India has a new plan for hydropower

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how, too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and watch the videos on YouTube. You can also watch The Daily Brief in Hindi.

In today’s edition of The Daily Brief:

India has a new plan for hydropower

Why our steel still runs on foreign coal

India has a new plan for hydropower

This week, India’s Central Electricity Authority (CEA) quietly unveiled a monster ₹6.4 lakh crore master plan spread over the next 2 decades, primarily for the Brahmaputra basin. A massive announcement by any means.

But here’s the twist — the plan doesn’t approve a single new dam.

Instead, the entire amount is earmarked for transmission infrastructure: power lines, substations, and high-voltage direct current (HVDC) corridors to evacuate tons of potential hydropower from India’s Northeast by 2047.

This is India flipping the script on how it builds energy infrastructure. For a long time, it focused on power generation rather than power transmission. Now that’s changing, and the starting point of this strategy is the Brahmaputra basin. In terms of the budget, this is one of the largest plans for energy transmission in India’s history.

This raised plenty of questions amongst us about India’s strategy for hydropower. So, we decided to take a look at where hydropower sits in India’s energy mix, and our plans for it.

Let’s dive in.

Why hydropower?

The first question in our minds was: why is hydropower getting so much focus? For one, dams take a really long time to build and require lots of capital. And in the age of solar panels becoming far cheaper than ever, wind turbines becoming more viable, and nuclear energy getting a revival, that doesn’t seem very appealing.

That’s because hydropower does something other renewables can’t: it’s flexible, acting as a huge balancer in India’s power grid.

Think of India’s grid as a massive balancing act. During sunny afternoons, electricity generated through solar reaches a peak. Wind kicks in when the breeze picks up. But what happens on cloudy monsoon days when solar drops 60%? Or calm evenings when wind generation flatlines? You need something that can ramp up fast, on demand. That’s hydropower’s superpower: it can fill the gap when weather conditions aren’t sunny or windy.

