Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and watch the videos on YouTube. You can also watch The Daily Brief in Hindi.

In today’s edition of The Daily Brief:

The Gensol Saga

How much energy do machines need to think

The Gensol Saga

The Gensol Engineering fraud case honestly reads like a corporate thriller. It has a bit of everything – falsified documents, money laundering, personal shopping sprees with company funds, and even the occasional golf set thrown in for good measure.

We talked about this story before, when it was just beginning to break. But as time has passed, things have become increasingly murky. SEBI has now passed an interim order listing out the many skeletons in the company’s closet.

Here’s everything that’s come to light.

The glory days

Before we get into Gensol’s many problems, let's start with the basics – what exactly is Gensol Engineering?

Gensol is essentially a green energy play. They started out providing solar consulting services and doing EPC – that's Engineering, Procurement, and Construction work – mainly in the renewable energy space. They then expanded into electric vehicle leasing. In fact, they owned most of the cars that the cab company Blusmart ran. They even had ambitious plans to manufacture their own EVs.

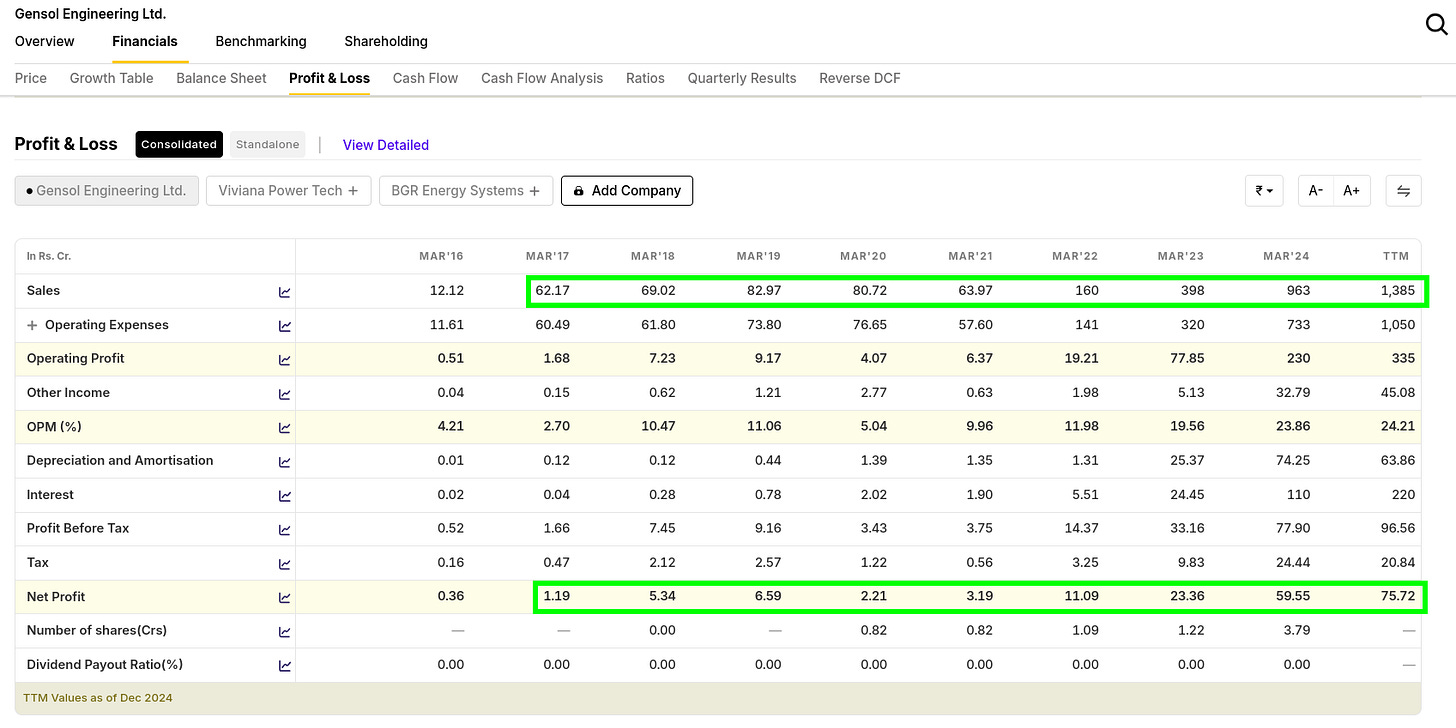

On paper, this company was absolutely crushing it. Their revenue shot up from about 61 crore in 2017 to over 1,100 crore by 2024. That's a growth story that would make most companies green with envy (pun absolutely intended).

This apparent success attracted a ton of retail investors – their shareholder count exploded from just 155 when they first listed on the BSE SME platform in 2019 to nearly 110,000 shareholders by March this year.

But all this while, behind the scenes, there was something shady going on. The company’s promoters – mainly Anmol Singh Jaggi and his brother Puneet — were slowly reducing their stake, bringing it down from over 70% to just 35%.

As recently as last year, Gensol's stock price hit 1,126 rupees, giving the company a market cap of around 4,300 crore. Everything seemed great. But appearances can be deceiving.

