Premiumisation - The next big thing for companies?

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and videos on YouTube. You can also watch The Daily Brief in Hindi.

Today on The Daily Brief:

Are Indian consumers ditching affordable products for premium?

Big Tech’s trillion-dollar AI race

Are Indian consumers ditching affordable products for premium?

Right now, there's a lively debate in India about changing spending habits, especially between rural and urban areas. On one hand, urban spending—which used to be a major driver—is starting to slow down. Meanwhile, rural spending is actually picking up.

This shift has economists talking, and it's also becoming a common topic in corporate earnings calls. But there’s another trend grabbing attention, and it’s not just about how much people are buying; it’s about what they’re choosing to buy.

More and more people in India are opting for higher-quality, often more luxurious versions of everyday products—things like soap, snacks, and even cars. In response, companies are launching premium products: upgraded, refined versions of their usual offerings, aimed at customers willing to pay a bit extra for that added touch of quality or exclusivity.

So, why the shift towards premium? With demand for standard products cooling off, brands see an opportunity to grow by offering premium options. The approach is simple: take a product people already enjoy, make it a little more special, and sell it as a premium choice. By focusing on quality and uniqueness, companies hope to counter the slowdown in regular sales and appeal to customers who appreciate that extra touch of quality.

From food and beverages to everyday goods and even cars, companies across India are embracing premiumization in their own ways, all with the same goal: to offer a better version of something familiar to customers who care about quality. Let’s take a look at how some big names are adapting to this trend.

