Zomato wants more money!

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

Check out the audio here:

And the video is here:

Today, we look at we look at 1 interesting tidbit about Indian fund managers and 5 big stories.

Zomato Wants More Money!

Are Gig Workers- Employees or on Contract?

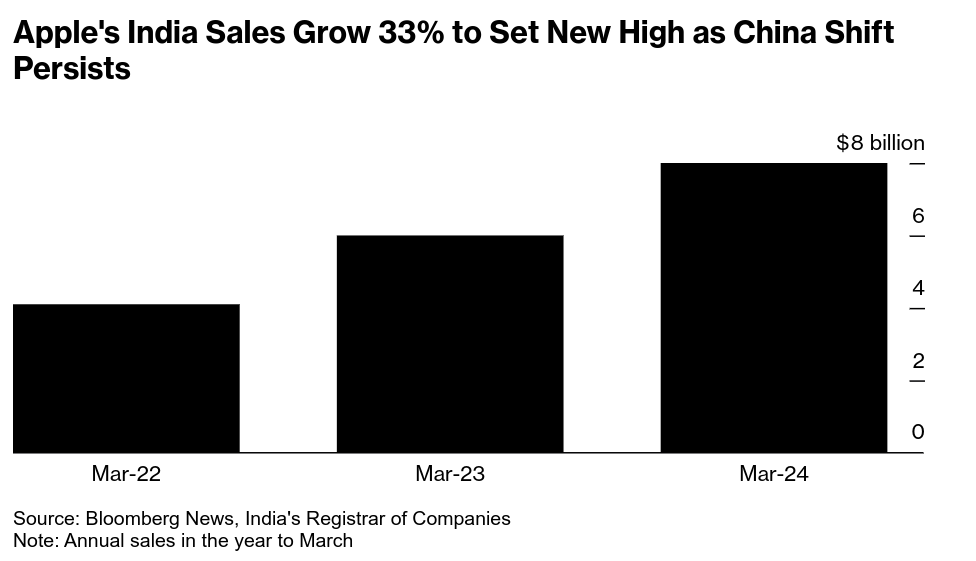

Apple's Sales Growth in India

India's Credit Growth

Is India's Economy Fit?

Are Indian fund managers really value investors?

Mutual funds typically maintain a portion of their Assets Under Management (AUM) as cash reserves. Currently, equity mutual funds are holding about 5% of their AUM in cash, marking the lowest level in five months. This trend suggests that fund managers might be feeling optimistic about the market's prospects. However, this behavior raises questions given the current high market valuations and concerns about potential bubbles.

Key Points:

Low cash levels often indicate that fund managers are confident about market opportunities and are less cautious.

Despite ongoing market optimism, many experts believe Indian markets are overvalued, and some segments may be in a bubble.

Fund managers must balance holding enough cash to capitalize on market drops and investing enough to benefit from market rallies.

Evaluating whether Indian fund managers are value investors or merely chasing returns can be inferred by closely examining the portfolios of the funds you’re invested in.

Zomato wants more money!

Zomato recently raised its platform fee from ₹5 to ₹6 in some metro cities, marking the fifth increase since its introduction in August last year. This move aligns with similar fees charged by Swiggy, reflecting the competitive dynamics in India's food delivery duopoly. As a publicly listed company, Zomato is under pressure to maintain revenue growth and shareholder satisfaction, especially with Swiggy's upcoming IPO adding further competitive pressure.

Key Points:

Zomato raised its platform fee from ₹5 to ₹6, the fifth hike since August 2023.

Swiggy introduced a similar fee in April 2023. Given the duopoly, both companies have significant pricing power.

Zomato, being a publicly listed company, needs to show consistent profit growth to keep shareholders happy.

The impending IPO of Swiggy adds pressure on Zomato to maintain competitive pricing strategies.

Internationally, companies like Doordash and Uber Eats also charge platform fees, referred to as "service fees."

Zomato's management noted that platform fees significantly boost revenue, alongside better ad monetisation.

Akshant Goyal, CFO of Zomato, mentioned that the platform fee is small enough not to impact customer behavior, and the company might continue experimenting with the fee amount.

With 22-25 lakh orders daily, a ₹6 platform fee can generate approximately ₹1.5 crore daily, ₹45 crore monthly, and about ₹550 crore annually.

Are gig workers- employee or on contract?

India's youth unemployment problem is significant, with about 50% of the population aged 18-44 facing issues due to skill gaps and pay disparities. However, the gig economy has emerged as a sector rewarding skills and hard work with better pay. According to NITI Aayog, there are over 2.5 crore gig workers in India, a number expected to grow substantially. Despite the rapid growth, the gig economy faces several challenges related to job security, benefits, and working conditions.

