The death of bank deposits? A new era of investing

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and video on YouTube.

You can also listen to The Daily Brief in Hindi.

Today on The Daily Brief:

Investment bankers and SME IPOs

Slowdown in personal loans

What’s happening with the home textiles industry?

Money is imaginary

Investment bankers and SME IPOs

In our first story, let’s dive into some shady dealings happening in investment banking, especially with SMEs (Small and Medium Enterprises). Lately, some investment bankers have been caught making under-the-table deals with SMEs, and here’s how it works:

These investment bankers promise to help SMEs raise more money by inflating their company valuations. In return, they take a cut of the extra cash raised. Normally, bankers charge a fee of around 1-3%, but with these secret deals, they’re pocketing as much as 50% of the extra funds.

If that sounds a bit confusing, let’s break it down with an example.

Imagine there’s a company worth ₹500 crore. The investment banker comes in and says, “We can make it look like you’re worth ₹1,000 or even ₹2,000 crore.” They pump up the valuation, raise extra money from investors, split the excess, and then vanish. The company walks away with more money than it’s actually worth, the investment banker gets a hefty payout, and investors are left holding overpriced shares that are likely to drop in value.

And this isn’t just a one-time thing—it’s spreading fast. It started in Gujarat and Maharashtra, but now it’s making its way across India. SEBI, the market regulator, has been sounding the alarm and warning investors, but often, by the time anyone catches on, the damage is already done.

Just last year, SMEs raised over ₹6,000 crore through IPOs (Initial Public Offerings). Nearly half of the money raised on SME platforms in the last decade came in the past 12 months. This market is booming, but it’s also raising some serious red flags.

So, how did we end up here?

The SME IPO market started with good intentions. The idea was to make it easier for smaller companies to raise money without the costs and red tape of a regular IPO. Banks usually aren’t eager to lend to smaller businesses, and when they do, the interest rates are often sky-high. That’s why, in 2012, NSE and BSE created special platforms just for SMEs to go public.

But it hasn’t been smooth sailing. Some companies have found sneaky ways to exploit the system. Take Varanium Cloud, a small tech company. In 2022, they raised ₹33 crore through an SME IPO, claiming the money was for business growth. But when SEBI dug deeper, they found the funds were being misused. Varanium inflated expenses, shuffled money around, and misled investors—classic smoke and mirrors.

Is SEBI doing anything about it? And if they are, what exactly are they doing?

SEBI knows this is a big problem, and they’ve started to crack down. NSE recently introduced a rule requiring SME IPOs to show positive cash flow in at least two of the last three years before they can go public. The goal is to filter out companies with weak finances so they can’t scam investors.

But it’s not just the SMEs under the microscope—SEBI is also tightening the rules for the investment bankers who handle these IPOs. The regulations for merchant bankers haven’t been updated since 1992, which is ancient history in financial terms. SEBI now wants to ensure that only serious, well-funded bankers are managing public issues.

Currently, merchant bankers need a net worth of ₹5 crore, but SEBI is pushing to raise that to ₹50 crore for those dealing with larger IPOs. It’s a move to ensure that only experienced, stable bankers are in charge. SEBI also wants to limit what these bankers can do because many are involved in other businesses, like loan syndication and project advisory, which create conflicts of interest. The aim is to keep them focused on the securities market.

But here’s the tricky part: SEBI is trying to strike the right balance. They want to protect investors without making it impossible for SMEs to raise money. If the rules are too strict, small companies might struggle to get the funds they need to grow. But if they’re too loose, we’ll see more fraudulent and inflated IPOs.

What does this mean for you?

SEBI’s new rules for SMEs and merchant bankers are steps towards cleaning up the market. But it’s still a work in progress, and only time will tell if they can get it right—where companies can raise money fairly, and investors don’t end up getting burned.

In the meantime, if you’re thinking about investing in SME IPOs, here’s a piece of advice: be extra cautious. The market is growing quickly, but with growth comes risk, and right now, there are plenty of red flags to watch out for.

