Hello and welcome to Beyond the Charts! A newsletter where we dive into fascinating charts from the world of finance and the economy, breaking down what’s happening in a way that’s easy to understand.

This post might break in your email inbox. You can read the full post by clicking here.

If you prefer watching video over reading, you can watch the episode here:

It’s December—the time of year when global research firms start sharing their predictions and outlooks for the upcoming year. Let’s be honest, predicting the future is tricky, and things rarely go exactly as planned. Like the famous baseball player Yogi Berra once said, “It’s tough to make predictions, especially about the future.”

That said, these reports often have valuable data and insights worth exploring. So, we took a deep dive into the outlooks from major investment banks, asset managers, and brokers to pick out the most interesting highlights.

In this edition, we’ll walk you through what these analysts are forecasting for 2025.

Let's start with India.

As we’ve discussed = about in a recent episode of Beyond the Charts, high-frequency indicators are pointing to a slowdown in India’s economic growth. This was evident in the September quarter’s corporate earnings, where several companies reported results that fell short of expectations. So, it’s not surprising that India’s GDP growth for the second quarter of FY 2024-25 came in below estimates.

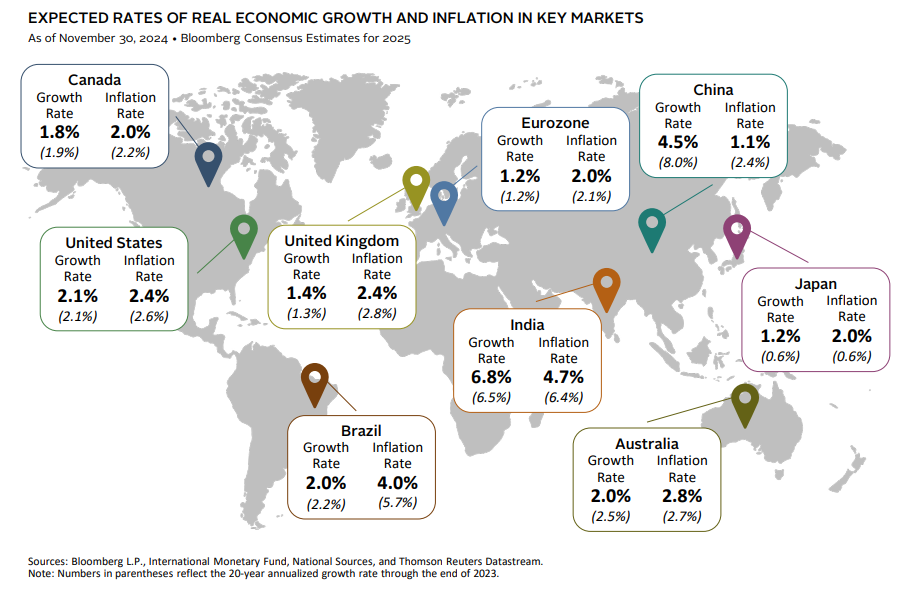

Even so, the broader outlook remains encouraging. Analysts expect India to stay on top as the fastest-growing major economy in 2025, with an estimated growth rate of 6.8%.

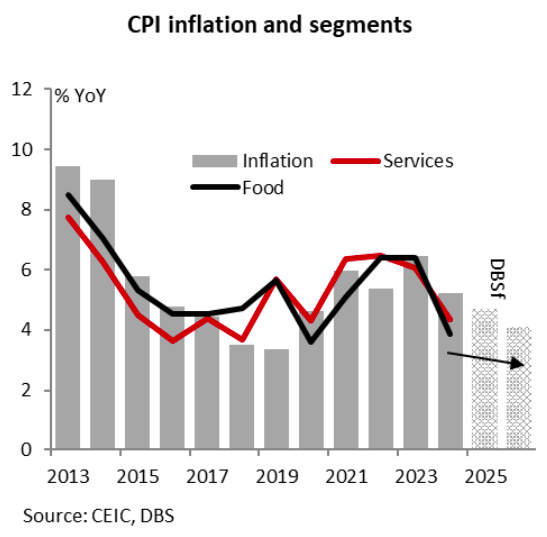

That doesn’t mean everything will be smooth sailing. Inflation has been on the rise over the past few months, driven mainly by higher food prices caused by weather-related disruptions. It’s expected to stay above the RBI’s target of 4% in 2025 as well.

