The three forces shaping Indian autos this quarter

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, we’ll tell you why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and watch the videos on YouTube. You can also watch The Daily Brief in Hindi.

In today’s edition of The Daily Brief:

The three forces shaping Indian autos this quarter

A quiet steel stock, and a 4 crore payday

The three forces shaping Indian autos this quarter

India’s auto sector looks to be confidently bouncing back. At least, that’s the sentiment expressed by the country’s largest car maker, Maruti, who said:

“Once again, I am happy to share that the Indian consumer has demonstrated her true strength. She is the one who is actually driving us. We are the ones to follow.”

This optimism is not misplaced, either. Volumes seem to have picked up across most parts of the automobile market — be it 4-wheelers, 2-wheelers, or EVs. In turn, factories are running at higher utilisation to meet growing demand. And waiting periods, which had almost disappeared over the last year, are beginning to show up again. Perhaps, after a long stretch of sluggish demand and uncertainty, the sector might finally be turning a corner.

However, this wasn’t a gradual improvement driven by rising incomes or a slow return of confidence. What we saw instead was a sharp, price-led response that moved the entire system at once. And once that system started moving, it ran into very real constraints.

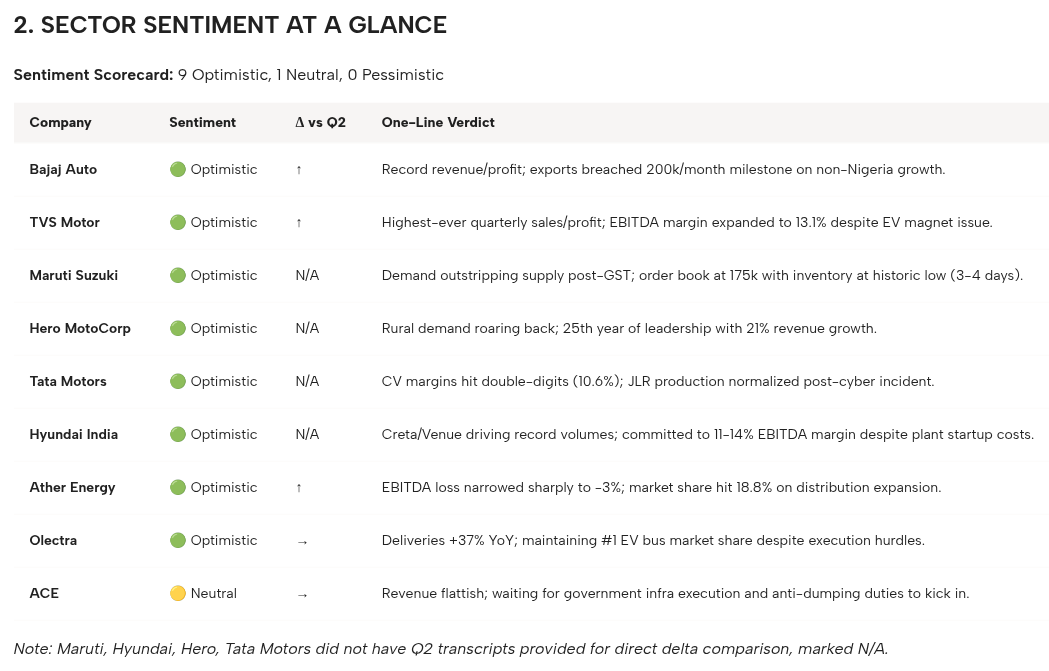

That’s the story we’ll be dissecting in this episode — through the earnings calls of Maruti Suzuki, Bajaj, TVS and Ather. There are three forces that have dominated all of autos, no matter 4-wheelers or 2-wheelers. That’s what we’ll be looking into broadly.

[Before we dive in, we’d love to have you check Concall Monitor by Tijori. Our team uses it to track concalls as soon as they’re released, speeding up research times and even generating a quick sector report. Do check it out if you are an active investor.]

The GST shock

The most important driver of this quarter was not marketing, new launches, or even macro sentiment — but price. Most Indian households buy a vehicle only when they feel financially comfortable enough to take on the commitment. And they’re incredibly responsive to changes in price.

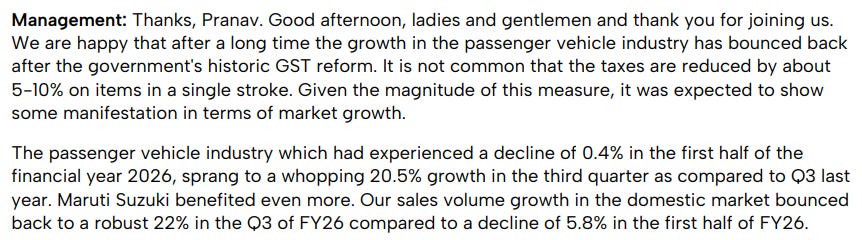

That’s why the recent GST reduction mattered so much. Maruti Suzuki captured the significance of this better than anyone else on their earnings call:

“It is not common that the taxes are reduced by about 5% to 10% on items in a single stroke.”’

Bajaj Auto was completely unambiguous about where the momentum came from:

“The momentum was set by the GST rate cuts, which sustained itself beyond the festive season”

A 5–10% reduction in the price of cars (which cost lakhs) is no chump change for the price-conscious middle-class Indian consumer. And this wasn’t even temporary, like a festive-season discount or a dealer-led scheme. This was a structural shift in affordability, making a purchase that was earlier postponed for months feel more doable now.

