Budget 2025: Tough Choices Ahead!

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and videos on YouTube. You can also watch The Daily Brief in Hindi.

In today’s edition of The Daily Brief:

The Budget 2025-26: What are we looking for

Are the best days of Bajaj Finance behind?

Tata Motors vs Maruti Suzuki

The Budget 2025-26: What are we looking for

Tomorrow’s budget comes in an interesting time.

The global economy is in a tough spot. Growth is slow in many parts of the world, and even China — once the engine of global trade — is struggling to regain momentum. In the midst of all this, India, so far, is staying afloat. Our GDP is projected to grow at 6.8% in FY25, making us the fastest-growing major economy in the world.

But once you look under the hood, there are major concerns. Foreign investment is declining, with a noticeable drop in net FDI inflows over the last couple of years. Consumption, particularly in urban India, is slowing down. And in a world where trade relations are quickly eroding and foreign markets are becoming less attractive, this is worrying. There are no other engines of growth India can rely on.

How do we get past this critical juncture? That’s the big challenge for Budget 2025-26.

Here are five questions we’ll be paying attention to, tomorrow.

Will we see a rationalisation in tax requirements?

Our income tax laws need a major rationalisation. This is something the government clearly understands. The Finance Minister has been trying to nudge people into a simplified tax structure, with the new tax regime. And last year, she hinted at a new ‘direct tax code’ — a long-term pipe dream to make it less complicated to pay income tax.

A related issue is simply the fact that our government takes too much tax for an economy of our size. India’s tax-to-GDP ratio is almost 19% — which is high by global standards. Most of the world’s fast-growing economies have much lower tax rates. As the economist Surjit Bhalla recently pointed out, for instance, the tax-to-GDP ratio across the East Asia region is at 14.5%.

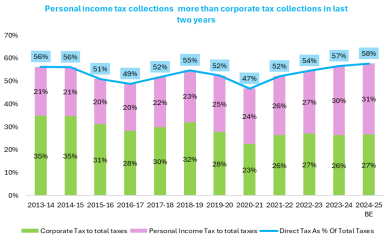

A lot of this tax is paid by individuals. Personal taxes have, in the last few years, come to eclipse the taxes that companies pay. With lower taxes, people will find more money reaching their hands — which could improve consumption.

SBI Research, in a recent report, suggested combining these two goals. All people, it suggests, may be moved to the new tax regime. Meanwhile, tax rates may be cut. For those earning between ₹10-15 lakh, tax rates could be slashed to 15%, while the peak tax rate could be cut from 30% to 25%. All exemptions — barring important things like NPS and medical insurance — may be done away with.

There’s a trade-off here, of course. These measures could cost the government between ₹50,000 crore to ₹1.2 lakh crore in lost revenue. However, the consumption boost to the economy might be worth it.

How Do We Reverse the Investment Outflow?

Over the last few years, India has seen anaemic foreign investment. As Surjit Bhalla points out, for instance, in 2014, FDI made for 2.5% of our economy. Today, that has shrunk to 0.8%. That’s a problem for our economy, because domestic capital simply isn’t enough if we want to accelerate the pace of our development.

We’ve talked about this before. While some of this has to do with larger global trends, India has also been surprisingly closed to business, with considerable arbitrariness and policy flip-flops.

Consider, for instance, a major policy shift in 2015, when India scrapped Bilateral Investment Treaties. This meant that foreign investors could no longer take disputes to international arbitration—they had to resolve them only in Indian courts. In the short-run, this felt like a good idea — India was protecting its sovereignty from foreign tribunals. In the long run, though, we simply created a situation where people had no recourse to justice. After all, even Indian businesses avoid Indian courts because of delays and inefficiency.

We’re looking at this budget to lay the red carpet for foreign investors once again. This could take the form of anything — from a reinstation of BITs, to simplifying investment regulations, to FDI policy announcements.

Can we do more to boost export competitiveness?

While the global economy is down, foreign markets can still play a much more important role for India’s economy. After all, countries like Vietnam are seeing massive upsurges in export growth, even in this environment. If anything, Vietnam is looking to optimise its economy further, cutting regulation to increase its competitiveness.

It is imperative that India does not fall behind its competition.

