What 2025 Holds for India’s Economy and Markets

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and videos on YouTube. You can also watch The Daily Brief in Hindi.

In today’s edition of The Daily Brief:

India’s Fiscal Deficit Story: Survival, Strategy, and Growth

India in 2025: Growth, Risks, and Investment Opportunities

India’s Fiscal Deficit Story: Survival, Strategy, and Growth

In today’s first story, we’re diving into a topic that’s been making headlines: India’s fiscal deficit. If that sounds unfamiliar, don’t worry—by the time we’re done, it’ll feel much simpler.

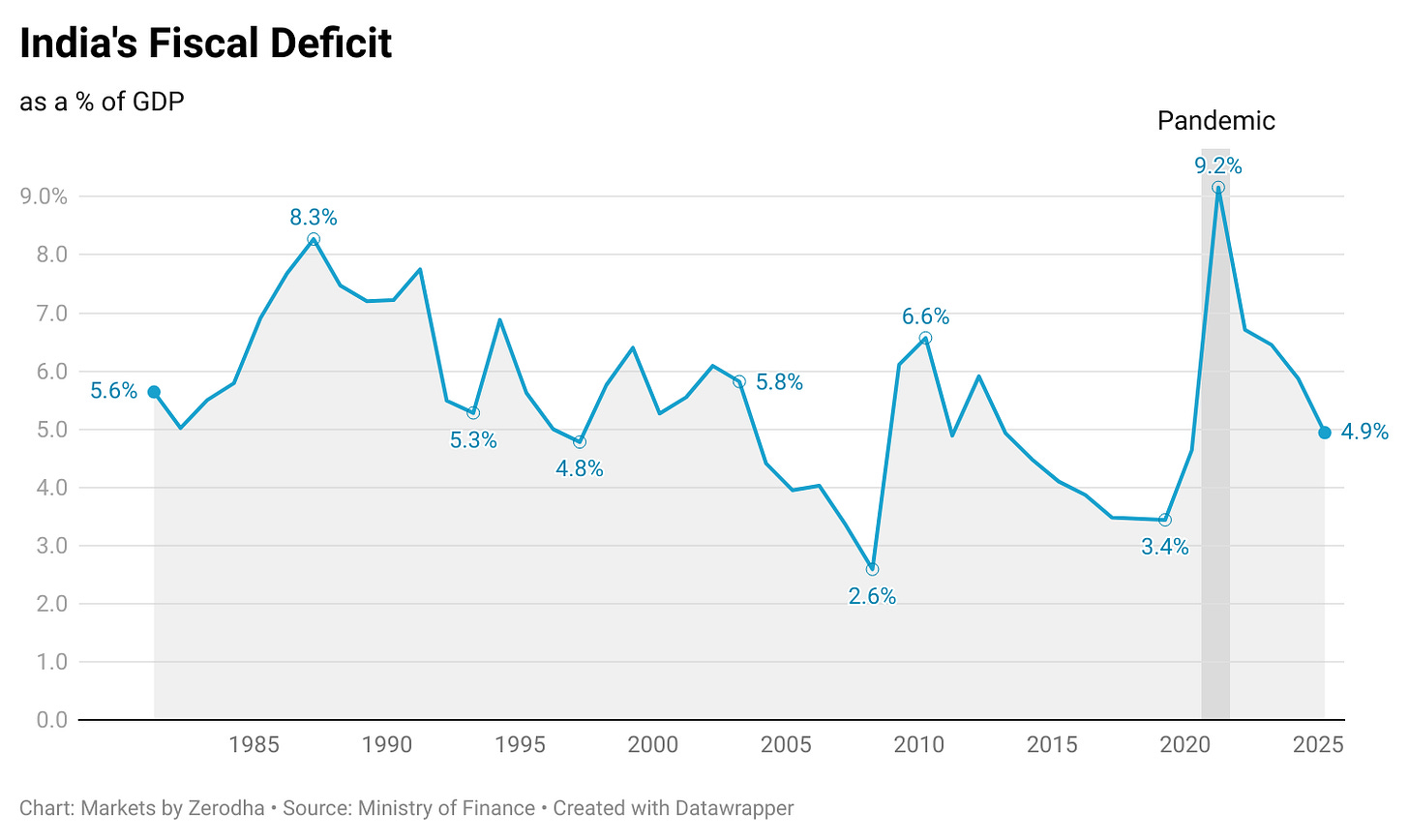

India’s fiscal deficit—basically the gap between how much the government spends and how much it earns—hit a record 9.2% of the country’s GDP during the pandemic. That’s the highest it’s been in decades. Think of it like this: running a household budget where ₹100 comes in every month, but you spend ₹120. You’d have to borrow the extra ₹20 to make up the difference, right? That’s essentially what happens when a government spends more than it earns.

Now, 9.2% might sound pretty alarming. It raises questions like: Why did the government let the deficit grow so much? Does this mean India’s economy is in big trouble? Let’s break it down step by step and get some clarity.

Let’s first understand what a fiscal deficit is and why it matters.

Governments earn money mostly through taxes—like income tax, GST, and corporate tax. They use this money to run the country, funding things like building roads, paying salaries, and supporting schools. But when the government spends more than it earns, it has to borrow to cover the gap. That borrowing is called the fiscal deficit.

A small deficit is normal. Most countries have one because it’s tough to match spending and earnings perfectly. But when the deficit gets too big, it can lead to problems like inflation, higher borrowing costs, or even a debt crisis. It’s a bit like managing a credit card. Borrowing for something useful, like education, can be a smart move if it pays off later. But borrowing too much for things that don’t add value can land you in trouble.

So, why did India’s deficit grow so much?

The pandemic is the main reason. COVID-19 didn’t just slow the economy—it brought the world to a standstill. Businesses closed, jobs were lost, and economic activity froze. Governments everywhere had to step up and spend heavily to support people and businesses through the crisis.

In India, the government focused on critical areas like:

