AI Is Changing Again—And It Matters

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and watch the videos on YouTube. You can also watch The Daily Brief in Hindi.

In today’s edition of The Daily Brief:

The Daily Brief AI round-up

Is the power of OPEC+ eroding?

The Daily Brief AI round-up

We’re big AI nerds, over here at Markets. We aren’t directly involved in AI — we aren’t “tech folks”, and none of us are experts on how any of it works — but at the same time, we’re tuned into it as a massive technological force that’s ripping through our economy, for good and for bad. Naturally, this makes us extremely curious about what’s happening in the industry, and how it might shape the world to come.

This, of course, leads us into some fascinating sci-fi-ish rabbitholes. So, as an experiment, we thought we’d bring you up to speed on everything we found interesting. Now, this isn’t a comprehensive AI review, by any standard. Nor is this expert commentary. This is just stuff that caught our attention, and we thought it might catch yours too.

Anyhow, let’s dive in!

Training AI has unintended consequences

OpenAI just gave people access to O3, its latest thinking model.

While it’s remarkably good, it has a weird flaw — it lies through its nose. We’ve always known that AI models “hallucinate” a lot, but this seems much worse. O3 supposedly makes up things all the time, in a way that actively hurts how much you can trust it. And crucially, it seems like O3 has a far worse problem with this than previous models.

There’s a pattern to its lies. If you give it a task, it seems to make up the actions it took to get to a response. This is worse than getting confused about what it remembers, it actively seems to lie to you about what it did. For instance, when one user asked it to come up with random prime numbers, it came up with a number that wasn’t prime. When prodded, though, it went on to fib about an elaborate, made-up process it followed, with a fake code it had written. It also made up a story about how it had generated a different number, that it copied wrongly and then forgot.

That’s weird, isn’t it?

It looks like this is the product of reinforcement learning — where it was rewarded for getting the right answer to a bunch of questions, without anyone looking at how it got there. This probably taught it to reward-hack — becoming comfortable with pretending to get answers instead of actually getting them.

Anthropic’s Claude Sonnet 3.7 has similar issues.

It’s not just a problem with the thinking models, by the way. OpenAI was hit by a recent controversy that was both hilarious, and extremely telling of the world we will soon be entering: that is, for a while, ChatGPT became incorrigibly sycophantic. It began praising people to the high heavens for even the most basic questions. Like why the sky is blue.

Now, this could seem innocuous, but there are ways this could go seriously wrong. For instance, if you start out with poor mental health, it could really amplify it, creating a one-person echo chamber that can really push people to spiral. Take this example:

Ultimately, OpenAI withdrew the update that made ChatGPT behave this way, and is now pulling it back to normalcy.

But all of this is yet another demonstration of something we’ve already seen in technologies like social media. When technology is fine-tuned to push people to engage and interact more with it, that often comes with serious costs. In social media, algorithms pushed content that stoked outrage and bitterness. Now, it’s trying flattery instead.

While OpenAI may have rolled back an update that made this painfully obvious, the underlying incentive hasn’t gone. Over time, you should expect AI to be more subtle about this sort of thing, even though the underlying problem persists.

AI consumer technology is moving fast

If there’s one thing that’s been clear since the early days of GPT-3, it’s that AI wasn’t simply a sophisticated chatbot technology. It was always destined to be plugged into all sorts of other contexts, to perform a variety of functions.

Even if AI development stalls completely at this very moment, we would spend years find newer and newer uses for the technologies we have already developed. There’s most probably a boom in AI-based consumer technology that will come in the not so distant future.

And OpenAI looks like it wants to drive that charge.

Here’s one that caught our eye: OpenAI is releasing a native shopping feature. Basically, this allows you to tell ChatGPT what you’re looking to buy, and it will then go and fetch individual product listings that match your description. You’ll be able to buy these through ChatGPT itself, instead of having to go to the original website. Essentially, if you want to buy something, you no longer have to sort through hundreds of listings and reviews, from a series of websites — nor will you have to keep clicking from page to page and filling out forms. AI will do all the grunt work for you.

