Hi folks, welcome to another episode of Who Said What? I’m your host, Krishna. For those of you who are new here, let me quickly set the context for what this show is about.

The idea is that we will pick the most interesting and juiciest comments from business leaders, fund managers, and the like, and contextualize things around them. Now, some of these names might not be familiar, but trust me, they’re influential people, and what they say matters a lot because of their experience and background.

So I’ll make sure to bring a mix—some names you’ll know, some you’ll discover—and hopefully, it’ll give you a wide and useful perspective.

India’s prefab construction sector enters a rapid growth phase

So I was going through the concalls of three companies in the prefab space — EPACK, Pennar, and Interarch — and something really stood out to me. Not just what they said, but the way they said it. There’s a certain confidence, almost a sense that they all believe this industry is about to get much bigger than it currently is.

Now, before we get into the quotes, let me quickly set the context.

Prefab, or pre-engineered buildings, is construction that behaves like manufacturing. Instead of building everything brick-by-brick at the site, the entire steel structure is designed first in software, cut precisely in a factory, packed like a kit, shipped to the location, and assembled.

Think of it a little like Lego blocks but for buildings. Each piece is made for a specific position, and the site becomes the final assembly stage instead of the place where everything is created from scratch. We even covered this in The Daily Brief a while ago.

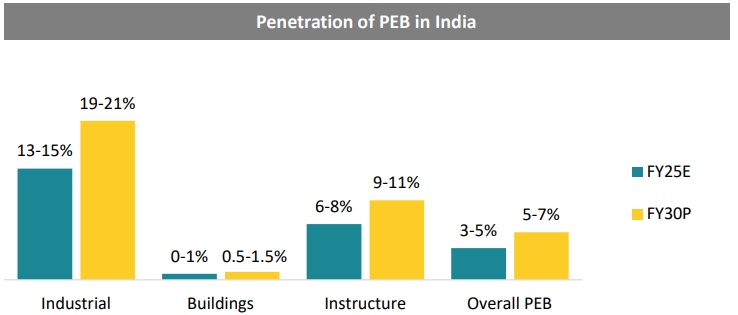

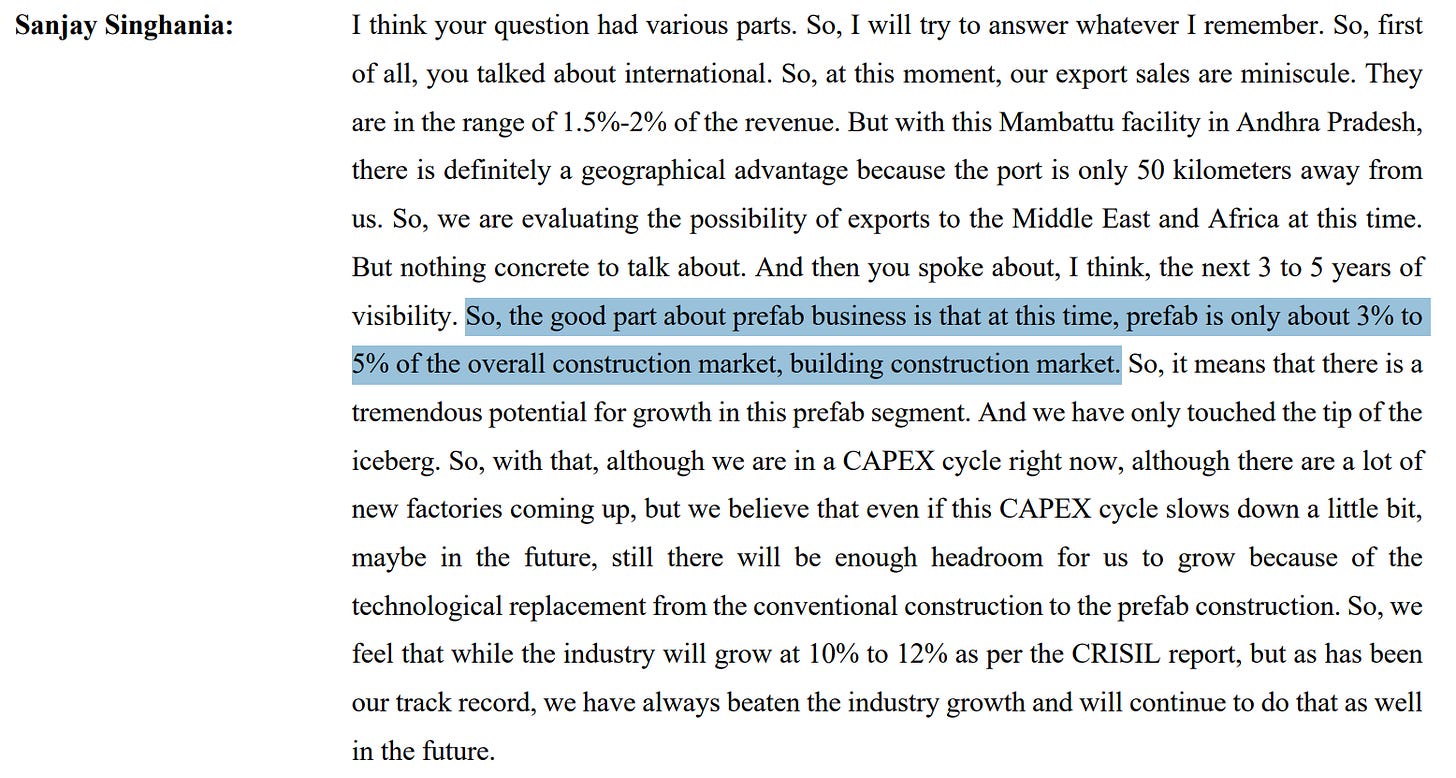

It’s still early, of course. Prefab is a small slice of India’s construction market.

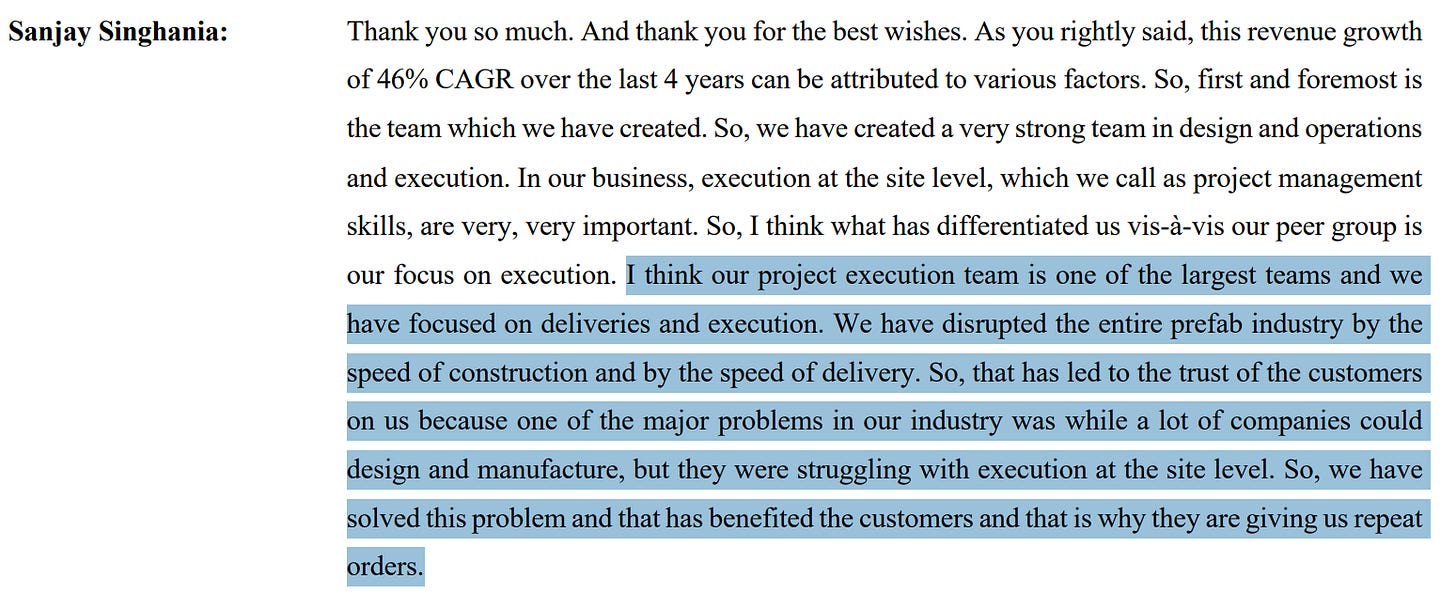

But the concalls made it sound like the sector is entering a very interesting phase. And the quotes explain why. Let’s start with EPACK. Their CEO said:

“We have disrupted the entire prefab industry by the speed of construction and by the speed of delivery.”

