Nuclear: From Dangerous to Desirable?

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and watch the videos on YouTube.

In today’s edition of The Daily Brief:

Everything you need to know about nuclear power

The State of India’s Defence Industry

Everything you need to know about nuclear power

We’ve touched upon nuclear energy a couple of times here on The Daily Brief. But by-and-large, we’ve stuck to the Indian context — about some of the recent moves we’ve made to bring more nuclear power online. What we’ve never done, though, is to go into the mechanics and technicalities behind nuclear energy.

There’s a bunch of things happening in this space all over the world. China, for instance, recently approved plans to build 10 new nuclear reactors. Countries like Germany are moving away from a multi-decadal opposition to the technology. Vietnam is taking Russian help to set up more nuclear power.

All this activity makes this a good time to dive deeper into the whole nuclear energy industry. Now, we aren’t experts — there’s a good chance that we miss something. We’re just trying to put together everything we found cool. If there’s anything else that’s interesting that you’re aware of, let us know in the comments below.

The nuclear resurgence

Until recently, nuclear power was the second most abundant low-emissions source of electricity worldwide — behind hydropower. Solar power just overtook nuclear power recently, as per Ember’s global electricity review.

But we don’t think that signals that nuclear power’s falling out of favour. If anything, it seems to be waking up from a long slumber.

See, for years, nuclear power was seen as too dangerous, too expensive, and too slow. But lately — in the face of climate targets, grid instability, and energy security concerns — countries are starting to give nuclear power a serious second look.

Why now?

The math is getting harder to ignore. Renewable energy, for all its benefits, has major intermittency problems. Relying solely on them can leave power grids fragile. The sun doesn’t shine at night, and the wind doesn’t blow on schedule — and we don’t have nearly enough energy storage capacity to use them without inviting serious problems.

Meanwhile, fossil fuels like coal, oil, and gas are politically and environmentally costly.

We need something that’s both clean and reliable. Nuclear power fits the bill: it gives you clean, reliable baseload power that can run for 18 months without refuelling.

That’s why, to us, 2025 looks like the year of nuclear power’s return. We’re seeing China build new reactors at record speed. The US, after a 30-year pause, has finally completed two new ones. India is preparing to open up its nuclear sector to private investment. And France, which already gets 70% of its electricity from nuclear, is planning to build even more.

A brief history of nuclear power

To really understand this nuclear moment, we need to go back — way back, to where it all started.

We begin in 1938. Two German physicists, Otto Hahn and Fritz Strassmann, discover that when you bombard uranium atoms with neutrons, the atoms break apart. Uranium turns into something else — and, in the process, releases energy. That process is called nuclear fission. This discovery changed the world.

By 1942, in a makeshift lab under the University of Chicago, Enrico Fermi created the world’s first controlled nuclear chain reaction. That is, he figured that once you bombard one Uranium atom with neutrons, that atom would itself create new neutrons, which then go on to bombard other Uranium atoms. Once you started creating energy, the process would turn automatic.

It seemed like he had unlocked an endless source of energy. The race was on.

At this time, of course, we were in the middle of the Second World War. And so, the first use of this technology wasn’t for creating power. It was for destruction. With just two bombs, America flattened the Japanese cities of Hiroshima and Nagasaki.

The bombings sear the word “nuclear” into the global imagination. But even amid the horror, scientists began to wonder: can this terrifying energy be used for good?

In 1953, US President Dwight D. Eisenhower delivered his famous “Atoms for Peace” speech at the United Nations. He proposed repurposing nuclear technology to generate electricity. The idea caught on. One year later, the Soviet Union fired up the world’s first grid-connected nuclear power plant in Obninsk. The UK followed in 1956, with its Calder Hall plant. The US launched its Shippingport plant in 1957.

The age of civil nuclear energy had officially begun.

Through the 1960s and 70s, nuclear power grew at a blinding pace. Governments poured billions into building fleets of reactors. In the US alone, more than 100 plants came online. France bet big, standardising designs and training a generation of nuclear engineers. Japan, South Korea, Canada, Germany — everyone built nuclear capacity.

