Why is De Beers struggling, DMart betting big & Bajaj Finance tightening loans? | Who said What?S2E5

Hi folks, welcome to another episode of Who Said What? I’m your host, Krishna. For those of you who are new here, let me quickly set the context for what this show is about.

The idea is that we will pick the most interesting and juiciest comments from business leaders, fund managers, and the like, and contextualize things around them. Now, some of these names might not be familiar, but trust me, they’re influential people, and what they say matters a lot because of their experience and background.

So I’ll make sure to bring a mix—some names you’ll know, some you’ll discover—and hopefully, it’ll give you a wide and useful perspective.

With that out of the way, let me get started.

The fall of De Beers

So the president of Botswana just said something pretty wild about DeBeers:

They are “broke” and they are “not doing its job. Maybe we should take over and sell them ourselves.”

This is the head of a country, talking about a company his government literally co-owns. And not just any company - De Beers, the world’s largest diamond company.

This is, by the way, the same company that once told the world "a diamond is forever."

For over a century, De Beers was the diamond cartel—controlling supply, setting prices, and calling the shots. So when Botswana's president announces that De Beers is broke, you pay attention.

But you might be wondering: what's Botswana got to do with diamonds?

Well, Botswana is the reason De Beers even exists in its current form. Back in the late 1960s, Botswana found diamonds - some of the best in the world, in fact. When De Beers showed up, Botswana didn't just hand everything over. They negotiated a 50-50 joint venture called Debswana.

That’s extremely rare. De Beers was already this massive cartel controlling most of the world's diamonds. They could've easily bullied a newly independent African country into some terrible deal - that's what usually happened. But Botswana somehow got 50-50.

This deal transformed everything.

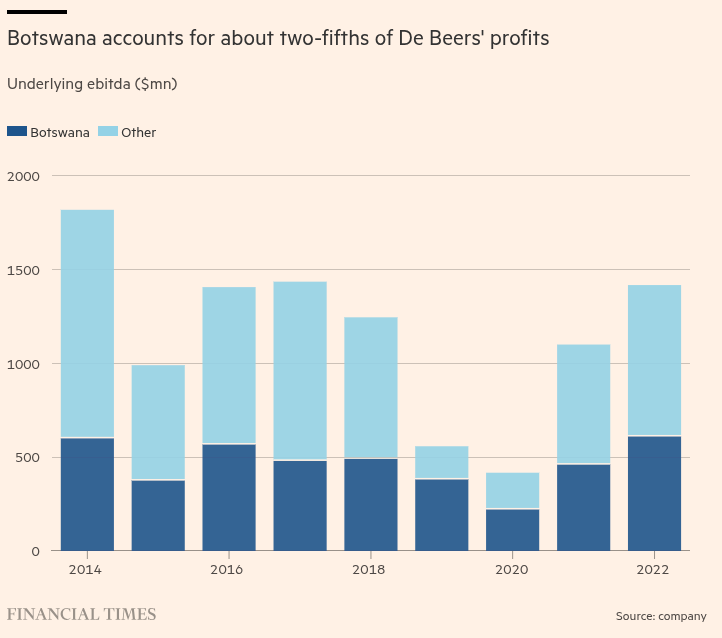

Botswana went from having nothing to becoming one of Africa's fastest-growing economies. They actually used the diamond money properly - built schools, roads, hospitals. Meanwhile, De Beers got a stable supply of high-quality diamonds. It worked brilliantly for decades. Today, about 70% of De Beers' diamonds come from Botswana. As do a good chunk of their profits.