Now, this is a very bold sentence — “disrupted the entire industry.” Especially when the entire prefab market is still tiny:

“Prefab is only about 3–5% of the overall construction market… we have only touched the tip of the iceberg.”

EPACK’s entire pitch is built around speed — and to be fair, speed is the one area where prefab genuinely changes the game. Pennar, meanwhile, had two comments that together tell a very different story.

The first one is surprisingly honest:

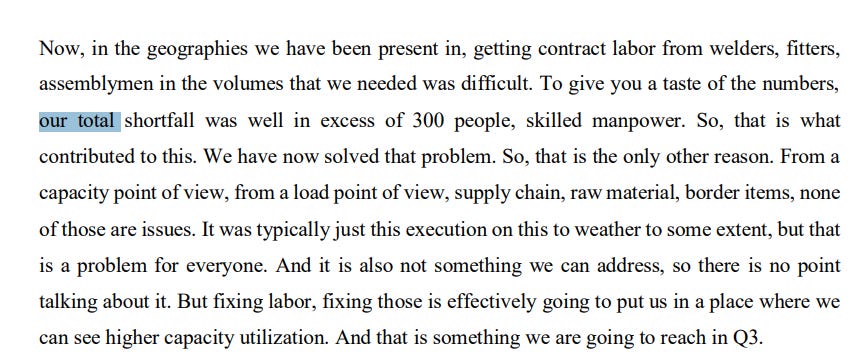

“Our total shortfall was well in excess of 300 skilled manpower.”

This is not something companies usually admit so directly. And it reveals something important: prefab sounds automated, but it’s still hugely dependent on skilled labour — welders, fitters, assembly specialists. If you don’t have enough of them, your timelines slip. Your margins slip. Everything slips.

And then, right after acknowledging this very real bottleneck, they say this:

“A floor of 20% is what you can expect… sustainably over the next few years.”

Now, that’s a bold statement. But they backed it up by saying that they have resolved labor issues, capacity utilization above 70-75%, record U.S. bookings in October, and an order book at multi-year highs.

And then we get to Interarch — who, in my opinion, gave the most insightful definition of the entire industry. Their MD said:

“We are making a building into a product.”

This is the cleanest articulation of prefab I’ve heard. Because that’s exactly the shift — from construction as a slow, site-led process dependent on weather and labour, to construction as a manufactured product that you can design, version, optimise, and assemble.

But Interarch didn’t stop there. They went one level up and tied this to India’s broader macro trend:

India steel construction -- steel consumption is still very, very low compared to what’s happening in the world.

“India’s steel consumption is still very, very low… and the pre-engineered building industry will play a very critical role going forward.”

This matters because the whole reason prefab is rising now — and not ten years ago — is the nature of the projects India is building: EV factories, semiconductor facilities, logistics hubs, data centres. These are not structures where you pour cement for six months and hope the monsoon doesn’t interrupt. These are precision projects with deadlines, sequencing, and global vendors. And steel-first prefab fits that world far better.

Interarch’s point is simple: India is still under-consuming steel, and as manufacturing grows, steel-based prefab becomes the logical choice.

When you put all these quotes together, you get a surprisingly coherent narrative:

EPACK says: prefab is small today, but it’s moving fast

Pennar says: growth is real, but scaling is messy and people-dependent

Interarch says: this is not just a trend — it’s a structural shift in how India will build going forward

And the real story isn’t that everything will go perfectly. It won’t.

But for the first time, the confidence isn’t random. It’s grounded in the fact that India is entering a phase where construction itself needs to behave more like manufacturing — predictable, modular, and fast.

Prefab won’t replace all construction. But it’s going to take bigger and bigger bites out of the categories that matter.

Is gold eating into India’s personal loan boom?

