The chip wars get wilder, twistier, and more intense

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how, too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and watch the videos on YouTube. You can also watch The Daily Brief in Hindi.

In today’s edition of The Daily Brief:

Tracking the chip wars: September 2025

India's Data Center Gold Rush

Tracking the chip wars: September 2025

A lot has changed in the global battle for chip supremacy over the last few months.

The space, today, is marked by a collision between two immensely powerful, but somewhat contradictory forces. On one hand, the emergence of AI has unleashed an insatiable demand for computational power. This has created a once-in-a-lifetime tailwind which is propelling the chip industry to unimaginable heights, arguably making them the most important piece of technology in the world.

But with that, chips have also come to symbolise national power — placing them at the heart of an escalating geopolitical rivalry between the United States and China. Both countries are pouring vast resources into ensuring they control the future of this industry. That clash threatens to rip the global chip supply chain into two.

There are many facets to this story — most of which are too technical for us to grasp. But here is our best understanding of how this clash is proceeding, at this moment in time.

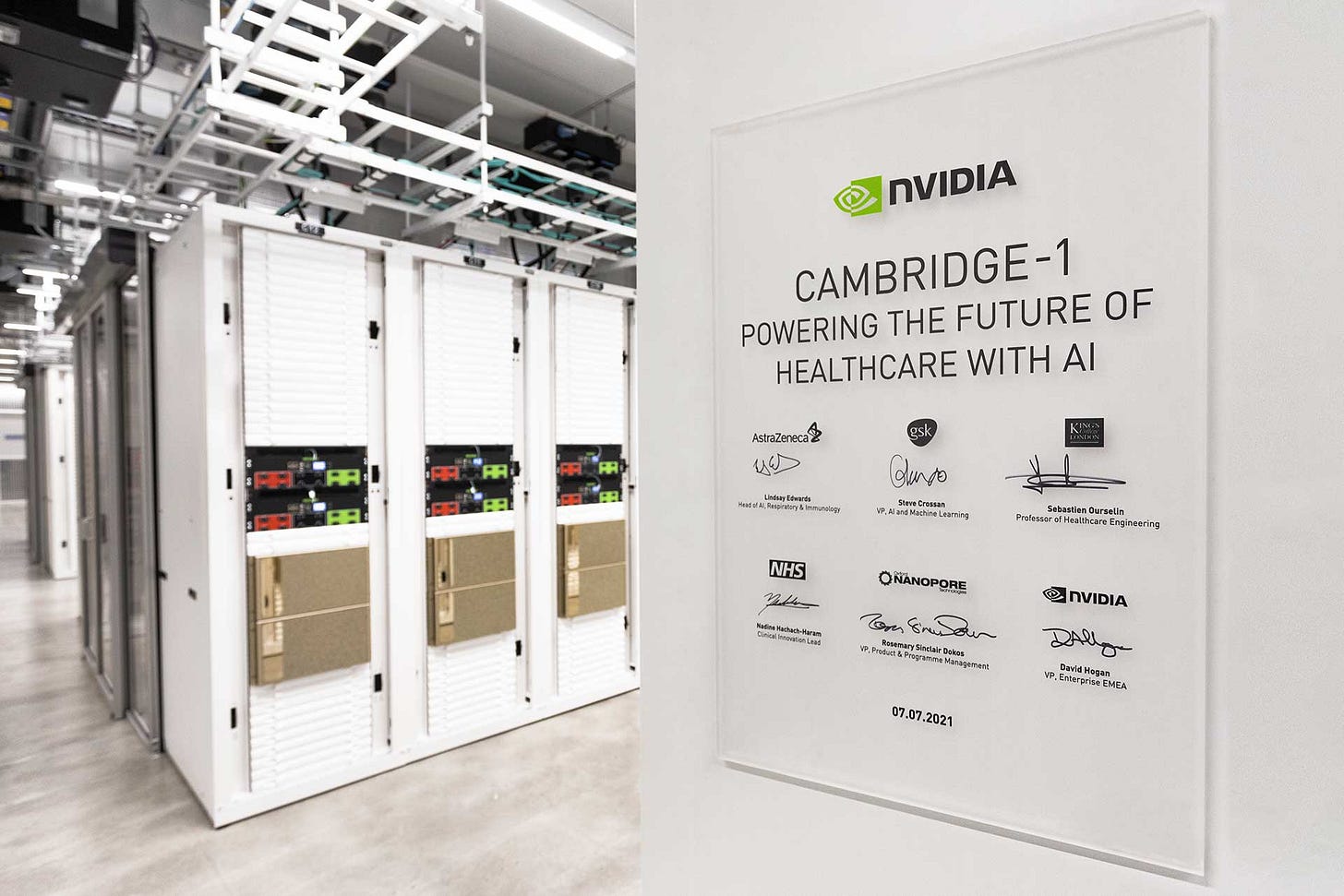

The Goliath: NVIDIA

To understand the global chip war we’re living through, you have to begin with the giant at the heart of it: NVIDIA.