India has various protectionist policies that hurt its global competitiveness. For example, we’ve imposed high import duties on raw materials and intermediate components that Indian manufacturers actually need. This raises costs and makes our exports less competitive.

We also retain severe regulatory hurdles, which hold our businesses back from generating the kind of export revenue that other Asian countries have seen over the last decade.

Even though we’re trying to improve manufacturing through production-linked schemes, except in a few sectors, these haven’t had the intended effect. Industrial policy is incredibly hard to do well, and very easy to mess up. Our approach, in many industries, has been to shield Indian manufacturers from competition, rather than incentivising them to enter the global fray. Over time, this has weakened Indian industry. Contrast this with a country like Korea, that explicitly linked its industrial policies with exports — and now is home to giants like Hyundai and Samsung. If we’re choosing to opt for state-led growth, such measures are a must.

This budget, we’ll be looking for reductions in red-tape, rationalisations in tariff, and sharper industrial policy.

Will we return to more capital expenditure?

One of the specialties of the Modi government has been its focus on capital expenditure. Capital expenditure is a big tool for growth: one, in the short-term, it puts money in the hands of people, and two, in the long-term, better infrastructure makes our industries more competitive.

Last year, we budgeted ₹11.1 trillion for capex. Ultimately, however, we fell short of this goal. Our actual spending was behind at ₹9.7 trillion — a 12% shortfall. Much of this drop came in the lull that immediately followed last year’s Lok Sabha elections.

Ramping up capital expenditure once again — even to last year’s budgeted ₹11.1 trillion — could help us boost our growth significantly. Beyond boosting consumption, it might help “crowd in” private investment, by creating new opportunities that people can take advantage of.

The government may also try unlocking more private investment as well. For instance, it could introduce special bonds for infrastructure projects, allowing private borrowers to get loans at better-than-market rates.

Fiscal Prudence vs. Growth Fillip?

The Modi government has consistently focused on maintaining a low fiscal deficit. This is worth appreciation — it greatly improves the financial stability of our economy. It also opens the path towards a better sovereign credit rating, which will make it much easier for the Indian government to borrow, over time.

This push towards fiscal prudence will perhaps continue this year. India’s fiscal deficit is projected to be 4.5% of GDP in FY26, down from 4.9% in FY25.

That’s a good sign, but it also means less room for big spending programs. And in a time where growth is flagging and consumption is falling, spending — at least high quality spending — might be the only way out for India. The question is: does the government continue down this path, or does it deviate slightly to support growth?

One thing that will make this choice easier, though, is RBI’s record ₹2 trillion dividend to the government for Fiscal 2024. This gives the government some breathing room to spend, without shaking up its commitment to fiscal responsibility.

Are the best days of Bajaj Finance behind?

When the country’s largest non-banking lender announces its quarterly results, it’s time to sit up and pay attention. That’s exactly what we did when Bajaj Finance released its numbers recently. We covered the banking sector’s performance a few days back—so think of this as part two of that story!

First, the good news: growth looks strong across the board. Bajaj Finance’s total assets under management (AUM)—essentially, all the loans and advances they’ve handed out—shot up by 28% compared to last year. They also set new records by adding 50 lakh new customers and booking 1.2 crore loans in just three months. That’s like getting twice the size of the whole of Manipur to sign up for Bajaj Finance’s services. That’s huge!

However, profitability took a hit. Interest expenses (the cost of the money they lend out) inched up, and Bajaj Finance also had to set aside more funds to cover potential defaults. As a result, their return on equity dropped from 22% to 19%.

But, as they say, the devil’s in the details. Here are three things you’ll want to keep an eye on.

Building stress in unsecured lending book

Bajaj Finance is practically the poster child of unsecured retail lending in India. From sanctioning personal loans to helping you buy your first television from the nearest electronics store through no-cost EMIs, they do this across the length and breadth of the country. This unsecured lending segment accounts for around 35% of their total loan book—just ahead of their home loan business at 30%.

However, there’s been a bump in their Non-Performing Assets (NPAs) in this area, which suggests more loans might default. The same is true in their SME Lending segment, which offers loans to small and medium businesses for working capital or expansion purposes.