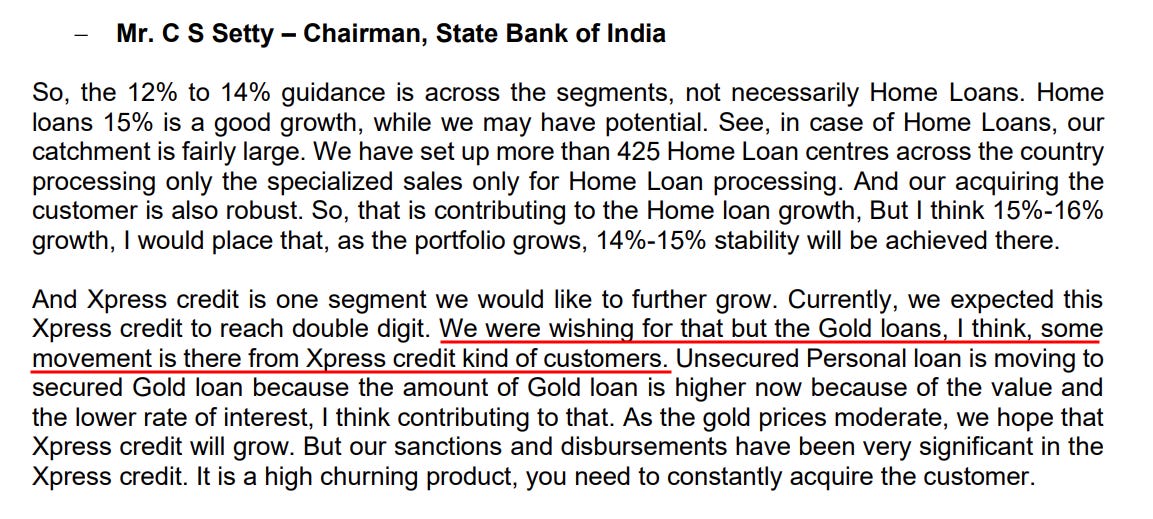

SBI’s Chairman in their recent concall said that SBI’s gold loan business is cannibalising their Xpress Credit business — the unsecured personal loan product. In simple words, customers who earlier took personal loans are now taking gold loans instead.

So let’s break this down. Let’s understand what he actually meant, why it matters, whether it’s happening across other big banks, and what it says about the way India borrows money today.

What did Setty mean?

For the past couple of quarters, SBI has been showing confidence in returning to double-digit growth for its Xpress Credit portfolio. They were attributing a slowdown to a deliberate technology revamp, back in Feb 2025 and May 2025 concall.

However, in the Nov 2025 call, after this growth failed to materialize yet again, a new reason was provided, citing unexpected cannibalization from gold loans. This was a material shift from a narrative of a planned and temporary slowdown to one of unforeseen internal product competition.

