SEBI is making some really big changes

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

Check out the audio here:

And the video is here.

In today’s episode, we look at 4 big stories:

SEBI is changing the way Indian markets function

Foreign investors are going with the flow

Tata motors is preparing for an electric age

End of the world—software edition

SEBI is changing the way Indian markets function

In the last couple of months, SEBI has introduced significant regulatory changes that could affect investors and traders in the Indian markets. One of the key updates came in June when SEBI issued a circular mandating market infrastructure institutions (MIIs) to be “true to label” in the charges they levy.

For those unfamiliar, MIIs include stock exchanges like NSE, BSE, MCX, clearing corporations like NSE Clearing, and depositories like NSDL and CDSL.

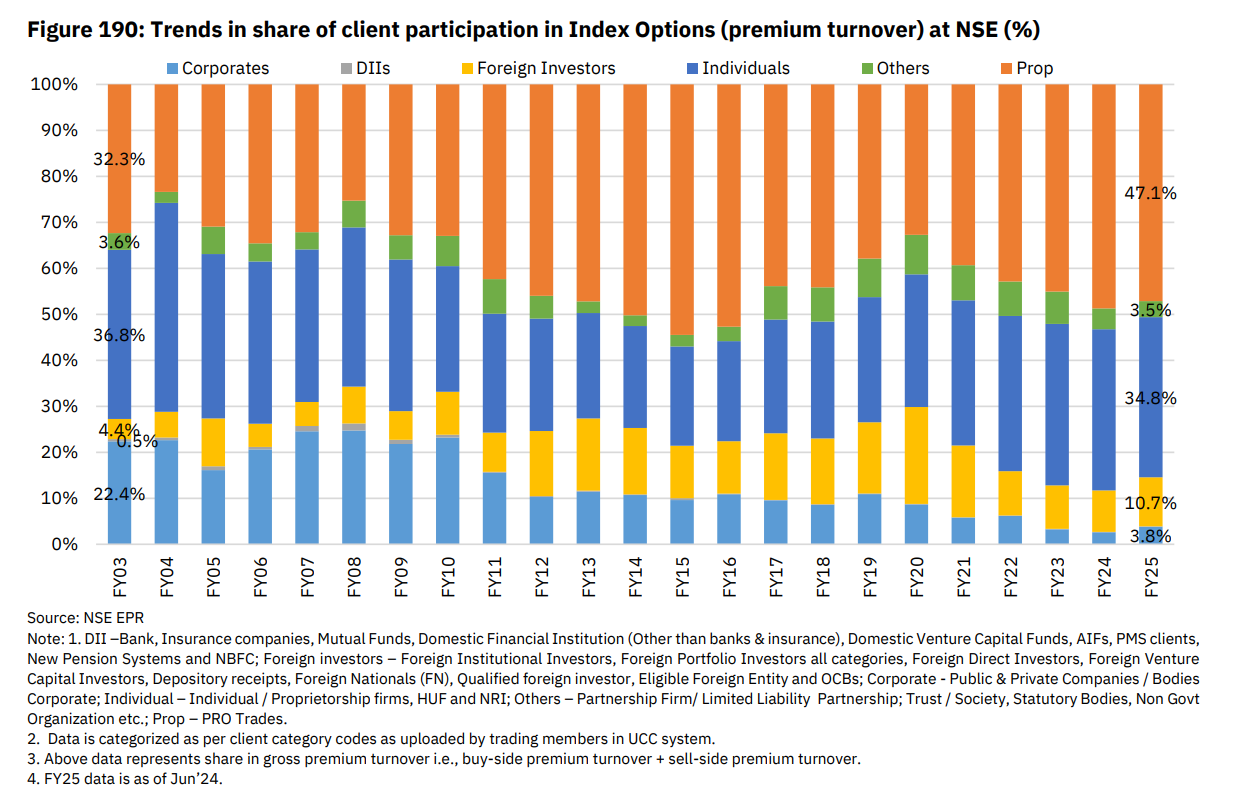

On July 30th, SEBI released a consultation paper seeking comments on measures to reduce speculative activity in index futures and options. These measures, while well-intentioned, could have unintended consequences on the market structure, impacting traders and investors.

In June, SEBI required market infrastructure institutions like exchanges to be transparent in how they levy charges. This circular has directly impacted the way brokers are incentivized by stock exchanges.

Traditionally, stock exchanges charge a slabwise transaction fee based on a broker's monthly turnover. Higher turnovers attract lower fees, and the difference between what brokers charge their customers and what the exchange charges the broker at the end of the month acts as a rebate. This structure is common across major markets globally.

