The puzzle of why rural India is consuming more

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how, too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and watch the videos on YouTube. You can also watch The Daily Brief in Hindi.

In today’s edition of The Daily Brief:

Why rural India is really consuming more right now

The Daily Brief AI Round-up: September 2025

Why rural India is really consuming more right now

When we talk about India’s demographics, we often break them down into Rural and Urban. The differences between them are usually defined loosely based on population density, type of occupation, and level of development. Still, this split gives us a rough way to look at things on the ground.

For now, your imagination should be enough to visualize the split. Rural India is farms and fields stretching into the horizon, villages linked by narrow roads, where life is tied to farming and community making up ~60% of Indian population. Urban India, by contrast, is concrete buildings, crowded streets, tall offices, and constant movement — people chasing jobs, technology, and a faster pace of life.

Today, we want to focus on how the former — rural India — is doing, both economically and socially. Are people earning enough? Are they spending more? And how does life there look right now?

Of course, we’ll answer this using hard numbers. They don’t capture the full story, but they give us a good starting point. Let’s dive in.

On the surface

The story can be boiled down to this: rural India’s consumption stayed muted through the first three post-pandemic years (between 2021–2023). But things flipped from 2024 onwards.

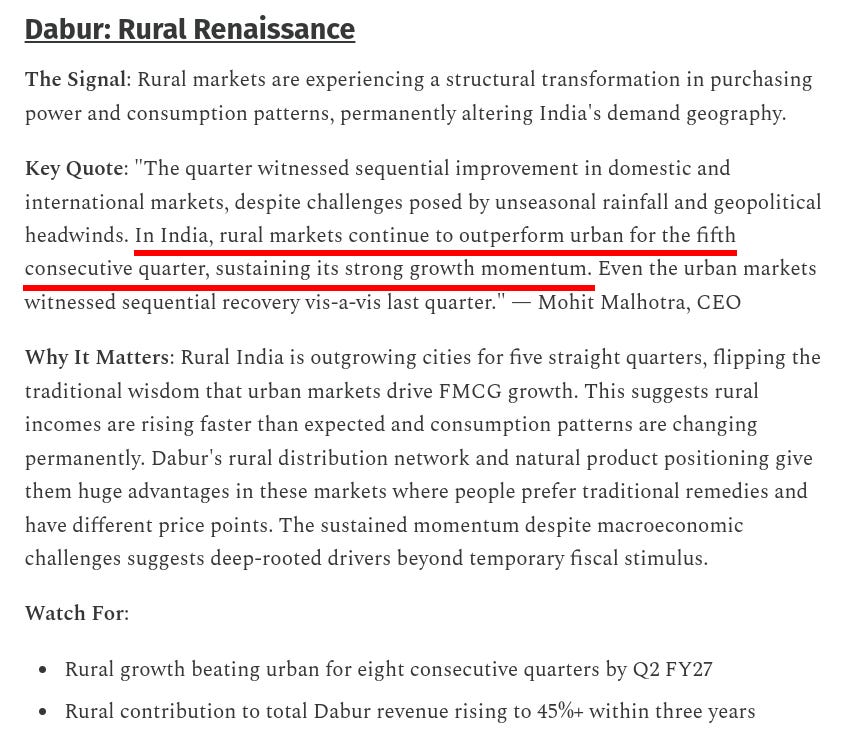

Now, rural shelves are moving again. In the March quarter, FMCG value sales rose about 11%. If we account for the effect of inflation, then rural volumes grew ~8.4% compared to just 2.6% in urban areas. This marks the sixth straight quarter where rural growth has outpaced urban, according to NielsenIQ. In short, rural areas are doing pretty well.

The weather seems to have helped. The India Meteorological Department had forecast an above-normal monsoon this year—around 105% of the long-period average—and early sowing season reflected that optimism. Cultivated area was up too by ~6.6% from last year. For rural India, where more than half of households depend on agriculture, good rains and more acreage are big positives.

