The surprising reason for HDFC Bank's slowdown

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and videos on YouTube. You can also watch The Daily Brief in Hindi.

Today on The Daily Brief:

HDFC Bank’s growth is slowing but Investors are not disappointed

Quick Commerce vs The Government

Corporate bonds made easier

HDFC Bank’s growth is slowing but investors are not disappointed

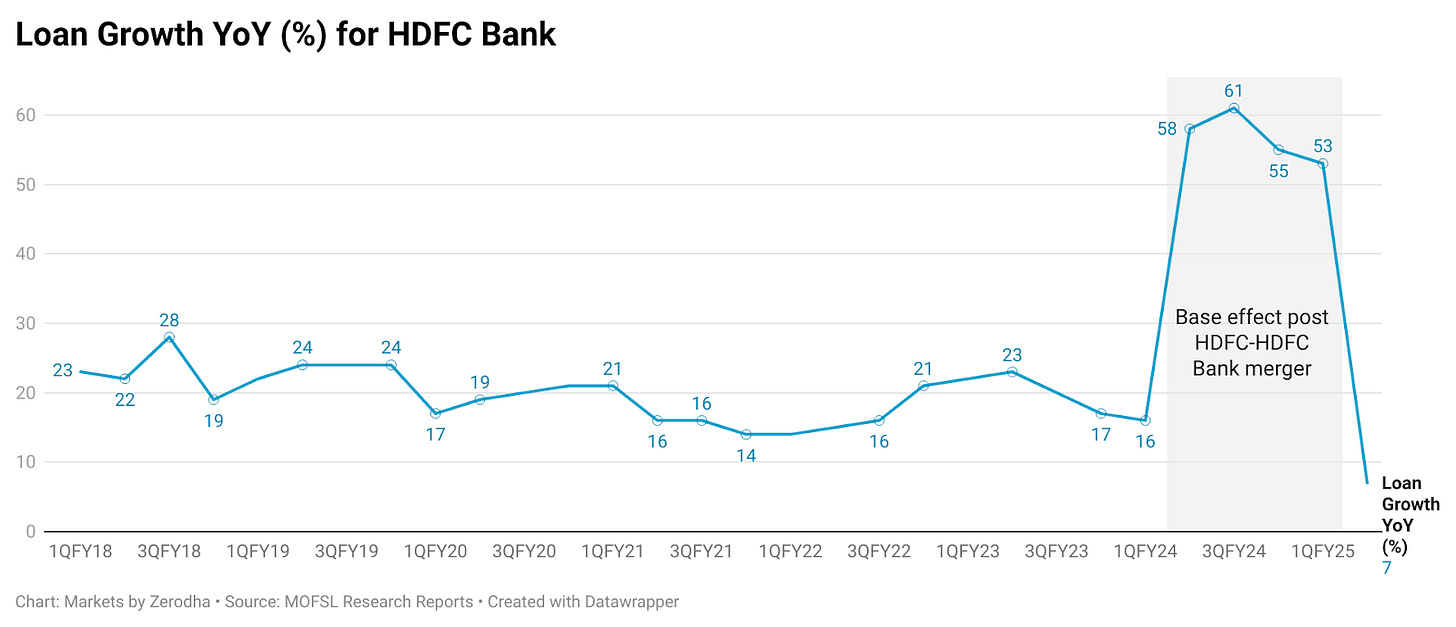

HDFC Bank is known for many things, but one thing that has always stood out is its steady, high loan growth. For years, it was almost a given: HDFC Bank would consistently grow its loan book by about 20% annually. But something surprising happened in Q2 of FY25 (July to September 2024)—the bank's loan growth slowed to just 7% year-on-year, marking the first time in years that it slipped into single digits.

Now, if you know HDFC Bank, you might wonder: is something going wrong? A drop like this could easily set off alarm bells.

But here’s the interesting part: the market didn’t panic. In fact, the bank’s share price went up by 2.5% after the results came out. So, what’s really happening?

To understand this better, we need to look at the merger between HDFC Ltd. and HDFC Bank.

