Recap: Rising scams, India's changing food habits, Adani's port ambitions and more

We publish a new episode daily to help you understand the biggest stories in the Indian markets. But we understand that you may be busy and don't have the time to listen to the daily episodes. So don't worry; we've got you covered.

Every weekend, we publish an edition simplifying the biggest stories of the week so that you can still look smart in front of your friends.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and video on YouTube.

If you have already listened to daily episodes of The Daily Brief, do check out our other podcasts, The Big Perspective and Please help me understand!

In this week's edition, we recap these stories:

Another mega trading scam

Tel (oil) lene gaya

How big is the front-running problem in the Indian stock market?

A decade of change on India's plate: Progress and Challenges

Adani's big port ambitions

Another mega trading scam

In recent times, the rise in investment and trading scams in India has been really alarming. People have lost thousands of crores to these scams. Just in the past few months, scams worth ₹10,000 crores have been uncovered in Assam alone. And those are just the ones we know about! Who knows how many more are out there?

One of the big scams happening now is through illegal forex trading platforms. According to The Economic Times, the Enforcement Directorate (ED) recently banned dozens of shady forex platforms that were involved in money laundering. This particular scam was worth over ₹10,000 crores!

But this isn’t the first time the ED has busted a forex trading scam. This year alone, they’ve cracked down on several across the country.

What’s truly shocking is how these fraudsters operate. They don’t just create a few fake forex websites—they build entire fake ecosystems! They set up fake e-commerce sites, sketchy forex platforms, and illegal payment gateways. And this isn’t just a local scam—these fraudsters have connections with international networks in places like Spain, Dubai, Russia, Pakistan, and more.

So, how did these scams go unnoticed for so long?

The answer is simple: these scammers are sneaky. They don’t just stop at creating fake websites. They go all out—setting up networks of shell companies, opening multiple bank accounts under fake names, and even hiring former bank officials to help them move the money around! Some platforms even open new bank accounts and change their UPI IDs regularly to keep the money flowing, even when one account gets flagged.

Take OctaFX, for example. This platform has been at the center of many scams, and they’ve even roped in Bollywood stars and famous cricketers to promote their schemes!

Here’s how these scams usually play out

Scammers set up unregulated trading platforms that manipulate trading conditions. They make it look like users are making profitable trades, which draws in more investors. But when people try to withdraw their money, it’s nearly impossible.

Some platforms operate like Ponzi schemes. They pay out returns to older investors using the money from newer investors. But eventually, the whole system collapses, and everyone loses their money.

Another trick these scammers use is routing money through fake forex sites to make illegal funds look clean. The ED found that money from people who thought they were trading forex was actually being moved into SEBI-registered Alternative Investment Funds, giving it a legal appearance.

The Reserve Bank of India (RBI) has repeatedly warned people about these platforms, saying that anyone caught trading on them could face serious consequences. Yet, these platforms keep popping up, and lakhs of Indians are still falling for them.

But it doesn’t stop there.

These scammers have also found ways to exploit the digital payment system. They use illegal payment aggregators to route funds, creating layers of transactions that make it almost impossible for authorities to trace the money back to its source.

With so many of these platforms still active, what the ED has uncovered is probably just the tip of the iceberg. So, the main takeaway for all of us is: if you’re thinking about trading forex or investing online, do your research. Make sure the platform is registered with the RBI, watch out for promises of crazy-high returns, and always be cautious about where you’re putting your money.

Tel (oil) lene gaya

Since the last time we talked about crude oil prices, things have changed quite a bit—and not in a good way. Given that India imports 90% of its oil, this is something we really need to keep an eye on.

As of now, WTI crude is trading at around $68 a barrel, and Brent Crude is sitting at about $71.

Just to give you some context: WTI, or West Texas Intermediate, is the main benchmark for oil produced in the U.S. Brent, on the other hand, originally referred to oil from the North Sea but is now used as a global benchmark for light, sweet crude oil.

The difference between these two prices is called the Brent-WTI spread. This spread can change depending on things like supply-demand, geopolitical events, and transportation costs. Typically, Brent trades at a higher price than WTI because it has a broader global reach and better access to shipping routes.

