Affordable Housing: The New Goldmine?

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and watch the videos on YouTube. You can also watch The Daily Brief in Hindi.

In today’s edition of The Daily Brief:

HFCs have a strong quarter

What if rare earth elements vanished overnight?

HFCs have a strong quarter

India’s housing finance sector has seen impressive strength and growth in the last quarter (Q4FY25). Four of the sector’s biggest names — Bajaj Housing, PNB Housing, Aavas Financiers, and Aadhar Housing — all delivered solid results.

Each of these companies has its own manner of doing business, but there’s a clear trend emerging all across the sector: they're shifting gears towards affordable housing, especially given the recent changes in interest rates.

In this piece, we'll unpack how these companies stack up against each other. We’ll also explore their latest moves, and highlight a few subtle yet important warning signs that people shouldn't overlook.

Let’s start with Growth

Bajaj Housing Finance stood out as the sector’s clear leader. It grew its assets under management (AUM) by an impressive 26% year-on-year, reaching ₹114,684 crore. Their moat lies in their diversified approach — they have their hands in everything from prime housing loans, to affordable segments, to lease rental discounting, to developer financing.

In their recent earnings call, Bajaj Housing's management stated clearly: "The company has strengthened its management team and will invest deeply in strategic business units and non-metro markets in FY26 to ensure sustained growth." In other words, they're committed to maintaining strong momentum, even as the market anticipates potential interest rate cuts.

PNB Housing Finance recently managed a massive turnaround. Its retail loan assets climbed 18% year-on-year to ₹74,802 crore. The real highlight was their affordable housing segment, which surged an extraordinary 183% year-on-year, reaching ₹5,070 crore. This, as we’ll soon see, points to a shift in its strategy.

MD Girish Kousgi was notably optimistic on their recent concall. In his words: "FY26 is going to be far better than FY25 for the industry. By March '27, our retail loan book will hit ₹1,00,000 crore, with affordable housing at ₹15,000 crore and emerging markets contributing ₹25,000 crore." Clearly, affordable and emerging segments are becoming pivotal to their growth strategy.

Aavas Financiers delivered steady performance. It grew its AUM by 18% year-on-year, to ₹20,420 crore. Their strategy seems focused on expanding the number of branches they have. Over the last year, they’ve opened 30 new branches, to reach 397 locations.

Yet, they struck a rather cautious note during their recent call. As MD Sachinder Bhinder emphasized: "We remain cautiously optimistic, aiming to sustain our growth around 20% of AUM." They seem to be taking a measured approach for times to come, signaling careful expansion rather than aggressive growth.