SEBI found this structure opaque and mandated a flat transaction fee instead of slabwise charges. This change could impact proprietary traders and high-frequency traders (HFTs) if the new flat fee is higher than the current lowest slab. Their overall trading costs could increase, potentially raising brokerage rates. Some smaller brokers have already started increasing their rates.

The recent hike in Securities Transaction Tax (STT) for futures and options by the government is another concern. Proprietary traders and HFTs, major players in market segments, provide significant liquidity. An increase in STT raises the break-even point, making futures trading less attractive and potentially shifting traders to options or other areas with lower taxes.

Source: NSE

SEBI's recent consultation paper proposes measures to curb speculative retail activity in the F&O segment. One significant proposal is increasing the contract size for futures and options, making futures trading less accessible due to higher margin requirements. Another suggestion is reducing the number of weekly expiries to improve market stability, which, while beneficial, might push more traders towards options—contrary to SEBI's intentions.

If major traders like proprietary traders, foreign institutions, and HFTs reduce their trading volumes due to these changes, the overall volumes in futures and options could drop significantly. A report by Jeffries suggests that volumes could fall by 20-25%. This reduction would increase the impact cost—the gap between the buy and sell prices—which adds to trading costs beyond brokerage and government charges.

Lower volumes are detrimental to market development as they increase trading costs. While some of these volumes might move to the cash market, benefiting it, the F&O segment could suffer from lower liquidity, which is problematic in the long run.

Source: NSE

One alternative SEBI could consider is introducing a product suitability framework, common in Europe and the US. In these regions, not everyone can trade F&O. Traders need to meet specific net worth criteria, have relevant trading experience, and pass an exam. Even then, there are restrictions on leverage and trading methods.

If SEBI's measures lead to a significant reduction in F&O volumes, the era of brokers offering zero brokerage or unlimited trading plans could end. These models were feasible because derivatives trading subsidized equity delivery investors. With brokers no longer receiving exchange volume incentives and SEBI cracking down on derivatives trading, reduced volumes and broking revenues could signal the end of free broking models in India.

The Indian markets are undoubtedly entering a new era. While SEBI's regulations aim to protect investors and enhance market stability, they also bring changes that could reshape the trading landscape. It's crucial for market participants to stay informed and adapt to these evolving regulations.