According to research by DBS Bank, inflation is forecast to average 4.7% by the end of this financial year and 4.1% in FY 2026.

On the upside, there’s some positive news about interest rates. DBS expects the RBI to start cutting rates as early as February next year, with a potential total reduction of up to 0.75% by the end of 2025. This could bring the repo rate down from the current 6.5% to 5.75%.

There are other concerns as well—such as potential tariffs from U.S. President-elect Donald Trump. If such tariffs are imposed on Indian exports, it could put additional pressure on the Indian Rupee, which has already been on a downward trend.

If tariffs are imposed on Indian exports, DBS Bank projects that the Indian Rupee could weaken further, reaching ₹86 per dollar by the end of 2025.

If you’re curious why tariffs on Indian exports might come up again, there’s a clear reason: the U.S. trade deficit with India has grown significantly since Trump’s first term.

And let’s not forget, this wouldn’t be the first time Indian exports have been hit with tariffs. Back in 2018, the U.S. imposed tariffs on steel and aluminum imports from India. In retaliation, India slapped tariffs on U.S. agricultural products, escalating trade tensions between the two countries.

Moving on, let’s look at some other trends.

Private capital expenditure in India has been a mixed bag over the years. While FY 2022-23 showed strong growth in private investments, the momentum didn’t last. By FY 2024, investments had plateaued, staying mostly flat. On top of that, these investments have been heavily concentrated in just a handful of sectors.

For India to maintain and boost its economic growth, it’s essential for the private sector to step up—not just in terms of scale, but also by diversifying across a broader range of industries.

Over the past four years, India’s market capitalization and corporate profits have grown significantly. This naturally raises questions: Are the markets overvalued? Are current valuations justified? And how sustainable is this trend in the long run?'

The number of overvalued stocks in the BSE 500 index has more than doubled, rising from 79 in January 2020 to 181 in December 2024. This significant increase highlights the growing valuations in the Indian stock market over the past few years.

At the sectoral level, Consumer Durables, Infrastructure, Telecom, and Capital Goods are trading significantly above their historical valuations.

On the other hand, sectors like Private Banks and Automobiles are trading below their historical valuations and have been doing so for an extended period. So whether something is overvalued or undervalued, it can remain in that state for a prolonged duration, often defying expectations.

Despite concerns about overvaluation, India’s equity market has some distinct strengths. One standout factor is the consistently high return on equity (ROE). About one-third of Indian companies boast an ROE of over 20%, making India one of the most ROE-driven markets globally.

For some perspective, India’s 10-year average ROE is 14%, outperforming peers like Mexico (13%) and China (12%).

On top of that, India’s market risk is relatively low. The 1-year rolling beta of MSCI India against MSCI Emerging Markets has been on a downward trend, signaling reduced volatility and lower risk compared to other emerging markets. These factors make India’s equity landscape particularly appealing for long-term investors.

Now, let’s dive into the global economic forecasts.

The Economist Intelligence Unit (EIU) expects global GDP growth to stay moderate at 2.6% in 2025, the same as in 2024.

In the United States, growth is projected to ease to 1.7% in 2025, reflecting a broader slowdown. Still, consumer spending is likely to remain strong, thanks to a resilient job market and stable wage growth. That said, risks like potential tariff hikes and stricter immigration policies under the Trump administration could create uncertainties for the U.S. economy.

For advanced economies like Japan, Germany, and the UK, growth is expected to pick up slightly compared to 2024 but will remain below the global average.

Beyond India, China stands out as the only other major economy poised to grow significantly above the global average in 2025.