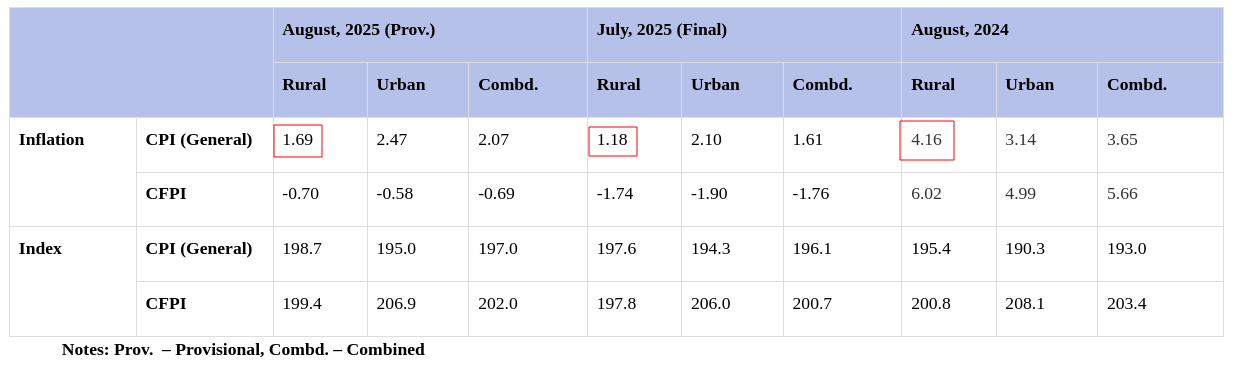

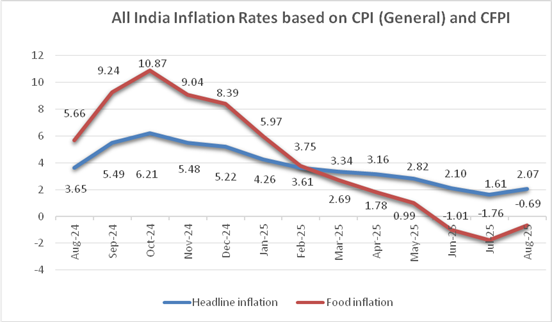

Inflation has been easing as well — especially food inflation. Since rural households spend a larger share of their budgets on food, falling food prices are a clear win.

Companies are seeing the same trend too. Dabur’s CEO, for instance, sounded confident on a recent earnings call that rural demand would “sustain its growth momentum”. We actually picked this up while going through Dabur’s earnings call transcript for The Chatter — where we run a section called Plotlines that digs into recurring themes from corporate commentary. And rural strength has been one of those themes building steadily in the background.

The short of it: good weather, more acreage, and low inflation make rural shelves look alive again.

But….and here’s Always a But

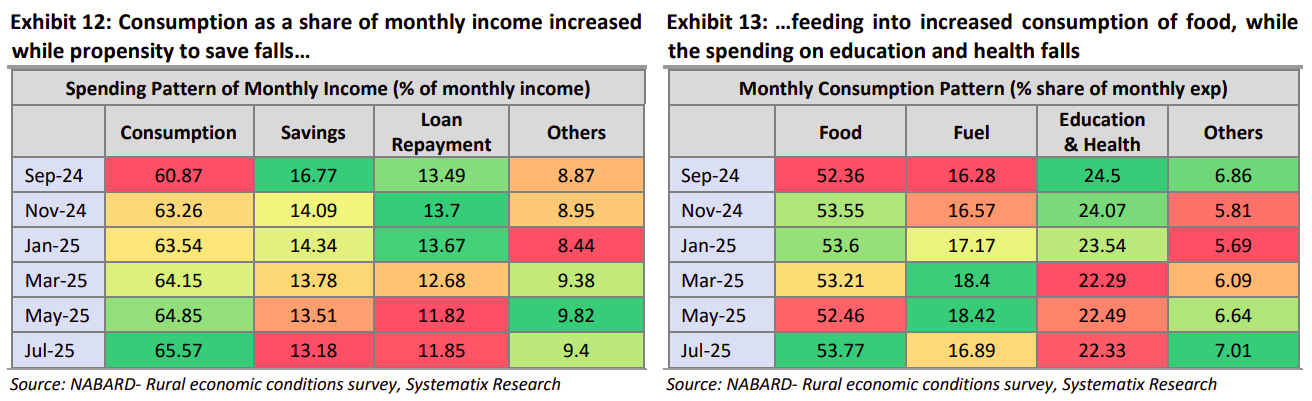

Here’s where the story stops being simple. Look at the numbers from a different angle, and the conclusions change. Research by Systematix, in its Household Situation Tracker (authored by Dhananjay Sinha), points in a different direction. And what we get from it is that demand looks better because prices cooled, but not because wages grew. What do we mean, and why does it matter?

Take agriculture, for instance. Good weather may have increased output, but that didn’t translate into higher farm incomes because crop prices stayed muted. Mandi prices for wheat have remained flat for months, while wholesale food inflation actually contracted from April. More crops may lift sentiment — especially considering how devastating climate change has been for Indian farmers. But poor realizations meant that farmers received no real income boost.