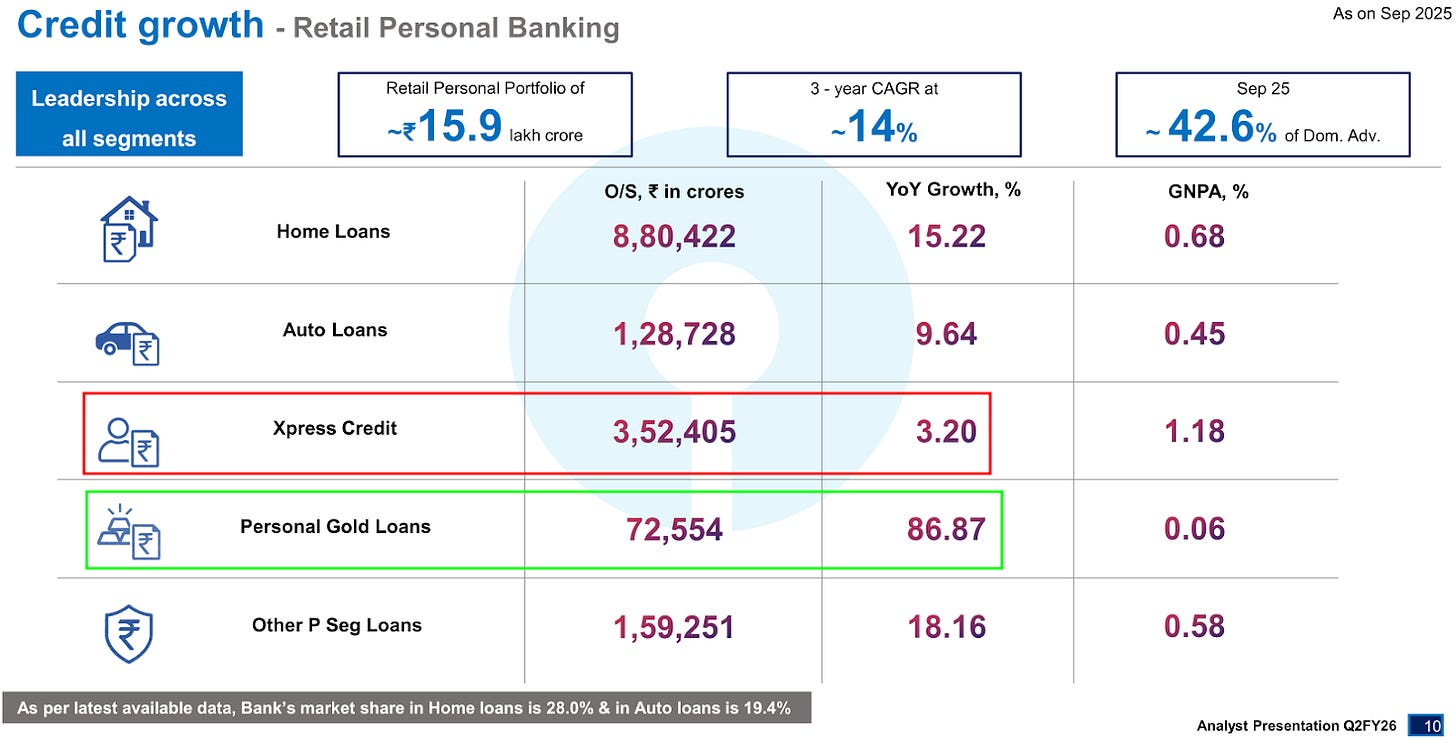

SBI’s own data screams the same story.

While Xpress Credit grew just ~3% from the last year, personal gold loans grew ~87%. Now we know the former has a much larger base, but this still warrants attention, especially after what the Chairman himself said.

And remember — this is SBI, India’s largest lender. When SBI sneezes, the whole banking system feels the breeze. Which brings us to the more interesting question: Why are people suddenly replacing personal loans with gold loans?

Why this shift is happening

See, gold loans are cheaper than personal loans, sometimes by a lot.

Personal loans are unsecured. That means the bank has zero collateral, so they must charge high interest to compensate. But, gold loans? They are fully secured. The bank holds your jewellery.

If you’re a middle-class borrower trying to save money, the choice is obvious, provided you have gold at your disposal, which isn’t a big assumption to make since Indians love gold. Not forgetting that gold prices have skyrocketed, so you get a bigger loan on the same jewellery. For many households, this is a blessing during a tight financial cycle.

From a lender’s perspective too, this isn’t a bad deal either. Even though the gold loans yield them lower interest rates, it also costs them less to provide for them. Since these are secured, nobody wants to default on them, keeping the credit costs much lesser than unsecured loans.

RBI’s own data for FY25–26 shows that gold loans are one of the fastest growing personal loan categories at various points, while other personal loans are slowing sharply.

Do other banks show the same pattern?

This is where the story gets even more interesting. SBI is the only bank that presents gold loans separately in a clean, standalone line item — which is why their trend is glaringly obvious.

But other giants — HDFC Bank, ICICI Bank, Kotak – don’t really break gold loans separately in their investor presentations. That makes it difficult for us to confirm this, but they still give us a direction.

HDFC bank’s management commentary gave us something.

They said gold loans have been growing 5–6% every quarter and yield “pretty rich” returns — without the risk profile of unsecured loans.

And at the same time, they’ve been more cautious on unsecured PLs because of RBI’s stance. Put the pieces together, and the direction is identical to SBI’s — even if we can’t quantify gold vs. personal loans from the slides.

