The New World Order: Understanding Global Economic Realignment in the Age of Trump

A brave and scary new world

"We are witnessing the end of a 50-year global economic system happening in real time."

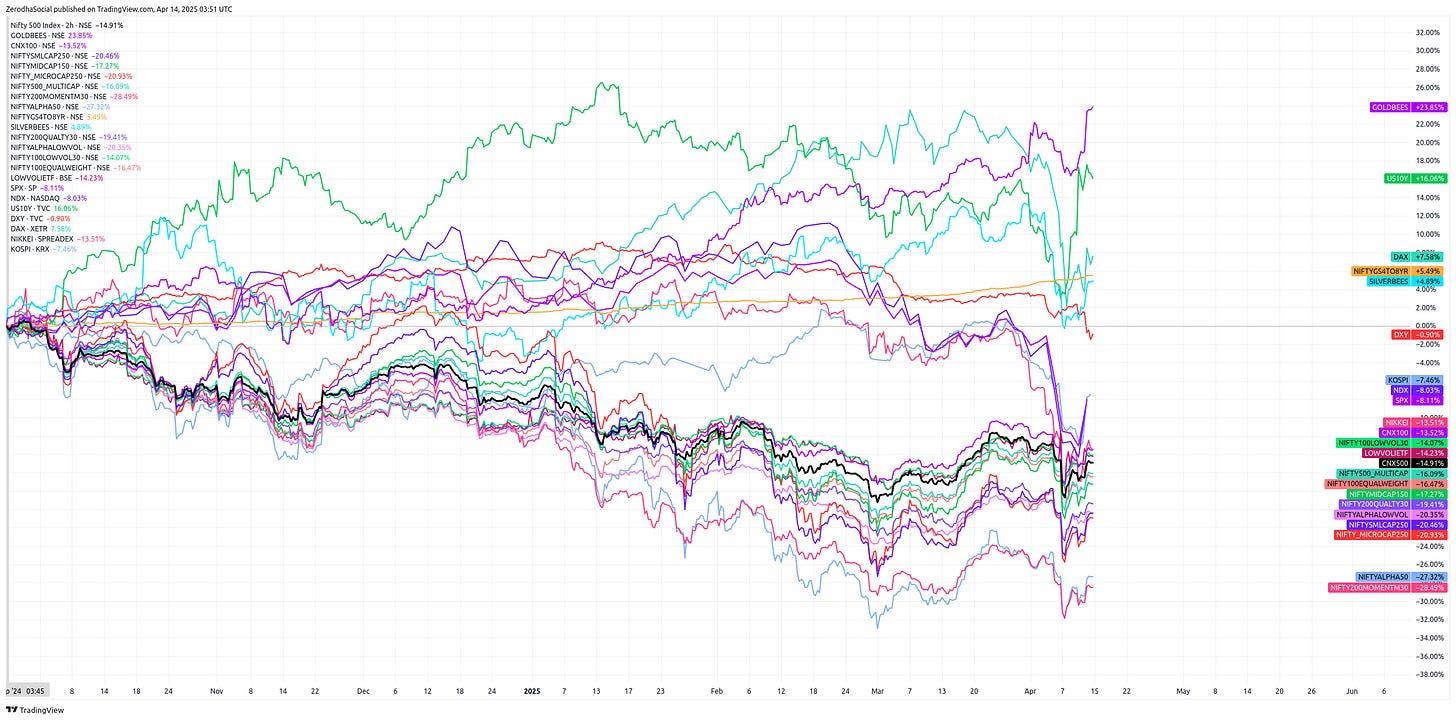

Last week, global markets plunged as Trump announced sweeping tariffs that sent shockwaves through the financial world—not just 10% across the board, but punitive rates reaching as high as 145% for China. The Indian markets weren't spared, with broad indices down 18-20%, midcaps and smallcaps firmly in bear territory, and the S&P 500 experiencing volatility that makes the 2008 crisis look like "a cute correction."

But what if these market gyrations aren't just another correction but the visible symptoms of a profound rewiring of the global economic order?

