The Roadblock to India’s Rise

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and watch the videos on YouTube. You can also watch The Daily Brief in Hindi.

In today’s edition of The Daily Brief:

The economics of talent

What should India expect in FY 2026?

The economics of talent

If you’ve been following us for a while, you probably know that we’re suckers for cool bits of research from the world of economics which crack open ideas that one wouldn’t expect economists to look into. That’s why, when we came across this IMF article by Ruchir Agarwal and Patrick Gaule, which went into the ‘economics of talent,’ we were instantly sold.

Intuitively, we know that different people have different abilities. Some people are particularly talented — at writing, drawing, playing the guitar, or some other random thing — that is, they just have a special knack for doing it well. This is the sense in which we’re talking about “talent,” here — not as a broad synonym for “human capital” but in terms of the special ability that some people have.

When you zoom out to the scale of entire economies, these special abilities really add up. A society’s most talented people tend to push the frontier of its growth. Over time, their influence is disproportionate: after all, individual people can shape entire industries. At the same time, talent doesn’t guarantee anything. Whether these special abilities actually translate into something meaningful depends a lot on how societies harness them. This is why it’s deeply important to understand the economics of talent.

Now, we can’t promise you a comprehensive piece. We’re just starting to learn about this all. Human talent and ability is incredibly complex — and our own talent and abilities are too limited to give you a complete picture of things. So, instead, we’ll give you a brief gist of the major bits of research we’ve seen. Consider this a rough first draft of our thoughts on the topic. We’ll hopefully top this up as we come across more.

What impact can talent have on an economy?

Economics tends to see everything as a resource and tries to puzzle out the most efficient way in which it can be allocated. That is also true of talented people. If an economy’s talent is allocated in the best fashion — that is, its best minds are doing the best work — that economy is likely to do well.

If you look across history, at different times, there are different ways in which people try and seek wealth in power. In ancient Rome, for instance, “respectable” people saw industry and commerce as degrading — and tried to earn money by holding land or political office. In medieval China, people went to the bureaucracy to earn money and prestige. And so on. Looking at different societies from across the world, the great economist William Baumol concluded that a society gets really good at the things that talented people within it try to do.

Essentially, in a well-functioning economy, talented people are pushed to innovate and create things. In dysfunctional ones, they instead exploit loopholes or engage in socially wasteful contests. If the path to success in a society lies in creating value — like engineering or entrepreneurship — that society tends to be productive. If it lies in something unproductive — like manipulating the financial or legal system — that society becomes unproductive as a whole.

Interestingly, the impact of talent is highly skewed. This is called the “superstar effect” — where creating even a small number of high achievers can have large payoffs in innovation and wealth creation. Some fields, in particular, scale this exceptionally well — a brilliant CEO, for instance, can create a whole new industry.

These exceptional people don’t just improve their own lives. They also have a notable impact on the people around them. Researchers have noticed a marked “spillover effect” — where exceptional people noticeably improve the work of those around them. In academia, for instance, whenever a “star” scientist joins a research department, the entire department’s productivity rises by as much as 25%. Similarly, other researchers found that when a superstar scientist dies, the output of their co-workers and collaborators falls permanently.

What should this tell us? If you’re looking to fuel growth in your economy, instead of traditional tools — such as tax cuts — another way of looking at the question is how you can hone its best minds. Some research finds that this would actually be a better approach to take.

Between the years 1960 and 2010, for instance, a substantial number of women and non-white men entered the economy for the first time. The talent pool of the economy, in a sense, suddenly grew much larger. Some researchers find that anywhere between 20-40% of America’s economic growth over this period was owed to this widening of its talent pool.

Recognising and nurturing talent

Sadly, talent alone can’t get a country too far. For talented people to actually achieve anything, you need a system that feeds and nurtures that talent. That’s where countries like ours fall behind.

Take mathematics, for instance. There’s a global high school-level competition — the International Mathematics Olympiad — that students from across the world write. If two students from different countries get the same IMO score, in theory, their talent levels should be roughly equal.

Now, here’s something interesting: as you follow the lives of similarly talented students, you find that a gap opens up — depending on where they live. People from higher-income countries do better than people from poorer countries with the same level of talent. They’re more likely to complete a PhD, earn publications and citations, and even win the Fields Medal. Clearly, there’s something that richer countries do to ensure that their most talented people get ahead, which poorer countries cannot.

Given the degree to which talent changes an economy, however, it’s deeply important for a developing country like ours to crack this equation and learn how to nurture talent better. Research suggests that you need a two-pronged strategy for this. One, you need a broad approach that helps everyone reach a floor level — such as universal education and healthcare. Two, you need targeted support for the best talents you discover — from gifted programs in K-12 schools to selective high schools or academies to early college admission and mentorship schemes.

