Recap: Oil prices and the world economy, Indians spending less, Automakers vs dealers and more

We've been experimenting with the weekend edition quite a bit. Last week, we tried something new and most of you had positive feedback for it. So, we're revamping the weekly edition accordingly and will be back with fresh content next week. For this weekend's edition, we will do a recap of some of the best stories we covered during the week.

You can listen to the podcast on Spotify, Apple Podcasts or wherever you get your podcasts and video on YouTube.

If you have already listened to daily episodes of The Daily Brief, do check out our other podcasts, The Big Perspective and Please help me understand!

In this week's episode, we look at these stories:

Is oil telling something about the global economy?

Indian consumers are finally starting to spend

Auto manufacturers vs Auto dealers

Reliance wants to go green..ish

Is the IPO gold rush over?

Is oil telling something about the global economy?

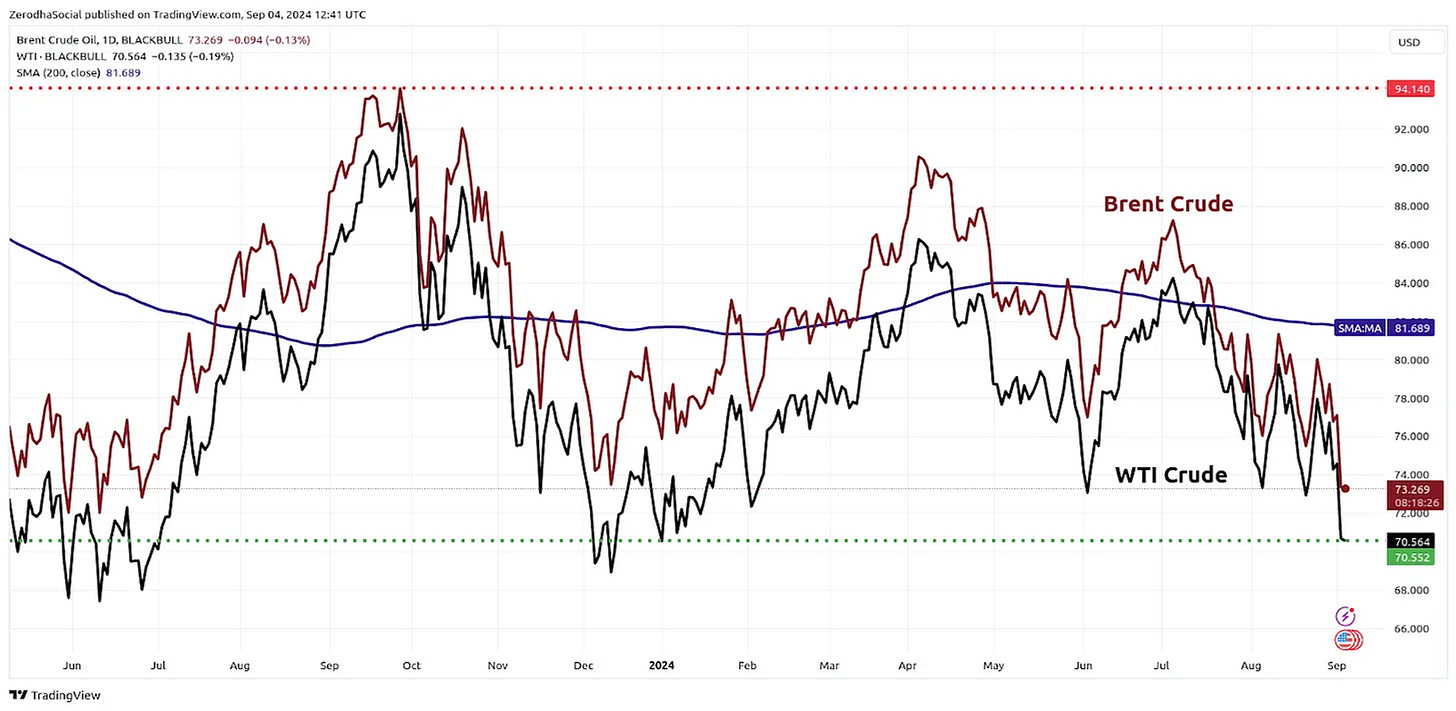

Crude oil prices have recently plunged to nine-month lows. WTI crude is down about 6.48%, while Brent has fallen 4% in the past five days. Brent is now hovering just above $73 a barrel, erasing all of this year's gains.

