The biggest stories in the stock market this week.

This is the fourth weekly brief. We publish a new episode every day to help you understand the biggest stories in the Indian markets. But we understand that you may be busy and don't have the time to listen to the daily episodes. So don't worry, we've got you covered.

Every week, we'll publish a new episode simplifying the biggest stories of the week so that you can still look smart in front of your friends.

Check out the audio here:

And the video is here:

In this week's episode, we look at these stories:

1) Reliance is feeling the blues

2) Bajaj Finance is in a mixed state

3) This quarter, Axis got axed

4) Did the budget disappoint you?

5) Gold fell by more than 5%

6) India China, bhai bhai…again!

7) China has become a hoarder!

8) India is building Aadhaar for agriculture?

We have launched two new shows: Please Help Me Understand and The Big Picture.

On Please Help Me Understand, we'll ask experts all the dumb questions that you are embarrassed about asking. The goal is to help you understand things that seem complicated.

On The Big Picture, we will talk to some of the smartest people in the markets about big trends that are shaping the financial markets.

If you want to be an expert on finance, just listen to our shows.

Reliance is feeling the blues

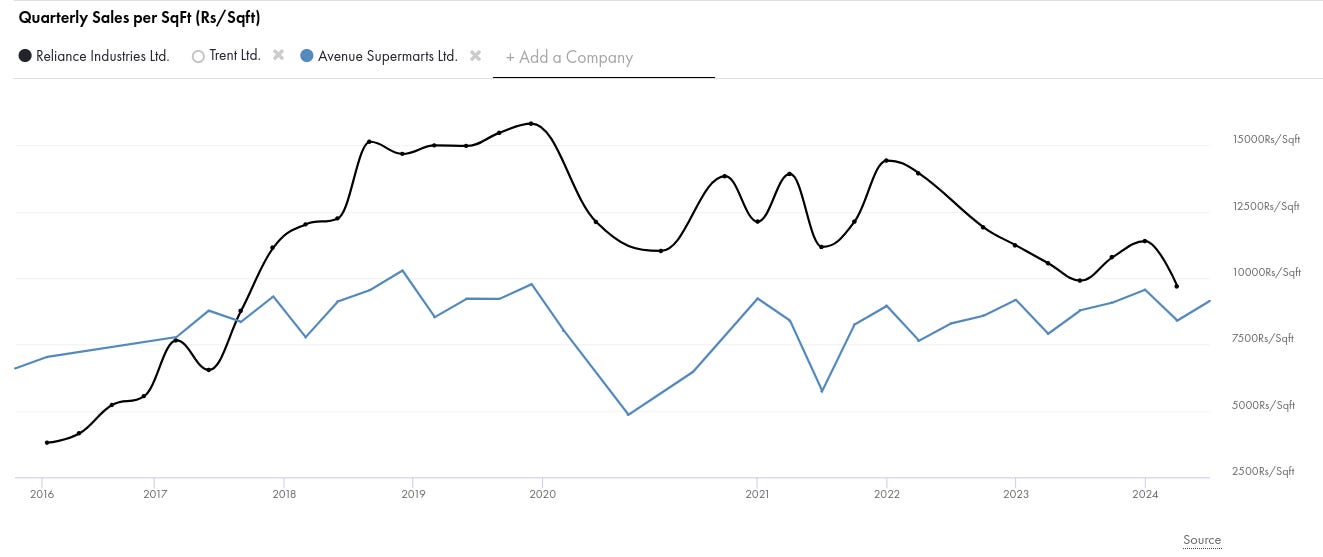

Reliance Industries, one of India's largest conglomerates, reported its latest quarterly results with some mixed outcomes. While overall revenues increased by 12% to 2.36 lakh crore, profits dropped by 20% compared to the last quarter.

The dip in profits was primarily due to the performance of its Oil-to-Chemicals segment, which constitutes almost half of its revenues. However, looking beyond the numbers, there are several interesting long-term trends emerging from Reliance's results.