It's hard to explain just how important NVIDIA has become in the last few years. The company utterly dominates the AI chip market — controlling as much as 90% of the world’s market for AI chips. But its role is far larger than just market leadership. It's the central pillar that bears the load of the world's AI ecosystem. Every major AI breakthrough, thus far, is downstream of Nvidia’s advances. The rest of the industry operates in its shadow.

Ever since AI first made a splash, NVIDIA has been innovating at a frenetic pace. Even as its competitors scramble to simply match the capability of NVIDIA’s chips (including its older products), the company rapidly built an entire ecosystem that included processing units, entire supercomputer systems that put its chips together, and even the software to tie it all. This has given the company a series of inter-locking moats, breaking out of which feels unthinkable.

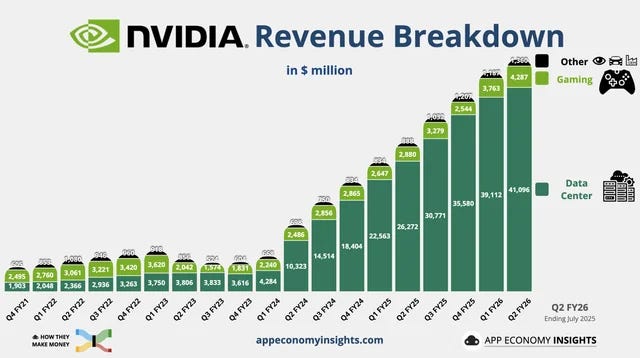

That has made NVIDIA the most valuable company in the world. In the June quarter this year — a single quarter, mind you — it touched $46.7 billion in revenue — 56% higher than last year. It’s a testament to just how high expectations around the company are that analysts were disappointed by these numbers, nevertheless.

The real magic, however, lies in the feats of engineering the company is still capable of. It just unveiled a whole new class of GPUs — “Rubin CPX”, which can, in a single second, perform 30 quadrillion calculations — 7.5 times what its current cutting edge systems can manage — while using its memory much more efficiently.

These numbers are way too big for us to make sense, but the future of AI demands them. As AI systems grow more “agentic”, performing large, complex tasks, they increasingly need to work with databases containing billions of pieces of information at the same time. This is the future that NVIDIA expects.

The competitors

But this dominance shouldn’t detract you from the fact that NVIDIA is just a single entity — in a whole ocean of chip-makers. For now, nobody comes anywhere close to challenging NVIDIA’s clout. They’re all fighting to find some way of emerging from its shadow — something NVIDIA itself had pulled off not too long ago.

The Americans

Until a few years ago, NVIDIA played second fiddle to two semiconductor giants: AMD and Intel. They made the main processors for computers of all kinds, while NVIDIA just made graphics cards for gamers. While the AI revolution upended this hierarchy, it’s important not to write NVIDIA’s rivals off.

AMD, in particular, remains a behemoth in its own right. Although it has ceded a large lead in AI computing, it still commands nearly 40% of desktop CPU revenue, and 41% of global server revenues — dominating traditional chip markets.

The company isn’t sitting still in the AI data center market either. In 2024, the segment netted the company a revenue of $12.6 billion — well below Nvidia’s mammoth earnings, but 94% better than its own 2023 performance. Its MI325X chip can go toe-to-toe with NVIDIA’s best offerings, at roughly one-third the price. That value proposition has fetched it contracts from leading AI companies — securing deployments with Microsoft, Meta, and OpenAI.

Hardware, though, is just half the battle. NVIDIA has a crucial moat over AMD — CUDA, its proprietary software platform that has already locked in millions of developers, who exclusively build for Nvidia’s ecosystem. AMD is trying to break through this moat with an open-source platform, ROCm (Radeon Open Compute). But that could be a long, slow war of attrition — as the company tries convincing developers that, over the long term, the switch shall be worth it.

On the other hand, Intel, as we’ve covered before, is in a precarious position. The company has been bleeding money, and its line of AI accelerators have flopped miserably. The very inventor of the microchip is now fighting for survival.

But after months of despair, recently, the company found an unlikely sliver of hope. The US government sees a lot of value in its ability to manufacture cutting-edge chips on American soil, and put their money where their mouth is. In an unprecedented step, this August, the US government converted $8.9 billion in CHIPS Act grants into a 10% equity stake in Intel — making it the company's largest shareholder.

The company is now trying to pull off a pivot. Instead of trying to compete against the likes of NVIDIA, the company is embarking on what it calls its IDM 2.0 strategy — trying to become a foundry that, much like TSMC, shall make chips designed by other companies. In this, it just got a massive vote of confidence when NVIDIA itself announced an investment into Intel. We’ll get to that shortly.