The collapse begins

So how did this house of cards start to collapse? The first hints of trouble came in early March this year. The credit rating agencies CARE and ICRA both downgraded Gensol's credit rating to "D" – which stands for Default.

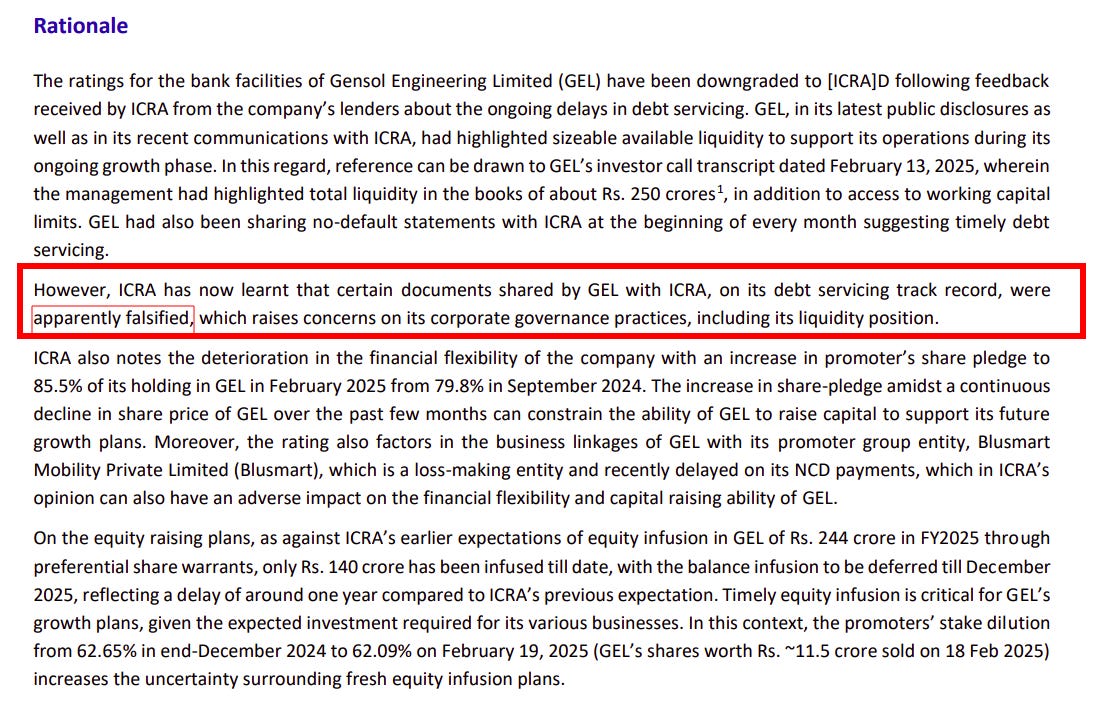

Now, a credit rating downgrade isn't automatically a sign of fraud – companies hit rough patches all the time. But what raised serious red flags was a statement by ICRA: "certain documents shared by Gensol with ICRA on its debt servicing track record were apparently falsified."

Those are not words that credit rating agencies throw around lightly. It was a big allegation to hurl. They were essentially saying, "We think this company is faking documents to hide the fact that they weren't paying their loans on time." If ICRA was right, the company was playing fast-and-loose with ethical and legal norms.

Gensol's CEO, Anmol Singh Jaggi, quickly issued a statement denying any "involvement in falsification claims." The company insisted this was just a "short-term liquidity mismatch" – basically saying, "We have the money, just not right this second."

Investors, though, were getting nervous. The stock price started to tank, dropping by almost 50%.

And this is where SEBI – the Securities and Exchange Board of India – enters the picture.

The Investigation Begins

SEBI had actually started examining Gensol all the way back in June 2024, when it received a complaint alleging price manipulation and fund diversion. But after the credit rating downgrades, the investigation picked up serious steam.

And what they found was pretty shocking. Going by SEBI’s interim order, the company was running a masterclass in creative accounting and financial sleight of hand.

Here's what SEBI discovered: Gensol had taken loans totaling about ₹978 crore from two lenders – IREDA and PFC – much of it supposedly for purchasing electric vehicles. Specifically, they were meant to buy 6,400 EVs to lease to BluSmart, which was also co-founded by the Jaggi brothers.

But Gensol actually only purchased about 4,700 EVs, not the 6,400 they got funding for. That's a shortfall of roughly 1,700 vehicles. Where did the rest of the money go? From the looks of it, here was a textbook case of fund diversion.

Let’s walk you through one example that perfectly captures how brazen this scheme was.

