India’s Diabetes Crisis: A Ticking Time Bomb

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and videos on YouTube.

In today’s edition of The Daily Brief:

Diabetes: India’s Silent Health Crisis

Capex Slowdown: A Temporary Blip or a Sign of Caution?

Diabetes: India’s Silent Health Crisis

Today, let's talk about a health crisis that’s impacting millions of lives quietly but seriously—diabetes. This problem goes far beyond individual health issues. It is reshaping economies, adding stress on families, and changing the very structure of our society. In India especially, diabetes is a huge issue affecting our economy, social lives, and productivity, which makes it critical to understand this in detail.

To start, it’s important to know what diabetes really is. Think of it as a condition where the body struggles to manage sugar levels in the blood. Usually, our body relies on a hormone called insulin to help process sugar from the food we eat. In diabetes, either the body doesn’t produce enough insulin or can’t use it properly. This results in high blood sugar levels, which can lead to long-term health problems like heart disease, kidney damage, and even blindness.

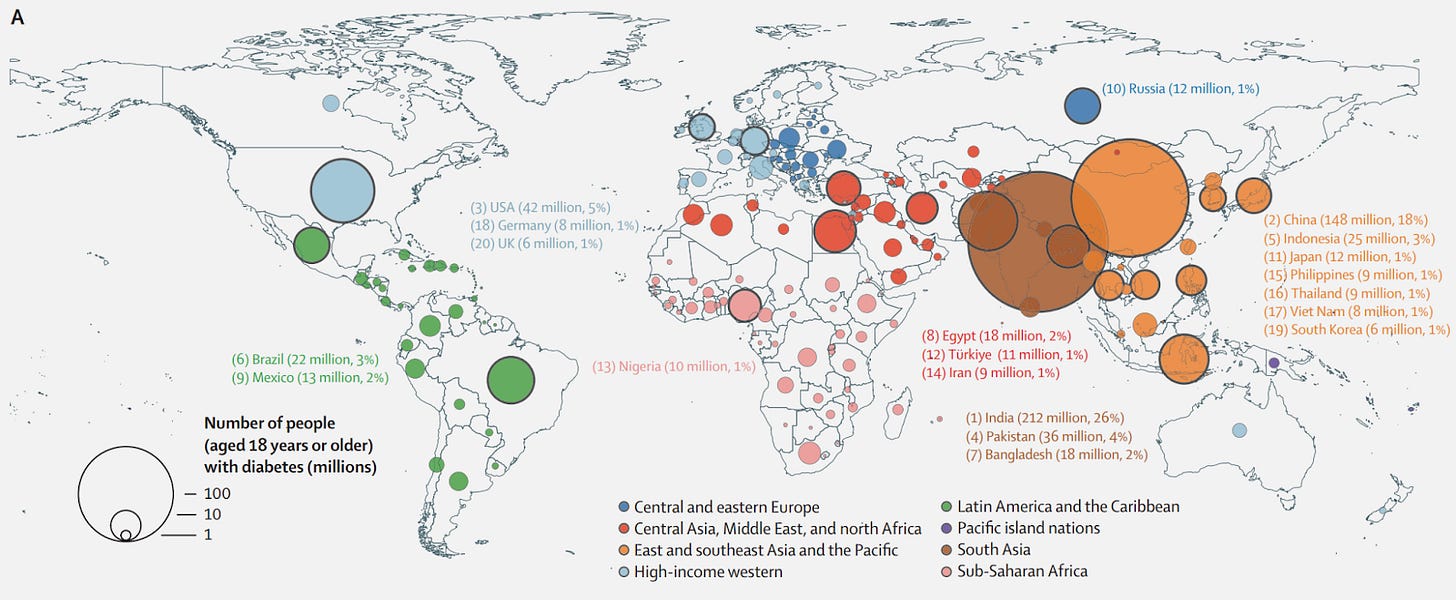

Globally, diabetes has become a crisis. In 1990, about 63 crore people worldwide were living with diabetes. By 2022, this number had increased to around 83 crore! This rapid rise shows just how serious the problem has become, especially in low- and middle-income countries like India, where healthcare systems are often already under pressure.

