Hi folks, welcome to another episode of Who Said What? I’m your host, Krishna. For those of you who are new here, let me quickly set the context for what this show is about.

The idea is that we will pick the most interesting and juiciest comments from business leaders, fund managers, and the like, and contextualize things around them. Now, some of these names might not be familiar, but trust me, they’re influential people, and what they say matters a lot because of their experience and background.

So I’ll make sure to bring a mix—some names you’ll know, some you’ll discover—and hopefully, it’ll give you a wide and useful perspective.

With that out of the way, let me get started.

Rock and a Hard Place

Diamonds are one of those topics we’ve returned to more than once on this channel. We’ve done a Who Said What on it recently and a full deep dive on The Daily Brief where we spoke about the downfall of DeBeers. And I’m coming back to it again today because of an interview that Botswana’s president, Duma Buko, gave to Bloomberg.

If you haven’t followed the earlier episodes, you will obviously wonder why should anyone care about what he has to say. You see, Botswana supplies about 70% of De Beers’ diamonds.

It owns just around 15% of the company. The majority is controlled by Anglo American, which has now publicly said it wants out.

The Bostwana president had earlier hinted at buying out more of DeBeers but this time, though, the president left no room for ambiguity. He told Bloomberg:

“We we are resolute now and we have communicated a firm intention to increase our stake in De Beers to a controlling stake that is upwards of 50%.”

And when pressed on whether the government would go beyond that 50% mark, his answer was:

“We will. Will. Yes, we will go higher.”

That’s a remarkable level of confidence, not just because De Beers itself is in trouble —sitting on huge stockpiles, prices cut for the first time, the parent company preparing its exit — but also because Botswana isn’t exactly flush with cash. The interviewer was sharp to press him on the funding bit.

“Where do you get the funds from, though?”

We have we have lined up a number of potential collaborators with us, if I may put it that way”

But one question that you also might have had is why does it want to have more stake in a company thats bleeding. An industry that’s not doing so well.

“We produce 70% of De Beers’ diamonds through Jwaneng mine and Orapa. So, we want to have a firm voice and the direction that the industry is taking. We want to have some control and involvement in the diamond value chain, including its marketing, which we believe has slacked somewhat over the years. And we now see the advent of synthetic diamonds purportedly almost seeking to supplant and replace natural diamonds. Well, it is our firm belief and stance that there is no way in which a fake can outshine the real.”

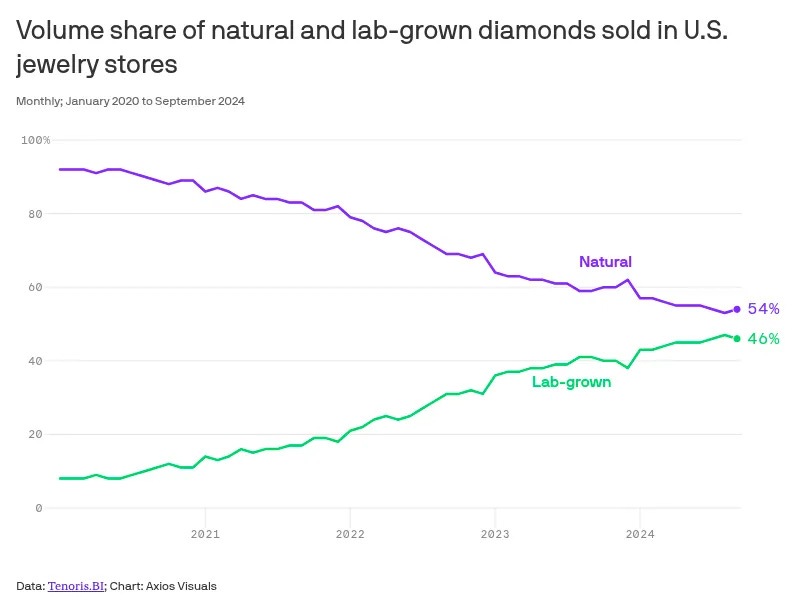

That’s a good aim but the main problem still remains that people aren’t buying “natural” diamonds.

On this, the interviewer asked:

“But we’re seeing it in the numbers. People are not paying money for diamonds,” his reply was unwavering:

“Well, people who are serious about about value will appreciate that the natural diamond is a repository of value….They are real, they’re genuine, they are rare. And so they they store value.”

It’s a powerful line, but also one that shows the stakes for Botswana. The country’s prosperity has long rested on people believing exactly this — that diamonds are rare, special, and enduring. For decades, De Beers sold that story through advertising. But the world has changed. Today, lab-grown diamonds are chemically, visually, and structurally identical to natural ones. The only difference is origin — and price. A lab-grown stone costs a fraction, which means millions more people can afford this once-exclusive commodity.