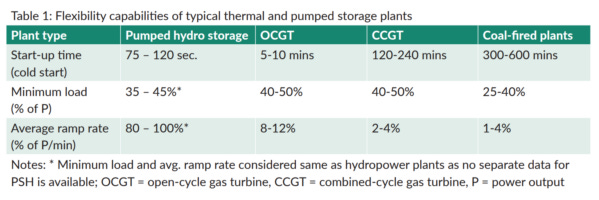

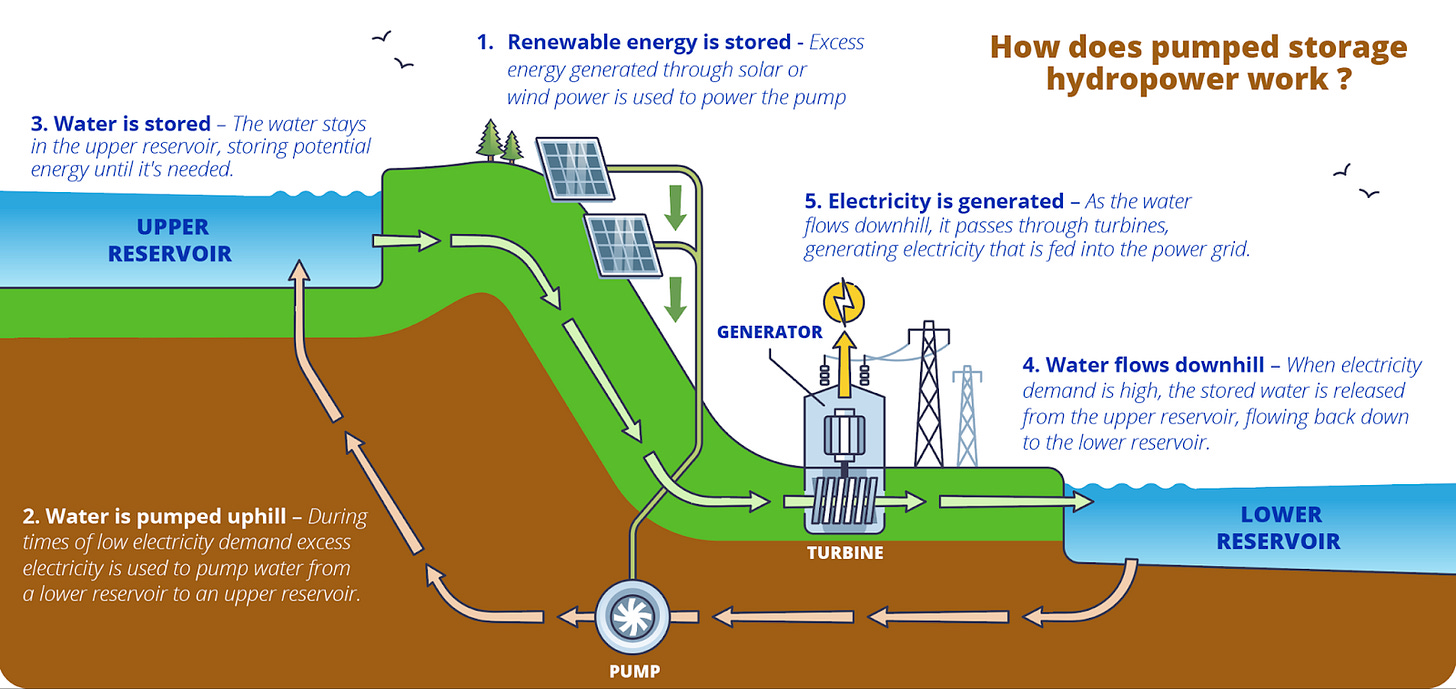

There’s more: while coal and nuclear aren’t easily switched on and off, hydropower is. Unlike nuclear plants (which prefer steady, baseload operation) or coal plants (which take hours to kickstart), hydro turbines can go from zero to full power in minutes. They provide what grid operators call “frequency regulation“—the split-second balancing that keeps your lights from flickering when a million ACs switch on at 3 PM.

This flexibility also provides hydropower with another edge: it’s easier to store than most other renewable sources. And the primary storage device of hydropower is a pumped storage plant (or PSP).

Here’s how a PSP basically works. It has electric pumps that are powered using solar. So, when you have excess solar power at midday, the PSP pumps water uphill from a lower reservoir to an upper one. Come sunset, when solar dies and demand spikes the PSP releases the same water, whose downhill gravity powers wind turbines. The water also gets stored back again in the lower reservoir.

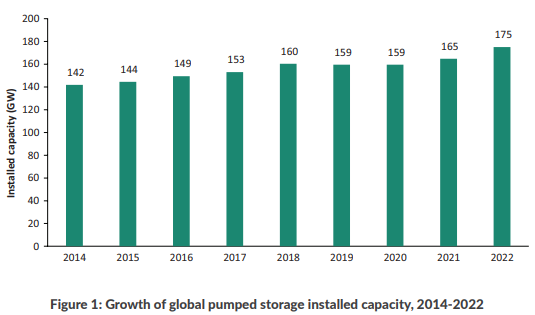

In short, a PSP uses energy conversion to ensure that excess power is never wasted. This is what has made it the most popular form of energy storage in the world.

PSPs are also incredibly cost-efficient. As per TERI, hydro can deliver energy at ₹4.80 per kilowatt-hour (kWh) for a 6-hour cycle. With two daily cycles (charge during day, discharge at night), that’s effectively ₹2.40/kWh. In comparison, lithium battery systems in their current state cost ₹10.84/kWh for just 2 hours of storage. PSPs also outlast batteries spectacularly—40 to 60+ year lifespans versus 10-15 years for lithium-ion.

For India targeting 500 GW of non-fossil capacity by 2030, this flexibility really seems necessary.

Which brings us to the Brahmaputra—and why this specific river basin matters.