Now, back to crude prices—these current numbers are a big drop from earlier this year, when Brent was trading at around $90.

So, what’s causing crude prices to tumble, you might wonder?

First, there are growing concerns about global demand, especially from China. As the world’s second-largest economy, China’s struggles to keep up its growth are putting serious pressure on oil consumption.

Recently, Trafigura, one of the largest commodity traders, said that crude prices could drop to as low as $60 a barrel. At the same time, the co-founder of Gunvor, another big player in the commodities space, mentioned that oil’s fair value should be around $70, given the current supply and demand situation.

Adding to the gloomy outlook, the market is currently dealing with an oversupply. Even though OPEC+ recently decided to hold off on increasing output, there’s still a lot of oil sloshing around in the market. Historically, OPEC has cut production whenever prices fall below $75 to keep them stable, but the current market dynamics are trickier than usual.

To make things more complex, non-OPEC countries like the U.S., Canada, Guyana, and Brazil are all set to increase production next year, which could flood the market even more.

It’s not just traders who are feeling bearish—big banks are also lowering their forecasts. Morgan Stanley recently cut its oil price outlook because of worsening market concerns. They now expect oil to average around $75 a barrel. For context, earlier this year, they were expecting oil prices to be $85!

Interestingly, Goldman Sachs highlighted an unexpected factor—artificial intelligence. They believe AI could help reduce costs in the oil industry by improving logistics and resource allocation, which could eventually lead to more supply and lower prices. It’s an optimistic view, but only time will tell if AI really makes that big of a difference.

Now, after all this talk about crude prices, you might be wondering, “Does this really matter to me in India?” The answer is—absolutely.

Let us explain

For starters, lower oil prices are generally good news for India’s trade balance. As one of the world’s largest oil importers, our import bill is highly influenced by crude prices. To give you some context, the price of oil in India’s crude basket has dropped from $84 a barrel in July to $75 right now. This could help India save billions on its import bill, reduce the trade deficit, and even support the Rupee.