In the latest episode of "Please Help Me Understand," Bhuvan sat down with investment strategist Debashish Bose to decode what's really happening beneath the headlines. Debashish has 25 years of experience in the markets and used to previously run the PMS by OAKS Asset Management. He now manages Prana India Equity, an India-focused UCITS fund.

Our conversation revealed that Trump's tariffs aren't creating something new—they're accelerating fundamental changes that have been brewing for decades, compressing what might have been a 15-20 year transition into perhaps just five years.

The End of an Era: De-Globalization Accelerates

One of the most striking insights from our conversation is how Trump's policies aren't creating something new but rather accelerating shifts already underway. As Debashish explains:

"What Trump has probably done is just basically accelerated all of it. So the timelines are probably getting crunched... if we had thought that maybe there's a reset of the financial system... that happens maybe over 15, 20 years, chances are now that timeline has just got crunched to, God knows, five years maybe."

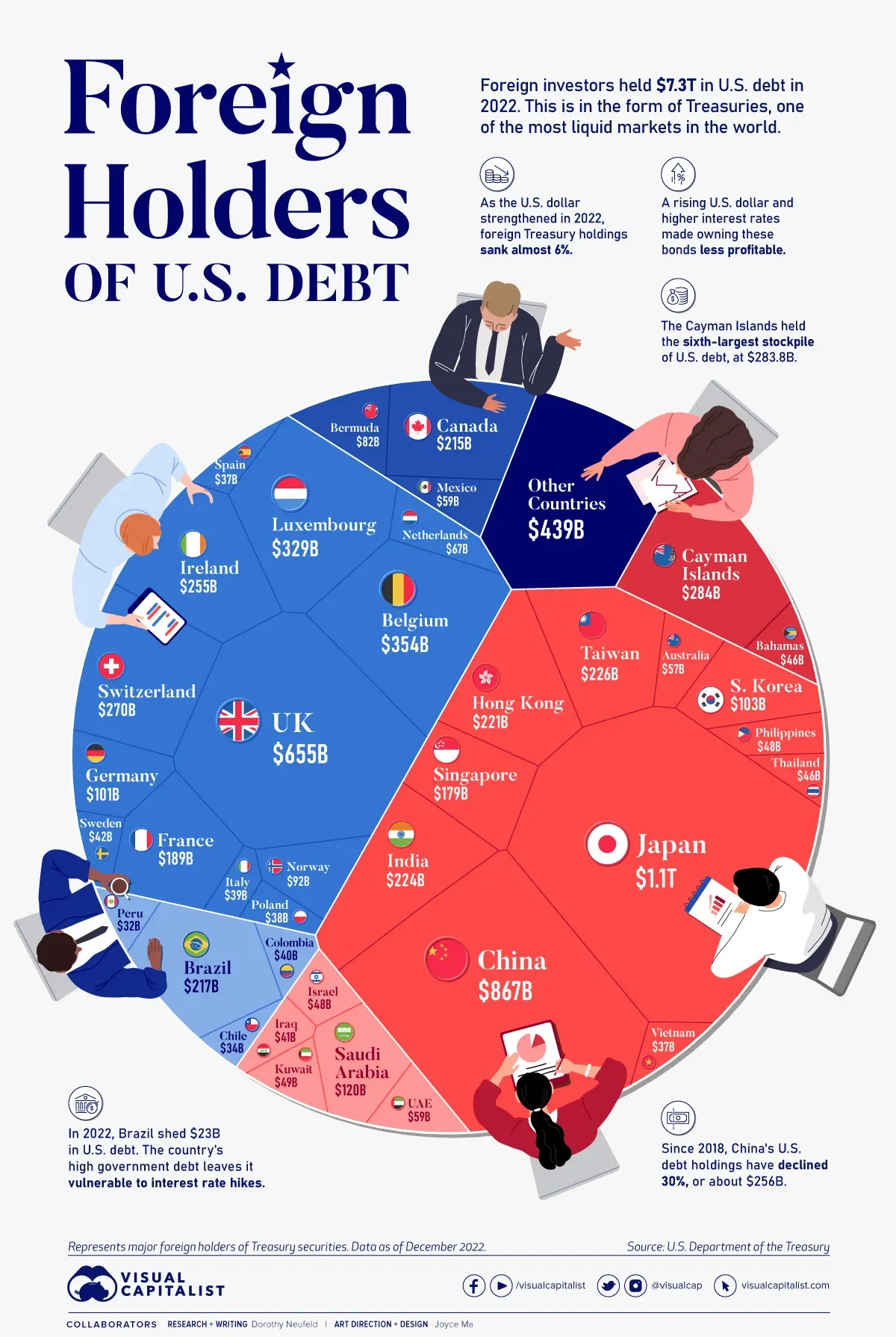

We're witnessing the unraveling of a post-World War II economic order where the U.S. dollar served as both the global reserve currency and primary settlement medium for international trade. This system created a feedback loop:

The U.S. ran trade deficits, effectively financing global trade

Dollars accumulated with exporting nations like China, Japan, and oil producers

These nations reinvested those dollars into U.S. bonds and financial assets

These bonds served as collateral for the massive derivatives markets

Think of it as a global company store: The U.S. issued the currency (dollars), other countries worked to earn that currency by producing goods, then they spent those earnings back at the "company store" (U.S. financial markets). This arrangement benefited everyone—until now.

Real-world example: This system is already fracturing. Saudi Arabia, traditionally one of the largest holders of U.S. Treasury bonds, reduced its holdings by 38% over the past year. Instead, they're investing directly in U.S. companies and diversifying into other currencies. What's happening now is a decisive break in this chain—a shift from what Debashish calls "vendor financing" to a world where direct investment is prioritized over financial market flows.

The Rise of National Capitalism

Perhaps the most significant theme is the emergence of what Debashish terms "national capitalism"—a system where governments actively direct industrial policy, picking winners and protecting domestic industries rather than subordinating decision-making to market forces.

"What's really happening is your voter base and therefore you need to do what appeals to your voter base... and that's really what is National Capitalism, that's where it comes in."

After decades of neoliberal consensus, we're seeing:

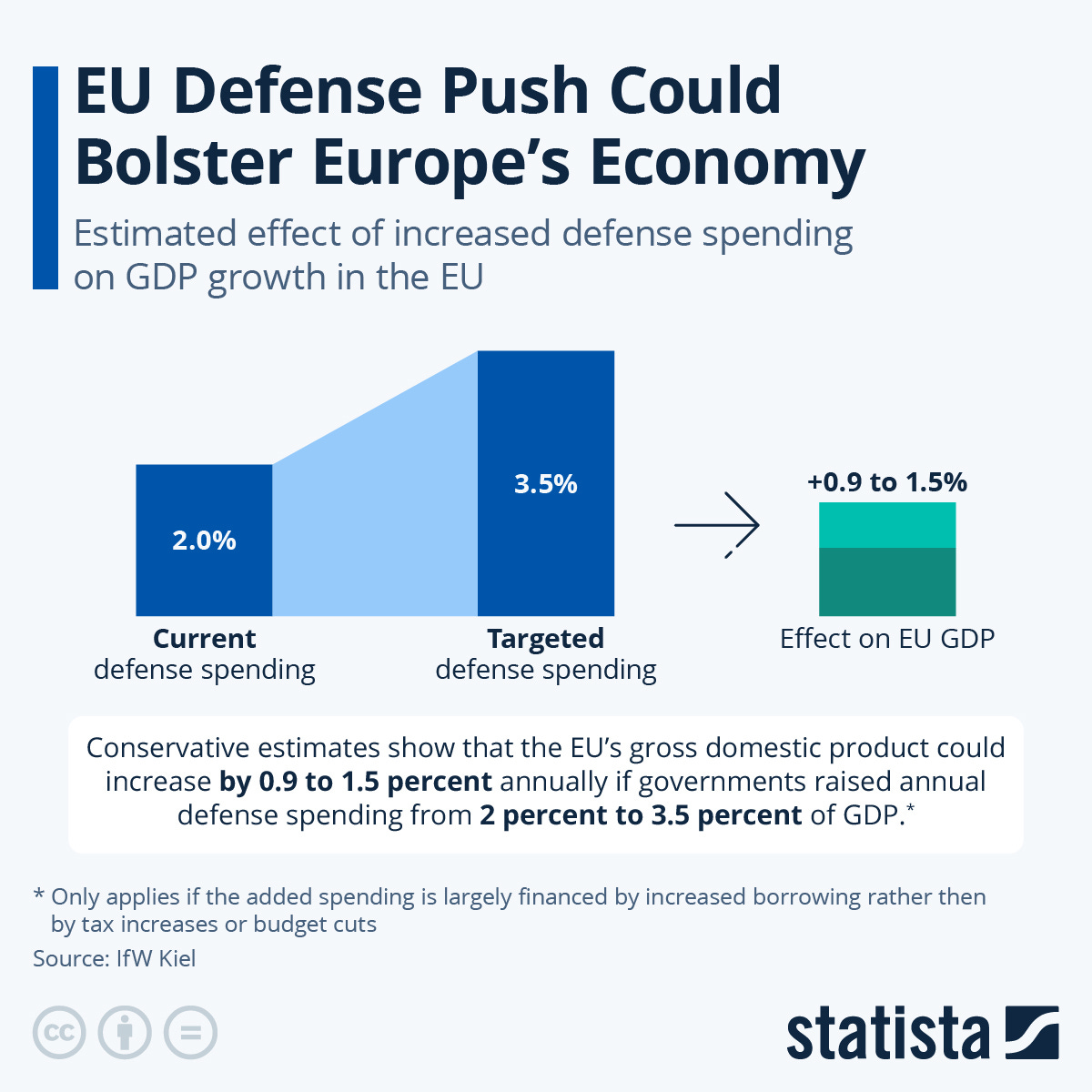

A return to industrial policy across major economies: Countries are no longer letting markets decide which industries thrive. In the US, the CHIPS Act represents a direct government intervention to ensure semiconductor manufacturing returns to American soil. Similarly, European nations like Germany are announcing massive industrial policies, including what Debashish described as investments of "10 to 20 percent of GDP... things which Germany has not done in a hundred years."

Prioritization of domestic manufacturing and supply chain security: The pandemic exposed vulnerabilities in global supply chains, but Trump's policies take this concern to new heights. Rather than simply securing critical components, there's now pressure to bring entire manufacturing processes home—even when economics would suggest otherwise. As Debashish explains, the challenge will be enormous: "A country which is earning 70,000, $80,000 per capita GDP is unlikely to find workers willing to work for $20,000," suggesting automation and AI will need to fill the gap.