The Chinese close in

China has, as we’ve covered before, has been pouring staggering amounts of money into its chip ambitions. Its Big Fund III, with roughly ~$47.5 billion in capital, has been trying, steadfastly, to crack through America’s chip monopoly.

These efforts are beginning to show some success, with a wave of domestic chip-making activity. China’s internet giants, Alibaba and Baidu, now design their own in-house chips. New start-ups like Cambricon and Biren are designing their own advanced AI processors. YMTC, a Chinese memory chip-maker, can now make memory chips that are at par with global leaders.

But two companies stand out above the rest.

The first is SMIC — China’s leading foundry. Not a year ago, most people would have written them off. After all, all Chinese firms had been prohibited from accessing the world’s most advanced chip-making tools, which ran on “EUV lithography”. All they could access were older, inferior DUV machines, which weren’t nearly as capable. But that wasn’t enough to stop SMIC. The company discovered complex new “multi-patterning techniques”, which let it mass-produce 7-nanometer chips with those older machines.

Today, SMIC isn’t nearly as efficient as foundries like TSMC or Samsung. Its chips aren’t world-beaters, but they probably don’t have to be. They’re good enough to power China’s consumer electronics industry and its AI systems. This has given SMIC a captive market in Chinese chip design, and slowly, the company has captured 5.5% of the global foundry market, becoming the world’s third largest foundry.

With the support of SMIC’s foundries, China’s Huawei has arguably become NVIDIA’s most potent competitor.

Once left for dead under the weight of American sanctions, Huawei has since become the flag-bearer of China’s chip ambitions. Its phones run on Kirin 9000 processors, made in collaboration with SMIC. More importantly, however, Huawei has been rolling out its own line of AI accelerators — like the Ascend series, which powers Chinese AI heavyweights like Deepseek.

Just last week, Huawei broke a long silence to announce a multi-year plan to challenge NVIDIA’s dominance. Its strategy is fascinating. Individually, the company can’t match the quality of NVIDIA’s chips. But it doesn’t have to; instead of trying to make better GPUs than NVIDIA, Huawei is instead trying to create “superclusters” — massive systems which connect thousands of inferior chips together. Huawei’s bet is that its superclusters could collectively beat those of NVIDIA.

This may well become the next battleground in the global chip contest, as NVIDIA itself has admitted.

The geopolitical battle

All of this is happening in the backdrop of a raging US-China geopolitical war.

Earlier in the year, we spoke about America’s AI chip license raj. China had instantly responded in kind, with an immediate ban on the export of various minerals that were critical to chip-making, like gallium, germanium, and antimony. When President Trump first came to office, he escalated the battle further — banning the export of the inferior H20 chips to China as well.

Tensions stayed high for a while. China was cut off from most American chips — including those that were nowhere near the cutting edge.

In reality, of course, these bans were incredibly hard to enforce. Chinese companies could still access top-notch US chips on the black market. Countries like Malaysia and Singapore turned into major hubs for smuggling chips into China, while restricted chips were sold openly in the electronics markets of Shenzhen. At least on paper, however, it was the United States that was blocking China from reaching its chips.

Over the last few months, though, there has been a flurry of activity that has turned this equation upside down. In August, after months of lobbying, the United States government eased its restrictions. NVIDIA and AMD would get licenses to export some of their weaker chips — H20 and MI308 respectively — to China. In exchange, the United States government would get a cut, in some sort of reverse-tariff. Both companies would have to pay the United States 15% of their China sales.

If NVIDIA hoped for business from China, however, what it got was brutal retribution.

Last week, China's State Administration for Market Regulation (SAMR) announced accusations that Nvidia had violated the country's anti-monopoly laws. This was just the opening salvo. Chinese authorities then all but froze NVIDIA’s access to the Chinese market. Chinese tech firms like Alibaba and ByteDance were asked to terminate orders for Nvidia's RTX Pro 6000D chips — which were specifically designed to comply with US export restrictions.

China has effectively announced that it doesn’t need American chips — if anything, it is they that need the Chinese market. And NVIDIA, it seems, is the biggest casualty.

NVIDIA turns investor

NVIDIA, though, is busy plotting its own moves. Now, it’s rapidly expanding its presence across other parts of the AI stack.

This isn’t new. The company had pursued an aggressive acquisition strategy last year as well. It had poured $700 million into the Israeli start-up, Run:AI, which helps companies optimize their compute resources. It also invested $1 billion across fifty different AI start-ups.

In just the last couple of weeks, however, it has announced mammoth partnerships, dwarfing anything it did last year.

