Why India Is Betting Big on E-Buses!

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and watch the videos on YouTube. You can also watch The Daily Brief in Hindi.

In today’s edition of The Daily Brief:

India’s getting serious about electric buses

Understanding India’s Mutual Fund journey

India’s getting serious about electric buses

After years of hype, doesn’t it look like we’re finally getting the promised electric vehicle (EV) boom? Everyone from your colleagues to your thrice-removed uncle seems to have opinions on everything from Teslas to Tata Nexons to electric scooters. But there's a massive gap hiding in plain sight: when we talk about vehicle electrification, very little of the conversation seems to involve commercial vehicles (CVs).

That’s funny, because trucks and buses — despite making up less than 8% of vehicles (and that’s after excluding two- and three-wheelers) — are responsible for over 35% of direct CO₂ emissions from road transport. If we’re serious about tackling emissions, buses and trucks can't sit this conversation out.

Now, a couple of recent research reports got us thinking about electric buses or "e-buses". This is a space that deserves special attention. There’s tremendous scope for us to increase our e-bus fleet, and this segment is seeing a significant governmental push. At the same time, it faces its own unique challenges.

So, can we electrify our e-bus fleet? Who might lead this charge? And why are we falling behind so far? Let’s dive in.

E-buses the world over

But before we get into India's story, let's first glance at the global landscape.

Amongst commercial vehicles, buses are leading the charge (pun unintended) towards electrification. It’s easy to see why. For one, buses run on predictable schedules along fixed routes. You can plan for charging times as part of your bus schedule. You’re also more likely to get the long-term investments you need into place. Unlike trucks, it’s governments that foot much of the bill for bus electrification — either through subsidies or because they run transport networks. They can thus think long-term and have more financial legroom.

The results are evident. Globally, e-bus sales are way ahead of trucks sales. Some European countries, like Belgium, Norway, and Switzerland, have already electrified more than half of their bus fleets. So has China.

China is an interesting case. While it is rich, industrialised countries, by and large, that have moved towards electrification, China was an early mover. It electrified a large part of its bus fleet much earlier in its economic journey. In fact, for many years, e-bus sales were practically synonymous with China. Back in 2020, in fact, it made up about 90% of global electric bus sales! However, by 2023, their share dropped to 60% — not because others caught up dramatically but mainly because China's domestic demand slowed. This was partly because the country cut subsidies but also because it already had a massive electric fleet by then.

But here's a twist: while China's internal market cooled down, it still had a lot of manufacturing capacity. And so, those buses were routed abroad. Chinese manufacturers like BYD and Yutong actually increased their exports significantly, dominating markets like Latin America (85% market share) and even carving out about 30% of the European market.

What about India?

This brings us neatly to India. Unlike Europe and Latin America, India isn't heavily dependent on imports for e-buses. In fact, we have a robust manufacturing base right here.

According to CareEdge, just five Indian companies – Tata Motors, Olectra, JBM, PMI, and Switch Mobility – held 88% of India’s e-bus market share in FY24. Between themselves, they have the capacity to make 40,500 e-buses per year. To put that in context, we currently have around 11,000 total e-buses in operation.

This number, though, is changing rapidly. Sales volumes have grown dramatically of late. In 2024 alone, we saw a whopping 81% jump — to 3,516 units.

By FY27, CareEdge expects the annual sales volume to exceed 17,000 e-buses — around 15% of all the buses sold in India. While that’s a dramatic jump to project in just three years’ time, even directionally, it seems like India is set for more electrification. Clearly, domestic capacity is not a bottleneck. But then, what is?

What’s stopping e-Bus adoption in India?

Most of India's bus demand still comes from State Transport Undertakings (STUs). And those, sadly, have notoriously fragile finances. Sadly, this is a perennial problem for government corporations — it simply isn’t easy to provide public services while also maintaining good financial health. Those two goals often clash head-on.

Now, over the long run, Electric buses make economic sense. That is, their total cost of ownership (TCO) is less than that of a regular diesel-powered bus. ‘TCO’ includes all costs associated with owning and operating a bus over its lifetime, including purchase price, fuel or electricity costs, maintenance, and operational expenses. The TCO for AC e-buses is nearly 15-20% lower than AC diesel buses over 12 years. In theory, this makes e-buses an attractive proposition.