If you’ve been following our updates, you’ll know this isn’t a one-off. We’ve seen signs of stress in the retail lending space across the industry for a while. Just the other day, we noted in our banking story how IDFC First Bank’s microfinance NPAs jumped from 1.3% to 4.6% in a year. Kotak Mahindra Bank also tightened its purse strings on unsecured loans, pulling back from 11.3% of its book to 10.5% in just three months.

Comparing which lender is struggling the most with unsecured loans can be tricky, but Bajaj Finance’s management did highlight a couple of areas that need extra attention: rural B2C loans and loans extended to businesses and professionals. They’re not in serious trouble yet—it hasn’t blown up—but it’s worth watching closely because things could improve in the next couple of quarters.

Number of locations for expansion may have peaked out

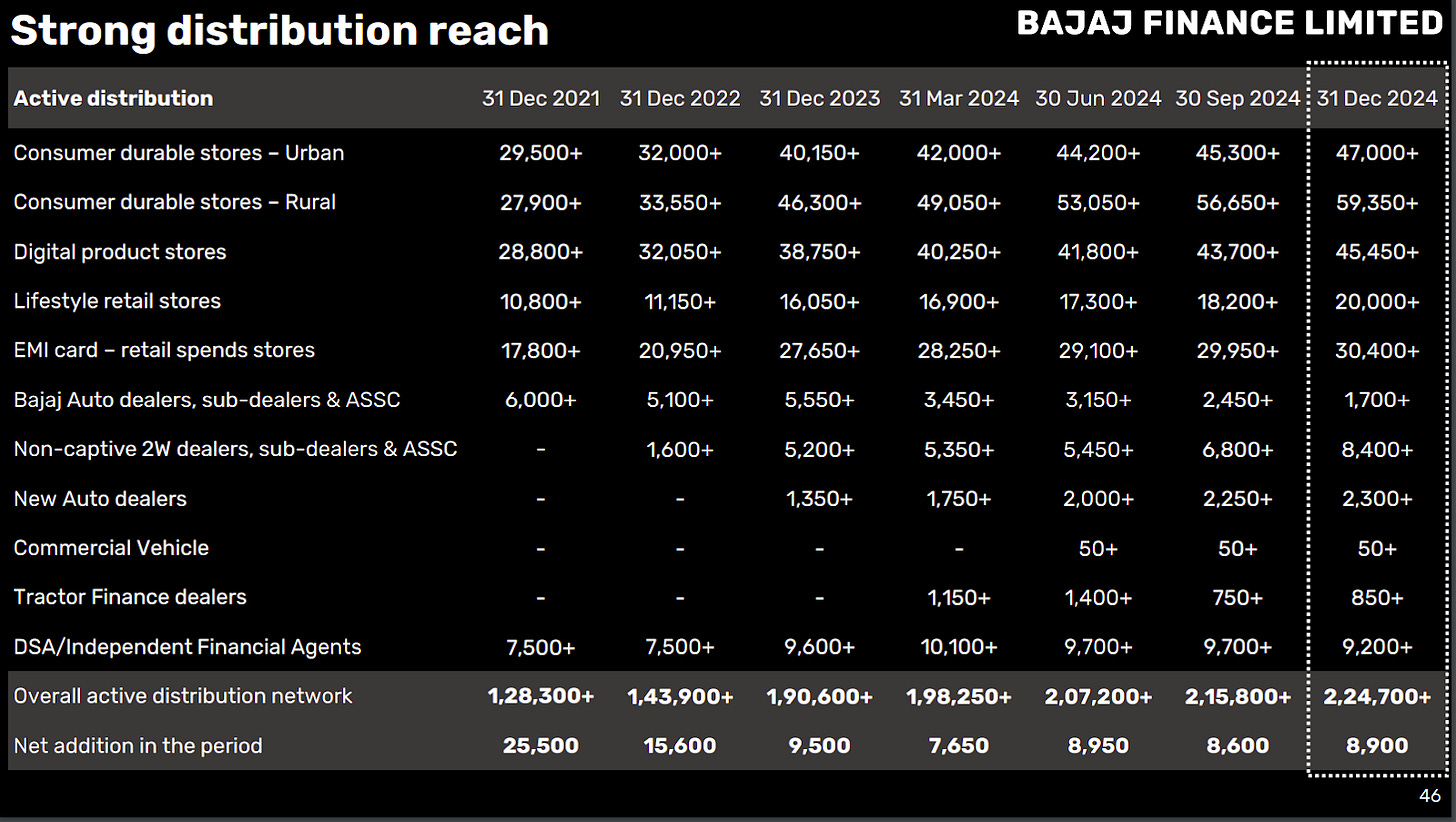

India is huge and still credit starved, which has always been great for lenders wanting to grow—there’s usually a ready market waiting. That’s why Bajaj Finance has grown its footprint exponentially — they’ve expanded the number of locations they cover 36 times over the past 16 years! But now, that pace seems to be cooling off. Last quarter, they added just 14 new locations, taking the total to 4,259, which is much less than before.