As per the CEA, 80% of India’s untapped hydropower potential sits in the Brahmaputra river basin. Arunachal Pradesh alone holds 52 GW of feasible capacity — for context, 1 GW can run 3-4 million households for a year. The eastern Himalayan rivers of Siang, Dibang, Lohit and Subansiri carry enormous flow all year-round, fed by glaciers and monsoons.

The Brahmaputra river is also geopolitically very important to us. The river crosses the Chinese border before flowing into our territory. China has constructed a massive dam on their side to make use of hydropower. The Indian government worries that this dam may cut water flows in the dry-season by up to 85%. So, we need to act on it as quickly as possible.

At the moment, most of our existing hydropower capacity is actually located in North India. For how much potential there seems to exist in the North-East, the installed hydro capacity there is quite low.

Now, why is that? Well, it’s not entirely for a lack of trying. However, India encountered multiple problems in its hydropower strategy.

Some pressing issues

The first major problem is that India has generally prioritized power generation over its transmission.

What this means is that things like coal plants, solar farms, and hydropower dams were prioritized far more than the grid required to sustain them. So, while power might get generated, there’s few ways to transmit them to consumer markets. This has also caused mismatched timelines between production and transmission — it’s far faster to build wind and solar projects than power grids. This leaves our potential energy capacity stranded with a path to nowhere.

And this has seriously dampened private interest. For instance, in the mid-2000s, the government allotted dozens of projects in the Brahmaputra basin to private developers. By 2023, it had to revoke and reallocate 12 stalled projects in Arunachal Pradesh projects to state-run firms after 15 years of little progress. Why? Because developers wouldn’t invest in remote dams without the confidence that power could actually reach markets.

This pattern repeats across various energy sources. Over 50 GW of renewable capacity currently sits stranded or underutilized due to transmission constraints. In FY25, India added only 8,830 circuit-kilometer (ckm) of transmission lines against a 15,200 ckm target—a 42% shortfall and the lowest in a decade.

However, there are some systemic bottlenecks in building power grids that add to its longer timelines.

For one, land acquisition disputes can kill power-grid projects. Securing corridors for long lines of electricity towers or PSPs meets fierce resistance from landowners, leading to litigation that drags on for years. Forest and wildlife clearances add more delays, especially in ecologically sensitive areas like the Northeast. It’s nearly impossible to build transmission lines through tiger habitat or bird migration routes without disturbing the biodiversity.

Secondly, the terrain in North-Eastern states makes it really hard to build lines — or even dams, for that matter. It’s rugged and mountainous, with not a lot of flat land. With worsening climate change, such an area becomes really prone to landslides and floods due to melting glaciers. And this risk is not theoretical — it’s already happening. In 2023, for instance, a glacial flood destroyed Sikkim’s Teesta III dam, killing 50 people.

Additionally, hydropower projects often suffer through coordination failures between the Centre and states. One such example of this was the 3000-megawatt (MW) Etalin Hydropower Project, in which the Arunachal Pradesh government locked horns with the Centre over environmental concerns. Or the Polavaram dam in Andhra Pradesh, which led to a funding dispute between Centre and state government. Sometimes, there can be conflicts between states on water rights, like between Assam and Arunachal Pradesh over the Subansiri dam.

All of this is shrinking hydropower’s effective window of opportunity.

Social consent from the local population for such large projects is getting harder to obtain. Accelerating climate change is making the North-East more unstable. Solar farms are far faster to build than large dams, which can take a whole decade to get built. Solar is also more popular than any other renewable source. And on top of all that, China’s upstream dam construction adds a ticking clock. It’s a now-or-never moment for Indian hydropower.

Behind the CEA’s new Master Plan

That’s where the CEA steps in.

The CEA released a “Master Plan for Evacuation of Power from Hydroelectric Plants in the Brahmaputra Basin”. And not only is it ambitious, but it’s also different.

The master plan reflects a fundamental shift in how India is building out power. Implementation will use a “transmission ahead of generation“ approach. Specific transmission lines will be built proactively based on developers’ applications and project milestones, before hydro plants are even finished. The grid will be ready when dams come online, not five years later.