But here’s the catch: You only see the benefits of lower costs over a bus’s lifetime. However, the math isn’t that favourable when you're making immediate purchasing decisions. The upfront cost for an e-bus is around 30% to 70% higher compared to diesel buses, according to the IEA. These high one-time costs immediately hit the budget of an STU, instead of small, recurring costs that are paid out over years. This is, arguably, why STUs are hesitant to invest in these buses.

Recognizing these immediate financing challenges, the government has rolled out multiple initiatives to boost e-bus adoption. From FY15 till now, the government has committed over ₹28,216 crore across several major schemes:

FAME I: ₹280 crore for 425 e-buses

FAME II: ₹3,435 crore for 6,862 e-buses

PM-eBus Sewa: ₹20,000 crore to deploy 10,000 e-buses

PM Electric Drive Revolution in Innovative Vehicle Enhancement (E-DRIVE): ₹4,391 crore for 14,028 e-buses

Clearly, the central government is using subsidies to ease the headache of STUs in a bid to ramp up electric mobility significantly as part of public transportation.

But beyond straightforward subsidies, the real game-changer has been the introduction of the ‘Gross Cost Contract’ (GCC) model. In this model, STUs don’t buy buses on their own books. Instead, they lease them from private operators or from the Original Equipment Manufacturers (OEMs) themselves, who manage everything from purchase to maintenance. These operators are paid per kilometer, significantly reducing financial pressure on STUs.

However, operators and OEMs hesitate to enter such agreements because they still worry about STUs defaulting on payments. To ease these fears, the government introduced the ‘Payment Security Mechanism’ (PSM). This sets up a mechanism to ensure that payments aren’t held up because of STU delays. Essentially, if an STU signs up with this scheme, it assures operators that they will be paid their due, no matter what. If the STU themselves don't pay, operators may instead request Convergence Energy Services Limited (CESL), a government entity, to step in instead. That ensures that they’re made good. Instead, STUs then owe CESL the money.

Here’s the interesting bit: if the STU doesn’t pay CESL, it can ask the RBI to directly deduct payments from state government accounts. So, in essence, it’s much harder for STUs to dodge payments if they sign up for this scheme.

All of this essentially guarantees any demand from public STUs, backed not by pure market dynamics but strong policy support. This could possibly nudge private entities to purchase e-buses, which they would then rent out to the government — creating a new source of demand while easing the pressure on the books of STUs.

The Way Ahead?

Electrifying our bus fleets makes clear economic and environmental sense. Yet, adoption won't just happen automatically. Buses are huge investments, and in a poor country like India, there’s no guarantee that you can run a financially viable enterprise with them — especially when most bus transport is state-owned.

This is why the government is stepping in. Just as China’s early adoption of electric buses required heavy government intervention and structured policies, India's journey is also heavily shaped by active government efforts. That intervention was successful in China — it is now a global success story for electric buses, and the country has now moved on to electrifying other segments. India, meanwhile, is still writing its own chapter.

It will be fascinating to watch whether India can replicate China’s success with these policy-driven efforts or if hidden pitfalls still remain.

Understanding India’s Mutual Fund journey

Recently, CRISIL and AMFI came out with a very interesting report, which gives you a great sense of how the mutual funds business is doing. Now, this is the sort of stuff that we really care about at Zerodha — this is our bread-and-butter, after all. But this isn’t merely interesting to a broker.

Because here’s the thing: India’s capital markets have seen a sea change in the last few years. We, here, are part of the same story — but we’re only a tiny part of it. Across our country, there is a growing recognition that capital markets are a good place to build long-term wealth.

That’s really the single largest takeaway from this report: India is maturing as an investing culture. More Indians are investing than ever — and they’re feeding more money into our capital markets than ever. Our investment base is expanding and growing both deeper and wider. Indians are becoming more resilient and disciplined with how we invest. These are the stories we’re going to look at today.

Here’s one caveat, though: a lot of this data ends in March 2024. That was back when India’s markets were still buoyant, and people were rushing to get in on the action. We’re past that phase now. In the months since, the market has become considerably more pessimistic.

The remarkable growth of Indian mutual funds

The report points to the remarkable growth of A decade or two ago, mutual funds were a relatively small segment of the financial market. We’ve all seen it turn into a powerful force right before our eyes, over a decade of “Mutual fund sahi hai” ads. But even so, the numbers are sincerely incredible.

Consider this: in 2024, the total money managed by Indian mutual funds was nine times as much as it was in 2008. It currently stands at an impressive ₹53.40 lakh crore. Back in 2008, it was managing about ₹5.89 lakh crore — a fraction of its current size.