One we don’t understand that well is OpenAI’s plans to create its own social media app. There are some benefits to it — for one, it could give it access to a new source of data, all of it updated real time. It would also give it a source of “viral” moments, somewhat like what Grok enjoys on X. But we aren’t sure if there’s any real room for a new AI-powered social media app.

Of course, this isn’t close to the limit of the kinds of consumer technologies that AI can allow. Here’s just a sample of the other stuff we’ve come across:

Microsoft is trying to put an AI agent into XBOX, that’ll see how you play and then become ‘a gaming coach’ to you.

Grinder is tying up with Anthropic to release an “AI wingman” feature.

Gemini is learning to play Pokemon

Here’s a story that probably makes no sense at all, at least at first glance, and yet points to something incredible. Google’s Gemini 2.5 Pro is playing through the Pokemon video games — and is making tremendous progress. It has now collected 5 badges. The record, before this, belonged to Claude, at 3 badges. You can watch the game here.

Google CEO Sundar Pichai even joked about how the company was working on developing API, or “artificial pokemon intelligence”.

Why the hell, you wonder?

Well, think about it. When you play a game of Pokemon, you’re supposed to understand what to do and where to go, understand the quests you’re doing and what they would take to complete, take independent decisions that you think will get you the furthest, and monitor what’s happening on your screen the entire time you’re doing all this. And it must do so for hours at end.

The game may seem easy enough for humans to complete. For an AI system, though, doing all this is a monumental achievement.

This is a glimpse at the nascent “agentic” capabilities that AI labs are developing, where they can give their AI systems broadly defined goals — importantly, without giving them any step-by-step instructions — and then trust them to find a way to complete them. While using them to play old video games might seem like a weird idea, those same capabilities can then be put to use for all sorts of other tasks.

It also helps AI labs understand where their models can fail, giving them critical feedback on how to improve themselves.

Incidentally, Google has also just released an “agent toolkit” that helps people create AI agents of their own.

Meta wants AI to know you better than you know yourself

Meta seems like a straggler in the AI race — overshadowed by rivals like OpenAI, Anthropic, Google, and even newcomers like DeepSeek. People have panned its latest models, while Meta’s chief AI scientist seems to be looking away from generative AI entirely.

But it’s perhaps too early to write them off. In fact, in a recent interview, Mark Zuckerberg laid out an ambitious vision to leapfrog his competition entirely — bringing everything Meta has done so far to bear.

If you use AI regularly, you’ve probably noticed how it now knows all sorts of little details about you, that it has picked up over months’ worth of conversations. Zuckerberg wants to double down on that. His first big gambit is to build an AI that understands you intimately, using years of data collected through Facebook and Instagram. That means AI will no longer talk to you from a distance. Meta’s models will know you inside-out, the way the Instagram Reels algorithm knows you.

In this future, he imagines a version of AI that’s embedded in your daily life — not as just another chatbot, but as a companion you talk to naturally throughout the day. Sort of like Iron Man's JARVIS. In fact, he sees this as a solution to our loneliness epidemic. AI, in this vision, could practically replace your friends.

But that’s just a vision. How does he get there? For one, he’s doubling down on voice, rather than text, as being the way in which you talk to AI most often. Other labs have done that too, of course. But we’re not sure if the experience is the same when your AI model understands you as intimately as Facebook’s other products.

Zuckerberg’s main focus, in fact, isn’t to chase conventional AI benchmarks (like solving complex academic puzzles). He instead aims to maximize engagement. The way we see it, Zuckerberg is looking to replicate the addictive, sticky experience of apps like Instagram — but with AI at its core.

All of this might come to you from a new form factor like Meta’s glasses. This means you’re not just using AI through a device, like your phone or laptop. Your AI system is constantly before your eyes, and you can talk to it all day, without any barriers.

Stitch it all together and you see his vision: a world where you’re constantly speaking, through your spectacles, with an AI model that understands you better than yourself. We’re not sure if this is exciting or disturbing. We, frankly, are leaning towards the latter. But who knows? This could well be what the future looks like.