To those consumers, the emotional symbolism of a diamond doesn’t vanish just because it came out of a lab.

And that’s what makes the president’s next prediction striking. When asked if he believed prices would recover, he said:

“Absolutely. It is anticipated that there will be an upswing indeed, over the next 2 to 3 years. But obviously, it will also be a function of proper marketing and differentiation in the market and traceability.”

That last word — traceability — is worth pausing on.

In practice, nobody can really tell the difference between a lab-grown and a natural diamond. Both pass through the same polishing centers, often handled by the same workers, and insiders admit that mixing is common. I was watching a documentary called Nothing Is Forever, and a diamond expert said outright: both types are processed side by side, and once they’re in circulation, nobody really knows what’s real and what’s fake. In that context, “traceability” is not just a technical fix. It’s the industry’s last hope of persuading buyers that they can trust what’s on offer — and by extension, that it’s worth paying more for something called “natural.”

Whether that works is another story. Marketing built the modern diamond industry. But it looks like marketing may not be enough to save it.

EA Sports…no longer in the game

The gaming industry has just been rocked by an unexpected, geopolitically-charged, and truly blockbuster deal with plenty of behind-the-scenes action.

Remember EA (Electronic Arts)? The creator of the legendary FIFA games, the beloved Cricket 07, NFS Most Wanted, and this unforgettable tagline?

Well, they have just been bought out for a whopping $55 billion, all cash, and will no longer be publicly-listed. This is the largest leveraged buyout in history.

But more than the figures, what is really a surprise is who two of the three main buyers are:

Saudi Arabia’s Public Investment Fund (PIF) — also the world’s largest sovereign wealth fund, and now the majority owner of EA

Affinity Partners — a fund led by Donald Trump’s son-in-law, Jared Kushner

Well, why does the government of Saudi Arabia want a piece of EA? And what’s someone from the Trump family doing here? Here’s a statement from Kushner on the deal:

“I’ve admired their ability to create iconic, lasting experiences, and as someone who grew up playing their games - and now enjoys them with his kids – I couldn’t be more excited about what’s ahead.”

And here’s the official statement from Turqi Alnowaiser, the Deputy Governor of the PIF:

“PIF is uniquely positioned in the global gaming and esports sectors, building and supporting ecosystems that connect fans, developers, and IP creators.”

Before we get into all these pressing questions, let’s take a brief look at where EA stood before the deal.

Contrary to their popular tagline, for a long time, EA isn’t “in the game”. In 2019, they laid off 350 jobs — or 4% of its workforce — after games like Battlefield V didn’t perform well. Since giving up the FIFA brand in 2022, their rebranded “FC” football series has underperformed. Their bets in indie and mobile games have largely failed.

As a result, their finances have not done well at all.

PIF — was already keen on taking more of it. They just needed a catalyst.

From building a whole city meant only for culture and sports, to having an F1 circuit, Saudi Arabia is doing everything to position itself as a global sports hub. This strategy has made the PIF one of the world’s biggest sports investors. For them, it’s a strategy of procuring soft power in the world, even whitewashing some of their atrocities.

And Saudi Arabia happens to love football. It’s evident from all the insane headlines lately: be it signing Cristiano Ronaldo for an eye-popping $225 million, or hosting the 2034 FIFA World Cup. Buying a gaming behemoth like EA would be like magically finding another oilfield for Saudi Arabia.

But a buyout never truly materialized until the catalyst — Jared Kushner — entered the picture. FT dug in on how the deal went down, and someone close to the deal said:

“Kushner has a personal relationship and he has deep ties in Saudi Arabia. He is very comfortable operating in the Middle East. It created a basis of trust.”

Since its first term, the Trump administration has grown very close with Saudi Arabia, led by Kushner’s efforts. Reportedly, it was Kushner who convinced the PIF to take EA private. Silver Lake, one of the other investors, was keen to work with Kushner. And Silver Lake is known as a hard negotiator on Wall Street that could drive the price down.

So, the stage was set. Kushner brought everyone on-board — including the EA management who wanted maximum price. The PIF wanted more soft power. Silver Lake saw cost savings owing to AI reducing game production times.

And to facilitate the deal smoothly, JP Morgan was brought in as the underwriter and provider of $20 billion debt for the deal. In fact, head honcho Jamie Dimon responded within minutes of when the first call was made to his office. This deal is also not expected to run into too many regulatory problems, from either the US or Saudi Arabia. As a source said to FT:

“What regulator is going to say no to the president’s son-in-law?”

