Stock Market 24/7: The future of trading is here!

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and videos on YouTube. You can also watch The Daily Brief in Hindi.

In today’s edition of The Daily Brief:

24/7 Stock Markets: The future of trading?

The RBI-Government tug-of-war on interest rates

24/7 Stock Markets: The future of trading?

In today’s online world, there aren’t many services you can’t access at night. Whether it’s ordering a bar of ice cream, buying a microwave, or booking movie tickets, you can get it done at any hour. The idea of fixed business hours is quickly fading away.

Except when it comes to the stock market.

Across the globe, stock exchanges stick to short trading hours, usually 6–8 hours a day. That’s all the time you have to buy, sell, or manage your investments. If you miss that window, you’re out of luck until the next trading day.

But this might not be the case for much longer. In the U.S., the SEC has approved a new stock exchange with a game-changing feature: round-the-clock availability. It’s called 24-Exchange, or 24X. Starting in 2025, 24X will allow you to trade stocks 23 hours a day, five days a week. This marks the first time a stock market will officially operate almost non-stop—a huge shift. If this idea takes off, we could see similar plans popping up in other countries too.

So, what does 24-hour trading mean for investors and traders like us? Let’s dive into how this could change the way we interact with the stock market.

A Quick Look Back: From Coffee Houses to Algorithms

To see how significant this change is, it helps to understand why trading hours work the way they do now.

Back in the 1600s, trading wasn’t something you could do from the comfort of your couch. Early stock exchanges—like those in Amsterdam and London—were physical places where people met face-to-face to trade. These places didn’t even start as formal businesses. The London Stock Exchange, for example, began in a coffee shop.

Back then, everything about trading was physical. No apps, no screens—just people shouting prices across tables. Because of this, trading hours were limited. You could only trade when everyone was physically present.

This setup became the foundation for how markets still work today. Even as stock markets modernized and big exchanges like the New York Stock Exchange came along, the tradition of set hours stuck. And that’s where we are now. Most markets operate between 9:30 a.m. and 4:00 p.m. local time. Anything outside of that, like after-hours trading, is more of a workaround than a true solution.

But here’s the thing: today’s stock markets run on technology. Trades are processed electronically, often in milliseconds. And yet, we’re still tied to a schedule that was built for a world where everything had to happen in person.

A 24-hour stock exchange isn’t about reinventing the wheel—it’s about aligning business practices with what technology already makes possible.

Now, after-hours trading isn’t entirely new. There’s already demand for it, and platforms like Robinhood and Interactive Brokers offer trading before and after the regular market hours. They do this using electronic communication networks (ECNs), which help match buyers and sellers outside the official trading window. While this gets the job done to some extent, it’s not the same as having an official, fully functioning stock exchange running around the clock.

This lack of a proper exchange creates its own challenges. After-hours trading comes with restrictions—you can’t trade all securities, and certain types of orders aren’t allowed. Liquidity is often thin, meaning there aren’t enough buyers and sellers. This makes trades less smooth than during regular hours. Prices can also swing wildly, making it harder to get a fair deal.

A true 24-hour stock exchange could solve these issues, creating a smoother and more reliable trading experience no matter the time of day.

For starters, a 24-hour stock exchange offers incredible convenience. Take global investors, for example. Right now, if you’re in Asia or Europe and want to trade U.S. stocks during your daytime hours, you’re stuck waiting for U.S. markets to open—or dealing with after-hours trading, which has limited options. A 24-hour exchange would change all that. You could trade in real-time, reacting instantly to news and events, no matter where you are in the world.

But it’s not just about making life easier for international investors. Let’s say a big company announces its earnings after regular market hours. Today, most traders have to sit tight until the market reopens the next morning. With 24-hour trading, they wouldn’t have to wait. They could act on that news immediately.

If this all sounds familiar, it’s because we’ve seen it before. Cryptocurrencies already trade 24/7. You can buy Bitcoin or Ethereum at any time of day, and the markets never close. Currency markets work in a similar way too. Stocks are simply catching up.