Some quick geopolitical bytes

Here are some other major international developments we saw on AI:

Stargate mulling UK move: When Trump just arrived in office, OpenAI had announced plans to set up a giant compute cluster in the United States, in a project that would eventually amount to $500 billion. That, of course, was before Trump announced tariffs on most of the world. WIth all the uncertainty on the supply chains for most things that go into setting up a data centre, though, they’re wondering if they should look elsewhere. The United Kingdom, reportedly, could receive some of that investment.

Taiwan’s GDP booms unexpectedly: When Trump announced his worldwide tariffs, many people were uncertain about Taiwan’s economic future, given how dependent the country is on exports. But its first quarter GDP growth for 2025 came up much higher than expected, at 5.37% — an absolutely phenomenal number for a developed country. This was partly because AI investments are proceeding at a ridiculous scale, and partly because companies tried to front-load imports to get around Trump’s tariffs. The quarter’s surprise figures have pushed Taiwan to increase its expectations for its 2025 GDP — from 3.14% to 3.6%.

EU tries to regulate AI as well: While AI companies are cutting corners to get the results they want, the EU is moving in the opposite direction. Its AI Act, the world’s first AI law, is kicking into action in a phased manner — and will be completely in force by August next year. It tries to classify AI systems into different risk levels, and prescribes different levels of compliance for each. Given the many ways in which AI can go wrong, this isn’t entirely misguided. But as Mario Draghi famously pointed out, its zeal to regulate new technologies has pushed it behind the curve in many waves of technology. And yet, it is doing so again.

Is the power of OPEC+ eroding?

A few days ago, Kazakhstan's Energy Minister Erlan Akkenzhenov made a bold statement. He said Kazakhstan would "prioritize national interests over those of the OPEC+ group when deciding on oil production levels." Simply put, he was saying Kazakhstan might not follow the OPEC+ rules, if it conflicts with what the country needs.

Later, that same day, he softened his position somewhat, saying Kazakhstan was "fulfilling its OPEC+ obligations and working with the group to find mutually acceptable solutions." But the damage was already done. His first statement had sent a clear message: Kazakhstan could break ranks with OPEC+.

You might wonder why we even care about this.

See, even though Kazakhstan might not be the biggest player in the game, the fact that they are willing to go against the bloc points towards something that’s been brewing under the surface for a while now – OPEC+ may not be as all-powerful and important as they once were.

We know, that’s a big claim. Before we make such a bold statement, let’s dig into it a little deeper.

What is OPEC and OPEC+?

Kazakhstan is a part of OPEC+. That’s an extended version of OPEC, or the ‘Organization of Petroleum Exporting Countries’.

OPEC is basically a 12-member group of countries that produce and sell a lot of oil. It was created in 1960 by Saudi Arabia, Iran, Iraq, Kuwait, and Venezuela. Until then, global oil production sat in the hands of a small set of Anglo-American oil companies. OPEC came together to push them back, nationalise their businesses, and take the market into their own hands.

Today, though, the OPEC basically tries to police global oil prices.

OPEC+, meanwhile, is an expansion of that group. It includes all OPEC members, plus 10 other oil-producing countries. This larger group was formed in 2016, to give the group even more control over global oil supply. Together, OPEC+ countries controlled the production of the majority of the world's oil. Or at least they did until recently.

The bloc works by having all member countries agree to produce specific amounts of oil. In doing this, they control oil supply, which in turn helps determine global prices. When they want higher prices, they "turn down the faucet" by producing less oil. Oil becomes more scarce across the world, and its price goes up.

In rare cases, though, they actually want lower prices for their oil. Then, they "turn up the faucet" by producing more, and the opposite happens.

These countries basically work like a giant, international cartel. But there’s a problem inherent to any cartel: it only works if everyone sticks to their promises. If anyone refuses to follow whatever the cartel dictates, the rest of the cartel becomes weaker.

OPEC, and OPEC+, have the same issue. If one country produces more oil than it agreed to, it stands to profit by being the world’s cheapest source of oil. Meanwhile, it weakens everyone else, pushing down the demand for their oil. Now, OPEC+ decisions are not legally binding, so countries might only adhere to them if it's in their benefit.

