Yes Bank's Big Comeback?

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and watch the videos on YouTube.

In today’s edition of The Daily Brief:

Japanese Giant Bets on Yes Bank

Jewellery Titans Sparkle in Q4

Japanese Giant Bets on Yes Bank

Japan's Sumitomo Mitsui Banking Corporation (SMBC) is planning to acquire a significant 20% stake in Yes Bank. Such a substantial foreign stake in an Indian private bank is rare, especially given the Reserve Bank of India’s (RBI) typically stringent guidelines regarding bank ownership.

The deal will see SMBC purchase shares from Yes Bank’s 2020 rescue investors – primarily State Bank of India (SBI) and a consortium of Indian banks – for a total of about ₹13,483 crore (roughly $1.6 billion). Yes Bank share price rose 9% on Monday in response to the news.

Now, this might look like a fresh headline, but the reality is that this development has been building up quietly over many years. Which is why, to understand why SMBC’s entry is such a milestone, we need to rewind — all the way back to when Yes Bank was flying high.

Yes Bank was supposed to be the next HDFC Bank

In 2015, Yes Bank was not only the talk of the banking industry, but also a general symbol of rapid growth and aggressive expansion. The bank was growing at breakneck speed. Its loan book was swelling dramatically year after year.

However, growth, when unchecked, brings risks. And that’s exactly what happened with Yes Bank.

One fine day, in July 2015, global financial giant UBS sounded an alarm about the bank's lending practices. UBS went on to claim “It is most vulnerable to a large corporate default” in its report.

See, Yes Bank, in the pursuit of continuing high growth, had begun extending loans to troubled businesses — often those who couldn't secure funding from more conservative lenders. Initially, this seemed like a bold but profitable stance for the business. Yet, beneath the surface, it was setting the stage for severe trouble. It had built up significant exposure to a long list of future high-profile failures — Dewan Housing Finance Corporation (DHFL), the Reliance ADA group, Essel/Zee Group, Vodafone Idea, and Jet Airways, and more. Each of these was a ticking time-bomb.

Soon, these loans started turning bad. And when that happened, Yes Bank tried sweeping things under the carpet, underreporting its non-performing assets (NPAs).

By FY2019, Yes Bank was still officially reporting NPAs of around only ₹3,277 crore. But the RBI started digging around. And its inspectors found a major divergence between what Yes Bank declared and the actual reality. An Asset Quality Review (AQR) by RBI revealed the true gross NPAs were exponentially higher — around ₹17,000 crore by late 2019, and still climbing. In fact, by September 2019, the bank’s bad loans had reportedly ballooned to a staggering ₹50,396 crore.

This scale of under-reporting couldn’t be a mere oversight. It hinted at systemic governance failures. At the heart of the issue was Rana Kapoor, Yes Bank’s charismatic CEO, whose aggressive approach ultimately led to the bank’s financial strain. Kapoor himself seemed to be profiting at the bank’s expense, allegedly receiving ₹600 crore in kickbacks for extending loans to distressed entities.

By 2019, the situation had become dire. Kapoor stepped down amid regulatory scrutiny, selling off nearly all of his stake in the bank. This marked the beginning of a period of severe capital erosion for Yes Bank. The bank’s NPA losses kept piling up, eating into its capital. And capital is the raw material of any bank. The bank desperately needed new equity capital to come in from somewhere.

But capital was hard to find. Efforts to raise this capital from various external sources kept failing. Yes Bank was quickly approaching the brink of collapse. A potential bank run loomed, threatening not only the depositors but also the stability of the broader financial system.

RBI came to the rescue

Seeing no other choice, in March 2020, the RBI intervened decisively to stabilize Yes Bank.

In an unexpected move, it imposed a moratorium on withdrawals by depositors — to ₹50,000 per account — which stalled the possibility of a bank run. It then swiftly drafted a resolution plan. This plan was anchored by the State Bank of India (SBI), which, along with seven other major banks such as ICICI and HDFC, were asked to infuse approximately ₹10,000 crore into Yes Bank.

This investment came with a lock-in. More on that later.