Still, convenience comes with its own set of challenges. Two big questions stand out: what happens to liquidity and volatility? These factors are critical because they affect how smoothly markets function and how risky trading feels.

Breaking It Down

Liquidity: How Easy Is It to Trade?

Liquidity simply means how easy it is to buy or sell something without affecting its price. The more buyers and sellers there are, the easier it is to trade without causing big price changes.

With a 24-hour market, two things could happen:

More Participation: Longer trading hours might encourage more people to trade, especially those in different time zones, improving overall liquidity.

Spread Too Thin: On the flip side, trading activity could stretch out over 23 hours, leaving some periods—like the middle of the night in the U.S.—with very little activity. That means fewer buyers and sellers during those times, making it harder to execute large trades without impacting prices.

In reality, we’ll probably see a mix of both. While total liquidity might improve, some hours would likely remain “thin,” with less activity.

Volatility: How Much Do Prices Move?

Volatility refers to how much prices swing up or down. A 24-hour market could help smooth out volatility. Right now, when major news breaks after hours, traders can’t react until the market reopens, often causing sudden price jumps. With 24-hour trading, prices could adjust gradually as news unfolds, reducing the chance of sharp, unpredictable movements.

For instance, if something big happens overnight, traders can act immediately, avoiding the rush of activity when markets open. Instead of sudden price gaps, we might see prices evolve more steadily through the night.

That said, the level of volatility would still depend on how many people are active during different parts of the day. Thinly traded hours could see sharper swings, while busier periods might feel more stable.

But—and this is a big “but”—volatility could also spike during those quieter hours when liquidity is low. Imagine a single large trade taking place when there aren’t enough buyers or sellers. That one trade could swing the price up or down dramatically, creating wild price movements that wouldn’t usually happen during busier times.

And let’s not overlook the human factor. In a market that’s always open, the absence of “cooling-off periods” could lead to more impulsive or speculative trading. Right now, when markets close, it forces everyone—retail investors and institutional traders alike—to take a step back. These pauses allow people to process the day’s events, reassess their strategies, and avoid making rushed decisions.

Without those natural pauses, we could end up in a market where emotions take over even more than they already do. Fear and greed are already big drivers of market activity, often causing exaggerated price movements. Without time to reflect after market hours, emotions could spiral out of control, leading to rapid surges or crashes that have little to do with the actual value of the stock.

It’s a double-edged sword, and it’s definitely something to keep an eye on.

If this 24-hour model works in the U.S., it could set the stage for similar changes in markets worldwide. Even if countries like India don’t go fully 24/7, we might see extended trading hours or other efforts to make markets more accessible.

For now, all we can do is watch how this plays out in the U.S. Who knows? In the not-so-distant future, you might find yourself trading Indian stocks at midnight.

The RBI-Government tug-of-war on interest rates

Imagine this: you’re planning to buy your first car or start a small business. But no matter how much you try, things just won’t fall into place.

You can’t seem to find financing at a rate that makes sense. The interest you’d have to pay is so high that it eats away any potential benefits of making such a big investment. So, you keep putting it off, waiting for the right time.

That’s exactly what’s happening across the country right now, and it’s having a big impact on India’s economy. After several quarters of strong growth, the economy is now slowing down sharply.

This slowdown has the government concerned. Key ministers like Finance Minister Nirmala Sitharaman and Commerce Minister Piyush Goyal have been vocal about one possible solution: they believe the Reserve Bank of India (RBI) should lower interest rates to make borrowing cheaper and encourage investments.

But the RBI doesn’t seem to be on the same page. While the central bank will discuss its policy on December 6, many economists believe the RBI will keep interest rates where they are—at least until February next year. RBI Governor Shaktikanta Das has maintained a tough stance on inflation, and so far, there’s no sign that he plans to change course.

So, what’s behind this standoff between the RBI and the government? And why does it matter so much for our economy?

The Government’s Perspective

India’s economy grew at a remarkable pace last year, clocking over 8% growth—especially impressive in today’s slow global economy. But that momentum has now faded.