HDFC Ltd., a housing finance company, was the parent company of HDFC Bank. On July 1, 2023, the two officially merged, creating a financial giant. But this merger wasn’t just about making the bank bigger—it also added some challenges, especially when it came to managing the bank’s balance sheet.

When HDFC Bank merged with HDFC Ltd., it didn’t just gain assets; it also took on liabilities, or debts, from HDFC Ltd., which changed the bank’s balance sheet almost overnight.

Banks usually fund themselves in two main ways:

Deposits: The savings and fixed deposits that customers keep with the bank. This is a bank’s preferred way to get funds because it’s cheaper—customers are more interested in safety than in high returns, so banks can offer lower interest rates.

Borrowings: Money the bank raises from the market, often through bonds. Borrowings are more costly since investors expect higher returns.

Before the merger, only 8% of HDFC Bank’s liabilities came from borrowings, with the rest from deposits. But after the merger, borrowings shot up to 21%. This means that for every ₹100 the bank owed, ₹21 now came from borrowings, compared to just ₹8 before.

This shift directly affected two key areas: the Cost of Funds and the Credit to Deposit (C/D) Ratio.

Cost of Funds: This refers to how much it costs the bank to raise money. Since borrowings are more expensive than deposits, HDFC Bank’s cost of funds increased from 4% to 4.8%.

Source: HDFC Bank C/D Ratio: This ratio shows how much of the bank’s deposits are being used for lending. After the merger, the bank’s C/D ratio jumped to 110%, up from around 86-87%. This means HDFC Bank was lending ₹110 for every ₹100 in deposits—relying heavily on more expensive borrowings to fund its loans.

A C/D ratio above 100% isn’t ideal because it means the bank is lending more than it’s collecting in deposits. This could put the bank at risk if the economy slows down or if deposits decrease. So, reducing the C/D ratio has become a top priority for HDFC Bank.

To manage this shift and ensure stability, HDFC Bank is following a three-part strategy:

1. Slowing down loan growth: The bank is intentionally being cautious with its loan growth. CEO Shashidhar Jagdishan has outlined a plan to grow deposits faster than loans over the next few years. In the most recent quarter, HDFC Bank actually reduced its wholesale loans (those to large businesses), showing a more careful approach. Retail loans (those to individuals) are also growing more slowly, while commercial and rural banking remains a focus. The plan is to grow conservatively in FY25, match the market in FY26, and then aim to outpace competitors by FY27. This gives the bank time to adjust to the merger without sacrificing long-term growth.

2. Growing deposits: HDFC Bank is working hard to increase its deposit base, which is a cheaper and more stable source of funds than borrowings. To do this, the bank is expanding its branch network rapidly, opening 241 new branches in the last quarter alone. This effort is already paying off, with deposits growing by 15%, which is faster than the industry average. The goal is to bring the C/D ratio back down to pre-merger levels of around 85-90%.

3. Securitization: The bank is also selling off some of its loans to external investors. By doing this, HDFC Bank can free up capital and reduce the size of its loan book. This helps lower the C/D ratio and improves liquidity, giving the bank more flexibility to manage its cash flow.

These strategies are already showing positive results. For the first time since the merger, HDFC Bank’s C/D ratio has dropped below 100%, a significant milestone. The bank aims to bring it back to pre-merger levels within 2-3 years, which is faster than initially expected.

Despite the slower loan growth, investors have reacted positively. The disciplined, long-term strategy seems to have reassured the market, with the bank’s share price rising by 2.5% after the Q2 results were announced.

HDFC Bank is going through a major transition after merging with HDFC Ltd. While the slowdown in loan growth might seem concerning at first, it’s actually part of a broader plan to strengthen the bank’s financial health. By focusing on growing deposits, taking a careful approach to lending, and using securitization, HDFC Bank is setting itself up for sustainable growth in the coming years. And judging by the market’s reaction, investors seem confident in the bank’s direction.

Quick Commerce vs The Government

In recent years, India has seen a rapid rise in the quick commerce sector. Companies like Swiggy, Blinkit, and Zepto are delivering groceries and everyday essentials in as little as 10 minutes. This kind of fast delivery has changed how people shop. Instead of planning their purchases in advance, many now rely on these services to get what they need instantly.