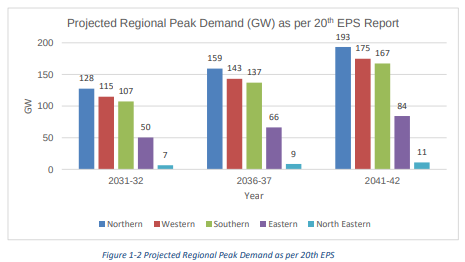

The ₹6.4 lakh crore will be split in two phases. Phase 1, which will cost ₹1.91 lakh crore, will last between 2025-2035, in which time~10,000 ckm of new transmission lines, and 12 GW worth of HVDC links will be built. Between 2035-2047 lies the bigger Phase 2, where the grid scales up dramatically: ~21,500 ckm of additional lines — including 15,000 ckm of ultra-high capacity HVDC corridors — and 30 GW more of HVDC. These two phases together are expected to unlock ~65 GW worth of power.

This will be aided by PSPs, which are expected to unlock ~11 GW of pumped storage power. Additionally, pooling substations will be set up at generation clusters in Arunachal and Sikkim. From these pools, trunk transmission corridors export power out of the region.

In sum, the CEA Master Plan hopes to unlock a total of ~76 GW of annual power — all through transmission infrastructure. In the best case scenario, that could potentially power more than 150 million Indian households in a year sustainably.

Execution will involve India’s central utility — the Power Grid Corporation of India (PGCIL) for interstate HVDC links, and state transmission companies for local networks. The government plans to use tariff-based competitive bidding (TBCB) to invite private transmission developers for key corridors.

Fast-track mechanisms for forest and land clearances are expected—this recognition that delays here have killed past projects. The plan also emphasizes on redundancy—N-1 capability, in grid-speak. If one transmission line goes down due to a landslide or earthquake (both common in the Himalayas), there’s a backup route so power keeps flowing. Gas-insulated switchgear (GIS) substations are planned for mountainous areas to save space and handle high altitudes better than conventional air-insulated equipment.

A big piece of India’s energy puzzle

This master plan is more than just transmission lines. It’s India trying to change track from a generation-first approach to power infrastructure that led to many mistakes..

If executed well, this unlocks controllable renewable power that India desperately needs for its climate targets. But execution will be tough, as it needs the alignment of all kinds of stakeholders: civil society groups, state governments, Centre, private players, and so on. Without this, hitting 500 GW of non-fossil capacity by 2030 and net-zero by 2070 becomes exponentially harder.

The Brahmaputra basin’s hydro potential has been “just around the corner“ for 50 years. With climate urgency mounting, geopolitical pressures building, and the window for large hydro narrowing, this plan might be India’s last, best shot at making it happen.

Why our steel still runs on foreign coal

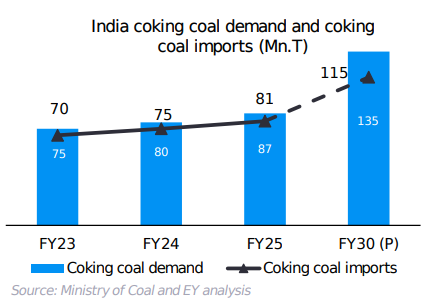

We’ve written about steel quite a few times on The Daily Brief. But something we’ve only mentioned in passing is the raw ingredient that makes steel possible: coking coal.

Coking coal, (or met coke, a direct product of coking coal), pops up in the news every now and then, either because imports are high, or because there’s a new duty or ban being discussed. In fact, the latest headline was that India is imposing a $125-per-tonne anti-dumping duty on met coke imports.

So we figured we’d take a closer look at coking coal itself, where it comes from, why it matters, and why India finds it difficult to find an alternative to importing it.

Let’s dive in.

How steel is actually made

Let’s start with the basics of how steel is made.

Steel is basically iron that’s been refined — made purer, stronger, and more workable. And most of the world makes it using the blast furnace–basic oxygen furnace (or BF-BOF) route. Around 70% of the world’s steel comes from this method.

