Weight Loss Just Got Easier in India?

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and watch the videos on YouTube.

In today’s edition of The Daily Brief:

Mounjaro comes to India

What’s up with PLI Schemes?

Mounjaro comes to India

After one-and-a-half years of us sitting out a medical hype train that took the world by storm, weight loss medications have finally reached India!

Eli Lilly just launched Mounjaro, its tirzepatide drug, in India. That’s a little like Novo Nordisk’s semaglutide — the chemical behind the world-famous Ozempic — except that it’s supposedly even better for weight loss.

At the moment, the drug costs a fair bit. Eli Lilly is selling single-dose vials of the drug: at a price of Rs. 3,500 a pop for 2.5 mg, and Rs. 4,375 a pop for 5 mg. That is for one single dose, by the way — which you’ll take at least once a week. By a quick calculation, ChatGPT tells us that the annual cost of taking Mounjaro, if you’re on a moderate dose of 5 mg, could be upwards of ₹2 lakh. That’s a huge sum.

That said, this is only the start. Novo Nordisk is eyeing the Indian market too. And once its patent over Semaglutide expires, in early 2026, the space could suddenly become a lot more crowded.

The important thing is, that weight loss therapies are finally, officially available in India. And there’s clearly a market for them — given that Indians are already sourcing these drugs from abroad.

Because we embraced these drugs much later than other countries did, their experiences can tell us what to expect. And that’s a great thing because frankly, they can do a lot. As far as we can tell, nobody’s completely sure of how these drugs work. But somehow, they seem to do a surprisingly wide range of things — from curing people’s alcoholism to reducing anxiety. And these effects are so dramatic that you can see system-wide ripple effects in other countries.

So, what should India expect to see, as these drugs make their presence felt? Here’s a round-up of everything we could figure. As always, we aren’t experts in any of this — just a bunch of nerds who are trying to figure out the world. 🙂

All the wonderful things GLP-1 drugs can do

For a long time, we knew GLP-1 drugs as an excellent sort of diabetes medicine.

See, GLP-1 is a hormone that all our bodies produce. It pings off a series of signals to one’s digestive system, which collectively bring down one’s blood sugar. This is tremendously helpful to diabetic people, whose bodies struggle to control their sugar levels. The only problem is that GLP-1 breaks down within a couple of minutes, so for a long time, it was impossible to make a medicine out of it.

In the 1980s, though, scientists found that there was something in the venom of the “Gila monster” — a half-meter-long reptile from Mexico and the Southern US — which behaved just like GLP-1. Only, this was actually stable. They started experimenting with it, and in time, they thought they had found the perfect diabetes medicine.

When Novo Nordisk first patented Semaglutide, this was what they thought they had: a very promising medicine to normalize your blood sugar.

But there was something weird: people who took GLP-1 drugs seemed to lose a lot of weight. First, we thought this did something weird to our digestive systems. Maybe it changed the speed at which we digested food or something. But that wasn’t the case: instead, these drugs could hit the brain. It seemed to switch off some part of our brains that craved food. It wasn’t doing anything to our ability to eat or digest food itself, it just seemed to kill one’s unhealthy cravings for junk. People talk about how these drugs seem to shut down “food noise” — that little voice in your head that pokes at you to eat something tasty.

Not surprisingly, this finding quickly launched a multi-billion dollar industry. We had actually cracked something that dozens of scam products claimed to do: help you lose weight without all the discomfort of dieting or exercise.

But as a huge new wave of people took to GLP-1 drugs, we found something much weirder than mere weight loss. These were turning out to be some sort of magic drug that cured bad habits as a whole. It seemed to fix people’s substance abuse issues — from alcoholism to cocaine addiction, to compulsive smoking. And magically, it also seems to help with compulsive behaviour that has nothing to do with taking substances at all. There’s some evidence that it even helps with problems like compulsive shopping.

