's feelings. RBI released the survey’s latest edition for January 2025. Here’s what it said.

Households expect inflation to rise further. The median one-year-ahead inflation expectation increased slightly to 10.2% from 10.1% in November 2024, reflecting persistent concerns about price pressures. Short-term worries are also climbing. The three-month inflation expectation rose by 20 basis points (bps) to 9.3%, signaling renewed anxieties over near-term inflation.

Food and housing are the primary drivers of inflation fears. More than 80% of respondents expect food prices and housing costs to rise further, making inflation concerns deeply personal.

The survey suggests that despite some moderation in actual inflation, price pessimism is rising across the board. However, what stands out is that the current inflation expectation of 8.3% is significantly higher than the actual inflation rate of approximately 6%, as reported by the RBI in the MPC meeting earlier this month.

So why are expectations off from reality by almost one-third? There are many explanations we can turn to.

For one, people suffer from what’s called an ‘availability heuristic’. Research suggests that people tend to overestimate price changes in goods they purchase often (e.g., food, fuel) while ignoring price stability or reductions in less noticeable categories (e.g., electronics, clothing). They also pay more emphasis to recent sharp price spikes (like onion or petrol prices) but fail to account for stable or declining prices in other items.

Studies also show that people update their expectations more based on extreme news rather than objective inflation trends. Most people do not track official inflation data — they rely on unreliable, anxiety-inducing sources: extreme news headlines, biased and limited personal experiences, and conversations within social circles. And so, there’s bound to be a difference in expectations and real numbers.

Why do inflation expectations matter

If consumers have it so wrong, you might wonder: why even be bothered about inflation ‘expectations’ when we already have reliable and actual inflation data at our disposal? What more could the opinions of random people on inflation offer? Why would it even matter?

It matters a lot, it turns out. Empirical evidence suggests that inflation expectations of households and firms affect their actions but the underlying mechanisms remain unclear. Let’s give you three compelling reasons why monitoring inflation expectations matters:

1. Influence on Consumer Spending and Saving Decisions

Consumers' expectations about future inflation directly affect their current spending and saving behaviors.

When consumers expect higher future inflation, they are more likely to increase current spending to purchase goods and services before prices rise further. This creates a vicious circle. As people ramp up their immediate spending, there’s an uptick in aggregate demand, potentially fueling inflationary pressures.

A study found that providing consumers with information that altered their inflation expectations led to significant changes in their spending intentions. This goes to show how sensitive consumption decisions are to people’s inflation expectations.

2. Contribution to Wage-Price Spirals in Business Settings

Inflation expectations play a pivotal role in the wage-setting and pricing strategies of businesses, potentially leading to a wage-price spiral.

If employees anticipate higher future inflation, they are likely to demand higher wages to maintain their purchasing power. To maintain profit margins in the face of rising labor costs, businesses may increase the prices of their goods and services. This interaction can create a self-reinforcing cycle, where rising wages lead to higher prices, which in turn lead to further wage demands.

3. Guiding Central Bank Monetary Policy

Clearly, high inflation expectations can become a self-fulfilling prophecy. Therefore, making sure that not just actual inflation, but even inflation expectations remain in range, is in the best interest of central banks — who have the job of targeting inflation.

Before explaining this further, let me briefly explain two terms: ‘anchored’ and ‘unanchored’ inflation expectations

‘Anchored’ inflation expectations mean that people trust the central bank to keep inflation under control. Even if prices go up for a short while (maybe because of a bad crop year or a temporary oil price surge), people believe inflation will return to normal soon.

On the other hand, when inflation expectations become ‘unanchored’, people stop trusting that the central bank can control inflation.

Stable and well-anchored inflation expectations allow central banks to implement policies that focus on economic growth without triggering undesirable inflation. On the other hand, if inflation expectations become unanchored and start to rise, central banks may need to increase interest rates to cool down the economy and prevent actual inflation from escalating.

This is why central banks want to make sure that people’s inflation expectations are anchored. This isn’t always easy. A study by the World Bank suggests that inflation expectations are usually well-anchored for advanced economies, but are less stable in emerging economies.

Even the Monetary Policy Committee (MPC) of RBI considers inflation expectations when deciding interest rates.

