The Untold Story of India’s 1991 Economic Miracle

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and videos on YouTube. You can also watch The Daily Brief in Hindi.

In today’s edition of The Daily Brief:

Manmohan Singh: The Visionary Behind India’s Economic Reforms

India’s Growth Engines in Trouble: The MSME Story

Manmohan Singh: The Visionary Behind India’s Economic Reforms

Last week — on December 26 — India lost one of its greatest modern leaders: Dr. Manmohan Singh.

You’ve probably heard a lot about Dr. Singh in the past few days. He was a towering figure in public life for decades, and his work drew both admiration and criticism.

But even with all the tributes, his legacy often feels misunderstood. Most people know he was crucial to India’s economic story, but the “why” is still unclear to many.

Let’s break it down.

Dr. Manmohan Singh was a pioneer in economics. Born in 1932, he grew up in a world where most believed India’s economy wasn’t strong enough to compete globally. Many thought we could only grow by keeping foreign businesses out. And this wasn’t just an Indian idea, mind you — experts around the world believed developing countries should protect their economies.

So, after independence, India embraced exactly this model of keeping foreigners out to protect our economy. We planned our way to development. But the results didn’t quite match the ambition. Growth was too slow, and instead of questioning the system, most started to blame external factors.

Even as a young scholar, Dr. Manmohan Singh questioned this approach. During his time at Oxford, he refined these ideas under his mentor, Dr. Ian Little, who was challenging the status quo. In his 1962 PhD thesis, Dr. Singh argued that India’s obsession with cutting imports was holding us back. Trade, he believed, was essential for real progress.

But India wasn’t ready to change. For the next 30 years, we stuck to the same policies.

At that time, Dr. Singh worked his way up through the government. He was often a lone voice calling for India to rethink its economic strategy. Through papers and speeches, he argued that India needed to open up to the world. Slowly, some in the government started listening to him.

However, real change was politically tricky. India had followed a socialist model for so long that reform felt risky. While the government made small adjustments, it couldn’t openly commit to big changes. Meanwhile, problems kept building up.

By 1991, the crisis hit.

Through the late 80s, India’s import bills soared, and we took big loans to build infrastructure. Money was constantly leaving the country, but our tightly controlled economy couldn’t attract enough foreign investment. By the end of the decade, we were in serious trouble.

Then, two shocks made things worse. A war in the Middle East drove up oil prices, and the Soviet Union — our biggest trading partner — collapsed. Inflation shot up to nearly 15%, and we ran out of foreign reserves.

With no other choice, we turned to the IMF. They agreed to help, but with conditions: India had to change how it managed its economy.

This was easier said than done. The Chandra Shekhar government tried to introduce reforms, but parliament blocked the budget. The government collapsed, elections were called, and Congress came to power in June 1991, barely holding on. India was at the edge of economic collapse.

In this critical moment, Prime Minister PV Narasimha Rao made a bold decision. Instead of giving the Finance Ministry to a politician, he chose Dr. Manmohan Singh — an economist with a sterling reputation.

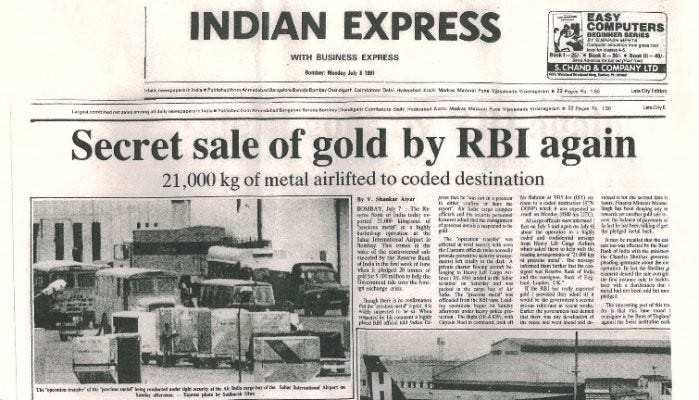

Dr. Singh’s first task was to stabilise the economy. He took tough, unpopular steps. He devalued the Rupee by over 20%, letting its value drop significantly. He also mortgaged India’s gold reserves. The sight of Indian gold being flown abroad angered many, and the public was furious.

Dr. Singh almost quit, but the Prime Minister refused to let him. Despite the outrage, these steps gave India some breathing room.

Then came the real game-changer: Dr. Singh’s first budget.

Everyone expected him to play it safe — to cut spending and conserve resources. But instead, he presented a bold vision to completely transform India’s economy.

The night before the budget, he introduced a new industrial policy that dismantled much of the ‘License Raj’. In his budget speech, he pushed for reducing subsidies, privatising public sector companies, attracting foreign investment, and reforming banks and capital markets. Over the next few years, these reforms kept going.