Side note: here’s another hilarious coincidence:

Turns out, when these drugs hit the brain, they are actually doing two things. One, they are setting off a process that reduces people’s hunger. At the same time, though, they seem to dampen any sort of unhealthy craving in people’s heads. Even more interestingly, they seem to specifically target unhealthy cravings, not happiness or desire in general. That’s why these drugs help with all kinds of addictive, obsessive behaviours.

This is all very new, and very controversial. But if there’s any truth to it — and from some quick Googling, there seems to be a lot — GLP-1 drugs solve many of the most debilitating problems humanity has ever faced.

The list of miracles these drugs perform seems to continue. There’s now research that suggests that these work for everything from Alzheimer's to Parkinson's. There’s even some very early evidence that they can help reduce the risk of some kinds of cancer.

Now, as Scott Alexander, one of our favourite bloggers, cautions, we might be riding a huge wave of hype. Chances are that, with time, a lot of the supposed benefits of these drugs will fail to materialize. Ultimately, we’ll probably see a smaller, more believable list of things GLP-1 drugs can help with. There are also a host of side effects that people are reporting: from vomiting and diarrhea to mood disorders, to insomnia.

But all that said, what’s entering India right now is still a medical marvel. It goes far beyond weight loss — it can help Indians with a suite of problems that, for all of human history, were considered impossible to cure. And that’s something worth being excited about.

How GLP-1 drugs can shape wider society

When you give lots of people something this transformative, all those little changes should, in theory, add up to send major society-wide ripples.

The most immediate impact is on the healthcare industry itself, which is seeing a very interesting dynamic emerge. See, because weight issues are correlated strongly with a series of other health problems, the kind of people who seek GLP-1 drugs are the very people at risk for a variety of other diseases. Earlier, these people would only reach the hospital when it was already too late. Now, in a country like America, as part of the screening process for GLP-1, doctors are catching a lot of other diseases in time — from diabetes to sleep apnea — because they’re suddenly screening a lot of people with weight issues. For instance, Resmed, a company that makes CPAP machines, thinks that part of its sudden 11% jump in revenues came because of GLP-1 drugs, basically because many people with sleep apnea suddenly turned up at the doctor’s clinic.

As the diabetic capital of the world, this sort of thing would be incredible for India.

In other countries, people are moving to GLP-1 drugs en masse. According to one poll, one in every eight Americans had already tried GLP-1 drugs by mid-way last year. By one estimate, by 2030, 10% of all the money Americans spend on medication will go to these drugs. They are, in short, a craze. Now, India may not take to the drug that fast — simply given the high price — you could expect a similar rush among affluent Indians.

Many have actually found the drugs helpful. After taking these drugs, people are making real, sustained changes in their relationship with food. They’re eating smaller portions, and are avoiding binge eating. The effect is noticeable enough that companies are feeling the pinch. The supermarket chain Walmart, for instance, apparently saw a noticeable drop in the amount of food people were buying. Companies that make junk food are scrambling to find recipes that could appeal to people on GLP-1 drugs.

It’s harder to find data on the other impacts these drugs have. But things look encouraging. As per some preliminary data, for instance, people who take these drugs are drinking a lot less. You see something similar with smoking too: there’s a noticeable drop in how many cigarettes people using this drug smoke. Researchers are now trying this drug out to treat all kinds of addiction issues.

Of course, every craze has its problems. On one hand, an increasing number of people are being sold fake GLP-1 drugs. On the other hand, there’s a new cottage industry of people who will prescribe GLP-1 drugs to you, many of whom are rather shady. Even gyms are getting into the act, hiring people to prescribe GLP-1 drugs to their clients.

As these drugs catch on in India, expect to see a shadow industry of scamsters and underhand dealers here as well.

What’s to come

India might be late to the GLP-1 party, but that’s not necessarily a bad thing. We have seen how things have played out elsewhere, and on the whole, it’s quite likely a “net positive” for society. Now, we get to watch — in real-time — if Indians see the same differences in how they eat, shop, smoke, drink, sleep, and live.