What’s even more alarming for us in India is that we have the highest number of people with diabetes in the world! In 2022, roughly 21 crore adults in India were living with diabetes—that’s over 15% of our population.

What’s even more worrying is that diabetes is now affecting younger people at a growing rate. If you’re a 20-year-old woman living in an Indian city today, you have a 64.6% chance of developing diabetes during your lifetime. If you’re a young man, your risk is also quite high at 55.5%. Even for those who reach the age of 40 without diabetes, the chances of getting it remain high—about 59.2% for women and 47.3% for men. This shows that diabetes is no longer just a disease of older people; it’s impacting young adults too, creating new challenges for the future.

India’s diabetes crisis is even more severe in urban areas. City life often means eating more processed foods, sitting for long hours, and dealing with high stress. In cities, about 18.5% of people have diabetes compared to 14.9% in rural areas.

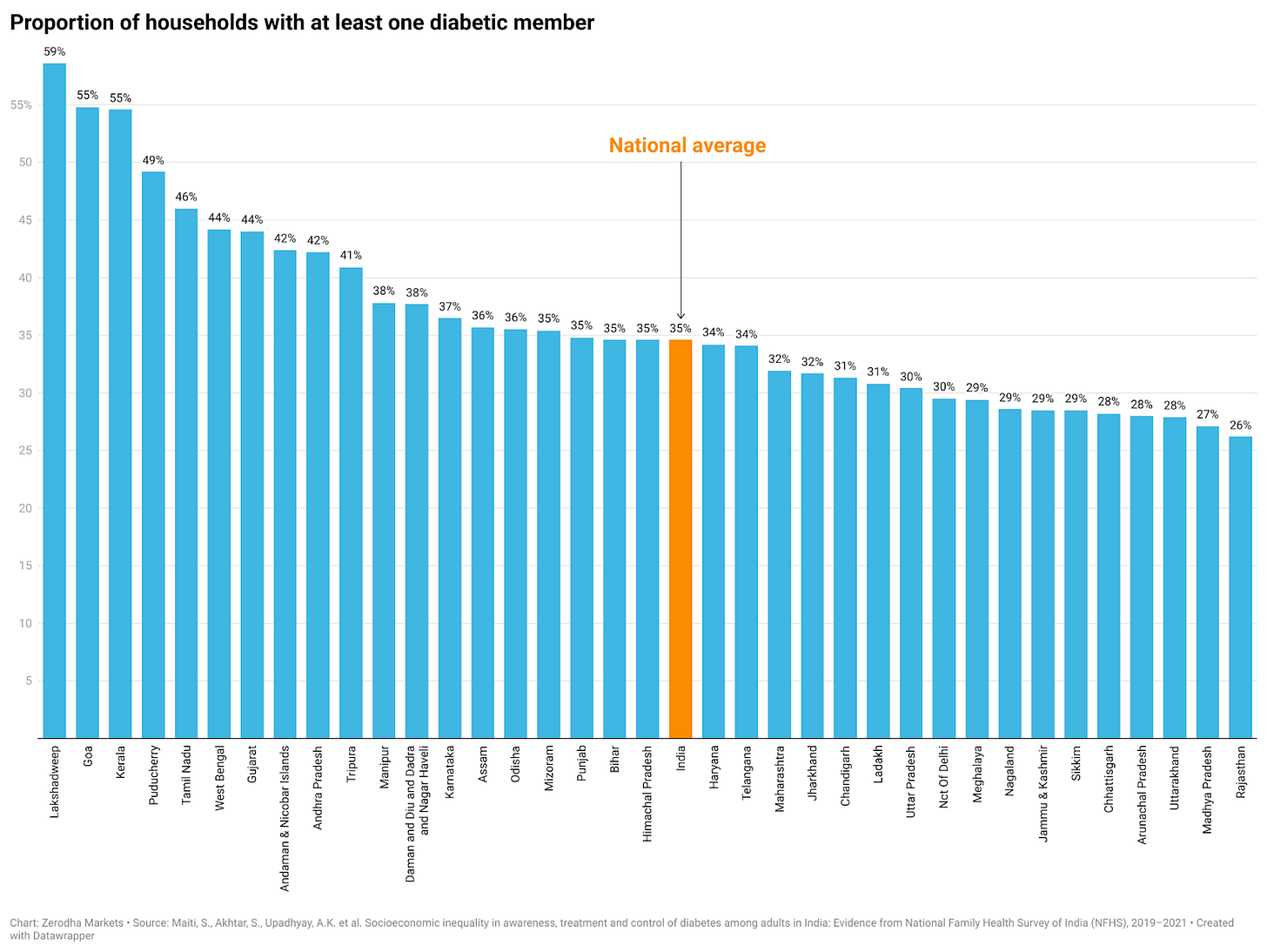

The southern states of India, such as Kerala, Tamil Nadu, Andhra Pradesh, and Karnataka, have particularly high rates of diabetes. This is partly due to diets heavy in carbohydrates and sugar, along with less physical activity. For example, over half the households in Kerala have at least one person with diabetes. By contrast, only 25.3% of households in Rajasthan deal with this issue. States like Karnataka also report high rates, driven by similar factors. While southern states often have better healthcare facilities, meaning more cases are diagnosed, it also underscores just how widespread diabetes has become.

A major challenge in India’s diabetes crisis is the cost of healthcare. Less than a quarter of Indians have health insurance, which means most people have to pay for their healthcare out of their own pockets. On average, diabetes care costs around INR 15,535 per person each year, a heavy burden for many families. And this estimate might even be on the lower side since healthcare costs are rising fast.

The problem gets even more complicated in states with limited access to healthcare, like Bihar, Uttar Pradesh, and Madhya Pradesh, where insurance coverage is low. This makes it difficult for many people to get the care they need. On the other hand, states with better healthcare infrastructure, like Chandigarh, Goa, and Delhi, have higher awareness and better treatment rates.