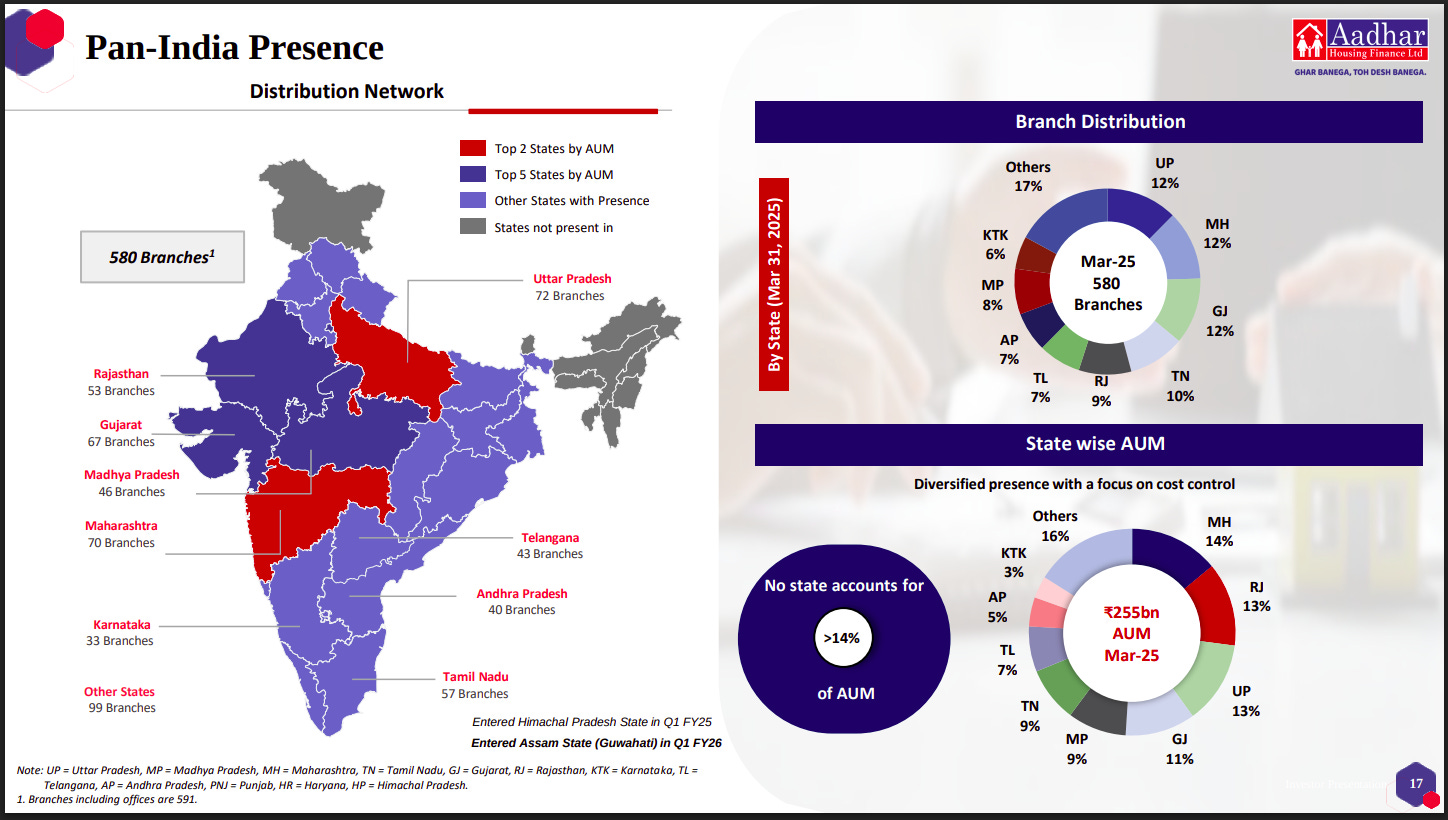

And finally, Aadhar Housing Finance reported substantial growth for the quarter. Their AUM rose to ~₹25,500 crore. They've also diversified where they’re sourcing their business, now. Now, no one state makes up more than 14% of their portfolio. They've recently entered new markets such as Himachal Pradesh and Assam. Clearly, they see opening new geographies as key to their growth.

Asset quality seems pristine

If you look more closely at asset quality, you see interesting differences among the big HFCs.

Bajaj Housing Finance sets the gold standard. Their Gross NPAs are at just 0.29%. Net NPAs are lower, at 0.11%. And yet, despite their industry-leading asset quality, they've chosen a conservative stance, increasing their provisioning coverage ratio to 60.25% — up from 55.44% in the previous quarter.

In simpler words: the lender is keeping aside a larger portion of their profits to tide themselves over those loans that are currently categorized as Gross NPA. Even if they recover nothing at all from those borrowers, it won’t hurt the bank in future — those losses have already hit their books. Clearly, they're staying cautious even while leading the pack.

Aadhar Housing Finance, too, seems to have a relatively clean book. This is especially impressive considering their business largely caters to people from lower-income segments — who, conventional wisdom suggests, are the most likely to repay their loans. And yet, their GNPA stands at just 0.21%. Our reading: the company seems to have high underwriting standards, and does a good job at managing the risk of default.

PNB Housing Finance, while behind the pack, made noteworthy progress this quarter. Their Gross NPAs have improved greatly — to 1.08%, from 1.50% a year ago. Behind this improvement was a robust recovery effort. They got back ₹336 crore from accounts they had already written-off — posting a sharp 236% increase year-on-year. This signals that they're getting much better at dealing with past risks.

On the other hand, Aavas Financiers saw a slight uptick in their GNPA — which rose slightly to 1.08%, from 0.94% a year ago. This isn’t a crisis — these are still manageable levels of bad loans. But their may be larger risks on the horizon.

