Hi folks, welcome to another edition of Who Said What? I’m your host, Krishna. For those of you who are new here, let me quickly set the context for what this show is about.

The idea is that we will pick the most interesting and juiciest comments from business leaders, fund managers, and the like, and contextualize things around them. Now, some of these names might not be familiar, but trust me, they’re influential people, and what they say matters a lot because of their experience and background.

So I’ll make sure to bring a mix—some names you’ll know, some you’ll discover—and hopefully, it’ll give you a wide and useful perspective.

With that out of the way, let me get started.

TCS made some announcements

So, TCS just announced its Q2 results. In their official statements, they’ve called it a resilient quarter.

But if you’ve been looking at the news, you would know that these numbers hide how wild times have been for TCS. Just last quarter, they fired over 12,000 employees, which was a whole 2% of their global workforce.This quarter, their workforce dropped by over 19000 people to below 6 lakh — which has never been crossed in the last 3 years. That’s pretty big for a company that is Inida’s largest employer.

They recorded a very dismal first quarter this financial year — so this new-found growth is, to some extent, owed to a lower base. On top of that, it seems like TCS and its peers don’t yet have a proper strategy for the age of AI.

However, in a recent interview with ET NOW, senior executives from TCS gave us more clarity on the direction they’re headed in. This quarter, they announced a big foray into data centers, installing 1 gigawatt worth of data center capacity in the next 5-7 years. Here’s what CEO K Krithivasan said:

“Demand, in the next 5-6 years is expected to grow up to 10 gigawatts. Supply is only expected to be 5-6 gigawatt in the next 5-6 years. So, there is going to be a lot of unmet demand. And that’s the reason we said we will commit 1 gigawatt of data centers over the next five to seven years.”

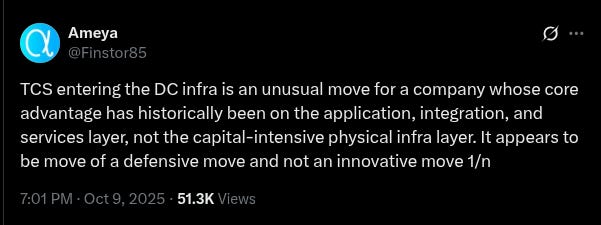

This is an unusual move for a company like TCS. Much of their business model involves working at the services layer — putting manpower on a client’s project and helping the client build out their systems. This model typically doesn’t require a lot of capital-intensive investments.

Which is why this decision came as a surprise to many. TCS has called it both an opportunity to enter AI, as well as to boost their core services business:

“We want to increase the participation in the overall AI ecosystem, so what are the ways we can participate? Like in the previous quarter, we announced TCS getting into secure sovereign cloud, that is one adjacency we want. We’ve not actually been a significant cloud provider player.”

But what part of it is AI-driven, versus what part of it is meant for their core business, is really up for debate. It doesn’t necessarily have to be an innovative move — having their own data center will help reduce data costs that client projects, or even the company’s own internal operations, will incur. They don’t have an AI product of their own yet that requires a data center.

On the other hand, as we’ve covered before, data centers themselves are proving to be a huge business opportunity in India. What’s more, this opportunity is, at least for now, not primarily being driven by AI needs. TCS, right now, stands somewhere in that opportunity — build a data center to optimize non-AI needs, while also being in a position to lend its data center to other companies that need it.

How should we think about India’s economy?

As an investor, at the moment, there are probably many macro questions running through your mind.

How should you think about India’s economy, with all the trade headwinds it faces? Can we still grow at the same pace as before? What can the streamlining of GST laws really do? With all this negativity, are there reforms that India should look to pursue?

Well, in a recent interview to CNBC-TV18, India’s Chief Economic Advisor, V. Anantha Nageswaran, answered some of those questions.

We’ll begin with the big one. In this assessment, India’s GDP growth will not just stick to the band that they had forecasted — 6.3-6.8% — but will probably land in the higher end of that band.

“We have given a range 6.3 to 6.8% in real terms. I’m more comfortable, now, in saying that we will be tending towards the upper end of this range rather than the lower end of this range…”

What makes him so confident? Well, he thinks the recent GST reforms are going to be hugely beneficial to our economy, and combined with the rationalisation of income taxes earlier this year, could create a lot of new economic activity across the country.

That’s partly a simple outcome of the fact that, by paying less tax, people will have a lot more money left in their hands, which they will spend in the economy. By his estimate, all said and done, the recent GST reforms are going to add more than ₹1 lakh crore to people’s pockets.