For example, in the October 2024 MPC meeting, inflation was a big topic. The media was worried about rising prices. However, the MPC members remained confident that inflation was under control. One key reason for their confidence? The latest survey showed that people’s inflation expectations were stable and even moving lower.

You still need a pinch of salt

Not everyone agrees that inflation expectations are all that important to look at, however. For one, the RBI is merely talking to ~300 households from India’s largest cities. That’s likely to give one a deeply skewed sense of what people believe.

Even beyond this, however, there are some other arguments you should know:

1. Limited Predictive Power of Inflation Expectations

Inflation expectations, especially those derived from household surveys, often fail to accurately predict future inflation trends.

A study by the Federal Reserve Bank of Cleveland found that professional economists' and businesses' expectations are more accurate than those of households and financial market participants.

Surprisingly, even the business expectations have no 100% certainty of being accurate. The Congressional Budget Office (CBO) highlighted that consumers and firms often rely on heuristics or past experiences, leading to expectations that may not align with actual future inflation. If they don’t have any predictive power, why even use them?

2. Disagreement Amongst Economic Agents

Significant disparities exist in inflation expectations among consumers, businesses, and policymakers. This can undermine how useful any one of these cohort’s expectations are, in guiding economic policy. There is research that documented this.

This complicates the use of a unified expectation when formulating policy. If there is no one inflation expectation number, what use is it for policymakers?

3. Questionable Impact on Actual Inflation

Some economists argue that inflation expectations may not significantly influence actual inflation, challenging the emphasis placed on them in monetary policy.

Jeremy Rudd of the Federal Reserve questioned the conventional view, suggesting that the relationship between inflation expectations and actual inflation is not as strong as traditionally believed. He argues that inflation often follows real economic factors (supply shocks, labor market conditions, monetary policy) rather than expectations-driven behavior.

Therefore focusing on expectations might divert the attention of central bankers from more direct determinants of inflation.

Now, if you ask us, we feel both arguments have merit. That said, it seems fair to say that inflation expectations do influence actual inflation, even if they don’t direct it entirely. Even though the reliability of this metric isn’t always certain, and there’s no foolproof way to measure its impact, central banks worldwide still factor it into their decisions.

At the end of the day, what people expect shapes how they behave.

Why isn’t Swiggy making money?

Swiggy recently released its quarterly results, following Zomato’s results a few weeks ago. We had covered Zomato’s performance in detail, highlighting pressures from quick commerce expansion and competition. Now, we are taking a look at how Swiggy is performing in this highly competitive space.

For a quick summary: Swiggy saw strong growth in key metrics, but its profits were impacted by the high costs of quick commerce expansion.

Swiggy's net sales for the quarter rose to ₹3,993 crore, reflecting a 31% YoY increase and 10.9% QoQ growth. However, the company’s net loss widened to ₹799 crore, up 39.2% YoY and 27.6% QoQ. These oversized losses were driven by the significant spending required to expand its quick commerce operations and acquire customers.

As a result, Swiggy’s operating margin declined to -18.17%, compared to -17.23% a year ago and -15.39% last quarter. While the company achieved strong sales growth, its profitability has taken a hit.

Food Delivery

Swiggy's food delivery business grew strongly in the quarter. It showed a Gross order value (GOV) of ₹7,436 crore — growing by 19.2% YoY and 3.4% QoQ. For a business that seems relatively mature, adding almost one-fifth to order values within a year is a robust performance.

But Swiggy’s legacy business is fairly stable. What we’re more interested in are its new lines of business.

One of Swiggy's newer ventures from the past few months has been Bolt, the 10-minute food delivery service. According to Swiggy’s management, Bolt has scaled to over 425 cities, contributing 9% of its total food delivery volumes. Btw, this figure was just 5% in December.

That’s a marked jump within just one quarter. Bolt focuses on shorter delivery distances and pre-prepped meals, allowing Swiggy to lower last-mile delivery costs. However, as Bolt's share of orders grows, we have to ask: what are the trade-offs in shorter delivery times? Will this new model secure long-term profitability? Or does 10-minute delivery require a complete overhaul in approach?

This is a question that Swiggy’s own management seems to be grappling with. That shows in the newest product it has introduced — “Snacc”.