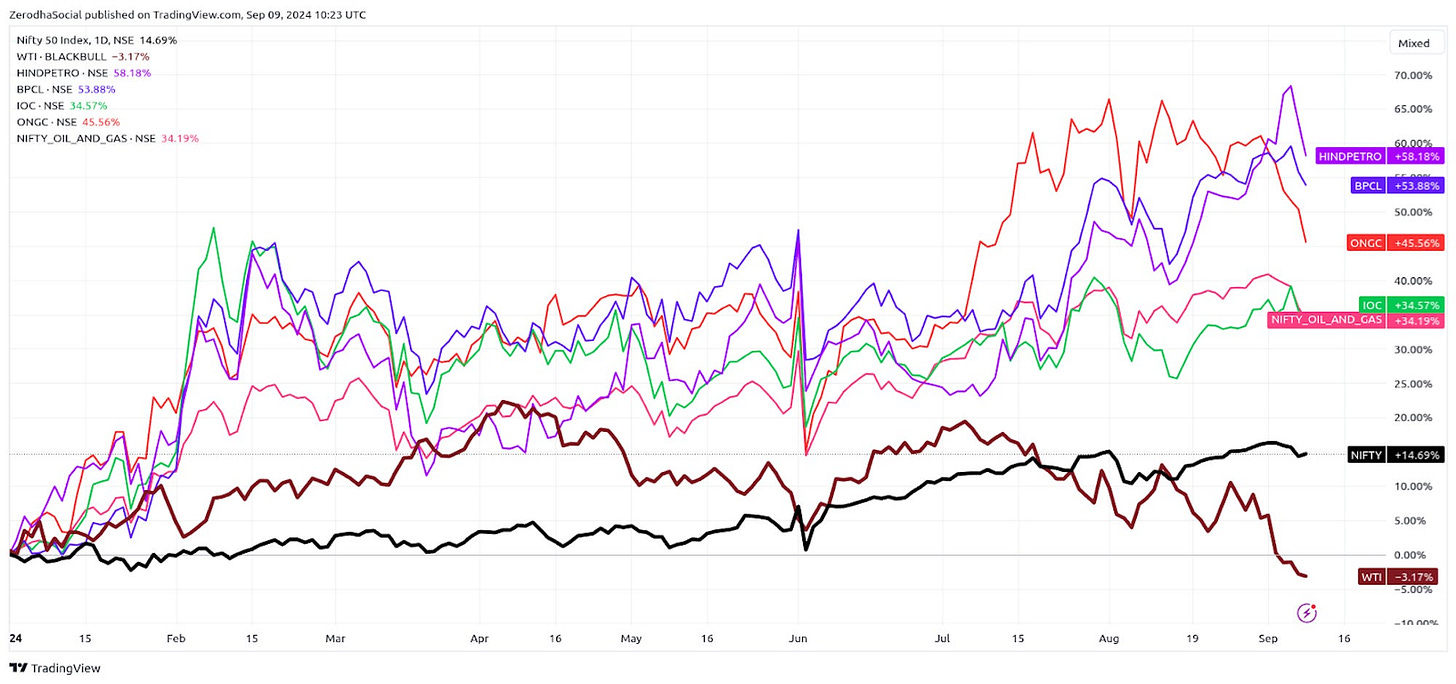

For oil companies, lower crude prices are a mixed bag. It’s great for oil marketing companies like HPCL and BPCL since lower input costs can boost their profit margins. This is already being reflected in the stock market—while the Nifty 50 is up about 15% year-to-date, the Nifty Oil & Gas index has jumped by 34%! Lower oil prices also benefit industries that rely heavily on crude, like paint manufacturers, airlines, and pharma companies.

However, it’s not such great news for oil exploration and production companies like Oil India and ONGC. Lower prices can squeeze their margins, making it tougher for them.

A few key events in the coming days—such as OPEC and IEA’s monthly reports and China’s trade data—could shake things up in the oil markets, so it’s worth keeping an eye on those.

How big is the front-running problem in the Indian stock market?

Recently, the Enforcement Directorate (ED) registered a case under the Foreign Exchange Management Act (FEMA) against Viresh Joshi, the former dealer at Axis Mutual Fund. The ED is now conducting searches at locations linked to Joshi in connection with a forex violation case. If you recall, Joshi was also caught by SEBI in a front-running investigation involving Axis Mutual Fund.

But first, let's break down what front-running actually means. Front-running is an illegal practice where someone uses insider knowledge of a large upcoming trade to make personal trades for profit. In the case of mutual funds, it often involves a fund manager or dealer buying or selling stocks just before their fund makes a large trade, profiting from the price changes that follow.

The Axis Mutual Fund case is a prime example of how damaging front-running can be. SEBI’s investigation found that Viresh Joshi, along with others, had allegedly been front-running Axis MF’s trades for months. They used a network of accounts to make trades based on non-public information about the fund’s upcoming large orders, reportedly generating over ₹30 crores in illicit profits.

But the damage goes beyond just the money. It shakes investor trust in mutual funds, which are supposed to be managed by professionals acting in the best interests of their clients. When fund employees exploit their positions for personal gain, it undermines the entire system.

And this isn’t an isolated incident. Just last week, the Wall Street Journal reported on a whistleblower complaint alleging that Bank of America’s Asia division engaged in similar practices. The report claimed that bankers in BofA’s Mumbai office shared non-public information with investors before the bank sold hundreds of millions of dollars’ worth of stock. This allegedly allowed some investors to "front-run" these large trades.

The WSJ highlighted two specific transactions where this may have happened. One involved a $200 million stock sale for a subsidiary of Indian conglomerate Aditya Birla and financial firm Sun Life. The other was a roughly $500 million IPO for SoftBank-backed retailer FirstCry. If proven true, these allegations represent a serious breach of market integrity.

Unfortunately, this is part of a growing trend. Over the past few years, several major players in India’s financial markets have faced front-running allegations. In 2022, the Life Insurance Corporation of India (LIC) came under scrutiny when SEBI issued an order against five entities involved in a front-running scheme related to LIC’s trades. SEBI found that these entities had made ₹2.44 crore in profits through their activities.