If things play out anything like they have elsewhere, the next few years will be messy. Prices will fall. Scams will rise. Shady influencers and shady doctors will crop up everywhere. There’ll be hype, backlash, and maybe even regulatory chaos. But in the middle of all that noise, something remarkable might still unfold: a genuine transformation in how India deals with obesity, addiction, and some of the hardest health problems we've never really known how to fix.

It’s too early to say how big this moment will be. But it’s definitely one worth paying attention to.

What’s up with PLI Schemes?

On paper, the Production Linked Incentive (PLI) Scheme was the government’s ambitious masterstroke to turn India into a manufacturing powerhouse. But if a recent report is to be believed, four years down the line, it looks like things haven’t exactly gone according to plan.

As of today, the PLI schemes have missed almost two-thirds of their targets. Most sectors are lagging badly, and manufacturing’s share in India’s GDP has actually slipped backward.

But hold up. Why does manufacturing even matter so much in the first place? Well, to answer that, let’s rewind a bit and revisit some good old Grade XII economics.

We are students of economics, and a lot of how we think about the world is shaped by economic models. Personally, one of Kashish’s favorite models to explain economic growth is the "Structural Transformation Theory."

It simply describes how economies shift their focus from agriculture to manufacturing and finally to services as they develop.

Interestingly, India is a glaring exception. We leap-frogged from agriculture directly into services. Did we achieve economic growth? Of course. But this unconventional leap came with its own set of problems.

One glaring consequence is unemployment. Manufacturing jobs have a uniquely powerful effect on economic growth. A research by Asian Development Banks shows that manufacturing jobs create about 2.3 times more indirect employment compared to services. In terms of poverty reduction, a 10% increase in manufacturing growth reduces poverty 2.1 times faster than a similar growth in services. Clearly, the manufacturing sector fosters inclusive growth.

Another study highlights that a 1% increase in the manufacturing sector's share of GDP can boost growth by 0.5–0.7% in low and middle-income countries, something you don’t see with the services sector. So more manufacturing also means faster growth.

Another obvious consequence is India's persistent reliance on imports. The lack of robust manufacturing has meant that we depend heavily on imports, particularly from countries like China. That’s a constant drag on our balance of payments.

Enters the Production-Linked Incentive (PLI) Scheme

Recognizing these issues, the Indian government took action: it announced the Production-Linked Incentive (PLI) scheme in November 2020 — as part of the broader ‘Atmanirbhar Bharat’ plan.