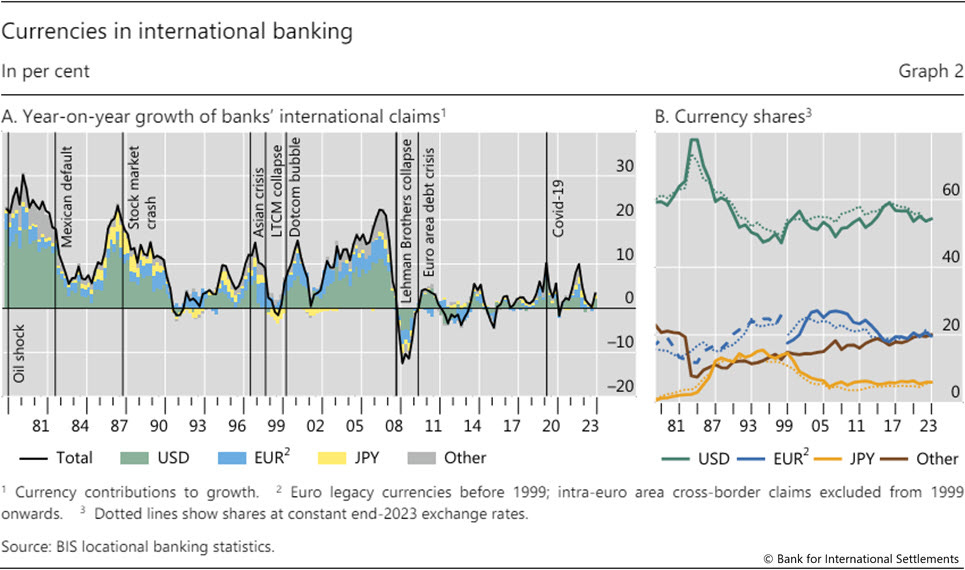

Competitive currency devaluations beginning: We're already seeing early signs with the Chinese yuan and Australian dollar leading the way. This "race to the bottom" helps countries maintain export competitiveness in the face of tariffs but risks a destructive cycle of tit-for-tat devaluations reminiscent of the 1930s.

The potential for capital controls: If tariffs trigger inflation while governments simultaneously try to maintain low interest rates (yield curve control), capital controls become almost inevitable. "You mix these three together," Debashish warns, referring to yield curve control, capital controls, and price controls. "It is a different version of capitalism. Yes, there's a lot of conditions attached."

Remilitarization of traditional powers: Defense spending is set to explode, particularly in Europe. Debashish notes: "What Germany basically came out and announced... is essentially something of the order of 10 to 20 percent of GDP... Things which Germany has not done in a hundred years." This massive spending will cascade across Europe as historical rivalries and security concerns resurface.

This represents not just an economic shift but a political one—the discarding of the belief that free trade and capital flows automatically benefit all participants. As Debashish notes:

"For the first time in whatever history that I know is that multiple countries are competing for the same industries at the same time at very different stages of their own economic evolution... who's going to ultimately succeed no one knows."

The Future of the Global Financial System

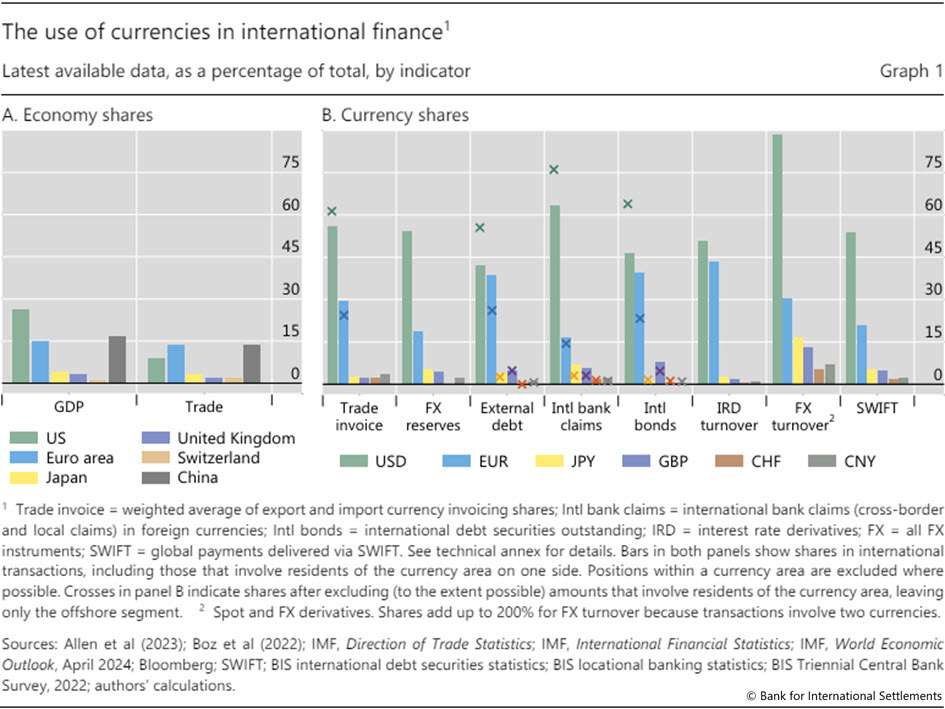

The most alarming aspect of our conversation concerned what happens to the global financial system when its cornerstone—the U.S. dollar's role as reserve currency—is deliberately undermined by its own issuer.