This substantial bailout was necessary, but it came with steep consequences. Existing shareholders were massively diluted. The bank's ownership structure changed overnight, with SBI becoming one of its largest shareholders.

Controversially, Yes Bank’s Additional Tier 1 (AT1) bonds were written off completely. These are perpetual, unsecured debt instruments issued by banks to boost their capital base, which can absorb losses by being written down or converted into equity if the bank's capital falls below a certain threshold. This write-off sparked a legal battle, which is still unresolved in the courts today.

With the immediate danger averted, the challenging phase of recovery began. Under its new CEO, the SBI veteran Prashant Kumar, Yes Bank undertook significant strategic changes.

One of the first major steps was offloading a massive ₹48,000 crore of bad loans to JC Flowers Asset Reconstruction Company, effectively cleaning up its balance sheet. Its NPA figures now looked under control. The bank also successfully recovered over ₹5,000 crore in previously non-performing loans, improving both its financial health and public perception.

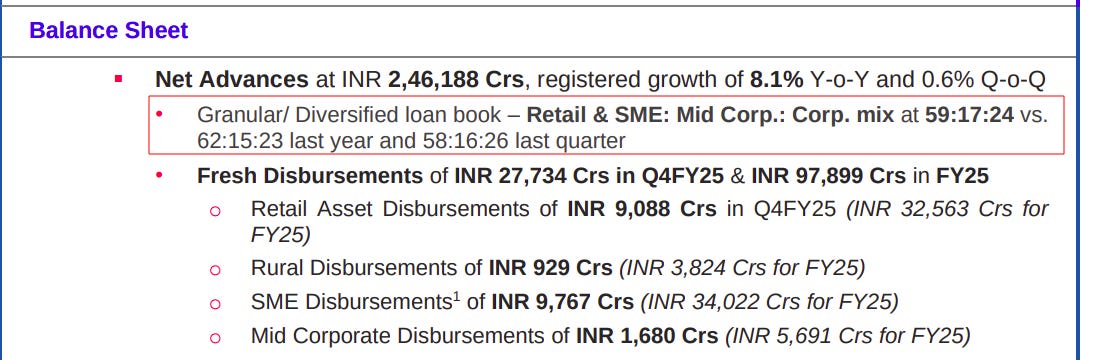

Recognizing the dangers of lending large sums to a few big companies, Yes Bank diversified its loan book, pivoting to retail and SME lending. As of March 2025, ~60% of its loan book now belongs to the Retail & MSME segment — compared to just 36% in March 2020.

To further solidify its recovery, the bank also attracted fresh capital from private equity giants like Carlyle and Advent — which brought in both financial stability and expertise.

All of these efforts gradually restored investor confidence, boosted capital adequacy ratios, and returned Yes Bank to consistent profitability. The markets, though, have never warmed up to the bank in the way they once did.

Fast forward to 2023: the lock-in period for Yes Bank’s rescuers expired. But although they had the option to sell their stakes, they wisely waited — hoping that the turnaround would fetch them a better offer. And their patience, it seems, has paid off.

The landmark deal with SMBC, valuing the 20% stake at ₹13,483 crore, offers these initial investors a relatively profitable exit.

Why SMBC? Why now?

To SMBC, this deal is a leap into the Indian banking landscape.

Sumitomo Mitsui Banking Corporation is not a stranger to India – it has operated a branch presence in the country for years, mainly catering to Japanese corporate clients and doing wholesale banking. But in recent years, SMBC (and its parent Sumitomo Mitsui Financial Group, SMFG) has been executing what it calls a multi-franchise strategy across Asia. It has been selectively buying stakes or subsidiaries in key markets.

In 2021, SMFG made a notable move in India by acquiring a 74.9% stake in Fullerton India, a non-bank finance company known for retail and small business loans. They later increased that stake, and by 2024 Fullerton India was a wholly-owned subsidiary of SMFG, rebranded as SMFG India Credit.

But while that gave SMBC a foothold in India’s lending market, it still didn’t have a bank in its name.