You should pay close attention to their early-stage delinquency indicator — the 1+DPD ratio. This stood at 3.39%. The indicator basically looks at how many borrowers have missed at least one EMI payment. These aren't yet NPAs — for that, a loan should be overdue for 90 days. But that said, every bad loan begins with one missed payment. The 1+ DPD ratio gives you an early sense of the loans that might eventually become NPAs.

Fortunately, Aavas Financiers' 1+ DPD ratio has been falling ove the last few months, and is somewhat flat against last year. This suggests that Aavas Financiers' collection processes are still effectively handling these early-stage risks, even if some loans remain under stress.

It’s hard to stay profitable in a Falling Rate Environment

One big theme from these recent earnings calls was how these HFCs are staying profitable in a time where interest rates are falling. Since most loans that HFCs give out are linked to repo-rate, we see the interest on these loans fall quickly. But, only the incremental borrowings that they take are at lower interest rates, which causes the yields to fall faster than cost of borrowing. Also, just to be clear, compressed margins doesn’t mean outright losses, just lower profitability.

Aavas Financiers noted that they were facing some pressure on this front. Their spreads shrunk slightly to 4.89% last quarter, down from 5.00% in the quarter that came before. Spreads, in a crude sense, are the difference between how much they charge to lend (yields) and the cost at which they get funds (cost of borrowing).

The company openly recognized the challenges ahead. During their call, CFO Ghanshyam Rawat elaborated: "In a falling interest rate scenario, there will be some negative impact on spreads. But historically, we've found ways to protect our margins effectively."

For now, the company remains confident. As per the company: "Our endeavor is to maintain spreads around ~5%." But it’s hard to ignore that their spreads have never fallen below 5% before, in the past 8 years.

On the other hand, PNB Housing Finance looked more optimistic about its net interest margins (NIMs). As we noted earlier, the company’s moving to higher margin segments, and that’ll help it stay afloat despite the broader shift in rates. As MD Girish Kousgi clarified: "We expect our NIMs to stay stable, around the 3.6% to 3.65% range, even as policy rates fall. This stability comes primarily from shifting our loan mix and growth in corporate lending."

Meanwhile, Bajaj Housing Finance faced a slight dip in their gross spreads, slipping to 1.8% from 1.9% in Q3FY25 due to increasing competitive pressure.

This trend of compressing NIMs isn’t just affecting housing NBFCs. The whole banking sector is suffering from it. A recent report from CareEdge Ratings shared “Ongoing regulatory changes and intense competition for deposits further exacerbated the pressure on NIMs. Looking ahead, NIMs are likely to stay moderate. Additionally, the repricing of loans linked to repo rates is expected to put further strain on NIMs.”

Across banks, this quarter saw the lowest NIMs in 8 quarters.

Affordable housing is the new frontier

Across the sector, there's a clear shift: HFCs are increasingly betting on affordable housing and emerging markets.

PNB Housing Finance is moving aggressively into the sector. It already makes up 40% of its quarterly retail disbursements. Highlighting their success, Valli Sekar, Chief Sales & Collection Officer for Affordable Business, noted proudly: "We ended the year with a remarkable loan book of ₹5,070 crore—an exceptional 183% jump compared to last year."

Bajaj Housing Finance has also stepped up its game. It’s launching a dedicated business unit specifically targeting near-prime and affordable housing customers. According to their presentation, this specialized unit is "continuing to deliver results exactly as planned."

Of course, for others, affordable housing has always been at the heart of their strategy. 84% of Aavas Financiers’ loans focused on amounts below ₹15 lakh. Similarly, 66% of Aadhar Housing Finance’s total loan book is dedicated to economically weaker sections (EWS) and low-income groups (LIG).

Should they be worried about increased competition from the big guys like Bajaj or PNB? We don’t think so.

For one, low income borrowers are severely under-funded. This is a space that can absorb substantial amounts of financing — giving everyone room to grow.

Affordable housing finance is also a very location-specific business. Lenders usually focus on small pockets of the country, where they feel they understand the local customers well. In this business, for this customer segment, knowing your customer really matters. That’s why most of these players don’t compete directly with each other. Instead, they keep growing their loan books in the regions they know best.

Subtle warning signs

So far, we’ve painted a fairly positive picture of the sector. But there are some reasons to be cautious,

Aavas Financiers, for instance, has voiced concern about certain market segments. As Managing Director Sachinder Bhinder highlighted: "We’re noticing rising delinquencies in unsecured microfinance loans and customers becoming increasingly over-leveraged, creating ripple effects." Translation: some customers are taking more loans than they can afford, and might end up in a bad place. This is why the company is tightening lending standards — their loan approval rates (login-to-sanction ratio) have dropped from around 42% a year ago down to 38% .

