Mega Indian crypto hack

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

Check out the audio here:

And the video is here:

Today, we look at we look at 5 big stories:

1) SEBI proposes a new asset class for people who want to take risk

2) Another mega crypto hack

3) The global economy is a little good, a little bad

4) Will the bull market continue?

5) Results roundup

SEBI proposes a new asset class for people who want to take risk

First up, let's dive into a new proposal from SEBI that could really shake things up for Indian investors. If you're a regular retail investor, you're used to the usual options—stocks, ETFs, and mutual funds. But if you've got deep pockets, you can access Portfolio Management Services (PMS) and Alternative Investment Funds (AIFs), which require hefty minimum investments of Rs 50 lakh and Rs 1 crore, respectively. SEBI has identified a big gap here, one that could be fueling unauthorized portfolio management and advisory services.

Details:

SEBI's proposal introduces a new asset class requiring a minimum investment of Rs 10 lakh, aimed to sit between mutual funds and PMS.

This asset class would allow the use of futures and options for more than just hedging. Unlike mutual funds and PMS, it can make directional market bets.

Strategy of the new asset class:

These funds can have both long and short positions in the same fund, unlike the long-only mutual funds and PMS.

These strategies move opposite to an index, allowing investors to short the Nifty index without directly using futures or options.

Higher risk tolerance:

Take higher concentrations in single stock positions.

Include more risky bonds.

Have more flexible sectoral exposure limits.

Interestingly, SEBI is proposing to allow leverage at the Rs 10 lakh level, while it isn't permitted at the Rs 50 lakh level in PMS.

Why It Matters:

This new asset class offers a regulated avenue for investors with higher risk appetites to access leveraged products, something currently only available through AIFs with a Rs 1 crore minimum investment.

SEBI has been trying to curb F&O participation, but this proposal provides a way for high-risk investors to engage in regulated leveraged trading.

Remember, this is just a proposal for now. SEBI is seeking public comments, and we'll have to wait and see what the final outcome will be.

Mega Indian crypto hack

Let's dive into a crucial story that rocked the crypto world yesterday. One of the largest cryptocurrency exchanges, WazirX, suffered a massive security breach. Hackers managed to steal over $230 million worth of crypto assets from the exchange, specifically targeting one of WazirX's wallets on the Ethereum blockchain.

Key Points:

Hackers stole $234.9 million, according to cybersecurity firm PeckShield, making this potentially the eighth-largest crypto hack in history.

WazirX acknowledged the breach and has temporarily suspended all withdrawals to safeguard user assets.

The largest crypto hack was the Ronin Network breach in 2022, which saw $625 million stolen.

Crypto growth has outpaced security investments. In 2022, $3.8 billion was stolen from crypto exchanges via hacks, dropping to $1.7 billion in 2023.

The government has made crypto trading expensive, with a 30% tax on gains from crypto and NFTs and a 1% TDS on transactions above ₹50,000.

The hacker has been dumping less valuable tokens like Shiba-Inu, causing these meme tokens to fall by 10-20%.

The global economy is a little good, a little bad

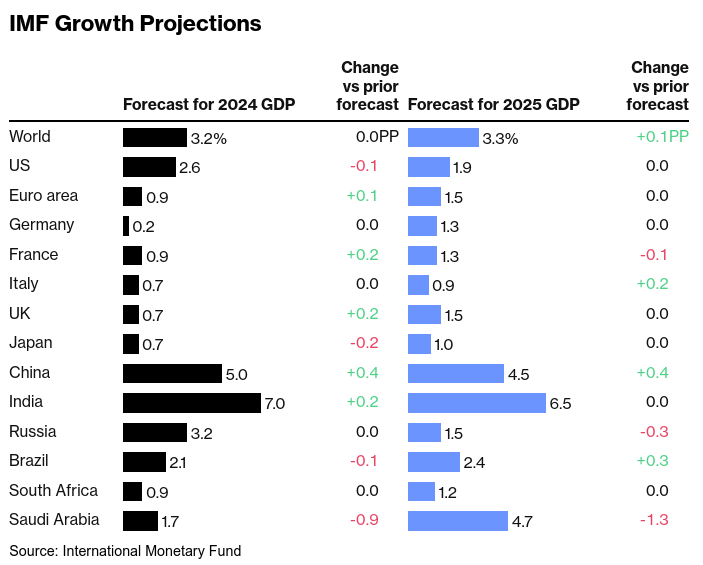

The International Monetary Fund (IMF) has released its latest World Economic Outlook update for July 2024. Published twice a year, this report provides a comprehensive overview of global economic performance, highlighting key trends and forces shaping the world economy.

Key Points:

Global Growth Projections:

2024: 3.2%

2025: 3.3%

These figures signal a return to pre-pandemic growth levels, excluding the 2020 drop due to COVID-19 and the subsequent rebound in 2021.

Country-Specific Trends:

Positive Growth: Most countries are seeing positive growth.