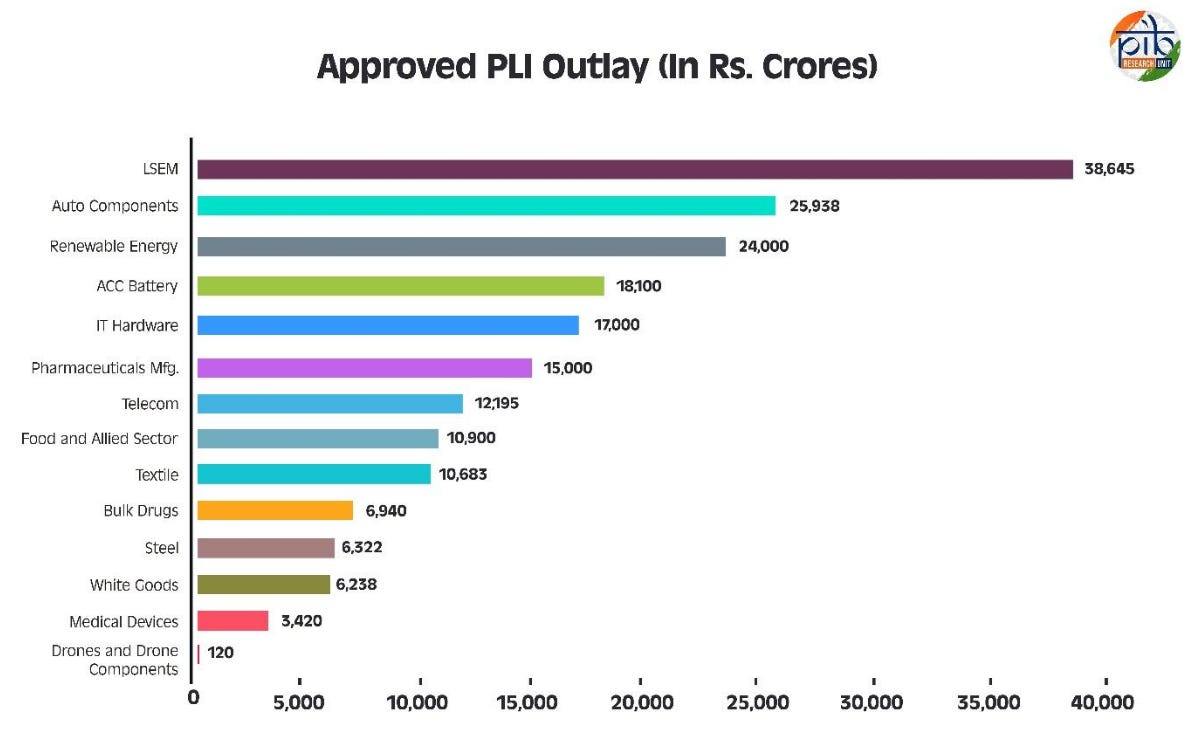

These schemes targeted 14 sectors with an impressive outlay of ₹1.97 lakh crore. The hope? These schemes would spark production worth over $500 billion worth of goods within five years, boost employment, and raise manufacturing’s share of GDP to 25% by 2025.

But as the saying goes, man plans and God laughs.

Reality Check: Progress vs. Targets

A recent analysis reported by Reuters shows a stark contrast between ambitions and actual outcomes:

Production so far: As of October 2024, firms in the PLI program produced $151.93 billion worth of goods — just 37% of the target set by the government.

Incentive payouts: Only $1.73 billion has been paid out in actual incentives—under 8% of the total allocated funds.

The PLI was meant to be a big game-changer for India’s economy. In reality, though, there are mismatches on both sides. At times, businesses haven’t responded as enthusiastically as the government would have hoped. At others, the government hasn’t kept up its part of the bargain, holding up the money it was supposed to give out. The program hasn’t been nearly as smooth as one would have hoped.

And that failure shows up in the numbers: since the plan’s launch, manufacturing’s share of the economy has actually fallen from 14.1% to 12.9%

So the headline numbers tell us that PLI does not seem to be working.

Zoom in, though, and you see a divergence. It’s not as though it has seen no success stories at all — but those successes are all heavily skewed towards just two sectors: electronics manufacturing services (EMS) and pharmaceuticals. For instance, mobile phone production surged by 63% to $49 billion in FY2023-24. Big players like Apple now manufacture their newest models in India. Pharma exports similarly grew impressively, nearly doubling to $28 billion from a decade ago. But those are just two out of fourteen sectors.

Earlier, there was talk of extending PLI to more industries. That plan is now dead. What’s more, existing schemes may soon be shelved too. The government has hinted they won’t expand if existing participants can’t meet their targets. And so, there’s a real chance that a lot of the incentive money they had kept aside could expire before being tapped.

What’s holding back all the other schemes?

So here’s the big question: why have so many of these schemes failed to do what the EMS and pharma schemes managed? Here’s everything we could figure:

One, setting overambitious targets and falling short

It’s not that companies don’t want to meet their PLI obligations — they simply can’t match the sky-high expectations. Take the solar industry as a prime example: out of 12 firms, eight are on track to miss their targets, according to a December 2024 renewable energy ministry analysis. Even household names like Reliance, Adani, and JSW appear behind schedule, with some not even having placed equipment orders yet. Meanwhile, in steel, 14 of 58 approved projects have been withdrawn or dropped altogether for failing to show real progress.

You can see a similar story play out in all sorts of sectors. Many companies bit off more than they could chew, and the whole program is now falling apart.