What’s important here is not just that demand improved, but how it improved. This was a price-led response, and price-led responses tend to be fast and broad. Premium vehicles benefited because the absolute price drop was meaningful. EVs benefited because they already sit close to the affordability threshold for many buyers.

That’s why volume growth showed up across two-wheelers, four-wheelers, EVs, and non-EVs almost simultaneously.

When demand returns faster than supply can respond

So, due to lower prices, demand did come back. But, at the same time, supply proved to be a huge bottleneck — in more ways than one.

Limited factory capacity

See, auto manufacturing doesn’t scale overnight. After all, plants have fixed capacities, and suppliers work on forecasts. Many critical components come from a small set of specialized vendors. When demand jumps suddenly, the system doesn’t adjust smoothly at all.

Maruti’s management, for instance, had to tighten their operational belts with overtime:

“We had to work on Sundays and holidays to meet the demand.”

In fact, this shortage of supply causes some of the lowest inventory levels they’ve experienced recently. Automakers usually aim to hold several weeks of inventory across their dealer networks. For Maruti, though, it was mere days:

“We ended quarter 3 with a very low network inventory of just about 3 to 4 days.”

This means that vehicles are being sold almost as soon as they arrive. And when inventory falls that sharply, waiting lists only grow. Here’s Maruti again:

“Along with a healthy order book of around 175,000.”

The combination of ultra-low inventory and a swollen order book tells you how demand has overtaken the system’s ability to deliver in the short term.

The rare earth barrier

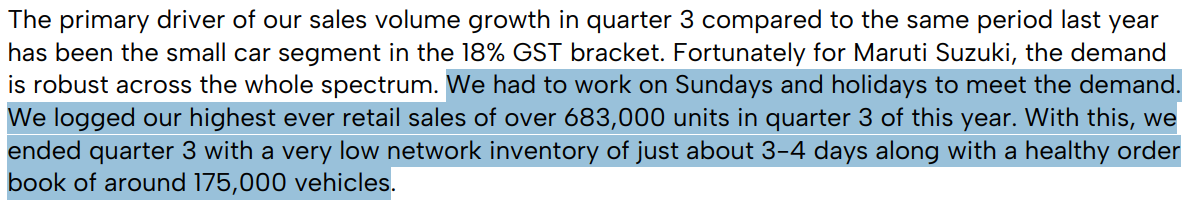

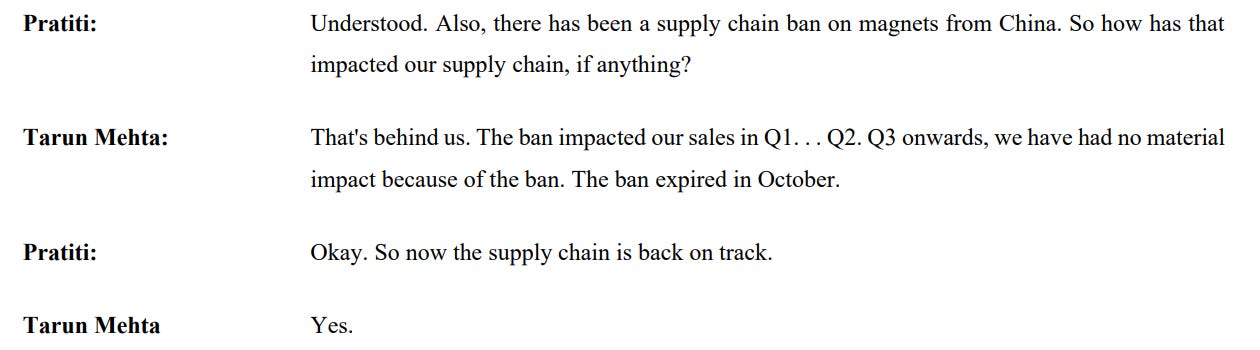

This wasn’t limited to passenger vehicles or factory capacity either. In electric two-wheelers, supply constraints showed up in a more specific form. TVS pointed directly to a very critical bottleneck that we’ve talked about on The Daily Brief before: rare earth magnets.

“We had some challenges on the magnets availability.”

Without these magnets, EV production simply cannot scale, and they can’t be swapped out easily. They sit at the core of the motor, and if they don’t arrive on time, the vehicle doesn’t get built, regardless of how strong demand is.

Over the last few months, the global supply of certain rare-earth magnets tightened, with China controlling most of the processing capacity. This stung Indian manufacturers, who suddenly found themselves in an odd position: customers were ready, factories were staffed, and demand was clearly there — but one critical input was missing.

For instance, Ather indicated that the disruption was largely behind them. Management clarified that while the magnet ban from China did impact sales in Q1 and Q2, there was no material impact from Q3 onwards since the ban itself expired in October. As a result, Ather said its supply chain was now back on track.

Meanwhile, instead of redesigning motors or waiting for supplies to normalize, Maruti chose an interesting workaround. Since they couldn’t source magnets directly, they imported larger sub-assemblies where the magnets were embedded as part of a bigger unit. In effect, rather than buying the magnet separately, they bought the entire assembly that already contained it.

This kept production moving, but it wasn’t free. Maruti pointed out that “rare earth supply issues” had a margin impact, because importing larger assemblies is more expensive than sourcing individual components. The company absorbed that cost in the short term in order to keep vehicles flowing to dealers.