PNB Housing Finance saw its operating expenses rise significantly, jumping by 19.4% year-on-year in Q4FY25. Such a sharp increase in expenses might hint that the company is dealing with major cost pressures, which could start eating into its profits.

Bajaj Housing Finance is seeing margin pressures. Their portfolio yield slipped slightly to 9.7% (down 10 basis points from the previous quarter). This small drop hints that the rising competition may squeeze their margins further going forward.

Lastly, even though these companies all seem confident in their ability to maintain healthy margins, history shows us that it’s hard for HFCs to keep their margins high in a declining-rate environment. Investors would do well to keep a close eye on this.

Strong growth, but with a dose of caution

Overall, India's housing finance sector looks promising. But there are nuances to consider:

Growth Momentum: All four companies we looked at appear poised for strong growth. Housing finance remains underpenetrated in India, giving them room to forge ahead. There’s added government support through initiatives like PMAY 2.0, which should provide them an extra tailwind — especially for affordable housing.

Profitability Pressure: As interest rates trend downwards, these companies will struggle to maintain their profit margins. Companies that have a higher proportion of fixed-rate loans could initially face tougher headwinds — they’ll have to cut down the rate they lend at, but their own capital will stay as expensive as ever.

Asset Quality Vigilance: Although asset quality currently remains strong across the sector, it’s worth remembering the cautionary notes from Aavas, about rising delinquencies and increasing customer debt loads. These could potentially be early signals of broader stress ahead.

Conclusion

The housing finance landscape in India is shifting to a new reality. Interest rates are falling, the competition is intense, and affordable housing seems to be the way ahead. All the companies we’ve looked at seem well equipped to handle these transitions, at least at the moment. But you should stay alert. Keep an eye out on their spread management, asset quality, and operating expenses.

The shift to affordable housing and emerging markets presents exciting opportunities — but it’s also risky. Higher potential growth and yields must be balanced carefully against possibly higher credit costs. Ultimately, companies that maintain discipline in who to lend to while growing this portfolio are the ones likely to succeed in the long run.

As Aavas Financiers succinctly put it, "FY26 is going to be far better than FY25 for the industry." Yet, the subtle caution you see in their outlook reminds us — optimism must go hand-in-hand with vigilance.

What if rare earth elements vanished overnight?

Imagine waking up one day and realising that your phone didn’t ring, your fan didn’t spin, and even your WiFi router stayed dead. If you try making breakfast, your induction stove doesn’t turn on. You try turning on the TV to watch the news, but it does nothing.

Horrible, right? But this is actually how the world, and our lives, would look if the ‘rare earth’ elements suddenly vanished.

Well, they won’t actually vanish. But they might get a lot harder to lay one’s hands on. These obscure minerals — with their strange names, like neodymium or dysprosium — are currently creating massive geopolitical tensions. They might be one of the world’s most significant supply chain vulnerabilities, at least for Western economies.

Today, we'll unpack what rare earths are, why they matter, and how they've become pawns in an increasingly complex global chess game.

What are rare earths?

Rare Earths are a set of 17 metallic elements listed on the periodic table.

Most of those — 15, to be exact — fall into a category called the ‘lanthanides’. The remaining two, scandium and yttrium, don’t formally belong to this group, but they behave similarly in chemical reactions, so they’ve been lumped in the same category.

Despite what the name suggests, rare earths are not actually rare. In fact, some of them are quite abundant. Cerium, for example, is about as common as copper in the Earth’s crust. Even the least abundant ones are 200x more abundant than precious metals like gold.

That name is a historical misnomer. Back in the 1700s, scientists found these minerals in unusual-looking rocks, somewhere near the village Ytterby, in Sweden. Back then, “earths” were a generic term for oxide-based minerals. So, these new oxides that came from rare rocks became the “rare earths”. That antiquated name has stuck ever since. But it isn’t strictly accurate.

The real challenge isn’t that these minerals are rare — it is that they’re dispersed. Unlike metals like iron or copper, rare earths aren’t found in large, concentrated deposits. They’re scattered all over different rock formations, in tiny quantities. Very rarely do you find a rare earth deposit that you can mine at a rate that is economically feasible.

