US sanctions on Russia make things tough for India

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and videos on YouTube. You can also watch The Daily Brief in Hindi.

In today’s edition of The Daily Brief:

US vs Russia but India has to suffer

Is Argentina making a comeback?

US vs Russia but India has to suffer

When Russia invaded Ukraine in February 2022, it set off one of the biggest geopolitical shifts in recent history. The world—led by the U.S. and the EU—quickly realized that directly confronting a nuclear-armed superpower could have devastating consequences. Instead, the response came in the form of economic warfare, with sanctions becoming the main tool.

Sanctions are essentially penalties imposed by countries or groups to limit a target nation’s ability to function economically or politically. The idea is straightforward: if open combat isn’t an option, especially with a nuclear power like Russia, you target the resources that fund its actions—its economy.

In Russia’s case, the West targeted its oil and gas sector, a critical pillar of its economy, accounting for roughly 15-20% of its GDP and a major source of funding for its war effort.

The first wave of sanctions imposed in 2022 was sweeping. Europe, once Russia’s largest energy customer, decided to drastically cut its dependence on Russian oil and gas.

At the start of the war, Europe accounted for over 50% of Russia’s energy exports. By the end of 2022, European purchases of Russian oil had plummeted.

This left Moscow scrambling to find new buyers, and it didn’t take long for India and China to step in. Russia, desperate to keep its oil flowing, offered steep discounts—a lifeline for both nations, which were grappling with surging global oil prices.

The G7 also implemented a price cap of $60 per barrel on Russian crude. The enforcement mechanism was innovative: any tanker carrying Russian crude priced above this limit couldn’t be insured or financed by Western companies. Since Western firms dominate 90% of the marine insurance market, shipping Russian oil above the cap became riskier and more expensive.

To bypass these restrictions, Russia turned to a shadow fleet of older, poorly regulated tankers, some over 20 years old and often uninsured. This fleet became a key player in transporting discounted Russian oil to India and China, enabling Moscow to maintain its export volumes despite Western sanctions. However, the discounts came at a cost: Russia’s revenues from oil exports shrank as it sold crude at $20-30 below Brent crude prices.

India and China quickly became Russia’s biggest oil customers.

Before 2022, Russian crude made up virtually none of India’s imports. By 2024, it accounted for 40-45%, helping India manage its $180-200 billion annual energy bill. Meanwhile, China, the world’s largest energy consumer, was purchasing nearly 47% of Russia’s total crude exports. The steep discounts made Russian oil not just attractive but essential for both nations.

Fast forward to 2025, and the U.S. has now imposed its toughest sanctions yet. These measures target two major Russian oil companies and 183 vessels out of more than 600 from Russia’s shadow fleet, tightening the loopholes that allowed Russian oil to flow freely to India and China. With fewer tankers available and higher risks involved in shipping, transporting Russian oil has become significantly more challenging.

The U.S. aims to erode Russia’s oil revenues further, which have already been under pressure. Fossil fuel export earnings dropped by 5% year-on-year in 2024.

While crude oil revenues rose by 6% due to higher global prices, export volumes dropped by 2%. The new sanctions are expected to cut Russia’s oil revenues by another 20-25%, adding to its economic troubles.

For India and China, these sanctions are already creating challenges. Indian refiners, who had been relying heavily on discounted Russian crude, are now being forced to turn to Middle Eastern suppliers. Yogesh Patil, an energy expert, explained in an interview with the Economic Times that Indian oil companies will face difficulties since they can’t pass on the higher crude costs to consumers due to frozen domestic fuel prices.