First came Intel. Shortly after the United States government announced its stake in the company, Nvidia jumped into the fray. The two companies announced that, together, they would develop the next many generations of custom data center and PC products. Intel would build custom processors for Nvidia’s infrastructure platforms and also integrate NVIDIA chiplets on chips for PCs. To cement this alliance, Nvidia shall make a $5 billion investment in Intel's common stock.

This is, perhaps, a sort of geopolitical insurance. As we had mentioned above, Intel has been trying to pivot into becoming a foundry-for-hire. This deal effectively allows Nvidia to benefit from that business. Intel could prove to be a credible Plan B in case, for some reason, TSMC can no longer service the company.

But the Intel deal was just the beginning.

Its real masterstroke came days later, when NVIDIA and OpenAI announced a letter of intent for a landmark partnership. In the coming years, NVIDIA shall invest up to $100 billion in OpenAI. In exchange, 4-5 million new NVIDIA GPUs shall be deployed in OpenAI's next-generation AI data centres — all with the cutting-edge Rubin CPX chips we mentioned before.

The deal locks the two companies in a symbiotic, co-dependent relationship. NVIDIA is, in essence, funding its own biggest customer. This will effectively give it a steady source of demand for many years — possibly locking in its chip monopoly.

As one of the largest investments in history, this deal leaves more questions than answers. One thing is clear, though, NVIDIA appears to be turning itself into some sort of lightening rod to consolidate America’s AI ecosystem — building a formidable “team USA” front in the global technology competition with China. In just a couple of weeks, it has married its design and innovation capabilities with Intel’s manufacturing muscle, and OpenAI’s AI platforms.

The bottomline

The global chip war may well be the most consequential story of our time, shaping the future of technology itself. This is no longer just the story of an industry. It’s a struggle over the foundations of intelligence, power, and progress. For now, Nvidia sits at the center of this battle. But things are far from settled. We’re living through a titanic clash of innovation, capital, and geopolitics. The industry’s balance of power could turn on a dime.

The chip war, from what we can tell, is only beginning to heat up.