Healthcare: Building hospitals, boosting medical infrastructure, and providing vaccines.

Food distribution: Making sure no one went hungry during lockdowns.

Direct cash transfers: Sending money directly to those who needed it most.

Employment programs: Expanding initiatives like MGNREGA to create work opportunities in rural areas.

Economists call this kind of approach counter-cyclical fiscal policy. When businesses and people stop spending, the government steps in to fill the gap by spending more. Without this kind of intervention, the economic damage could have been far worse.

Here’s the key point: not all deficits are bad. What really matters is how the borrowed money is used.

Good Deficits: If the government borrows to invest in things like roads, railways, or power plants, it’s creating something valuable. These are productive assets that generate jobs, improve efficiency, and help the economy grow over time. Economists call this capital formation.

Bad Deficits: On the other hand, if borrowed money is spent on things that don’t have lasting benefits—like excessive subsidies or poorly planned welfare programs—it can cause problems. This kind of spending increases debt without helping the economy grow in the long run.

India’s pandemic spending found a balance. While a large part of it went toward immediate relief—like food distribution and direct cash transfers—a good portion was also invested in infrastructure. For example:

The government-funded projects to develop roads and railways.

States received funds to carry out their own development programs.

This focus on long-term investments helped support the economy during the pandemic and laid the foundation for growth in the years ahead.

Now, some countries—like Greece—have faced serious trouble with high deficits in the past. Problems like inflation, falling currency values, and overwhelming debt left their economies struggling. So why hasn’t India faced the same issues?

Here are three key reasons:

Domestic Debt Financing: Most of India’s debt is owed to domestic lenders—like banks, insurance companies, and citizens—rather than foreign investors. This keeps things more stable because there’s less risk of currency devaluation or sudden demands from overseas lenders.

Strong Financial Markets: India’s financial system has enough funds to handle government borrowing. In some advanced economies, heavy government borrowing makes loans expensive for businesses, which can hurt private investment. But India has avoided this issue so far.