Reliance Retail:

Added 331 new stores, bringing the total to about 19,000.

Now make up 18% of total revenues. JioMart is available in 180+ cities.

Entering "slow" quick commerce with 30-60 minute delivery promises.

Bought stakes in companies like Zivame and Urban Ladder.

Fueled by grocery and electronics segments. The fashion and lifestyle segments saw less impact due to discretionary spending declines.

Expanding into premium offerings like Pret A Manger and Ajio Luxe.

Reliance Jio:

Added 8 million new subscribers, totaling over 480 million.

Stayed flat at ₹181.7, but recent tariff hikes of 12-25% could boost this number soon.

5G accounts for 31% of Jio's mobile data traffic, with plans to invest $10 billion over the next three years for nationwide rollout.

Added over 1.1 million new home connections this quarter.

Bajaj Finance is in a mixed state

IIFL recently put out a report saying that bad loans in the microfinance sector are increasing slightly. States like Tamil Nadu, West Bengal, and Madhya Pradesh are seeing more overdue loans.

Credit growth in India post-pandemic has been skyrocketing. Unsecured personal loans, for example, have been growing at over 30% compared to the pre-pandemic rate of 10-15%.

This rapid growth in unsecured personal loans has made the RBI nervous. To curb this, the RBI increased the risk weightage by 25%. Let me simplify this with an example:

Imagine a bank gives a Rs. 10,000 unsecured personal loan to a borrower. Previously, the bank needed to set aside Rs. 10,000 as a buffer against defaults. But under the new rule, they now need to set aside 125%, or Rs. 12,500.

This move seems to be working as the growth of these unsecured loans appears to be slowing down.

But why bring this up? It turns out that microfinance isn’t the only sector showing signs of stress.

Bajaj Finance, India's largest non-banking lender with a market cap of over four lakh crore rupees, provides a good lens to understand trends in unsecured lending.

While this quarter seemed okay for Bajaj Finance, the rise in their Non-Performing Assets (NPAs) is concerning. Their bad loans increased from 0.31% last year to 0.38% this year, and loan collections have declined across the board.

Before diving into specifics, let’s clarify how banks classify loans based on credit risk—the chance that a borrower might not be able to pay back.

During an earnings call, the management said:

“Loan losses and provisions in Q1 were elevated primarily due to muted collection efficiencies."

They further noted: "Given elevated Stage 2 assets, loan losses may remain at current levels in Q2 and should start to normalize by Q3."

In simple terms, Stage 2 loans are starting to show signs of trouble. Borrowers are facing issues but haven’t completely defaulted yet. The number of loans in this category is increasing—it went up by ₹865 crore from the previous quarter because people are repaying less.

In such situations, financial institutions set aside money as a buffer, and Bajaj Finance did the same. However, it wasn’t enough, so they had to dip into an additional ₹105 crore for loan losses.

The net loan losses and provisions, after using this buffer, amounted to ₹1,685 crore, which is 1.99% of the average outstanding loans.

Overall, Bajaj Finance’s rising bad loans are a concern, but this is just one quarter. The increase could be due to elections, heatwaves, or seasonal effects. We’ll have to wait and see if this is an isolated issue or the start of a larger problem.

This quarter, Axis got axed

In yesterday's episode, we discussed how Bajaj Finance saw a rise in bad loans. While this quarter seemed manageable for them, their Non-Performing Assets (NPAs) tell a different story. Bajaj’s bad loans increased from 0.31% last year to 0.38% this quarter, and their loan collections have declined across the board.

I concluded with this:

Overall, Bajaj Finance’s rising bad loans are a concern for now, but we can't predict the future based on one quarter. The increase in bad loans could be due to elections, heatwaves, or seasonal effects. We'll have to wait and see if this is a one-off situation or the beginning of a troubling credit cycle.

However, it seems like this issue isn't isolated to Bajaj Finance. Axis Bank, India’s 3rd largest private bank, also released its quarterly earnings, and things aren't looking great there either. Their number of bad loans has risen slightly, which is worrying.