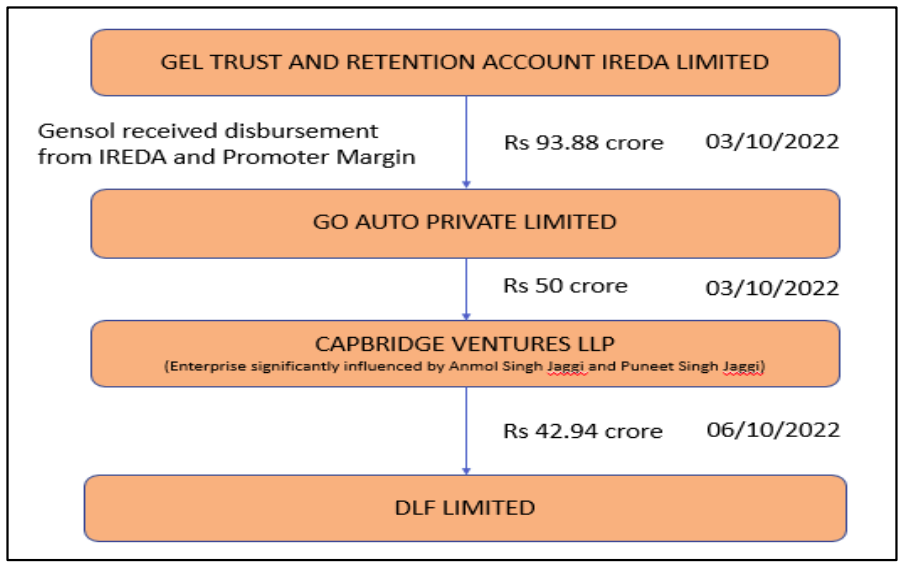

In September 2022, Gensol got a loan of 71.41 crore from IREDA, supposedly to buy electric vehicles. Three days later, they transferred 93.88 crore to a company called Go-Auto, their EV supplier. But the very same day, Go-Auto transferred 50 crore to a firm called Capbridge Ventures LLP.

Guess who controls Capbridge? Well, none other than Anmol Singh Jaggi and Puneet Singh Jaggi, the promoters of Gensol!

A few days later, Capbridge used 42.94 crore of this money to pay DLF Limited. What for? To buy a luxury apartment in DLF's ultra-premium project, The Camellias in Gurgaon — what MoneyControl described as “a project that sets the luxury benchmark”. Loan money that was supposed to buy electric vehicles for Gensol's business — public money from a renewables-focused PSU, no less — ended up buying a luxury apartment for the promoters instead.

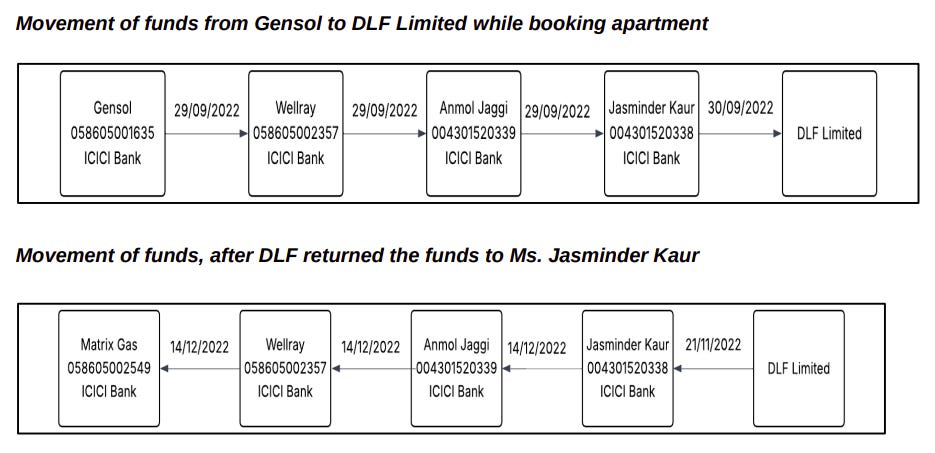

It doesn’t end there. The initial booking amount of 5 crore for this apartment was paid by Jasminder Kaur, who happens to be the mother of the Jaggi brothers. Where did she get this money? You guessed it – from Gensol!

When DLF later returned this 5 crore booking amount to Jasminder Kaur, the money didn't go back to Gensol. Instead, it was transferred to yet another related company called Matrix Gas and Renewables.

This wasn't a one-off incident. SEBI found multiple instances where Gensol's funds were routed through various entities and ultimately ended up with the promoters or their related entities.

Here’s another case: funds from a ₹43.7 crore loan were transferred to Go-Auto. It then transferred ₹40 crore to another entity, Wellray Solar Industries. Wellray then transferred funds to various entities, including ₹50 lakh to a stock broker, Sharekhan Limited, which was then used to trade in – you guessed it – Gensol's own shares!

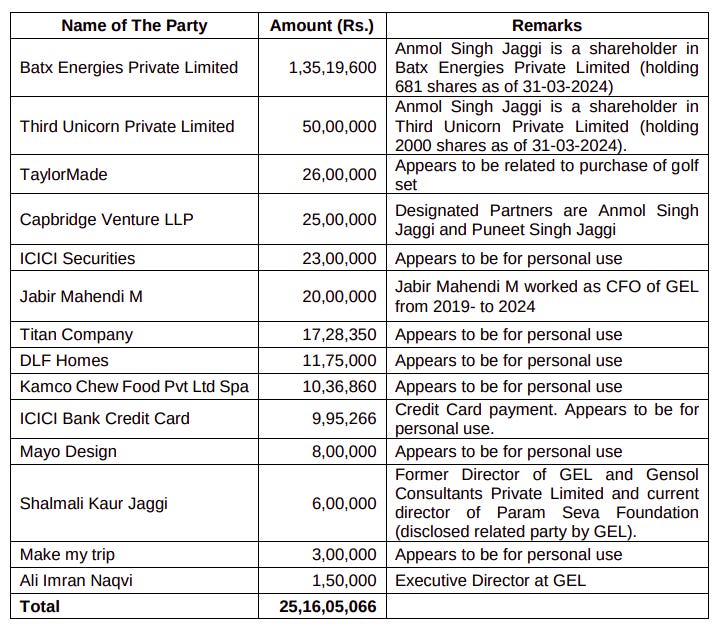

The promoters also used diverted company funds for their personal expenses. Here are just a few examples:

They bought a golf set from TaylorMade for ₹26 lakh

They shopped at luxury retailers like Titan Company for ₹17.28 lakh

They made travel bookings on MakeMyTrip for ₹3 lakh

They even received spa services at something called "Kamco Chew Food Pvt Ltd Spa" for ₹10.36 lakh

The scale of the alleged fraud is staggering. Of the ₹978 crore that Gensol borrowed from IREDA and PFC, about 664 crore was specifically for purchasing those 6,400 electric vehicles. With an additional 20% equity contribution from Gensol, the total funds available for EV purchases should have been around ₹829 crore.

But Gensol only spent about ₹567 crore to buy 4,704 EVs from Go-Auto. That leaves about 262 crore unaccounted for, just from EV loans.

In fact, SEBI's investigation found that the company had created an elaborate network of entities to route and divert funds. In one particularly egregious example, ₹10 crore was circulated four times in a single day between different entities, creating the appearance of legitimate business transactions.

The interim order also suggests that Gensol was falsifying key disclosures to investors. For instance, in January this year, Gensol told investors it had received pre-orders for 30,000 of its newly launched electric vehicles. But when SEBI investigated this claim, they found the company just had vague "memorandums of understanding" with no details on pricing or delivery schedules.

Even more damning, when NSE officials visited Gensol's supposed EV manufacturing plant in Pune in April, they found no manufacturing activity at all – there were just 2-3 laborers at the site. The electricity bills for the facility showed minimal usage, suggesting no actual manufacturing was taking place.

So what happens now?

SEBI has issued several interim directions while it continues its investigation. Anmol Singh Jaggi and Puneet Singh Jaggi are barred from holding any director or key managerial position in Gensol. The company and its promoters are also prohibited from buying, selling, or dealing in securities.

SEBI has appointed a forensic auditor to examine Gensol's books and those of its related parties. The auditor has six months to submit a report, after which we might see more serious actions taken.

The case has broader implications too. Gensol's loans were from IREDA and PFC – both government-backed lenders focused on funding renewable energy projects. This case could lead to greater scrutiny of how these institutions monitor the end-use of their loans.

For investors, particularly the nearly 110,000 retail shareholders who bought into Gensol's growth story, this is a harsh reminder that explosive growth numbers sometimes hide explosive problems.

The Gensol case demonstrates once again that when a company's story seems too good to be true – growing from 61 crore to 1,152 crore in revenue in just seven years – it sometimes is. While green energy and EVs are undoubtedly growth sectors, this case shows that even sunrise industries aren't immune to sunset behaviors.

How much energy do machines need to think

The way things look, by our best guess, we’re in the early days of an all-encompassing new technological era — the era of artificial intelligence. We have taught machines how to think by feeding them mountains of data. We don’t completely know what thinking machines mean for the state of the world — all we know is that the world is set to change very rapidly. Leading AI labs seem to believe that super-intelligence is right around the corner. And when that happens, even reasonable voices think that all bets are off.

What’s there to do now? As the adage goes, during a gold rush, sell shovels. What are the shovels of this new era? There are, of course, chips. But there’s also energy.

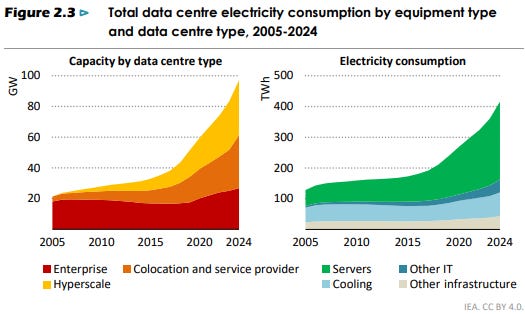

Behind the magic of AI are a massive sink of energy — data centres. AI cannot exist without them. These data centres are filled with hundreds of racks stacked with processors whirring over every request you send in. Each of these are supported by giant pools of memory and data storage. Little bits of networking equipment constantly ping messages between these processors, and in and out from the outside world. All of this processing throws out intense amounts of heat — and so, data centres run massive air conditioners and other cooling systems to zap all this heat out.

All of this takes a profound amount of energy. How much? We recently came across a couple of reports — one from the International Energy Association (IEA) and another from Goldman Sachs — that have given us a way of thinking through this question.

Here’s what we’ve taken away from them.

Where all that energy goes

Artificial intelligence is a tremendously energy-hungry bit of technology. Every step of the way consumes markedly more energy than anything else we’ve attempted.