While this growth is impressive in absolute terms, equally impressive is just how important mutual funds have become to India's economy. In FY 2024, mutual fund investments amounted to 18.2% of India's GDP — the highest level ever recorded. This means that for every ₹100 of goods and services produced in India, more than ₹18 was invested in mutual funds.

Behind all this is a big shift: Indians are increasingly trusting equity mutual funds with their money. Equity funds now manage 44% of all mutual fund assets. This is largely a post-COVID era phenomenon — back in 2019, for instance, equity just made for 30% of mutual fund AUMs. Indian investors, clearly, have grown enormously in their confidence in the stock market as a way to build wealth. That said, we’ve just seen our first serious market downturn in many years. We aren’t sure how that changes people’s preferences.

Indians are building an investing culture

Retail investors have been a major engine behind this remarkable growth. Between 2019 and 2024, the share of retail investors in the industry’s AUMs increased significantly — from 19.8% to 27.9%. Clearly, an increasing number of regular people are taking to mutual funds.

Behind this, perhaps, is the fact that the number of India’s unique investors has more than doubled over these five years. It isn’t a surprise to us that more Indians are investing — we’ve seen it first-hand, after all. But the numbers are still astounding.

Investing is also penetrating deeper into India. A majority of India’s investing activity traditionally comes from its top 30 cities. But over the last five years, other cities have increased their presence in the markets substantially.

In fact, a lot of this growth has come from cities well outside India’s top 100 cities.

This shows up in something that’s been in the news for a long time — that over the last few years, domestic mutual funds have slowly increased their ownership in India’s listed companies, even as the share held by foreign investors has declined.

More women are investing than ever

As investing grows roots into Indian culture, it is also spreading to people that would traditionally sit outside the markets — such as women.

In the last five years, the AUM of women investors more than doubled, from ₹4.59 lakh crore in March 2019 to ₹11.25 lakh crore. One-third of all the money held by individual investors in mutual funds now belongs to women.

Interestingly, women make up around a quarter of all individual investors in India.

Their higher investment share, then, suggests that the average woman who does invest in mutual funds puts in more money than men do.

This gap continues to grow. Women have increased the ticket size of their investments far more aggressively than men over the last five years. Their average folio size has grown by 23% between Fiscal 2019 and 2024 — compared to 5% for men.

The rise in investor discipline

This isn’t just a story about a rise in the absolute numbers of India’s investors, though — that’s hardly a surprise. More interestingly, as more Indians join the stock market, the way we invest has also changed. For all the discussion on how wild the Indian markets were, arguably, we’re actually showing signs of maturity, investing like people from more developed financial markets.

This shows up in a few things: in the number of people that are embracing SIPs, those that are taking to passive funds, and those that are willing to hold on through a downturn.

People like SIPs

Systematic Investment Plans are slowly becoming India's favorite investment method. Over the past five years, SIP assets under management have quadrupled — from ₹2.66 lakh crore in March 2019 to ₹10.62 lakh crore by March 2024. Millions of Indians are embracing disciplined, regular investing.

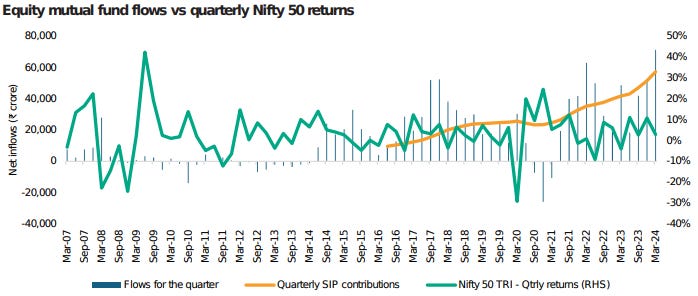

This growth is powered, to a great extent, by monthly SIP contributions. These have surged more than six-fold since 2016, from ₹3,122 crore to ₹19,270 crore per month by March 2024. A lot of this rise has come in the years after COVID.

People are becoming more resilient

Here’s something even more interesting, particularly in a time like today, when there’s so much discussion online about how one should stop their SIPs. Indian investors are learning to show greater resilience.