At its peak, it seemed like electricity would become "too cheap to meter."

But then, things went off the rails. In 1979, the Three Mile Island plant in Pennsylvania suffered a partial meltdown. There was no radiation leak, but the accident scared the public. Then, in 1986, came Chernobyl.

This one you might have heard about — because of the critically acclaimed show called, well, Chernobyl. A flawed reactor design, combined with poor safety culture in the Soviet Union, led to a terrible explosion, and a raging nuclear fire. This became the worst nuclear disaster in history. 350,000 people were evacuated. The fallout spread across Europe, with ashes falling in parts of Germany. Global opinion shifted overnight.

Suddenly, nuclear power seemed terrifying.

Years later, when some confidence was returning, the disaster of Fukushima hit. In 2011, an earthquake and a tsunami knocked out the cooling systems at the Japanese plant. Three reactors melted down. No one died from radiation exposure, but Japan shut down nearly all of its nuclear plants.

To much of the world, though, this was enough to pull the plug on this experiment. Germany announced a complete nuclear phase-out. Even countries with long, stable programs hit the brakes.

But here’s what’s remarkable: despite all the bad press, nuclear power never quite went away. France still gets the bulk of its power from nuclear. The US never shut its fleet. Russia keeps building new reactors at home and abroad. China accelerates its nuclear plans. By the late 2010s, as the climate crisis intensified and countries faced the need for clean, 24/7 electricity, nuclear power started to creep back into the picture.

Understanding nuclear power generation

Before we go further, let’s explain how a nuclear power plant actually works.

At the heart of it is nuclear fission. Take an atom of uranium-235. Hit it with a neutron. It splits into two smaller atoms, releases energy, and emits more neutrons. Those new neutrons then hit more uranium atoms. Soon, you have a self-sustaining chain reaction.

This chain reaction releases energy, in the form of heat. There are water pipes running through this set up, and that water turns into steam. That steam, then, spins a turbine. And the turbine powers a generator.

In a way, a nuclear power plant is basically a very sophisticated way to boil water.

Now, left to itself, this chain reaction would keep ramping up, until the plant explodes. And so, you need to control the reaction. For that, you need control rods — usually made of boron or cadmium — that absorb stray neutrons. Lower them in, and the reaction slows. Pull them out, and it speeds up.

This whole set-up is housed in a reactor vessel, surrounded by thick layers of concrete and steel. It has layered safety systems, with built-in redundancies, and the whole thing is tested extensively. Modern reactors are built to withstand earthquakes, floods, and even aircraft crashes.

There are several types of reactors, but 3 dominate the global landscape.

First, Pressurised Water Reactors (PWRs). Around 70% of the world’s reactors are PWRs. These use high-pressure water as both coolant and moderator. The water doesn’t boil in the core. Instead, it pulls the heat into a secondary loop, where steam is created. This design is the most common worldwide.

Second, Boiling Water Reactors (BWRs). Close to 15% of the reactors in the world are BWRs. These reactors allow water to boil inside the reactor core. The resulting steam directly spins a turbine. This is simpler, but it means parts of the turbine system can become radioactive.

Third, Pressurised Heavy Water Reactors (PHWRs), such as Canadian CANDUs. These use heavy water (deuterium oxide) as both the moderator and coolant. Heavy water is better at slowing neutrons down, which allows the use of natural, unenriched, uranium as fuel.

As of 2025, the world has around 440 nuclear reactors operating in over 30 countries, providing about 10% of global electricity. The US has the most installed capacity — over 90 GW — but has built very few new plants in decades. France gets about 70% of its power from nuclear. Russia, besides having 37 domestic reactors, is actively exporting its technology. China, with 57 operational reactors and 26 under construction, is scaling up faster than anyone else.

Here, in India, we have around 8 GW of nuclear power — across 24 plants.