Growing Out of Debt: India’s economy is growing faster than the interest rates on its debt. This means the country can manage its debt as long as economic growth stays ahead of borrowing costs.

A study by the National Institute of Public Finance and Policy (NIPFP) explains why India’s fiscal deficit hasn’t caused major disruptions:

Minimal Impact on Interest Rates: In India, the fiscal deficit hasn’t led to a big jump in borrowing costs, unlike in some countries. Instead, factors like inflation expectations and global capital flows play a bigger role in deciding interest rates.

RBI’s Role in Stability: The Reserve Bank of India (RBI) stepped up to keep the financial system stable. It:

Kept short-term interest rates low to encourage borrowing.

Used tools like the Variable Rate Reverse Repo (VRRR) and Operation Twist to control long-term borrowing costs.

These measures allowed the government to borrow what it needed without disrupting financial markets or pushing private businesses out of the lending space.

While India’s fiscal management during the pandemic was impressive, we can’t ignore deficits forever. High deficits can strain public finances if left unchecked. The solution? Focus on investments that truly add value—like better infrastructure, education, and healthcare—so they contribute to long-term growth.

India’s fiscal deficit during the pandemic wasn’t a disaster. It was a well-planned response to an unprecedented crisis. With smart management and built-in structural advantages, the country avoided many problems that others faced. But, like fire, deficits need to be handled carefully. They can be helpful when controlled but harmful if left unchecked.

Looking ahead, India’s challenge is clear: stay disciplined with spending while investing in areas that will keep the economy growing and stable for years to come.

India in 2025: Growth, Risks, and Investment Opportunities

Every December, banks and investment firms release their big predictions for the year ahead. These reports, often titled “Investment Outlooks,” are a bit like horoscopes for the economy—interesting, sometimes helpful, but often way off the mark. While they don’t always get it right, these reports are valuable for two reasons: they pull together useful data and give us insight into what most investors and analysts—the “herd”—are thinking.

Today, let’s dig into what some big players like Goldman Sachs, UBS, Axis Bank, and Franklin Templeton are forecasting for India in 2025. We’ll break it down step by step, looking at GDP growth, corporate earnings, inflation, valuations, and even the potential impact of global events like Donald Trump’s influence on trade.

Let’s start with the big one—GDP growth. This is essentially how much the economy is expected to grow. Most banks predict India’s growth for the financial year 2025-26 (FY26) will be around 6.5% to 7%. That’s solid, but nothing extraordinary for India. Goldman Sachs is a bit more cautious, estimating growth at 6.3%, and here’s why:

Public Spending Is Slowing: From 2021 to 2024, government spending grew rapidly—about 30% year-on-year. But in 2025, it’s expected to barely grow in the single digits. That’s a significant drop, and it’s showing in the numbers.

Credit Growth Is Cooling Off: The growth in loans given by banks slowed from 16% in the first quarter of CY 2024 to 12.8% by October 2024. What caused this? The Reserve Bank of India (RBI) has been tightening rules on unsecured loans (like personal loans) since late 2023 to reduce risks. We’re now starting to see the impact of those changes.

It’s not all bad news—there are some bright spots that could help keep India’s economy steady:

State Welfare Schemes: In recent years, Indian states have introduced large income transfer programs for women. These schemes now transfer about ₹2 trillion annually—roughly 0.6% of India’s GDP—to around 134 million women. Research from Axis Bank shows that these programs are boosting household spending by 7–45% in the target groups. That’s a big push for consumption, and it’s not getting the attention it deserves.

Now, let’s talk about corporate earnings—how much money companies are making. This is a key indicator of market health, and here’s what the outlook looks like:

Top Companies: Standard Chartered Bank expects earnings for the Nifty 50 (India’s top 50 companies) to grow by 7% in FY25, then pick up to 14% in FY26 and 12% in FY27.

Mid and Small-Cap Companies: These companies are predicted to do even better, with earnings growth of 27% and 25%, respectively, in FY26.