Slowdown in personal loans

There’s something interesting happening in the personal loans and unsecured lending space right now. The Reserve Bank of India (RBI) recently released its September bulletin, and it seems like the NBFC (Non-Banking Financial Company) sector in India is facing a significant slowdown, especially in personal and unsecured loans. Let’s break down what’s going on:

First, it’s important to know that unsecured loans make up a big chunk—around 26%—of all loans given out by NBFCs. So, when this segment slows down, it drags the whole NBFC sector down with it. And this slowdown isn’t small or gradual; for NBFCs in the middle tier, growth in unsecured loans has dropped from over 50% year-on-year to just about 10%.

To give you some context, a middle-tier NBFC is one with assets of ₹1,000 crore or more. They face stricter rules than smaller NBFCs but are not as heavily regulated as banks.

But it’s not just NBFCs feeling the pinch; banks and fintechs are also experiencing a slowdown. Personal loans, which were growing at over 25% before, are now only growing at around 18%. According to a recent report by TransUnion CIBIL, new loans grew by just 3% in the quarter ending June 2024, compared to a whopping 36% growth a year ago!

What’s causing this slowdown?

It all started when the RBI increased risk weights on certain retail loans in November 2023. They did this to cool down the rapid growth in unsecured consumer credit. This move hit not just personal loans but other types of loans as well. The same TransUnion report shows that credit card originations dropped by a massive 30% year-on-year in the June 2024 quarter.

One big reason behind this is the rising default rates. Credit card companies are dealing with higher costs and have started tightening their policies by issuing fewer cards, reducing benefits, and lowering credit limits.

But it’s not all bad news—there are some bright spots too.

While personal loans and credit cards are struggling, other areas are picking up. According to RBI data, loans to the agriculture sector are doing well. This shift toward agriculture is a good sign, showing that not all credit growth is stalling.

Gold loans are also booming, especially in rural areas where they’re seen as a quick and reliable way to get credit. These loans are growing at nearly 40% year-on-year, compared to just under 15% in April. George Muthoot, MD of Muthoot Finance, mentioned that with personal and SME loans becoming harder to get, people are turning to gold loans.

However, when it comes to unsecured loans, there are early warning signs of trouble. Delinquency rates—loans that are overdue by 30 to 90 days—are rising for both secured and unsecured loans. While personal loan delinquencies have stayed stable, issues are creeping up with credit cards and small loans.

The TransUnion CIBIL Credit Market Indicator also points out that while credit performance is improving for most products, credit cards are an exception, with delinquencies on the rise.

It’s also worth noting that public sector banks are seeing a sharper increase in early-stage delinquencies compared to private banks. Even home loans, usually seen as safe, have seen delinquency rates rise from 1.9% in 2023 to 2.3% in 2024.

Why is this happening?

Factors like inflation, higher interest rates, and tighter liquidity are making it harder for people to keep up with their loan repayments, especially on unsecured loans, which are already risky.

Another trend is in auto loans, where high-value loans (₹20 lakh and above) are growing rapidly. Since 2020, their value has increased by 2.8 times, and their volume has risen by 3.2 times, suggesting that consumers are increasingly leaning toward buying more premium vehicles.

All these challenges mean that lenders are becoming more selective, especially with borrowers who don’t have a strong credit history. The TransUnion report shows that the share of first-time borrowers in new loans dropped to a record low of 12% in the June 2024 quarter from 16% a year ago. Lenders are simply not willing to take risks on new borrowers in the current environment.

What’s happening with the home textiles industry?

Let’s talk about a sector that doesn’t get enough attention but is quietly growing—home textiles. And trust us, there’s more to this market than just bedsheets and curtains. It’s a much bigger space than most people realize, and it’s growing faster than you might think.

Let’s start with some numbers. The global home textile market was valued at $122 billion in 2022 and is expected to reach $134 billion by the end of next year. Looking even further ahead, it’s set to become a massive $185 billion market by 2030! So, this is definitely a space investors shouldn’t overlook. But what’s really driving this growth?