Socioeconomic factors also play a big role in diabetes care. People with lower incomes are less likely to get proper treatment, especially in rural areas where healthcare is harder to reach. In urban areas, high stress and lifestyle changes lead to more cases of diabetes. This creates a complex situation—under-treatment in rural areas and a higher number of cases in cities—showing how challenging the diabetes crisis is in India.

One of the most concerning issues is the lack of awareness about diabetes. Around 27.5% of people with diabetes don’t even know they have it. This means millions of people are living with a potentially dangerous disease without knowing it. Only about 21.5% of those with diabetes are receiving treatment, and fewer than 7% manage to keep their blood sugar levels under control.

Without awareness, there can be no treatment, and without treatment, diabetes can lead to serious health problems. Untreated diabetes can cause heart disease, kidney failure, nerve damage, and even blindness. The gap in awareness is especially wide in rural areas and among people with lower incomes, who often have less access to information and healthcare resources. Interestingly, wealthier people are about 10-12% more likely to know about their condition, get treatment, and manage it better. Gender also plays a role, with women often being underdiagnosed and undertreated due to social and cultural factors.

Diabetes doesn’t just affect people’s health; it has a huge impact on the economy too. In the United States, diabetes costs an estimated $412.9 billion in 2022, including both direct costs like medical bills and indirect costs such as lost productivity. In India, even though healthcare costs are lower, the impact is still very serious. The yearly per-person cost of diabetes care is about INR 15,535, which can be a big financial burden for many lower-income families.

But direct costs only tell part of the story. Diabetes also reduces productivity, as people often have to take time off work or aren’t able to work as efficiently. Back in 2017, the estimated productivity loss due to diabetes was worth INR 176.6 lakh crores, or roughly $2.6 trillion. This loss came from missed workdays, reduced work efficiency, and early retirement caused by complications from diabetes.