What’s more, where some areas had good rains, others had way too much. For example, Andhra Pradesh and Telangana are currently going through a terrible spate of floods, denting cotton and rice production. For them, good monsoon weather has tipped over to the other extreme.

That forms the bigger picture: rural purchasing power today is being lifted by disinflation, not wage growth, and this has benefited various areas unevenly.

But even more important is the fact that inflation trends themselves are fickle, so we don’t know how long this increased power will last. Rural inflation fell to 1.7% in July 2025, pushing real wages to their highest since 2017, but the report warns this relief is most probably short-lived. Household incomes themselves remain stagnant. 45% of rural households, and an even higher 56.7% in urban areas, report no income growth — the worst since 2012.

This strain shows up in household ledgers. Savings have dropped to 13.2% of income, while the consumption-to-income ratio has climbed to 65.6%. Food now takes up 53.8% of the monthly budget, the highest in the series. In effect, that high share squeezes what can be spent on education and health spending. One in five rural homes is back to borrowing from informal sources. None of this looks like a durable recovery; it looks like survival during a period of low prices.

This is also why companies have been touting strong rural growth. With some disinflation, households can buy a little more of the same goods, which shows up as stronger rural volumes and a lift for smaller, value-for-money brands. It flatters margins too—until input costs rise or companies test price hikes. The feel-good is real, but it’s running on disinflation that is also volatile. And once this price tailwind fades, the so-called recovery will disappear unless it’s propped up by higher wages.

Another huge red flag is gold loans, which we wrote about in our credit story from last week. While overall credit growth has been slowing, gold loans— ~5% of the personal loan book—have been booming, with triple-digit growth since March 2025. Families typically pledge gold when cash runs short and other borrowing options are scarce. Unlike housing or business loans, gold loans aren’t often used to build something. Instead, they’re small, quick, and meant to tide over short-term distress.

The takeaway is clear: rising gold loans often signal liquidity stress, not prosperity.

Even the consumption markers have what we can only call a split personality. Tractor sales were up in Q1 FY26 while entry-level two‑wheelers were down. In simple terms, investments in farms seem to be holding up, but everyday discretionary spending stays weak.

So, what’s the verdict?

The market loves neat headlines—“Rural > Urban, five quarters in a row”. And sure, that’s not trivial. But it’s also a highly selective (mis)reading of what’s actually happening.

The same surveys that show rising real wages also show households saving less and leaning on riskier credit. Systematix even highlights a growing dependence on government cash transfers among relatively better-off rural households. That’s not the start of a new consumption cycle; that’s a bridge. And bridges, while useful, aren’t destinations.

This doesn’t mean the next few quarters must disappoint. With healthy acreage, easier credit, and the upcoming festive season, these numbers should ideally hold up. Staples will likely keep moving, and the value end of discretionary spend could surprise in Tier-3 and Tier-4 towns.

But if you’re betting on a runaway rural boom, it might be wise to slow down. Some indicators worth tracking would be mandi prices for wheat and rice, rural CPI, whether two-wheelers catch up to tractors, and so on.. If prices tick up while realizations stay weak, the very tailwind that lifted rural demand will just as quickly take it away.

This recovery has some very shaky foundations.