1. Consumer Products – spotlight on Dabur and Hindustan Unilever (HUL)

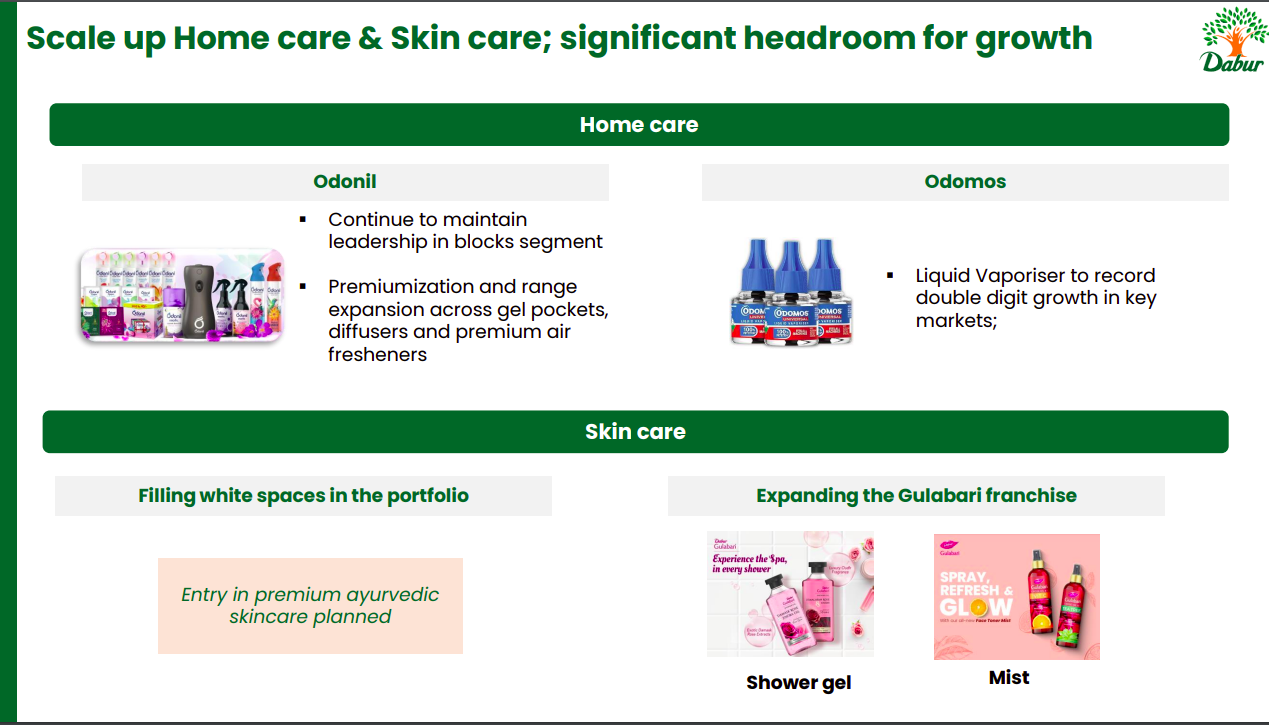

Dabur: Known for its health-focused products, Dabur is expanding into premium Ayurvedic products with its new Cesaare brand of hair oils. By tapping into Ayurveda, they’re appealing to health-conscious customers willing to pay more for natural, traditional products. Dabur is also adding a touch of luxury to home fragrances. Through its Odonil brand, they’re transforming air fresheners into small indulgences, with items like gel diffusers that make home fragrances feel less like a basic need and more like a luxury.

Hindustan Unilever (HUL): HUL is also riding this premium wave, especially with popular brands like Lakmé and Dove. But they aren’t stopping at cosmetics; they’re branching into the premium food segment, offering products tailored for health-conscious consumers. As HUL’s managing director, Rohit Jawa, notes, the premium segment is growing about 30% faster than regular products—even in rural areas. This suggests that the interest in premium products is no longer limited to big cities.

2. Food and Beverages – spotlight on Tata Consumer Products and Nestlé India

Tata Consumer Products: Tata has embraced premiumization, especially in its tea segment. Products like Tata Tea Gold and the Tata Soulfull wellness brand focus on quality and sustainability, catering to consumers who are increasingly thoughtful about what they consume—not just for taste but also for environmental impact.

Nestlé India: Nestlé is also investing in higher-end, health-focused products that attract consumers looking for quality ingredients and trusted brands. Their focus on premium options reflects a broader shift toward food products that consumers can feel good about purchasing.

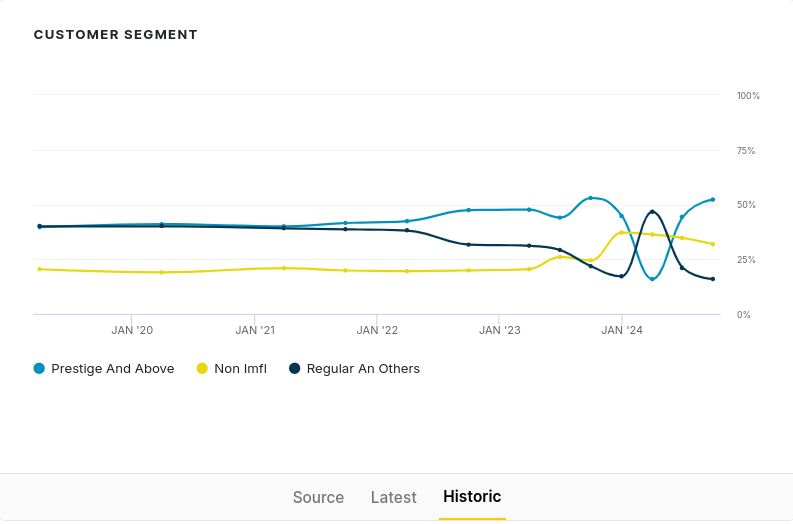

3. Alcohol – spotlight on United Spirits and Radico Khaitan

United Spirits: The premium trend has reached the alcohol industry, where demand for high-end options is rising. United Spirits, for instance, is focusing on luxury Scotch and other premium brands as key growth drivers, reflecting a broader shift towards quality among consumers.

Radico Khaitan: Similarly, Radico Khaitan is emphasizing premium whiskey and rum products within its “Prestige & Above” range, targeting consumers who are willing to spend a bit more for a refined drinking experience.

4. Consumer Durables – spotlight on Havells

Havells: In the consumer durables sector, Havells is raising the bar in design and quality to bring premium choices to the market. Through its Lloyd brand, Havells offers high-end fans, lighting, and appliances tailored for customers who prioritize top-notch features. This focus on premium products has proven effective for Havells, especially as demand for standard options slows down.