For a long time, following OPEC+ rules, or at least pretending to, was in the best interest of any country. The group was just that powerful. But suddenly, there seems to be something afoot.

Recent OPEC+ decisions

Since late 2022, OPEC+ has cut oil production by about 5.85 million barrels per day, or about 6% of what the world uses. These cuts helped keep oil prices up — between $70 and $90 per barrel.

But suddenly, on April 3, 2025, eight OPEC+ countries (Saudi Arabia, Russia, Iraq, UAE, Kuwait, Kazakhstan, Algeria, and Oman) surprised everyone. They announced they would increase oil production by 411,000 barrels per day in May. This was three times more than they had planned before.

Why the reversal? Officially, they said they were doing this because oil demand looked healthy. But they also said something that hinted at their true intentions: that countries that had produced too much oil in the past would need to make up for it by producing less in the future.

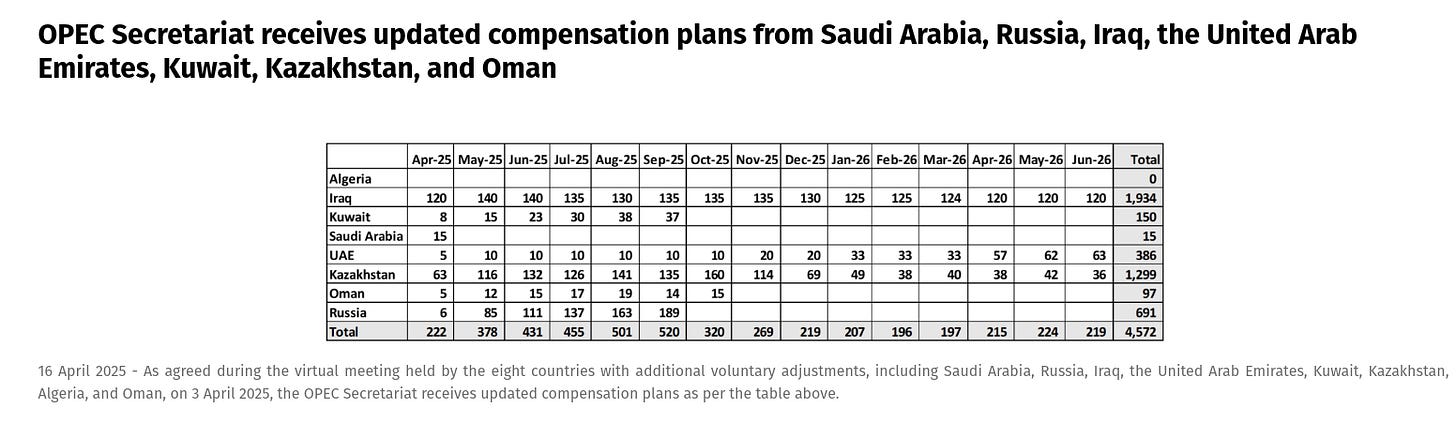

Following that, on April 16, OPEC announced that seven countries (including Kazakhstan) turned in plans showing how they would pump less oil in the coming months to make up for producing too much oil in the past.

Kazakhstan is a repeat offender in terms of overproduction. But it isn’t the only one. Iraq, too, has consistently overproduced oil, and is now required to cut 1.93 million barrels per day by June 2026 for "required compensation" because of its past overproduction. Even Russia, despite its strategic partnership with Saudi Arabia in forming OPEC+, has not really complied with production targets.

Even if these countries start cutting production later, it should be worrying for OPEC+ members. This pattern of weak compliance among key members points to a deeper issue: OPEC+ can no longer enforce the discipline it once did. But why?

The Changing Global Oil Landscape

This problem has been brewing for a long time. Back in the 1970s, OPEC could unilaterally dictate global oil prices. Today's OPEC+, though, can only hope to influence price movements within narrower ranges, not wild swings.

That is due to a few major factors:

1. The Rise of Non-OPEC+ Production

For one, a lot more countries started pumping out oil.