For one, it takes considerable amounts of energy to make the chips that run artificial intelligence. Modern chip-manufacturing is one of the most impressive pieces of nanotechnology humans have ever come up with. But it’s an energy intensive process, built with inputs that are sourced from all over the world.

This is aside from the energy we actually use in training and running these models. Right now, data centres already consume 1.5% of all the energy the world creates:

To train these models, you need to process incredible amounts of data simultaneously. While there isn’t a lot of data on this, IEA estimates that training GPT-4, for instance, may have taken 42.4 GW-Hrs — as much as more than 70,000 households might use in a day, in the developing world. If anything, subsequent models will only be more energy intensive.

Every time you use those AI models, they eat up more energy. The amount of energy they take varies extensively — depending on everything from the model you use, to the task you give it. For instance, a low quality AI-generated video — 6 seconds in length, 8 frames per second — eats up as much electricity as you need to charge a mobile phone 8 times.

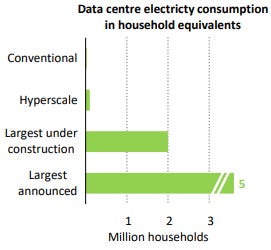

Here’s some context. Modern AI-focused data centres consume roughly as much energy as 100,000 households — a mid-sized town. There are already data centres under construction that would consume as much energy as 2 million households — a sizeable metropolis. There are already plans afoot for data centres that might consume as much energy as 5 million households.

Essentially, any place with a data centre will see a sharp increase in energy needs. Consider this: already, one-fifth of Ireland’s energy goes to data centres. One-fourth of the energy in the US state of Virginia goes to data centres. You should expect to see similar trends play out in any place that builds out a concentration of data centres.

Data centres and energy: A clash of opposing forces

All of this said, the story of data centres and energy isn’t linear. It is marked, in fact, by a clash of two opposing forces.

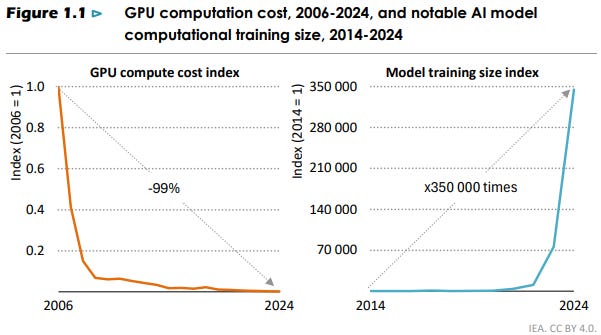

On one hand, the cost of computation is coming down rapidly. The scale of our progress really begins to show as you zoom out. Compared to 2006 — less than two decades ago — the cost of one unit of computation has come down by 99%.

On the other, the total amount of computation we need is increasing exponentially.

The energy needs of AI data centres is a matter of how these two trends play out.

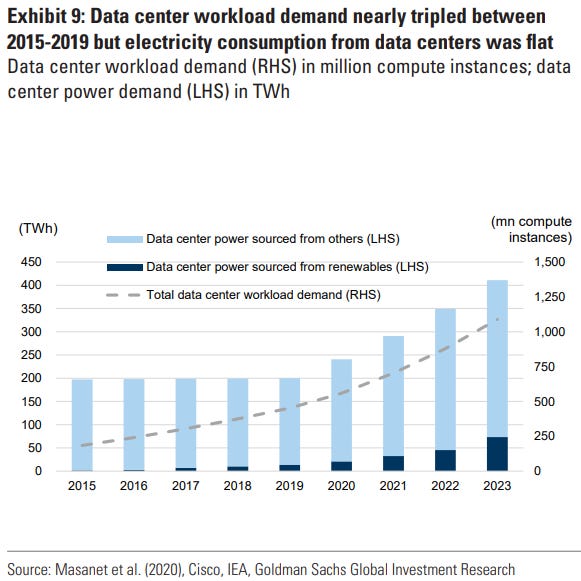

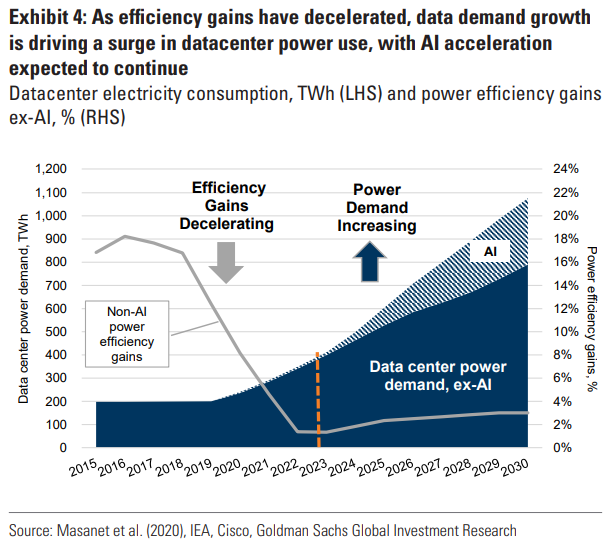

How do these trends play out? For a while, they cancelled each other out. Between 2015 and 2019, power demand from data centres was roughly flat, even though their workload tripled. But those efficiency gains have started to plateau.