Here’s how it works: You start with iron ore, which is basically iron mixed with oxygen and other impurities. To get the oxygen out, you need something that reacts with it, like a reducing agent. And that’s where coke — and therefore coking coal —- comes in.

Coke is made by heating coking coal in the absence of oxygen until it bakes down to a hard, carbon-rich material. Then, this coke is fed into a blast furnace along with iron ore and limestone (which helps to remove impurities). As a result, it burns and releases carbon monoxide, which strips away the oxygen from the ore and leaves behind molten iron. This is the blast furnace process.

That molten iron is then refined in another furnace with oxygen to make steel. This is the “basic oxygen furnace” part of the process.

Why India imports 90% of its coking coal

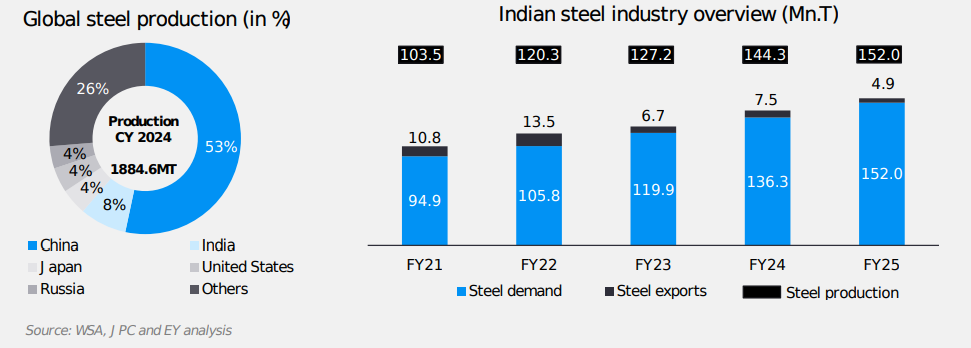

Now, India is the world’s second-largest steel producer.

But when it comes to coking coal, we’re almost entirely dependent on imports — nearly 90% of what we use comes from abroad.

Why? There are four main reasons.

Firstly, the quality problem. India does have coking coal reserves, but most of it is low quality. A lot of our coking coal contains ash content, which is the incombustible stuff left behind after coal is burnt. Indian coking coal has 25–35% ash, while steelmakers prefer coal with 10–12%.

High ash is a problem because it acts like unwanted rock inside the furnace. It doesn’t burn at all and soaks up the heat, meaning that you need to burn more coal to reach a given quality. Additionally, to remove the same amount of impurities, you need to consume more limestone. Due to high ash, coking coal also leaves off a glassy waste called slag, which needs to be removed constantly from the furnace.

At the end, you end up with weaker coke that breaks apart inside the furnace. Essentially, high ash coal wastes energy, shortens furnace life, and adds cost.

