Why Pakistan’s Solar Revolution Backfired

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and watch the videos on YouTube. You can also watch The Daily Brief in Hindi.

In today’s edition of The Daily Brief:

Pakistan’s colossal solar mess

The new vision for copper

Pakistan’s colossal solar mess

We usually stick to stories that matter most to the Indian audience. Sometimes, we dip into global events—but only if there’s a clear India link. Today’s a bit different.

Because today we’re talking about a topic that always deserves more attention—solar energy—and a country that frankly doesn’t: Pakistan.

We came across this headline from Reuters some time back stating “Pakistan's solar revolution leaves its middle class behind”, and it immediately caught our attention. How could Pakistan possibly end up screwing themselves over with such a beautiful piece of tech - solar.

Now, if you have been tracking the energy transition space, you wouldn’t be surprised to know that Pakistan pulled one of the fastest solar revolutions in the world. But … it was all an accidental outcome triggered by the wrong reasons. And it all starts with how abyssmal the Pakistan’s power sector is.

Pakistan’s power problems

Pakistan is a populous country that never managed to build enough power generation capacity to meet its demand. It has always faced a power shortage crisis. Before opening up the sector to public investment in 1994, electricity production in Pakistan was managed entirely by public sector power plants. Many of these plants were outdated, inefficient, and prone to frequent breakdowns, leading to high fuel consumption and unreliable electricity supply.

Then in 1994, it sought to attract foreign investment to establish new power plants with some really questionable promises, like:

guaranteeing them returns in USD, not Pakistani ruppee,

promised full government sovereign guarantees on payments,

locked in capacity payments; meaning producers would be paid for idle capacity even if plants weren’t producing any electricity.

These promises came back to bite them hard. The guaranteed returns in USD backed by sovereign guarantees were absurdly high. Moreover, since they were take-or-pay contracts, Pakistan had to pay even if it didn’t need the electricity. So demand didn’t matter — payment was locked.

And even if, let’s say, none of these generation problems mattered, there was severe underinvestment in transmission and distribution, leading to huge transmission losses.

All of this became the root of Pakistan’s infamous “circular debt” problem.

Power contracts were too expensive for the common man — and that too for a service that still wasn’t reliable, with blackouts being a common sight. Discoms were barely able to recover enough money to pay back power producers, who were “guaranteed” returns. All this while the Pakistan government continued to bail out the discoms.

Consumers were disgruntled, discoms weren’t making money, and the government was basically bankrupt.

This continued until it reached a tipping point for consumers.

Pakistanis were left helpless

Do you remember when Russia first attacked Ukraine and it left the global energy market scrambling? Since most of Pakistan’s fossil fuel is imported, the war-induced supply chain disruptions made it extremely hard for them to get their hands on this fuel. This caused prices to skyrocket. Electricity prices went up in response too.

Moreover, as part of the $6 billion Extended Fund Facility (EFF) program that the IMF was promising to Pakistan, a condition was imposed: increase electricity tariffs. These conditions aimed to address the country's mounting circular debt and ensure the financial viability of its energy sector — something we discussed earlier.

As a result, between 2021 and 2024, electricity tariffs in Pakistan surged by 155%. Funnily enough, it became more expensive to power a house than to rent it.

What would an average Pakistani do in this case, when grid electricity is getting more expensive by the day and has zero reliability? They looked for alternatives — and they found one.

Enters Rooftop Solar

While Pakistanis were suffering through this crisis, the world was enjoying cheap electricity thanks to solar. A global oversupply of solar panels—particularly from China—led to a significant drop in prices, and everybody was benefitting from it.

So the average Pakistani thought: why not? And purely out of survival instinct, we started seeing Pakistanis slowly picking up these panels from the global market. It became a huge demand centre.

By mid-2024, Pakistan had become one of the world’s largest markets for distributed solar energy (read: rooftop solar). Reports indicate that solar panel imports surged to unprecedented levels—roughly 22 gigawatts (GW) of capacity brought in during 2023–24 alone. That’s nearly half of Pakistan’s total installed generation capacity, all because the people decided to take things into their own hands and stop relying on grid electricity.

Besides the obvious economic benefits that triggered this whole shift to rooftop solar, there were also policies in place that incentivized and accelerated it.