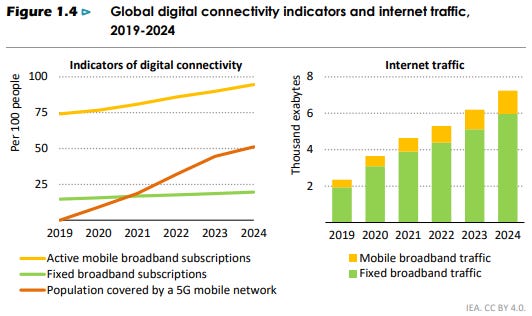

In fact, there are currently several overlapping trends that are driving up data centre usage at the same time. For one, internet penetration itself hasn’t come close to plateauing, and internet traffic continues to see substantial growth.

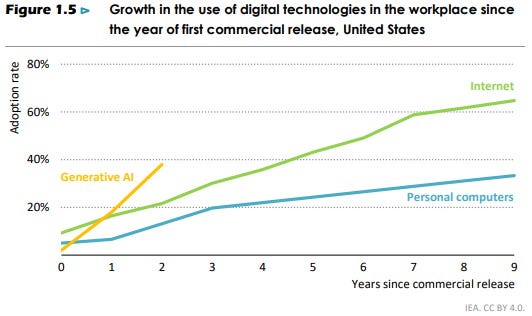

But even as we’re still making our way through the internet revolution, the AI revolution is quickly eclipsing it in scale. While internet use is scaling linearly, AI adoption is progressing at a speed that’s unprecedented even in the tech world. The use of generative AI has grown faster than previous technological waves like the personal computer or the internet, in fact.

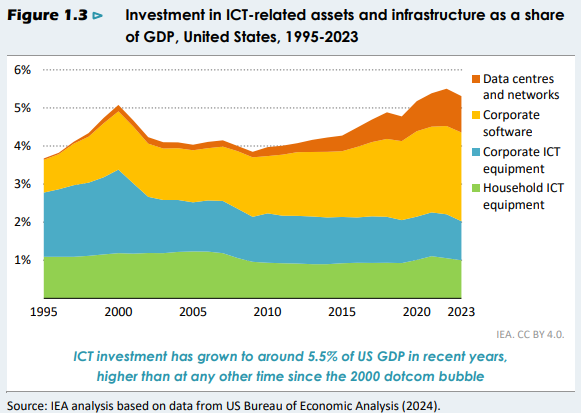

All of this means that data centres are currently receiving investments at a scale that we’ve never seen before. Investments into information and communication technology has recently hit ~5.5% of US GDP. That is the highest it has ever been — even more than during the dot-com bubble. And this data is a little old. With AI having well-and-truly taken off in the last year, chances are that this number might be even higher.

Together, this has unleashed an almost biblical flood in energy demand.

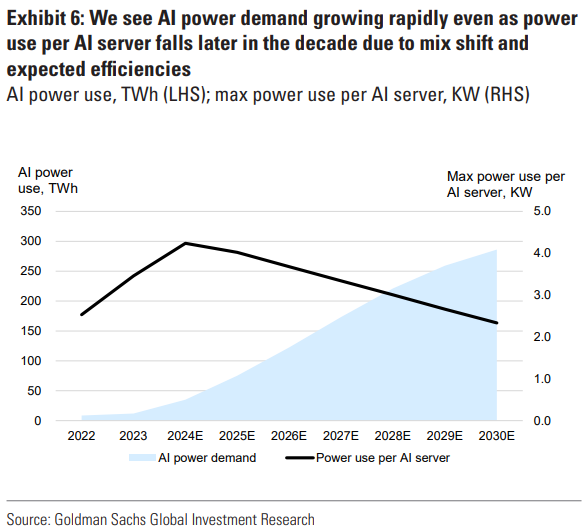

So while the growth in efficiency and demand are counteracting each other, ultimately, demand is growing much faster than efficiency. As per Goldman Sachs, we should expect a rapid increase in the amount of energy that’s going into powering AI, even as the per-server demand for power drops.

This isn’t set in stone, though. Consider a revolution like Deepseek, which cut down energy requirements by 95% with its innovative mix-of-experts model. You could see something like this play out again. But we’re not banking on it.

Where does this energy come from?

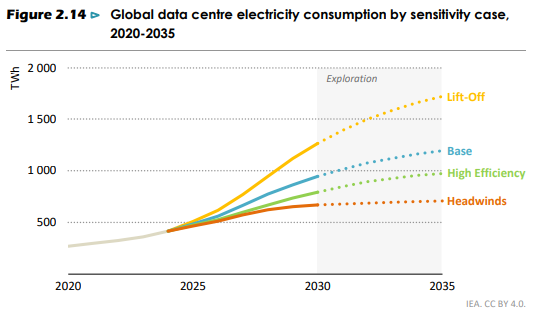

At least at this moment, a couple of things look increasingly likely: one, that AI is here to stay, and with that, our data centre capacity will only grow. As per Goldman Sachs estimates, between 2023 and 2030, the energy consumed by data centres will probably grow by 160% or more.