The simple answer is that people are spending more on making their homes look good. Ever since the pandemic, we’ve all been spending more time at home, and that’s made us want to invest in things like new towels, bed linens, and other essentials to make our spaces cozier.

Now, here’s a question for you: Can you guess which country is the leader in home textiles? No surprises—it’s China, with about $23 billion in exports! But here’s the good news: India, with $5.7 billion in exports, is catching up fast, growing at about 8-10% a year.

In India, just six major companies control around 65% of the market, and they’ve managed to stay strong despite global economic challenges. So, why is India doing well in this space? A big part of it is the “China+1” strategy.

Let me explain. After the COVID-19 pandemic, many countries wanted to diversify their supply chains to reduce their dependence on China. That’s where India stepped in, taking on some of that demand.

But India’s success isn’t just about being the alternative to China. There’s also a growing focus on sustainability. Eco-friendly and organic home textile products are gaining popularity, and Indian manufacturers are stepping up with greener, more sustainable options.

However, it’s not all smooth sailing.

The backbone of the home textile industry is cotton, and cotton prices have been all over the place. In 2022, poor crop yields sent prices sky-high, only to crash down later that year. Right now, things are more stable, but that price volatility has been a headache for manufacturers trying to maintain steady operations.

When cotton prices spike, it eats into profit margins, especially for Indian companies that rely heavily on cotton-based products like bed linens. The hope is that with more stable prices this year, things will settle down a bit.

And then there’s the issue of freight costs, which we’ve talked about before in previous episodes. Shipping has become ridiculously expensive due to global issues like the Russia-Ukraine conflict and tensions at the Suez Canal, which is a key shortcut from Asia to Europe. These problems have driven up oil prices and made shipping routes longer and more expensive.

For Indian home textile exporters, logistics costs have jumped up nearly five times in some cases. So, while demand for home textiles is strong and the growth potential is huge, these supply chain challenges are making it tough to turn a good profit.

Money is imaginary

Recently, Arundhati Bhattacharya, the former head of the State Bank of India, shared some interesting insights in an interview with CNBC. When she talks about banks, people pay attention. She pointed out that Indians aren’t relying on bank deposits as much anymore to save and grow their money. Instead, the younger generation is getting more into investing in the capital markets. She even suggested that this could mark the end of the “deposit-led banking era.”

This isn’t just her opinion. RBI Governor Shaktikanta Das has also been talking about how people, especially retail customers, are finding other investment options more attractive, and as a result, they’re keeping less money in banks.

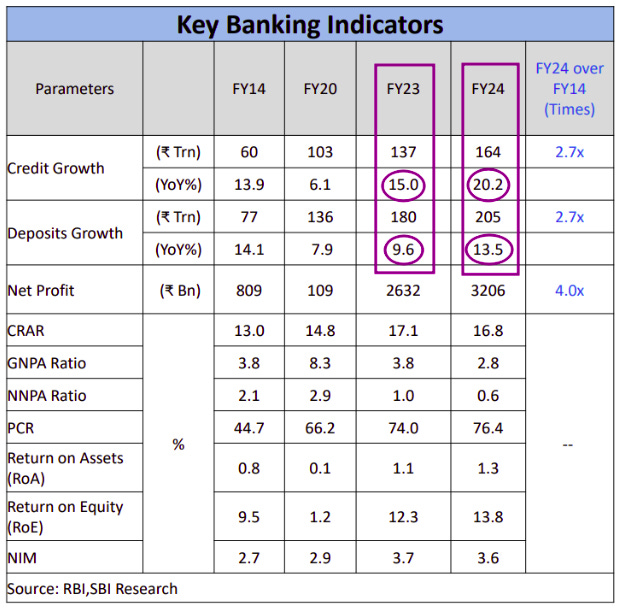

These comments come at a time when banks are facing something unusual—deposit growth isn’t keeping pace with loan growth. In the past two years, bank credit grew by 15% and 20% (in FY23 and FY24), but deposits only grew by 9.6% and 13.5%.