The Daily Brief AI Round-up: September 2025

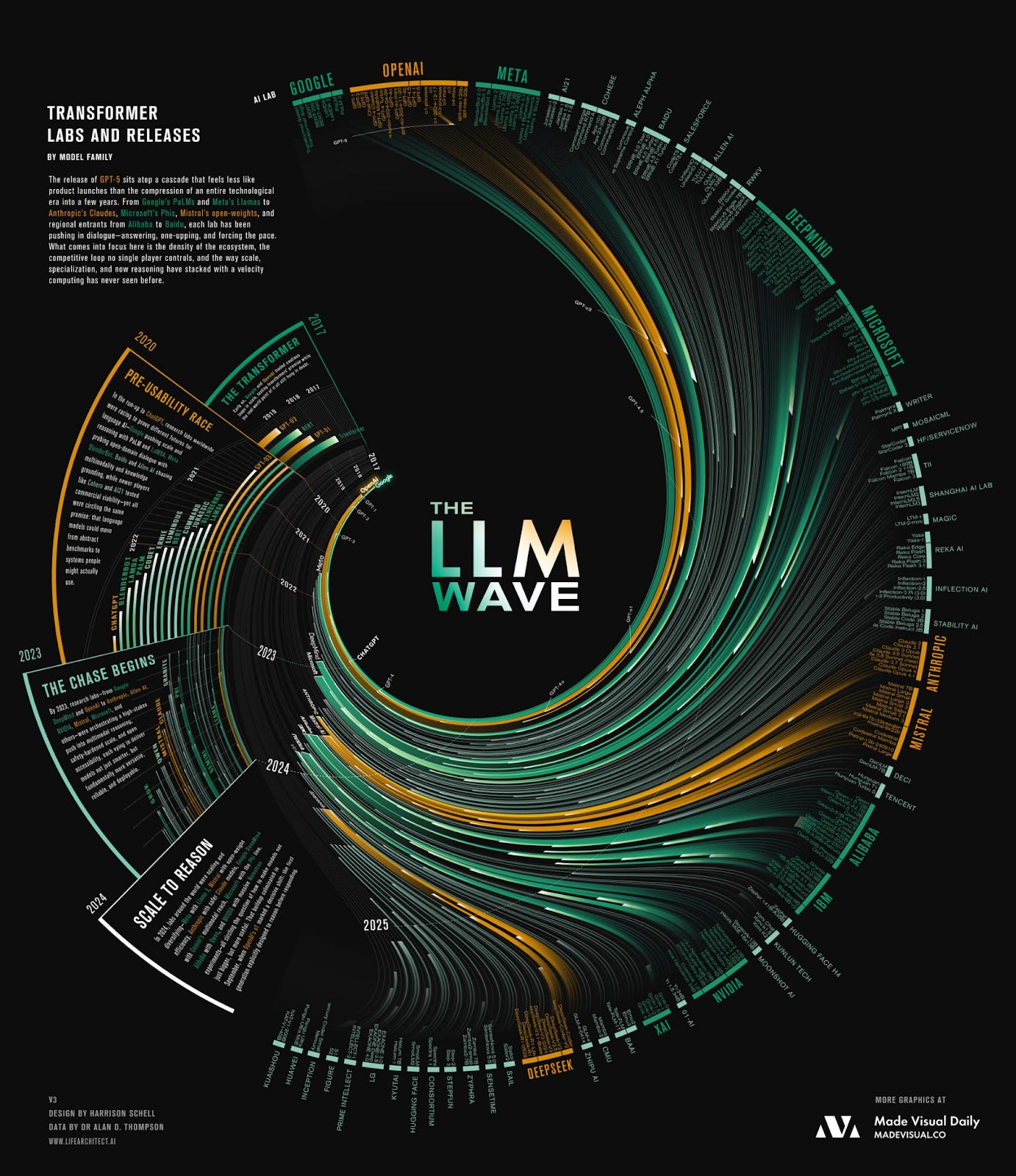

It’s been less than three months since the last time we did our last round-up on all things AI. But, since then, somehow, absolutely everything has transformed. And, at The Daily Brief, we’re not in the business of exaggerating.

So, we’re back with our umpteenth (we’ve lost count) run-through of all the AI-related news that caught our attention in that time. The industry is moving at the speed of blinding light — too fast for us to cover the whole space, so it won’t be too comprehensive. But, as always, we’ll do our very best.

Let’s dive in.

The frontier models are all evolving

Earlier, each new model release marked a substantial leap forward in a model’s raw intelligence. That march has now slowed. But in its place, different models are now exploring weirder, more interesting trajectories.

Take OpenAI’s newest release, GPT-5.

When it came out, OpenAI loudly proclaimed that this was their best, most capable model ever. So confident were they, in fact, that they cut off access to all models other than their newest.

But as soon as people took to the technology, they absolutely hated it:

Turns out, Sam Altman thinks so, too, when he said: “I think we totally screwed up some things on the rollout.”

One of the things that put many people off the new model was, in fact, its big innovation: a router-based system.

See, GPT-5 was never a single model. Behind the scenes, in fact, are a variety of models that all work differently, with different capabilities and efficiencies. A router examines your prompt on a variety of parameters — how complex it is, how many tools it needs, how specific the answer needs to be, and so on. It then chooses the best model to answer your question.

For OpenAI, this was cost-effective — its router could now send you to the cheapest model, and might even create new ways for the firm to monetise your queries. However, it perhaps wasn’t all that helpful to users, at least directly. The new model is good, but not substantially smarter than OpenAIs older flagships. If anything, many power users suddenly lost access to the variety of options they had.