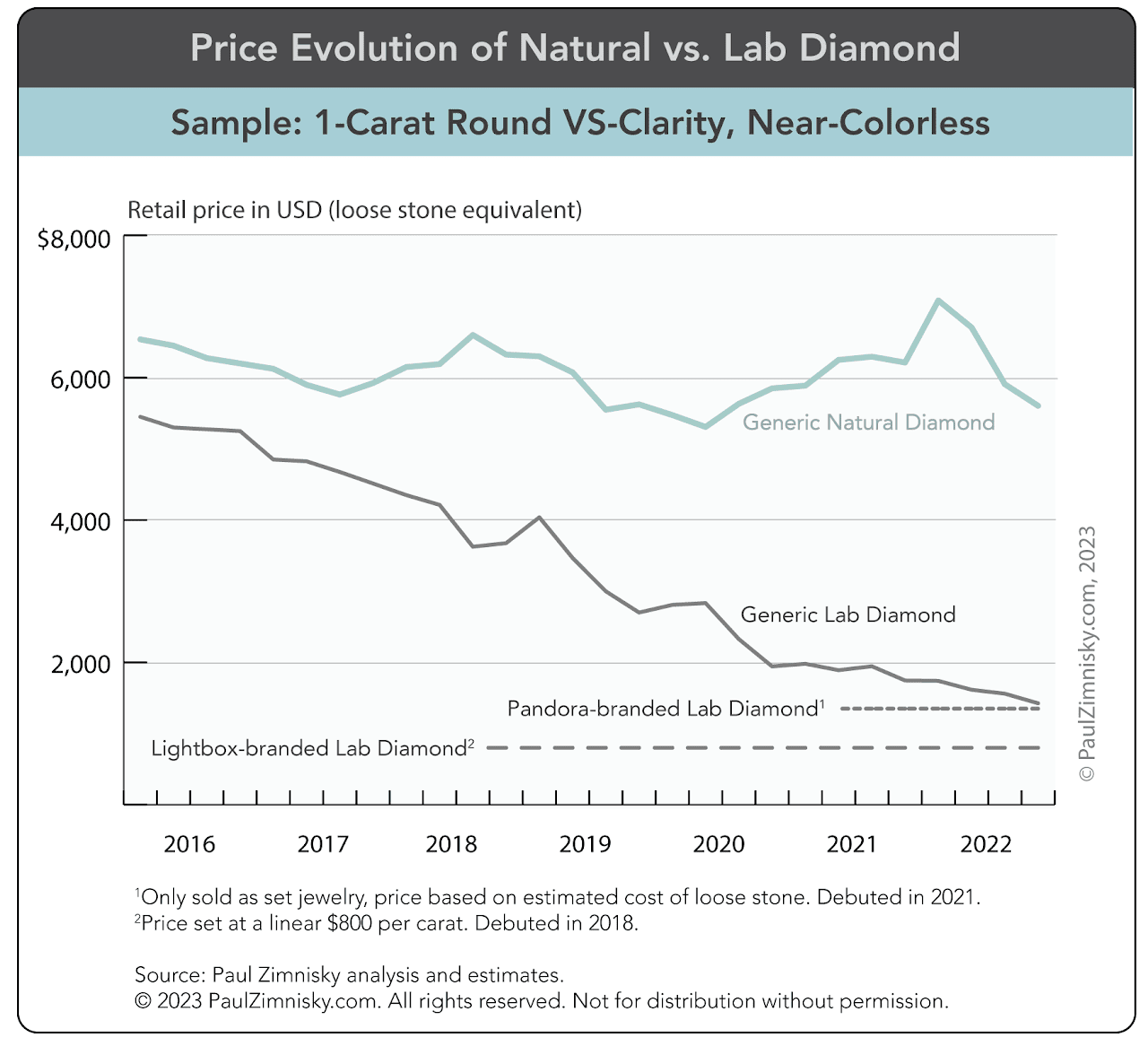

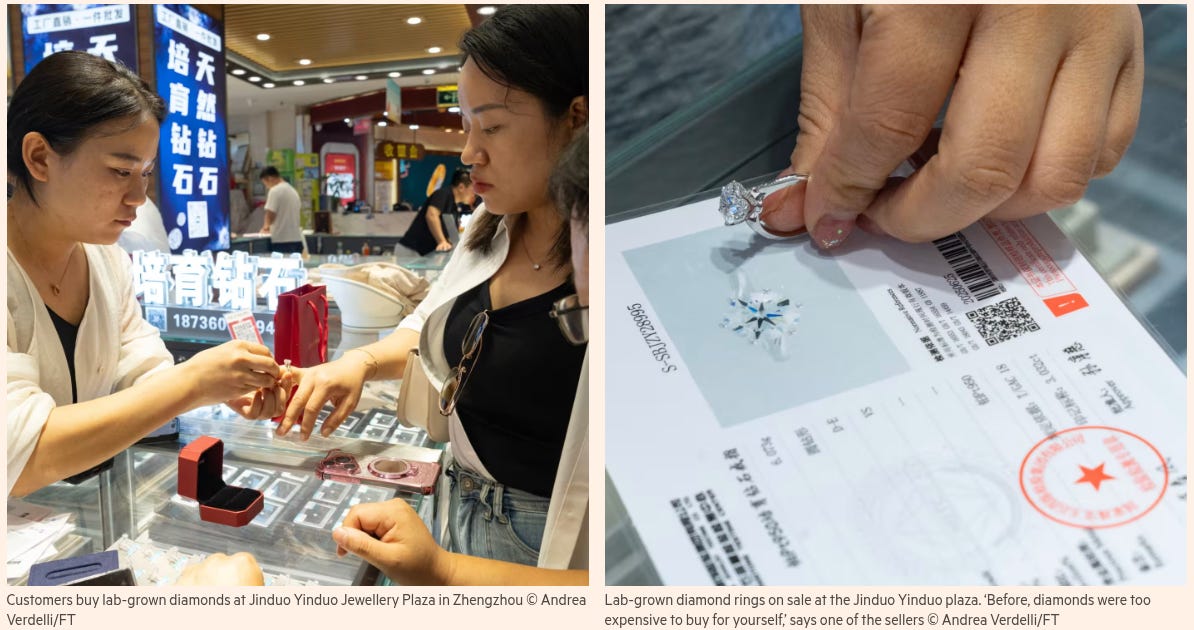

If you’ve been following the space, though, this is not surprising. The diamond market is in serious trouble — all because of lab-grown diamonds. These are practically identical to natural diamonds. But they cost a fraction of mined diamonds, and can be produced endlessly in labs.

Their entry effectively turned diamonds from luxury items into commodities. In US and China, the largest diamond markets, people simply aren't buying natural diamonds like before. Instead, the consumption of lab-grown diamonds has skyrocketed.

De Beers tried fighting this by launching their own lab-grown brand, Lightbox. It backfired. They triggered a price war and eventually shut it down earlier this year, stuck with a massive $2 billion stockpile of natural diamonds—the biggest since 2008. DeBeers even cut it’s prices which has never really happened before.

Then came another blow: Anglo-American, De Beers’ parent company, wanted out. Due to facing pressure from a hostile takeover attempt by BHP, they decided to offload non-core assets, including De Beers

Until recently, it seemed like Botswana was giving the company a lifeline. Just before the current president, Duma Boko, came to power, the previous government signed a new 10-year deal with De Beers. This deal was supposed to be a big win for Botswana. Instead of keeping just 25% of the diamonds from their joint venture, Botswana's share would jump to 30% immediately, then 40% in five years, and eventually 50%.

But does this matter? Selling diamonds has become really hard — especially now, considering the biggest seller is facing such a tough time.

Bostwana is basically getting more diamonds at a time when nobody wants them.

When President Boko first came in, he sounded supportive. He talked about needing to "safeguard the goose that lays the golden egg" - basically saying the De Beers partnership is valuable, let's protect it.