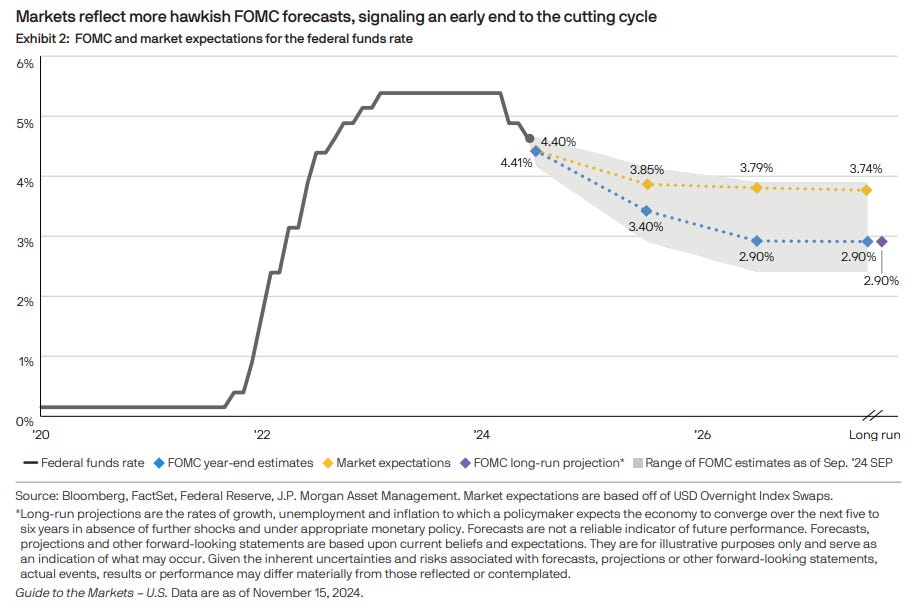

While easing inflation might pave the way for rate cuts, it’s unlikely that interest rates will return to pre-pandemic levels. Current market expectations suggest that U.S. interest rates will stabilize around 3.85% in 2025, with no major reductions expected beyond that.

Inflation continues to be a key concern for economies worldwide. However, in most advanced economies, inflation levels are expected to ease, moving closer to central bank targets of around 2%. This moderation could open up opportunities for further interest rate cuts, offering some relief to businesses and consumers alike.

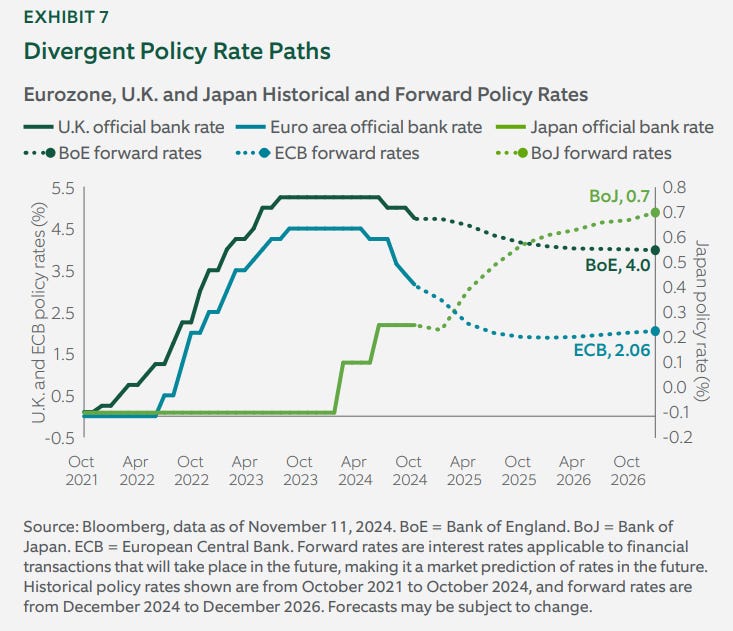

By the way, different central banks are taking different approaches to rate cuts.

The euro area is expected to experience weak economic growth in 2025, driven by both internal and external challenges.

Germany, the region’s largest economy, continues to struggle with slowing industrial output and declining global competitiveness.

Externally, China’s economic slowdown and the potential imposition of U.S. tariffs on European goods add further pressure on trade and manufacturing sectors.

In response to these challenges, the European Central Bank is expected to cut interest rates to around 2%, aiming to stimulate growth and support the region’s fragile economic recovery.

In the United Kingdom, persistent inflation and increased government spending are expected to lead to a more gradual approach to interest rate cuts by the Bank of England.

Meanwhile, Japan is an outlier among developed economies. After years of ultra-loose monetary policy, the Bank of Japan is expected to continue raising rates, with projections suggesting an increase to 0.75% in 2025. Rising prices and political challenges have prompted this policy shift, marking a significant departure from Japan’s long-standing stance on interest rates.

Coming to China, the economy is expected to grow at a decent rate, supported by recent stimulus measures aimed at stabilizing growth. However, these measures are unlikely to provide a significant boost to the overall economic trajectory, indicating that growth will remain steady but not spectacular.

The Chinese economy is facing structural challenges, such as a slowdown in domestic consumption, deflationary pressures, and a struggling real estate sector.

To put this into perspective, despite lower mortgage rates, household borrowing has remained subdued, highlighting a lack of confidence among consumers.