But this growth in quick commerce is raising concerns, especially for small, traditional retailers—particularly the local Kirana shops that have been the backbone of India’s retail sector for decades. These local shops are feeling the heat because they’re finding it harder to compete with the tech-driven companies that offer ultra-fast deliveries at lower prices.

To understand just how much of a challenge quick commerce is for Kirana stores, consider this: by 2027, the quick commerce market is expected to be worth more than ₹1,80,000 crore. People seem to have become hooked on the convenience of ordering whatever they need and having it delivered almost instantly, especially at competitive prices!

Because of this explosive growth, traditional retailers and even the government are now raising alarms. One of the key voices here is the All India Consumer Products Distributors Federation (AICPDF), which represents about 400,000 small shop owners.

They believe that quick commerce companies are engaging in predatory pricing—a strategy where companies sell products below cost to push out smaller competitors. The AICPDF has taken this issue to the Competition Commission of India (CCI), accusing companies like Swiggy, Blinkit, and Zepto of driving small Kirana shops out of business by offering prices that smaller retailers simply can’t match. The federation fears that if these quick commerce companies continue unchecked, India’s retail landscape could shift dramatically, with these large players gaining even more control over the market.

If the CCI investigates and finds evidence of predatory pricing, these quick commerce companies might have to rethink how they price their products. This could slow their growth and give smaller businesses a better chance to compete.

Another aspect of this story is the growing use of dark stores—small warehouses that quick commerce companies use to make ultra-fast deliveries possible. The government is now looking closely at whether these companies are following India’s foreign direct investment (FDI) rules in how they set up and manage these stores.

To explain the issue, here’s a bit about India’s FDI regulations:

- Foreign-owned companies are not supposed to directly manage or own inventory in online marketplaces.

- They are meant to act as intermediaries, connecting buyers and sellers, not as retailers themselves.

To comply with these rules, quick-commerce companies claim that their dark stores are owned and run by separate entities. But the ownership structures are often unclear and complex. This lack of transparency raises concerns for the government. While quick commerce companies technically don’t own the products or the dark stores directly, their close relationships with these “separate” entities blur the lines of control and ownership—which might violate FDI rules.

This isn’t the first time we’ve seen scrutiny in India’s digital retail space. Similar issues arose with major e-commerce players like Amazon and Flipkart, both of which faced accusations of controlling inventory through third-party sellers to get around FDI rules.

For example, Amazon’s relationship with Cloudtail, one of its biggest sellers in India, raised questions in the past. Although Cloudtail was technically a third-party seller, Amazon’s stake in the company had a significant influence on pricing and availability, which critics argued went against the spirit of FDI rules. Flipkart had a similar arrangement with WS Retail.

Both companies used these partnerships to offer deep discounts that made it tough for smaller competitors to survive. In response, the Indian government tightened e-commerce rules in 2018 and 2020, forcing Amazon and Flipkart to adjust their business models. But concerns about their dominance haven’t completely gone away.

So, what’s next for quick commerce?

As the sector faces growing scrutiny, it might be at a turning point. If the CCI investigates and finds these companies guilty of either predatory pricing or violating FDI rules, their operations could change significantly.

Commerce Minister Piyush Goyal has been openly critical of business models that rely on deep discounts while incurring heavy losses to gain market share. His concern is that these practices are unsustainable and create unfair competition, especially for smaller businesses that simply can’t afford to compete at those price levels.

Ultimately, how the government and CCI respond to these concerns will shape the future of quick commerce in India. With small businesses at stake, it’s definitely a space worth watching closely.

Corporate bonds made easier

SEBI, India’s market regulator, has recently introduced a new “liquidity window” for corporate bonds. While that might sound a bit technical, it’s actually pretty simple, and it could have a big impact on how corporate bonds work. So let's break down what this means.

First, corporate bonds are a way for companies to borrow money from investors. Think of it like lending your money to a company—in return, they pay you interest and promise to pay back the full amount when the bond matures.

But there’s a catch—if you want your money back before that maturity date, selling your bond can be tricky, especially if demand is low.