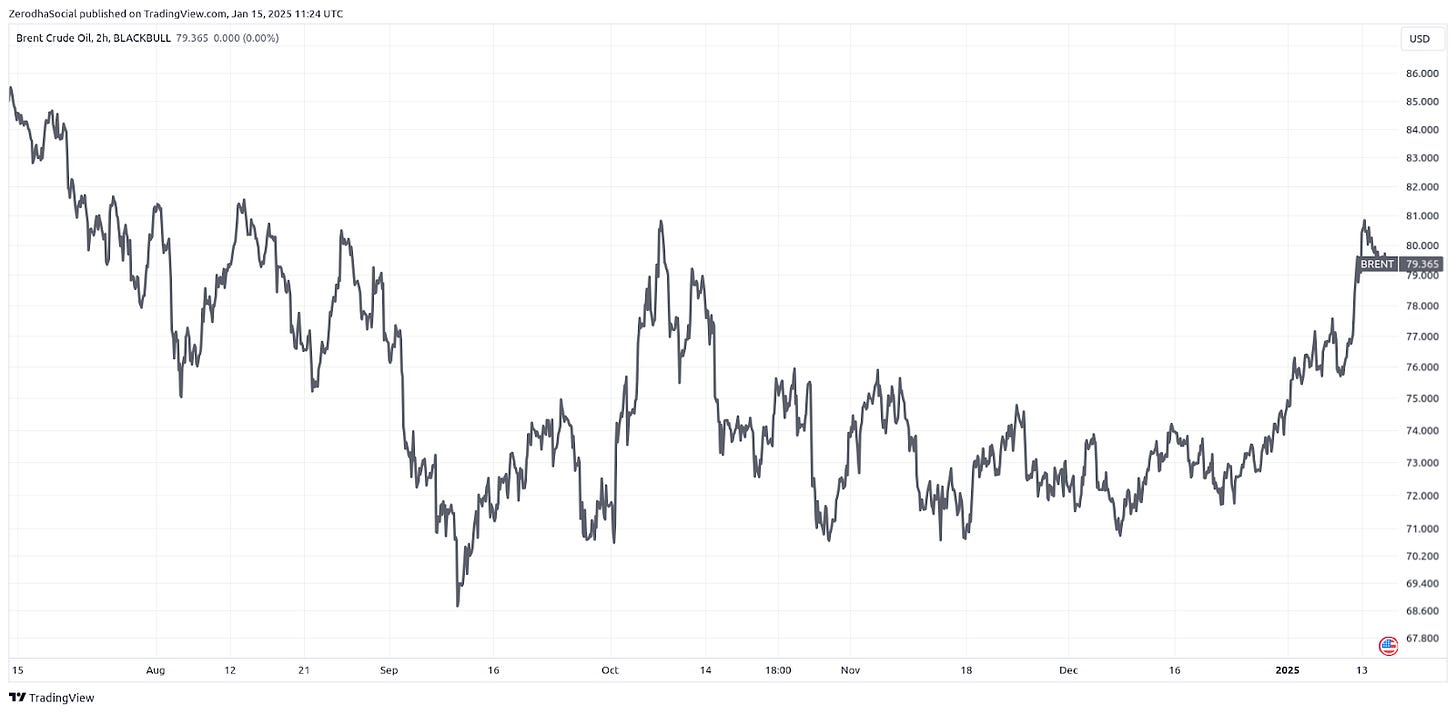

In China, refiners are also shifting to other sources, such as Africa and the Middle East. This growing demand for alternative crude is pushing up spot prices, adding more pressure to global oil markets. Brent crude has already risen above $81 per barrel, reflecting the impact of these disruptions.

The sanctions are reshaping global oil flows yet again. For Russia, losing access to its shadow fleet could jeopardize its ability to maintain export volumes. For countries like India and China, higher crude prices mean inflationary pressures, rising transportation costs, and potential fiscal challenges. The West, meanwhile, is betting that these new measures will force Moscow to confront the economic costs of its war-driven policies.

As the sanctions continue to bite, the stakes remain high for everyone involved. Will Russia find a way to adapt, or will the U.S. strategy finally achieve its goal of choking off Moscow’s war machine? The next few months will be critical in determining the outcome of this economic warfare.

Is Argentina making a comeback?

There’s a famous saying often attributed to Nobel Prize-winning economist Simon Kuznets: “The four types of economies in the world are: developed, underdeveloped, Japan, and Argentina.” While Japan deserves its own story another day, today, we shine the spotlight on Argentina—a country once among the wealthiest globally, now grappling with a new experiment in radical governance under President Javier Milei.

To understand why Milei’s policies are making waves far beyond Argentina’s borders, we first need to unpack the paradox of this nation. Argentina went from incredible wealth in the early 20th century to becoming a cautionary tale of economic mismanagement, caught in a repeating cycle of growth followed by crisis for over a century.

The Paradox of Argentina: A Century of Decline

In the early 1900s, Argentina was thriving. Its fertile plains and booming agriculture made it a top exporter of beef, wheat, and other commodities. Its cities were modernizing, foreign investment was pouring in, and trade made up a staggering 80% of its GDP. Back then, Argentina rivaled countries like France and Germany in wealth, and its capital, Buenos Aires, earned the moniker “Paris of South America.”

But everything changed with the 1929 Great Depression. Global demand for agricultural exports collapsed, and Argentina, overly reliant on foreign trade, was caught completely unprepared. The sudden economic contraction exposed deep vulnerabilities. Trade as a share of GDP plummeted, never fully recovering.

Then came political instability: a series of military coups, populist governments, and ideological flip-flops. Each regime brought a fresh wave of nationalizations, privatizations, and re-nationalizations, frustrating and scaring off foreign investors. I am not kidding when we say they were frustrated; once Argentina had 5 presidents in a matter of 11 days, that’s how bad things were.

To appease a struggling population, successive governments turned to massive spending on subsidies, welfare, and bloated public sector jobs. But these populist measures came at a cost. Inflation soared as the government printed money to fund its programs. There are stories of shopkeepers changing the prices of their products daily to keep up with their inflating currency.