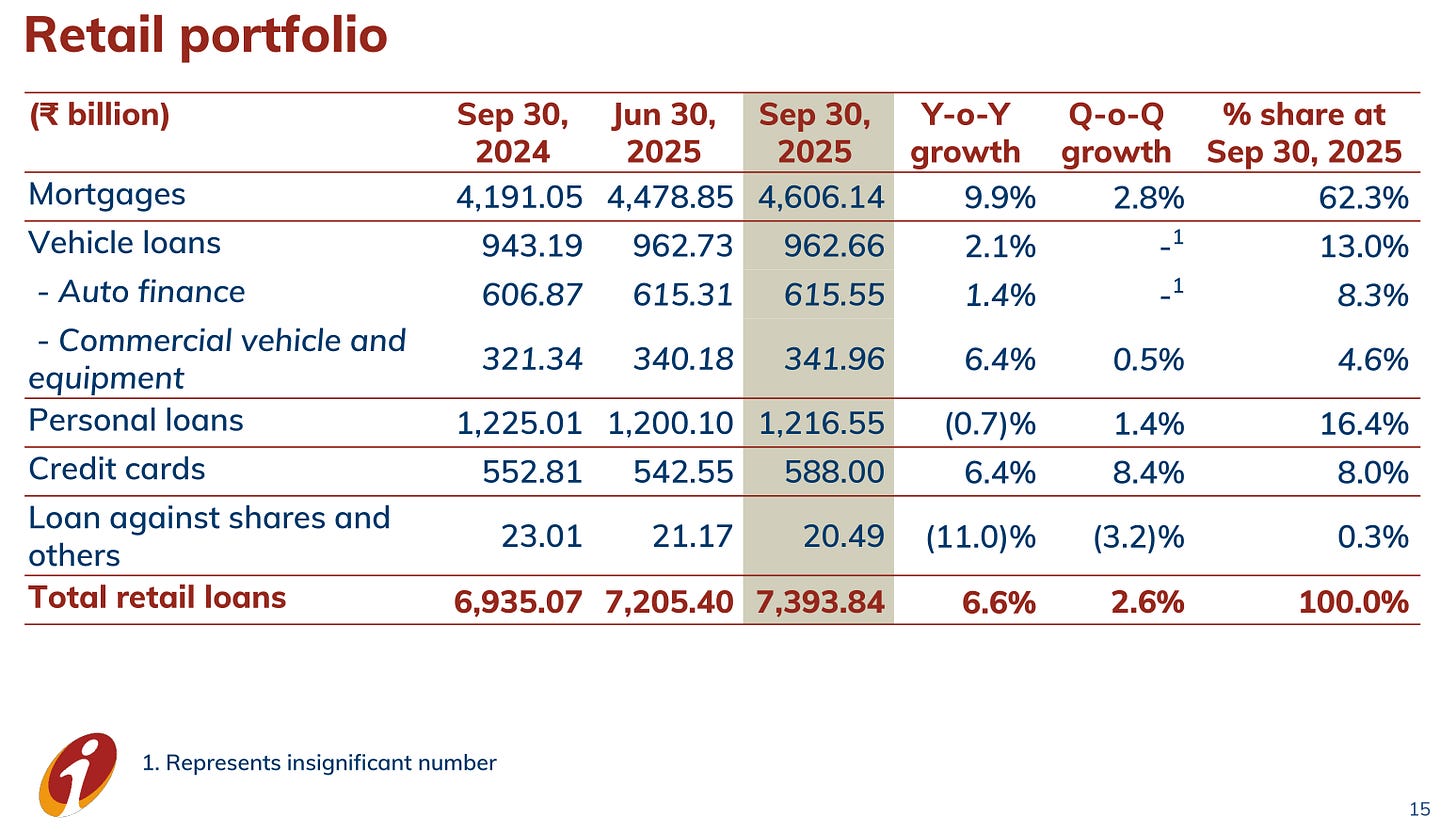

ICICI is also cagey about breaking out gold loans separately. But here’s the key datapoint from the deck.

Personal loans have degrown 0.7% YoY, while everything else in retail is still growing.

When your unsecured engine slows down to a halt while secured products (home loans, auto, etc.) continue thriving… something has clearly shifted. So while we can’t draw a perfect line like we can with SBI, the pattern matches the system-level trend.

Kotak is the most transparent about its strategy. Unsecured book is down to 9.2% of the loan book. They are “gradually building back” unsecured after slowing it while the most growth is “mainly in secured business”

This is the same behaviour as SBI — the tilt toward secured.

Putting it all together

When you stitch the pieces together, the pattern is unmistakable. Different banks might have different reasons, but still show one trend.

So yes, gold is eating India’s personal loan boom. And it’s happening because everything lined up at once: gold prices jumped, unsecured rates stayed high, RBI tightened rules, borrowers turned cautious, and banks turned to safer, capital-efficient retail growth. Gold loans became the perfect middle path.

The real intrigue now is what happens next. Does this unwind if gold prices cool? Do borrowers return to personal loans once the regulatory pressure eases? Can households keep pledging gold forever? Do gold loans stay the “safe” choice if the economy tightens?

Those answers will decide whether this is just a phase — or the start of a whole new borrowing mindset in India.

That’s it for this edition. Thank you for reading. Do let us know your feedback in the comments.

Introducing In The Money by Zerodha

The newsletter and YouTube channel aren’t about hot tips or chasing the next big trade. It’s about understanding the markets, what’s happening, why it’s happening, and how to sidestep the mistakes that derail most traders. Clear explanations, practical insights, and a simple goal: to help you navigate the markets smarter.