5. Automobiles – spotlight on Maruti Suzuki

Maruti Suzuki: Even in rural areas, the automobile sector is seeing a shift towards premium options. Maruti Suzuki has observed that rural consumers aren’t just buying more cars—they’re choosing higher-end models like SUVs over budget vehicles. This shift shows that the premium trend is spreading beyond just urban areas.

For these companies, premiumization is a strategy to sustain growth in a market where overall consumption is slowing. By introducing higher-end versions of their products, they’re attracting consumers who are still spending but looking for more value and quality, rather than just buying more of the same. This approach not only helps companies navigate slower sales but also builds loyalty among customers who value quality and brand trust.

But the big question is: Can premiumization keep growth going?

While premium products are driving growth for now, some analysts wonder if there might be a tipping point. Will consumers continue to prioritize quality, or will affordability become more important if economic conditions get tougher?

For now, though, premiumization is clearly reshaping how Indians spend, with companies stepping up to meet the demand for quality in both urban and rural markets. Only time will tell if this trend is here to stay or just a phase in India’s changing consumer landscape.

Big Tech’s trillion-dollar AI race

By now, we all know how quickly AI has transformed from just a futuristic buzzword into a tool that’s become part of our daily routines. In just a year or two of mainstream use, it’s reached a point where people are starting to ask if AI could revolutionize the world in the same way the internet did.

Some disagree, though. They believe we’re living in an “AI bubble,” with too much hype about its potential. But here’s why this topic is especially relevant for us right now.

Three of the world’s biggest tech giants—Microsoft, Google, and Meta—have all announced major moves in AI and shared their latest progress in recent earnings calls. Each of these companies is pouring billions into AI. While they have slightly different plans, they all share the belief that AI is a huge opportunity. So, as investors and market watchers, it’s essential for us to stay up-to-date with what’s happening in the AI world today.

With that in mind, let’s dive into what each company is doing, starting with Microsoft.