Bloomberg's commodities columnist, Javier Blas, made an interesting observation on Twitter. Adjusted for cumulative inflation, oil prices are now at the same level as they were 20 years ago. This is a huge shift because, just last year, crude prices soared to $120 after Russia invaded Ukraine. But now, OPEC+ countries are suffering from a loss in purchasing power—an oil barrel buys fewer goods and services today than it did decades ago.

There are both demand and supply reasons for this drop in oil prices.

Demand Concerns:

China’s economy is showing significant signs of weakness. Factory activity has been declining for four straight months, and new home sales are also falling. The real estate sector, a major consumer of diesel, is particularly affected.

China’s oil imports have dropped significantly, with July and August seeing 800,000 fewer barrels per day compared to last year. Refineries are operating at lower rates, and Q3 throughput is expected to be well below last year’s levels.

The U.S. manufacturing sector is also struggling, contracting for five consecutive months. This has raised fears of a broader global economic slowdown, which could further dampen oil demand.

Supply Issues:

Earlier this week, there was a crisis in Libya, leading to a shutdown in oil production. However, this appears to be nearing resolution, which could bring over 500,000 barrels per day back to the market, raising concerns of oversupply.

Despite weak demand, OPEC+ plans to increase output by 180,000 barrels per day in October. This decision has added to worries about oversupply in an already weak demand environment.

Market sentiment is currently bearish, with speculative traders increasing short positions and reducing long positions to 52-week lows. This combination of weak demand, especially from China, and the prospect of increasing supply has created a pessimistic outlook for oil prices. The question now is whether OPEC+ will reconsider its production increase to avoid a growing supply glut.