Here’s the interesting part — most reactors in developed countries are old. The average American reactor is more than 36 years old. In the EU, many old reactors have been phased out. And so, its nuclear capacity has dropped — it once made up 34% of the power mix, now it’s down to 23%.

But there’s now a new kind of reactor, that’s suddenly driving up interest in the technology: SMRs — or Small Modular Reactors.

The new kid on the block: SMRs

SMRs are often described as the “future” of nuclear power — at least in theory.

One big advantage they carry is that they don’t have to be set up on-site. With a capacity that’s typically under 300 MW, these reactors are designed to be built in faraway factories, shipped to sites, and plugged in quickly. Think of them as Lego blocks for nuclear — modular, scalable, safer. Because these are to be built in factories, rather than on-site, they are standardised and benefit from economies of scale, which makes them much cheaper. They also have passive safety systems — meaning they don’t need power or human intervention to shut down safely in an emergency.

Think of the flexibility that cheap, mass-produced, standardised reactors can give energy planners. SMRs can avoid the delays and cost overruns that large projects typically see. A 20% cost overrun on a $1 billion SMR project is a lot less painful than on a $15 billion mega-project. Because they’re cheap and smaller in scale, they can also serve smaller grids, remote areas, or pair up with renewables or hydrogen plants.

This is why they have the attention of tech giants like Amazon, Microsoft, Google, and OpenAI, who are heavily investing in SMRs — primarily driven by their enormous electricity demands from data centres.

But here’s the thing: there’s no commercial SMR that’s actually operating in the West yet. NuScale, the leading US SMR company, has delayed its first project and has lost key customers. Russia has a floating SMR. China’s Linglong One is under construction. India is developing a 220 MW SMR design, but it’s still on paper.

So while the potential is huge, SMRs are still early into their innings. There are big questions around costs, licensing, and who will actually buy them — and those questions will remain until the market matures.

But as we’ve written before, here, in India, we’re hopeful that they’ll take off.

The economics of nuclear power

The economics of nuclear power can vary wildly, depending on where you are. It can cost a lot in some countries — and little in others.

In China, for instance, the latest batch of 10 new reactors is expected to cost $27 billion for 12 GW. That’s ~$2.3 million per megawatt. Compare that to:

Hinkley Point C in the UK — which costs $43 billion for 3.2 GW (over $13 million per MW)

Vogtle 3 & 4 in the US — which costs $37 billion for 2.2 GW (about $16.6 million per MW)

That’s a 3 to 7x cost gap. And that’s just the money — build times also differ massively. Chinese reactors often finish in 5–7 years. Vogtle took 15. Hinkley may take 13.

So what’s driving this disparity? There are several reasons:

First, standardisation. China builds the same designs repeatedly — Hualong One, CPR-1000. They reuse plans, teams, and supply chains.

Second, labour costs. China and South Korea have cheaper, more experienced workforces for nuclear builds.

Third, permitting. In the US and Europe, it can take years just to get approval. In China, approvals are faster and more predictable.

Fourth, financing. Chinese state banks offer loans at ~1.4%. In the West, rates can be 5–10%. That interest, over the long period of construction, can balloon up to billions in the final bill.

Fifth, political will. China sees nuclear power as critical infrastructure. It’s part of the long-term energy strategy. In the US and Europe, nuclear has become politically divisive.

But perhaps the biggest differentiator is momentum. China builds many reactors every year. The US went 30 years without building one. France hasn’t finished a new reactor since the 1990s. Each time you stop and restart, you lose skills, suppliers, and speed.

And that’s why the leadership of nuclear construction has decisively shifted from advanced economies to China. That isn’t just a matter of the scientific technology involved, but also execution, scale, and state capacity.

Momentum grows all across the world

That said, globally, nuclear momentum seems to be shifting. In America, the Inflation Reduction Act offered tax credits for both new and existing nuclear plants — although Trump might slash those incentives. After a long struggle, the EU classified nuclear power as a ‘green investment’. Japan is restarting reactors. South Korea has reversed its nuclear phase-out. Even countries like Poland, Bangladesh, and Egypt are building their first reactors.