First, Pakistan’s 2015 national net metering policy allowed people to sell excess solar power back to the grid at retail rates. So not only could you avoid paying exorbitant electricity rates with your rooftop solar setup—you could actually sell the excess at those same inflated rates. (This, although, has changed now, as the government has slashed the buyback rates.)

Second, there were very few import restrictions on solar panels in Pakistan. While there’s no customs duty, the government did propose an 18% general sales tax on solar panels this year—which was ultimately rejected.

This sets the perfect stage for us to now decode that Reuters headline about the “middle class” suffering.

The Utility Death Spiral and the Collapse of Scale Logic

Here’s the thing: utilities are a business of scale. They work when millions of people are plugged in, consuming power in a predictable, centralized manner. The math is simple—more users spread the fixed costs, making electricity more affordable for everyone.

But when the reverse starts happening—when users leave the grid in droves—the whole model begins to fall apart. That’s what’s happening in Pakistan.

The country’s power sector was already financially crippled, buried under circular debt, unviable take-or-pay contracts, and years of underinvestment in distribution. But rooftop solar has triggered the next phase of the crisis: the collapse of utility logic.

As more households defect to solar—especially the wealthier, higher-paying ones—the burden of paying for the grid’s fixed costs is falling on a shrinking base of poorer consumers. Remember: Pakistan imported 22 GW worth of solar panels in 2023–24 alone—nearly half its total generation capacity. And this shift isn’t theoretical anymore—it’s ripping holes in utility balance sheets.

The invisible price of defection

Let’s revisit something we mentioned earlier: Pakistan’s infamous circular debt problem. The government remains locked into expensive take-or-pay contracts with independent power producers (IPPs)—meaning it has to pay for electricity whether it’s used or not. Even if rooftop solar reduces actual grid consumption, the government still owes the same money to producers.

So when solar users leave the grid, the cost of this unused electricity doesn’t disappear—it simply gets dumped onto whoever’s left behind. That’s usually the poorer households who couldn’t afford solar panels in the first place.

Pakistan’s response: punish solar users

Instead of reforming the utility model, the government has gone after solar users.

In 2025, it slashed net metering buyback rates from Rs 27 per unit to Rs 10 per unit—making it far less profitable to sell excess solar to the grid. And now, they're considering fixed monthly charges for solar users—essentially charging people just to stay connected to the grid, even if they barely use it.

That’s a desperate move. And it’s not unique to Pakistan—California tried this too. Their utilities pushed for "solar taxes" and fixed grid fees to recoup lost revenues. But it backfired—hitting low- and middle-income solar adopters hardest, and stalling the transition.

Who gets punished?

This is where the real inequity kicks in.

Rooftop solar is capital-intensive. Most adopters are upper-income households that can afford the upfront costs. Once installed, they cut their grid bills close to zero. But that leaves the rest—especially middle and lower-income consumers—carrying the entire weight of rising tariffs.

And it’s only going to get worse. The more people leave the grid, the more expensive it becomes for those who stay. This forces even more people to leave—a classic death spiral.

Duttatreya Das from Ember Energy sums it up well:

“Though penetration of rooftop solar can raise concerns around the financials of discoms, these trends are only expected to grow further. The traditional model of discoms—managing electricity supply in a centralized, one-way fashion—will increasingly be questioned. The shift towards a platform operator–based model is inevitable.”

The only way out? Acknowledge that the centralized grid model is dying—and redesign policy for a decentralized, dynamic energy future.

What next?

The current situation is precarious. The very thing that came to save the Pakistan during their energy crisis of 2021, is having second order effects that nobody would have thought.

Not only is that becoming a reason for poor people being forced to pay even higher tariffs, it is putting the power generators of the country is an extremely uncomfortable position where their financial viability has never been worse. And honestly, we are no policy experts, but the possible solutions to these problems are more structural in nature revolving around creating a reliable transmission system, re-neogtiating competitive power contracts or maybe even building utility scale solar plants to socialize their benefits to larger population.

The new vision for copper

Copper again? We know we’ve spoken about copper before time and time again but honestly, there’s no escaping it. The government's ambitious plans for 500 gigawatts of renewable energy by 2030 and 30% electric vehicle adoption mean copper will be everywhere — in wind turbines, solar panels, EV batteries, and charging stations. It is also one of the 24 critical minerals under MMDR Amendment Act, 2023 and important updates keep coming on it which we can’t help but cover.