Indian consumers are finally starting to spend

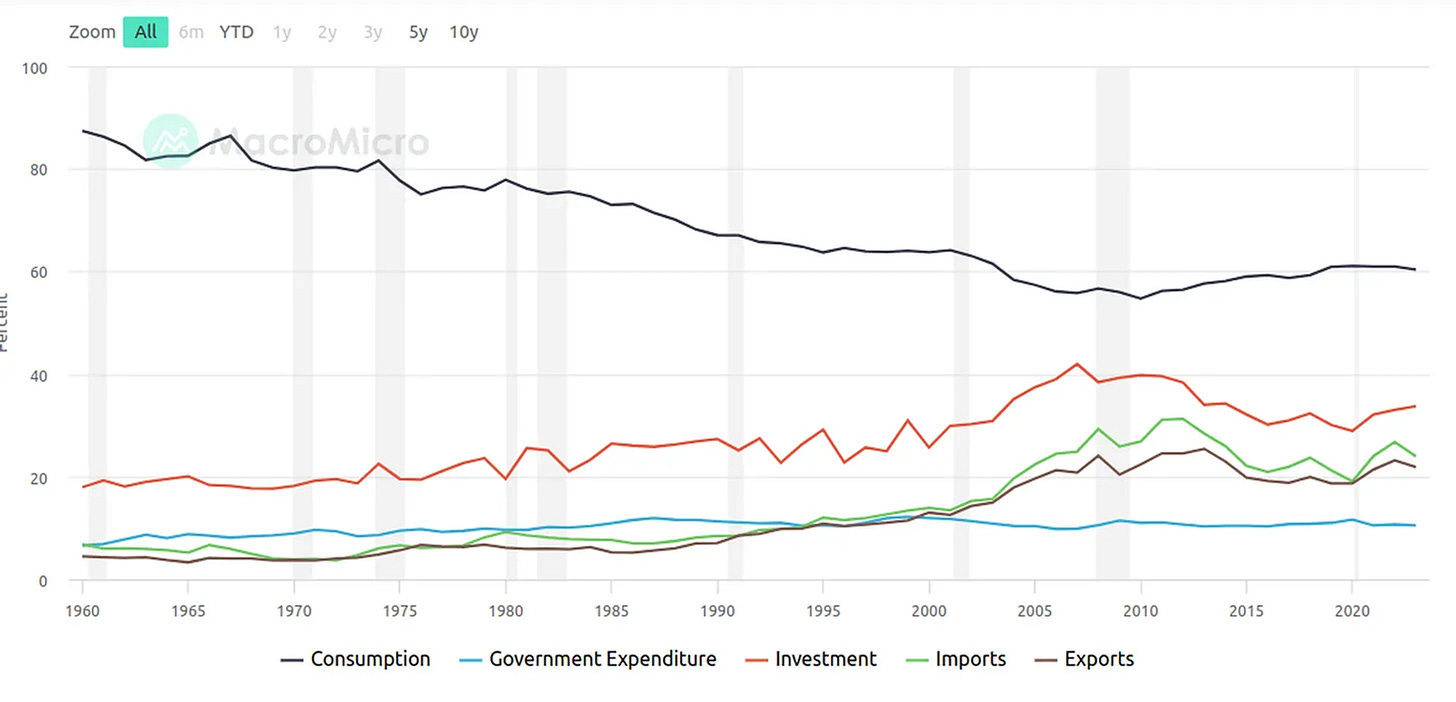

The government recently released economic data for the first quarter of this financial year, and there are some interesting trends to note. Real GDP growth came in at 6.7%, which was below the RBI's forecast of 7.1%. In the previous quarter, GDP growth was 7.8%. The slowdown can be attributed to the elections and heat waves, both of which we have discussed in previous episodes. These factors disrupted economic activities across sectors, from construction and agriculture to overall consumption.

However, what stood out was the uptick in the Private Final Consumption Expenditure (PFCE) and Gross Fixed Capital Formation (GFCF).

Let’s break down these terms:

Private Final Consumption Expenditure is a term used to describe the money households spend on goods and services for their own use. It’s a good indicator of consumer confidence—if consumption is strong, it generally reflects a healthy economy.

Gross Fixed Capital Formation refers to investments in physical assets like buildings, machinery, and infrastructure made by businesses and governments. This gives us an idea of whether businesses are confident enough to invest in their operations.

Following COVID, we faced a massive inflationary shock, particularly in food prices, which further strained household budgets. Much of the money that households would typically spend on other goods and services was instead directed towards essentials like fuel, energy, and food, with the added burden of higher EMIs due to rising interest rates. To make matters worse, the rural economy suffered from poor monsoons and severe heatwaves, complicating life even further. The last three to four years have been a case of "when it rains, it pours."

You might be wondering, if households were in such dire straits and not spending, how was the Indian economy still growing at 7-8%? The answer lies in government spending. Over the past few years, the government has made significant investments, which have largely driven the positive GDP numbers we’ve seen. However, the previous quarter coincided with the elections, so government spending was minimal. This meant that private consumption and private investments had to carry the weight. In the last quarter, private consumption grew by 7.4%, the highest in seven quarters.

This is good news because durable economic growth isn’t possible without robust household spending. The government can't continue to prop up GDP numbers indefinitely through spending. So, the question is, will consumption growth remain strong?

There are some positive signs

The rural economy appears to be doing well. Sales of two-wheelers and tractors—often leading indicators of rural demand—have been strong compared to passenger vehicles, which have also performed relatively well.

Enrollment in the Mahatma Gandhi National Rural Employment Guarantee Scheme (MNREGA) has been declining, suggesting improving rural employment conditions. Additionally, monsoons have been favorable, and sowing activity has been good.

In the recent earnings season, nearly all FMCG companies were optimistic about rural demand.

Food inflation seems to be under control, and the RBI is likely to start cutting rates in the next few meetings.

However, there is a downside. Urban consumption appears to be declining. So, while rural consumption is picking up, urban consumption is falling. The question is, will these trends cancel each other out?

Another significant factor is the global economy, which is slowing down—a potential headwind for India. We’re already seeing a sharp decline in China's growth, a major engine of global economic activity, and the U.S. is also expected to slow down.