When you do find them, you’re likely to find a bunch of rare earths tangled together. And because they’re all chemically so similar, it’s really hard to separate them from each other. That takes a complicated process, with hundreds of complex chemical steps, that use a lot of acid and industrial materials. It also creates a lot of waste — some of which can even be radioactive.

This immense difficulty in isolating rare earths, not their geological scarcity, is what makes them a serious challenge for the global economy.

Why rare earths matter

Rare earths have some very special physical properties, which make them absolutely critical to modern technology.

Perhaps the most important of these is magnetism. Magnets made from neodymium, iron, and boron are the strongest permanent magnets we know of. They can be up to ten times stronger than regular magnets, while also being compact and lightweight. And a lot of modern technology — everything from speakers, to hard drives, to electric generators, to vehicle motors — runs on magnets. It’s because of lightweight rare earth magnets that all of this comes in sleek, miniaturised forms today.

Then, rare earths have optical properties. Elements like europium and terbium are used to produce the red and green colours you see on your phone or TV screens. These chemicals are hosted in a lattice made of Yttrium. Without these elements, screens would look entirely different — they would be thicker, and would have nowhere near the same sharpness or colour quality.

Some rare earths have catalytic properties. They help speed up chemical reactions, which makes them essential in oil refining, and in the ‘catalytic converters’ that cut down the harmful smoke that leaves your car exhaust.

This is just a small list. Rare earths are part of all kinds of modern marvels — from lasers, to medical equipment. Ultimately, though, there are two high-stakes uses for rare earths that make them indispensable — and why China is threatening to choke its enemies off rare earth supply:

Defence: Modern defence equipment, by and large, involves extremely complex machines. Consider a fighter aircraft: it needs rare earth magnets for its many electronic systems, rare earth-based screens for displays, rare earth alloys in its jet engines, and rare earth paint to maintain stealth. Every single F-35 jet, for instance, contains nearly half a tonne of rare earth materials — 3% of its body weight.

Clean energy: You need magnets whenever you want to switch between electricity and motion. Wind turbines take as much as one tonne of rare earths each to turn wind energy into electricity. EVs take a couple of kilos of rare earths to turn electricity into motion. And so on. This is why rare earths are crucial for the green transition.

The demand is growing fast. The International Energy Agency expects rare earth demand to rise by anywhere from 3-7 times by 2040. And as per one estimate, for every 1% increase in green energy deployment using current technologies, global rare earth reserves will shrink by 0.18%. That’s a steep price to pay for a cleaner future.

Whatever your vision of the future may be, rare earths will probably play a big role in getting there. Which is why if you control the world’s rare earth supply, you control its future.

Who controls the supply?

Even though rare earths are found all over the world, the vast majority of mining, processing, and manufacturing is dominated by just one country: China.

Right now, China mines around 70% of the world’s rare earths. It processes 85-90% of the world’s rare earths — giving it a veritable monopoly over turning these materials into something useful. And it makes the products that use these rare earths. For instance, China produces over 90% of the world’s rare earth magnets.

This dominance wasn’t accidental.

Back in the 1970s and 80s, when the rest of the world was focused on oil or semiconductors, China began developing its rare earth industry. Deng Xiaoping, the Chinese leader at the time, understood their importance early on. He’s often quoted as saying, “The Middle East has oil. China has rare earths.”

It took the industry over, bit by bit, from the United States. The United States used to dominate the world’s rare earth production, from the Mountain Pass mine in California. This one mine supplied most of the world's rare earths from the 1960s to the 1990s. Early development of these materials was driven by military applications – for instance, U.S. labs invented samarium-cobalt magnets in the 1960s for powerful radar systems.

But China played the long game.

From 1978 to 1995, it increased its rare earth production rapidly — by nearly 40% each year. It overwhelmed the global market with cheap supply, which made it hard for Western producers, especially in the U.S., to compete. This wasn’t just a matter of cheap labour — China invested heavily in separation technology, vertically integrated its supply chains, and accepted far higher levels of environmental damage that other countries were unwilling to bear. This allowed it to undercut the rest of the world. As competitive pressures grew, once-leading Western sites either shut down or scaled back operations.