That’s why EV production, even in a quarter where demand clearly returned, has scaled fairly unevenly. Beyond demand, supply chains will truly shape how fast EV adoption in India can really grow from here.

Rising input costs

The complications didn’t end here, either. Rising input costs were quietly pushing back, as well.

See, auto manufacturing is unusually sensitive to raw material prices. After all, metals sit at the heart of almost every vehicle. When prices of, say, aluminum and copper rise, the cost of making each vehicle rises with them. This quarter, that increase in costs arrived at exactly the same time as volumes returned.

Now, higher sales help profitability because factories and other fixed overheads are largely fixed in the short term. When more vehicles move through the same plant, those fixed costs get spread over a larger base — reducing per unit costs. That alone can make margins look healthier even without any change in pricing. This is what firms call operating leverage.

But raw materials don’t work the same way. If aluminum or copper becomes more expensive, every additional vehicle costs more to make. So while higher volumes were pulling margins up, rising input costs were pushing them down at the same time.

For now, the volume effect has been stronger. Companies sold enough units for operating leverage to offset a large part of the cost inflation. That’s why margins held up better than many feared.

But, naturally, this balance is delicate. If volumes slow while raw material prices remain elevated, there is nothing left to cushion the impact. The same cost pressures that are being absorbed today would show up directly in profitability. That is why, even in what looks like a strong quarter, management commentary carries an undertone of caution.

Conclusion

This was a strong quarter for the auto sector, but not for the reasons people usually assume. More than anything else, the rise in demand was driven by a price shock. Lower taxes changed affordability, and affordability changed behavior quickly.

While the demand response lifted fortunes across the board, it also exposed the limits of the system. Inventory collapsed, supply chains tightened, and EV production ran into very specific bottlenecks. And at the same time, rising input costs quietly ate into margins.

For now, higher volumes are doing most of the work. They are keeping factories busy, spreading fixed costs, and masking a lot of the pressure coming from raw materials. That’s why the numbers look reassuring today.

But that also tells you where the risk lies.

If volumes hold up, the sector will continue to look healthy. If they slow — even modestly — while input costs remain high, profitability will come under pressure very quickly. There is no hidden cushion waiting in the system.

A quiet steel stock, and a 4 crore payday

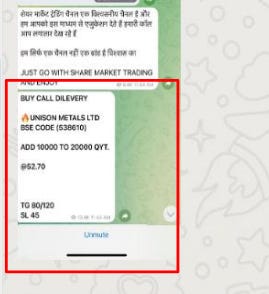

Imagine: it’s a chilly Monday morning in December 2021 when your Telegram app pings. It’s a notification from a channel called Intraday Trading Equity Stock. You’ve watched this channel for weeks. It’s filled with “sure shot” buy calls, with mouth-watering screenshots of green P&L statements.

The newest message is typed in aggressive all-caps: “BUY CALL DELIVERY. UNISON METALS LTD. BSE CODE (538610). ADD 10,000 TO 20,000 QYT. @52.70. TG 80/120. SL 45.”

So you look for the company, Unison Metals Ltd (UML). You see a boring industrial outfit based in an industrial estate in Vatva, Ahmedabad. They make stainless steel sheets and “pattas.” There is no news. No groundbreaking invention. No sudden surge in global steel prices. But maybe they know something you don’t?

What you don’t see, however, is the cold, calculated machine behind that Telegram notification. That is the machine unravelled by SEBI, in a recent order. The regulator discovered a 15-day masterclass in deception that took place in December 2021, which manufactured over ₹4.29 Crores in illegal profit. Here’s what happened.

Meet the Cast

Behind this story were three distinct groups of people: one, those who needed to get out of the stock at profit; two, those who helped them get out; and three, those who provided the keys to the house.

The Beneficiaries

There was a core circle in the middle of the web.

At the center sat the Nada family, which held a massive 17.03% stake in Unison Metals. They had just seen their holdings quadruple “for free”, thanks to a bonus share issue in October 2021. They were now sitting on millions of shares in a stock. Only, there was almost no daily trading in those shares. If they tried to sell even a fraction of their stake normally, the price would crater.

If they needed an out, they required thousands of buyers to show up at the exact same time, so they could dump their shares without moving the price down.

The Operators

For any buyers to appear, someone would need to get the word out to an audience. That was where the Operators came in.

Coordinating this program — the timing of the “Buy” messages, as well as the flow of illegal commissions — was Jalaj Agarwal. On one end, the link between this enterprise and the Nada family was Shailesh Patel. At the other end was Arvind Shukla, who operated massive telegram channels, like Sure means Sure and @Owner_intraday. He brought an audience of anywhere between 5-15 lakh. He was the one who actually hit “send“ on the messages that lured the public into the trap.

We’ll soon get to how they worked together.

The Insiders

A scam of this precision requires real-time data. That’s where the company insiders came in. They leaked the “Benpos” — the Beneficiary Position — to the Operators. This sensitive weekly list shows exactly who holds how many shares. We’ll get to why this was important in a bit.

The Modus Operandi

The plan was set in November 2021, at the Karnavati Club in Ahmedabad, when Shailesh Patel made Jalaj Agarwal a proposition.

The Nadas had to exit their massive stake in Unison Metals. And for that, they needed Jalaj’s shadowy services. If the Operators would manufacture a buying frenzy in the stock, in return, they would take a 13% success fee on every share the Beneficiaries sold. Jalaj knew just the person: Arvind Shukla, who ran a series of popular traders groups on Telegram.