GPT-5 is probably not a big leap in intelligence. But it is a leap in how that intelligence can be paid for and kept sustainable. That alone might be a big deal.

Claude, meanwhile, made leaps in a completely different direction: tool use.

What does that mean for you? Well, Claude has quietly gotten very good at all sorts of regular office software: from making McKinsey-level slides on PowerPoint, to making complex, multi-faceted spreadsheets on Excel — or even replicated full-blown images on Excel, colouring cell-by-cell:

It can use your personal calendar, schedule meetings, and even plan your entire itinerary around nearby places — all at once. That’s being scarily close to having a real-life assistant.

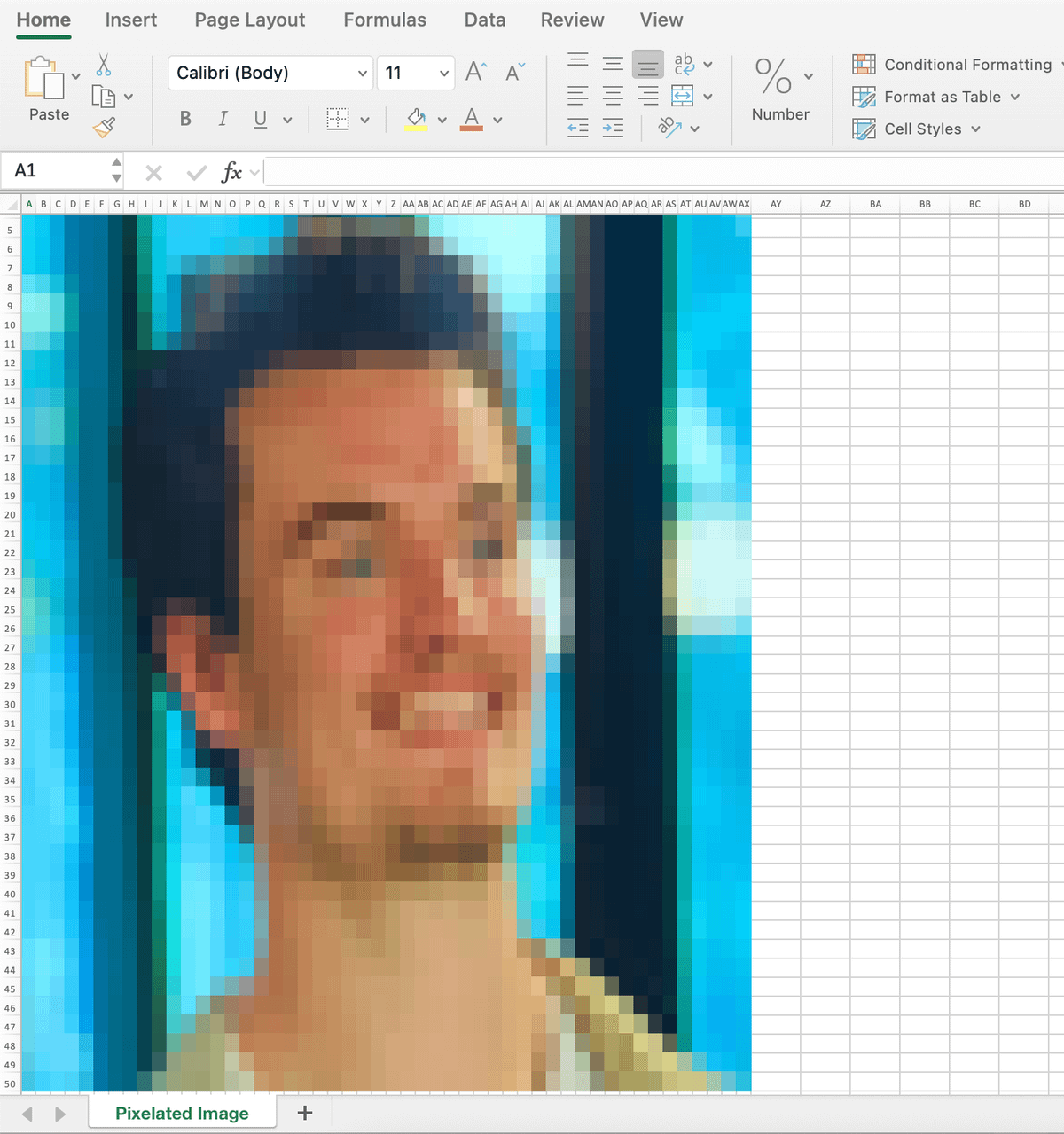

Google’s recent release, meanwhile, expands its multi-modal abilities.