In other words, it seems like the world is warming up to the technology once again.

Now, the old concerns still remain. Nuclear power isn’t perfect. Disposing nuclear waste remains a politically sensitive matter. Public opposition hasn’t disappeared. And new builds, especially in the West, are still painfully expensive.

But the maths is still making it more and more attractive. As grids get cleaner but more fragile, the need for firm, zero-carbon power is growing. And in that world, nuclear — for all its flaws — might just be essential.

The State of India’s Defence Industry

Yesterday, we explored how India buys its weapons – how our defence procurement rules evolved, and how we made a concerted push for indigenisation. Today, we’ll pick up where we left off, to answer one question: how far has India come in building weapons at home?

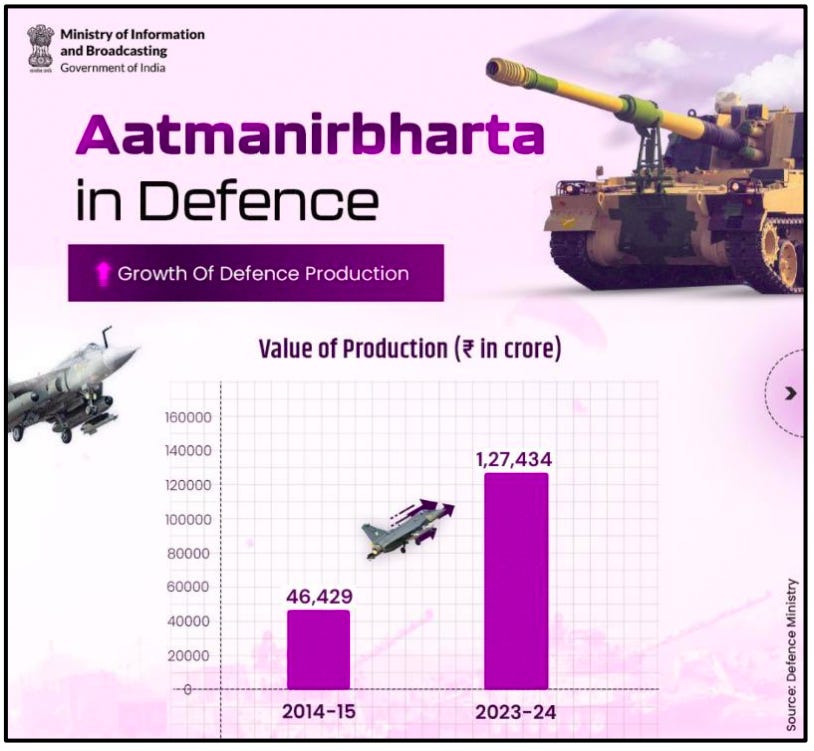

The numbers tell a striking story. India’s annual defence production hit a record ₹1.27 lakh crore in FY23-24. About 79% of that came from public sector units, while another 21% came from the private sector — roughly reflecting an 80/20 split in output.

Of a record 193 contracts in 2024-25 given out by the Ministry of Defence, 92% were awarded to the domestic industry, with 81% of the total contract value.

This is a complete reversal from an era of ~70% import dependence. Consider this: in less than a decade, we’ve practically tripled our defence production.

Meanwhile, our exports have also surged to new highs. As per government figures, in the last fiscal year, India’s defence exports hit ₹23,622 crore, up from just ₹686 crore a decade ago. That’s a 34x jump. Indian-made defence equipment have found buyers in over 100 countries — with the U.S., Armenia and France among the top importers. And we’ve set our sights even higher. The government now eyes an ambitious ₹50,000 crore in annual defence exports by 2029.

This manufacturing push has been backed by hefty spending. India’s defence budget stands at ₹6.81 lakh crore for 2025-26. That’s the third-largest in the world in absolute terms – albeit still far smaller than the U.S. (~$850+ billion) or China (est. $230–300 billion)

As a share of the economy, India’s defence spend is roughly 2.2% of GDP. This is similar to the UK. On paper, at least, this is higher than China’s official ~1.7% (take that with a pinch of salt) — although we’re well below the U.S. (~3.4%).