But there’s more. Every rupee added to the economy multiplies itself. After all, if you spend more in a shop, the shopkeeper has more money to spend. Anyone they buy from, then, has more money to spend. And so on. Those tax savings, therefore, wouldn’t just create ₹1 lakh crore in extra economic activity - they’ll do more.

As he says, “If you really assume a marginal propensity to consume — which basically means depending on how much households consume, it leads to further income growth — so two-three rounds of multiplier effect, then the total impact on the economy will be even more than two and a half lakh crores.”

All of that will show up as extra economic activity. And that economic activity could shelter the Indian economy against all the pain coming its way from the United States. As he says:

“If the GST rate reductions were not there … this year’s impact will be about 0.4 to 0.5% of GDP reduction from the trend growth rate of 6.5%... Next year it would have been closer to 1%. But again, now that the GST rate reductions have happened it might actually be a lower impact.”

The big fear many had, with the world’s trade uncertainty, is that India’s quickly losing its shine as an investment destination. But if the CEA is to be believed, that too isn’t something he’s seeing.

“If you look at the first quarter numbers, April-June, the gross FDI flows were $25 billion. So, annual run rate of hundred billion at the moment, compared to last year, which is $80 billion. I think the investment interest from whatever I have seen — people who have visited us from other countries or even from the United States themselves — the picture of attractiveness of India as an investment destination or a manufacturing destination … I don’t I haven’t seen any diminishing of that interest.”

But that doesn’t mean more work isn’t required. And it doesn’t mean the government is sitting on its hands after the GST reform. The next item on its economic agenda, it seems, is deregulation.

As the CEA says, “...the other thing that we are focusing on is deregulation, because our goals are to boost private capital formation, get manufacturing share of GDP up, and increase the share of small and medium enterprises in this. All these three goals are well served by deregulation — not just at the union government level, but also at the state government level. So I think the next important policy agenda would be to get the deregulation committees to submit their reports and start acting on them immediately.”

Well, that’s a massive project, but it could also be transformational.

Will Reliance pull off another Campa?

We’ve already written in The Daily Brief about how Reliance crashed into India’s soft drink market — bought Campa Cola for just ₹22 crore, spent ₹8,000 crore setting up plants, and somehow turned that dusty old brand into a ₹1,000 crore business in barely a year and a half.

But that was just the teaser.

Because when we wrote about it then, T. Krishnakumar — the man running Reliance Consumer Products — had already dropped a hint. He’d said the plan was to reach 600 million consumers at the mass end, and work closely with neighbourhood stores by giving them margins at today’s cost. In other words: win India from the kirana up, not from the top down.

Now, cut to this week — he was on CNBC-TV18 saying this:

“By this time next year, you’ll find us available nationally across almost every major FMCG category — food, beverages, home and personal care, and general merchandise.

Within food, we’ll expand into biscuits, snacks, and ready-to-cook and ready-to-eat products. In beverages, Campa will continue to grow. And in home and personal care, Velvette is just the beginning.”

That’s not subtle. That’s a full-blown declaration of war on everyone from HUL to ITC.

Now think about the playbook here. They’ve revived forgotten Indian names — first Campa, now Velvette, and they’re bringing them back to life with Reliance-style pricing and muscle.

When they launched Independence water, they sold 750 ml bottles at ₹10 and 1.5 litres at ₹20 when everyone else was charging the same for smaller sizes. Then GST cuts came in, and they still priced a litre at ₹15. It’s volume warfare.

T. Krishnakumar further says:

“By the end of 2027, we should have at least five ₹1,000 crore brands in our portfolio — if not more.”

That’s the goal. Five Campa-sized brands by 2027. The consumer products arm itself is only three years old. But it’s already pulling in over ₹11,000 crore in revenue, and it has two ₹1,000 crore brands under its belt — Campa and Independence.

We are living in interesting times.

That’s it for this edition. Thank you for reading. Do let us know your feedback in the comments.

Introducing In The Money by Zerodha

The newsletter and YouTube channel aren’t about hot tips or chasing the next big trade. It’s about understanding the markets, what’s happening, why it’s happening, and how to sidestep the mistakes that derail most traders. Clear explanations, practical insights, and a simple goal: to help you navigate the markets smarter.

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, even the smaller logistics firms—and copy the full transcripts. Then we bin the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.