Goldman Sachs’ View: Goldman Sachs is slightly more cautious. They expect earnings for MSCI India (another market index) to grow by 12% in 2024 and 13% in 2025, which is a bit lower than most other analysts’ expectations of 13% and 16%.

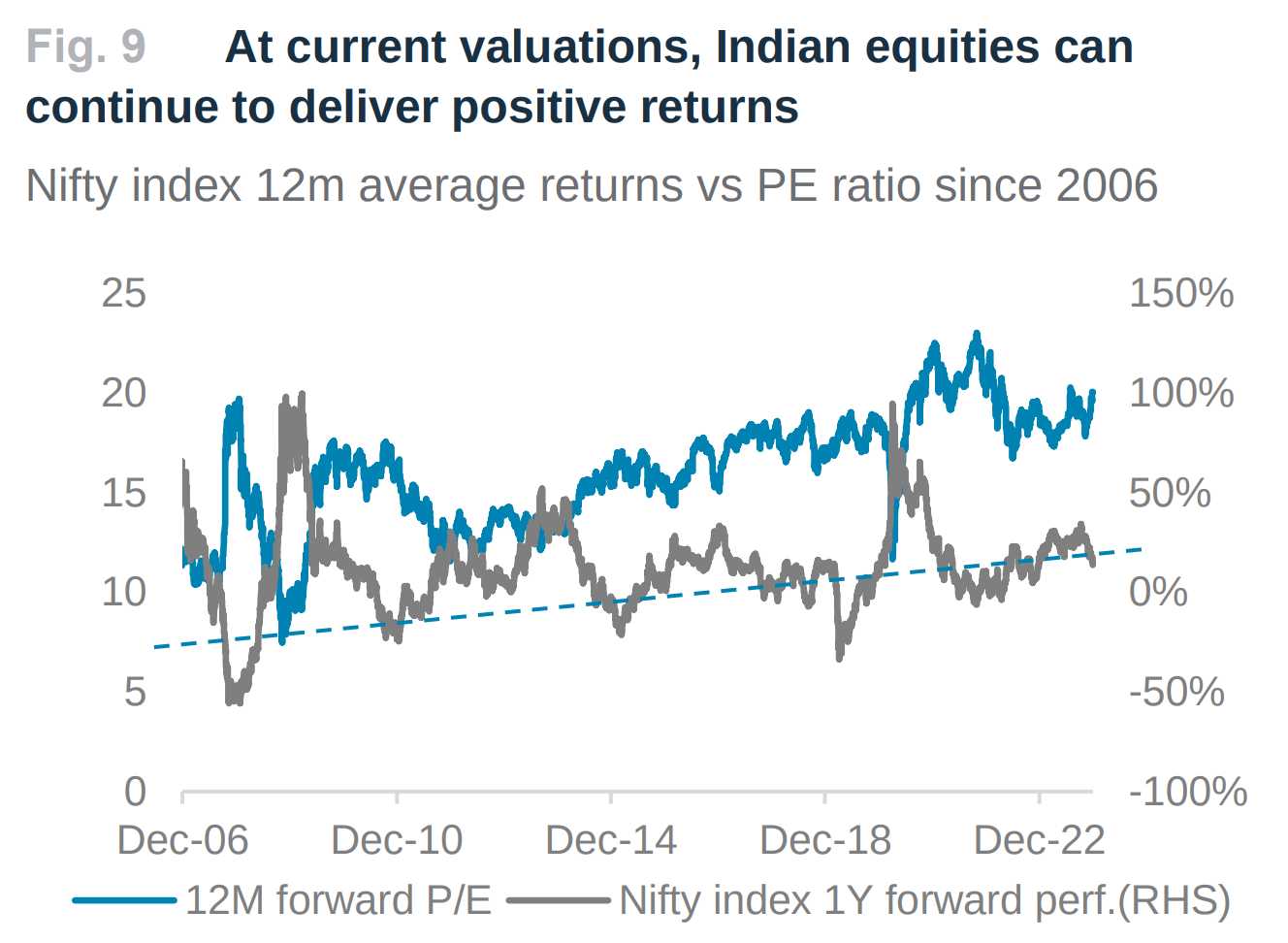

What about valuations—how expensive stocks are compared to earnings? Right now, the Nifty 50 is trading at a forward price-to-earnings (P/E) ratio of 20.2x. That’s below its recent peak of 23x but still higher than the long-term average of 18.2x.