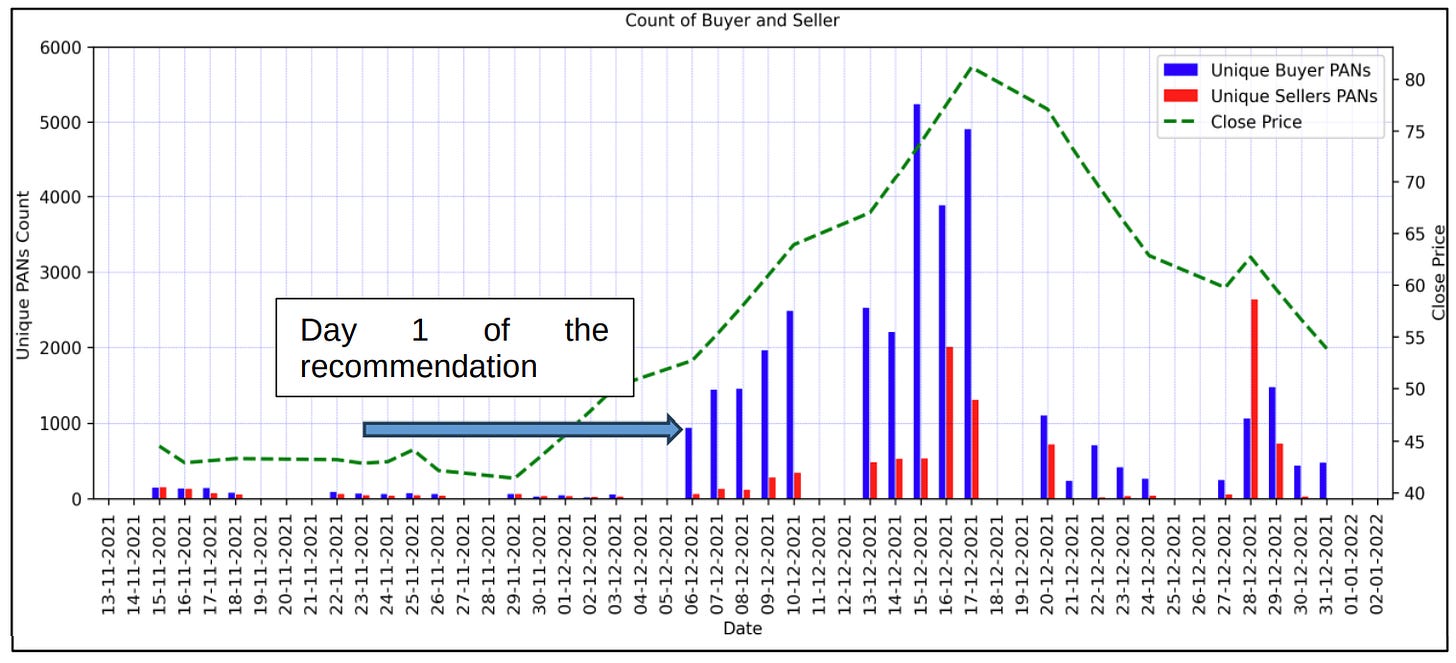

The scheme was set. On December 6, the first Telegram message was sent out. The impact was an electric shock, which animated the hitherto dead stock. On the previous trading day, only 60 unique buyers had touched UML. On December 6, that number jumped to 943. The messaging campaign continued, with new “buy prices” sent daily, drawing more traders in. By December 15, the frenzy reached its peak. Over 5,000 unique buyers had descended on the stock, clamoring for a piece of a stainless steel company they had likely never heard of a week ago.

This market-manufacturing was carried out with scary precision. On 7 of the 12 days when recommendations were posted, either the opening price or the day’s high matched the Telegram “target” almost down to the paisa.

What those new traders didn’t realise, perhaps, was that while on one side, the Operators were pushing group members to buy UML at a specific price, on the other side, the sellers — the Beneficiaries — were placing sell orders at that exact same price. The buying was being steered to a pre-decided level, creating the conditions in which the dumping could proceed profitably.

For example, on December 14, a recommendation was posted at 8:55 AM to buy at ₹70.35. The stock opened at exactly ₹70.35. This wasn’t a coincidence. That precision was only possible if the sellers were already waiting with their sell limit orders at that price. It was all scripted.