Many high-ability individuals never get the chance to become “talents,” at least in the economic sense. This is sometimes called the “lost Einsteins” problem. As per one study, for instance, children from families in the top 1% of income are 10 times more likely to become inventors than those from the 50% poorest families. This isn’t because rich kids are ten times as talented; rather, many poor and middle-class talented children are never identified or cultivated. This is why one part of the equation is to find talent from underrepresented parts of the country. This is where broad policies can help.

At the same time, it’s important to push the talent you do find to greater success. For that, you need to both challenge and support people with high abilities. Part of this lies in putting such people through difficult situations: through academic acceleration programs or exposure to rigorous coursework. At the same time, talent also requires support. This can come through access to strong peer groups or expert mentorship, which provide both intellectual stimulation and guidance. National policies — such as research funding, skilled immigration programs, and investments in world-class institutions — can provide the backdrop for such talent to thrive.

All of this, taken together, is an extensive exercise in human resource management. But it’s deeply important — not just to elevate individuals, but to economic progress and global competitiveness.

Talent tends to cluster

Because different parts of the world are different in their ability to nurture talent, over time, that has an interesting repercussion: talent isn’t spread evenly around the world — or even within the same country. Instead, it tends to cluster in specific geographies.

Cities, for instance, are obvious clusters of talent. They have better economic opportunities, educational institutions, and networks of talented people. This turns some cities into ‘talent magnets’. But as talented people start congregating in cities, something interesting happens — the “spillover effect” starts taking hold. As the share of highly educated, skilled workers in a city rises, that increases the productivity and wages of those around them. For instance, researchers have found that when an urban area has a dense concentration of college-educated workers, that leads to more innovation and productivity growth for the entire city.

Essentially, talented professionals, such as developers or financiers, become more effective when they’re surrounded by other top minds. And so, when talent piles up together, it creates a virtuous loop, leading to entire “superstar cities”. This is why a city like Bengaluru, for instance, doesn’t just attract talent — but amplifies it.

Over time, this creates a feedback loop. As top talent congregates in one place, top companies — such as tech giants or financial firms — all compete to hire from the same place. People from those areas have outsized rewards as a result. That attracts even more talent.

Living in a place also gives you exposure to the kind of thing that happens there — and that determines what you do through your life. For instance, researchers studied people living in Boston, who grew up in other parts of America. They found something interesting: people who grew up in Silicon Valley were more likely to get patents in computers. Those born in Minneapolis, which has many medical device manufacturers, were more likely to patent medical devices. And so on. All of this was despite the fact that they all currently lived in the same city.

These effects don’t just play out at the level of cities. They also show up in entire countries. A country like the United States, for instance, has a world-beating research ecosystem, which draws scientists from across the world. As a result, more than 60% of the world’s top scientists now live in America. You see something similar with the Nobel Prize. Most of the world’s Nobel Prize winners come from just three geographies — the United States, Europe, and Japan.

The multiplicative effect of talent

Ultimately, the economics of talent boils down to a simple question: How do we make sure that the right people end up doing the right things? This is a deeply important question for a country like ours, which regularly wastes so much of its potential.

If we can figure this out — by broadening access so that nobody’s gifts go unnoticed and by doubling down on those who show exceptional ability — we set ourselves onto a long-term path to stronger growth and innovation. A lot of our growth over the last three decades has come from early investments of the sort, in institutions like the IITs. That is too limited a program, however. It’s important to understand what else we can do.

This project, ultimately, is not just about individuals. Talent compounds itself. Nurturing a handful of high achievers has a multiplier effect: when talented people succeed, everyone else benefits from the ripple effects.

What should India expect in FY 2026?

Now that we’re closing in on the end of the year, it’s worth zooming out to see what next year has in store. A new CRISIL report does just that, forecasting India’s economic outlook for FY26. The report offers some excellent insights—some familiar, some fresh, and a few that genuinely surprised us. So, as we often do, we've taken the liberty to simplify and serve up the key insights for you—minus all the econ-speak.

Let’s dive in.

Quick Macro Snapshot

Let’s start with the big numbers estimated by the report.

GDP Growth: CRISIL expects India to grow at 6.5% in fiscal 2026, matching the growth pace of fiscal 2025. It’s not the 9.2% spike we saw last year, but it’s still solid relative to many other major economies.

Inflation: CRISIL believes that India’s inflation is likely to soften to 4.4% by fiscal 2026, down from about 4.9% the previous year. We’ll talk more about this soon.