Yes Bank fills the gap. SMBC likely sees this as “the last missing piece” in its Asia expansion puzzle. By investing in Yes Bank, SMBC instantly gets a meaningful stake in a scheduled commercial bank in India, with an existing customer base, an extensive branch network, and a full banking license.

Timing-wise, SMBC’s move comes at a time when Yes Bank has largely de-risked and stabilized, but still has plenty of room for growth. It’s buying in at a point where the heavy lifting of cleanup is done, and with its worst days out of the way, the bank is poised for an “expansion and growth” phase (as Yes Bank’s management likes to say).

It’s worth noting that pulling off this deal required navigating India’s regulatory framework.

RBI typically doesn’t allow a foreign bank to own more than 15% of an Indian bank without special circumstances. In the past, the central bank has made exceptions only when a bank was in trouble and needed rescuing – for example, it allowed Singapore’s DBS Bank to take over the struggling Lakshmi Vilas Bank in 2020, giving DBS full ownership as a one-off measure for stability.

Yes Bank’s case is slightly different. Its crisis had already been addressed in 2020. But RBI’s willingness to bless a 20% foreign stake now suggests it is comfortable with Yes Bank having a strong international partner.

What the SMBC partnership means for Yes Bank

For Yes Bank, the deal with SMBC is transformative in multiple ways. And it achieves this without requiring another dilutive capital raise.

First and foremost, it provides a strong foreign anchor investor that boosts confidence. Until now, Yes Bank was majority-owned by a clutch of Indian banks (essentially its competitors) and a couple of PE firms. That served a purpose during recovery, but it didn’t make sense as a long-term arrangement. Having SMBC on board changes the narrative: Yes Bank is no longer an orphan in need of caretakers. It now has a committed, world-renowned parent-figure — even if it’s not a majority owner yet.

Second, the deal offers better governance and greater expertise. With SMBC likely taking board seats and involving itself in oversight, Yes Bank stands to gain from the Japanese bank’s global best practices in risk management and corporate governance.

For the initial rescue investors — SBI and friends — this deal is a graceful and profitable exit (at least partially), which was one of their goals from the start. They’ve pulled the bank through a huge crisis, and by selling a chunk now to SMBC, they’ve now handed over the baton of its stewardship.

This deal undeniably represents a significant milestone in Yes Bank’s journey—marking the end of an exhausting recovery phase, and hopefully, the beginning of a promising chapter (maybe??). As observers, we’re cautious but optimistic — to us, this looks like the climax of a compelling turnaround story.

Jewellery Titans Sparkle in Q4

Today, we’re going to look at results from India’s jewellery majors.

This is an interesting time to follow the space. India’s ~₹5.5 lakh crore jewellery market, of course, is ancient, and intensely competitive. But that doesn’t mean it’s static. Until very recently, almost the entire market consisted of unorganised, local players that had earned the trust of people around them. Now, however, a variety of factors — from transparency, to regulatory scrutiny — is quickly pushing the market towards the organised sector. In just five years, between 2019 and 2024, the share of the organised sector went up from 23% to 37%.

Much of this upside is being captured by a handful of listed players — that are seeing rapid, double-digit growth, and are now setting up hundreds of new stores a year. And that’s why we’re extremely interested in two of the largest players in the space — Titan Company, and Kalyan Jewellers.

Beyond the sector’s wider expansion, there were two other trends to watch out for, over this quarter. One, the price of gold went up sharply the world over as uncertainty rose, and if you sell jewellery, that changes your entire calculus. Two, a longer-term trend we’ve seen is the increasing popularity of lab grown diamonds — which could very well upend a major part of a jewelers’ portfolio.

As we go through these results, we’ll get into all of this, and more. Let’s dive in.

The bird’s eye view

Despite all the uncertainty around their business, both Titan and Kalyan looked quite upbeat about their Q4 results.

Let’s start with Titan.

Titan saw healthy growth this quarter. Its consolidated revenue went up by over 21% over last year’s figures. Its consolidated revenue from the core engine of its business — jewellery sales — grew at a robust 23.7% year-on-year. Some of this growth came because the company was expanding, but importantly, its existing stores did quite well too. Same-store sales rose 15% year-on-year.