Still, it’s only natural that at some point, you run out of new places to set up shop. So, Bajaj Finance seems to be getting more out of the existing locations. So, if your town used to have 3 electronics stores where Bajaj Finance offered no-cost EMIs, they might now do so from 5 such stores plus 3 new auto dealerships. In other words, they’re trying to grab a bigger slice of the credit business in areas where they’re already present.

But here’s the thing, we may be no experts, but we suspect that launching in fresh locations must have been a big driver of Bajaj Finance’s asset growth (AUM) so far. If they’re close to maxing out on that strategy, their growth could slow down. A company that once grew over 50% year-on-year is now eyeing a medium-term CAGR of 25%. That’s still solid, but not quite as explosive.

But this makes us think, is increased physical presence the only way to acquire new customers and growth? There has got to be other ways, especially in this digital era.

Which brings us to Bajaj Finance’s new partnership with Airtel. This tie-up will let them offer retail and MSME loans to Airtel’s subscribers, helping them find new customers in a more digital way. However, at the same time, Bajaj Finance has stopped issuing co-branded credit cards with RBL Bank and DBS Bank. So while the Airtel deal seems promising, losing those old partnerships might knock off some growth. We’ll have to wait and see how it plays out.

The outliers in Bajaj’s growth story

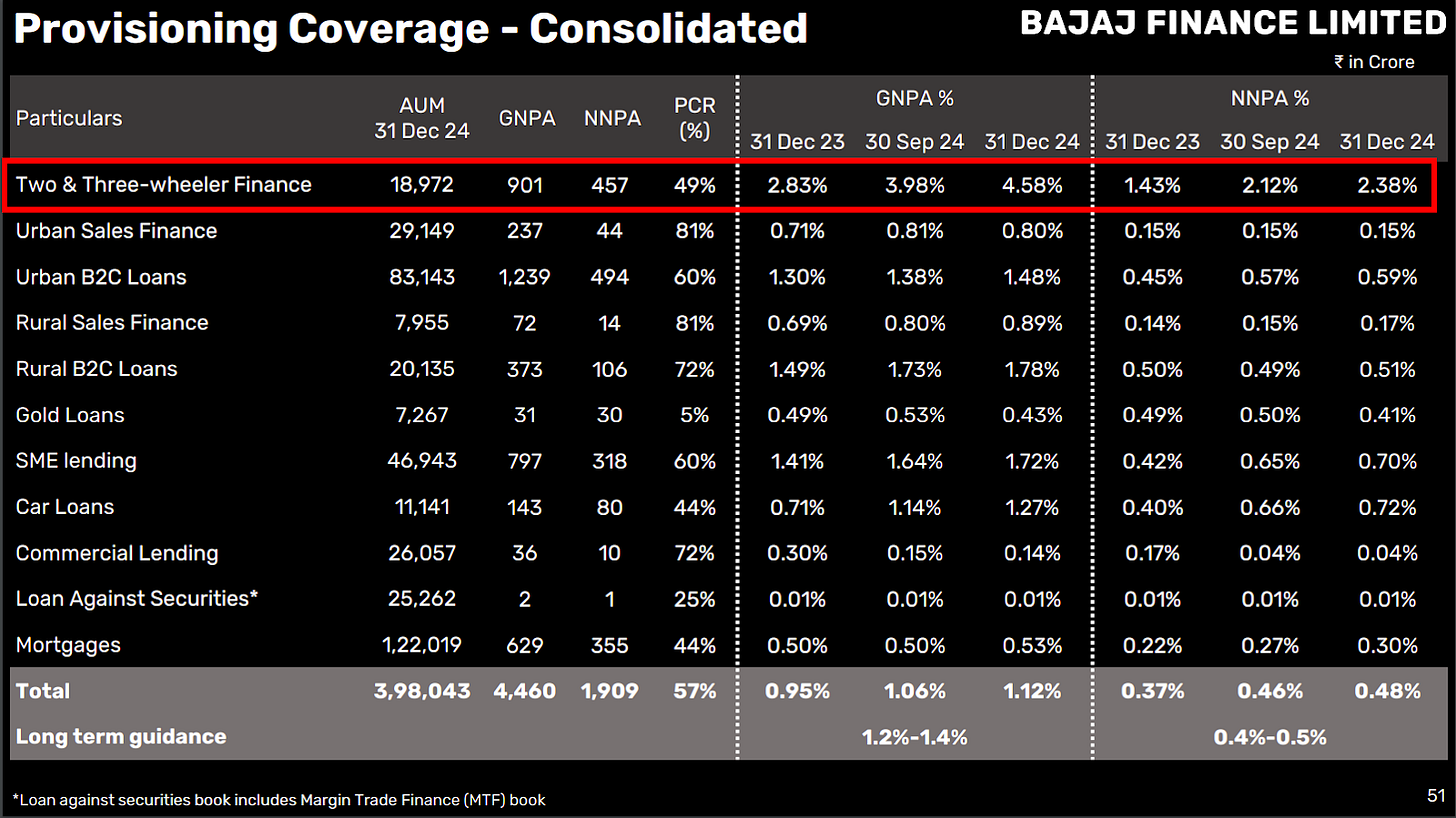

While Bajaj Finance’s overall numbers were strong, there was one glaring exception: its two- and three-wheeler loan segment. This part of the business shrank from 6.2% of the total loan book last December to 4.8% now. When everything else is growing, you can’t help but wonder what’s happening here and put your thinking caps on.

Historically, majority of Bajaj Finance’s two- and three-wheeler financing came from customers who visited Bajaj Auto showrooms. This arrangement was convenient and brought in many borrowers with minimal effort. But there was a catch: Bajaj Finance had less control over who they were lending to, which is likely why this segment consistently saw higher NPAs (3–5%) compared to the rest of the portfolio (which was under 1.2%).