In fact earlier this year, Al Cook, the chief executive of De Beers, told the Financial Times the Botswana government “has expressed an interest to increase its stake” in the group.

Now that makes sense, considering diamonds are 90% of Botswana's exports and about a third of their GDP.

But as the weeks went by, his tone changed. That's when he dropped the "they're broke" comment. And honestly, it might be strategic. See, Botswana owns 15% of De Beers, and all the diamonds flow through them. Any sale of Anglo's 85% stake basically needs Botswana's blessing. So maybe this is just leverage - a way of saying "you can't sell this without us."

There are so many more nuances and context to this whole story but the format of this show really let us get into all that- that's what Daily Brief is for, and I’ll soon write a story there. Keep an eye out for that please 🙂

But here's the bottom line: we're watching the potential end of an empire. De Beers controlled diamonds for over a century by controlling the story - that diamonds are rare, forever, essential for love. Lab-grown diamonds killed that story. The parent company wants out. And now the country that supplies most of their diamonds is publicly calling them broke.

DMart doesn’t believe in FOMO

If you’ve run a business as successful as that of D-Mart, for as long, the brave new world of quick commerce must be a confusing nightmare. D-Mart has always had a core proposition that was custom fit for India — its customers wanted value. If you could relentlessly chase that as your North star, you could create a cash machine.

Quick commerce flipped the script. It was willing to burn profound amounts of money, to deliver customers convenience — often at the cost of value. The bet a company like Zepto took could not have been more different than that of D-Mart. These new age businesses were willing to bet that customers cared more for convenience. If you could give them things instantly without them having to go anywhere, they would pay a sizable premium.