There’s some turbulence once you look beneath the surface. A lot of that’s because of the sharp rise in gold prices: perhaps the most important input for the jewellery business. That put sharp pressure on the company’s margins. But the company managed to cut costs elsewhere — it did a good job of cutting down its overhead costs, and hedged against the volatility in gold prices effectively. All in all, its margins in the jewellery business fell by a mere 0.25% year-on-year — even though gold prices went up by ~30-40% since last year. As a result, its consolidated EBIT went up

Not all its products did equally well. The company’s studded jewellery segment lagged its growth elsewhere — which is why its share of studded jewellery went down by 3%, year-on-year. At least some of this has to do with how people’s choices in diamond jewellery are changing. We’ll come to that soon.

Jewellery, of course, makes for ~85% of Titan’s revenues. But beyond jewellery, its watches business had a great quarter as well. Its revenue grew nearly 20%, led by Fastrack’s whopping 44% year-on-year growth, and strong gains in the premium Helios channel. Its eyecare business, too, held its own with 16% revenue growth. On the other hand, its emerging businesses, like fragrances and ethnic wear, are yet to stabilise. At least this quarter, they saw a year-on-year fall in revenue, and posted widening losses.

All things considered, Titan ran a tight ship in an uncertain time. It navigated a tough environment for gold prices with operational discipline, and expanding its reach without overextending itself. The company’s core remains strong — and if gold prices stabilise, could help it shine even brighter.

Kalyan wasn’t too far behind.

It had a stellar quarter. Its consolidated revenue went up by an incredible 37% year-on-year. Its Indian jewellery business led the charge, growing 38% on the back of very strong wedding demand. Impressively, a lot of this growth came from its existing stores: in fact, same-store sales grew by 21%.

If there’s one thing to watch out for, it’s the company’s margins, which came under some pressure this quarter. This was because of a mix of two factors: one, as we’ve already discussed, gold prices went up; and two, more of the company’s business moved to a franchise-based model, where the company earns less profit for every Rupee of revenue. As a result, the EBITDA margin of the company’s India business slipped slightly — to 6.4%, down from 6.6% in the same quarter last year. But overall, the company remains hugely profitable. In fact, its profit after tax rose by 36% year-on-year.

Interestingly, unlike Titan, Kalyan’s studded jewellery business did particularly well. Revenues in this segment rose by 47%, pushing its share up to 31% of the company’s product mix — a 2% gain year-on-year.

Beyond its core business, Kalyan’s Middle East arm also posted a 26% increase in revenue, while maintaining steady margins. On the other hand, its digital-first arm, Candere saw a muted quarter. The company is now thinking of a larger offline footprint for Candere, with 80 new stores planned for the year. From what the company says, it looks like this is a business line that’s yet to reach maturity — though the company is investing heavily into making that happen.

All in all, Kalyan is expanding at breakneck speed. At the same time, it has managed to keep its costs and margins under control.

Heavy expansions ahead

With strong quarters behind them, both companies are now racing to expand quickly.

Titan is taking a measured approach. It plans to open 40 to 50 new Tanishq stores over the coming year. It’s also expanding or renovating another 50 to 60 stores — and many of these expansions, according to the company’s management, are practically like opening another store. A vast majority of this expansion will happen outside tier 1 India.

The company’s also playing around with new business models. It’s piloting a new franchise-owned, company-operated (FOCO) model, especially in its largest 10-12 markets. This is meant to address a few key issues in how the company’s franchise partners conduct their business. For one, many of them don’t have proper succession planning in place, which means that once these stores change hands, there could be a sudden break in continuity. Moreover, Titan’s business is growing more complex, and many partners don’t have the organisational chops to pull it off. In these cases, the company will take over the management of these stores, even though their assets will still stay in the hands of their franchise owners.

This push, as per the company’s management, was inspired by Kalyan’s playbook.