According to IEA projections, non-OPEC+ producers will contribute a remarkable 76% of the net global capacity increase between 2023 and 2030. Just take a look at how production has changed in some of the important non-OPEC+ countries in the recent past, to get a clearer picture of this shift:

The United States has almost tripled its production in 15 years, and now adds more than 13 million barrels per day to global markets — equivalent to Saudi Arabia and Russia combined.

Brazil, too, has seen steady growth in oil production. It pumps out 4.3 million barrels per day, adding significant volumes to global markets.

Canada, similarly, has grown its oil production to 5.8 million barrels per day, and is now a major global oil supplier. Moreover, it has opened the new Trans Mountain Pipeline expansion, that lets it ship oil directly to Asia, instead of loading it on to ships.

More countries are now entering the market. Guyana, for instance, has just emerged on to the scene, going from zero to significant production in just a few years, with further growth expected to reach 1.3 million barrels per day by 2030.

With this ramp up in capacity, non-OPEC members have been securing an ever-larger part of the market. For the last couple of years, in fact, more than half of the world’s oil comes from these countries.

And that’s crucial to understanding the decline of OPEC+. At the end of the day, one key metric decides who rules the oil market: market share. OPEC+'s share of global oil supply has declined from approximately 53% in 2016 to around 47% in 2024, the lowest since OPEC+ was formed in 2016. And this trend is only expected to continue.

This shift has wider implications beyond just OPEC+. We’re seeing something called a “supply cushion”, where production capacity is greater than actual demand. By 2030, total global oil production capacity is projected to reach nearly 114 million barrels per day, far exceeding expected demand. The surplus — a massive 8 million barrels per day — could forever undermine OPEC's ability to manage prices.

After all, who will pay more for oil when there’s so much supply that they could just get it elsewhere?

2. Structural Shifts in Demand

While OPEC+ grapples with rising competition on the supply side, demand patterns are also changing. And not in a good way, at least if you are an oil producer:

Global oil demand is projected to plateau around 106 million barrels per day by the end of this decade.

Electric vehicle adoption is expected to replace the road fuel demand of approximately 6 million barrels per day by 2030.

Countries all over the globe are reducing, or at least trying to, their own oil consumption for power generation by switching to natural gas and renewables.

So, the oil market has two dynamics that are, together, pulling down the relative power OPEC+ countries enjoy. It’s a market that is becoming increasingly crowded, while, at the same time, the market size is beginning to plateau as well.

And on top of that, it looks like OPEC+ countries themselves are beginning to feel their relevance waning.

3. Saudi Arabia's Strategic Pivot

The de-facto leader of both OPEC and OPEC+, Saudi Arabia, is itself is shifting away from crude oil. In early 2024, Saudi Arabia suspended its planned crude capacity expansion to 13 million barrels per day. Instead, it’s trying to find other sources of revenue to replace its reliance on petrol: with its main focus on natural gas liquids and alternatives. Rather than doubling down on crude oil output, Saudi Arabia is diversifying its hydrocarbon strategy.

This is a massive pivot: it shakes up the very basis of the country’s economy for half a century.

It’s only a matter of time before other countries follow.

The Future of Oil Market Governance

Let’s end this on a tone of caution: none of this means the group is falling apart and is doomed forever. But it does show that, at least for now, OPEC+ probably has less power to control oil prices than it used to. Today’s oil market is more complicated. A lot more countries and companies play a role in oil prices now.

OPEC+ can no longer take unilateral decisions. The power of OPEC+ now depends on the situation before it — it can still influence prices when there are supply problems, or when members work closely together. But when there’s too much oil, or if countries don’t follow the rules, its influence drops.

That’s what we just saw with Kazakhstan.

OPEC+ doesn’t have easy options. It can no longer keep cutting oil production to boost prices, as long as it risks losing business to other oil producers outside the group. Nor can it keep flooding the market with supply so that prices drop, to punish the others or push them out. That’s no longer a viable strategy when they barely control half the market.