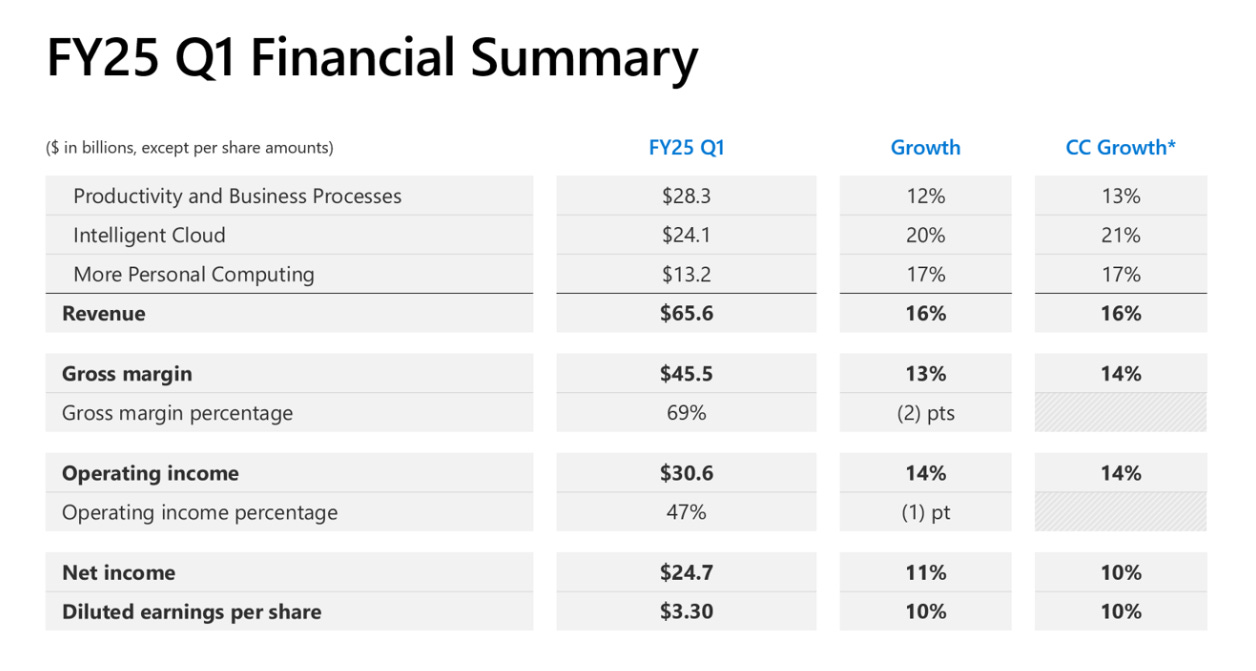

Microsoft has been rapidly integrating AI into most of its existing products, and this push is paying off. They expect to generate $10 billion in AI revenue by next quarter, making AI their fastest-growing area. That’s a big number, but it’s unclear exactly which products are contributing to this AI revenue. It could include new products like Copilot, as well as AI-powered features in older tools like MS Word and Excel.

A key highlight is that nearly 70% of Fortune 500 companies are now using Microsoft’s Copilot tool, which is already showing positive results. Vodafone, for example, reports that Copilot has saved their employees about three hours each week. While this sounds impressive, it’s important to remember that it’s still early days. We’ll have to see if these productivity gains hold up as Copilot is adopted on a larger scale.

Microsoft’s AI strategy is focused on making AI accessible to businesses by embedding it into everyday software. Customer demand is high, with commercial bookings up by 30% this quarter. Plus, Microsoft’s partnership with OpenAI, the creators of ChatGPT, has been a major competitive advantage in this space.

Now, let’s turn to Google and see what the makers of the world’s largest search engine are doing with AI.

An interesting point is that AI now generates about 25% of all new code at Google, with human engineers only reviewing it before deployment. This raises the big question of whether AI might eventually replace coders and programmers—a possibility that remains to be seen.

Google has also been enhancing its AI infrastructure, the technology stack that powers its AI systems. Over the past 18 months, they’ve reduced AI processing costs by 90% while doubling the size of their models. AI-powered Google products already reach massive audiences. For example, Google Lens handles over 20 billion visual searches each month, and AI-enhanced search features serve more than a billion people across 100 countries.

On the business side, Google Cloud—which includes their AI services—grew by 35% this quarter, bringing in $11.4 billion in revenue. Google’s strategy here is to build a complete AI stack, from hardware to software, aimed at creating powerful, efficient AI systems.

Now, let’s take a look at what Mark Zuckerberg’s Meta is doing in the AI space.

Meta is taking a unique approach by going open-source, making some of their AI tools and models available to anyone who wants to use them. This move has gained a lot of attention and support from the programming community.

Meta’s AI systems, integrated into its social platforms, now have around 500 million monthly active users, making them some of the fastest-growing AI products in the world. AI-driven recommendations have increased time spent on Facebook by 8% and Instagram by 6%. In advertising, Meta’s AI tools are popular as well—over a million advertisers used them last month alone, creating more than 15 million ads and boosting conversion rates by about 7% for businesses using AI-generated images.

Meta’s open-source approach is powered by its Llama models, with one of the largest computing infrastructures in the industry used to train the latest Llama 4 model. The company believes open-source AI will make development more adaptable and affordable.

When we zoom out, we see just how massive these companies really are. For perspective, in this quarter alone, the combined total revenue of Google, Meta, and Microsoft was approximately $182.7 billion, with a net income of about $66.7 billion. And this doesn’t even include Amazon, Apple, and other tech giants.

Consider this: Meta’s Threads now has nearly 275 million monthly active users, and Google Lens processes 20 billion visual searches each month. Every day, over 70 billion Shorts are watched, 2 billion calls are made on WhatsApp, and more than 3.2 billion people use at least one Meta app daily. These numbers highlight the vast reach and impact these companies have on our daily lives.

To support AI advancements, there’s a massive need for infrastructure. Microsoft, Google, and Meta are collectively spending over $42 billion a quarter on this. Microsoft spent $20 billion, split evenly between building data centers and purchasing computing equipment like servers and AI chips, and they’ve indicated that spending will remain high into 2025 to keep up with AI demand.