Goldman Sachs believes the Nifty could reach 27,000 by the end of 2025, but they caution that the road might be a bit bumpy. Why? It might take time for stock valuations to catch up with earnings growth.

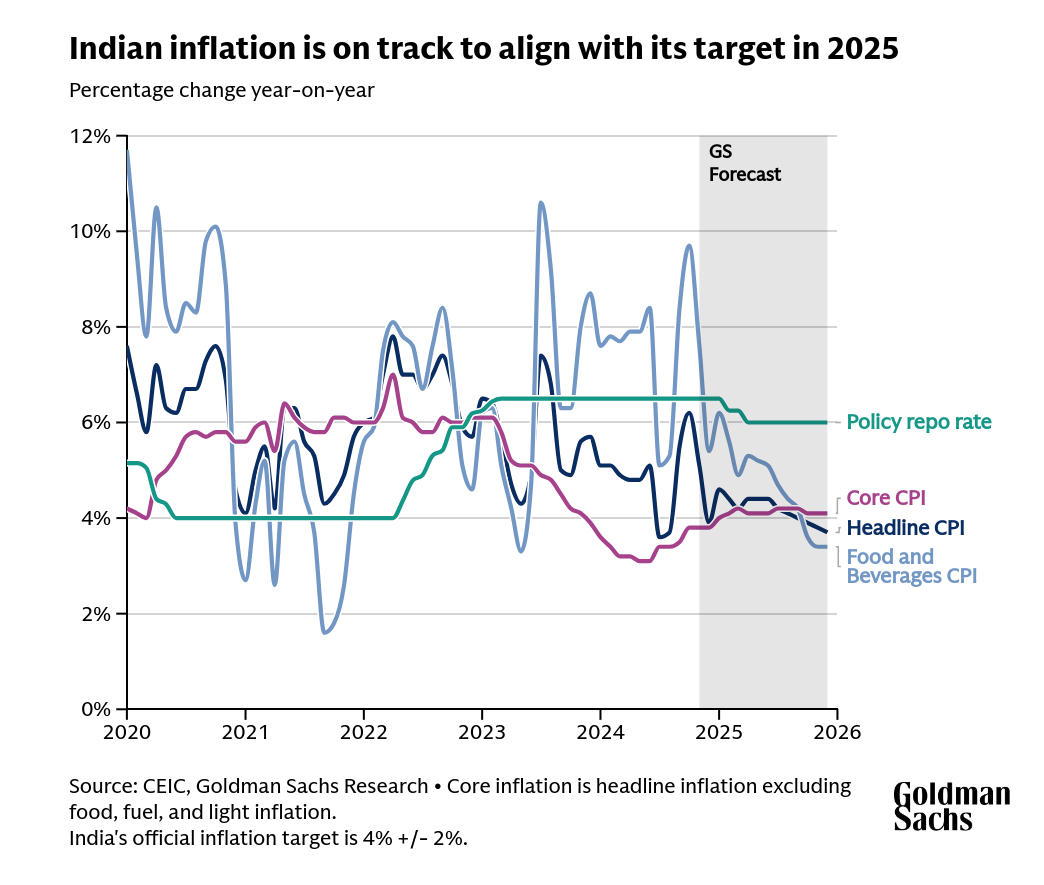

What about interest rates? Most banks think the RBI will start cutting rates in 2025, but they expect the cuts to be small.

Standard Chartered’s Prediction: They foresee a “shallow” rate cut cycle, with rates dropping by around 50–75 basis points (0.5–0.75%) starting in the first quarter of 2025.

Why the Caution? Inflation is still a concern, and if the economy picks up slightly, the RBI may have limited room to lower rates further.