Foreign investors are going with the flow

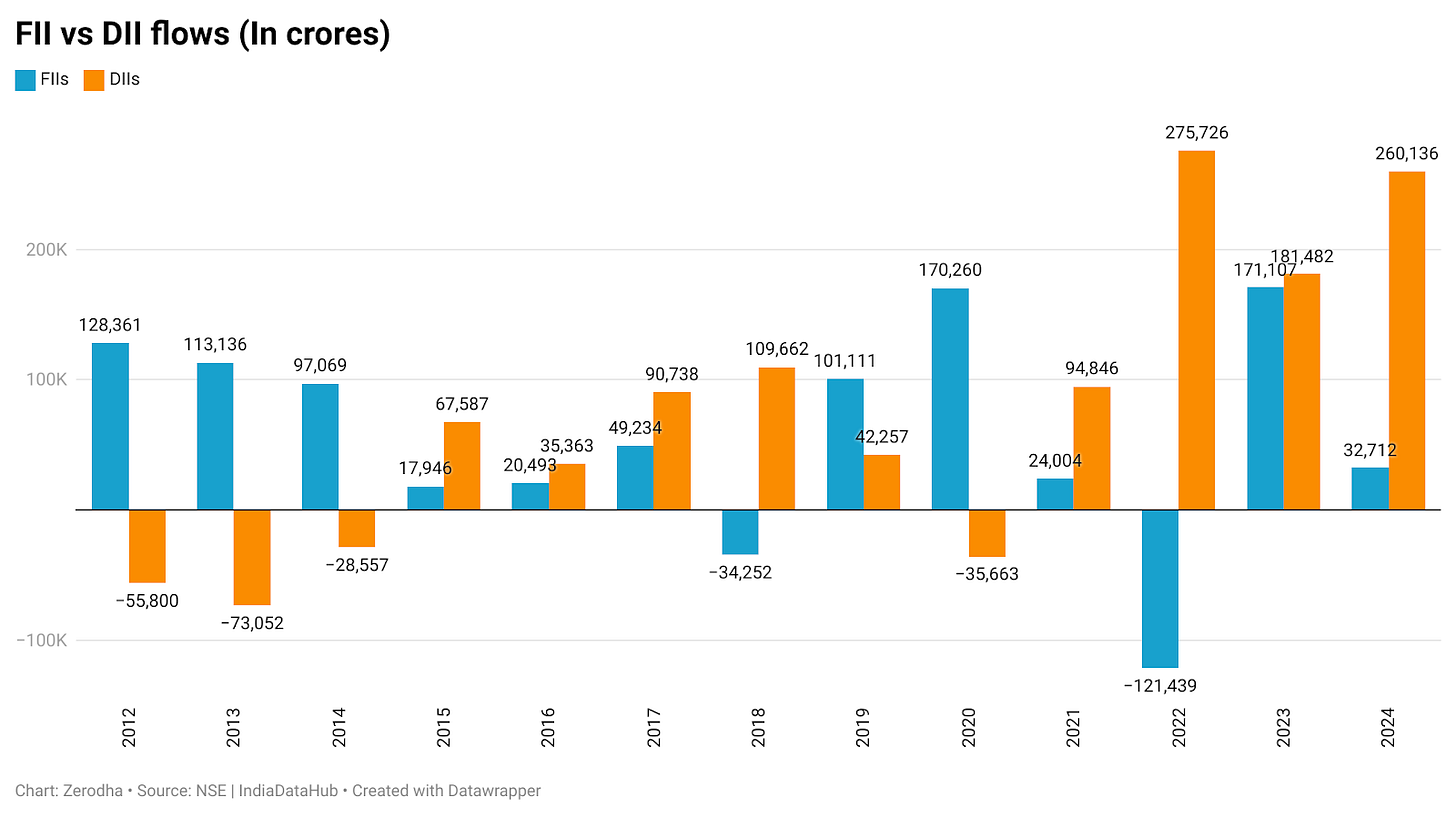

The sentiment about India has never been more bullish, with investors worldwide eager to get a piece of the Indian action. The headline economic numbers look great, and since COVID-19, the markets have been on a nearly unbroken upward trajectory. This optimism is reflected in the investment flows. Since 2020, foreign institutional investors (FIIs) have been net buyers of Indian equities, with the exception of 2022.

In 2023, FIIs purchased equities worth 1.7 lakh crores. Back in June, many experts predicted that foreign investors would pull back from India. They reiterated this after the budget, citing the increase in both long-term and short-term capital gains tax. However, none of these predictions have come to pass.

So far in 2024, FIIs have invested 32,700 crores. Comparing this to the same period last year, when FIIs had already invested 1.2 lakh crores by July 2023, shows that while the pace has slowed, it has not turned negative. With four months left in the year, things could still change significantly.

One of the most stunning developments has been the rise of domestic institutional investors (DIIs) such as mutual funds, insurance companies, and pension funds. Since 2020, DII investments have far outpaced those of FIIs. Specifically, since 2020, DIIs have invested a whopping 7.5 lakh crores, compared to 2.47 lakh crores by FIIs.

This dominance of DIIs is a recent phenomenon. Looking back at the previous decade, FII investments were much larger. This shift can be attributed to several factors:

Investing has never been easier, thanks to Aadhaar, which has made the process fully online. The COVID-19 pandemic also acted as a significant trigger for this change.

After the pandemic, there was a sudden influx of new investors into the markets. In 2020, there were just 3 crore unique investors in India. By June 2024, this number had surged to nearly 10 crore investors—a massive expansion of the investor base.

The ongoing bull market has been a major motivator. Nothing excites people about investing more than rising markets.

There has been a growing pool of domestic savings funneled through investment vehicles like insurance, provident funds, and the national pension scheme. The Employees' Provident Fund Organisation (EPFO) alone invests a few thousand crores a month into equity index funds.

Will this bullish trend continue? It's always challenging to predict such trends. Regardless of whether it's DIIs, FIIs, or individual investors, everyone tends to chase performance. As long as the markets continue to perform well, investment flows are likely to remain strong.

In conclusion, the Indian markets are experiencing a significant influx of investments, driven by both domestic and international investors. The ease of investing, the bull market, and the growing pool of domestic savings are key factors contributing to this trend. While future predictions are always uncertain, the current momentum suggests a robust and optimistic outlook for India's markets.

Tata motors is preparing for an electric age

Tata Motors, one of India’s largest passenger and commercial vehicle manufacturers, recently released its quarterly performance results, offering some intriguing insights into the Indian economy's demand situation. Let's delve into a few key trends highlighted by these results.

Tata Motors is leading the Indian electric vehicle (EV) segment, commanding nearly 70% of the market share for new EV registrations. This means almost 7 out of 10 new EVs on Indian roads are Tata vehicles. Despite being early days for the Indian EV market, Tata's dominance is clear.