That’s not the only risk on the horizon. Donald Trump’s proposed tariffs on exports from China and other countries could create additional headwinds for global economic growth if they are implemented.

According to Schwab’s outlook, these tariffs could hit the U.S. economy the hardest, with a projected -0.4% drag on GDP growth. Globally, the impact is expected to be less severe but still notable, with a projected reduction of around -0.1% to overall GDP growth.

Trade restrictions are not a new phenomenon, they have gained significant momentum since 2014 and have only escalated in recent years.

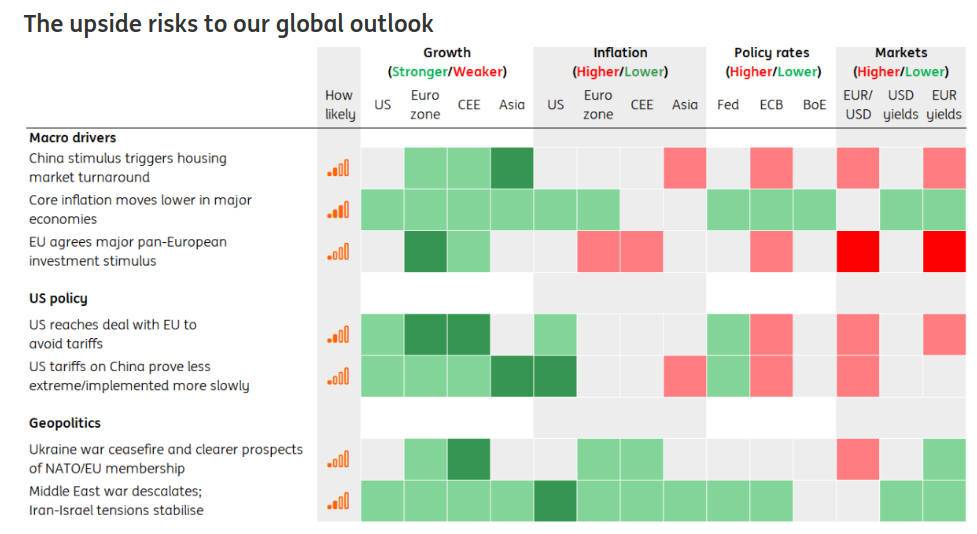

Here’s a handy breakdown, based on a chart from ING, of the biggest risks that could either hurt or boost global economic growth. Let’s start with the risks that could hurt the economy:

Property Market Crash: The ongoing crash in property prices and oversupply could slow down global growth. Cheaper exports flooding markets might further disrupt trade dynamics.

Rising Unemployment: A sharp increase in unemployment in 2025 could significantly impact the U.S. economy, with ripple effects across global markets.

Aggressive U.S. Policies: Drastic policy shifts in the U.S. could lead businesses to pull out of Europe, delivering a blow to its already fragile economy.

US-Europe Trade Battle: An escalating trade war between the U.S. and Europe could disrupt global supply chains, slowing economic growth worldwide.

Geopolitical Tensions: Escalation in the Ukraine-Russia conflict or rising tensions in the Middle East and Asia could inject significant uncertainty into the global economy, hampering trade and investment.

On the brighter side, there are several factors that could positively impact global economic growth:

China’s Stimulus Efforts: Fresh stimulus measures from China could stabilize its struggling property market, boosting confidence and driving growth across Asia.

Lower Core Inflation: A decline in core inflation in major economies would ease pressure on central banks, giving them more flexibility to support economic growth.

European Investment Packages: A large-scale investment initiative in Europe could revitalize its economy, driving innovation and creating jobs.

Trade Cooperation: Avoiding tariff disputes and fostering collaboration would bolster global trade and support business expansion.

Geopolitical Stability: A Ukraine ceasefire, easing tensions in the Middle East, and progress on NATO/EU membership could bring much-needed stability.

Moving forward, a look at the debt levels of economies.

Debt is climbing globally, with governments allocating an increasing share of GDP to service this debt. Countries like Japan, the U.S., and Italy are bearing the heaviest burdens, as sovereign debt ratios in advanced economies continue to rise.

This growing debt strain limits the ability of governments to invest in critical areas such as education and infrastructure—investments that are essential for long-term economic growth.

What’s more, excessive debt can drive inflation, especially if governments turn to risky fiscal policies to manage their obligations. Over time, a high debt load also discourages business investments, slowing economic progress and making it even tougher for countries to maintain sustainable growth.