Now, let’s move on to Gross Fixed Capital Formation, or investment growth, which indicates whether businesses are feeling confident enough to invest in new projects. This grew at a robust rate of 7.5% in Q1, compared to 6.5% in the previous quarter, despite the challenges posed by elections and heatwaves. This suggests that private companies are starting to invest again. If you recall from our previous discussions, investment growth had also been a concern, as Indian companies were not investing enough. But it seems this trend is beginning to reverse.

So, will India be able to maintain a 7% growth rate? The odds are challenging, but not impossible. There were positive signs in Q1, but the big question is whether this is just a one-off or the start of a sustained trend.

Auto manufacturers vs Auto dealers

Selling automobiles is a tricky business, and one of the main challenges is inventory management—essentially, the number of vehicles stored in warehouses ready to be sold. Inventory optimization is crucial because both automobile dealers and manufacturers bear significant costs for storage space. They also incur expenses to finance the vehicles sitting in their warehouses before they’re sold, not to mention the depreciation of unsold vehicles.

Currently, India’s automobile industry is grappling with a high inventory problem—there’s an excess of stock but low demand. Passenger vehicle sales are expected to decline by 6-8% year-on-year, according to an estimate by Motilal Oswal. Excluding two-wheelers, sales remain weak across the board.

Interestingly, there’s a heated debate between auto manufacturers and auto dealers over the severity of this inventory problem. The Federation of Automobile Dealers Associations (FADA) claims that the current automobile inventory is around 70 days, which is alarmingly high. On the other hand, the Society of Indian Automobile Manufacturers (SIAM) estimates this number to be just 38 days.

So, who’s right?

The stark difference in these inventory estimates arises from the fact that both associations calculate the inventory differently. Automobile manufacturers base their numbers on the cars they produce, while auto dealers use sales data and registration information to calculate theirs.

Ideally, these numbers should align, but that’s not the case. It seems likely that manufacturers may be downplaying the situation to keep market sentiment positive, while dealers might be amplifying it to avoid being forced to take on more vehicles than they can sell. However, it’s tough to determine who’s right. What’s clear is that there is an inventory problem in the automobile sector today.

Take Mahindra & Mahindra, for example. In their April conference call, they mentioned a waiting period of more than 2-3 months for some of their models. But now, that waiting period has shrunk to as little as 2-3 days in most cases!

To clear out inventory and boost sales, automobile companies and dealers are offering deep discounts and promotional schemes—far more than they typically would. For instance, Maruti's discounts have decreased by 10% month-on-month (MoM) for the ARENA channel but increased by 5-7% MoM for the NEXA channel. Tata Motors increased discounts on its best-selling compact SUV, Punch, to ₹20,000 from ₹10,000 last month, while the Nexon continues to see a discount of up to ₹1 lakh on some variants, according to the same Motilal Oswal report.

From the dealers’ perspective, this strategy makes a lot of sense. If there are about 7 lakh unsold cars sitting in warehouses, dealers are losing crores each month just to hold them! That’s a substantial amount of money to lose, which justifies the deep discounting.

However, it’s not that dealers can’t manage inventory. As an industry practice, most dealers can sustainably hold inventories of 30-45 days, especially around the festive season, anticipating strong sales during this period. But this year, inventory levels have ballooned to 2.5-3 months, leading to significant challenges.

As a proposed solution, FADA has written to SIAM twice in the last two months, urging automakers to reduce the number of vehicles they send to dealerships to better align with the weak demand. Additionally, FADA is advocating for the continuation of the FAME-3 policy to boost demand for electric vehicles (EVs). FAME policies are subsidies and incentives provided by the government to promote EV adoption. FADA is also pushing for a reduction in the GST on entry-level passenger cars and two-wheelers from the current rate of 28% to make vehicles more accessible.

In the meantime, the automotive industry is hopeful that the upcoming festive season will bring some relief to the current low-demand situation. It will be interesting to see how this sector navigates these challenges in the coming months, and we’ll continue to monitor and report on any developments.

Reliance wants to go green..ish

Reliance Industries, one of India's largest industrial conglomerates, boasts a market capitalization exceeding ₹20 lakh crore and holds a substantial 9% weightage in the Nifty 50. The company's diverse portfolio spans from oil and gas to retail, telecommunications, and new energy.