By the early 2000s, China had taken control of nearly 98% of the world’s rare earth production.

Today, it’s hard for anyone else to enter the market. The barriers to entry are simply too high. It can take anywhere from 7-15 years, once you discover a deposit, to actually mine it. Setting up a processing facility can cost over a billion dollars. And the technical know-how needed to separate these metals sits with China.

It’s also a dirty process. For every ton of rare earth you produce, processing generates approximately 2,000 tons of mining waste. This includes acidic and radioactive waste streams that require careful management. China played fast-and-loose with environmental concerns, and accepted a severe cost for it: it has destroyed water bodies and farmlands all around its rare earth mines. Not everyone can stomach such devastation.

But that also means it’s immensely difficult to pull the rare earth supply chain away from China.

Sidenote: Indian rare earths

India has about 5-6% of global rare earth reserves, totalling around 6.9 million metric tons. But as of 2024, we produce less than 1% of the global total.

What’s holding us back? Our rare earth sector has historically been controlled by a single government entity, IREL, which operates under the Department of Atomic Energy. Our deposits are often found alongside Thorium, a mildly radioactive metal, which we consider a nuclear fuel — which creates all sorts of regulatory complications. This has limited our rare earth processing capabilities, and has stunted the development of downstream industries.

Things are starting to change though.

In 2023, we amended our mining laws to allow private companies to explore and extract rare earths. We also launched a National Critical Minerals Mission, and joined the U.S.-led Minerals Security Partnership — all intended at securing our critical mineral supplies. The Indian government also announced a massive ₹13.6 lakh crore ($163 billion) investment plan for building processing parks, stockpiles, and recycling infrastructure.

We’re even exploring international partnerships, like joint investments in rare earth projects in Australia. We’ve started manufacturing small batches of magnets domestically through a new facility at the Bhabha Atomic Research Centre.

But a full-blown rare earth industry, at least, is decades away.

Weaponised rare earths

Because China controls the world’s rare earths, it can wreak havoc on anyone it’s unhappy with.

In 2010, for instance, China and Japan got into a diplomatic standoff over the Senkaku Islands. During the dispute, China quietly restricted rare earth exports to Japan. This wasn’t an official ban, but shipments slowed to a crawl.

Prices for rare earths skyrocketed. Neodymium prices jumped up by 575%. Dysprosium, too, saw a ~500% increase, going up from $250/kg to around $1,500/kg. Japanese industries — especially automotive and electronics firms — were caught completely off guard, and billions of dollars’ worth of industrial output was at risk.

Eventually, Japan recovered from the shock. It came up with a five-point strategy, based around cutting down its rare earth usage, and securing alternative supplies. Over a decade, it reduced its dependence on Chinese rare earths from 90% to around 60%.

But that became a demonstration of what China can do.

In April 2025, China introduced new export restrictions on seven rare earth elements — including samarium, terbium, dysprosium, and yttrium — in response to American tariffs. These are critical for defence applications and high-performance magnets. The message was clear: it was ready to use rare earths as a tool for geopolitical pressure.

This ties into a broader idea that we’ve written about before — “weaponised interdependence.” As trade relations are souring all over the world, increasingly, countries are turning their control over chokepoints in global supply chains into strategic leverage. A country that dominates a key economic node, like the processing of rare earths, can easily influence, pressure, or retaliate against others. That’s what China is willing to do.

Don’t get us wrong. As Japan demonstrated, in the long term, these chokepoints aren’t fatal. Countries can find ways of getting out of China’s stranglehold. As Pranay Kotasthane and Tannmay Baid write, even in a worst case scenario, the world will eventually find alternatives without particularly severe damage.

But that requires a plan — and so far, many countries don’t seem to have one. A recent report from the Center for Strategic and International Studies (CSIS), for instance, warned that if China were to pause or stop exports — especially of heavy rare earths — the U.S. would be left scrambling for alternatives. It’s not that it’s unaware of these vulnerabilities: it has recently spent millions in building local supply chains — but those will all take years to come online. Meanwhile, in many ways, America’s defence sector is still deeply reliant on China.

A race against time

If there was a major disruption today, it would seriously hit a lot of modern technologies. EV production would drop by up to 25%. Wind turbine output could fall by up to 90%. Production of fighter jets like the F-35 could stop entirely. Technologies like MRI machines might become unavailable for months.