Now let’s focus on market performance. US markets have outperformed the rest of the world both in terms of returns and earnings by a wide margin since 2010. And it is expected to continue in 2025.

Despite the fact that the price-to-earnings (PE) ratio of U.S. markets remains well above the long-term average, expectations for growth are still optimistic. Analysts project a 6% annual increase in sales, alongside improved profit margins driven by the adoption of AI technologies.

The U.S. markets are often viewed as exceptional, thanks to their strong earnings growth, particularly among the "Magnificent Seven"—Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta Platforms, and Tesla. These companies continue to dominate the market, driving much of its growth and resilience.

On the other hand, when you look at Europe or other parts of the world, their profitability growth isn’t that great.

China’s case is even worse. There’s been massive equity share dilution, which has kept returns for investors nearly flat. Add to that a struggling economy, and it’s no surprise their stock market has done nothing.

A look at some interesting trends in financial markets.

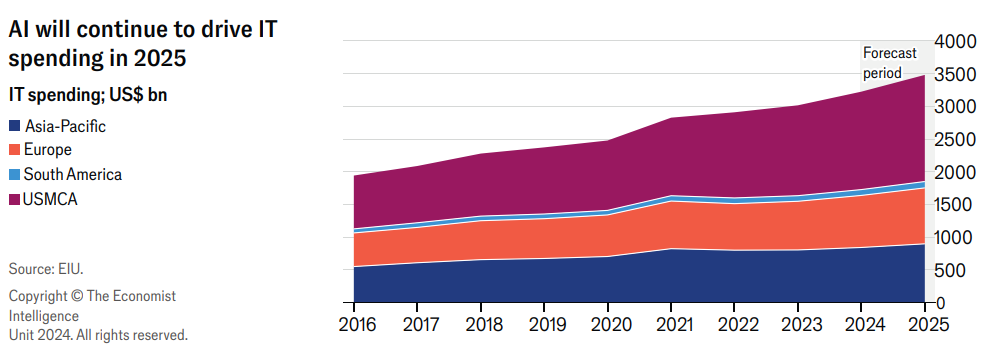

AI is expected to remain a major driver of IT spending globally, attracting significant investments, particularly in advanced economies.

Private equity is quickly becoming a key funding source, with assets under management projected to nearly double by 2029, reflecting growing interest in alternative investments.

Despite substantial investments in green energy, the global economy remains heavily reliant on fossil fuels. Renewable sources like wind and solar are growing but it will take time to reduce this dependence significantly.

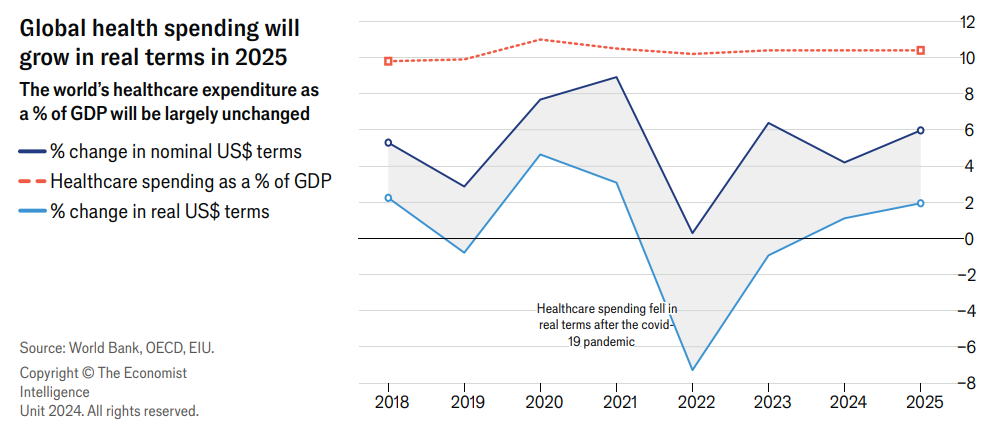

Global healthcare spending is expected to grow by 6% in 2025 as per EIU, outpacing inflation. This increase will be driven by public spending in developing countries and rising demand in aging populations across wealthier nations.

By 2025, 12% of the global population will be aged 65 or older—a figure set to rise further.

That’s it from us today. Do share this with your friends to spread the word.

Also, if you have any feedback, do let us know in the comments.