Unlike before, mutual fund inflows don’t seem to be impacted all that much by market downturns. A large number of investors, in fact, might actually see these as opportunities to invest further. Consider this: in March 2008, when markets saw a one-month decline of 9.3%, there was also a 10.3% drop in net flows into equity funds. In March 2020, in contrast, the markets dropped by 23%, but equity mutual fund inflows went up — by 8.6%!

This shows up in SIPs, too. People aren’t simply starting SIPs — people are holding on to them. The share of SIP investments held for over five years has nearly doubled in the last five years, from 12% in 2019 to 21% in 2024. Clearly, an increasing number of investors are committing to long-term wealth creation.

Passive investing booms

Just like in mature markets like the United States, an increasing portion of Indians are now putting their money in passive funds — side-stepping active management. In fact, passive funds saw their assets grow by over six times in just the five years between 2019 and 2024. That is, the AUMs of passive funds are growing at a CAGR of a ridiculous 44%. Clearly, a lot of the global conversation around the superiority of straightforward, low-cost options has penetrated into India as well.

Roughly speaking, five years ago, passive funds got one in every 17 Rupees that were invested in mutual funds. Now, they get one in every 6.

This money, a lot like that of more mature markets, is increasingly going into index funds. Consider this: the AUM of money going into index funds via SIPs has grown 29x in the last five years.

Interestingly, it is HNIs that have led this charge. HNI AUMs in passive funds grew by a mind-boggling 56x between 2019 and 2024. A lot of this money, it seems, has gone into ETFs.

Post-COVID: A sea change in India’s investing climate

This is, frankly, just a small sampling of everything the report talks about. This piece could easily have been five times as long as it is, given all the data the report contains.

But all in all, this should give you a sense of one thing: that India’s capital markets, since the COVID-19 pandemic, have transformed dramatically. They’re now far larger and more active than they have ever been. Bhuvan’s written about this before, in great detail.

People often see this as a negative thing — that there’s speculative froth in the market, and people are losing money. Certainly, that’s part of what is happening. But speculation and investment go hand-in-hand. As these bits of data tell you, there’s another side to the story. Indians are also learning to invest responsibly. They’re learning to take responsible risks, maintain financial discipline, and stay resilient in the face of uncertainty. This is, all in all, fantastic news. It’s a clear sign that we’re maturing as an economy.

Tidbits

India’s retail inflation fell to a seven-month low of 3.61% in February, driven by a sharp decline in food inflation to 3.75% from 6% in January. Vegetable prices dropped 1.07%, pulses 0.35%, and eggs 3.01%, while edible oils surged 16.36% and fruits rose 14.82%. Rural inflation declined to 3.79% from 4.59%, and urban inflation eased to 3.32% from 3.87%. Meanwhile, industrial output growth surged to 5.01% in January, led by a 5.5% rise in manufacturing. However, capital goods and consumer durables saw slower growth at 7.8% and 7.2%, respectively.

India’s sugar production for 2024-25 is now projected at 26.4 million tonnes, down from the earlier estimate of 27.2 million tonnes due to lower recovery in Uttar Pradesh and reduced output in Maharashtra. However, with a high opening stock of 8 million tonnes and a closing stock of 5.4 million tonnes (exceeding the two-month buffer of 4.5 million tonnes), no supply shortage is expected. Ethanol diversion has been revised to 3.5 million tonnes from 3.7 million tonnes. Retail sugar prices have gradually risen, with the all-India average at ₹44.87/kg in 2024-25 (up from ₹42.24/kg in 2022-23).

India and Mauritius elevated their partnership with eight agreements, strengthening trade, maritime security, and financial collaboration. The deal includes cross-border transactions in national currencies, reducing reliance on the US dollar, and maritime data sharing to enhance regional security. PM Modi, attending Mauritius' National Day as chief guest, launched MAHASAGAR (Mutual and Holistic Advancement for Security and Growth Across Regions), expanding on the SAGAR policy introduced in 2015.

- This edition of the newsletter was written by Kashish and Pranav

🌱Have you checked out One Thing We Learned?

It's a new side-project by our writing team, and even if we say so ourselves, it's fascinating in a weird but wonderful way. Every day, we chase a random fascination of ours and write about it. That's all. It's chaotic, it's unpolished - but it's honest.

So far, we've written about everything from India's state capacity to bathroom singing to protein, to Russian Gulags, to whether AI will kill us all. Check it out if you're looking for a fascinating new rabbit hole to go down!

Subscribe to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Thank you for reading. Do share this with your friends and make them as smart as you are 😉