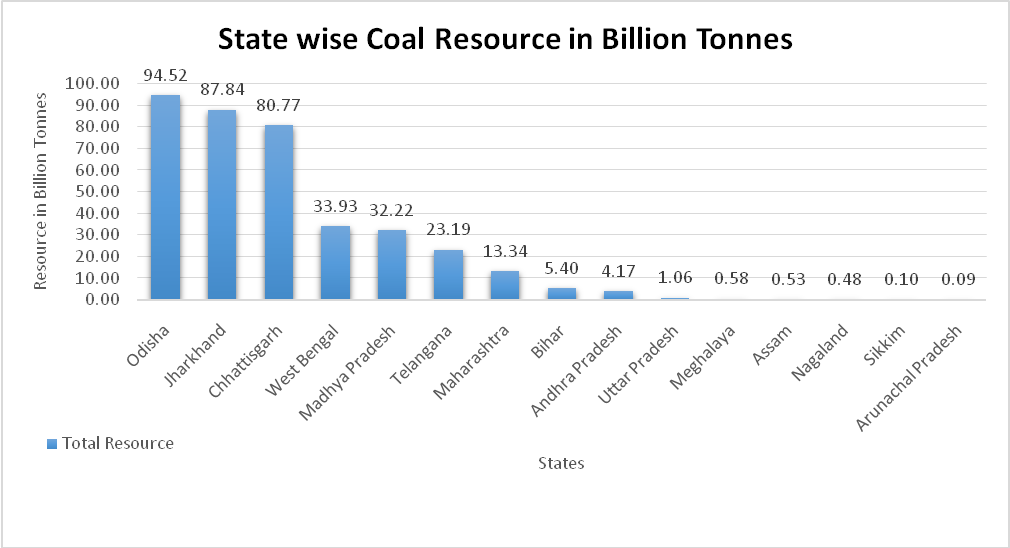

Secondly, the geography problem. Most of our coking coal reserves we have are concentrated in the eastern belt — Jharkhand, Odisha, and Chhattisgarh.

But most of India’s steel plants are in western and southern states like Maharashtra and Karnataka. Transporting coal that far is expensive and slow, and the railway links are quite congested.

Even within our reserves, only one area produces the best quality of coking coal.

India’s finest quality of coking coal — low ash and high strength — lies in the Jharia coalfield in Jharkhand. But Jharia has been burning underground for over a century. Entire stretches of land are unstable, and thousands of families still live above active fire zones. Relocation has been slow and politically tangled. Mining deeper is dangerous, while surface operations are limited.

So despite having reserves on paper, India can’t mine or use most of it easily.

The government has been trying to mine coal here. Under Mission Coking Coal, the goal is to produce 140 million tonnes of raw coking coal by 2030. But here’s the catch: raw doesn’t mean usable. Once you account for ash and impurities, only a small part of that — maybe 15 to 20 million tonnes — will be good enough for steelmaking. That’s still barely one-fifth of what the industry needs.

Third, mining itself is a maze of hurdles.

Mining an area requires plenty of environmental and forest clearances. Many coal belts overlap with tribal land, where getting permissions are politically sensitive. Land acquisition takes years, and infrastructure to move the coal — like railways, sidings, and loading terminals — often lags behind production.

Even when coal comes out of the ground, getting it to a steel plant is its own battle. Railway lines from Jharkhand and Odisha run near full capacity. Trucks are expensive and inefficient for such heavy material. So our coal piles up near our mines while steelmakers continue to import their coking coal needs.

