Hi folks, welcome to another episode of Who Said What? I’m your host, Krishna.

For those of you who are new here, let me quickly set the context for what this show is about. The idea is that we will pick the most interesting and juiciest comments from business leaders, fund managers, and the like, and contextualize things around them. Now, some of these names might not be familiar, but trust me, they’re influential people, and what they say matters a lot because of their experience and background.

So I’ll make sure to bring a mix—some names you’ll know, some you’ll discover—and hopefully, it’ll give you a wide and useful perspective.

For all the sources mentioned in this video, don’t forget to check out our newsletter; the link is in the description.

With that out of the way, let me get started.

Why is Titan entering the lab-grown diamond space?

For nearly six quarters, Titan’s stance on lab-grown diamonds was remarkably consistent. Quarter after quarter, even as analysts pushed the narrative of LGDs as the next big disruption in Indian jewellery, management refused to play along.

As far back as Q1 FY25, Titan’s leadership was clear that whatever noise existed around lab-grown diamonds was not showing up where it mattered most: inside their stores. The management said they were actively tracking customer behaviour across Tanishq, CaratLane, Mia, and Zoya, and yet they were “not seeing material inquiries.” What they were hearing instead was something far more defensive than aspirational.

Customers were not asking for lab-grown diamonds; they were asking whether the diamonds Titan sold were natural. Some went so far as to demand certification that what they were buying was “entirely natural.” In other words, LGDs were entering the conversation not as a product customers wanted, but as a source of anxiety they wanted reassurance against.

Management repeatedly stressed that the growing narrative around LGDs was being driven more by analysts, media coverage, and the rapid growth of new players than by actual consumer pull.

By Q1 FY26, Ajoy Chawla, the CEO of Titan, would explicitly frame the disconnect by saying that despite “50-odd players,” over a hundred stores, and multiple online platforms, the “narrative is far larger than the reality.” Titan’s own estimate placed lab-grown diamonds at less than 2% of the overall diamond-studded market. This, he called, a “hard reality check.”

They even said that wholesale prices for lab-grown diamonds were falling fast, and that retail prices were following. By FY26, retail prices in India had dropped to somewhere between ₹30,000 and ₹50,000 per carat, and newer players were undercutting even that. The barriers to entering this business were low, and there wasn’t much to differentiate one LGD seller from another. There was plenty of capital chasing the opportunity—private equity money was fuelling aggressive store rollouts. It wouldn’t take much, they suggested, for another 100 or 200 LGD stores to pop up across the country.

But this was exactly why Titan was hesitant.

The falling prices, the low barriers to entry, the ease with which new players could replicate the model—management saw all of this as a warning, not an invitation. Without some kind of proprietary edge, they argued, lab-grown diamonds would turn into a commodity business where the only pitch is “bigger stones for less money.” In a market like that, brand doesn’t count for much, and margins come under pressure quickly.

Titan was clear that it had no interest in entering just for the sake of being there. If the company was going to participate, three things had to line up:

“So, for Titan to make a meaningful play, one, the consumer should be excited and there is something that she wants. Two, what is the IP that we can create? And three, unit economics have to start making sense.”

Titan also made a point that often gets overlooked: the consumer herself was confused.

Management described customers as uncertain i..e they are curious about lab-grown diamonds, willing to experiment, but also worried about whether these stones would hold their value. First-time diamond buyers were especially hesitant. For many Indian households, the first diamond purchase happens somewhere in the ₹70,000 to ₹1 lakh range, and at that price point, the idea of diamonds as a store of value still matters a lot.

The people actually experimenting with LGDs, Titan observed, were not new buyers. They were existing diamond owners—people who had already built their collections and were now picking up a lab-grown piece on the side, as an addition, not a replacement.

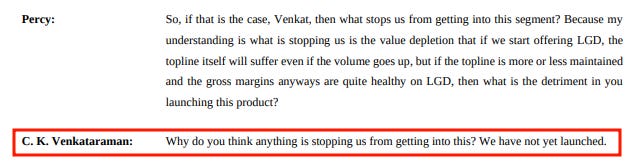

Given all of this, Titan’s answer for most of the last year and a half has been patience. Management was upfront about it—they were in “wait and watch” mode. Analysts pushed repeatedly, sometimes bluntly, asking what exactly was stopping Titan from entering a segment where margins appeared healthy, and competitors were scaling quickly. The answer, each time, was not that Titan could not enter, but that it would not do so prematurely.

And yet, despite all of this, Titan has now stepped into the lab-grown diamond space.

So the question now is: What changed? Are customers finally asking for lab-grown diamonds in a way they weren’t before? Has Titan figured out how to make this business defensible—or have they decided that doesn’t matter as much as they said it did? And if none of their three conditions have actually been met, why move now? Is this opportunity, or is it the worry that staying out costs more than going in?

That’s it for this edition. Thank you for reading. Do let us know your feedback in the comments.

Deepti's perspective on LGD option/ positioning is investors point of view and practical too.

Titan,having established a Leadership position in its segment tapping with LGD with present challenges is a Bold steps and pave ways for others to follow.This is a healthy and positive trend.

Thanks

Congratulations on your first anniversary.

Wishing you many more Anniversaries to come 🫴