"For this, let's step back to what we had spoken about, that whole financial repression concept with the size of the debt which is there all over the West. There is really no way out but to undertake financial repression where you keep your bond yields artificially lower than inflation."

Trump's policies signal a U.S. that no longer wishes to be the reserve asset provider for the world. This has profound implications:

Dollar dynamics will be counterintuitive: While the dollar has weakened initially (with the DXY falling from 110 to 102), Debashish expects this to reverse: "As these tariffs kick in... structurally you reduce the availability of dollars around the world. So you will then probably see a phase where the dollar starts appreciating." This dollar strength, paradoxically, will accelerate the search for alternatives to the dollar system, creating a feedback loop.

Weaponization of financial plumbing: As dollar scarcity increases, countries will struggle to service dollar-denominated debts. "There is interest payments you have to meet now," Debashish notes, which means countries will need access to the Fed's swap lines. These swap lines will become powerful tools of economic coercion: "The Fed will activate and weaponize [swap lines] and say, 'Okay, I'll give you a swap line, give me this.'" This mirrors how Russia's foreign reserves were frozen after the Ukraine invasion.

Digital alternatives will emerge: Interestingly, Debashish sees stablecoins as a potential solution for the U.S.—allowing dollar-denominated transactions globally without the burden of managing reserve assets. "Bitcoin may just be the headline reel on which all of this is sort of legitimized," he suggests, noting that major financial institutions like BlackRock and Fidelity "have been investing into building digital custody businesses for significant amounts of time. And people don't do that unless they know something's coming."

Bifurcation of the global financial system: We're likely heading toward a world split between competing financial spheres. China is already building direct bilateral settlement mechanisms that bypass the dollar system. "They've already been using it," Debashish reveals, citing examples of Chinese infrastructure projects in Africa where payments bypass local payment systems and flow directly back to China.

"The transition was already starting. We don't know what the next reserve asset is going to be. So that is up for grabs. The reserve currency is another dynamic, but we don't know what the reserve asset is going to be."

To understand the magnitude of what's at stake, imagine the global financial system as a massive building with the U.S. dollar as its foundation. Trump's tariffs are essentially saying, "We don't want to maintain this foundation anymore." Everyone inside the building now faces a choice: stay and hope the foundation holds, or start building their own structures with different foundations. This transition period will inevitably be chaotic.

Debashish believes this transition will be volatile and unpredictable, with wide-reaching consequences:

"The entire financial edifice is what is getting hit directly... This entire financial edifice is built on bonds which act as collateral and then the derivatives on top of it could be a few quadrillion dollars that nobody truly knows. You're breaking this now."

Investment Implications: Navigating Uncertainty

So what does this mean for investors? Debashish offers a pragmatic approach to navigating this new landscape:

Prepare for a multipolar investment world: The era of U.S. market dominance may be ending. Capital will scatter across markets, with major beneficiaries potentially including Europe, Japan, China, and India. However, Debashish cautions that India may not be as obvious a destination as many believe: "In any of the discourses I've heard from people not from India, India doesn't feature in that piece of reallocation of capital." Countries with critical resources (Canada, Australia) or advanced industrial bases (Germany, Japan) may benefit more immediately.

Expect increased volatility and rapid rotation: Market participants are facing a world where fundamental views shift constantly based on headlines rather than fundamentals. "We're probably at peak global thinking on markets," Debashish notes, where everyone has opinions but certainty is scarce. The days of making annual allocation decisions are gone—now portfolio shifts may happen quarterly or even more frequently. For the Indian market specifically, he observes: "It's sort of rapidly rotating between sectors... it's very hard to find a floor right now."

"The more you act, the more you're likely to [suffer]... you will need to act also because the grounds will shift quickly."