Snacc is, in theory, similar to Bolt — it too focuses on 10-minute deliveries. But unlike Bolt, which gets you select items from Swiggy’s existing restaurant network, Snacc focuses on low-ticket snacking orders, like protein shakes and noodles, for quick, low-involvement consumption. Think of it like the canteen in your office or college. This is similar to Zepto Cafe and Bistro by Blinkit who have opened their own cloud kitchens to bring you food in under 10 minutes.

Both models are designed to increase frequency and engagement. But the approach they take is completely different. CEO Sriharsha Majety explained, "Both models target different consumption moments, allowing us to broaden the addressable market for food delivery."

So what’s the future of 10-minute delivery? Does it become a sort of Swiggy Lite, with less choice but faster delivery? Will Swiggy pivot to a whole new office canteen-like model? Or do both survive as independent business lines? We’ll be watching closely for how things develop.

Quick commerce

Instamart, Swiggy's quick commerce arm, reported a GOV of ₹3,907 crore, growing 88.1% YoY and 15.5% QoQ.

More interestingly, the quarter saw it make a strong bid for expansion — in order to survive the intense competition in the space. Swiggy’s growth strategy involves two things: (a) increasing the efficiency of existing stores, and (b) diversifying its product offering to drive higher AOV.

Instamart’s average order value or AOV now stands at ₹534, up 14% YoY. For comparison, Blinkit's AOV is ₹707, and Zepto's AOV is around 500. A higher AOV boosts margins by spreading fixed costs like delivery over a larger revenue base, improving profitability per order.

Swiggy also added 96 new dark stores this quarter, bringing the total to 705 stores. For comparison, Blinkit has around 1000 and Zepto around 700.

But this aggressive expansion has come at a cost.

The competition in quick commerce is fierce, and as Swiggy’s management acknowledges, the heightened sector’s intensity is putting its profitability under intense pressure. Swiggy’s contribution margin for quick commerce deteriorated to -4.6%, compared to -1.9% last quarter. Why so? A big factor was the large sums it had to invest in growth — including big spends for performance marketing, and dark store expansion across geographies. A company’s contribution margin, for context, measures how much revenue is left after paying for direct costs like rider fees. It’s a key indicator of how efficiently the platform operates.

Explaining the rise in marketing costs, CFO Rahul Bothra said, "Performance marketing is meant to give immediate results. Now, due to heightened competitive action, the CACs can go up or down depending on how much investment is going into it by the category."

However, with competitors like Blinkit and Zepto expanding aggressively, Swiggy will need to maintain strong momentum to justify its current level of investment.

In an intriguing development, Swiggy has decided to launch a standalone Instamart app, marking a shift from its previous “super app” strategy. In doing so, it hopes to streamline the quick commerce experience for users, offering faster access and potentially reducing app friction. Instamart’s CEO, Amitesh Jha, emphasized that this move is part of a broader strategy to improve user adoption and convenience.

However, this raises a critical question: Is Swiggy fragmenting its app ecosystem too much? The company has a history of launching and shelving standalone apps for services — like Swiggy Daily and InsanelyGood. On the other hand, with Zomato and Blinkit thriving as separate apps, clearly, this model isn’t impossible to pull off. Will Instamart’s standalone app succeed where these past efforts have failed, or is this another sign that the super app model is losing steam?

How does Swiggy ever make profits?

Since Swiggy is still loss-making, it’s turning to strategies like Swiggy One Black to diversify revenues and boost customer loyalty. This premium membership offers zero service fees, priority slots, and exclusive discounts across the Swiggy ecosystem. The goal is to increase order frequency and reduce churn by locking in high-value customers—similar to how Amazon Prime builds loyalty through bundled perks.

That said, there’s a bigger point here: Swiggy is growing fast, but growth alone doesn’t make for a good business. Quick commerce is bleeding money, and Bolt and Snacc are untested experiments to see what sticks. The company’s path to profitability, at least from the outside, isn’t completely clear.

But here’s the real problem: Swiggy has to spend heavily to win in a market where everyone is burning cash. No one really knows how long that game can last. The question isn't just if Swiggy can turn profitable — though that is a key question. It's whether this entire business model can ever make real money.