Kalyan, by contrast, is going all in. The company plans to open 170 new stores this year — nearly four times Titan’s additions — over a much smaller base. 90 of these will be under the flagship Kalyan brand, making for nearly a quarter of its existing 278 stores. But interestingly, it’s also opening 80 stores under its ‘Candere’ label — more than doubling the offline presence of what was previously a digital-first brand. A lot of this expansion is happening outside Kalyan’s traditional stronghold in South India. In fact, last quarter, a majority of Kalyan’s revenue — 53% — came from outside South India.

Much of Kalyan’s expansion will follow a franchise-led model. This helps the company expand quickly without buying too many assets, or taking on too much debt. In fact, the company expects nearly 55% of its India business to come from franchise stores by FY27, up from ~40% right now.

This rapid expansion shows just how quickly large, branded jewelers are breaking into spaces that were previously controlled by small-scale jewelers.

What happens when gold prices go up

The last quarter was one where, the world over, there was immense uncertainty in how global trade could pan out. Many investors, having pulled their money out of the USD, also saw gold as a safe haven. As a result, gold prices have been rising rapidly since the beginning of this year.

To Kalyan and Titan, this showed up in all sorts of weird business dynamics.

Titan, for instance, saw a visible shift in customer behaviour. As gold crossed critical price thresholds, entry-level demand began to shrink — particularly in the sub-₹50,000 price band. Many first-time or budget-conscious buyers chose to sit it out.

Titan adapted to this by shifting its product strategy. It launched more lightweight designs, and pushed lower-karatage jewellery (including 18k and 9k gold, even in traditional designs), to bring down costs. For higher value customers, it trimmed down the complexity, so that they would get the same amount of gold with lower making charges. This helped Titan keep its jewellery margins nearly flat, even as gold prices climbed steadily.

Less visibly, Titan’s also contemplating changes to how it funds its gold purchases. It plans on increasing its exposure to Gold-on-Lease (GOL) — instead of paying for all its gold upfront and tying up capital, the jeweller will “borrow” physical gold and pay a lease rate. But this, too, is turning into a rather expensive option.

Kalyan Jewellers, meanwhile, had a very different set of outcomes from the same gold rally.

One of the more surprising ones was that Kalyan actually found it easier to upsell studded products. Its management noted that, given the rising gold prices, many consumers were willing to upgrade from plain gold to studded jewellery — given that the price differential was suddenly much lower. In fact, studded jewellery sales grew 47% in Q4, outpacing gold jewellery growth.

But it wasn’t all good news. Kalyan relies on Gold Metal Loans (or GML — which is roughly similar to GOL) to finance its gold inventory. But this quarter, that got expensive fast. GML interest rates rose from 3.5% to ~5% — a significant hike in a low-margin business. Making matters worse, the company faced a temporary disruption in the domestic gold metal loan environment, forcing it to shift gears mid-quarter. When the quarter began, Kalyan had planned to reduce its non-GML debt. But with all this chaos, it actually ended up reducing GML debt instead, simply because that market became volatile.

Titan doesn’t care for lab-grown diamonds

Titan, specifically, talked a lot about lab-grown diamonds in its analyst con-calls.

The upshot: Titan’s in wait-and-watch mode, but for now, it’s sitting this one out.

They’re not yet convinced that the economics of lab-grown diamonds has settled down. The price of lab-grown diamonds has been falling steadily as production gets cheaper. From around ₹50,000–60,000 per carat a year ago, many players are now selling at ₹30,000 per carat. And even at that price, the margins are still healthy — which means that even more new players might enter the market. More price-cutting is likely. This isn’t an environment that rewards a brand like Titan.

So far, they don’t seem to be missing much. While lab-grown diamonds are rapidly eating into the market for solitaires, it hasn’t yet taken over the market for smaller stones. Over 95% of Titan’s studded jewellery sales come from small natural stones, not large solitaires. That part of the market has remained resilient. If anything, the company has seen strong growth in buyers for small stones.

By the way, we only came across any of this because we dug through the company’s analyst calls. If you want more such nuggets, but don’t have the time to go through lengthy company calls, we’ve got your back. We’re picking out the best of these calls for The Chatter. Check it out!