More recently, Quant Mutual Fund has also come under investigation, with SEBI conducting search and seizure operations at its offices in Mumbai and Hyderabad. SEBI’s own data confirms the growing scale of the problem. According to SEBI's latest annual report, insider trading investigations more than doubled from 85 in 2022-23 to 175 in 2023-24. Even more alarming, front-running cases shot up from 24 to 83 in the same period—a staggering 245% increase.

The growing number of cases has pushed SEBI to take action. The regulator has proposed expanding the list of "connected persons" in its insider trading regulations, broadening the scope of who can be held accountable for violations.

In a consultation paper released in July, SEBI proposed widening the net of individuals considered "connected persons." The proposed changes would include more family members, business associates, and individuals with close financial ties to those already classified as connected persons. This is aimed at capturing people who might have access to insider information through their relationships, even if they don’t have a direct connection to the company.

SEBI’s proposal also seeks to align the definition of "relative" with the broader one used in the Income Tax Act, potentially bringing more family members under scrutiny. The goal is to close loopholes and make it harder for insider information to be misused.

However, this proposal hasn’t come without criticism. Sandeep Parekh, a well-known securities lawyer, has expressed concerns that the expanded definition could criminalize innocent people. In an article, Parekh warned that these changes might result in "100% false positives and 100% false negatives"—meaning innocent individuals could be implicated while actual wrongdoers might still slip through the cracks.

Parekh’s concerns highlight the tricky balance regulators need to strike. On one hand, it’s crucial to crack down on front-running and other forms of market abuse. But on the other hand, overly broad regulations could have unintended consequences and stifle legitimate market activity.

As these cases unfold, they serve as a reminder of the challenges facing India’s financial markets as they continue to expand. In response to these issues, the Association of Mutual Funds in India (AMFI) has recently introduced new standards to prevent front-running and market abuse at asset management companies.

AMFI’s new framework includes stricter surveillance measures, improved alert systems, and tighter controls on the personal transactions of key employees. These standards will be rolled out in phases, starting with large equity funds in November 2024, and gradually covering all types of funds by August 2025.

The goal of these measures is to build a more robust system for detecting and preventing market abuse, ultimately protecting investors and maintaining the integrity of the market. While these steps are encouraging, their success will depend on how well fund houses implement them and the ongoing oversight from regulators.