Here's what Axis Bank's CFO, Punit Sharma, said during the earnings call:

“The gross slippage of our wholesale business increased year on year due to small value accounts, all less than 100 crores in individual size. This resulted in the bank's gross slippage ratio being 1.97%, a 10 basis point increase. We continue to monitor our retail unsecured portfolio closely and have proactively taken risk actions on growth and underwriting filters as needed.”

The retail segment was hit the hardest, contributing to over 80% of the bad loans this quarter. Their bad loan ratio for this quarter stood at ~2.0%, a significant increase from 1.4% in the previous quarter. Although this is just for one quarter, it is still concerning.

Regarding the overall industry, the management said:

"We have seen a slight increase in unsecured loans across the industry, primarily driven by high leverage and loan stacking."

This means borrowers are taking on too much debt from multiple lenders, which is a big problem. It indicates that consumers are in bad shape, and historically, when people borrow too much, it rarely ends well.

So, while Bajaj Finance's rising bad loans are a concern, they aren't alone. The whole industry seems to be facing similar issues, making it essential to keep an eye on how things develop in the coming quarters.

Did the budget disappoint you?

Let's dive into the biggest topic of the day—the budget! This year's budget had some fascinating changes that are worth discussing. We'll cover the highlights that might impact you and me the most.

First up, capital gains tax changes, which will affect traders and investors:

The short-term capital gains tax has increased from 15% to 20%.

The long-term capital gains tax has increased from 10% to 12.5%.

However, there's a bit of good news here—the exemption limit has been bumped up from ₹1 lakh to ₹1.25 lakhs, which might help offset some of the additional taxes the government will collect.

This rule took effect yesterday, so being a long-term investor might now seem a bit less attractive.

Also, the Securities Transaction Tax (STT) on options has increased from 0.062% to 0.1%, and on futures from 0.0125% to 0.02%. This change will kick in on October 1st, making trading a bit more expensive and potentially reducing volumes.

On a brighter note, customs duty on gold and silver has been reduced to 6%, and on platinum to 6.4%.

Now, let's talk about changes in income tax.

For those of you who have opted for the new tax regime, the tax slabs have been slightly revised this year:

Income up to ₹3 lakhs: 0%

₹3-7 lakhs: 5%

₹7-10 lakhs: 10%

₹10-12 lakhs: 15%

₹12-15 lakhs: 20%

Above ₹15 lakhs: 30%

The standard deduction has also been increased from ₹50,000 to ₹75,000. According to the finance minister, this should help an average Indian save as much as ₹17,500 on taxes every year.

Interestingly, there was no mention of the old regime in the budget speech, which suggests the government might be making the new tax regime more attractive to phase out the old one.

Moving on to jobs and employment:

The government announced one month's salary support for first-time employees. Freshers earning less than ₹1 lakh per month will receive a month's salary of up to ₹15,000 in their PF account.

Additionally, there's a new scheme to provide internships to 1 crore youths over the next 5 years, with interns receiving a monthly allowance of ₹5,000.

Next up, corporate taxation:

Great news for startups—the angel tax has finally been abolished! This means startups won't have to pay extra taxes when they receive funding from angel investors.

Corporate tax for foreign companies has also been reduced from 40% to 35%.

Lastly, let's talk about urban housing:

The finance minister announced a massive investment of ₹10 lakh crore in housing, aiming to help 1 crore urban poor and middle-class families. There's also a ₹2.2 lakh crore push to make housing more affordable across the country.

Gold fell by more than 5%

Gold prices fell by more than 5% on budget day, and while that sounds bad, it was actually due to positive news. The finance minister announced a cut in customs duty on gold from 15% to 6%. Here’s an interesting tidbit: gold is the second biggest part of India’s household assets, with real estate being the first.

But why is the government being so generous with gold import duties?