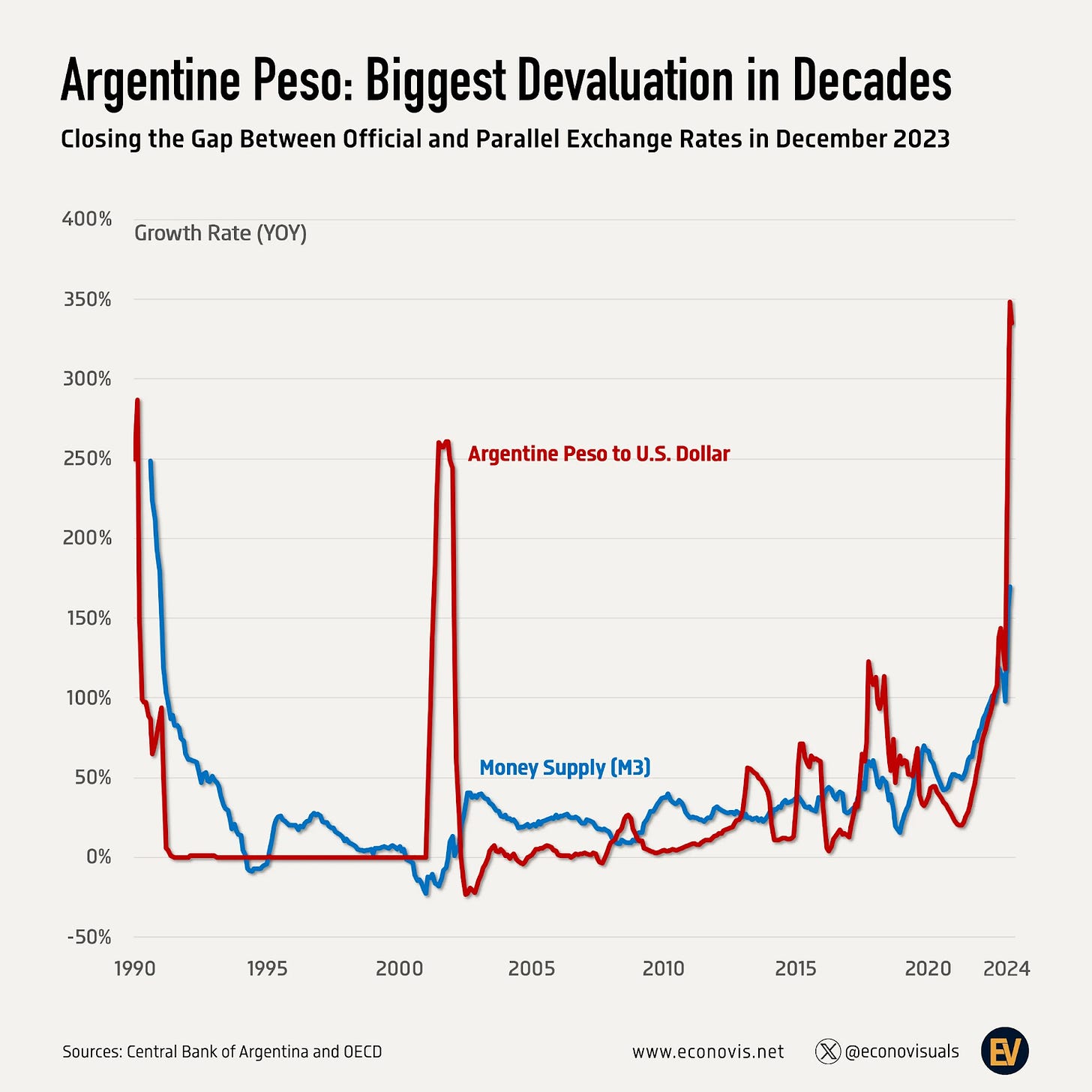

The Argentine peso devalued repeatedly, losing public trust.

Over time, unofficial currency markets flourished, offering a more realistic exchange rate than the government’s controlled rate. This dual exchange system reflected a deep mistrust in the state’s ability to manage its finances.

Even the international markets had lost faith in Argentina. After all, you really don’t keep high expectations from a country that has defaulted 9 times in its history on its debt and currently has the highest debt owed to the IMF by more than double that of the second most indebted country.

Too Many Factors, Too Many Failures

If anyone claims to know the exact reason for Argentina’s decline, they’re probably oversimplifying or not being honest. A mix of internal mismanagement, external shocks, and deep-rooted structural problems has shaped Argentina’s journey. What we’ve shared here is just the surface of a much more complex story. The real picture involves countless interconnected factors.

By the time Javier Milei stepped onto the stage, Argentina’s economy was in shambles. Inflation had soared into triple digits, half the population was living below the poverty line, and the country was drowning in debt, including billions owed to international creditors like the IMF.