You’ve probably already seen the memes around the “Nano Banana” image update. It is perhaps the most remarkable AI image editor we’ve seen. Most image-generating AI, so far, has struggled to keep faces or styles consistent, practically changing entire photos while editing. Nano Banana, though, seems really good at holding on to a subject’s identity. You can ask the model to change anything at all about someone’s photo —- the backgrounds, their outfit, the time period they’re in, or more. You can even merge several different photos into one scene, and you could find it hard to tell the difference!

Here’s one example of that:

And another:

Nano Banana is more than just a highly-talented image creator — it’s a bona fide AI image editor. And that opens up a whole universe of new options. A simple scroll through the internet will tell you just how powerful this has all become.

Even with all this, we’ve barely covered half of the story. Here’s more developments in brief: the French Mistral just released an open-source speech-based model; Tencent’s new model lets you turn any image into an entire 3D world you can explore; Microsoft is going it alone with its own line of in-house models. And we can go on and on.

AI grows across all sorts of domains

We’ve all become used to slightly mundane, chatbot-based AI systems doing whatever we want. But consider this your timely reminder that this is just a single form factor. There are a host of other experiments that look very, very different. Here are a few that caught our eye.

Real virtual reality

Google’s DeepMind, for instance, has started playing around with “world models” — with its latest “Genie 3”. The magic of Genie 3 is that with a single prompt, it creates an entire 3D world that you can move around in. This world is internally consistent — walk away from somewhere and come back, and it’ll look exactly the same.

Think about what you can do with this technology: make video games, create architectural prototypes from scratch, and so on. But it has real-life applications, too — you can create entire environments to test everything from virtual agents to robots, without putting anyone’s life or limb in danger.

Genie 3: Creating dynamic worlds that you can navigate in real-time

A new device for the AI age?

Meanwhile, OpenAI is taking a crack at re-imagining consumer hardware.

Recently, OpenAI acquired the AI-hardware start-up, io, founded by famed Apple designer Jony Ive. The thesis of this deal is this: the devices we use today — laptops, smartphones and the like — are married to outdated ideas like apps and icons. AI opens the room for new kinds of device behaviour, where you can talk or gesture to your phone to carry out complex chains of tasks.

Right now, the company has been tight-lipped about their work. But the optimistic case could be that, much like smartphones in 2007, an AI device might bring about a whole new paradigm.

Royalty inside my DNA

Perhaps the most interesting AI-based work, though, is happening in the realm of medical research.

DeepMind just came out with a very interesting new model: AlphaGenome. This is an AI model that can read large parts of your DNA (up-to a million base pairs together) at one go, and then make predictions for what specific, individual base pairs might do. And if this model lives up to the hype, it could mean a giant leap for medical science.

Here’s why. So far, we only knew how to read small fragments of one’s DNA, but we didn’t understand how all those parts worked together. Hence, answering the simplest questions took weeks of experimentation. AlphaGenome, though, helps us build working models of how entire stretches of one’s genetic code might behave in living cells. You could take someone with a rare genetic disease or cancer, read their entire genome, understand what is causing it, even model “what-if” situations”, and then concoct a precise cure for them — all in a few days.

Stanford University, meanwhile, is trying to replicate entire laboratories in AI form: with virtual labs staffed by “virtual scientists” using AI agents. Imagine having virtual personas of real-life science roles: a principal investigator, specialists in immunology, computational biology, and so on — that brainstorm together, critique each other’s findings, and plan experiments. All we have to do is give the AI a high-level problem with broad goals.

If early demos are anything to go by, this virtual lab is also really fast. For instance, it was able to come up with CoVID vaccine molecules in a few short days!

AI and its discontents

With this eruption in AI capabilities, it’s hardly a surprise that people have started to take to AI for all sorts of things.