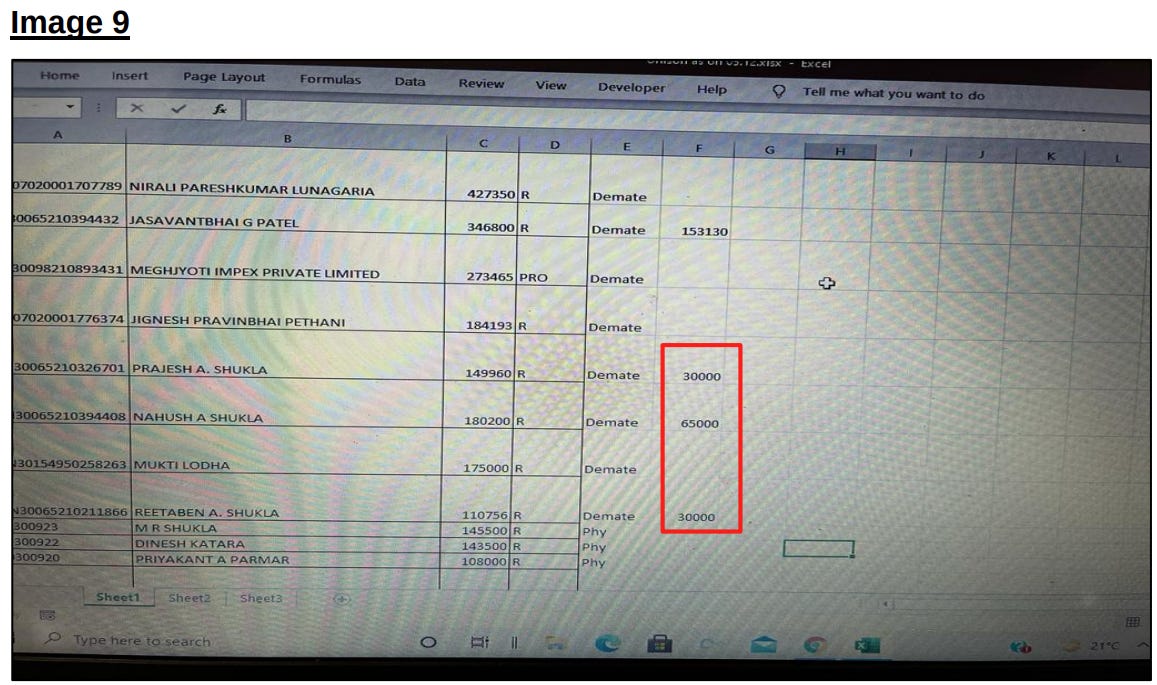

How did the Operators know that everything was on track? Well, they got that data straight from the company, in the form of leaked benpos data. This was essentially data from the company’s internal ledger. SEBI found an Excel sheet Operator’s phone, which showed they were tracking specific sellers from the Nada family. This confirmed that the dump was working — and told them exactly what commissions they were entitled to.

The company Insiders claimed they shared this data because they were “raising capital” for a Sodium Silicate plant. SEBI investigators, though, saw through the ruse immediately.

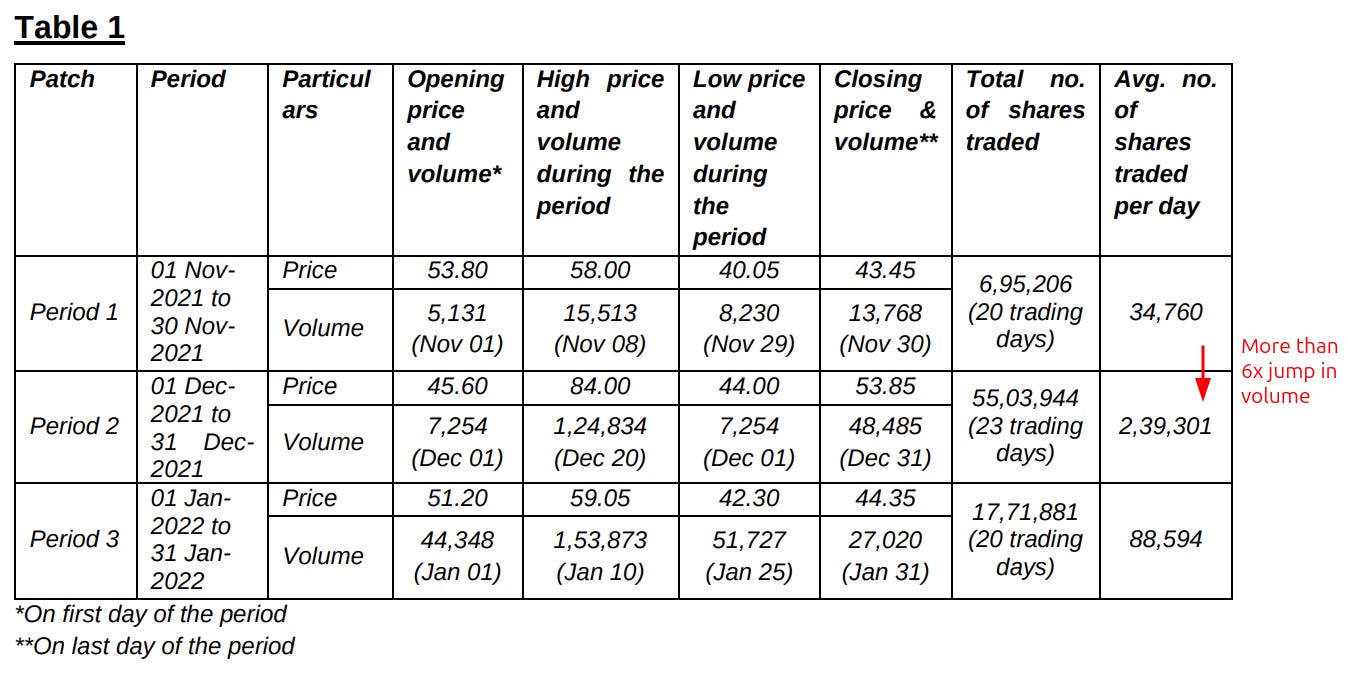

A simple data point shows how fishy it all was: just compare the number of trades in November, the “Quiet Period”, and those in December, the “Scam Period”.

In December, the volume exploded to nearly seven times the November average. The price of the company’s scrip surged 84% within that single month, for a company with zero fundamental changes. With that, in less than one month, the Nada family had pocketed ₹4.29 crores of unlawful profits.