Chances are, countries will eventually build alternatives. But meaningful change will take years. And until then, anyone hit by these restrictions will be deeply vulnerable. These seemingly obscure materials could be focal points of severe geopolitical tension.

Tidbits:

Coal India to Invest ₹25,000 Crore in 4.5 GW Renewable Energy for AM Green

Coal India has announced plans to set up 4.5 GW of renewable energy capacity at a cost of ₹25,000 crore to supply carbon-free power to AM Green’s green ammonia facilities in Gujarat’s Kandla or other locations. The project will combine 2,500–3,000 MW of solar and 1,500–2,000 MW of wind capacity, with wind projects likely in southern states and solar plants in Gujarat and Rajasthan. AM Green, backed by Greenko Group founders, aims to produce 5 million tonnes per annum of green ammonia by 2030, equivalent to 1 million tonnes of green hydrogen and accounting for about a fifth of India’s national green hydrogen target. Coal India and AM Green have signed a non-binding MoU for long-term renewable power supply, marking one of the world’s largest renewable energy contracts. AM Green plans to integrate the supplied solar and wind energy with pumped hydro storage to ensure steady power. Coal India said this initiative aligns with its strategy to become an integrated energy provider while continuing to meet India’s current energy needs with coal.

L&T Q4 Profit Surges 25% on Strong Infrastructure and Energy Orders

Larsen & Toubro (L&T) reported a 25% year-on-year rise in consolidated net profit to ₹5,497 crore for Q4 FY25, supported by a 10.9% growth in revenue to ₹74,392 crore. The profit includes an exceptional gain of ₹475 crore from a partial reversal of earlier impairment in its LT Special Steels and Heavy Forgings joint venture. Sequentially, profit jumped 63.6% from ₹3,358 crore in the previous quarter. The company’s order inflow for Q4 stood at ₹89,613 crore, up 24% year-on-year, with international orders making up 70% or ₹62,739 crore. L&T’s consolidated order book reached ₹5,79,137 crore as of March 31, 2025, a 22% increase over the previous year. The infrastructure segment reported a 21% annual growth in orders to ₹1,73,226 crore, while the energy segment saw a 19% rise to ₹87,569 crore, including a more than 100% surge in Q4 driven by the Qatar Energy order. L&T has declared a final dividend of ₹34 per share for FY25. Looking ahead, the company anticipates 10% order inflow growth in FY26, with two-thirds expected from international markets.

Sunil Mittal, Warburg Pincus in Talks for $2 Billion Haier India Stake

Billionaire Sunil Mittal, founder of Bharti Airtel, is in advanced discussions to acquire a 49% stake valued at $2 billion in the Indian arm of Chinese appliance giant Haier, according to Bloomberg. Mittal has partnered with private equity firm Warburg Pincus for the deal, which could be finalized in the coming weeks. Haier’s Indian unit currently operates three manufacturing plants producing air conditioners, refrigerators, washing machines, and other appliances. The talks remain ongoing, and Haier may still opt out or consider alternative buyers. Indian media previously reported that Reliance Group chief Mukesh Ambani was also exploring a significant stake in Haier’s Indian business. Neither Haier, Warburg Pincus, nor Mittal’s representatives have publicly commented on the matter so far.

- This edition of the newsletter was written by Bhuvan and Kashish.

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, even the smaller logistics firms—and copy the full transcripts. Then we bin the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

🌱Have you checked out One Thing We Learned?

It's a new side-project by our writing team, and even if we say so ourselves, it's fascinating in a weird but wonderful way. Every day, we chase a random fascination of ours and write about it. That's all. It's chaotic, it's unpolished - but it's honest.

So far, we've written about everything from India's state capacity to bathroom singing to protein, to Russian Gulags, to whether AI will kill us all. Check it out if you're looking for a fascinating new rabbit hole to go down!

Subscribe to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Thank you for reading. Do share this with your friends and make them as smart as you are 😉

Fantastic article- I have been unable to read Aavas earnings report so far so this summary helped and shows why stock has suddenly gone cold this month. However, it is an underpenetrated market for sure and I am happy to remain in this industry long term having read this article.

"Thank you for your dedicated efforts in analyzing the parameters of HFC companies. As a regular reader, I would like to request you to write a few more articles on interesting quarterly results across different sectors."