Key Points:

Significant unemployment among India's youth, aged 18-44, due to skill gaps and pay disparities.

Over 2.5 crore gig workers currently in India, with projections from BCG suggesting this could increase to 90 million in the next 10 years.

Most gig workers in developing countries like India are younger than 35.

Challenges in the Gig Economy:

Gig workers are not classified as employees, leading to a lack of job security, benefits, and regular wages.

The uncertain employment status causes significant stress for gig workers.

Legislative Efforts:

Indian government classifies gig workers as unorganized workers, making them eligible for some social security benefits.

In July 2023, Rajasthan introduced a bill to protect gig workers.

Recently, Karnataka introduced a draft bill for social security and welfare of platform-based gig workers.

Provisions in Karnataka's Bill:

Digital platforms and gig workers must register with a new Welfare Board within 60 days.

Government will establish a Welfare Fund for registered gig workers.

Platforms must provide fair contracts and a 14-day notice for terminations.

Concerns and Unanswered Questions:

The bill does not classify gig workers as employees, so they miss out on many benefits that employees receive.

The bill does not specify who will bear the cost of welfare fees—companies or customers.

The bill is silent on how companies should handle customer misbehavior towards workers.

India is the Apple of Apple’s eye

Apple, the world's most valuable company, recently achieved a significant milestone in India by generating $8 billion in annual sales, marking a 33% increase from last year's $6 billion.

While this figure represents just 2% of Apple's global sales of $380 billion. It highlights India's importance as one of Apple's fastest-growing markets.

Apple's journey in India has been fueled by strategic decisions to diversify production and sales, especially amid rising US-China tensions.

Key Points:

To mitigate risks from US-China tensions, Apple has diversified its production, with Foxconn heavily investing in an iPhone factory in Tamil Nadu.

Foxconn's operations in India face higher material costs, higher defect rates compared to China, and cultural and technical challenges, necessitating Chinese engineers to train the local workforce.

The lack of familiarity with high-tech electronics manufacturing among the Indian workforce exemplifies the broader issue of skill gaps in India.

Tata Electronics' Role:

Tata Electronics has entered Apple's supply chain, setting up a plant in Hosur, Tamil Nadu, to make iPhone casings and acquiring Wistron's iPhone manufacturing business in India.

This allows Tata to scale up manufacturing capabilities quickly, supporting Apple's diversification efforts.

Government Support:

India's Production Linked Incentive (PLI) scheme offers financial incentives to attract manufacturing companies, resulting in over ₹1 lakh crore of investments.

CEO Tim Cook mentioned a focus on developers, markets, and operations in India during a recent earnings call, signaling Apple's long-term commitment to the region.

Credit looked like a party, until RBI stepped in

The Reserve Bank of India (RBI) recently released its credit growth data, revealing some intriguing trends in the lending landscape. While credit growth was weak before the pandemic, post-pandemic recovery has been strong, especially in personal loans and credit cards. However, recent data suggests a shift in bank lending strategies.

Key Insights from RBI's Latest Credit Growth Data:

Currently at 16% year-on-year, up from just 6% in July 2021. Despite peaking in December 2023, it has remained flat since then.

Growing at about 18% year-on-year. However, growth has slowed from 22% in November 2023 to 17% in May 2024 due to increased risk weights for unsecured personal loans and credit cards imposed by the RBI.

Banks are reducing personal loans and increasing agricultural loans. Agricultural credit growth has jumped from 18% in November 2023 to nearly 22% in May 2024.

Analysis and Concerns:

Despite increased agricultural lending, the sector's growth has fallen from high to low single digits. However, bad loans in agriculture are under control and have decreased.

Citi Bank research highlights that previous periods of high agricultural credit growth (2008-09 and 2015-16) were followed by difficulties for banks involved in agri-lending. This raises questions about potential future risks.

Is India’s economy fit?

India's trade deficit is a crucial economic indicator, reflecting the balance between imports and exports. It impacts everything from consumer goods to essential commodities. The latest data reveals interesting trends and offers a snapshot of the country's economic health.

Key Points from the Latest Trade Deficit Data:

India's goods trade deficit in June stood at approximately $21 billion, showing a slight improvement from May, primarily due to lower oil imports.

Services, especially IT and consulting, continue to generate a steady surplus of $13 billion monthly, significantly contributing to the economy.

Totaled around $35 billion, marking a slight dip from May but still substantial.

Remained steady at $56 billion, with notable components including machinery and electronics, and a reduction in gold imports.

Projections and Implications:

Analysts from Kotak Mahindra Bank predict that India's Current Account Deficit will remain around 1.1% of GDP for the fiscal year. This indicates that imports might outpace exports due to strong domestic demand.