Current Account Deficit (CAD): CRISIL expects our current account deficit to stay around 1.3% of GDP, which it views as comfortable. We also have enough foreign exchange reserves (covering 10-11 months of imports), which means India’s fairly prepared for a nasty surprise. Even our fiscal deficit is projected at 4.4% of the GDP, reflecting the government’s plan to control spending after the pandemic stimulus years.

Now, it’s important to remember that nobody can predict the future. You shouldn’t take these numbers as the gospel truth — but only as a benchmark to shape your expectations. These projections assume many things, including stable geopolitics — even a bad oil price shock could throw them off. But for now, 6.5% growth looks like a realistic possibility.

That’s it for the big-picture numbers. Beyond that, though, the report had interesting takes on everything from geopolitics to investments. Here are the big ones:

One: World in Flux, but India on Track

Over the past two years, global trade tensions have been heating up, and there are a few big reasons behind this. First, the US trade policy is turning protectionist, raising tariffs on countries like India, as it levies an average tariff of around 9.45% on US imports, compared to just 3% in the other direction.

Then, there’s the impact of geopolitical conflicts. Ongoing crises in Ukraine and the Middle East have disrupted supply chains, making global trade more unpredictable. On top of that, investor sentiment has been shifting toward “safe havens” like the US dollar and gold, which has triggered capital outflows from emerging markets like India.

Where’s the proof of uncertainty?

The uncertainty isn’t just a feeling—it’s showing up in the data. According to CRISIL, the World Trade Uncertainty Index surged by over 19 times in the last quarter of 2024 compared to the previous year. That’s a massive spike, reflecting just how volatile the global trade environment has become.

The consequence? India’s currency felt the impact. The rupee fell 4.4% in FY25 but held firmer than past crises.

But India might withstand the storm

Despite all the turbulence, India is in a relatively strong position to weather the storm. One major factor is its foreign exchange reserves, which stood at over $640 billion as of February 2025—enough to cover about 10-11 months of imports. That’s a solid buffer against external shocks.

Another reassuring sign is India’s current account deficit (CAD), which remains low at 1.0-1.3% of GDP—a level that CRISIL describes as “comfortable.” This means that while India is importing more than it exports in goods, the gap isn’t large enough to create immediate financial risks.

And then there’s India’s services trade surplus. Our share in the export of services across the world has climbed to 4.3% from roughly 2.3% two decades ago. We continue to make up for weaker merchandise exports with its booming IT, consulting, and professional services sectors. This steady inflow of foreign earnings helps stabilize the economy, even when global trade tensions are high.

Two: Manufacturing to outdo services

For years, India’s economy has been driven by services — IT, tourism, and financial services have been the backbone of growth. But a shift is underway. Manufacturing is expected to grow at an average of 9% annually, outpacing the 6.8% growth projected for services.

So, what’s driving this change?

One big reason is the “China+1” strategy, where global firms are looking to reduce their dependence on China and diversify into other markets. India, with its growing infrastructure and workforce, is emerging as a strong alternative.

The government is also playing a big role, offering incentives like the Production Linked Incentive (PLI) scheme to attract large-scale investments.

And then, there’s the rise of new industries—booming demand in solar, batteries, and semiconductors is drawing big investments. CRISIL estimates that these sectors alone could attract ₹8-10 lakh crore in private investments by 2030.

That said, India’s services sector isn’t losing its edge—it still plays a huge role in the country’s trade surplus. But if India manages to hit that 9% manufacturing growth mark, it could push manufacturing’s share of GDP from ~17% today to nearly 20% by 2030. That would be a major transformation.

Three: Rising consumption expected in 2026?

FY2025 was a tough year for consumption. Almost every consumer-facing company was sounding the alarm—sales were sluggish, demand was weak, and people just weren’t spending the way they used to.

With consumption driving 60% of the GDP, weak spending dragged down India’s growth in FY25. But now, CRISIL expects things to take a sharp U-turn in 2026. Two big factors are driving this shift—easing inflation and middle-class tax cuts.

Why Consumers Could Spend More?

One, Inflation Eases

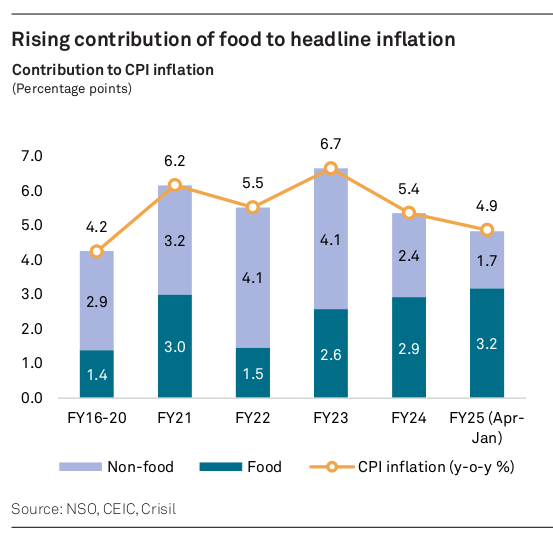

Food inflation, which drove 66% of overall inflation, curbed spending. However, relief is on the horizon. CRISIL projects that headline inflation will cool to 4.4% in FY26, down from 4.9% in FY25.