Google invested $13 billion, with $7 billion going specifically toward new data center construction for AI. They rely on a mix of custom TPU chips and NVIDIA’s GPUs to power their AI. Meta spent $9.2 billion, with around 60% allocated to servers and AI-specific hardware. They also follow a strict five-year cycle for updating equipment to stay current with the latest technology.

However, building these data centers isn’t easy—it can take up to two years, and there are challenges in finding locations with enough power and cooling. AI chip supply is also tight, with demand outpacing availability.

But there’s also a downside: these data centers consume a lot of energy, both for computing and cooling. Google has committed to powering its AI data centers with nuclear energy, aiming to generate 500 megawatts of carbon-free power. Microsoft and Meta haven’t shared specific sustainability plans yet, but as AI demand grows, the pressure to find eco-friendly solutions will likely increase.

Each of these tech giants is pursuing AI leadership in its own way:

Microsoft is integrating AI into established software products and forming key partnerships.

Google is building a comprehensive AI stack from the hardware up, optimizing for speed and efficiency.

Meta is focusing on open-source AI, using its social media platforms as a testing ground to deploy AI features at scale.

So, what does this all mean?

AI isn’t just another tech trend; it’s a technology these companies are heavily invested in. They’re treating it as the future of computing—much like the internet was two decades ago. Spending over $42 billion in a single quarter shows the scale of their commitment.

Right now, the race is to build the infrastructure needed to support AI. Microsoft, Google, and Meta are leading the charge, each with a unique approach but a shared belief in AI’s potential to transform how we work, connect, and live. Whether these investments will lead to long-term gains or fall short remains to be seen. But one thing is clear: AI is moving from hype to reality, setting the stage for a new era in technology.

Tidbits:

Dabur India is set to acquire a 51% stake in Sesa Care, a major player in the ayurvedic hair oil market, in a deal valued at around Rs 315-325 crore. This acquisition will strengthen Dabur’s position in the Rs 900 crore ayurvedic hair oil segment and align with its strategy to grow within personal care. The deal is expected to close within the next 15-18 months.

Meanwhile, Zydus Wellness has announced it will acquire Naturell India, the maker of popular healthy snacks like Ritebite Max Protein, for Rs 390 crore. This acquisition supports Zydus's strategy to expand its consumer wellness offerings and is expected to start contributing positively to earnings from next year.

In other news, Bharti Telecom, owned by Sunil Mittal, is planning to raise Rs 8,500 crore through the local bond market, marking its largest-ever rupee issuance. Following Bharti Airtel's recent earnings shortfall, the company is expected to offer bonds with a possible 9% interest rate, with terms ranging from three to ten years. Investor bidding is set to begin next week.

Thank you for reading. Do share this with your friends and make them as smart as you are 😉

If you have any feedback, do let us know in the comments

I see a fantasic opportunity for indian companies to compete with global companies in premium segment..

May it be apparel or cosmetics to daily essentials..

The real growth in economy will come from rural and semi urban areas it is a positive sign that rural consumption is increasing..In recent years there is a little shift in cobsumers pattern they are choosing oragnaic foods and healthy lifestyle (kudos to youtubers). But the fact is we are way behind the other foreign countries

Thank you for providing us with more information on the changing consumption patterns in India. I feel that with increasing awareness of the types of consumer goods people are buying, consumers seem to be choosing healthier, higher-quality products. This aligns with the current situation, where we are observing a fall in consumption in urban areas, alongside an increase in the rural economy. There is a good chance that people are shifting away from consumer goods produced by big firms, which they consider somewhat unhealthy, and moving toward goods from the rural economy, which are comparatively healthier.

This shift might explain the observed change in consumption patterns. The village consumption trend was noted in the previous Daily Brief through indicators like an increase in the number of vehicles purchased, among others (not necessarily related to FMCG consumption). In urban settings, this trend was measured by analyzing data from companies that have traditionally served urban populations but are now losing market share to rural products. Thus, there may not be an actual decrease in urban consumption; rather, some of it may be unaccounted for.

It’s also very unlikely that the urban population, assumed to be reducing their consumption, would switch to premium goods.