India's Data Center Gold Rush

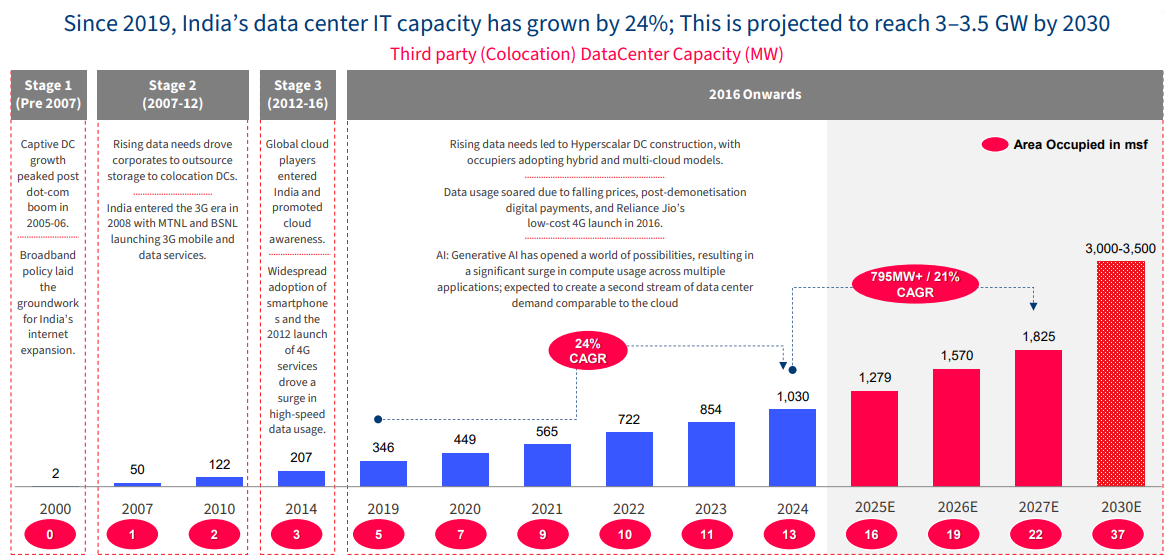

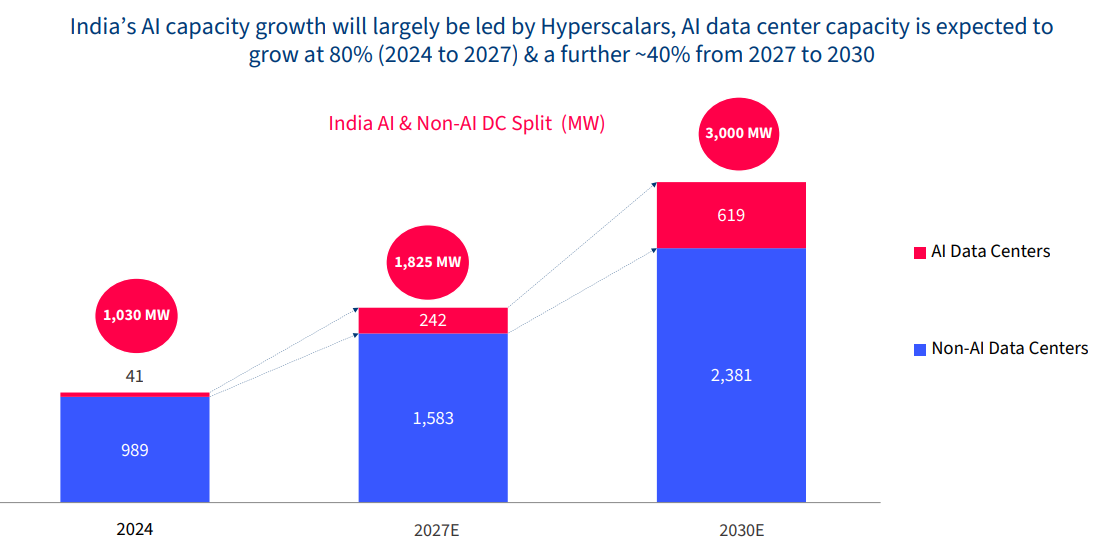

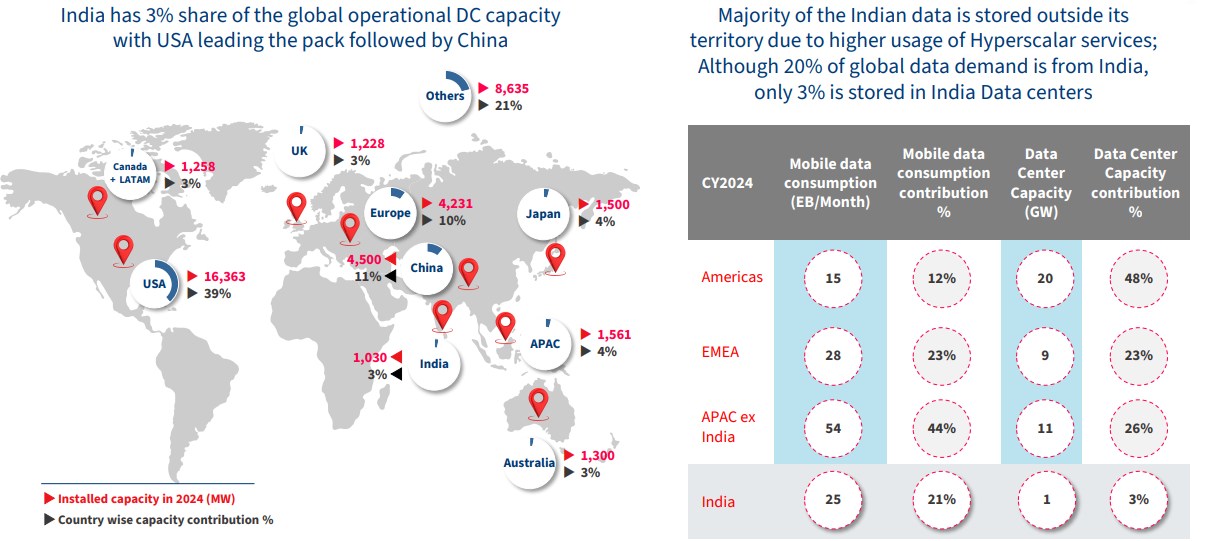

In 2019, India's data center capacity was roughly 350 megawatts (MW). By 2024, that number had tripled — to over 1,030 MW. While India’s data centre ambitions may pale against what countries like the United States and China are seeing, we’re in the middle of our own data center boom. And we’re only getting started.

What makes this story fascinating isn’t just the server farms we’re building. From real estate markets to renewable energy adoption, data centers present an opportunity across industries. This has sparked a massive rush — as telecom giants, construction companies, and state governments all race to bag the next big data center project.

Today, we’re looking at a few recent reports to give you the major trends shaping India’s data center industry. Let’s dive in.

The internet revolution

India's current data center boom began with a story we’re all familiar with: the mobile internet revolution.

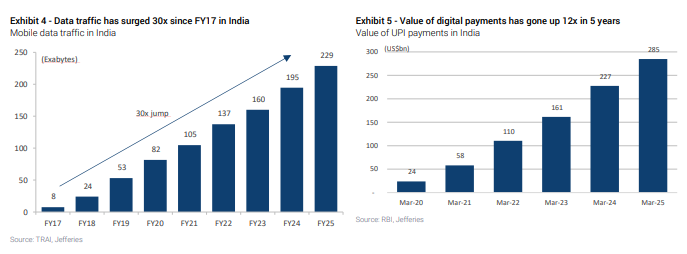

In September 2016, Reliance Jio was launched with rock-bottom data prices. Its impact was unmissable and immediate. By January 2017, for the first time ever, India’s mobile internet usage far surpassed that of the US. Since 2017, India’s data traffic jumped by more than 30 times.