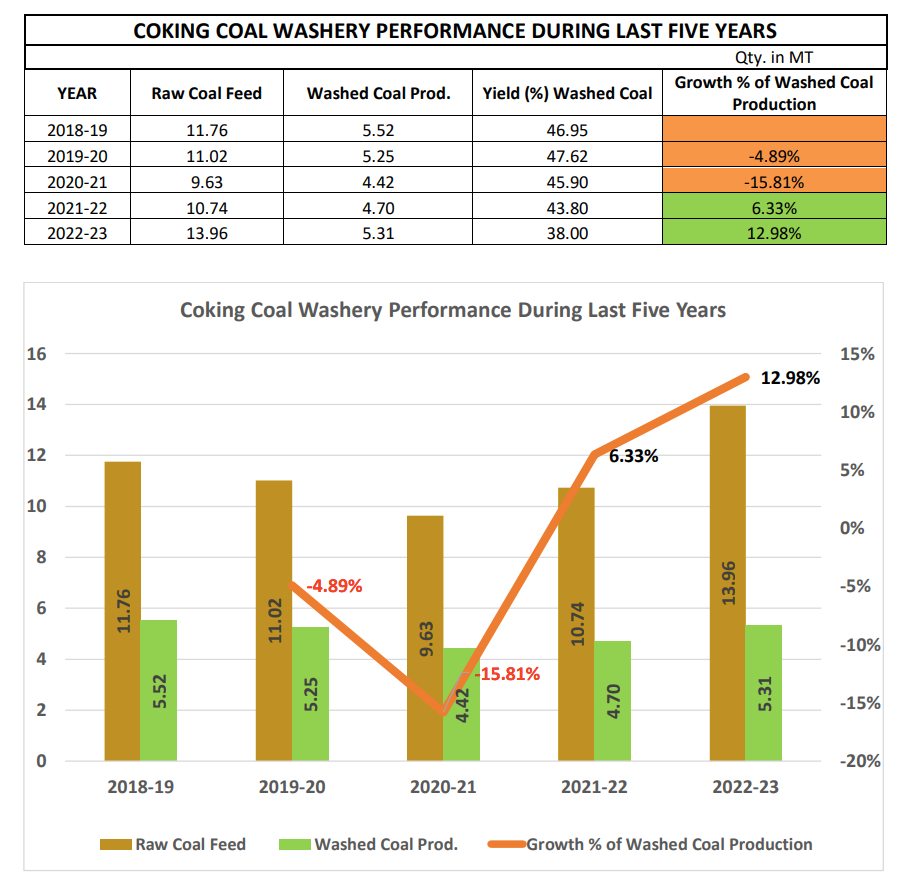

Lastly, even if you mine it successfully, washing it is really hard.

When coal comes out of a mine, it’s not clean. It’s mixed with rock, clay, and ash. To make it sellable to a steel plant, it has to go through a washery, which is a plant that separates the lighter, cleaner coal from the heavier waste.

How does it do that? By using water and gravity. Imagine shaking a bowl of gravel and sand in water — the lighter pieces float away, while the heavier ones sink. A washery simply does this on a massive industrial scale. You can check out this video to understand how the washing process takes place.

But washing has its own problems. It needs large amounts of water, which is scarce in coal belts. The leftover slurry that it produces can pollute rivers if not managed properly. Moreover, building washeries takes hundreds of crores and years of construction.

India has about 60 washeries, but they only process around half of our coking coal. As a whole, only 20% of Indian coal of all kinds gets washed. That’s why, even as mining expands, most of the coal stays “unwashed” — too dirty to feed into a furnace. It’s like having plenty of grain but not enough mills to process it.

Indian steelmakers find a way — or two

Now, steelmakers haven’t waited for policy to catch up and solve these problems.

Most large steel plants now use blending, which involves mixing small portions of Indian coal with imported coal to hit the right quality balance. A typical blend is about 30% domestic and 70% imported. If a blend has too much local coal, the ash content rises; but if imports are higher, then the costs shoot up.

To fine-tune this, plants use real-time analyzers that measure ash and moisture as coal moves through conveyors. Algorithms decide how much of each batch to mix to keep the furnace stable.

It’s not a long-term fix, but it’s clever engineering. In the Indian context, we would call this jugaad. The better plants get at blending, the less exposed they are to global price shocks.

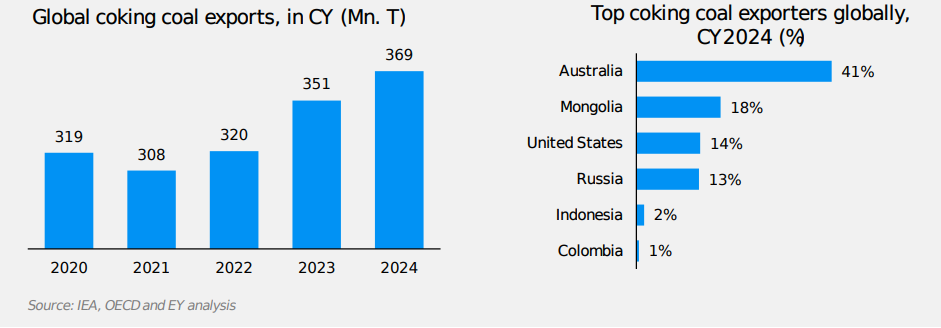

But there’s more. Because domestic production can’t meet the need, Indian steelmakers have been looking outward.

Companies like Tata Steel, JSW, and SAIL have invested or scouted for stakes in coal mines abroad — in Australia, Mozambique, Canada, and Russia. The idea is simple: if you own the mine, you don’t pay market price, you only have to pay the cost of extraction. That can be a difference of more than $100 a tonne when global prices swing.