A fascinating quarter

All in all, this was a fascinating quarter for India’s jewellery giants.

Both companies faced major headwinds, and shrugged them off like they were nothing. Titan played it steady — carefully navigating gold price shocks, experimenting at the margins, and holding back on the flashier parts of the market until the dust settles. Kalyan, in contrast, went full throttle — riding strong demand, expanding rapidly, and showing surprising strength in a turbulent pricing environment.

But how they navigate the next wave of volatility — in gold prices, in funding costs, and in customer preferences — might end up defining who pulls ahead.

Tidbits:

ACME Solar Commissions 52.5 MW in Rajasthan, Boosts Operational Capacity to 2,592.5 MW

Source: Business Line

ACME Solar Holdings Ltd has commissioned 52.5 MW of solar capacity in Rajasthan’s Bikaner district, marking the first phase of its 300 MW ACME Sikar Solar Project. Spread across approximately 1,300 acres, the project will transmit power to the Bikaner-II grid through a dedicated 220 kV transmission line. With this addition, ACME’s total operational capacity rises from 2,540 MW to 2,592.5 MW. The full project, once completed, is expected to generate around 780 million units of clean energy annually. Power from the project will be sold through power exchanges on a merchant basis. The project is funded by PFC Limited and is part of ACME’s broader renewable energy portfolio, which stands at 6,970 MW including operational and under-implementation capacity.

PVR Inox Q4FY25: Net Loss Narrows to ₹125 Cr, Revenue Slips 0.5% YoY

Source: The Economic Times

PVR Inox reported a consolidated net loss of ₹125 crore for Q4FY25, marginally lower than the ₹130 crore loss in the same quarter last year. Revenue from operations came in at ₹1,250 crore, down 0.5% year-on-year and 27% sequentially from ₹1,717 crore in Q3FY25. EBITDA rose to ₹344 crore, up from ₹327 crore in Q4FY24, indicating improved operational efficiency. The quarter saw 30.5 million patrons with an average ticket price of ₹258 and F&B spend per head at ₹125. Despite the muted financials, the company’s shares gained over 4% during market hours to close at ₹958. The decline in revenue was partly attributed to a 9% fall in overall gross box office collections, with Hindi and Hollywood films declining 26% and 28% respectively. However, Hindi-dubbed films saw a 153% surge, led by titles like Pushpa 2 and Kalki. PVR Inox currently operates 1,743 screens across 352 cinemas in 111 cities.

Fenesta Acquires 53% Stake in DNV Global for ₹44 Crore to Boost Integration

Source: Business Standard

DCM Shriram group’s fenestration business, Fenesta, has acquired a 53% equity stake in DNV Global for ₹44 crore. The acquisition is expected to be completed within the next two months. According to a company statement, the strategic investment is aimed at enhancing product reliability, deepening vertical integration, and creating new business opportunities in the hardware segment. Fenesta, which operates in the uPVC and aluminium doors and windows space, plans to leverage the acquisition for operational synergies across its supply chain. The move marks a step toward accelerated growth and improved customer experience. DNV Global, a manufacturer of door and window hardware, will support Fenesta in achieving backward integration. The ₹44 crore transaction reflects a focused effort to build scale and efficiency within Fenesta’s existing operations.

- This edition of the newsletter was written by Kashish and Pranav.

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, even the smaller logistics firms—and copy the full transcripts. Then we bin the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

🌱Have you checked out One Thing We Learned?

It's a new side-project by our writing team, and even if we say so ourselves, it's fascinating in a weird but wonderful way. Every day, we chase a random fascination of ours and write about it. That's all. It's chaotic, it's unpolished - but it's honest.

So far, we've written about everything from India's state capacity to bathroom singing to protein, to Russian Gulags, to whether AI will kill us all. Check it out if you're looking for a fascinating new rabbit hole to go down!

Subscribe to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Thank you for reading. Do share this with your friends and make them as smart as you are 😉

Good analysis but requesting for a lab grown diamonds analysis

Good analysis...