There’s a clear bottom line here: India is pouring more money into defence, and the results speak for themselves.

But headline numbers only paint part of the picture.

Domestic Capability by Segment

Export figures and budget outlays don’t reveal what India is actually good at making. To understand the health of India’s defence industry, we need to break it down by key segments. After all, different battle domains tell very different stories about both India’s capabilities and gaps.

Aerospace (Aircraft & Helicopters)

India has made long strides in military aviation over the last couple of decades. But we still have a long way to go. Hindustan Aeronautics Ltd (HAL) remains the nation’s premier aircraft manufacturer with a near-monopoly in fighter and helicopter production. HAL’s flagship product is the Tejas Light Combat Aircraft, an indigenous jet that finally entered service after decades of development.

However, we have a deep vulnerability in this segment: jet engines. Tejas and other indigenous planes all rely on imported engines, due to our longstanding inability to produce a high-performance turbofan. Advanced sensors are another challenge, often requiring foreign help.

In short, we can design and assemble fighter airframes and helicopters, but the most critical subsystems — like engines, or radar — frequently come from abroad.

Land Systems (Tanks, Artillery & Vehicles)

On land, India has mixed success. The DRDO-developed Arjun main battle tank and ATAGS artillery gun showcase some local engineering, but their induction has been slow and limited.

We haven’t yet learnt to trust these systems. Our Army still operates mainly on Russian-origin tanks and imports specialised artillery. Nonetheless, Indian industry has built capable armoured vehicles — where private players like Tata and Mahindra supply troop carriers and bullet-proof vehicles.

Missile systems

Our missile systems, as recent events have shown, are a relative bright spot. India’s surface-to-surface missiles (Agni, Prithvi, BrahMos) are mostly indigenous, and Bharat Dynamics Ltd (BDL) manufactures a range of missiles and torpedoes for the forces. Thanks to years of DRDO research, India is largely self-sufficient in strategic missiles. In fact, we’re even exporting missile systems like the BrahMos to friendly nations.

Naval Systems (Ships & Submarines)

This is arguably India’s most successful defence manufacturing segment.

Indian shipyards have delivered everything from aircraft carriers to nuclear submarines domestically. Mazagon Dock and Cochin Shipyard — both public sector companies — have built frontline warships like destroyers, frigates, and even India’s new aircraft carrier, INS Vikrant.

Meanwhile, private conglomerate L&T has become a critical partner in submarine and warship construction. In fact, today, the Indian Navy sources the majority of its surface combatants from Indian yards. This marks a remarkable turnaround from the early 2000s, when most warships were imported or built with heavy foreign assistance.

This is not to say we’ve perfected things. Certain gaps remain – for instance, high-end marine diesel engines and some weapon systems are imported – but broadly, our naval production ecosystem seems strong.

Defence Electronics

This is the fastest-growing segment of our military industry, and perhaps the most exciting for investors. Modern warfare requires cutting-edge electronics – radars, sonar, communications, electronic warfare, fire control systems, and now cyber and AI systems.

India has identified this area as a priority, and it’s seeing rapid growth, led by companies like Bharat Electronics Ltd (BEL), the PSU that dominates radar and defence electronics. Private players such as Data Patterns, Astra Microwave, Paras Defence, and others have also emerged as niche suppliers of electronics and avionics.

In all, India’s capabilities vary widely by segment. We’re world-class in missiles and warships, reasonably competent in aircraft and land systems (with some weaknesses), and rapidly scaling up in electronics. On the other hand, we have critical gaps. Advanced defence components — like engine technology, semiconductors, and some specialised weaponry – are still outside our reach. And that means India still remains one of the world’s biggest arms importers by value (accounting for roughly 9.8% of global imports).

Our next goal, now, is to plug these holes by nurturing domestic innovation.

India’s R&D Engine: Innovation or Imitation?