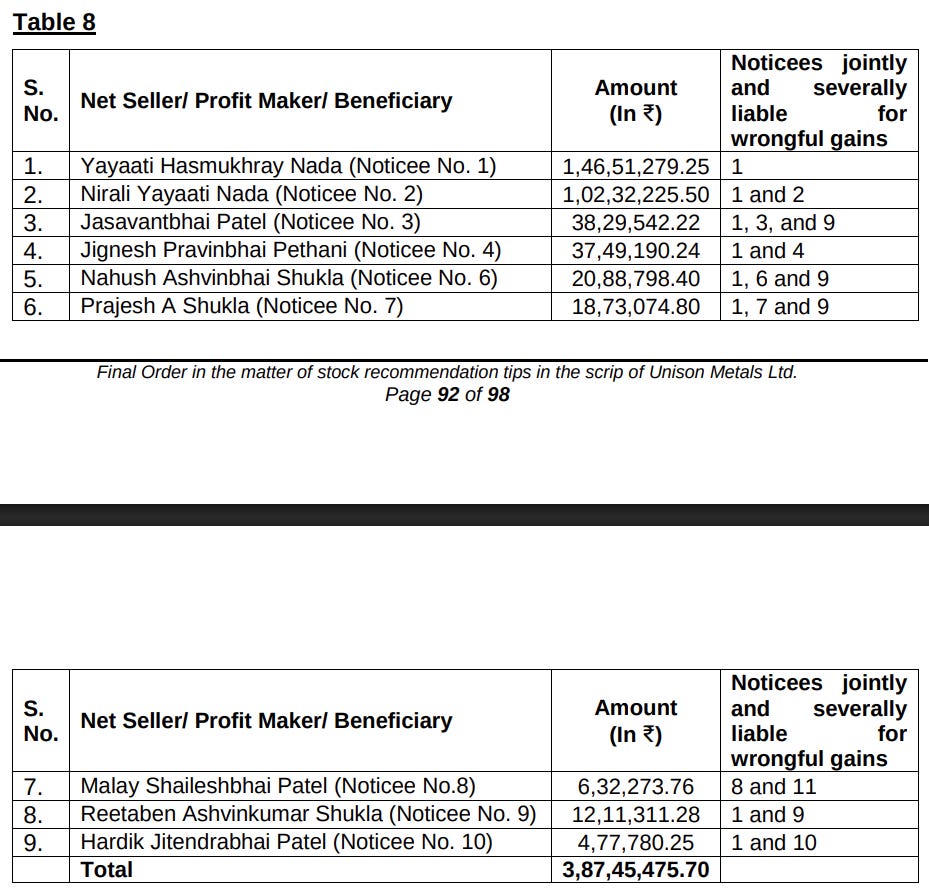

Tokens and Calculators

The Beneficiaries were happy. Their work was done; their shares were sold. It was time to pay the Operators.

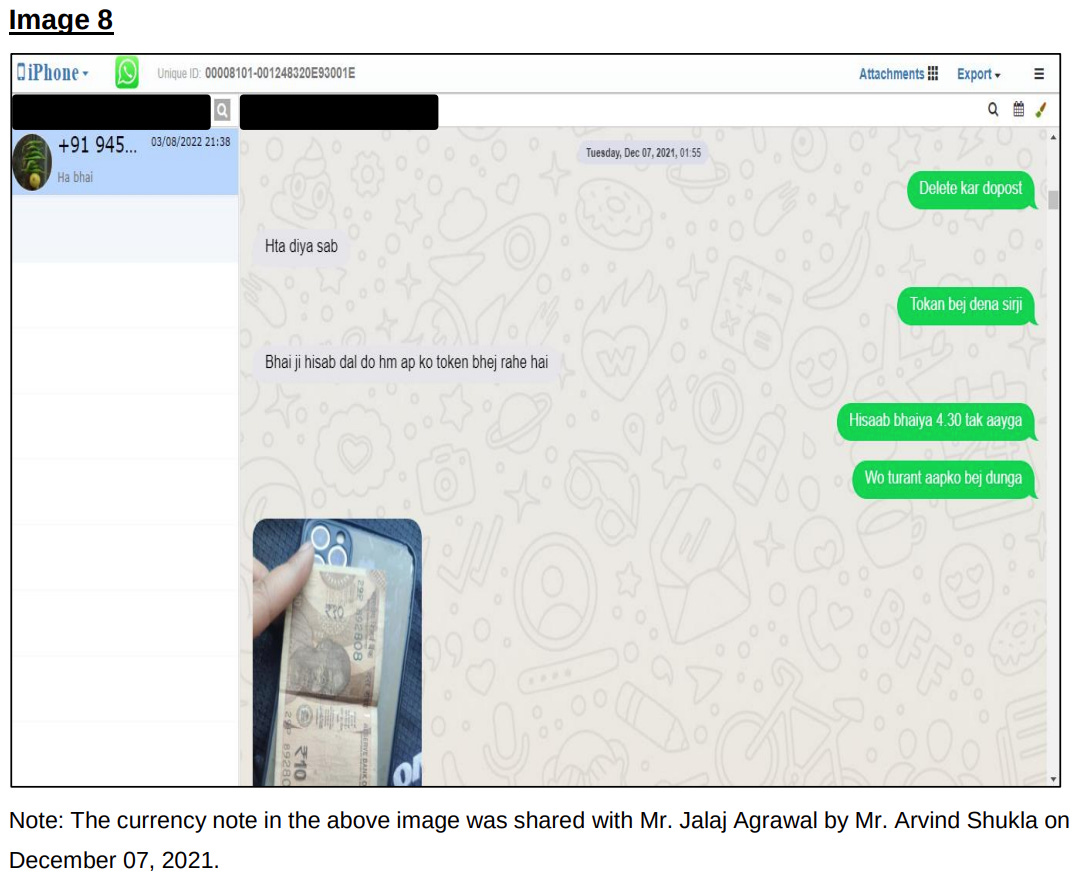

It wasn’t that easy, though. Moving tens of lakhs in illegal commissions — a 13% success fee — through a bank transfer would be suicide. So, they went old-school. The cash was delivered off-market.