Then came March 2024, when Bajaj Auto decided to set up its own financing arm—Bajaj Auto Credit Limited—to handle loans for its customers. That instantly diverted a huge chunk of new business away from Bajaj Finance. In October 2024, Bajaj Finance confirmed it would no longer originate loans from Bajaj Auto, going completely independent.

As you’d expect, losing a major source of loans overnight makes it tough to keep the growth engine running at full steam. So it’s not surprising the two- and three-wheeler segment is now smaller.

You might also be wondering why NPAs in this segment have jumped. The real reason is simpler than it seems: with fewer new loans being added, the existing bad loans now form a larger percentage of a shrinking portfolio. This isn’t necessarily a sign of overall stress in two- and three-wheeler sales or the broader economy—it’s more of a company-specific issue stemming from the changed arrangement with Bajaj Auto.

And there you have it. A brief, yet one level deeper dive into what the Bajaj Finance results tell us.

Tata Motors vs Maruti Suzuki

So, the results for the third quarter of the biggest automakers—Tata Motors and Maruti Suzuki are out. Looking at their results is a good way to understand what’s happening on the ground in the automotive industry, and what challenges they’re facing.

Let me first start with the largest automaker in the country i.e. Maruti Suzuki.

Maruti Suzuki

This quarter, Maruti posted ₹38,764 crores in revenue, reflecting roughly 16% YoY and 3.5% QoQ growth. And, the profit came in at ₹3,727 crores which is a growth of around 16% YoY and 20% QoQ.

However, their operating margin took a slight dip. The story of Maruti's earnings this quarter revolves around escalating discounts and margin pressures as the company sought to reduce dealer inventory by year-end. This heavy discounting impacted realizations. Management acknowledged that this aggressive discount strategy was necessary to stay competitive.

There’s some nuance here, however. The picture looks different depending on which segment you examine. SUVs are the shining star of Maruti’s portfolio right now. This isn’t just a recent premiumisation trend either.