At this rate, by 2030, a substantial chunk of the world’s energy will go into powering data centres alone. As per the IEA’s base case, for instance, 3% of global energy goes into data centres by 2030. If AI growth is exponential, this might go as high as 4.4%. For context, the entirety of India — all of its people, farms, factories, offices, shops, malls and more — currently consume 6% of the world’s energy.

We’ll need reliable, round-the-clock sources of power to run these data centres. So, the big question is: where does all this energy come from?

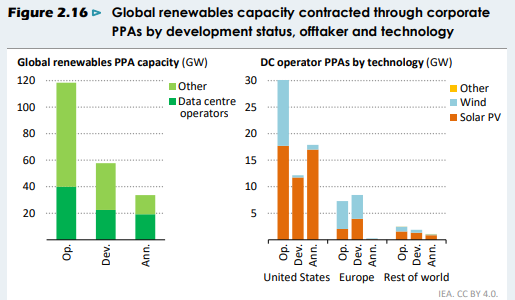

For one, you should expect a generational leap in energy investments in the coming years. Goldman Sachs, for instance, forecasts energy investments of $700 billion by 2030, in the United States alone. AI companies are already leading the way in signing a record number of Power Purchase Agreements with energy developers — especially those in renewables.

But will this be enough? There are severe energy bottlenecks that one might anticipate. For one, there’s a risk that data centres face severe delays in being connected to the grid. This could hold back data centre plans for years. There’s already severe congestion in the grids of most countries. This isn’t easy to sort either — there are currently huge delays the world-over in building the necessary transmission infrastructure.

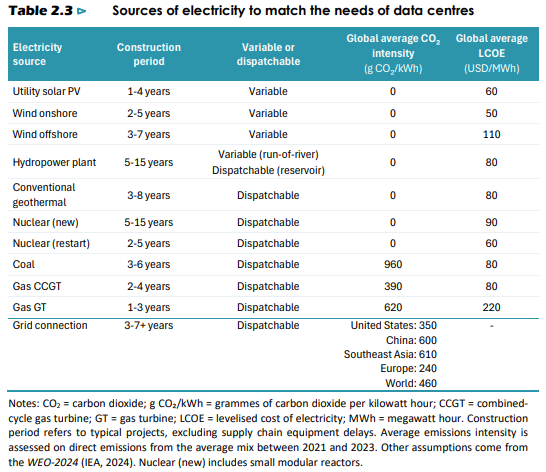

Even if those connections come through, there’s the fundamental challenge of getting all that energy up and running in time. Ultimately, the lead times to set up a data centre are much shorter than those for setting up the energy infrastructure you need to run it.

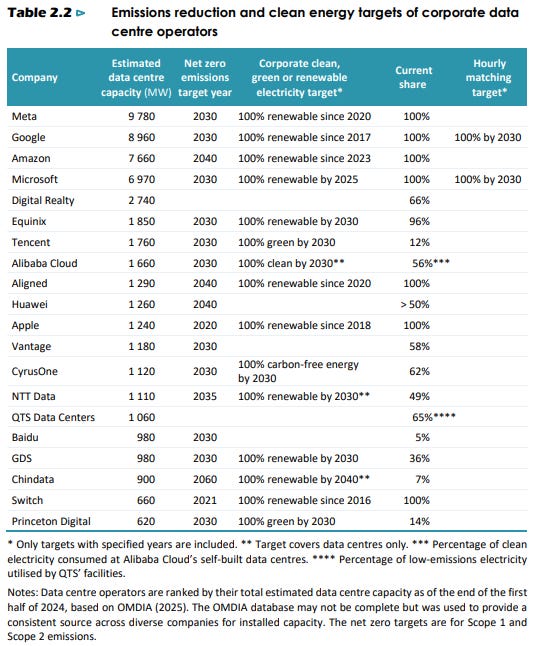

This is complicated further by the fact that most hyperscalers, at least today, are committed to using green energy.

In the short term, a lot of the new power we require might come from solar energy: simply because it’s the quickest to set up. More reliable sources of energy — such as natural gas plants or nuclear plants — have far longer lead times.

But solar power, unfortunately, has severe issues with intermittency. If the sun doesn’t shine, energy supply can suddenly vanish. More work is needed to make this dependable.

To make up the gap, expect massive investments in battery storage and back-up power generation capacity. AI companies may also be willing to pay a “green reliability premium” — paying extra for green sources can ensure uninterrupted supply regardless of bad weather conditions or other issues. For the time being, data centres will probably also draw on fossil fuels.

In the longer term, other, more stable energy technologies might take more of the load. Goldman Sachs, for instance, expects a “nuclear renaissance" as AI energy demand scales up, led by “Small and Modular Reactors”. AI companies are also pushing other novel alternatives. Google and Microsoft, for instance, are also supporting the development of alternatives like geothermal energy.

Given their long lead times, though, it’s only in the 2030s that you might see these sources shoulder more of the demand.

Where is India, in all of this?

At the moment, most of this explosion in energy demand is concentrated in the United States, followed by China and Europe. India is still a rather minor player in this race.