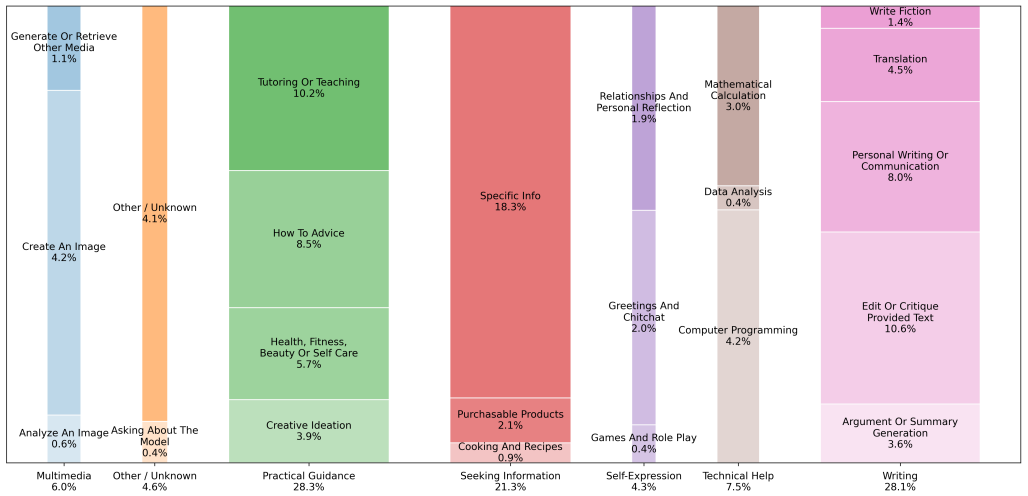

With chatGPT being used by nearly 10% of the world’s adult population, OpenAI has no shortage of data. They’ve used that data to write a paper on “How people use ChatGPT”. And the results are, well, very interesting.

While you’d expect the standard work-oriented usage — coding, writing, analysis, and the like — 70% of all chatGPT conversations happen in non-work contexts. Increasingly, people are pushing all sorts of mainstream personal tasks to it. They’re using it to learn new things, for personal advice, even using it to plan out parts of their life. Equally, ChatGPT is taking a para-social role in people’s lives: as a companion, a mentor, or even a therapist!

In one way or another, AI is going from a technological novelty to a large-scale utility. Here’s a stunning chart on how fast that’s actually happening:

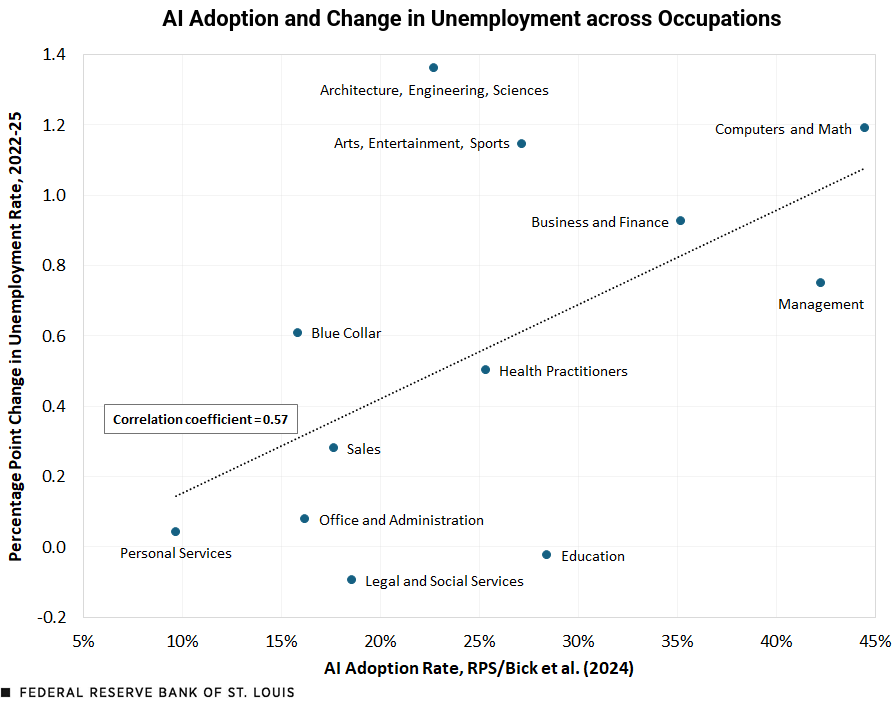

But with such an incredible rise comes problems. Perhaps the oldest and most persistent fear around AI boils down to jobs. And there’s some data that’s started to give that fear some form. Do note that this early evidence might amount to little in the long run. But it’s worth paying attention to.

Economists from the St. Louis Federal Reserve have been studying how recent jobs data compares with the use of AI tools at work. And they found a large correlation — jobs that were the most exposed to AI, involving heavy use of computers or mathematics, saw the highest upticks in unemployment rates.

This is corroborated by researchers at Stanford, who find more nuances to it in their recent, ominously-titled paper “Canaries in the Coal Mine”. Those worst hit by AI, they find, are early career workers (aged 22-25) in occupations that have special exposure to AI, like software development, or customer support. This cohort has seen a relative employment decline of 13%, compared to their peers in other industries, as well as older workers in the same industries.