There’s one critical piece of the puzzle that requires urgent attention: if our defence sector is to truly mature, research and development is key.

Historically, India’s military R&D was almost synonymous with the Defence Research and Development Organisation (DRDO) – a giant network of 50+ labs under the Ministry of Defence. DRDO has been the brains behind most indigenous platforms (from the Tejas jet to Agni missiles to Arjun tank). However, its track record shows both hits and misses. Some DRDO products may have improved our military capacity, but in all, it’s hard to escape the fact that India hasn’t invested nearly enough in R&D to actually leap ahead.

Consider the big picture: we need more local research and infrastructure if we’re serious about decreasing our reliance on imports. As long as we keep importing vital components used in defensive equipment, self-sufficiency will remain a distant dream. At the moment, just ~6% of our defence budget goes into research and development, much below the 15% and 20% allocated by nations such as the US and China, respectively.

This is a serious challenge. Our aspirations of being a high-tech weapons power are running into the reality of limited R&D spending. Cutting-edge defence tech – be it fifth-gen fighters, AI-enabled systems, or hypersonic missiles – require massive upfront investment and a tolerance for failure, which only a few nations have demonstrated. Because we can’t yet stomach that cost, cutting-edge technologies are still outside our reach.

Spending on research creates positive externalities too, that benefit the entire economy. We see this in Silicon Valley's emergence from defence R&D in the US. The internet itself, in fact, was created for the American military. Just think of the returns that single investment has generated for the United States.

The government is aware of this gap and has launched initiatives to spur innovation. One flagship scheme is Innovations for Defence Excellence (iDEX), launched in 2018, which funds startups and MSMEs to develop new defence tech solutions. So far, iDEX has engaged over 600 startups, issued 550+ problem statements, and even signed 430+ contracts for prototype development.

Beyond startups, India’s defence procurement policy now includes provisions like “Make-I” projects, where the government co-funds industry R&D for futuristic systems, and Defence Industrial Corridors set up in Uttar Pradesh and Tamil Nadu to cluster manufacturing and R&D facilities. Our bet, it seems, is to encourage private players and state governments to invest in defence innovation. Our progress has been slow but steady – dozens of indigenous development projects are now underway under the Make categories.

Despite these efforts, though, experts note that India’s defence R&D remains largely government-driven. And this creates problems. Without a thriving private sector, our defence research is perennially under-funded, and is wrapped in red tape.

Challenges for Indian defence

Our lack of R&D isn’t the only thing ailing our defence industry. To navigate this space, one must understand our structural bottlenecks — because those can slow down even the best-laid plans.

First, Long and Complex Procurement Cycles

India’s typical defence procurement lifecycle – from defining requirements, to R&D/prototyping, to rigorous user trials, to contracting and production – can span anything from several years, to even decades. If you’re a business built around selling weapons to the government, this can create serious problems. These elongated demand cycles mean that cash flows for companies can be volatile, while projects often face cost and time overruns.

We aren’t alone here: this is a global issue in defence. But in India, our bureaucratic procedures and changing requirements have historically added extra lag.

Second, Execution Delays and Quality Hurdles

If the delays on demand side were not enough, supply from Defence PSUs have in the past been saddled with production bottlenecks. Shipbuilding is a classic example – it can take years for a shipyard to build a complex warship or submarine, and any lapse in project management or supply of key components can push timelines out further. Delays aren’t just timeline issues; they often lead to cost escalations and penalty clauses, hurting a company’s profitability.

Quality control is another hurdle. Military equipment must pass stringent trials, and it’s not clear that all of it does. The Indian Air Force, for instance, has publicly commented on how it cannot trust HAL products. As an investor, this means that getting contracts doesn’t necessarily translate into execution.

Third, Overdependence on a Single Buyer

Unlike consumer industries, defence companies typically have one overwhelmingly dominant customer – the government. If orders from the Indian armed forces are delayed or reduced, domestic manufacturers don’t have a large civilian or export market to compensate — at least not yet. This concentration risk is significant.