So with that disclaimer, let’s dive into the Vision Document on Copper Sector released recently by the Ministry of Mines and look at some of the government’s plans on how to ensure we have a continuous supply of this valuable mineral.

The Demand story

Right now, India consumes about 1.7 million tonnes of copper annually. Putting it another way, the average Indian uses just half a kilogram of copper per year compared to a German who uses about 14 kilograms or a South Korean who consumes 11 kilograms.

The document says that’s going to grow and fast. By 2030, copper demand will nearly double to over 3 million tonnes. By 2047, when India celebrates 100 years of independence, the country will need almost 10 million tonnes of copper every year.

This increase in demand seems to closely follow India’s GDP journey as well. Economists measure this relationship using something called "elasticity" and the document tracks it in two phases:

2024-2030

During this period, copper demand has an elasticity of 1.1 to 1.3 relative to GDP growth. This "greater than 1" elasticity means copper demand is growing faster than the overall economy.

Why does this happen?

Think of India today like a house under construction. When you're laying the foundation, installing electrical wiring, and setting up plumbing, you need enormous amounts of materials upfront. Every new power line, metro station, apartment building, and factory requires copper for its electrical systems. India is essentially building its modern infrastructure from scratch - power grids, transportation networks, urban housing, and industrial facilities.

The elasticity above 1.0 reflects what economists call "infrastructure intensity." India is in a "catch-up" phase where copper demand grows disproportionately fast as the country builds the basic infrastructure that developed nations already have.

2030-2047

After 2030, things change fundamentally. The elasticity drops to 0.6-0.7, meaning copper demand is growing slower than the overall economy.

Is this bad news? Not really. This "less than 1" elasticity signals India's transition to a mature economy for three main reasons.

First, by then, the basic infrastructure will largely be complete. You only need to build the electrical grid once. After that, you're mainly maintaining and upgrading it, which requires less copper.

Second, technology becomes more efficient. Electric cars that needed 99 kilograms of copper in 2015 will only need 62 kilograms by 2030 - a 38% reduction per vehicle thanks to better designs, lighter materials, and more efficient motors. Similarly, power transmission systems, electronics, and appliances will require less copper per unit of performance.

Third, recycling starts to matter. By 2030, much of the copper installed in the previous decade will begin reaching its end-of-life and can be recycled, reducing pressure on primary copper demand.

However, even with lower elasticity, India's absolute copper demand will still be enormous because the economy itself will be much larger.

If we look at it in terms of numbers, a 13% increase on today's 1.7 million tonnes means adding about 220,000 tonnes of copper demand in a single year. But a 6% increase on a base of 9 million tonnes in 2047 means adding 540,000 tonnes in that year — more than double the absolute increase, even though the percentage growth is lower.

By 2047, even "slow" growth in copper demand will require adding more new copper capacity each year than India's entire current consumption.

And are we prepared for that? Unfortunately, not really.

The Supply Reality Check

While India dreams big about consumption, it produces remarkably little usable copper itself — only about 509,000 tonnes of refined copper in FY24. To make matters worse, domestic production actually fell — not only from the year before but from 843,000 tonnes in FY18.

Now, it would be unfair of us to point fingers at only India. Supply around the world is tight as every country pursuing green energy and electric mobility is competing for the same finite copper resources. Major discoveries of new copper deposits have become increasingly rare, while existing mines face declining ore quality and rising extraction costs. Environmental regulations are getting stricter. We’ve spoken about this at length previously, looking at the copper value chain and where India stands at each step.

Hindustan Copper Limited stands as India's lone copper miner, scratching out a tiny fraction of what the nation needs from mines in Rajasthan, Madhya Pradesh, and Jharkhand. To bridge this massive gap, India imports over 1 million tonnes of copper concentrate annually, and even more in refined copper and scrap, making the country dependent on foreign sources for more than 90% of its copper requirements.

Beyond the magnitude of imports, the concentration in the geographies from where we import raises concerns too.

About two-thirds of the country's copper imports — the raw material that feeds Indian smelters — comes from just three countries: Chile, Peru, and Indonesia. This concentration makes India vulnerable to policy changes, political instability, or simple business decisions in these distant nations. When Indonesia recently banned copper concentrate exports to boost its domestic industry, India had to scramble for alternative sources.

India’s dependency on copper imports has predictably created a growing financial burden. India's copper trade deficit has ballooned from $760 million in 2017 to a staggering $6 billion in 2023. Every time copper prices spike on international markets, India feels the pressure in its foreign exchange reserves.