Slowdowns: The US and Japan are experiencing slower growth.

Europe: Surprisingly, Europe is showing signs of economic revitalization after nearly a decade of stagnation.

Inflation Insights:

Inflation is still falling, but at a slower pace.

Goods inflation has dropped, but services inflation remains high due to increased demand and rising wages post-pandemic.

Near pre-pandemic levels in many countries, with lingering issues in some areas like India.

Higher-for-longer inflation suggests central banks may not cut interest rates significantly, which could impact markets negatively.

India's Economic Outlook:

Growth Projection is increased to 7% from 6.8%.

Expected improvement in private consumption, particularly in rural areas are the key drivers for the increase in projection.

Alongside China, India is set to contribute to nearly half of the world's economic growth amid slower growth in advanced economies.

Will the bull market continue?

In one of our previous episodes, titled "Are we in a Bull Market or a Bubble?", we explored the seemingly unstoppable rise in the Indian stock markets. All stocks, whether high-quality or not, have been surging, driven by strong domestic and foreign investor sentiment. The Nifty 50, Midcap 150, and Smallcap 250 indices have seen remarkable gains since the COVID lows, raising questions about market valuations and the potential for a bubble.

Why am I saying this?

Recently, Chris Wood, the head of Jefferies, spoke to CNBC about the outlook for Indian markets. He is best known for his "GREED and Fear" note, where he writes about markets and the global economy.

Chris Wood’s views:

Believes the Indian bull market will continue.

Draws parallels to the US 401K system, predicting a rise in domestic investments through vehicles like NPS, leading to sustained equity inflows.

Notes that India is under-owned by global investors, with limited exposure primarily through a few ADRs like Infosys and HDFC. Key growth themes like PSU banks, energy, infrastructure, and defense have been missed by global funds.

Warns about potential changes in the long-term capital gains tax, which could impact market dynamics.

Samir Arora of Helios Mutual Fund highlighted that no other countries levy capital gains tax on foreign investors, suggesting that maintaining or eliminating LTCG tax could attract more investment and create wealth for Indian investors.

Results Roundup

Asian Paints

Asian Paints recently released its Q1 FY 2025 results, and the numbers have raised some eyebrows. Known for its consistent double-digit growth, the company faced a challenging quarter due to several external factors. However, there's a silver lining as the company looks ahead to the next quarter.

Key Points:

Asian Paints delivered a surprisingly weak performance this quarter, falling short of the usual double-digit growth expectations.

General elections caused significant labor movement, leading to a shortage of painters.

Severe heatwaves across the country curtailed painting activities, particularly for exteriors.

Monthly Breakdown:

The company faced rough months due to the elections and heatwaves.

June showed signs of recovery in both volume and value growth as election-related disruptions and heatwaves subsided. Amit Syngle, MD & CEO, is optimistic about this upward trend continuing.

Positive Outlook for Q2:

The upcoming festive season is expected to boost demand, as people typically buy and refurbish homes during this time.

Improved weather conditions post-monsoons have positively impacted market sentiment, easing previous disruptions caused by heatwaves.

Inflation Impact:

Asian Paints announced a 1% price increase across all products to combat rising inflation. They are prepared to implement further hikes if necessary.

Premium Real Estate Trend:

The ongoing premiumisation trend in India's top 8 cities, where houses priced above Rs 1 crore contribute over 40% of total sales, is advantageous for Asian Paints. Sales in this segment have grown by 51% year-on-year, benefiting the company's premium and luxury segments.

Bajaj Auto

In one of our previous, we discussed Bajaj launching the world's first CNG motorbike. Now, let’s dive into Bajaj Auto’s Q1 results for FY 2025. The company has reported a stellar quarter, exceeding market expectations in both revenue growth and margin expansion. Here are the key takeaways and trends shaping Bajaj’s future.

Key Points:

Strong Quarterly Performance:

Bajaj Auto surpassed market expectations in revenue growth and margin expansion.

Electric Vehicle (EV) Sales:

EV sales grew by almost 30% from the previous quarter.

Sold nearly 40,000 Chetak scooters in the January-March quarter, almost matching the entire previous fiscal year's sales. For comparison, only 993 EV scooters were sold in 2022.

Three-Wheeler Success:

19% of their three-wheeler portfolio is now electric.

Bajaj is investing Rs 400 crore in a new dedicated electric three-wheeler manufacturing facility, expected by early FY2025.

Premium Bikes Focus:

Introduced a new 400cc Pulsar, targeting the premium bike market. The full impact on sales will be clearer next quarter.

CNG-Powered Motorcycle:

Launched a CNG-powered motorcycle with a mileage of 102 km per kg of CNG. With CNG prices at Rs 75 per kg, this could reduce costs for regular motorcyclists by up to 65%.

Affluent Market Growth:

The number of affluent Indians (earning Rs 10 lakh per year or more) is growing at 13% annually, potentially reaching 100 million by 2027. This segment is less affected by inflation, which bodes well for Bajaj's premium products.