A clash of Titans (and Kalyan)

Now, we’re talking about one of the biggest rivalries in India’s jewellery business—a real David vs. Goliath story.

On one side, there’s Titan, the giant of the industry, the name behind Tanishq, and the brand most people think of when they hear “organized jewellery.” On the other side, there’s Kalyan Jewellers—the challenger that’s growing faster than anyone else, opening new stores at breakneck speed, and trying to take a bigger bite of Titan’s market.

India’s jewellery market

Before we dig into their results, here’s a bit about India’s jewellery market. Indian jewellery is rapidly shifting towards organized retail, with brands like Titan, Kalyan, and Malabar now controlling 40% of the market — up from 32% in 2020. This shift means stricter compliance, less tax evasion, and more competition among big players.

Despite this competition, the industry is booming — driven by wedding demand, which accounts for 60% of total jewellery sales. With 25-30 lakh weddings annually, where families spend anywhere from ₹10 lakhs to ₹50 lakhs, jewellery remains a non-negotiable expense, keeping demand strong even when gold prices rise.

But while India’s jewellery market is booming in value, it’s shrinking in volume. According to the World Gold Council, jewellery demand dropped 2% YoY in tonnage, but total spending jumped 9% in 2024, as higher gold prices meant people were buying less gold but paying more. This price-driven growth, combined with weddings and rising formalization, is keeping the industry strong, even as affordability becomes a challenge.

Titan and Kalyan: The numbers

Back to the Titan vs Kalyan rivalry, what’s really fascinating about this battle is how both companies are growing like crazy, but profit margins are getting squeezed like never before. So what’s happening here and how are both these companies playing their cards?

Let’s start with some cold, hard numbers.

Kalyan’s revenue growth (+42%) outpaces Titan’s (+25.5%), but Titan still leads in market share.

EBIT margins are falling for both companies, but Titan still commands a much higher margin (9.5%) than Kalyan (4.8%). This can be explained by the bigger brand premium that Titan commands, but more on the margin compression later.

Contextually, Titan is expanding slowly relative to Kalyan, which is growing aggressively with 37 stores, largely under the FOCO model - Franchise Owned, Company Operated.

But there’s a real issue here—margin compression. The management of both companies has multiple explanations for the falling margins.

First is the government's cut of gold import duties.

This happened early last year, but its effect on jewellery companies’ inventory value is still unfolding. Jewellers buy gold in bulk, but if the government cuts import duties, new gold becomes cheaper, making their existing stock instantly lose value. In Q3FY25, Titan wrote off ₹253 crore in inventory losses, and Kalyan took a hit too. Their old gold became overpriced overnight, hurting profits.

Second, people are buying gold coins as investments.

Gold prices have been rising for 12 straight months, making customers more price-sensitive. This pushes jewellers to offer higher discounts and lower making charges, to maintain sales. At the same time, gold prices have been unstable — volatility is up 25-30% YoY. This is when customers start buying gold coins as an investment, rather than jewellery.

Titan reported higher gold coin sales in Q3FY25, meaning more buyers are opting for pure gold investments over jewellery. But gold coins have very low margins (almost no making charges), while jewellery has much higher margins (10-30%).

Beyond the industry-wide challenges squeezing margins, differences in strategy between Titan and Kalyan have also resulted in varied margin movements.

Titan: More Gold Sales, Lower Margins

Titan’s jewellery sales are shifting more towards pure gold jewellery, which has lower margins (10-12%). In contrast, studded jewellery (diamonds, polki, gemstones) has much higher margins (25-30%).

This quarter, gold jewellery sales for Titan outpaced studded jewellery, negatively impacting its profitability.

As a result, Titan’s studded jewellery mix fell to 23% (down 100bps YoY). Meanwhile, Kalyan increased its share of studded jewellery to 29.5% (up 230bps YoY). This shift worked against Titan’s margins but helped Kalyan.

Kalyan: Rapid Expansion, Lower Profit per Store

Kalyan is expanding aggressively using the FOCO (Franchise-Owned, Company-Operated) model, where franchisees own the store, but Kalyan manages operations. FOCO stores now contribute 40% of Kalyan’s revenue and will rise to 55% by FY27. This model allows faster store expansion with lower upfront costs, but it also results in lower margins since revenue is shared with franchise partners.