Consider physical assets and project finance: As governments direct investment toward rebuilding domestic manufacturing and infrastructure, project finance becomes increasingly important. "Project finance becomes a very important thing as opposed to venture capital," Debashish explains, noting that European and Japanese financial institutions are already well-positioned for this shift. These investments may offer lower returns but greater stability in a world prioritizing self-sufficiency over efficiency.

"Whether they'll truly succeed in all forms of manufacturing, whether it's the US, whether it's Europe, is anybody's guess. No one truly knows. Because as they say, sequencing matters."

Maintain a diversified approach with tactical flexibility: Rather than trying to time markets or sectors in this volatile environment, Debashish recommends a balanced allocation: "20% equity, 20% bonds/FDs, 20% gold and the other assets you want to own, real estate... 20% more which is just liquid cash for opportunities." This structure provides stability while maintaining the flexibility to act when genuine opportunities arise—which they will in a volatile market.

Prepare for tokenization and financial innovation: Looking further ahead, Debashish sees tokenization of real assets as potentially transformative. "Even something as simple as tokenization of real estate, it's not implausible," he notes, suggesting this could "unlock entrepreneurial capital" and enable more efficient financing of local manufacturing and production. This transition from "dealing with complete intangibles to something more focused" could fundamentally reshape capital markets.

India's Positioning in the New World Order

For Indian investors and policymakers, this global realignment presents both challenges and opportunities. Debashish offers a sobering assessment of India's current position:

Capital reallocation may bypass India: Despite the popular narrative of India being a prime beneficiary of global reallocation, Debashish cautions: "In any of the discourses I've heard from people not from India, India doesn't feature in that piece of reallocation of capital." Instead, countries with critical resources or established industrial bases are often mentioned first.

Internal reform is the real bottleneck: "We get too swayed by a lot of these things," Debashish notes about global developments. "Our issue is just far simpler. It's a lot of talk. It's very little execution." He emphasizes that supply-side reforms, not demand stimulation, should be India's priority.

Debt market development is crucial: One specific area Debashish highlights is India's underdeveloped debt markets: "You basically incentivized equities massively over bonds. But for a lot of this building, you need debt capital. That market's gone nowhere." A simple tax tweak could unlock significant capital for infrastructure and manufacturing.

India may be forced to pick sides: The luxury of strategic autonomy becomes harder to maintain in a bifurcated world. "Now we will very soon not have a choice but to act because the dice are going to be loaded against you in every way," Debashish warns, suggesting that India needs to accelerate internal capability building to maintain independence.

What's happening in the Indian markets now isn't simply a correction after strong performance—it reflects deeper uncertainty about how India fits into this rapidly changing global landscape. The government's policy choices in the next few years will be crucial in determining whether India can leverage this global realignment to its advantage.

Debashish points out a significant opportunity: "We've been talking about China plus one... Reality has shown we are nowhere close to being there. We're not even probably at China plus 20 at the moment." While this sounds negative, it also suggests substantial untapped potential if India can address its internal constraints.

Conclusion: Unprecedented Times Require New Thinking

What makes this moment so fascinating—and frightening—is that we're not simply experiencing a market correction but potentially witnessing the early stages of a fundamental realignment of the global economic order.

The comfortable assumptions that have guided investing for decades are being questioned, from "buy and hold" to the permanent dominance of U.S. markets. Old playbooks may not apply in a world of competitive devaluations, capital controls, and state-directed capitalism.

This article only scratches the surface of our wide-ranging conversation. In the full podcast, Debashish goes much deeper into:

Why Trump's approach to tariffs might actually be part of a negotiation strategy rather than a fixed policy

How automation and AI might be the only solution to America's reshoring ambitions

The surprising parallels between today's market and the 2000 tech bubble (not 2008)

A detailed breakdown of which countries might emerge as winners in this new economic paradigm

Why the current crisis feels so much more painful despite being less severe than 2008 (hint: it involves retail participation)

Listen to the complete episode for Debashish's unfiltered take on what may be the most significant economic transition of our lifetimes.

Thank you for your efforts.