You probably saw this play out in your own life. A decade ago, streaming a movie on your phone might have seemed unthinkable. Today, it's a routine activity. Multiply that behavioral shift by 900 million mobile internet users, and that’ll give you a sense of the sheer scale of how our data consumption has exploded.

This explosion created a perfect storm of demand for data centers that could handle such a huge workload. After all, companies needed a place to store all that information, process it, and serve it back to users quickly. Their own on-site servers couldn't have scaled fast enough. Third-party data centers came in to fill that gap.

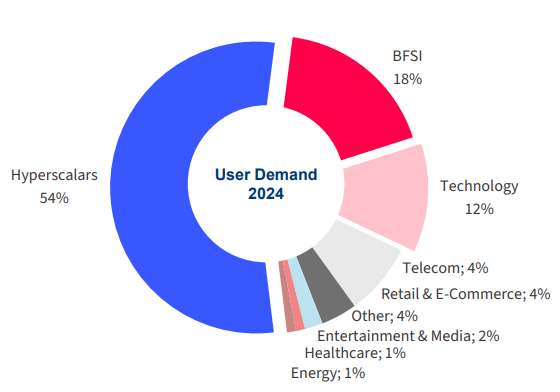

This is what fuels India’s data centre boom. While everyone talks about AI driving data center demand, in India, we’re seeing a cycle of growth that has mostly come from old-fashioned internet services — digital payments, cloud migration by enterprises, streaming, and so on. So far, AI workloads, despite the hype, represent a small slice of India's data center pie.

However, that's expected to change dramatically.

Telecom giants take the helm

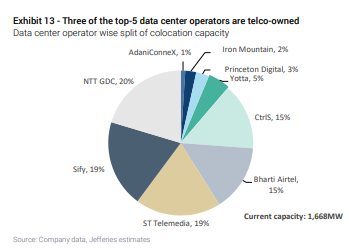

Right now, telecom companies are the biggest builders of data centers. Three of the five largest data center operators in India are owned by companies whose core business is telecom, like Airtel and NTT. And Reliance, though not a top player just yet, is building what could be the world’s largest data centre in Jamnagar. As 5G penetration proceeds across the country, telcos are expected to only increase their data center capacities.

But interestingly, telecom hardly makes up 4% of the demand for data centers. Most demand comes from hyperscalers — cloud providers like AWS, Google Cloud, and Microsoft Azure, who service companies that need cloud computing power. Telcos don’t really use most of their own data center capacity.

What explains this puzzle? Well, data centers fit quite neatly into what telcos are already good at — giving them a natural advantage.

Data centers cannot work without strong, uninterrupted connectivity. Telcos already own the fiber networks that could ensure that connectivity. It simply makes sense for them to set up data centers to complement their networks.

Data centers also require a lot of capital. You need to buy a large plot of land, construct a giant climate-controlled building, connect it with power, and pay for the devices and storage racks that’ll actually process that data. That takes a lot of money, and requires you to deal with reams of regulation that come with buying land and setting up power connections.

Indian telcos have two huge advantages there. One: they can get low-interest loans from banks easily, owing to their scale. Two: they’ve spent decades working through the ins-and-outs of Indian law. That’s a potent combination for this business. Even capital-rich hyperscalers might struggle to match the natural advantages that Indian telcos have.

All of this makes data centers a high-margin play for telcos. As we mentioned in our story on Starlink, telcos hardly made any money on selling cheap data to regular consumers. Their highest-spending customers are enterprises, who need to process a lot of data for their operations to run smoothly. And so, telcos bundle network access with data center capacity at a decent, but premium price point.

Imagine you run an OTT platform, for instance. Apart from the data you need for all your day-to-day work, you’ll need a heavy amount of data center capacity to handle the traffic from streamers. While standalone data center operators might be too expensive, telcos could offer you an attractive, cheaper bundle — looking after your own needs, as well as the demand from your customers.

The ancillary industries that benefit

This isn’t just a telco story, however. The data center boom benefits a range of other industries who aren’t directly involved in the business, but are crucial to its success.

The real estate play

Data centers are practically gulp down natural resources. They require land, proximity to water and power supply stations, and access to fiber networks. Putting all this together is the bread-and-butter of the real estate business, making data centres a new asset class that real estate developers are racing to capture. That;s already visible in their quarterly earnings calls.

