Will the budget fill your pocket or break your heart?

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

Check out the audio here:

And the video is here:

In today’s episode, we look at 4 big stories:

- Reliance is feeling the blues

- Slow and steady for HDFC

- Will the budget fill your pocket or break your heart?

- Will Amazon hit on Swiggy

Reliance is feeling the blues

Reliance Industries, one of India's largest conglomerates, reported its latest quarterly results with some mixed outcomes. While overall revenues increased by 12% to 2.36 lakh crore, profits dropped by 20% compared to the last quarter.

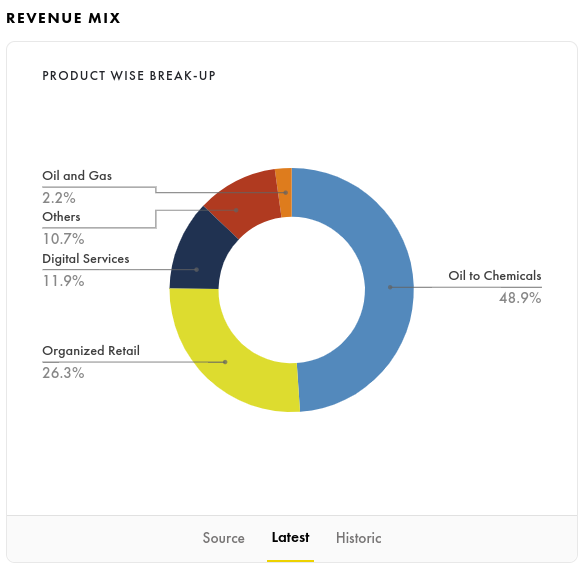

The dip in profits was primarily due to the performance of its Oil-to-Chemicals segment, which constitutes almost half of its revenues. However, looking beyond the numbers, several interesting long-term trends are emerging from Reliance's results.

Reliance Retail:

Added 331 new stores, bringing the total to about 19,000.

Now make up 18% of total revenues. JioMart is available in 180+ cities.

Entering "slow" quick commerce with 30-60 minute delivery promises.

Bought stakes in companies like Zivame and Urban Ladder.

Fueled by the grocery and electronics segments. The fashion and lifestyle segments saw less impact due to discretionary spending declines.

Expanding into premium offerings like Pret A Manger and Ajio Luxe.

Reliance Jio:

Added 8 million new subscribers, totaling over 480 million.

ARPU stayed flat at ₹181.7, but recent tariff hikes of 12-25% could boost this number soon.

5G accounts for 31% of Jio's mobile data traffic, with plans to invest $10 billion over the next three years for nationwide rollout.

Added over 1.1 million new home connections this quarter.

Slow and steady for HDFC

In this episode, we're diving into HDFC Bank's latest quarterly report to uncover some interesting trends. If you've been following our podcast, you know we've discussed inflation and credit growth extensively. Today, we'll focus on credit growth and what it means for HDFC Bank and the broader banking sector.

Net Interest Margins:

Improved from 3.4% to 3.47%, indicating a better spread between what HDFC Bank earns from loans and what it pays depositors.

Strategic Shift:

HDFC Bank's MD and CEO, Sashi Jagan, mentioned a strategic decision to grow loans more slowly than deposits. This aims to reduce their credit-deposit ratio, enhancing stability post-merger.

Credit Growth Trends:

Before the pandemic, credit growth was weak, but it has surged post-pandemic, especially in personal loans and credit cards.

RBI data shows overall credit growth at 16% year-over-year, compared to just 6% in July 2021. Personal loans are growing at 18% year-over-year.

RBI Governor's Insight:

Shaktikanta Das highlighted a shift where households are moving savings from bank deposits to mutual funds, insurance, and pension funds.

Banks are increasingly relying on short-term borrowings and certificates of deposit to fill the credit-deposit gap, making them more sensitive to interest rate movements and liquidity management challenges.

Expert Commentary:

Deepak Shenoy of Capital Mind noted that money in mutual funds eventually flows back to banks, suggesting a potential shift in the composition of bank deposits rather than a liquidity crisis.

The RBI Governor expressed concern about the gap between credit growth and deposit growth, stressing the need for a balanced approach.

Will the budget fill your pocket or break your heart?

As Finance Minister Nirmala Sitharaman prepares to present the Union Budget on July 23, various sectors have high hopes for impactful allocations and reforms. Let’s break down the expectations sector-wise.

Infrastructure and Social Welfare:

Expect increased funding for green and sustainable energy projects.

Focus on digital resources for rural India, in line with the Education Policy 2020.

Boost in funds for the Pradhan Mantri Awas Yojana scheme.

More investment in agriculture infrastructure and promotion of farm tourism to enhance rural incomes.

Tax Relief:

Potential increase in the tax-free limit to Rs 5 lakh.

Possible tax incentives for home loan borrowers and real estate developers.

No major tax rate cuts expected as the government aims to balance fiscal priorities.

Sector-Specific Expectations:

Solar Industry:

Hope for income tax benefits for adopting solar power.

Potential tax holiday for companies investing in solar cell/module production.

Insurance Sector:

Expectation for reduced GST on insurance products.

Education and Skilling:

Emphasis on enhancing STEM education and expanding digital infrastructure in rural areas.

Hope for a larger percentage of GDP to be allocated to education, beyond the previous 3%.

Fiscal Management and Tax Reforms:

Commitment to reduce the fiscal deficit to 4.5% by FY26.

Potential introduction of a new Direct Tax Code to simplify tax structures.

Expected changes to increase GST compliance.

PSU Divestment Plans:

Expectation of maintaining PSU divestment targets at 50,000 crores.

Instead of selling PSUs, the government may focus on making them more profitable by setting 5-year performance goals and investing in manager training.

Mutual Funds Industry:

Amfi hopes for tax benefits for pension-focused mutual funds similar to the National Pension System.

Proposal for a 10% tax rate on long-term capital gains without indexation.

A new scheme akin to ELSS to encourage retail bond investment.

Will Amazon hit on Swiggy?

Recent news suggests that Amazon might be interested in acquiring Swiggy's Instamart business. According to some sources, Amazon India has approached Swiggy to discuss the possibility of a deal.

Amazon is considering two approaches—either acquiring a stake in Instamart during Swiggy's upcoming IPO or buying out the entire Instamart business.

These talks are still in the very early stages, and no official offer has been made yet.

Why It Matters:

Acquiring Instamart would give Amazon a strong entry into the quick commerce market in India without the hassle of building it from scratch.

Selling Instamart could allow Swiggy to focus more on its core food delivery business, which might reassure investors who are bullish on food delivery but wary of quick commerce.

The quick commerce space is highly competitive and cash-intensive. Selling Instamart could help Swiggy save significant resources and move towards profitability sooner.

Partnering with Amazon could open up more strategic opportunities and wider distribution for Swiggy.

Impact on IPO:

Swiggy recently filed its papers with SEBI for a $1.25 billion IPO. If the deal with Amazon goes through, it could significantly impact Swiggy's IPO strategy and valuation.

Industry Implications:

This potential deal could see Swiggy and Zomato taking opposite paths. While Swiggy might sell its quick commerce arm, Zomato is heavily investing in its own quick commerce venture, BlinkIt.

Zomato CEO Deepinder Goyal has stated that quick commerce will soon outgrow food delivery. Goldman Sachs recently valued BlinkIt higher than Zomato itself, indicating the market's potential and competitive landscape.

Its a fine good information in have ever found. Thank you for the brief knowledge about the markets.