A decade of change on India's plate: Progress and Challenges

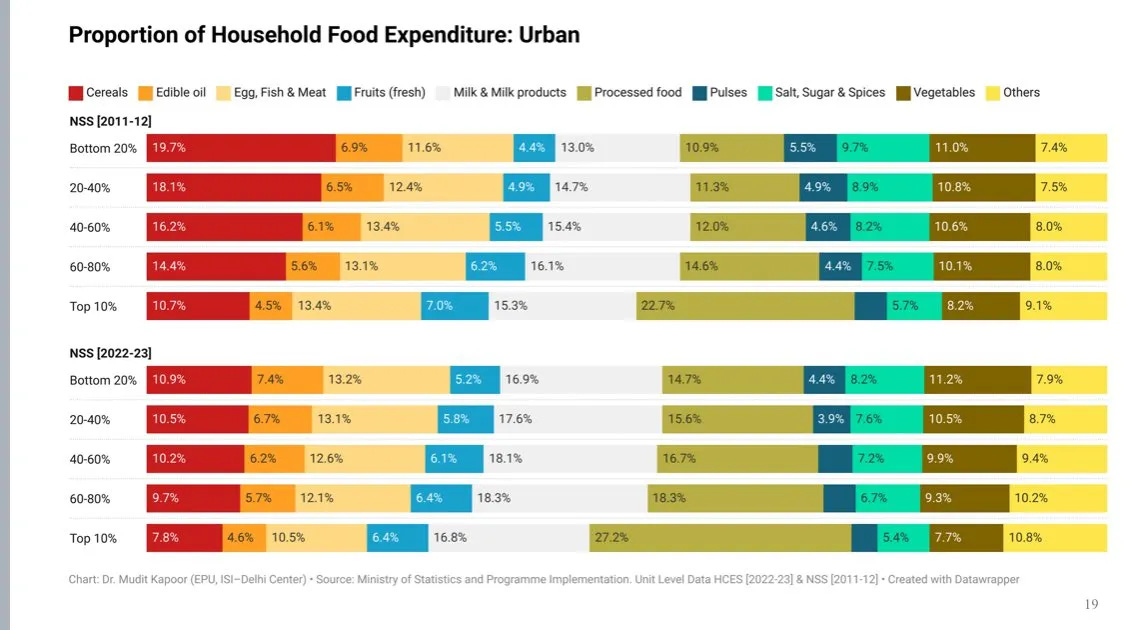

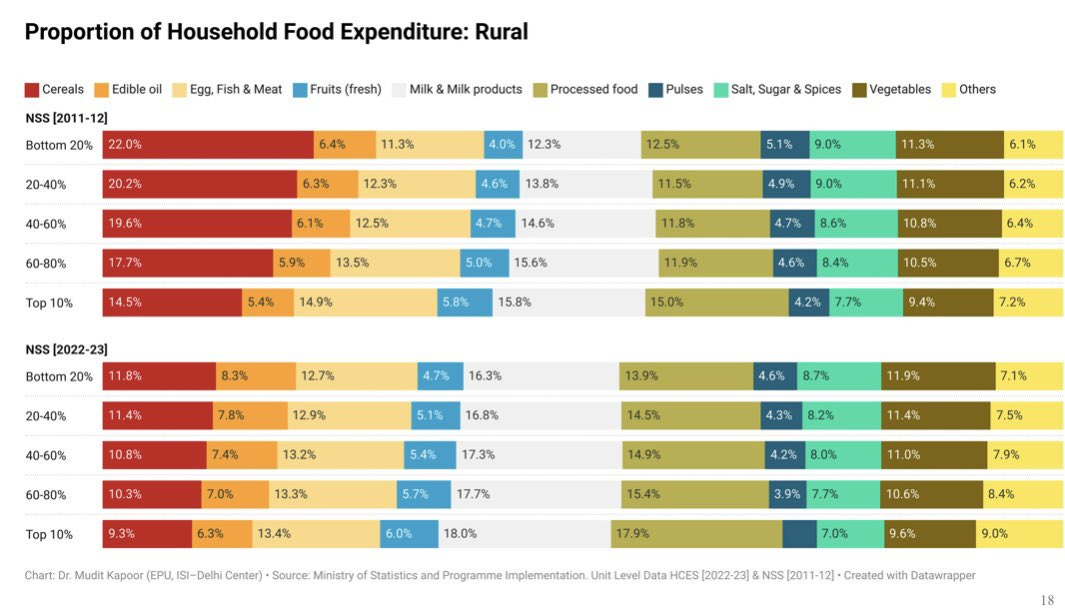

Ten years ago, the typical Indian meal looked quite different from today. Back then, cereals made up a big chunk of both the plate and the household budget. Fast forward to now, and we’re seeing a remarkable shift in what India eats.

For the first time in modern history, Indian families are spending less than half their income on food. It’s not because they’re eating less – quite the opposite. It’s a sign of economic progress, with rural food spending up by 164% and urban by 146% in the last decade.

The share of cereals in household food spending has dropped significantly – from 10.7% to 4.9% in rural areas and from 6.6% to 3.6% in urban ones. But this doesn’t mean Indians are cutting down drastically on cereals. One major reason for this decline is government food security programs.

Schemes like the Public Distribution System (PDS) have provided free or subsidized grains to millions of low-income households, especially helping the poorest. This has reduced how much families need to spend on cereals, freeing up their budgets for other foods.

For example, the bottom 20% of households saw the biggest drop in cereal spending. In rural areas, it fell from 22% to 14.5% of their food budget. With the money saved, these families are now able to add more variety to their diets.