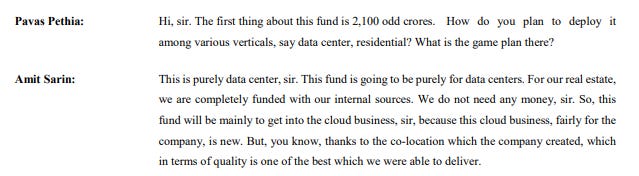

Real estate developer Anant Raj, for instance, has a separate “data center division” — even launching their own cloud service to rival the likes of AWS. They are trying to raise ₹2,100 crore in a fresh issue, almost all of which will go to their data center projects. In return, they think they can reach ₹1,200 crore in data center revenue by FY27. Here’s what they said in their Q2 FY25 earnings call:

Similarly, the Lodha Group — one of India’s largest real estate players — has also stepped into this race. Just last quarter, they sold around ₹500 crores worth of land for data centers.

The Mumbai-based Hiranandani Group has doubled down on the business too, taking ownership of data center operator Yotta — founded by ex-NTT (and ex-Reliance) employee Sunil Gupta. To run this business, they built a 600-acre township in Panvel, near Mumbai, designed around data center needs. The township houses Yotta's NM1 facility, one of Asia’s largest data centers.

This trend isn’t unique to India — the UAE’s largest data center operator, for instance, is real estate player Khazna. With time, expect more Indian developers to jump on data centers.

The power puzzle

Data centers guzzle power. A single data center could consume as much power as 1 lakh homes. By 2030, data centers are projected to consume about 3% of India’s electricity output — up from under 1% today.

This creates a huge challenge for India’s power infrastructure. After all, data centers need 24x7 power, and in massive quantities. Especially during times of peak demand, this could strain our power grid. With most of India’s power coming from coal, this could also be a sustainability nightmare.

However, there’s a silver lining — data center operators see this as an opportunity to procure renewable energy for their needs. Take Bharti Airtel's Nxtra, for example, which has partnered with renewable companies to set up solar and wind projects to power their data centres. Half of Yotta NM1’s energy, similarly, comes from renewables.

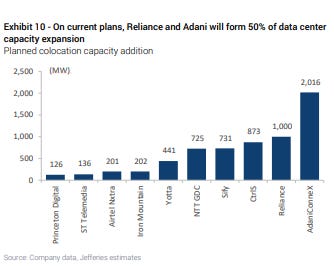

Adani has taken this even further with their Indo-American joint venture in data centers, AdaniConneX. They've raised $1.44 billion specifically for renewable energy-powered data centers. The Adani group, in fact, is jumping into this business with all guns blazing — putting the combined might of many verticals, from real estate, to coal plants, to solar modules, to wires & cables, behind data centres.

In fact, Jefferies thinks the capacities of groups like Adani and Reliance could super-charge the data centre boom. If current plans take shape, it says, then Reliance and Adani could prop up half of India’s data center expansion in the near future.

Where are India’s data centers?

Where are all of India’s data centers located? Here’s a hint: where are the headquarters of all the companies we’ve talked about — Reliance, Adani, Hiranandani and Lodha?

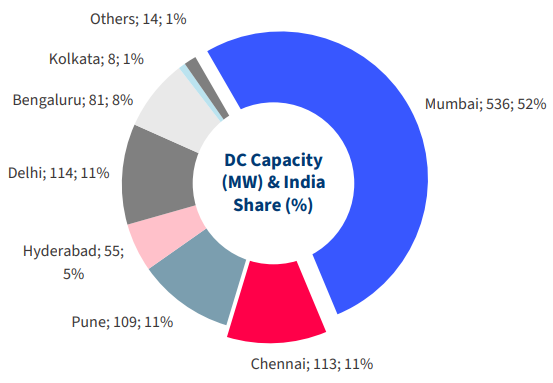

Yep, Mumbai beats every other city by a mile, housing a whopping more than half of all data centers in India.

This isn’t just because Mumbai is India’s biggest business hub. Its proximity to the sea plays a crucial role.

Undersea cables, as we covered recently, are crucial to the existence of the internet. Mumbai is where most of India’s international submarine cables land, making it India’s main gateway to the internet. If you're a company like Netflix, and want to serve Indian customers, the closer you are to these cable landing points, the more speed and reliability you can ensure.