The economic impact is especially concerning in a country where many families are still trying to achieve financial stability. Unfortunately, a lack of reliable data makes it hard to measure the full scope of the problem, showing the need for more focused research.

To address diabetes, we need a large-scale, systemic approach. Public health campaigns that raise awareness about diabetes and its risk factors are essential. Expanding insurance coverage and introducing early screening programs could help catch diabetes before complications develop.

Simple lifestyle changes, like adding a few extra minutes of exercise each day or reducing time spent sitting, can make a big difference in blood pressure and overall health. Even small changes, such as walking or cycling for an extra five minutes a day, can lower the risk of diabetes.

Countries with better awareness and treatment rates, like the U.S., offer valuable lessons. By promoting lifestyle changes and building stronger healthcare systems, we can make significant strides in managing diabetes.

Diabetes affects not just individuals but entire families. When someone in a household has diabetes, everyone feels the strain—financially, emotionally, and socially. Families often have to prioritize healthcare costs over other basic needs, and the stress of managing a chronic condition can weigh heavily on mental health, impacting both the person with diabetes and their loved ones.

Unhealthy habits within a family can also increase the risk of diabetes for future generations. This makes diabetes more than just a health issue; it becomes a social issue that affects family life and can even lead to health risks for children down the road.

Simply put, diabetes is a silent crisis with serious consequences. It’s a health challenge that impacts our economy, workforce, and society as a whole. Those who feel the impact the hardest are often the most vulnerable, like low-income families and people in rural areas. Without better awareness, improved healthcare access, and proactive policies, this crisis will continue to worsen.

By focusing on education, preventive measures, and better healthcare, we can tackle this epidemic head-on. It’s not just about treating an illness; it’s about protecting the future of our families, our workforce, and our country.

Capex Slowdown: A Temporary Blip or a Sign of Caution?

In today’s second story, let’s talk about the current slowdown in capital expenditure in India—a trend that goes beyond business and affects all of us, including job creation and infrastructure development.

Lately, there has been a noticeable slowdown in capital expenditure, or "capex," in India. Simply put, capex is the money spent on long-term investments, like infrastructure projects such as roads, railways, power plants, and more. It’s the government and private companies investing in things that keep the economy moving and create jobs. When capex slows down, it shows that both the government and businesses are cutting back on these major investments, which can have a big impact on the economy.

Let’s take a look at some numbers to understand the situation better. According to IndiaDataHub, the central government’s capital expenditure fell by 15% in the first half of this year compared to the same period last year. This means the government is spending less on major projects, which has a big ripple effect. But this decline didn’t happen all at once.

Breaking it down by quarters, the first quarter took the biggest hit, with a steep 35.4% drop in capex. That’s a major cutback. However, there was some recovery in the second quarter, with capex growing by 14.6%. So, while the decline wasn’t as severe in the second part of the half, overall, it still represents a noticeable drop.

It’s not just the central government pulling back—state governments are doing the same. According to CareEdge Research, capital expenditure by state governments fell by 10.5% during the same period. This means that spending on critical projects is slowing down at both the central and state levels.

Government capex is important because it serves as the backbone of India’s investment cycle. When the government puts money into infrastructure projects—like building highways, expanding railways, or funding defense equipment—it doesn’t just create jobs and improve public facilities. This kind of spending also encourages private companies to invest. Think of it as laying the foundation for economic growth: when the government leads with heavy investments, private businesses often follow suit.

Right now, however, the government’s three major areas of capital spending—defense, roads, and railways—are all facing cuts. These three sectors make up about 75-80% of the central government’s capital expenditure, so any slowdown here has a big impact. Here’s what the numbers show:

Defense spending is down by 15.2%.

Spending on road projects has dropped by 10.1%.

Railway investments have dipped by 4.8%.

In short, all the key areas that usually get a lot of government funding have slowed down, and that doesn’t bode well for long-term economic growth.