In contrast, Titan follows the COCO (Company-Owned, Company-Operated) model, where it fully owns and operates its stores, ensuring tighter control and higher margins. So, Titan focuses on premium stores with higher margins, while Kalyan is growing aggressively but taking a margin hit to do so.

So while both companies are dealing with industry-wide pressures, their individual strategies—Titan’s gold-heavy mix and Kalyan’s rapid FOCO expansion— affect their margin trends differently.

Are diamonds no longer forever?

Before we wrap up, let’s talk about a trend that many believe has shaken the jewellery industry—Lab-Grown Diamonds (LGDs). But if you ask Titan and Kalyan’s management, they aren’t too worried.

According to the companies, LGDs mainly impact solitaire diamonds—those large, single-stone pieces. Most customers don’t buy solitaires, however. Solitaires make up just 1% of Kalyan’s revenue and around 5% of Titan’s diamond business. And so, both brands have made it clear—LGDs aren’t hurting their overall sales.

Polki, uncut diamonds, and studded jewellery still dominate consumer preference, and these can’t be replaced by lab-grown alternatives. So if you’ve been wondering whether LGDs are the big disruptor in jewellery, the answer is no — or at least that’s what these companies claim.

However, Titan did mention in their conference call that a strategy around LGDs will be announced soon. So it’s not that these companies are ignoring the emerging trend — they’re simply not convinced enough, yet, to act upon it. On the other hand, Trent - another Tata company - launched its new lab-grown diamond (LGD) brand 'Pome' in Westside stores last year. There is no update on the initiative in their press release or investor presentation for Q3FY25, but we will keep a close eye on them too.

In summary, here’s how we see the sector:

Titan remains the premium market leader, but it’s feeling the pressure on margins. Kalyan is expanding aggressively, capturing market share but at the cost of profitability.

Rising gold prices, deep discounting, and shifting jewellery preferences are squeezing profits across the industry, but strong wedding demand is keeping sales steady. And as for Lab-Grown Diamonds? They’re not a major threat—at least, not yet.

Tidbits

Apple has surpassed ₹1 Lakh Cr. in iPhone exports within the first 10 months of FY25, marking a 31% increase from ₹76,000 crore in the same period last year. January 2025 alone saw a record ₹19,000 crore in exports, beating December 2024’s ₹14,000 crore. This growth is driven by local assembly through Foxconn, Tata Electronics, and Pegatron under India’s Production-Linked Incentive (PLI) scheme. The iPhone 16, launched in October 2024, pushed monthly exports above ₹10,000 crore consistently.

The Indian government will begin publishing monthly unemployment figures from April 2024, a shift from the current quarterly urban and annual combined data releases. Data collection started in January 2024, with sample designs modified to include district-level estimates. The sample size for the jobs survey has been increased from 16,000 to 22,000 to reduce the margin of error.

The Indian rupee is set to open between 87.90-88.00 against the U.S. dollar on Monday, breaching its lifetime low of 87.5825, following U.S. President Donald Trump’s announcement of 25% tariffs on steel and aluminum and reciprocal tariffs on other nations. The dollar index climbed to 108.39, and Brent crude rose 0.7% to $75.2 per barrel, adding further pressure on India’s import bill.

- This edition of the newsletter was written by Kashish and Krishna

🌱Have you checked out One Thing We Learned?

It's a new side-project by our writing team, and even if we say so ourselves, it's fascinating in a weird but wonderful way. Every day, we chase a random fascination of ours and write about it. That's all. It's chaotic, it's unpolished - but it's honest.

So far, we've written about everything from India's state capacity to bathroom singing to protein, to Russian Gulags, to whether AI will kill us all. Check it out if you're looking for a fascinating new rabbit hole to go down!

Subscribe to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Thank you for reading. Do share this with your friends and make them as smart as you are 😉 Join the discussion on today’s edition here.

Hey guys!

Do you want maybe consider reducing the length of these blogs?

I mean, the content is great and I love it, but sometimes just the sheer length is kinda daunting, and on a busy day, I miss reading it.

If not this, can you consider starting shorter blogs as well?