A big reason for this expected moderation is better food supply. Rabi sowing has seen a 1.5% year-on-year increase. This should boost household spending.

Two, Tax Cuts for the Middle Class

The government’s revised income tax slabs are also expected to play a role in reviving consumption. Under the new regime, a person earning ₹12 lakh per year could save up to ₹80,000 in taxes.

CRISIL believes that a portion of these tax savings will flow into discretionary spending, particularly on consumer durables, two-wheelers, and tourism—sectors that had been hit hard during the slowdown.

But, there’s a flip side

If global conditions take a turn for the worse—say, a sudden spike in crude oil prices—inflation and interest rates could climb again, denting purchasing power. A normal monsoon and moderate oil prices are crucial to ensuring this recovery plays out as expected.

Four: India Inc’s Debt and Financing Needs

India’s corporate sector is gearing up for a massive investment drive, and it’s going to need a lot of money to pull it off. According to CRISIL, India Inc. needs ₹120 lakh crore in debt by FY26 for expansion.

Where’s all this money going? A big chunk of it will be funneled into three key areas.

Manufacturing expansions—especially in electronics, auto components, and chemicals—are set to scale up as India pushes for self-reliance and global competitiveness.

At the same time, the renewable energy sector is witnessing a surge in investments, with projects in solar, wind, and battery storage getting a strong policy push.

And then there’s infrastructure—from roads and ports to smart cities, massive development projects will need steady financing to stay on track.

Why This Matters

With such an enormous borrowing requirement, banks and bond markets will play a crucial role in ensuring businesses get the funds they need.

Banks, with their cleaner balance sheets, can now lend more. But they still have to be mindful of their liability mix—if they don’t manage their deposits well, they could struggle to keep lending rates competitive.

With falling interest rates, bonds, too, could become a cheaper funding source.

CRISIL expects another 50-75 bps rate cuts over the year, which could lower borrowing costs. If banks pass these cuts along quickly, it lowers borrowing costs for businesses, encouraging more investment.

The key takeaway?

In short, CRISIL is optimistic about India, despite the challenges of a bad global economy. In an ideal scenario, this could be a great year: 6.5% growth, easing inflation, and steady reserves offer us a solid foundation. That said, global surprises could still rock the boat.

Tidbits

Hyundai Motor India Ltd (HMIL) has proposed seven related-party transactions worth ₹31,526 crore for FY26, with major deals involving Mobis India (₹12,525 crore), Kia India (₹5,824 crore), Hyundai Motor Corporation (₹4,607 crore), and Hyundai Engineering & Construction (₹3,000 crore). Proxy advisory firms are split—Stakeholders Empowerment Services (SES) has opposed six transactions, citing governance concerns, as these deals account for 40% of HMIL’s revenue and over 50% of total purchases in FY24. Institutional Investor Advisory Services (IiAS) has supported all resolutions, stating the transactions align with global business practices. SES flagged issues with Hyundai Engineering & Construction, a 10-employee firm, being awarded a ₹3,000 crore contract and questioned the transparency of subcontracting.

JSW Greentech Ltd, a JSW Group entity, is raising ₹1,487 crore through a long-term loan to set up a greenfield electric vehicle manufacturing facility in Aurangabad, Maharashtra. The plant will have an annual capacity of 10,000 electric buses and 5,000 electric trucks, with operations scheduled to begin by July 2027. The total capex will be funded through a mix of debt and equity infusion from the JSW Group.

Sun Pharmaceutical Industries Ltd. has announced the acquisition of U.S.-based Checkpoint Therapeutics for $355 million, offering $4.10 per share, a 66% premium over Checkpoint’s last closing price. An additional $0.70 per share may be paid if Cosibelimab secures EU approval by set deadlines.

- This edition of the newsletter was written by Pranav and Anurag

🌱Have you checked out One Thing We Learned?

It's a new side-project by our writing team, and even if we say so ourselves, it's fascinating in a weird but wonderful way. Every day, we chase a random fascination of ours and write about it. That's all. It's chaotic, it's unpolished - but it's honest.

So far, we've written about everything from India's state capacity to bathroom singing to protein, to Russian Gulags, to whether AI will kill us all. Check it out if you're looking for a fascinating new rabbit hole to go down!

Subscribe to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Thank you for reading. Do share this with your friends and make them as smart as you are 😉