Building India's Copper Infrastructure

So clearly there are problems and it appears the government has been looking. In the Vision document, the Ministry of Mines has come up with some strategies to support and boost India’s domestic supply of copper.

The document lays out how the Exploration License system, introduced all the way back in 2023, should be implemented.

Instead of waiting for government agencies to find mineral deposits, private companies can now bid for exploration rights across vast areas. The license grants exclusive rights to explore blocks up to 1,000 square kilometers for three years, with the possibility of extending for two more years.This shift could help unlock deep-seated minerals like copper that have remained underexplored because government agencies simply don't have enough resources or capacity to search everywhere.

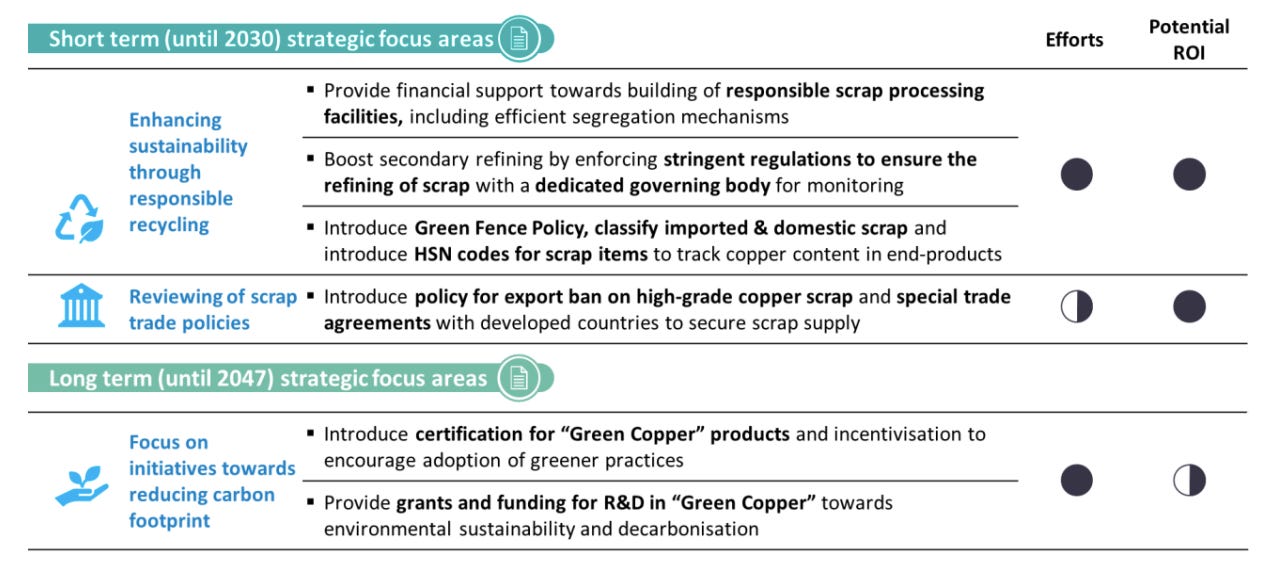

The government is also pushing for a recycling revolution. About 38% of India's current copper consumption comes from melting down scrap metal — old cables, pipes, electronic waste, and industrial offcuts. But most of this happens in the informal sector, with limited quality control and environmental oversight. The document consolidates them into a policy roadmap with new regulations to formalize this market, improve standards, and dramatically increase recycling capacity.

The Reverse Charge Mechanism, introduced in 2024, requires buyers of scrap metal to pay taxes directly to the government instead of trusting sellers to do it. Quality Control Orders mandate that specific copper products meet Indian standards and carry certification marks, gradually pushing out substandard imports and building confidence in domestic production.

The government is also considering restrictions on exporting high-grade copper scrap. Currently, India exports some of its best scrap to countries with superior recycling technologies. By keeping this material within India, the country can reduce its dependence on virgin copper imports. This could also add to a Strategic Copper Reserve — similar in idea to India’s petroleum reserves. The document suggests this in the form of physical stockpiles or secondary reserves to prepare for global supply shocks and price spikes.