Across its various business segments, Reliance reported ₹9.3 lakh crore in sales and ₹77,000 crore in profits over the past year. Given its size and extensive presence, any change in Reliance's operations has a ripple effect across the Indian economy. During their recent Annual General Meeting (AGM), several key insights were revealed.

Oil to Chemicals (O2C)

Reliance's O2C business remains its largest revenue generator, but it’s adapting to a changing world. The global pressure on oil producers and refiners to reduce emissions is pushing companies to move away from fossil fuel-based activities. Government-owned refiners like Indian Oil, Bharat Petroleum, and Hindustan Petroleum are making significant investments in petrochemicals to shift from the low-margin oil refining business. Reliance seems to be following a similar path.

Last year, the company processed 60 variants of crude oil, despite volatile crude prices. Reliance is also expanding into speciality chemicals like PVC, which are essential for India's growing construction sector. This move aligns with the government's focus on self-sustainability and infrastructure development.

Sustainability is becoming a focus for Reliance, albeit within the constraints of the industry. The company now recycles 2 billion plastic bottles annually and aims to increase this number to 5 billion next year. Despite the global pressure to reduce fossil fuel use, Reliance is finding ways to make its O2C business relevant for the future. This includes investing in advanced technologies and exploring more efficient production methods.

Retail

Reliance Retail operates in an increasingly dynamic environment. On one hand, there is a rising class of mass affluent Indians with growing spending power, along with trends like premiumization and the rapid penetration of digital payments. On the other hand, there's the rise of quick commerce, offering instant convenience—a sector where Reliance Retail is also making strides. In this environment, Reliance Retail operates 18,000 stores across India.

Interestingly, the jewellery market is attracting attention from major players, with the Birla Group entering the market with "Indriya," and now Reliance is also stepping into this segment.

Reliance is blending online and offline shopping experiences, much like Amazon, but with the advantage of a vast network of physical stores. By partnering with 4 million small shops, Reliance is turning potential competitors into allies. A significant highlight from the AGM was the company's aggressive expansion plan to double its revenue in the next 3-4 years.

Digital Services (Jio)

The Indian telecom sector has undergone a seismic shift in the past decade, largely due to Reliance Jio’s disruptive entry in 2016, offering ultra-low-cost 4G data plans. For context, in 2018, Vodafone was the market leader with 35-40% of mobile subscribers. Fast forward to today, and Vodafone's market share has plummeted to less than 20%, all thanks to Jio.

After years of intense competition and massive investments in infrastructure, particularly in 5G networks, telecom operators are now focusing on profitability. Jio recently led the way in increasing tariffs, with Vodafone and Airtel quickly following suit, signalling an industry-wide shift towards boosting Average Revenue Per User (ARPU). Last month, rating agency CRISIL projected that the ARPU for the industry is set to rise to ₹225 from the current ₹182. Higher ARPUs are crucial for recovering and sustaining the massive investments required for expanding and upgrading network infrastructure, especially as India races to roll out 5G services nationwide.

Jio has transformed from a disruptive telecom upstart to a comprehensive digital services provider, with ambitions that extend far beyond traditional telecom services. Some key highlights include:

Jio now has 490 million subscribers, with its network handling 8% of global internet traffic.

The company completed India's fastest 5G rollout, with 130 million 5G users already.

Recent tariff increases aim to boost average revenue per user, a key metric for telecom profitability.

Jio is expanding beyond mobile services into home broadband and business solutions.

The introduction of JioBrain signals Jio's ambition to be a leader in AI services, not just a network provider.

New Energy

As the world moves away from fossil fuels towards more sustainable energy sources, Reliance is positioning itself to not be left behind. With a global push for cleaner, renewable energy, Reliance—a giant in oil and petrochemicals—is making a bold move into the renewable energy sector. Adani, another major Indian conglomerate, has already established a significant presence in solar and wind energy.

Reliance’s entry into the renewable energy sector is significant:

The company plans to start manufacturing solar panels this year, reducing India's reliance on imports, particularly from China.

A large battery factory is being built, which could support India's electric vehicle ambitions—currently, China dominates the battery market, producing over 75% of the world’s EV batteries.