We know what this means for the world’s chessboard. But what does it mean for the gaming industry?

For good reason, there is plenty of skepticism about this deal. Saudi Arabia has strict censorship rules about games — especially around women and queer characters. Its human rights record has been pretty spotty. It’s possible that now, instead of being subject to market discipline as a public company, it will be swayed far more by geopolitical whims.

There is also no certainty that EA will suddenly change track and become more agile. They’re thinking of doubling down on existing IPs, while those same IPs are running out of steam. They have lacked true innovation for a while, and it’s unlikely that this deal will be a positive force. In fact, the opposite seems a little more likely.

What Jamie Dimon thinks about the market

Jamie Dimon has been the head of JPMorgan Chase for a long time — well before the 2008 financial crisis, in fact. He’s known for being pragmatic; instead of trying to forecast the future perfectly, his focus is perennially on building resilience. In many circles, in fact, he isn’t seen as a mere banker, but as some sort of statesman of finance.

And so, when he recently spoke to CNBC TV-18, we were naturally plugged in.

For one, we were looking to see what he thought of the American economy, given the direction it has recently taken on trade. You see many economists thought Trump’s policies on immigration and trade would push the economy into recession. But while they might eventually turn out to be right, as Dimon reminds us, none of that has shown up in the numbers just yet. As he says:

“There is a lot of conflicting data. Data itself is not perfect. But right now unemployment is still low. Consumers, both low end and higher end, are spending their money. At the low end, they’re a little stretched, and credit loss is going up a little bit. So it’s not a disaster — it’s a weakening.”

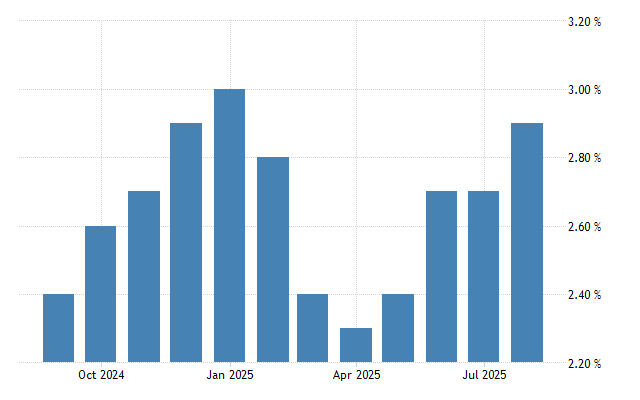

There’s one thing, however, that Dimon has his eyes set on: inflation. With the state of the world being what it is, Americans are likely to feel the pinch. As he says:

“I’m a little more cautious on inflation than other people. That may not go away so quick because of the global deficits around the world—those have an inflationary effect—the remilitarization of the world, the restructure of trade. Those things are all kind of inflationary.”

America usually targets an inflation rate of ~2%. But it hasn’t been that low for a long time — in fact, it has stubbornly remained a notch lower than 3%, with no signs of relenting.

But the biggest risk he flags is that asset prices are getting rather high.

“We’re getting into bubble stuff here. I’m not saying I know where we are, but there’s a lot of positive sentiment out there driving a lot of asset prices. Highest stock prices ever, highest gold ever, highest crypto ever…”

The other thing he talks about is artificial intelligence.

In the previous episode, I spoke about how everyone keeps circling back to the idea that money is pouring into AI. He acknowledges this too and even admits that perhaps there’s a little too much capital chasing the technology right now. Some of those bets will, more likely than not, go bust. But to him, that’s not a cause for alarm; it’s simply the nature of investment cycles. Every exciting technology has its losers.

In his words, “in almost every real investment boom, you’ve had people who didn’t do it right. When cars boomed, a lot of car companies went bankrupt. When television boomed, a lot of television companies went bankrupt. The internet bubble—that was real, too.”

But that shouldn’t detract you from the tremendous potential it brings. “It is real…. It’s going to solve cancers; it’s going to solve some terrible problems that mankind has.”

There’s life after burst bubbles too, and it might look better than today. Or that, at least, is the hope we’re clinging to.

That’s it for this edition. Thank you for reading. Do let us know your feedback in the comments.

Introducing In The Money by Zerodha

The newsletter and YouTube channel aren’t about hot tips or chasing the next big trade. It’s about understanding the markets, what’s happening, why it’s happening, and how to sidestep the mistakes that derail most traders. Clear explanations, practical insights, and a simple goal: to help you navigate the markets smarter.

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, even the smaller logistics firms—and copy the full transcripts. Then we bin the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

Good vestor read