So, what’s going on? Are people pulling money out of banks and putting it into the stock market? And if so, what does that mean for the loans banks can offer?

On the surface, it seems logical—if you’re investing in stocks or mutual funds, you have less money in your savings account. But it’s a bit more complicated than that. What makes sense for one person doesn’t always add up when you look at the bigger picture.

Here’s an example. If you decide to invest in a mutual fund instead of leaving your money in the bank, where does that money go? It moves from your account to the mutual fund’s account. If the mutual fund buys stocks, the money moves again—this time to the seller’s account. So, the money never really leaves the banking system. It’s always sitting in someone’s account, even if it’s not yours.

So, even though people’s investments don’t technically pull money out of the banking system, deposits are still growing slower than loans. How does that make sense? Aren’t banks supposed to use deposits to lend out money?

Not exactly. The way banks handle money is a bit different—they don’t need deposits to make loans. In fact, loans actually create deposits. Let me explain.

When a bank gives someone a loan, they don’t hand over a bag of cash. They just credit the borrower’s account with the loan amount, and voilà, that shows up as a deposit. So, in the banking world, every loan is a new deposit. Banks aren’t taking money from one person’s savings to lend to another; they’re essentially creating new money whenever they issue a loan.

But if banks can create money out of thin air, what’s stopping them from giving out unlimited loans?

That’s where the RBI comes in. The RBI sets rules to ensure banks don’t go overboard. Banks can only lend a certain percentage of their total assets, and for every loan they make, they have to set aside some cash, either with the RBI or in other secure assets, to make sure they can cover any debts if needed. This keeps things in check and stops banks from endlessly creating money.

Take a look at HDFC Bank’s balance sheet, for example. You’ll see their loans on one side, but you’ll also see a portion of their assets in cash, balances with the RBI, and other banks. This is what allows them to keep lending while meeting the RBI’s requirements.

But where do banks get the extra money they need to back up these loans?

They have a few options. The cheapest is your savings account. Then there are fixed deposits, which cost them a bit more. If they need even more, they can issue bonds, borrow from the money markets, or raise equity—though these options are more expensive.

And this is the crux of the problem. The money isn’t disappearing from the banking system, and banks aren’t running out of funds to lend. But with more loans being given out, banks are increasingly tapping into more expensive and less stable funding sources to meet RBI’s rules.

As more people invest, banks are struggling to attract the cheap, stable funds they used to rely on, like savings and fixed deposits, making their business riskier and harder to manage.

So, while Indians are becoming smarter investors, banks are finding themselves fighting harder for their share of the pie.

Tidbits:

Swiggy has received SEBI's approval for a ₹10,375 crore IPO, raising ₹3,750 crore through fresh capital and ₹6,664 crore via an Offer for Sale. This move will intensify competition with Zomato in India's food delivery market.

IIFL Finance plans to raise ₹10,000 crore by issuing bonds after the RBI lifted its ban on gold loans. The company is diversifying into SME loans and other business segments.

BookMyShow and Zomato Live are taking legal action against ticket resellers like Viagogo following chaos during Coldplay concert ticket bookings, aiming to combat scalping and protect consumers.

Airtel has launched India's first AI-powered, network-based spam detection system, offering real-time alerts for suspected spam without requiring any action from users.

Commerce Minister Piyush Goyal highlighted India's growing role in high-tech manufacturing and the importance of quick commerce platforms partnering with Kirana stores for sustainable last-mile deliveries, supported by the ONDC initiative.

Thank you for reading. Do share this with your friends and make them as smart as you are 😉

If you have any feedback, do let us know in the comments

I have very quickly become a big fan of 'The Daily Brief'. It is written in such a digestible manner yet does not shy away from explaining the finer nuances of the subject matter. I don't know the ABCs of the equity markets especially yet each time you guys speak about an industry or a story, I find myself reading the entire article/piece. Major props to the editorial team.

Perhaps some of that money is being invested in gold and silver outside the banking system. That would make it harder for banks to increase their deposits or assets.