Enter Javier Milei: A Radical Prescription

In late 2023, Javier Milei won the presidency by defying conventional wisdom. He had one of the most depressing political campaigns. His campaign wasn’t about promising hope or prosperity—it was a bitter pill of reality. He declared that Argentina couldn’t afford to kick the can down the road any longer. His proposals were stark: cut subsidies, shrink the bloated public sector, deregulate industries, and potentially dollarize the economy.

Why would people vote for such a grim vision? Perhaps because they were fed up. Decades of traditional policies had failed, and someone “crazy” enough to rip everything apart and start anew felt like a gamble worth taking. Milei branded his approach as necessary shock therapy, an economic and political restart.

A Year In: What’s Changed?

One year is too short a time to judge economic policies but excuse us for our stupidity, we still want to give a very brief overview of what’s changed since December 2023.

Since taking office, Milei has slashed government spending by 30%. More than 30,000 public sector workers have been laid off, energy and transport subsidies have been eliminated, and public works projects have been suspended. Pensions and state wages have been frozen.

The immediate effect? Inflation has dropped dramatically. In December 2024, prices rose by just 2.7% month-on-month, compared to 25.5% in December 2023. Argentina’s primary budget (excluding interest payments) is now in surplus for the first time in over a decade.

However, the reality on the ground is less rosy:

Poverty: Over 53% of Argentines now live below the poverty line, up from 42% just a year ago.

Consumer Spending: Down by 20% as purchasing power shrinks.

Construction Activity: Plummeted by 29% year-on-year.

While inflation has eased, essential goods—particularly those dependent on now-removed subsidies—have seen staggering price hikes. Transport and energy costs have surged by over 300% and 400%, respectively.

The Naomi Klein Perspective

Naomi Klein, in her book The Shock Doctrine, argues that times of crisis often serve as opportunities to push through radical reforms without public consent. She cites examples like Chile under Pinochet, post-invasion Iraq, and the Asian Financial Crisis to show how such reforms often exacerbate inequality. Critics of Milei’s policies echo this concern, warning that his reforms could widen the gap between Argentina’s wealthy elite and its struggling majority.

Is the Experiment Working?

Evaluating Milei’s presidency depends on one’s economic perspective. Free-market enthusiasts hail his radical approach as a bold experiment in deregulation and fiscal discipline. They see the potential for Argentina to break free from its cycle of debt and inflation. On the other hand, proponents of state intervention criticize the human cost of his austerity measures, pointing to rising poverty and social unrest.

Milei’s economic gamble remains precarious. While the numbers show progress in inflation and fiscal discipline, the structural issues—weak industries, labor market rigidity, and reliance on commodities—persist. Moreover, public tolerance for “short-term pain” has its limits, and without tangible improvements in living standards, patience could wear thin.

The Road Ahead

Argentina’s story is one of resilience, tragedy, and paradox. From the heights of prosperity to the depths of economic despair, its history offers lessons for the world. Whether Javier Milei’s radical reforms can rewrite the country’s narrative remains uncertain. For now, Argentina watches, waits, and hopes that this gamble will pay off.

As spectators, we leave it to you to decide whether this bold experiment is the bitter medicine Argentina needed—or just another chapter in its long story of economic mismanagement.

Tidbits

Hyundai and Kia are facing rising emissions in India due to their SUV-heavy lineups and slow progress in adopting electric vehicles (EVs). While they have plans to produce EVs locally, challenges like affordability and limited charging infrastructure may make it harder for them to meet India’s green goals.

Tata Electronics has become a major player in Apple’s supply chain, now producing 26% of India’s iPhone output in 2024. The company’s revenue hit ₹40,000 crore, thanks to a 180% surge in production.

Vedanta Ltd. is planning to split into five separate businesses to tackle its parent company’s debt and aim for higher market valuations.

India’s trade deficit widened to $21.94 billion in December, up from $18.76 billion a year ago, highlighting growing pressure on the country’s external trade balance.

-This edition of the newsletter was written by Krishna and Kashish

Subscribe to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Thank you for reading. Do share this with your friends and make them as smart as you are 😉 Join the discussion on today’s edition here.

Thank you for sharing the Argentina story, eagerly waiting for Japan story.

Appreciate you guys on the Argentina story. Reading stories of what took place in other countries gives us a fair picture as to how we would like governance in india.

Economic policies have long lasting effect on its people and their livelihood. It's sometimes hard to understand the consequences of economic policies as none of us are experts in understanding economics as there is no one to one relationship with any economic policy and if not implemented properly can have indispensable collateral damage.

Stories like these help us to understand economics and relate to government policies from a holistic point of view as to how it would affect the country rather than finding 'what is in it for me" in the policy.

This awareness would surely make us responsible citizens and keep the checks and balances of the economy in good stead