He also shaped India’s financial markets. He strengthened SEBI, opened up the mutual funds industry, and laid the groundwork for the NSE.

For India, these were revolutionary changes. Dr. Singh’s reforms didn’t just meet the IMF’s demands — they went far beyond. After over 40 years of isolation, India was ready for global business.

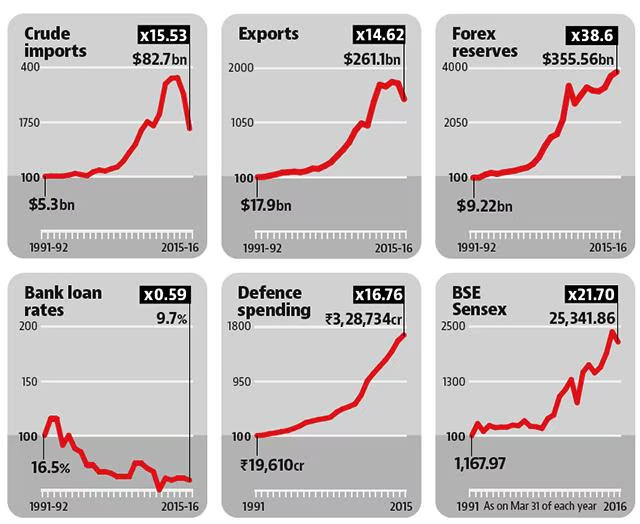

For anyone born in the 90s or later, it’s hard to imagine what the 1991 reforms meant. They shaped the India we live in today — stronger, more prosperous, and more connected to the world. These reforms created a new middle class and brought India closer to the global stage, both economically and culturally.

A decade later, in 2004, Dr. Singh was unexpectedly sworn in as India’s Prime Minister — as surprising as his elevation to Finance Minister in 1991.

In the beginning, India made huge strides under his leadership. The economy grew at its fastest pace in years. He introduced key policies like NREGA and RTI. He also took a big risk by building closer ties with the US, laying the groundwork for today’s strong relationship.

But his last few years as PM were tough. Age and health problems, including major heart surgery in 2012, left him frail. He struggled to manage the internal and external politics swirling around him. By the end of his term, his government was overshadowed by controversies and chaos.

At one of his lowest points, facing constant attacks on his legacy, Dr. Singh remarked that history would be kinder to him than his critics.

And now, as he passes into history, it’s clear why. Dr. Singh built the foundation for modern India’s economic strength. Without him, our economy would be a shadow of what it is today. There would be no stock markets as we know them — and no Zerodha.

We hope he rests in peace.

India’s Growth Engines in Trouble: The MSME Story

When we think about Indian businesses, certain names almost always come to mind. Tata, Birla, Ambani – these are the big players that dominate our headlines and control boardrooms. But here’s the thing: the real story of India’s economy isn’t just about these giants. Behind the scenes, there are unsung heroes quietly working to keep the entire system running smoothly. These are the Micro, Small, and Medium Enterprises, or MSMEs, often called the backbone of India’s economy. And rightly so.

Let’s talk numbers. MSMEs contribute about a third of India’s GDP. That’s a significant chunk of the economy coming from businesses that are small in size but massive in impact. They also account for 40% of India’s exports and provide jobs to over 22 crore people. Imagine this: out of every 100 people working in India, nearly 30 owe their livelihood to MSMEs. And we’re not just talking about one or two enterprises. There are 6.3 crore MSMEs across the country. That’s millions of businesses creating opportunities, driving local economies, and even making their mark on global trade.

But there’s a twist. Despite their importance, MSMEs face a host of challenges that make their journey far from smooth. Sure, they work hard, innovate, and contribute immensely, but they’re up against obstacles that can feel insurmountable. One of the biggest hurdles? Access to credit.

Now, what does that mean? Credit is essentially money that businesses borrow to expand, buy equipment, pay their staff, or simply keep things running. It’s like the fuel that powers a car. Without credit, many MSMEs can’t grow, compete, or even survive in some cases. The trouble is, for most of them, finding a reliable source of credit is incredibly difficult.

Let’s break this down. When MSMEs need funds, they usually have two places to turn. One is what we call non-institutional sources. These include borrowing from local moneylenders, friends, or relatives. While these loans might be easy to get, there’s a catch – the interest rates can be so high that they end up crippling the business. Imagine borrowing money to grow your business but then spending most of your profits just to pay back the loan. It’s a vicious cycle.

The other option is institutional sources. These are formal channels like banks, Non-Banking Financial Companies (NBFCs), or even angel investors and venture capitalists. Ideally, this is where MSMEs should be getting their funds. Why? Because these sources are regulated by bodies like the Reserve Bank of India (RBI) or the Securities and Exchange Board of India (SEBI), which means the terms are generally fairer and the interest rates lower.