But the government recognizes that domestic production alone cannot meet India's copper needs. Learning from China — which has spent $16 billion since 2010 acquiring stakes in copper mines worldwide — India is pursuing overseas copper assets aggressively. India's KABIL (Khanij Bidesh India Limited) is tasked with similar acquisitions, though it's starting much later in the game.

The diplomatic dimension is equally important. India is negotiating specific copper clauses in trade agreements with Chile, Peru, and Australia — the world's top copper producers.

Through all this, the government’s aim is clear and ambitious: add 1 million tonnes of new capacity by 2030, then another 3.5 million tonnes by 2047. It's like building an entirely new copper industry from scratch while the existing one continues to operate.

But it isn’t just the government working towards this. Private companies are playing a huge part. Leading this charge is Adani Group, which has committed $1.2 billion to build what will become the world's largest single-location copper smelter in Gujarat's Mundra port. When fully completed, this facility alone will double India's copper refining capacity.

But Adani isn't alone in this race. Hindalco is expanding its existing operations while investing heavily in recycling technologies. Vedanta is working to restart operations and expand across multiple states. JSW Group has announced plans for a massive 500,000-tonne facility in Odisha. These companies are betting billions in the hope that India’s growing copper appetite will eventually pay their investments back.

The Bottom Line

Looking towards 2047, India's copper story is ultimately about transformation. From a country that struggles to meet its copper needs domestically, India aims to become a processing powerhouse that not only serves its own massive demand but potentially exports value-added copper products to neighboring countries. It's an ambitious vision but only time will tell how the results will play out.

Tidbits

We’ve written about nuclear energy several times, because it’s absolutely fascinating. And increasingly important, as we can see through the latest update.

The Indian government is planning major changes to its nuclear power laws—like the Atomic Energy Act and liability norms—to let private companies handle areas now controlled by the state, such as mining, exploration, and fuel fabrication.(Source)

Rare earths may be rare but our stories and the updates on it are not.

India has moved imports of gold compounds — used in tiny but essential parts of electronics like circuit boards and semiconductors — from an unrestricted to a restricted category, causing customs delays. This new restriction comes on top of earlier China-led curbs on rare-earth magnets and could potentially disrupt India’s “Make in India” electronics growth plans.

(Source)We covered Samsung’s legal dispute with the Indian government over its e-waste rules and it looks like they have company now.

U.S. air‑conditioning firm Carrier’s Indian unit has joined Samsung, LG, Daikin, Voltas and others in suing the Indian government over new e‑waste rules that mandate higher recycling fees per kilogram. The companies argue the ₹22/kg minimum charge unfairly raises costs, while the government says it's needed to boost formal recycling and tackle India's growing e‑waste problem.

(Source)Reliance Retail has picked up a minority stake in UK-based skincare and facial fitness brand FaceGym. As part of the deal, it plans to launch FaceGym studios and set up dedicated sections in its Tira beauty stores across India over the next few years.

(Source)

- This edition of the newsletter was written by Kashish and Prerana.

📚Join our book club

We've started a book club where we meet each week in JP Nagar, Bangalore to read and talk about books we find fascinating.

If you think you’d be serious about this and would like to join us, we'd love to have you along! Join in here.

🧑🏻💻Have you checked out The Chatter?

Every week we listen to the big Indian earnings calls—Reliance, HDFC Bank, even the smaller logistics firms—and copy the full transcripts. Then we bin the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

“What the hell is happening?”

We've been thinking a lot about how to make sense of a world that feels increasingly unhinged - where everything seems to be happening at once and our usual frameworks for understanding reality feel completely inadequate. This week, we dove deep into three massive shifts reshaping our world, using what historian Adam Tooze calls "polycrisis" thinking to connect the dots.

Frames for a Fractured Reality - We're struggling to understand the present not from ignorance, but from poverty of frames - the mental shortcuts we use to make sense of chaos. Historian Adam Tooze's "polycrisis" concept captures our moment of multiple interlocking crises better than traditional analytical frameworks.

The Hidden Financial System - A $113 trillion FX swap market operates off-balance-sheet, creating systemic risks regulators barely understand. Currency hedging by global insurers has fundamentally changed how financial crises spread worldwide.

AI and Human Identity - We're facing humanity's most profound identity crisis as AI matches our cognitive abilities. Using "disruption by default" as a frame, we assume AI reshapes everything rather than living in denial about job displacement that's already happening.

Subscribe to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Thank you for reading. Do share this with your friends and make them as smart as you are 😉