The company is investing in green hydrogen, seen as a potential replacement for fossil fuels in industries like steel-making.

Reliance aims for this new segment to match its oil business in profitability within the next 5-7 years, an ambitious but strategic goal.

Oil & Gas Exploration and Production (E&P)

While currently a smaller segment, Reliance's Oil & Gas Exploration and Production (E&P) business is growing significantly. The Krishna Godavari Dhirubhai 6 (KG-D6) field, a deep-water natural gas field located off the eastern coast of India in the Bay of Bengal, now produces 30% of India's natural gas. This makes Reliance a major player in domestic energy production, enhancing India's energy security and reducing dependence on gas imports.

Reliance is also using new drilling techniques to extract more gas, potentially unlocking additional domestic energy sources.

Is the IPO gold rush over?

The IPO market has been on fire over the last 3-4 years, closely following the same upward trend as Nifty. After the COVID-19 pandemic, as Nifty rebounded from its lows and bullish sentiment took over, private companies rushed to go public, resulting in an IPO frenzy. From the financial year 2020-21 onwards, companies have raised over 3 lakh crore rupees through IPOs.

This is an enormous figure, and a significant part of the IPO boom can be attributed to the remarkable surge in retail investor interest in IPOs. You might be curious about the behavior of these IPO investors, but until recently, there was little data available on this. Fortunately, SEBI recently published a study titled Analysing Investor Behavior in IPOs, and it offers some fascinating insights.

Let’s take a look at some key highlights

While market experts often advise caution when it comes to blindly applying for IPOs, the fact is that IPO investors have performed quite well in recent years. Here's a snapshot of the listing performance across different segments:

The market has experienced such a strong bull run that if you had participated in all IPOs over the past four years and secured allotments, it would have been nearly impossible to lose money.

However, the challenge lies in the fact that people often overlook one key point: there’s a higher chance of being allotted shares in an underperforming IPO compared to one expected to do well. So, unless you received shares in every single IPO, the high percentage of positive listings wouldn’t necessarily guarantee a net profit.

According to the SEBI study, 42.7% of retail investors sold their IPO allotments within just one week of listing. High-Networth Individuals (HNIs) and corporates sold off 63.3% of their shares, while banks exited 79.8% of their positions within the same timeframe.

On the other hand, mutual funds took a different approach, selling only 3.3% of their allotted shares in the first week. This behavior, of course, varied depending on the performance of the IPO.

Unsurprisingly, investors were more likely to sell IPO shares that showed positive listing gains. For context, when returns exceeded 20%, individual investors sold 67.6% of their shares by value within a week. In contrast, when returns were negative, only 23.3% of shares were sold.

There has also been speculation that many new investors, who opened accounts post-COVID, did so primarily to participate in IPOs. SEBI’s study supports this, revealing that nearly half of the demat accounts used to apply for IPOs between April 2021 and December 2023 were opened after the pandemic began.

Previously, HNIs could take large loans from NBFCs to apply for IPOs, as shares were allocated to them on a pro-rata basis. This meant HNIs could receive shares in proportion to the size of their applications, giving those with larger bids an advantage.

However, in April 2022, the RBI imposed a 1 crore rupee cap on loans for IPO investments by HNIs. SEBI also changed the share allocation process from pro-rata to a lottery system, similar to the method used for retail investors. The lottery system randomly assigns shares, thus reducing the unfair advantage HNIs previously enjoyed.

The result of these changes has been overwhelmingly positive. It’s now less advantageous to apply for IPOs with large sums of money, leading to fewer big-ticket non-institutional investors and lower oversubscription rates. To give some perspective, oversubscription in the non-institutional investor category dropped from 38 times to 17 times.

Moreover, the exit rate of these investors within one week, which had been a major concern for SEBI, fell from 70% in 2021-22 to just 25% in 2022-23.

Overall, these regulatory changes have successfully balanced market excitement with more prudent investment practices, which is a positive development for the markets.

So, while many of these findings may seem obvious, we now have data to back them up.

That’s it for this week. Do share this with your friends and make them as smart as you are 😉

If you have any feedback, do let us know in the comments.