But here’s the harsh reality: most MSMEs aren’t able to access these formal channels. A staggering 93% of MSMEs either self-finance their operations or go without any financing at all. Only about 5% manage to secure funds from institutional sources, while another 2% rely on non-institutional ones. That’s it. And this gap isn’t small. According to an RBI report, MSMEs face a credit shortfall of ₹20-25 lakh crore. That’s how much money they need but can’t get their hands on.

Why does this happen? The problem has two sides. On one side, we have the supply-side issues. Even when an MSME has a profitable idea or business model, lenders are often hesitant to give them loans. Why? It’s because many MSMEs don’t have proper financial records or enough collateral to secure a loan. Lenders also see these businesses as risky because they’re small, informal, and sometimes not even registered.

On the other side, we have demand-side issues. Many MSMEs don’t even try to get loans because they know they’ll be turned down. They might lack credit scores, formal registrations, or even basic financial documentation. And without these, banks are unlikely to take the risk of lending to them. It’s a classic case of being stuck in a loop: MSMEs can’t grow without credit, but they can’t get credit because they’re too small or informal.

Recognizing the importance of MSMEs, both the government and the RBI have stepped in to try and address these challenges. The government has doubled the budget allocation for the Ministry of MSMEs and introduced various schemes to support the sector. The RBI, too, has been proactive with several initiatives to make credit more accessible.

One such initiative is Priority Sector Lending (PSL). Under PSL guidelines, banks in India are required to allocate a specific portion of their funds to micro-enterprises. This ensures that smaller MSMEs have a dedicated pool of money available to them. Another significant step is the policy of collateral-free loans for amounts up to ₹10 lakh. This removes a major barrier for small businesses that don’t have assets to pledge.

There are also technological solutions like the Trade Receivables Discounting System (TReDS), which allows MSMEs to get early payments on their invoices. Think of it as a way to unlock money that’s stuck in pending payments from buyers. Then there’s the Account Aggregator (AA) framework, which integrates data like GST filings to help lenders assess MSMEs’ financial health more accurately. This makes it easier for businesses without traditional records to secure loans.

In 2023, the RBI even piloted a Unified Lending Interface (ULI) to simplify and speed up the loan process. By automating credit assessments, this digital-first approach makes borrowing quicker and more aligned with the needs of MSMEs. Additionally, the RBI has introduced a revival framework to help struggling MSMEs restructure their loans and get back on their feet.

But the system isn’t just about what’s done for MSMEs. It’s also about what MSMEs can do for themselves. Formalizing their operations is a crucial first step. Registering on portals like Udyam, filing GST returns, and maintaining clean financial records can go a long way in building credibility. Lenders need to see that an MSME is a serious player, not a risky gamble.

Credit discipline is another essential habit. Choosing the right kind of loan, using it responsibly, and repaying on time can help businesses build a strong credit score. Investing in capacity building, like attending financial literacy programs or using fintech tools, can also make a big difference. Leveraging platforms like TReDS to ensure timely payments can improve cash flow and relationships with lenders.

The road ahead is challenging, no doubt. But it’s also full of potential. MSMEs are too important to fail. They’re not just businesses; they’re lifelines for millions of people. By working together – whether it’s policymakers, financial institutions, or the MSMEs themselves – we can bridge the credit gap and unlock the full potential of this vital sector.

Tidbits

Mankind Pharma has partnered with Innovent Biologics to bring the advanced PD-1 immunotherapy drug, to India within three years. With the Indian oncology market valued at ₹8,000 crore, this marks Mankind’s first collaboration with a Chinese firm for novel biologics.

IndusInd Bank is set to auction ₹1,573 crore in non-performing microfinance loans, with a reserve price of ₹85 crore—just 5.04% of the outstanding value. The microfinance segment, accounting for ₹32,723 crore (9% of the bank's loan book), saw a contraction and lower contribution to margins, impacting the bank’s profitability.

Jubilant FoodWorks, the master franchisee for Domino’s Pizza and Dunkin’ Donuts in India, has signed an MoU with Coca-Cola India to procure its sparkling beverages, starting April 1. This comes shortly after Coca-Cola announced selling a 40% stake in its local bottling unit, Hindustan Coca-Cola Holdings, to Jubilant Bhartia Group. Coca-Cola’s portfolio includes brands like Sprite, Thums Up, and Limca, which will now be available across Jubilant’s restaurant chains.

-This edition of the newsletter was written by Pranav and Kashish

Thank you for reading. Do share this with your friends and make them as smart as you are 😉 Join the discussion on today’s edition here.

Very well written.Good research,Clear writing.

Dr. Singh’s first task was to stabilise the economy. He took tough, unpopular steps. He devalued the Rupee by over 20%, letting its value drop significantly.

But how? Did the imports increased by a lot? Or are there other reasons?