It also means that the MoD has strong negotiating power on pricing which are usually capped on cost plus margin basis. Until Indian firms crack substantial export orders or diversify into dual-use products (where a military tech/good can be used for civilian purpose too), they remain tethered to the annual defence budget and procurement decisions of the government.

Conclusion

Despite these challenges, it’s important to note the big picture: India’s defence industry is on an undeniable upward trajectory. There is strong domestic demand, firm government commitment to local procurement, and growing technical know-how within the country.

All our issues have been around for a long time — none of those are a surprise. What’s new, though, are these powerful tailwinds. And if this trajectory holds, it signals a huge opportunity for those companies that can navigate the minefield of execution risks.

Tidbits

India’s Russian Crude Imports to Hit 10-Month High at 1.8 Million bpd in May

Source: Reuters

India’s imports of Russian crude oil are set to reach approximately 1.8 million barrels per day in May, marking the highest level in the past 10 months, according to ship-tracking data from Kpler. The surge is driven by strong demand for the light sweet ESPO crude, with Indian refiners recently securing over 10 cargoes for June-loading. The ESPO grade is currently trading at a premium of 50 cents to $1 per barrel over Dubai crude, making it an attractive option amid refinery shutdowns at Reliance Industries and MRPL. Some of these shipments are part of long-term supply deals with Rosneft, with increased arrivals noted at Reliance’s Sikka port since the beginning of the year. This jump in Indian demand has also lifted ESPO prices for China, where July-loading cargoes are now offered at $2 premiums, up from $1.50–$1.70 for June.

Bajaj Auto to Take Control of KTM with €800 Million Revival Package

Source: Reuters

Bajaj Auto has announced plans to take control of Austria’s KTM AG as part of an €800 million ($906 million) debt infusion aimed at reviving the financially troubled motorcycle brand. KTM, which filed for court restructuring in November due to severe liquidity issues, will see creditors receive 30% of their claims in cash by May 23. Bajaj, a stakeholder in KTM since 2007, has already infused €200 million and will deploy an additional €600 million to settle debts and resume operations. The Indian company will acquire a controlling stake in its unit Pierer Bajaj AG, thereby gaining indirect control of KTM’s parent firm, Pierer Mobility AG. Bajaj currently holds a 37.5% stake in KTM through its unit, although the final stake post-deal remains undisclosed.

TCS Secures ₹2,903 Cr Add-On Order from BSNL for 4G Expansion

Source: Business Standard

Tata Consultancy Services (TCS) has received an advance purchase order worth ₹2,903 crore, inclusive of taxes, from Bharat Sanchar Nigam Ltd (BSNL) for enhancing its 4G mobile network. The order covers planning, engineering, supply, installation, testing, commissioning, and annual maintenance across 18,685 BSNL sites. This is an extension of the earlier ₹15,000 crore deal TCS had with BSNL, which includes building data centres and 4G sites, and supporting 5G infrastructure development. Tejas Networks Ltd, a Tata group company, will supply radio access network and other equipment worth ₹1,525.23 crore (exclusive of taxes) to TCS for the project. TCS had earlier indicated that tapering revenue from the initial BSNL contract could be a headwind, and this new order offers partial relief. BSNL aims to deploy 100,000 4G towers by June. Shares of Tejas Networks rose 3.16% to close at ₹746.50 on the BSE following the announcement.

- This edition of the newsletter was written by Krishna and Kashish.

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, even the smaller logistics firms—and copy the full transcripts. Then we bin the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Introducing “What the hell is happening?”

In an era where everything seems to be breaking simultaneously—geopolitics, economics, climate systems, social norms—this new tried to make sense of the present.

"What the hell is happening?" is deliberately messy, more permanent draft than polished product. Each edition examines the collision of mega-trends shaping our world: from the stupidity of trade wars and the weaponization of interdependence, to great power competition and planetary-scale challenges we're barely equipped to comprehend.

Subscribe to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Thank you for reading. Do share this with your friends and make them as smart as you are 😉