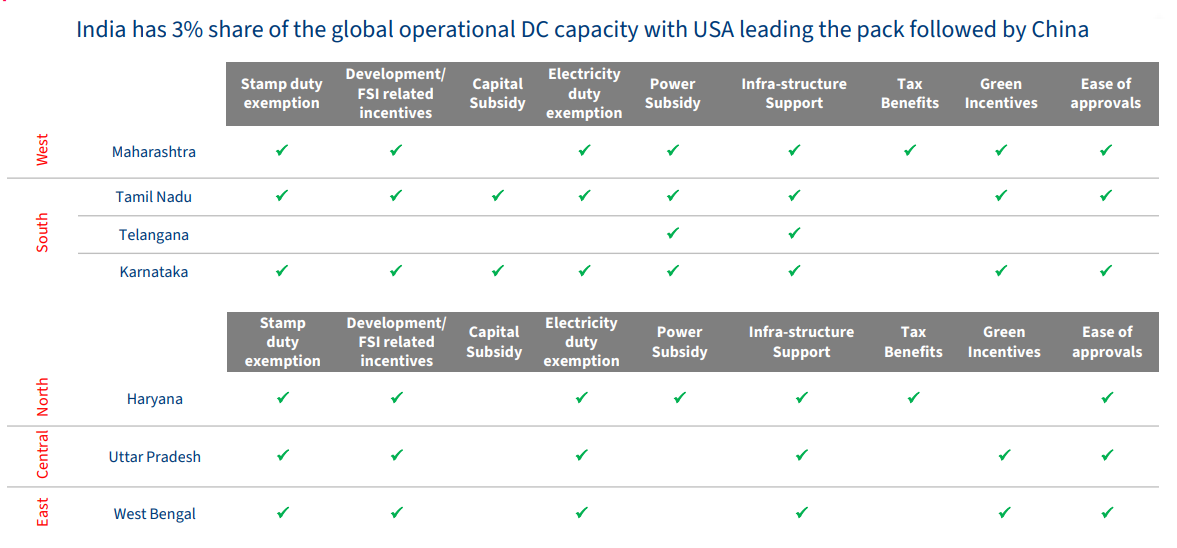

But other regions are catching up. State governments are offering massive incentives — from free electricity to land subsidies — to attract data centers to their capital cities. The UP government’s generosity, for instance, has made Noida a data centre hotspot. Hyderabad, similarly, has attracted lots of investment due to proactive government policy and reliable power.

What this means going forward

India’s data center boom is still in its early stages. We account for only 3% of global data center capacity, despite generating 20% of global data demand.

That gap represents both opportunity and necessity — especially as we’ve realized the importance of housing our own data and digital infrastructure within our borders. That’s why everyone from renewable energy firms to real estate developers want a piece of this business. And given that India has the second highest number of ChatGPT users after the US, AI will probably just accelerate things.

But with or without AI, India’s data center industry is moving at light speed. And it won’t stop anytime soon.

Tidbits

The government has directed ONGC to take charge of an oil block that previously belonged to Vedanta. This marks the first time in India that the government has denied the contract renewal request of an oilfield operator. However, Vedanta expects less than a 0.3% contraction in operating margins because of this move.

(Source)India’s core sector — which includes coal, crude oil, steel, cement, electricity, natural gas, refinery products and fertilizers — recorded a 6.3% increase in output. Steel marked the highest rise with 14.2% growth over August’s numbers.

(Source)Leading private space player AgniKul Cosmos is building India’s first additive manufacturing hub for rockets. The hub enables 3D-printing of rocket components up to one metre in height. This is expected to accelerate building timelines for AgniKul, while potentially reducing costs by half.

(Source)

- This edition of the newsletter was written by Pranav and Manie

So, we're now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what's a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content and where we can improve! Here's the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

Have you checked out Points and Figures?

Points and Figures is our new way of cutting through the noise of corporate slideshows. Instead of drowning in 50-page investor decks, we pull out the charts and data points that actually matter—and explain what they really signal about a company’s growth, margins, risks, or future bets.

Think of it as a visual extension of The Chatter. While The Chatter tracks what management says on earnings calls, Points and Figures digs into what companies are showing investors—and soon, even what they quietly bury in annual reports.

We go through every major investor presentation so you don’t have to, surfacing the sharpest takeaways that reveal not just the story a company wants to tell, but the reality behind it.

You can check it out here.

📚Join our book club

We've started a book club where we meet each week in JP Nagar, Bangalore to read and talk about books we find fascinating.

If you think you’d be serious about this and would like to join us, we'd love to have you along! Join in here.

Subscribe to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Thank you for reading. Do share this with your friends and make them as smart as you are 😉

Well written. I would suggest looking deep into the past work done by the brilliant team at SemiAnalysis to get the rivalry relationships on point. As an example, barring access to chips, it was Huawei who was/is the closest threat to Nvidia. They actually imported sufficient stock of chips and lithography stack for the 7nm chips pre-trade war to support scaling, only now to focus on SMIC and Cambricon to produce alt etching methods to ramp up scale. But ByteDance amd Tencent would still prefer Nvidia chips to scale models in a heartbeat. AMD is basically dead in water with the investment in OpenAI.

Dylan Patel and team at SemiAnalysis track this space like mad. 👍

Superb writing! Enjoyed it. India must build hardware engineers alongside software one's. I still stand on my opinion that the analytical mind of Indians is the best in the world. Saying this after working in the US for last 10 years. Go India!