It seems that while experienced workers are more likely to see AI augment their jobs rather than replace them, those yet to enter the workforce are barely getting their foot in the door.

Another emerging concern is AI’s ginormous, constantly-expanding energy footprint.

The US dominates the global data centre landscape, housing nearly half of the world’s data centres. But this is also causing an unprecedented energy crisis for them. The biggest electricity market in the US, PJM Interconnection, has repeatedly raised the red flag on AI power demand over the last few months — issuing 9 emergency alerts for its network between June and July. PJM holds an annual capacity auction to ensure that it has enough power at hand to meet peak demand. This year, that had gone up by more than 10x compared to 2023, hitting the cap of $329.17/MW-day. In fact, for the first time, the auction couldn’t even meet its targets, marking a significant shortage.

This noticeably raises electricity bills for all the customers it serves. In just the last year, for instance, power bills in New Jersey have climbed by 13.3%, while New Yorkers paid 14.4% more in power bills.

This immense load has pushed companies to try out creative new solutions. Google has signed agreements with utilities providers to scale back power use at its data centres. It volunteered to avoid using power during times of peak demand, in exchange for securing early connection to the grid.

There’s a whole lot more

There’s only so much we can fill into our periodic AI updates. But that isn’t to suggest, by far, that this is the limit of what’s happening.

For instance, we’ve barely managed to touch the massive advances that China’s AI labs have managed to make — be it rivaling American models at far less cost, or Huawei releasing a new AI chip. Nor have we managed to touch on new regulatory measures, like America’s new action plan for AI.

Without a doubt, geopolitics has followed the AI saga. The US briefly cut off China’s access to AI chips, before striking a wild revenue-sharing deal with chip companies in exchange for export access to China. In return, China has been playing hardball, slapping NVIDIA with an antitrust suit, before banning the use of their chips altogether. We’ll probably go into this in detail in another episode.

With AI, change is truly the only constant. By the time we do our next AI round-up, things will probably change completely again. What’s left to see is how.

Tidbits:

IEX challenges CERC order

Indian Energy Exchange (IEX) has appealed against a CERC order mandating market coupling from January 2026. IEX says the move is arbitrary, hurts competition, and redistributes business unfairly. Its stock had dropped 30% after the July order and still trades well below prior levels.

Source: The Economic TimesDixon acquires stake in Q Tech India

Dixon Technologies will buy a 51% stake in Kunshan Q Tech Microelectronics India for ₹552.99 crore. The deal will strengthen its manufacturing of camera and fingerprint modules for mobiles, IoT, and autos, boosting backward integration and technology transfer. Completion is expected within 90 days.

Source: CNBC-TV18Google’s Africa infrastructure hubs

Google plans four new infrastructure hubs in Africa to connect its latest subsea fiber-optic cables. The hubs will cover north, south, east, and west Africa, housing landing stations and data centers. The move aims to cut internet costs, reduce outages, and support Africa’s fast-growing digital and AI needs.

Source:Bloomberg

- This edition of the newsletter was written by Kashish and Pranav

Have you checked out Points and Figures?

Points and Figures is our new way of cutting through the noise of corporate slideshows. Instead of drowning in 50-page investor decks, we pull out the charts and data points that actually matter—and explain what they really signal about a company’s growth, margins, risks, or future bets.

Think of it as a visual extension of The Chatter. While The Chatter tracks what management says on earnings calls, Points and Figures digs into what companies are showing investors—and soon, even what they quietly bury in annual reports.

We go through every major investor presentation so you don’t have to, surfacing the sharpest takeaways that reveal not just the story a company wants to tell, but the reality behind it.

You can check it out here.

Introducing In The Money by Zerodha

This newsletter and YouTube channel aren’t about hot tips or chasing the next big trade. It’s about understanding the markets, what’s happening, why it’s happening, and how to sidestep the mistakes that derail most traders. Clear explanations, practical insights, and a simple goal: to help you navigate the markets smarter.

Check out “Who Said What? “

Every Saturday, we pick the most interesting and juiciest comments from business leaders, fund managers, and the like, and contextualise things around them.

📚Join our book club

We've started a book club where we meet each week in JP Nagar, Bangalore to read and talk about books we find fascinating.

If you think you’d be serious about this and would like to join us, we'd love to have you along! Join in here.

Subscribe to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Thank you for reading. Do share this with your friends and make them as smart as you are 😉