Fruits, vegetables, milk, eggs, and meat are becoming more common on plates across the country. Fresh fruit, once a rarity for low-income families, is now more widely consumed. Milk, which used to be a luxury for many, has also become more accessible.

This shift shows how government policies and rising incomes are not only helping people meet basic nutritional needs but are also allowing them to enjoy more diverse diets.

Improved infrastructure has played a huge role in this change. Better roads, storage, and transport have made it possible for fresh food to be available year-round, even in the most remote areas. The idea of eating only seasonally is slowly fading.

This change in diet isn’t just altering what’s on the plate – it’s also improving health. More diverse diets are linked to a 14% lower rate of anemia in children and women.

But this nutritional shift comes with challenges. As traditional staples give way to a more varied diet, overall cereal consumption is declining. While this opens the door to more nutrient-rich foods, it also calls for a rethink of agricultural policies that have long focused on cereals.

There’s also the rise of processed and packaged foods, which often contain too much sugar, salt, and unhealthy fats. This trend, especially in urban areas, is worrisome. At the same time, there’s been a slight dip in vegetable consumption.

What’s even more concerning is the increase in spending on tobacco and alcohol. In rural areas, households are now spending more on pan, tobacco, and intoxicants than on fresh fruits. Urban households show a similar trend.

So, while we’re seeing positive changes toward more diverse and nutritious diets, particularly among lower-income groups, the rise in processed foods, alcohol, and tobacco is troubling.

The shifts in what India eats have far-reaching effects. They’re reshaping agriculture, influencing public health policies, and reflecting the broader economic changes in the country. As India continues to grow and evolve, so too does its relationship with food.

This past decade tells a story of progress, with diets becoming more varied and nutritious across society. But it also highlights new challenges that need creative solutions. From policymakers to farmers, food manufacturers to consumers, everyone has a part to play in shaping India’s food future.

Adani's big port ambitions

Let's talk about the Adani Group, and we’ve got two interesting stories about it. The first one takes us to Kenya, where Adani’s plans to take over and run Nairobi’s main airport hit a major roadblock this week.

On Tuesday, hundreds of workers at Kenya’s main international airport went on strike, protesting a proposed 30-year lease deal between the Kenyan government and the Adani Group. This strike caused big disruptions, delaying flights and leaving passengers stranded.

So, what's the deal? Adani has made a $1.8 billion investment offer to lease and operate Kenya’s busiest airport, a key hub in the region.

However, airport workers and unions are worried about possible job losses and handing over control of such a strategic national asset to a foreign company. There are also concerns about how transparent the bidding process has been.

By Wednesday evening, the strike ended after the government promised that workers would have a say in the final deal. But this situation shows the kind of hurdles Adani faces as it pushes for global expansion.

The company has been rapidly expanding its airport business, now running seven major airports in India. Its move into Kenya is a clear sign that Adani wants to become a global player in airport management. But, as we’ve seen, breaking into new markets can come with challenges.

Now, for the second story — Adani’s massive port projects. This one needs a little more background, so stick with us.

India has over 200 ports along its 7,500 km coastline, handling around 1.5 billion tonnes of cargo every year. But here’s the catch — India’s ports are only running at about 60% capacity, and most of them can’t handle the world’s biggest ships because they aren’t deep enough.

That’s where Vizhinjam, Adani’s ambitious deepwater port project in Kerala, comes in. Located near India’s southern tip, this port is in a prime position to tap into international shipping routes.

So why is Vizhinjam important? It’s all about location, depth, and competition with Sri Lanka’s Colombo Port.

Right now, about 75% of India’s transshipped cargo is handled by ports outside India. Of that, Colombo, Singapore, and Malaysia take care of more than 85%, with Colombo alone handling 45%. The reason? Most Indian ports just aren’t deep enough to accommodate the mega container ships. If we handled this cargo ourselves, it could save us around ₹1,500-2,000 crore each year.