Let’s go back a bit. The last time the government increased the customs duty on gold was in 2022, right when Russia invaded Ukraine. Back then, crude prices were soaring, and both inflation and the rupee were under pressure. The government increased the duty to curb gold imports, which would have exacerbated the situation.

Fast forward to now, the government is in a much better spot regarding the current account deficit and inflation, so reducing the import duty makes sense.

Another reason is smuggling. No joke—India imports a lot of gold, accounting for over 5% of all imports. This number would be even higher if we include smuggled gold. Smugglers have all sorts of tricks, like overreporting gold imports, declaring fake exports, and swapping real gold with imitation jewelry through passengers, often bribing officials. In 2023, 60% of gold smuggling cases were in coastal states like Maharashtra, Tamil Nadu, and Kerala.

There's also the jobs angle to this announcement - the jewelry sector employs a significant number of people. Sanjay Kumar Agarwal, Chairman of the Central Board of Excise and Customs, mentioned that gold is crucial for the gems and jewelry sector, which employs around 50 lakh people and contributes nearly 8% to India’s exports. Reducing the duty helps curb illegal imports and supports this vital sector.

So, what does this mean for jewelry companies?

According to the managing director and CEO of Senco Gold Ltd on CNBC, organized players hedge their inventory through MCX or gold loans from banks, so there’s no major impact on their stock. The real focus is on the expected rise in demand, especially with the festive season around the corner.

Here’s a key point he made: The reduction in duty provides a benefit of about 590 INR per gram or 5,90,000 INR per kilogram. Initially, consumers might see a benefit of 300-350 INR per gram, gradually increasing to 550-600 INR per gram. So, with the festive season approaching, we can expect a rise in demand.

But what does this mean for companies that lend money against gold, like Muthoot Finance? According to George Muthoot, the chairman of the company, gold prices don’t really affect the demand for loans. People borrow money when they need it, regardless of whether gold prices are high or low.

Meanwhile, there’s another development in the gold space. The RBI isn’t too happy with some banks and gold loan companies due to how gold loans are handled through fintech startups. The RBI found some inconsistencies during audits, leading banks to talk to their fintech partners to fix the issues. They might even pause gold loan disbursements through these startups temporarily to ensure everything is done correctly.

India China, bhai bhai…again!

In a previous episode, we talked about Reliance bringing the fast fashion giant Shein’s products into India and touched on the 2020 ban on Chinese apps. Remember when the Indian government banned several Chinese apps back in 2020? Since then, all Chinese companies have needed government approval to enter India or make any investments.

But it looks like India wants to go back to the pre-COVID relationship with China. The Economist recently published an interesting story about how the India-China relationship might be heading toward some sort of normalcy.

India and China have had a rocky relationship since their border clash in 2020, but things seem to be improving. While India still wants China to resolve the border issue, it also needs Chinese technology and investments to boost its industries. Despite the push to make everything in India, there are some things that we just can't manufacture at home. Like it or not, we have to rely on China for certain things.

So, what's changed?

India has started allowing more Chinese professionals into the country by relaxing visa norms.

Prime Minister Modi recently mentioned in an interview that India’s relationship with China is “important and significant” and expressed hope for restoring border stability.

Both countries are trying to manage border tensions better.

India needs Chinese technology and expertise to boost its manufacturing and other industries. Despite efforts to cut down on Chinese imports, India still heavily relies on them, especially in electronics and machinery.

How will this change happen?

Leaders might refrain from making overtly negative statements about each other.

Indian and Chinese companies might find ways to work together because it benefits both sides. India needs technology, goods, etc., and China needs a new market to export its surplus capacity as its economy slows down.

The Indian government might relax more rules to facilitate this cooperation. Many Indian businesses are urging the government to allow more Chinese investment and expertise to help their operations.

So, while the relationship between India and China has had its ups and downs, it looks like both countries are taking steps to improve ties for mutual benefit. We'll have to wait and see how this plays out.

China has become a hoarder!