SEBI didn’t know exactly how that played out, but it’s clear that they had a creative system in place. The payee would send images of ₹10 or ₹20 currency notes as “digital receipts.” The unique serial number on that specific bill was the “password.” If a courier showed up at a meeting and presented that exact note, the receiver knew they were who the bags of cash had to be given to. It was a “hawala” style security layer, implemented via WhatsApp.

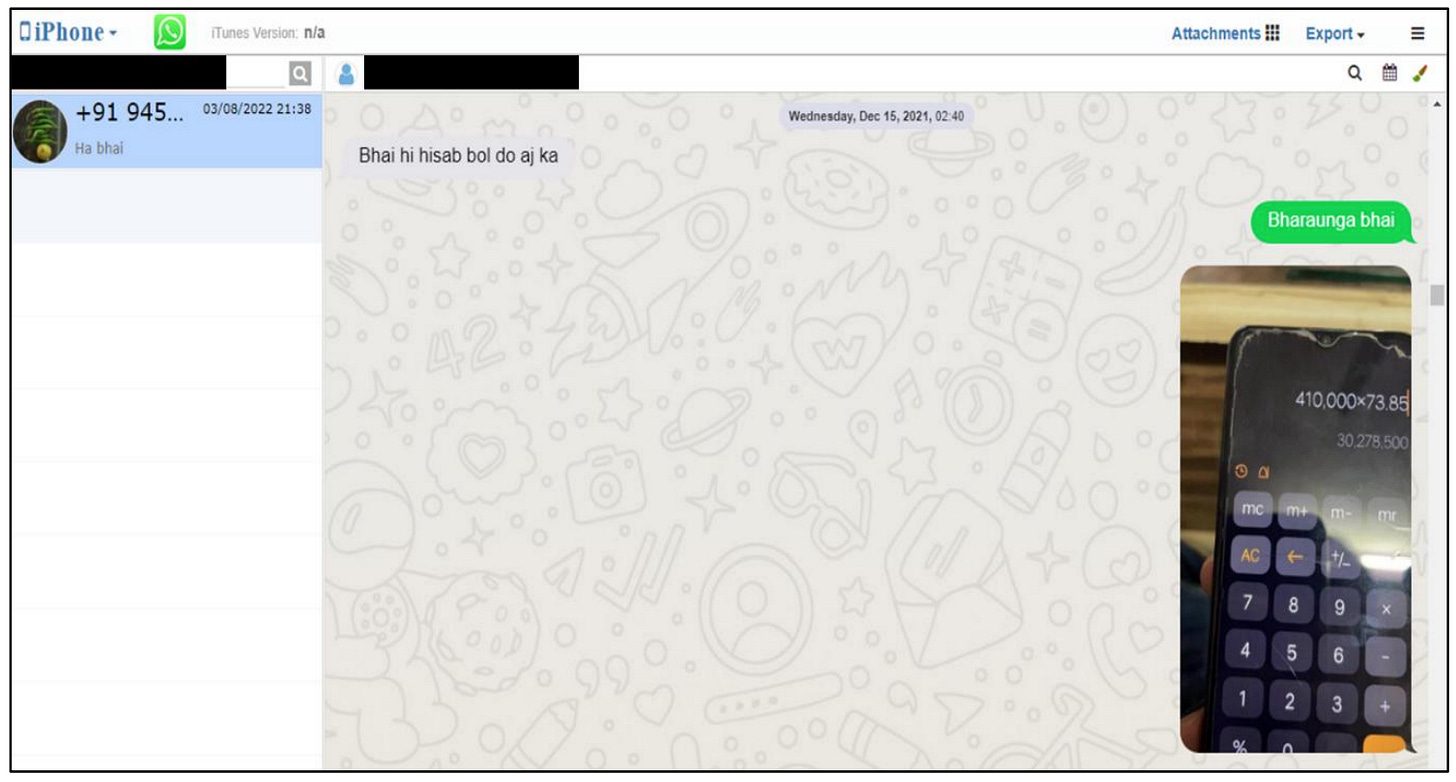

For all their care with currency notes, though, they were incredibly sloppy with their phones. When SEBI conducted its search and seizure in March 2022, all the evidence was right on the Operator’s device. In fact, SEBI found photos of physical calculators showing the exact math of the sums involved.

Consider these images from December 15. The first shows a calculation: 4,10,000 (shares) x ₹73.85 (closing price) = ₹3,02,78,500. Then, the second step: ₹30,278,500 x 13% = ₹39,36,205. That was the Operators’ cut for just one day of work.

How the House of Cards Fell

The scam may have been successful, but it was too loud to stay secret.