On the bond side, government bond yields are expected to stay between 6.5% and 6.75%. This could make high-quality corporate bonds an attractive choice for investors.

Now, let’s talk about where money might flow in 2025. Franklin Templeton is optimistic about three key sectors:

Banks: With strong growth and relatively affordable valuations, they seem like a safe bet.

Consumer Companies: A trend called “premiumisation”—where people buy more expensive goods—is driving profits in this sector.

Auto: The growing popularity of SUVs shows that Indian consumers are upgrading their spending habits.

Another potential winner is real estate. Analysts believe India is at the start of a multi-year real estate boom. Why? Property inventories in major cities are at their lowest levels in 15 years, which usually signals a surge in new construction. This could benefit industries like cement, steel, and consumer durables.

Axis Bank’s data reveals an interesting trend: over the years, core inflation (which excludes food and fuel) and food inflation have generally moved together, both increasing by about 120–125% between 2011 and 2024. Right now, food prices are unusually high compared to core inflation. This suggests that either food prices will come down, or other prices will rise to match.

Let’s not forget global challenges. Once Donald Trump returns to the U.S. presidency in 2025, it could shake up global trade. UBS highlights three ways this might impact India:

Slower Global Growth: A weaker U.S. and China could slow down global demand, which would affect India’s exports.

Delays in New Investments: If China starts dumping its extra manufacturing capacity on the global market, it might discourage Indian companies from investing in new projects.

Trade Imbalance: A weaker Chinese currency could make it harder for India to maintain a healthy trade balance.

But there’s also an upside. Standard Chartered thinks Trump’s policies could speed up the "China +1" trend, where companies look to move their supply chains out of China. India could gain from this shift as businesses diversify.

On the investment side, foreign investors pulled out a huge ₹94,000 crore from Indian equities in late 2023. Thankfully, domestic institutions stepped in, buying ₹59,000 crore. UBS notes that India’s equity market is now the fourth largest in the world, with a market cap of about $5 trillion. While that’s a sign of strength, it also means India is more exposed to global money flows, which could bring more market ups and downs.

When we look at the bigger picture, there are challenges—like food inflation, Trump’s trade policies, and China’s slowdown. But most experts agree that India’s growth story is still strong. Key drivers like rising investments, improving corporate profits, and a shift from consumption-led to investment-led growth remain intact.

2025 might feel like a pause in the journey, but it’s not a problem—it’s part of the process.

Tidbits:

The Indian government has injected ₹500 crore into the Industrial Finance Corporation of India (IFCI), keeping its ownership stake steady at 71.72%. This funding, approved as part of the First Supplementary Demand for Grants 2024-25, strengthens IFCI’s financial position without adding extra fiscal pressure, as the money comes from savings in other grants. This is IFCI’s second major capital boost this year, following ₹500 crore raised earlier through equity shares.

In the venture capital space, India saw $16.77 billion in funding across 888 deals from January to November 2024. That’s a 14.1% increase in deal value and a 21.8% rise in deal volume compared to 2023. The technology sector led the way with $6.50 billion in funding, up 52.5% year-over-year. It was followed by consumer discretionary at $2.30 billion and healthcare at $1.30 billion, which saw an impressive 177.6% growth. Notable deals included Zepto raising $1.3 billion and Poolside AI securing $500 million.

Gold loan non-banking financial companies (NBFCs) are seeing a rise in gold auctions as regulatory rules tighten. For example, Muthoot Finance auctioned gold worth ₹69 crore in Q1, which jumped to ₹250 crore in Q2. Manappuram Finance also auctioned gold worth ₹360 crore in Q2 to comply with the RBI’s 75% loan-to-value (LTV) cap, maintaining an average LTV of 58%. Meanwhile, bank credit against gold jewellery rose by 56.2% year-on-year as of October 18, 2024, compared to a growth of 13.1% during the same period last year.

-This edition of the newsletter was written by Kashish and Bhuvan

Thank you for reading. Do share this with your friends and make them as smart as you are 😉 Join the discussion on today’s edition here.