The slowdown became clear on Friday evening when new GDP data was released. For the September quarter, India’s growth dropped to just 5.4%. That’s the slowest pace in seven quarters—a stark contrast to the robust growth we’ve seen in recent years.

The signs of this slowdown have already started showing up in people’s everyday spending. Private consumption, which accounts for about 60% of our economy, has taken a serious hit in recent months. Big FMCG companies like Hindustan Unilever and Colgate-Palmolive are reporting weaker sales, which tells us just how stretched household budgets have become. From cars to biscuits, sales across the board have dropped.

The government believes our economy needs a push to get back on track. That’s why key ministers have been urging the RBI to cut interest rates. And it’s easy to see their point.

Every time someone takes a loan, the money they borrow enters the economy. Whether it’s spent or invested, that money becomes someone else’s income. But when people hesitate to take loans because of high interest rates, that potential money flow is held back, slowing down the economy.

Lower interest rates could change this. They wouldn’t just encourage more borrowing; they’d also create savings for those who already have loans. For instance, imagine a mid-sized company taking a ₹10 crore loan to build a new factory. At a 10% interest rate, the company would have to pay ₹1 crore each year just in interest. But if rates drop to 7%, the annual interest cost falls to ₹70 lakh, saving the company ₹30 lakh.

That extra ₹30 lakh could be used to hire more workers, improve operations, or expand their business—all of which would put more money back into the economy.

But here’s the catch: the RBI sees things very differently. While extra money can help boost economic growth, it can also drive up inflation.

Let’s rewind a bit. Back in 2021, interest rates were much lower than they are today. At the start of the COVID-19 pandemic, the RBI cut rates to give the economy the kind of boost the government is pushing for now. But that move came with some unintended consequences.

As more money flowed into the economy, it created a problem: there was more cash chasing fewer goods and services. This imbalance caused inflation to soar to unsustainable levels, making everyday essentials more expensive for everyone.

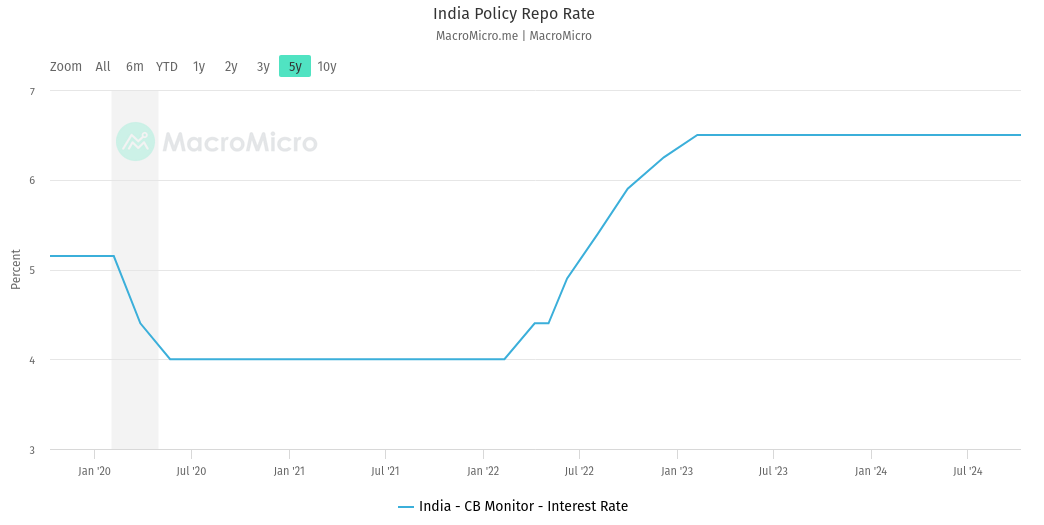

The RBI’s main responsibility is to keep inflation under control. So, when prices started rising, the RBI stepped in. Throughout 2022, it steadily raised interest rates to make borrowing more expensive and slow down the flow of money into the economy.

By the end of this rate hike cycle, the repo rate—the key rate that determines the cost of borrowing—climbed to 6.5%, the highest it had been in years. This tightening of monetary policy was aimed at bringing inflation back down to manageable levels, even if it meant slowing down economic growth in the short term.