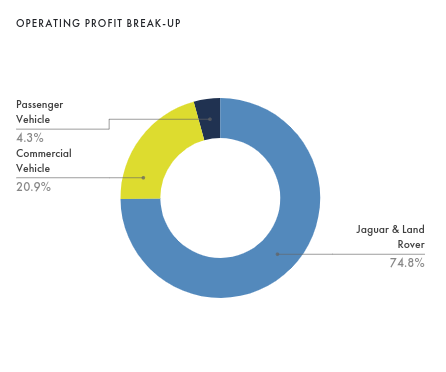

Source: Tata Motors

More than 70% of Tata Motors' profit comes from Jaguar Land Rover (JLR), which sells luxury vehicles like Land Rover. This quarter, JLR reported revenue exceeding ₹76,000 crore, up 5% from the previous year. Despite challenges, JLR remains a significant revenue generator for Tata Motors.

Source: Tijori

Wholesale volumes of EVs dipped due to the expiry of the Faster Adoption and Manufacturing of Electric Vehicles in India (FAME) subsidies. The government halted the subsidy scheme due to rampant misuse by auto manufacturers. However, sales of the 1-tonne variant of the Tata Ace EV, a small commercial electric vehicle, remained strong despite the lack of subsidies.

There is widespread anticipation of a new EV subsidy scheme, though the government has yet to announce anything. Earlier this year, Balaje Rajan, Chief Strategy Officer of Tata Passenger Electric Mobility (TPEM), mentioned that global case studies suggest that support for around 20% EV adoption is beneficial. If a new FAME EV subsidy scheme is introduced, it could boost demand for both the Tata Ace EV and Tata passenger vehicles.

Tata Motors plans to separate its commercial vehicle (CV) and passenger vehicle (PV) businesses. The CV business will be listed separately on stock exchanges, while the PV business will be fully integrated into Tata Motors Limited. Tata’s CVs compete with brands like Ashok Leyland.

Tata Motors is focusing on expanding its EV offerings to drive future growth. This includes new launches across both Tata and electric versions of Jaguar and Land Rover models. The company aims to leverage its leadership in the EV market to maintain momentum and capture more market share.

Tata Motors' joint venture with Chery will license the Freelander brand from Jaguar Land Rover (JLR) to create new EV products specifically for the Chinese market. This previously dormant brand will be renewed to cater to the local demand for EVs, potentially improving the muted growth in China. Despite the challenging economic conditions in China, Tata’s joint venture performance has remained steady.

End of the world—software edition

Last month, a significant outage at CrowdStrike, a popular cybersecurity firm, caused a massive global IT disruption. A faulty update released by the company resulted in a widespread outage affecting various sectors, including hospitals, airlines, banks, and more. The financial losses were immense, and parts of the tech-driven world nearly came to a halt. Now that the dust has settled, let's delve into the real impact of this incident.

The healthcare sector was severely affected. Critical services were delayed as hospitals had to revert to manual processes. The estimated financial loss in this sector alone was about $1.9 billion—a staggering figure.

The banking sector faced enormous challenges. Online banking services and ATMs were disrupted, causing chaos for customers. The sector lost approximately $1.15 billion due to the outage.

The airline industry was thrown into turmoil. Thousands of flights were cancelled, and social media was flooded with complaints from stranded passengers. Some airlines resorted to issuing handwritten boarding passes because their servers were down. Delta Airlines, one of the largest airlines in the US, cancelled over 6,000 flights and incurred losses estimated at $500 million.

The retail and IT sectors also faced significant losses, around $1 billion collectively. Point-of-sale (POS) systems crashed, and online services were disrupted, impacting sales for many stores and restaurants that rely on online billing.

Public transport and government services in some countries were also affected, highlighting the widespread nature of the outage.

According to Parametrix, a cloud monitoring and insurance firm, Fortune 500 companies faced approximately $5.4 billion in losses. However, insurance payouts are estimated to be only $1.1 billion, covering just about 20% of the total losses.

CrowdStrike's reputation took a severe hit. The company's stock dropped by nearly 34%, wiping out about $25 billion in market value.

The only positive outcome of this incident is that it may prompt companies to reconsider the use of proprietary and centralized tools capable of making changes to critical systems. In today's interconnected world, where everything from cars and phones to critical medical equipment is connected to the internet, the CrowdStrike incident has demonstrated the vulnerability of relying on a single piece of software. It highlighted how such an outage can cripple everything from hospitals and airports to financial markets and even some small governments. This serves as a stark reminder of the potential risks in our increasingly digital world.