In fact, during the earnings call, management reaffirmed that rural demand for SUVs is accelerating, aligning with changing consumer aspirations. Maruti executives highlighted an increased appetite for larger vehicles in rural regions.

Maruti Suzuki's CEO specifically noted:

“increasingly we are seeing that rural is… the trends are coming closer to… to Urban also but of course… we have got good traction for for lower models… for smaller models like Alto and… rural is doing good… in terms of growth better than Urban so that is good - it… it serves as a de-risking for India consumption not just for cars but for all Commodities”

This sentiment echoes what Maruti mentioned last quarter—rural buyers are indeed becoming a crucial growth driver for SUVs.

But while the company is capitalizing on this trend, there’s a less rosy reality they have to contend with. Their bread-and-butter entry-level cars, which traditionally commanded the largest share of rural sales, are seeing significant demand erosion. Management acknowledged this during the call, admitting that price-sensitive rural buyers have become more cautious with small car purchases.

Urban markets, meanwhile, are showing signs of fatigue. Management stated:

"We have observed a moderation in urban demand, with sales growth slowing down. On the other hand, rural markets are growing steadily, albeit at a gradual pace."

This balance between urban and rural demand has critical implications for Maruti's strategy. With urban growth moderating, the company is increasingly leaning on its rural network to sustain momentum, especially with higher-margin SUV models.

While domestic demand tells a mixed story, exports are delivering standout growth of 38%. Maruti reported export volumes of 99,200 units this quarter, contributing over ₹6500 crores in revenue.

The company attributed this success to strengthening footholds in key regions such as Latin America, Africa, and ASEAN markets. The export business has become a strategic priority for Maruti as it seeks to diversify revenue streams away from domestic market volatility.

"Export demand remains robust due to our focus on building region-specific product strategies and tapping new markets."

Maruti launched their flagship electric SUV, the e-Vitara recently. Management emphasized that their EV roadmap involves not just new models but also an ecosystem approach, including partnerships to install charging infrastructure in major cities. Despite intensifying competition in the EV space, Maruti remains confident that its wide network and product depth will help it maintain an edge.

In summary, Maruti's quarterly performance paints a sort of mixed picture. SUVs and exports are leading the charge, but entry-level cars—once Maruti’s stronghold—are under pressure.

Now, onto Tata Motors.

Tata Motors is not really a purely Indian automaker anymore. It's a truly global player, with around 70% of its business coming from countries outside India.

And, as we all know, Jaguar Land Rover (JLR) brings more than 70% revenue for Tata Motors.

But it doesn’t stop there—Tata is also India’s largest EV manufacturer, with more than 50% market share there. With that context, lets look at how they did this quarter.

Tata Motors posted net sales of ₹1,13,575 crore for the quarter, marking only around 3% YoY increase and around 12% QoQ increase. This growth on sequential basis was primarily driven by strong performance at JLR, better price realizations, and robust SUV and EV sales in the domestic market.

However, despite the impressive top-line growth, net profit fell sharply on a YoY basis by around 20%. Sequentially, though, there was a ~67% QoQ increase in PAT. The same drop in YoY happened in the last quarter as well but before that i.e. Q1FY25 and Q4FY24 had seen a really strong PAT growth on a YOY basis.

Overall what happened with Tata Motors

But coming back to the current quarter, why was there steep YoY PAT decline despite good revenue?

1. Higher Warranty and Quality Costs:

According to management, warranty provisions rose due to complex and costly repairs in high-margin markets like the U.S. Though the number of repairs decreased, the nature of these issues led to higher expenses.

“Although quality is improving, the type of repairs and the cost to fix them have risen”

2. Rising Discounting:

For Tata Motors, management acknowledged that discounting was necessary to stay competitive, particularly in the domestic market. They mentioned challenges in maintaining realizations, with price cuts and offers playing a role in clearing inventory at both JLR and domestic passenger vehicle (PV) segments.

Discounts rose to 4.2% from 1.7% last year.

3. Adverse Market Conditions in China:

JLR faced weak demand and high dealer distress in China, affecting profitability. Sales to Chinese dealers were deliberately reduced to normalize inventory and prevent heavy discounting. Management remained cautious about a recovery in this key market.