The body is caught between maintaining unity and accepting new realities. Its power is diminished, its influence diluted, and its future looks increasingly dependent on cooperation rather than coercion. Kazakhstan's defiance might be a small crack, but it's a telling sign of how fragile the OPEC+ consensus has become.

Tidbits

UPI Transaction Value Dips 3% in April, Maintains Strong Year-on-Year Growth

Source: Business Standard

In April 2025, Unified Payments Interface (UPI) transactions in India fell by 2% month-on-month to 1 thousand 780 crore, with the total value declining 3% to ₹23.95 lakh crore, following a strong March driven by year-end sales. March had recorded 1thousand 830 crore transactions worth ₹24.77 lakh crore. Despite the monthly dip, UPI showed robust year-on-year growth, with April volume up 34% and value up 22% compared to April 2024. Immediate Payment Service (IMPS) transactions also dipped 3% to 44.9 crore, with value down 7% to ₹6.22 lakh crore. FASTag transactions rose slightly to 38.3 crore, while Aadhaar Enabled Payment System (AePS) transactions dropped 16% to 9.5 crore in April, accompanied by a 13% decline in value to ₹26,618 crore. Despite the correction from March, the data indicates stable digital transaction patterns across India’s payment platforms.

Air India Faces $600 Million Cost Blow as Pakistan Closes Airspace

Source: Reuters

Air India expects to incur additional costs of around $600 million (₹5 thousand crore) if Pakistan’s airspace ban lasts for a full year, according to a letter sent by the airline to the Indian Civil Aviation Ministry. The ban follows Pakistan’s retaliatory move after an attack on tourists in Kashmir and is set to increase fuel expenses and require extra crew for longer rerouted flights. Air India, which holds a 26.5% share in India’s aviation market and reported a $520 million net loss on $4.6 billion revenue in fiscal 2023–24, is the most affected among Indian carriers. Together with IndiGo and Air India Express, there were roughly 1,200 flights scheduled from New Delhi to Europe, the Middle East, and North America in April. The airline has requested government subsidies proportional to the estimated economic hit and sought permissions for overflights through Chinese airspace. Discussions are underway between Indian carriers and the Civil Aviation Ministry to explore tax exemptions and other operational solutions. The Tata Group-owned airline is also navigating turnaround challenges amid aircraft delivery delays from Boeing and Airbus.

Eternal Q4 Profit Plunges 78% Amid Blinkit Expansion Push

Source: Reuters

Indian delivery giant Eternal, formerly Zomato, reported a sharp 78% drop in fourth-quarter profit, posting ₹39 crore compared to ₹175 crore a year earlier. The fall was driven by aggressive spending at Blinkit, its quick commerce arm, which more than doubled its store count to 1,301 year-on-year. Blinkit’s quarterly revenue surged to ₹1 thousand 709 crore, but its adjusted core loss widened significantly to ₹178 crore from ₹37 crore last year. Meanwhile, Eternal’s core food delivery business, Zomato, saw adjusted revenue rise 17% year-on-year to ₹2 thousand 409 crore, slightly below its forecast of 20% growth. The company also announced the shutdown of Zomato Quick, citing inconsistent customer experience. Eternal flagged rising competition from Swiggy’s Instamart, Zepto, and larger players like Amazon and Flipkart, which have shortened delivery times to four to six hours. Despite strong revenue gains, the company acknowledged limited margin expansion due to intense market pressures.

- This edition of the newsletter was written by Pranav and Prerana.

🌱Have you checked out One Thing We Learned?

It's a new side-project by our writing team, and even if we say so ourselves, it's fascinating in a weird but wonderful way. Every day, we chase a random fascination of ours and write about it. That's all. It's chaotic, it's unpolished - but it's honest.

So far, we've written about everything from India's state capacity to bathroom singing to protein, to Russian Gulags, to whether AI will kill us all. Check it out if you're looking for a fascinating new rabbit hole to go down!

Subscribe to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Thank you for reading. Do share this with your friends and make them as smart as you are 😉

I highly recommend you guys read ai-2027.com. It's deeply researched, and the predictions are stunning.

https://ai-2027.com/