Now, here’s a quick breakdown of transshipment: Think of massive container ships — they’re the size of multiple football fields. These giants can only dock at a few deep ports. So, they stop at places like Colombo or Singapore, offload their cargo, and smaller ships pick it up to distribute to other regional ports. It’s like a giant game of pass-the-parcel on the seas.

Vizhinjam, with its natural depth of 20-24 meters, can easily handle the world’s largest vessels. This could help India bring back a lot of the business that’s currently going to Colombo.

Here’s something interesting: Adani isn’t just competing with Colombo, they’re also investing there. In 2021, Adani signed a deal to develop and run the West Container Terminal at Colombo Port, with a $700 million project where Adani holds a 51% stake.

This dual strategy — building Vizhinjam while investing in Colombo — shows Adani’s ambition to dominate regional shipping.

But back to Vizhinjam. After delays and controversies since Adani won the contract in 2015, things are finally moving. In June this year, Vizhinjam welcomed its first commercial vessel, marking the start of operations at India’s first custom-built transshipment port.

Momentum is picking up fast. By September, trial operations at Vizhinjam were in full swing. The port has already hosted several large vessels, including ships with drafts of up to 16.5 meters, some of the deepest ever for Indian ports.

This is a big win for India. Vizhinjam’s natural depth — over 18 meters, going up to 20 meters in some areas — allows it to handle the world’s largest container ships without costly dredging. Its prime location on major international shipping routes makes it a serious player in global transshipment.

The world’s biggest shipping lines are taking notice. Mediterranean Shipping Company, the global leader in container shipping, has already sent five ships to Vizhinjam during trial operations. There are even reports that MSC and Adani are discussing a partnership, with MSC potentially becoming an anchor customer for the port.

Adani Ports plans to invest $1.2 billion to boost Vizhinjam’s capacity, aiming for an annual capacity of 6.2 million TEUs. This investment is part of Adani’s larger plan to dominate India’s port sector.

Adani Ports is already India’s biggest private port player, handling 27% of the country’s total cargo and a whopping 46% of container traffic. That’s a huge leap from just 14% market share in 2015, and it’s gone from running two ports in 2011 to 14 today. Ports are a capital-heavy business, and Adani is playing the long game.

Now, let’s quickly touch on something else about Adani’s Colombo port project.

In November 2023, the U.S. International Development Finance Corporation (DFC) announced a $553 million loan for the Colombo West International Terminal, the joint venture where Adani holds a 51% stake. The rest is owned by local partners and the Sri Lankan government.

Why does this matter? It’s not just about financing a port. This move is seen as part of a larger strategy to counter China’s growing influence in the region.

China has been heavily investing in ports across the Indian Ocean as part of its Belt and Road Initiative. In fact, China has some level of involvement in at least 17 ports in the Indian Ocean region, including Sri Lanka. For example, China holds a 99-year lease on Hambantota port because Sri Lanka couldn’t repay its loans.

So, when the U.S. backs an Adani project in Colombo, it’s not just about the port — it’s also about pushing back against China’s influence in the region.

For Adani, this U.S. backing is a big deal. It’s not just about the funding; it’s a vote of confidence in their ability to handle large infrastructure projects. The Colombo West Terminal isn’t just a port project — it’s a strategic move in the larger game of regional influence.

And the timing couldn’t be better for India. Colombo is facing congestion due to the Red Sea crisis and other geopolitical uncertainties. Vizhinjam has a real chance to establish itself as a major regional hub.

If Vizhinjam can attract the major shipping lines and prove its efficiency, it could shift trade patterns in the Indian Ocean. It’ll be fascinating to see how these projects play out and whether they can offer an alternative to China’s growing network of ports in the region.

That’s it from us. Thank you for reading. Do share this with your friends and make them as smart as you are 😉

If you have any feedback, do let us know in the comments.

the insight into Adani Port business is interesting . It instills confidence that Adani is in for a long haul and visionary leader in this space. Another aspect is Ship breaking business. It is currently unorganized and no big listed player is there. May be Adani will enter there on day and bring more transperancy and standardization into it. like Titan brought into retail jewellery.. first mover advantage is always there.

The whole article was written very well, was lucid to read and gave so much insight!!