Now, let’s talk about private-sector spending. CareEdge Research looked at data from 1,074 non-financial listed companies and found that their combined capital expenditure this year was ₹9.4 lakh crore, down slightly from ₹9.5 lakh crore last year. While this isn’t a huge drop, it does show that these companies aren’t increasing their investments either.

When we take a closer look, we can see that private investments are mainly focused on a few key sectors: oil and petrochemicals, power, telecom, automobiles, and iron and steel. These industries are crucial for keeping the economy running smoothly. So, when they hold back on spending, it often reflects concerns about the future.

The slowdown isn’t caused by just one factor; it’s a mix of several things that some might describe as a “perfect storm”:

Election-related restrictions in the first quarter limited how much the government could spend.

Weak domestic demand—people aren’t spending as much, and businesses are reacting by being cautious.

Geopolitical tensions around the world are making companies wary of long-term investments.

Chinese oversupply—China’s high production levels are affecting markets globally, putting pressure on Indian companies.

Higher borrowing costs due to rising interest rates are making it more expensive for businesses to fund new projects.

All of these factors together help explain why companies and governments are being careful with their spending on big projects. The caution is understandable, but it does mean fewer new projects, which could slow down economic growth in the long run.

The central government has set a big target for this year’s capital spending. To hit that goal, spending in the second half of this year needs to grow by a whopping 50.5%. But here’s the catch: reaching such a high growth rate is no easy feat. According to Motilal Oswal, a leading financial services company, capex growth has rarely gone past 25% in the last five years. The only exception was in FY22 when it surged by 57%, which was a rare spike. So, aiming for a 50.5% growth rate this year will be a tough challenge.

That said, while the slowdown is real and concerning, there are some signs it could be temporary. For example:

Capital goods companies are seeing an increase in orders. CareEdge reports that their order books grew by 23.6% in FY24, a huge jump compared to the average growth of 4.5% over the last four years.

Infrastructure companies are also showing positive signs. They experienced a 15% decline in order books in FY24, but have bounced back with a 20.5% growth rate in just the first half of this fiscal year.

These numbers suggest that even though there was a dip, companies might be on their way back up, hinting at a possible recovery soon.

Looking forward, SBI Research is forecasting strong GDP growth of around 7.2-7.3% for the third and fourth quarters of this fiscal year. This could bring India’s annual GDP growth to nearly 7% in FY25. These projections show that despite the current slowdown in capex, the fundamentals of India’s growth are still solid. With election-related restrictions now behind us, there’s a good chance that capex levels could pick up again as both the government and private companies regain confidence.

So, while the current capex slowdown is worth keeping an eye on, it’s not all bad news. There are signs of improvement, and with positive GDP growth projections, the Indian economy might just get past this temporary hurdle.

Tidbits

Tata Power Renewable Energy Limited (TPREL) has successfully launched a 126 MW floating solar project in Madhya Pradesh. This ₹596 crore project showcases Tata Power’s dedication to renewable energy innovation and adds significant capacity to India’s green energy network.

A recent study by Ericsson indicates that telecom companies could see a 5-12% boost in revenue from 5G services by focusing on providing high-quality connectivity for generative AI applications. This shift could open up new sources of income as demand for AI-powered applications grows.

Tata Sons is restructuring Tata Motors by creating a holding company for its demerged passenger vehicle (PV) and commercial vehicle (CV) businesses. This change aims to help each segment focus better on growth strategies and boost operational efficiency.

Quick commerce, which covers the rapid delivery of essential goods, has captured nearly 50% of traditional Kirana store sales. This sector is expected to reach ₹3.38 lakh crore by 2030, driven by consumers’ growing demand for convenience and speedy shopping experiences.

Thank you for reading. Do share this with your friends and make them as smart as you are 😉 Join the discussion on today’s edition here.

Sugar is the next tobacco. This needs to be addressed and a check to be put on FMCG companies. Rising income in FMCG companies (mass product driven like Five star, Sugar boiled candy, Kitkat..) implies that diabetes are gonna increase

Great article, thanks! Way too few are aware of India and the rest of the world struggling with diabetes. Numbers just keep growing.