JLR's troubles in China aren't isolated. European automakers like Volkswagen, BMW, and Mercedes-Benz have also faced similar headwinds in the Chinese market. These companies have been grappling with slowdowns in demand, intense competition from local electric vehicle (EV) manufacturers like BYD, and heightened dealer distress due to inventory pile-ups. To cope, many of these automakers have resorted to aggressive discounting, which has pressured margins.

What happened with JLR?

Despite challenges, JLR delivered a strong quarter, with revenue of more than 78,000 crore the highest for a third quarter in over a decade. Wholesales rose 12% YoY, driven by demand for high-margin models like Range Rover, Range Rover Sport, and Defender. North America grew 25% YoY while sales in China fell 27%.

Looking ahead, JLR plans to boost margins through the launch of the electric Range Rover by the end of the year, part of its long-term electrification strategy.

Domestic Market

On the domestic front, Tata Motors’ passenger vehicle business reported strong revenue growth to ₹12,400 crore, up from ₹11,700 crore last quarter. The festive season and new launches like the Nexon facelift drove sales higher, though profitability was under pressure from rising input costs and discounting.

The SUV segment, led by Tata Punch, showed stellar performance. In fact, Punch was the best-selling model in India for 2024, outperforming competitors in the entry SUV space. Shailesh Chandra, MD of Tata Motors Passenger Vehicles, remarked:

“Punch was the #1 model in the industry in 2024 and continues to remain strong as the #1 model in YTD FY25"

However, hatchbacks and sedans continued to face challenges, with sales declining due to the ongoing shift in consumer preference towards SUVs.

The EV market

Tata Motors remains India’s largest EV player, maintaining a market share of over 50% despite intensified competition. EV sales grew by 15% YoY, with strong demand for models like Tata Nexon EV. However, growth in fleet EVs slowed following the withdrawal of FAME-II subsidies.

The company emphasized its commitment to expanding EV infrastructure, with over 18,000 chargers deployed nationwide. Chandra commented,

“We are scaling up the charging network through partnerships with Tata Power and other providers. Expanding access to charging remains key to accelerating EV adoption.”

How did trucks and tempos do?

Tata’s commercial vehicle (CV) segment saw a flat performance, with heavy vehicles continuing to struggle. Buses and LCVs performed well, supported by infrastructure spending and fleet modernization.

Girish Wagh, Executive Director of Tata Motors, noted,

“Utilization rates and freight rates improved in November, signaling better demand ahead. Q4 is typically strong for commercial vehicles, and we expect a recovery led by government proj ects.”

In summary, Tata Motors is experiencing growth across key business segments but grappling with cost pressures.

Tidbits

The Indian government has unveiled a ₹34,300 crore National Critical Mineral Mission to secure essential minerals for industrial expansion. Of this, ₹16,300 crore comes from government funding (including ₹2,600 crore in budgetary support), and ₹18,000 crore is contributed by public sector undertakings (PSUs). The mission plans to auction 1,200 exploration projects and over 100 mineral blocks by the 2030-31 financial year.

The government has raised the procurement price of C-heavy molasses ethanol by 3% to ₹57.97 per litre for the 2024-25 supply year, while keeping prices unchanged for B-heavy molasses (₹60.73 per litre) and sugarcane juice-based ethanol (₹65.61 per litre). India’s ethanol blending has increased significantly, from 38 crore litres in 2013-14 to 707 crore litres in 2023-24, with an average blending rate now at 14.60%.

Employment in India’s unincorporated manufacturing sector remains below 2010-11 levels. Although the number of such establishments has risen from 17.2 million to 20.14 million, the workforce has fallen from 34.9 million in 2010-11 to 33.7 million in 2023-24. This decline is attributed to challenges like demonetisation, the introduction of GST, and pandemic-related lockdowns.

- This edition of the newsletter was written by Pranav, Kashish and Krishna

🌱One thing we learned today

Every day, each team member shares something they've learned, not limited to finance. It's our way of trying to be a little less dumb every day. Check it out here

This website won't have a newsletter. However, if you want to be notified about new posts, you can subscribe to the site's RSS feed and read it on apps like Feedly. Even the Substack app supports external RSS feeds and you can read One Thing We Learned Today along with all your other newsletters.

Subscribe to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Thank you for reading. Do share this with your friends and make them as smart as you are 😉 Join the discussion on today’s edition here.

Much detailed content, love reading.