In a previous episode titled "Is Jio Ready to be a Grown-Up," we discussed the Chinese economy. Let's do a quick recap: China's economy is facing significant challenges, suggesting a gloomy outlook. They missed their expected 5.1% growth in Q2 2024, achieving only 4.7%. They're heavily relying on government bonds, bank loans, and financial aid for struggling companies. Consumer demand is stagnant, youth unemployment is high, and home prices, which are the preferred investment for most people, have dramatically declined.

Sounds like bad news, right? You'd think they wouldn't be splurging under such circumstances. But that's not the case—China is stockpiling massive amounts of raw materials and commodities. Contrary to expectations, China's imports of many basic resources hit record highs last year, and this trend continues with a 6% increase in the first five months of this year.

So, why is China stockpiling? It's not due to increased consumption but as a precautionary measure. They're worried about future conflicts and are building up reserves of critical raw materials to be prepared for potential disruptions. China has been accumulating reserves of grain, petroleum, industrial metals, and defense-related minerals. Events like the US-China trade war, COVID-19 disruptions, and the war in Ukraine have only intensified this stockpiling.

Here are some interesting numbers and tidbits about China’s imports:

China relies heavily on imports, bringing in 40% of its natural gas and 70% of its crude oil.

They decided to buy critical minerals just when prices dropped, leading to 97% of their cobalt coming from imports.

China accounts for about 60% of global soybean imports and purchased more than half of all U.S. soy exports in the last five years.

Less than two-thirds of the food consumed in China is produced domestically; the rest is imported.

But where is China getting the money to do all this? They're using their massive savings to pay for this stockpiling. Additionally, the Chinese government prioritizes strategic reserves as part of national security and economic planning, ensuring sufficient funds are allocated.

So, while China's economy faces significant challenges, they're strategically preparing for potential future crises by building up their reserves.

India is building Aadhaar for agriculture?

Let's talk about a significant development in Indian agriculture. In the recent budget, the Finance Minister announced something called Digital Public Infrastructure (DPI) for agriculture.

The government's aim is to bring over six crore farmers into the country's formal land registry system. This is a huge task, and the government plans to tackle it with something called Agristack.

Simply put, Agristack is a detailed digital database for farmers, kind of like Aadhaar but specifically for farmers. It will be a massive digital repository with everything you’d want to know about a farmer—their identity, land records, crop details, income, insurance, loans, and even their revenue history.

The advantage here is that all this data won’t have to be built from scratch. The government plans to use APIs to source this data from various government sources and even plans to use satellite data from ISRO to get a detailed view of crops sown across the country during different seasons.

Now, you might be wondering if this complicated exercise is even worth it. Here's why it's such a big deal:

It eliminates all duplicate information related to agriculture. Right now, different government departments have their own databases, leading to duplication and sometimes conflicting data. With Agristack, there will be less paperwork for farmers and more consistent information for policymakers.

Agristack will provide easy access to information for both the government and farmers through a single platform.

With real-time data on crop production, supply chain players like food processors and distributors can plan their operations more efficiently, streamlining many systems and processes.

Agristack will integrate market price information with crop data, helping farmers make informed decisions about when and where to sell their produce.

Policymakers can design more targeted and effective agricultural schemes with comprehensive data available, speeding up problem resolution.

Banks and insurance companies can use Agristack data to assess farmers' creditworthiness more accurately, speeding up loan approvals and insurance claims.

While more and better data is good, Agristack can only be successful if the government and the private sector work together to address underlying structural issues like indebtedness, climate resiliency, and better farming techniques.

Now, all of this sounds great, but there are a couple of major challenges the government will face:

Many land records in India are outdated or incomplete.

The government will need a very complicated system to manage property disputes while digitizing so much data.

Not everything can be solved by technology. While Agristack can help, the challenges that plague Indian agriculture are structural, like outdated techniques, lack of access to formal credit, and socio-cultural barriers. Agristack can solve some of these issues but not all, so we need to temper the hype around these initiatives.

In conclusion, while Agristack is a great concept, it will only be effective if and when the government successfully implements it across the country.