The RBI has kept interest rates high and has refused to lower them since. This approach has been somewhat successful. After months of higher-than-normal rates, inflation finally came back within the RBI’s “tolerance band” of 2-6% for most of the past year.

But inflation isn’t fully under control yet. Food prices have stayed stubbornly high for months, and in October, overall inflation jumped back above 6%.

Lowering interest rates now could make things worse. If loans become cheaper, more people might borrow and spend, which could push demand higher. This extra demand could drive prices up even further, hurting the same households the government wants to help.

So, Who’s Right?

That’s a tough question to answer. Both sides have valid points, but this debate is full of uncertainties.

For example, one key disagreement is whether monetary policy—like changing interest rates—can effectively control food inflation. Some believe it doesn’t help much with food prices, while others think it plays a role. Either side could be right.

The tricky part is that we won’t know the full impact of today’s decisions for a while. Monetary policy works with a delay. By late 2025, we might find ourselves facing one of two situations: runaway inflation or stalled economic growth. Only then will we know if we made the right call today.

Not Uncommon

Tensions between governments and central banks aren’t unusual. For example, in the U.S., former President Donald Trump publicly clashed with Federal Reserve Chair Jerome Powell in 2018, even threatening to fire him for not cutting rates. Similarly, in 2021, Turkey’s President Erdogan went a step further, firing three central bank policymakers who opposed rate cuts.

These disagreements are natural.

Elected governments are accountable to the public, so they’re naturally drawn to decisions that show quick results. When money flows into the economy, it creates an immediate impact—businesses thrive, jobs are created, and the economy feels more vibrant. That’s why rate cuts are so appealing to any elected government.

This is where the central bank comes in as the “adult in the room.” It’s the RBI’s job to take a cautious, long-term view and balance against the government’s need for instant results.

In fact, the RBI is designed to make tough, sometimes unpopular, decisions. One of the key reforms introduced by the Modi government in 2016 was an overhaul of how the RBI operates. These reforms made controlling inflation the RBI’s top priority and set up a governance structure that ensures even the Finance Ministry cannot force the RBI to do otherwise.

So, when we see a debate or a tussle between the government and the RBI, it’s not necessarily a bad thing. It’s exactly how the system is supposed to work—both sides balancing each other to ensure the best outcomes for the economy in the long run.

Tidbits

Mahindra’s new EV models, the BE 6e and XEV 9e, offer fast charging and improved performance compared to the underwhelming XUV 400. However, these vehicles face challenges due to India’s underdeveloped EV infrastructure. With EVs making up just 10% of Mahindra’s production capacity, weak demand and skeptical investors suggest the road to widespread adoption won’t be easy.

The Airports Authority of India is working on modernizing 150 small airports to enhance air cargo capacity for goods like pharmaceuticals, perishables, and agricultural products. With domestic cargo expected to grow by 7-9% and international cargo by 11-13%, this initiative could strengthen India’s role in global trade logistics.

Mid-cap IT companies like LTIMindtree, Coforge, and Sonata Software are setting ambitious revenue targets. However, investor confidence remains cautious due to global uncertainties and the companies’ heavy reliance on AI strategies. Their success will depend on how well they execute their plans and whether they can provide clarity on short-term goals.

The Competition Commission of India (CCI) is investigating Google after Winzo Games filed complaints about being excluded from the Play Store. The outcome of this probe could lead to fines or policy changes, potentially reshaping India’s app and gaming ecosystem.

India’s top steelmakers are expanding capacity by 30 million tonnes per year (mtpa) by FY27, which is driving debt levels to a five-year high. While profitability is under strain, strong liquidity, and long-term growth plans suggest that the financial impact should remain manageable.

Thank you for reading. Do share this with your friends and make them as smart as you are 😉 Join the discussion on today’s edition here.

Great article. I also love the cover image. Would you please share what prompt you used and which image generator

As for platform trading almost all day, it almost appears the crypto world has developed demand for this opportunity.

Many people use their mobile these days and have it all the time available to trade.