Two, delayed rollouts & sluggish approvals

Many government departments took years to finalize who qualified for their PLI incentives. To the companies vying for those incentives, this was a real momentum-killer. By the time government authorities selected firms in 2022 (two years behind schedule), certain sectors had already lost precious time. This especially hamstrung capital-intensive fields like semiconductors and advanced chemistry cell batteries, neither of which have rolled out full-scale production yet.

Delays in incentive payouts add another headache. Only a fraction of the promised funds has actually reached firms, forcing companies that banked on timely financial support to foot bigger bills than they anticipated. Some have had to slow their projects down until funds come through.

Three, bureaucratic quicksand

The PLI scheme’s complexity has been compared to the historical “Licence Raj” in one analysis. Companies are wrestling with:

High minimum investment thresholds

Strict incremental sales targets

Domestic value addition criteria that require painstaking compliance work

All these come bundled with intense government oversight, creating a lot of red tape and confusion over the fine print. For some investors, it’s simpler to hold off or scale back rather than risk failing to meet each compliance checkpoint.

So, what now?

Look, we’re all just students of the economy — not masters. We don’t really have any predictions to give you.

The way we see it, it’s really hard to pull off a good PLI scheme. It’s not impossible — some schemes have really taken off, after all, but a majority haven’t. Maybe the targets were too ambitious. Maybe the incentive release is too slow. Maybe the compliance requirements are so complex that companies feel stifled. Whatever it may be, a large part of this experiment didn’t go according to plan.

What does remain true, though, is that India still needs a stronger manufacturing base. Many see PLIs as a vital stepping stone. After all, our economy can only go so far while manufacturing remains a weak link. But even if PLIs are eventually the solution that makes us a manufacturing powerhouse, they’ll have to look very different from how they currently do before they work.

Tidbits

The GST Council is likely to introduce a uniform Goods and Services Tax (GST) rate of 5% for all commercial drones, aiming to streamline taxation and reduce industry confusion. Currently, drones used for business purposes without cameras attract a GST rate of 5% under HSN code 8806, whereas those equipped with cameras fall under HSN code 8525, attracting a higher rate of 18%. Personal-use drones, despite sharing the 8806 code, are taxed even higher at 28%.

GHCL Ltd announced plans to establish a soda ash plant in Gujarat’s Kutch region, investing ₹3,500 crore in the first phase alone. The plant's total production capacity will reach 1.1 million tonnes, with phase one adding 550,000 tonnes annually. Currently, GHCL produces approximately 1.2 million tonnes of soda ash per year. The expansion responds directly to India's rising solar energy sector, which anticipates significant demand for soda ash, essential in manufacturing solar glass.

Bain Capital, a prominent US-based private equity firm, has acquired an 18% stake in India's second-largest gold financier, Manappuram Finance, for ₹4,385 crore. The deal was executed at ₹236 per share, representing a 30% premium over the company's six-month average trading price. This investment triggers a mandatory open offer for an additional 26% stake at the same price, potentially increasing Bain's total stake to 41.7%. Post-deal, Manappuram's promoters, led by V.P. Nandakumar, will see their holding reduced from 35.3% to 28.9%.

- This edition of the newsletter was written by Pranav and Kashish

🌱Have you checked out One Thing We Learned?

It's a new side-project by our writing team, and even if we say so ourselves, it's fascinating in a weird but wonderful way. Every day, we chase a random fascination of ours and write about it. That's all. It's chaotic, it's unpolished - but it's honest.

So far, we've written about everything from India's state capacity to bathroom singing to protein, to Russian Gulags, to whether AI will kill us all. Check it out if you're looking for a fascinating new rabbit hole to go down!

Subscribe to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Thank you for reading. Do share this with your friends and make them as smart as you are 😉

Oh my god! I haven’t read an article without skipping a single line in a long time. Such amazing content—kudos to the writing team! Please keep enlightening us.

Really well articulated. Could perfectly imprint in my mind what GLP is and what the drugs would cater to 🚀