But owning mines abroad isn’t easy. It needs billions in upfront investment. Host countries are also very careful about who they let in. And now, due to stricter ESG requirements, global investors and regulators discourage the ownership of new coal assets, making deals harder to close. India’s biggest attempt was a consortium called International Coal Ventures Ltd (ICVL), which bought mines in Mozambique. But production there has stayed tiny compared to India’s demand — a few million tonnes a year against a requirement of more than eighty.

So far, these overseas plays have been helpful, but nowhere near enough.

The alternatives

If India can’t escape coking coal today, can it at least plan for a future with less of it? There are a few paths, but all of them will take time.

One alternative is scrap-based steel (electric arc furnaces). This skips iron ore and coke altogether. You melt old steel — which is found in cars, buildings, machinery — using electricity. It’s cleaner and faster. But India doesn’t have enough scrap yet. The average Indian car or appliance is too new, and recycling is mostly still an informal industry with no organized players.

The government’s new vehicle scrapping policy is a start, but it’ll take years before there’s enough steady scrap to feed big furnaces.

Another alternative is hydrogen-based steelmaking. This replaces coke with hydrogen as the reducing agent. When hydrogen reacts with iron ore, it produces water instead of CO₂. It’s the future of green steel. The problem? Green hydrogen is expensive. You need cheap renewable power, electrolysers to produce hydrogen, pipelines to transport it, and new furnaces built for it. Pilot projects by Tata and JSW are promising, but they’re still small.

A third option is gas-based or hybrid routes. Some steel plants use natural gas in direct-reduced iron (DRI) units. It’s less coal-intensive but depends on the availability of gas, which in India is limited and pricey.

So for the next couple of decades, coking coal remains the mainstay.

What this all means

India will need more coking coal before it needs less. That’s not a problem we can solve overnight with a policy announcement or a new mine. It seems like the best path forward is to manage our dependence on imports better — better inventory management, better logistics, smarter diversification—while slowly reducing how much coal we need per tonne of steel.

It’s not exciting. But it’s what keeps the steel flowing. And steel is what keeps everything else moving.

Tidbits

India’s retail inflation fell to an eight-year low of 1.54% in September 2025, well below the RBI’s 2–6% target range, driven by a sharp drop in food and vegetable prices

Source: ET

Indian airlines like IndiGo, Air India, and Akasa are increasingly using long-range narrow-body jets such as the A321LR/XLR and Boeing 737 MAX to fly nonstop to Africa, East Asia, and the Middle East — expanding reach while keeping costs down.

We recently wrote a story on why commercial aviation is dominated by just two companies — Boeing and Airbus.

Source: ET

The WHO has warned about three contaminated Indian cough syrups after several child deaths in Madhya Pradesh’s Chhindwara district. Tests found toxic diethylene glycol levels nearly 500 times above the limit, though India’s drug regulator said none were exported.

Source: Reuters

- This edition of the newsletter was written by Manie and Krishna

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

Introducing In The Money by Zerodha

This newsletter and YouTube channel aren’t about hot tips or chasing the next big trade. It’s about understanding the markets, what’s happening, why it’s happening, and how to sidestep the mistakes that derail most traders. Clear explanations, practical insights, and a simple goal: to help you navigate the markets smarter.

Check out “Who Said What? “

Every Saturday, we pick the most interesting and juiciest comments from business leaders, fund managers, and the like, and contextualise things around them.

Subscribe to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Thank you for reading. Do share this with your friends and make them as smart as you are 😉

This is a compelling update — India’s renewed push in hydropower signals a clear shift toward sustainable baseload capacity. The plan’s emphasis on modernizing existing plants, streamlining approvals, and encouraging private investment could unlock much-needed momentum. But challenges remain — ecological concerns, local displacement, and water rights disputes will need careful handling. The government must balance speed with rigorous environmental safeguards. If done right, hydropower could fill seasonal gaps and complement solar/wind in India’s renewable future. Looking forward to seeing how policy execution unfolds on the ground.

Great share