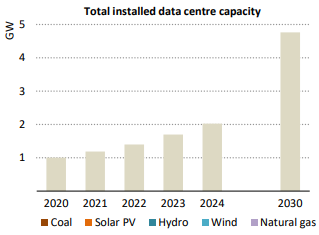

But we have our own ambitions too, that are growing rapidly. Back in June 2024, our data centres were at 2 GW of energy — the amount of electricity consumed by roughly 6.5 million Indian households. This was double of what we had in 2020. We’re planning to add twice as much — 2 GW more — in two years. By 2030, we’re on track to have data centres with a capacity of 5 GW.

But like with the rest of the world, energy could be a major bottleneck for this expansion. We have severe legacy issues in our power sector — with severe issues in grid reliability. We’ll have to solve these problems quickly if we want to match our data centre ambitions.

Without energy, there is no AI

Your base case, going ahead, is an avalanche in energy demand that’s right around the corner. Our ability to meet this demand is one of the key things to look out for, as you track the progress of AI.

There are other tail risks to artificial intelligence, of course. AI development could stall in the near future, perhaps for reasons we haven’t quite considered yet. AI companies may fail to find models that justify the gargantuan investments the technology needs. Social backlash might stem the ramp-up of AI — especially as AI gobbles up an ever-larger share of jobs. The current US-led trade war might break chip supply chains, slamming the brakes on further development.

But the main hurdle to the growth of AI is energy. As long as AI grows, energy demand is certain to grow concurrently. If you’re bullish on AI at the moment, it makes sense to track our progress in weeding out the barriers to energy availability. If we fail to get past the current problems, it could be a bottleneck for how much we can scale data centres — and, by extension, to the growth of AI itself.

Tidbits

India’s Trade Deficit Widens to $21.54 Billion in March Amid Rising Imports

Source: Business Standard

India’s merchandise trade deficit surged to $21.54 billion in March 2025, up from $15.31 billion a year ago and $14 billion in February, according to data released by the Department of Commerce. While exports inched up by 0.67% year-on-year to $41.97 billion, the increase was primarily attributed to frontloading of shipments ahead of the now-paused U.S. tariff threat. Imports grew by 11% to $63.51 billion, driven by a sharp rise in oil and gold purchases. Oil imports alone stood at $19 billion—the highest monthly figure since May 2024. On a full-year basis, exports for FY25 remained flat at $437.42 billion, compared to $437.07 billion in FY24, with outbound shipments contracting in six of the twelve months. This marks a challenging year for trade amid global price volatility and restrictive practices by the U.S. since January.

JioHotstar Set to Hit 300 Million Users by May-End, IPL Drives Digital Surge

Source: Business Standard

Reliance and Disney’s merged OTT platform, JioHotstar, is expected to reach 300 million users by the end of May 2025, riding on the popularity of the ongoing Indian Premier League (IPL). As of mid-April, the platform had already touched 250 million users, including 89 million direct subscribers, according to Media Partners Asia. The IPL is projected to generate $600 million in advertising revenue this season, up 50% from last year, with digital ad revenue expected to grow from $199 million in 2024 to $359 million in 2025. The merger of Reliance’s JioCinema and Disney’s Hotstar under JioStar, a ₹26,000 crore revenue entity, has allowed for ad consolidation and stronger monetization. With a unified app and bundled telco deals driving user acquisition, the platform’s growth puts it in close range to global OTT benchmarks. However, whether the subscriber spike sustains post-IPL remains to be seen.

India Launches Auction for 3 CBM Blocks and 55 Oil & Gas Fields; ONGC Bags 12 New Blocks

Source: Reuters

India has kicked off a fresh auction round offering three Coal Bed Methane (CBM) blocks—two in West Bengal and one in Gujarat—alongside 55 small discovered oil and gas fields. As part of the Hydrocarbon Exploration Licensing Policy, key public and private sector players have secured new exploration areas. ONGC emerged as the biggest participant, winning 11 blocks individually and one more in partnership with BP and Reliance. Oil India secured six blocks, with an additional three jointly with ONGC. Vedanta won seven blocks, while Hindustan Oil Exploration Company received one. The Directorate General of Hydrocarbons confirmed these updates during an industry event in Delhi, underscoring the government's continued push for increasing domestic production through competitive bidding and strategic exploration initiatives.

tariff by the U.S. provided temporary relief, the outlook remains uncertain.

- This edition of the newsletter was written by Bhuvan and Pranav

🌱Have you checked out One Thing We Learned?

It's a new side-project by our writing team, and even if we say so ourselves, it's fascinating in a weird but wonderful way. Every day, we chase a random fascination of ours and write about it. That's all. It's chaotic, it's unpolished - but it's honest.

So far, we've written about everything from India's state capacity to bathroom singing to protein, to Russian Gulags, to whether AI will kill us all. Check it out if you're looking for a fascinating new rabbit hole to go down!

Subscribe to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Thank you for reading. Do share this with your friends and make them as smart as you are 😉

That is some excellent work by team Zerodha. Keep it up. Would love to see an episode or long form article on the future and challenges of Indian Energy space and Power Sector

Love this! I’m Harrison, an ex fine dining industry line cook. My stack "The Secret Ingredient" adapts hit restaurant recipes (mostly NYC and L.A.) for easy home cooking.

check us out:

https://thesecretingredient.substack.com