This is where SEBI’s liquidity window comes in. It introduces a new option for bond issuers to offer something called a “put option.” This gives investors the right to sell their bonds back to the company before they mature, but only on certain dates.

Here’s how the liquidity window works in practice:

- Companies can choose whether or not to offer this put option. If they do, they must set aside at least 10% of the total bonds for this liquidity window.

- The company can open this option on a monthly or quarterly basis, giving investors some flexibility when deciding to sell their bonds back.

- The price at which investors can sell the bond isn’t fixed—it’s based on the bond’s value on the day before the liquidity window opens. The company can’t buy the bond back for more than 1% less than that valuation. Plus, any earned but unpaid interest is added to the sale price, so investors don’t miss out on interest.

- This window remains open for three working days, during which investors can sell their bonds. If too many investors opt to sell and the company can’t buy them all, the bonds are bought back proportionally, meaning each investor might only sell part of their bonds.

Now, why did SEBI introduce this, and why does it matter? Let’s look at the bigger picture of India’s corporate bond market.

Over the last decade, India’s corporate bond market has grown rapidly. Back in 2014, the market was valued at around ₹15 lakh crores, and by 2024, it has grown to over ₹47 lakh crores. This means it has more than tripled in size in about a decade.

But the way companies issue bonds has changed during this time. In 2014, around 12% of bonds were issued through public offerings (where anyone could buy them). Today, it’s just 2%. Instead, nearly all bonds—about 98%—are issued through private placements, where bonds are sold directly to institutional investors like banks or mutual funds, bypassing the public process.

While this method is quicker and cheaper for companies, it leaves retail investors with fewer opportunities to buy these bonds.

Even though the corporate bond market has grown, trading activity hasn’t kept pace. The daily average trading volume has been between ₹5,400 crores and ₹6,000 crores since 2018, despite a 72% increase in bonds issued. That means liquidity—the ability to quickly sell your bonds—remains a challenge.

This is a concern for investors, especially retail investors, who might need access to their money more urgently than larger institutions. And if it’s hard to sell bonds, people are less likely to buy them in the first place.

SEBI’s liquidity window is a direct response to this issue. By giving investors the option to sell bonds back to the issuer at specific times, it creates an “exit route.” This added flexibility makes corporate bonds more attractive because investors don’t have to worry about being stuck with a bond they can’t sell.

This liquidity window isn’t SEBI’s only move to make the market more accessible. They’ve also reduced the face value of privately placed bonds from ₹10 lakh to ₹10,000, making it easier for more retail investors to enter the market.

Additionally, SEBI has introduced the Request for Quote (RFQ) platform to make bond trading more efficient. This platform allows brokers to connect retail investors with bond buyers and sellers more easily, making trading faster and more transparent.

If you’re an investor interested in bonds, these changes are good news. The liquidity window adds flexibility, the reduced face value makes bonds more accessible, and the RFQ platform makes trading smoother.

In short, SEBI’s reforms are making India’s corporate bond market more friendly for investors, especially retail ones. Whether you’re a seasoned investor or just getting started, these updates make bonds a more appealing part of any portfolio.

Tidbits:

Adar Poonawalla is set to acquire a 50% stake in Dharma Productions for ₹1,000 crore. This partnership aims to boost content production for digital platforms, focusing on both local and international audiences.

Prestige Estates is investing ₹7,000 crore to develop a 62.5-acre township in Ghaziabad, marking their entry into the Delhi-NCR market. The project, called "Prestige City," is expected to generate over ₹10,000 crore in revenue.

Navi Finserv has canceled its ₹100 crore bond issuance following the RBI's crackdown on high-interest loans, which highlights the regulatory risks for NBFCs. This decision is likely to impact Navi's plans for raising capital and growth.

Sunil Mittal of Bharti Enterprises (Airtel) has called for another telecom tariff hike. He cited rising operational costs and emphasized the need for better digital infrastructure. According to him, India’s low revenue per user, compared to global markets, remains a major challenge.

Thank you for reading. Do share this with your friends and make them as smart as you are 😉

If you have any feedback, do let us know in the comments