This is how the world ends.

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

Check out the audio here:

And the video is here:

In today’s episode, we look at 6 big stories.

- Massive tech breakdown affected all types of companies

- Government’s new PSU plan

- RBI’s latest Indian economy report

- Netflix’s performance in India this quarter

- Infosys’s latest earnings report Insights

- Paytm’s quarterly earnings result

Massive tech breakdown affected all types of companies

On Friday, a major tech breakdown occurred that felt like a scene straight out of Die Hard 4. Crowdstrike, a leading cybersecurity software provider, faced a critical issue that wreaked havoc worldwide. Here's what happened:

Crowdstrike's Role:

Provides cybersecurity solutions to stock exchanges, airlines, hospitals, law enforcement agencies, and tech companies globally.

Uses an agent installed on devices (laptops, servers, etc.) that communicates with a central server in the US to protect against cyber threats.

The Breakdown:

Crowdstrike forcibly updated its agent on Friday.

Instead of enhancing security, the update corrupted Windows systems, causing them to enter a restart loop and rendering devices useless.

Global Impact:

Major banks, airlines, airports, stock exchanges, brokers, and hospitals were severely affected.

The chaos highlighted the vulnerability of relying on a single software provider for critical infrastructure.

Comparison to Past Incidents:

This incident is reminiscent of a previous issue with Cloudflare, another essential software provider, which once disrupted much of the internet.

Government’s new PSU plan

The Indian government is reportedly considering a shift in its approach to public sector companies (PSUs). Historically, PSUs have played a crucial role in India's economic development, particularly in the years following independence when private capital was scarce. However, the debate over privatization and divestment has been ongoing since India's economic liberalization in 1991. Recent reports suggest a new strategy might be on the horizon.

Post-Independence Era:

India lacked sufficient private capital to build necessary infrastructure.

The government established Central Public Sector Enterprises (CPSEs) in key sectors.

Over the years, the number of government companies increased significantly.

1991 Liberalization:

Economic reforms introduced the concepts of divestment and privatization.

The debate on the role and future of PSUs has continued since then.

Current Scenario:

Number of PSUs: As of 2022–23, there were 254 PSUs, with 193 being profitable and 57 being loss-making.

Privatization Debate:

Pro-Privatization: Advocates argue the government should focus on governance rather than running companies, citing inefficiencies and losses in some PSUs.

Anti-Privatization: Critics, mainly politicians, argue that selling PSUs is akin to "selling the family silver."

Divestment Targets: Both NDA and UPA governments have attempted to sell stakes in PSUs. Despite setting annual divestment targets, the government has consistently fallen short over the past five years.

Recent Developments:

Care Ratings Estimate: The government could potentially raise Rs 11.5 lakh crores by selling PSU stakes while retaining 51% ownership.

New Strategy: According to a Reuters article, the government may shift its focus from selling PSUs to improving their management and profitability. The new plan could involve selling non-core assets like land, reinvesting the proceeds, and attempting to turn these companies around.

Upcoming Budget: More details are expected when the budget is released on Tuesday. This potential change in strategy will be closely watched.

RBI’s latest Indian economy report

The Reserve Bank of India (RBI) recently released its July report on the Indian economy, and it contains some noteworthy insights. The monthly report provides a comprehensive overview of economic trends and indicators, offering a glimpse into the country's financial health and future prospects.

Strong GDP Growth:

India's economy is on a roll, with the RBI projecting a 7.4% GDP growth for the June quarter compared to last year.

A better-than-average monsoon bodes well for Indian agriculture, and the prospects for both services and manufacturing sectors look bright.

Fiscal Surplus:

India registered its first fiscal surplus in 22 months this May, meaning the government spent less than it earned.

This surplus was primarily due to increased income tax revenues while government spending remained flat.

Persistent Food Price Inflation:

Despite the RBI's efforts to control inflation, food prices continue to rise. The RBI's target is to keep inflation around 4%.

Interest rates were hiked six times from 4% to 6.5% in 2022 and 2023, but vegetable prices in June were nearly 30% higher than last year due to extreme summer heatwaves.

SME IPO Boom:

Small and medium enterprises (SMEs) are increasingly turning to stock exchanges to raise funds, instead of relying solely on bank loans.

In 2020-21, the median SME IPO was oversubscribed by 1.42 times. By 2023-24, this number had soared to over 62 times, outpacing mainboard IPOs.