The moment the “Buy” tips stopped, the price began to slide. Retail investors who had bought shares at ₹80 could only watch in horror. Those “Buy” messages, meanwhile, were deleted from those Telegram channels on the very day they were posted. Everything pointed to a pump-and-dump scheme trying to hide its tracks.

And so, in March 2022 — just a few months later — SEBI launched its offensive. It carried out search and seizure operations at the homes of Operators, finding a mountain of evidence. There were records of 49 calls between the Nada family and the Insiders during the investigation period. Clearly, there was a high-frequency communication channel during the dump. The paper trail also showed sensitive benpos data moving from the company Insiders to the Operators. There were also the “Token” images and the calculator screenshots we talked about above.

And beyond that, there was the sheer weight of “coincidences”.

The biggest, of course, was that the company Director’s close friends, the Nadas, sold 80% of their holding exactly when a Telegram channel with 15 lakh subscribers told people to buy. As was the fact that the Telegram “Target” price matched the market and the sell order of Nada’s exactly, on 7 out of 12 days. It all looked too suspicious to be random. SEBI had its case.

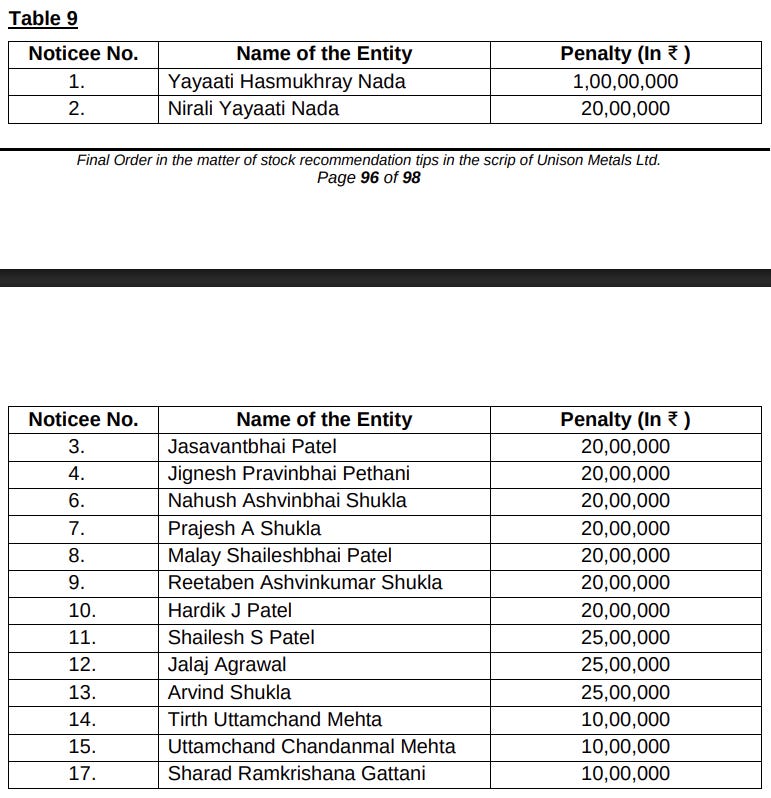

Who Paid the Price?

SEBI ordered the guilty parties to disgorge all the “Wrongful Gains” they made. The money they made in this scam will be remitted to the Investor Protection and Education Fund (IPEF).

This is over and above the monetary penalties imposed for violating securities laws — which comes to another ₹3.65 crore.

The Ghost in the Machine

If there’s one thing to take away from this story, it is this: any “tip” you receive is almost never for your benefit. If somebody knew of a stock with explosive potential, they would not tell you — they would simply load up and wait. There is no such thing as a “Sure Shot” shared for free with 1.5 million people. If you’re buying something based on a Telegram notification, you aren’t an investor.

You’re “exit liquidity.” That is true of the market in general. It is even more so in the world of low-cap stocks like UML.

Tidbits

Adani Energy Solutions secured long-term funding from Japanese banks MUFG and SMBC for a 6,000 MW HVDC transmission corridor connecting Rajasthan to Uttar Pradesh. The corridor spans 950 km and is expected to be operational by 2029.

Source : BSSweden’s SAAB proposes the induction of its Gripen E fighter jet in the Indian Air Force. As part of this deal, it is offering a technology transfer with 300+ MSME suppliers in India, rapid delivery from the third year post-contract, and capability to complement IAF’s Rafale and Tejas fleet.

Source: ETSEBI modified the Order-to-Trade Ratio framework for algorithmic trading effective April 6, 2026, exempting orders within ±0.75% of last traded price and equity options within ±40% or ±Rs 20, whichever higher, acknowledging market makers’ role in liquidity provision.

Source: ET

- This edition of the newsletter was written by Krishna and Kashish

Tired of trying to predict the next miracle? Just track the market cheaply instead.

It isn’t our style to use this newsletter to sell you on something, but we’re going to make an exception; this just makes sense.

Many people ask us how to start their investment journey. Perhaps the easiest, most sensible way of doing so is to invest in low-cost index mutual funds. These aren’t meant to perform magic, but that’s the point. They just follow the market’s trajectory as cheaply and cleanly as possible. You get to partake in the market’s growth without paying through your nose in fees. That’s as good a deal as you’ll get.

Curious? Head on over to Coin by Zerodha to start investing. And if you don’t know where to put your money, we’re making it easy with simple-to-understand index funds from our own AMC.

Thank you for reading. Do share this with your friends and make them as smart as you are 😉