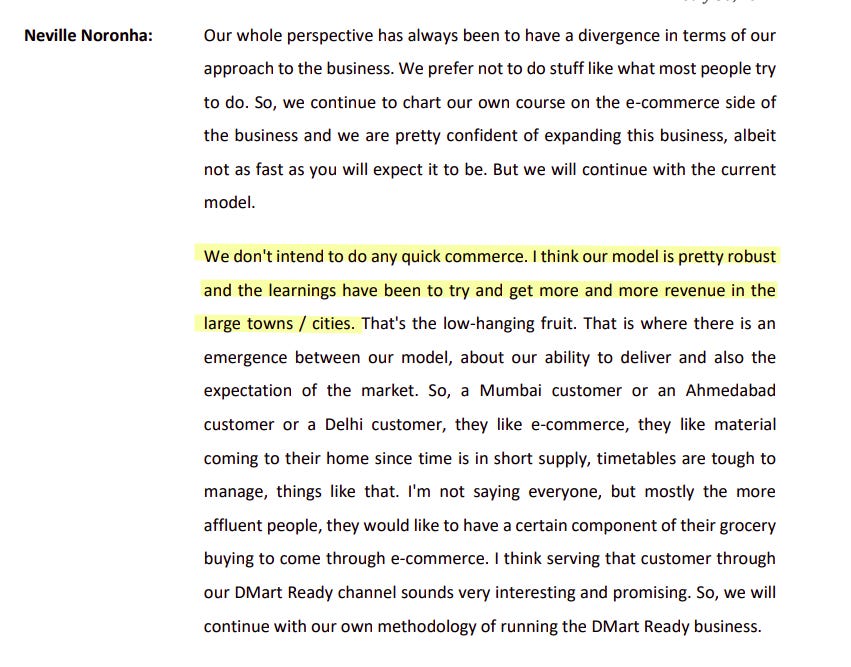

Over the last many quarters, D-Mart has been smarting over this new thesis. Infact, in their earnings call last year the CEO, Neville Noronha mentioned that they don’t even intend to do quick commerce.

And a few months after this many brokerages downgraded the company, arguing that it was no longer growing as it once did. Quick commerce, it seemed, had eaten into its moat.

But is it all hype? Or is there a genuine need for D-Mart to rethink its business? That’s perhaps a big question for the company. In its latest earnings presentation, D-Mart CEO Neville Noronha called the last year one of “evaluation and reflection”.

But the company isn’t running on FOMO. If anything, it’s certain that there’s still room for its business. In Noronha’s words:

“I have very high regard for what has happened in the quick commerce space... But the country, with its size of population, diversity, geographical space, creates also huge opportunity for an efficient brick-and-mortar business like ours. So, we continue to remain very bullish on the brick-and-mortar business.”

Outside metro cities, for instance, D-Mart’s value proposition is completely intact. As Noronha says:

“There has been zero impact on non-metros… DMart stores in Bombay or Bangalore are crowded because stores are smaller, but in smaller towns our stores are much larger, infrastructure is better, and the whole shopping experience is pleasurable. When you have pleasure and value, it’s a solid moat.”

That’s how you win such a game, the business believes.

The smart play, according to D-Mart, isn’t to start burning cash over ten minute deliveries. That’s a race to the bottom. Instead, D-Mart wants to focus on improving its physical store network, and doubling down on its value proposition. As Noronha said:

“One of the best ways to counter quick commerce is not actually digital. One of the best ways to counter quick commerce is to have more and more DMart stores, because from a value proposition we have an amazing positioning. So, for a value customer who’s spending ₹5,000 or ₹10,000 a month, they will save significantly more when they come to the store.”

How, then, do they win out?

Economics, Noronha answers. “For all the discussion around quick commerce, look at their operating costs versus DMart’s. That's our moat, and we believe we'll exist.”

But is this true? Or is it wishful thinking? We can’t say for sure, but this is one hell of a battle.