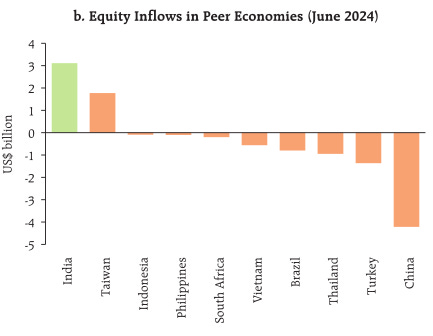

Resurgence of Foreign Investments:

Foreign investors returned to Indian markets, investing $5.3 billion in June 2024 after two months of withdrawals.

Significant investments were made in finance, telecom, and consumer services stocks.

The inclusion of Indian government bonds in JP Morgan's emerging markets bond index has played a significant role in attracting foreign investment.

Netflix’s performance in India this quarter

Netflix's Q2 earnings reveal that India has become its second-largest paid subscriber market. This is surprising given India's low ARPU (Average Revenue Per User) nature, reflecting Netflix's significant growth in a price-sensitive environment.

Initial Struggles:

Initially, Netflix's plans were significantly more expensive than competitors.

Struggled to attract Indian viewers due to insufficient localized content.

Strategic Changes:

In December 2021, Netflix slashed prices by 18-60%, reducing the entry-level plan from ₹499 to ₹199 per month.

Introduced a mobile-only plan at ₹149 per month, a global first for Netflix.

Cord-Cutting Trend:

The decline in DTH subscribers in India (down by 10 million) has driven more users to OTT platforms.

Recent Success:

India is now Netflix’s second-largest market globally for new paid subscribers.

India ranks as Netflix’s third-largest market in terms of revenue growth.

Netflix’s co-CEO predicts the company could reach 100 million subscribers in India soon.

Challenges Ahead:

JioCinema's annual plan at ₹299 challenges Netflix’s monthly rate of ₹199.

Netflix is heavily investing in exclusive Indian shows to maintain its growth trajectory.

Infosys’s latest earnings report Insights

Infosys recently announced its Q1 financial results, showcasing a net profit growth of 7.1% and revenue growth of 3.6%, surpassing estimates. While financial news outlets cover the numbers in detail, let’s dive into some of the intriguing trends from this quarter.

Reduced Attrition:

Attrition dropped to 12.7% from 17.3% last year.

Infosys plans to hire 15,000 to 20,000 freshers this year.

This highlights a contrast with competitors like TCS, which struggles with skill gaps and unfilled vacancies.

Focus on AI:

Infosys aims to become an AI-first company, similar to its previous “digital first” and “cloud first” initiatives.

The company has trained 250,000 employees in AI technologies.

CEO Salil Parekh noted strong client interest in generative AI programs, particularly using proprietary data sets.

AI Hype vs. Reality:

While AI is a global buzzword, its tangible impact on revenues is still emerging.

Infosys’s focus on AI reflects broader industry trends, but its real-world application and benefits remain to be fully realized.

IT Sector Trends:

Generalist IT companies like Infosys and TCS have shown single-digit growth recently.

In contrast, specialized IT firms like Persistent Systems and KPIT are experiencing better growth, indicating a shift in market dynamics.

Paytm’s quarterly earnings result

Paytm has faced a tumultuous year filled with regulatory challenges and significant leadership changes. The Reserve Bank of India (RBI) identified issues with Paytm Payments Bank’s KYC norms and cybersecurity protocols, leading to a ban on onboarding new customers and accepting new deposits. This crackdown posed an existential threat to Paytm, with key leaders like Surinder Chawla (CEO of Paytm Payments Bank) and Bhavesh Gupta (COO of Paytm) resigning. Despite these hurdles, Paytm managed to adapt and continues to navigate through these turbulent times.

The RBI’s scrutiny extended beyond Paytm, impacting the entire fintech industry. Kotak Mahindra Bank was also restricted from onboarding new customers and issuing new credit cards due to IT and cybersecurity issues.

Quarterly Losses:

Paytm reported a net loss of Rs 840 crore for this quarter, a 36% decrease from the previous year’s loss of Rs 1,502 crore.

Merchant Subscriptions:

The number of merchant subscriptions grew from 79 lakhs to 1 crore in June 2024, showing resilience in this segment.

User Base:

Monthly transacting users stabilized at around 7.8 crores by June 2024 after dropping from 10.4 crores in January 2024.

Merchant Lending:

The value of merchant loans fluctuated, peaking at ₹4,460 crore in December 2023 before dropping to ₹2,508 crore in June 2024. This indicates cautious lending practices but also highlights merchant lending as a bright spot for Paytm.