Bajaj Finance alerts about the slowdown in SME lending

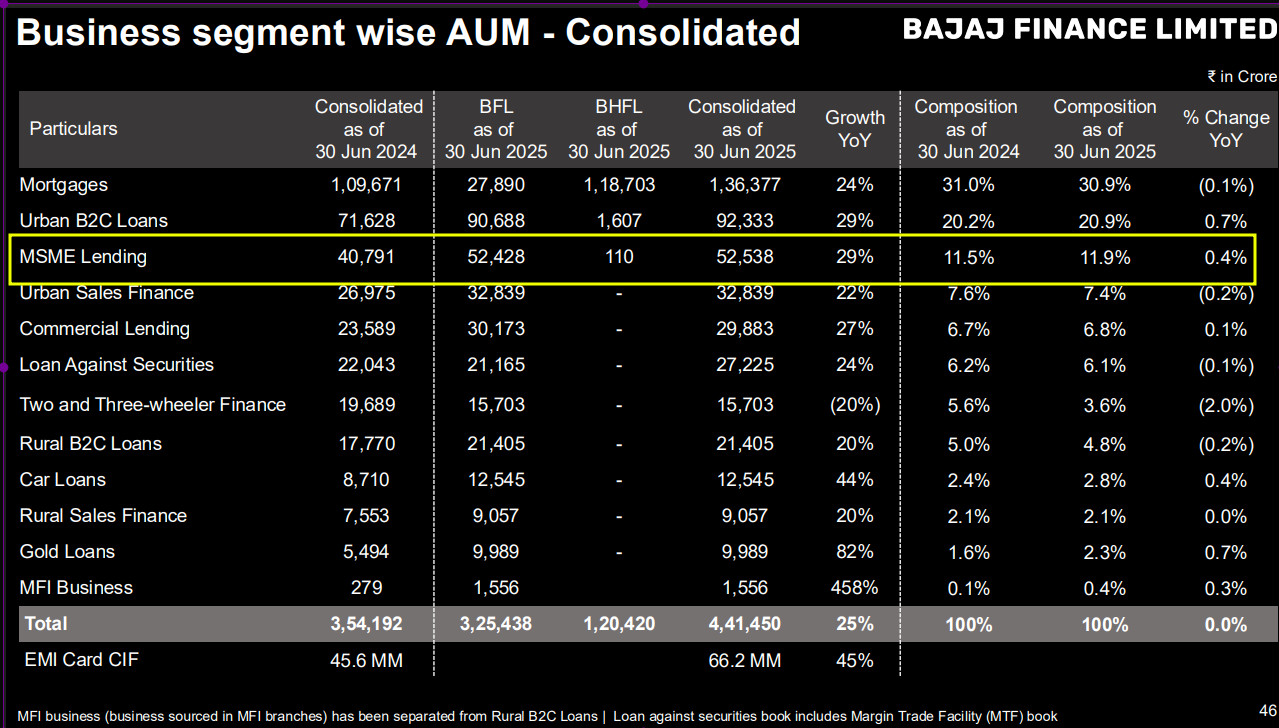

It’s the earnings season and Bajaj Finance released its result. In their earnings call, Bajaj said some things about their business that made us worried about Indian MSMEs:

“We principally track 17 key industries in MSME, out of which 13 that we are seeing are exhibiting signs of slowdown, and 3, actually. So in a way, it's all 17. It's other than 1; 3 are actually showing contraction.”

MSME lending — which makes up roughly 12% of Bajaj’s portfolio — has been a concern for Bajaj this quarter.

Many of their loans to small enterprises need restructuring, or are at risk of turning bad. One interesting thing we found in their concall is that how much of their MSME loans go mostly to doctors and clinics:

“Thankfully, we are reasonably diverse. In that, let me tell you, to the point you asked a rightful question that -- just go to Investor deck MSME portfolio is 60. Just go to – ₹50,000 crores. In that, principally, doctors is ₹15,000 crores.”`

Bajaj has been expecting this — MSMEs in India are falling in profits because our consumers are spending less. So, this hasn’t come out of the blue. However, it was taken a little by surprise as to when this unfolded:

“So it's virtually a perfect storm in a way, and it's come — let me make the third order point — that it's come a little too suddenly.”

Most of their MSME loans are unsecured — meaning that these loans were offered to MSMEs without any collateral in return. That makes loan recovery harder for Bajaj Finance. As a result, more of these loans have been classified as “Stage 2” and “Stage 3” — which represent the degrees of risk associated with these loans. The higher the stage, the worse. And their gross non-performing assets have increased from 1.48% to 1.76%.

So, Bajaj is making its lending standards for MSMEs stricter. And it has offered debt restructuring to certain customers — this would mean making the terms of the loan easier for MSMEs to pay back. This quarter, Bajaj’s restructuring efforts were worth ₹214 crores.

This isn’t just Bajaj Finance, though. As a whole, Indian banks are changing the way they’re lending to MSMEs. High-ticket MSME loans have become more common, but the number of loans has fallen. This means that banks aren’t just giving money to anyone — your credit score matters way more than before.

It seems like Bajaj is, so far, on top of this problem, and doesn’t expect it to deteriorate too badly. However, as we’ve covered before in The Daily Brief (here and here), our MSMEs are crunched on credit and raw material costs. Their falling business is hurting how much working capital they have to finance daily operations, and that, in turn, is hurting their ability to get loans.

The next quarter will be very important to see if, and how, this problem worsens.

If you’ve made it this far, please let me know if you have any feedback for me 🙂

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, even the smaller logistics firms—and copy the full transcripts. Then we bin the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

Recently I started reading concalls, there is lot of stuff to understand in those words. I like the way you bring a context out of the words from management. Thank you for this series

The Daily Brief in a short time has become a leader in financial news and data as it offers in-depth analysis,expert commentary, and today’s Brief presents factual and unbiased information as well who said what on why De Beers is struggling, DMart is betting big & Bajaj Finance is tightening loans. It’s easy to understand for small investor like me and helps me in making informed decisions.