On Ozempic & the GLP-1 Boom

ft. Ishmohit Arora (SOIC Finance)

Hi, I’m Kashish—rarely in front of the camera—but I sat down with Ishmohit Arora from SOIC Finance , one of the few sane voices in Indian finance who actually make sense. We talked through the GLP-1 boom end to end—from science to second-order effects to what investors should really watch.

TL;DR (what you’ll learn in this post)

What GLP-1 drugs actually do (beyond the “miracle” hype) and why they became huge so fast.

The real “catch”: side-effects, adherence realities, and second-order effects across consumer, fitness, and retail.

Where value pools sit in the injectable-first world (API → fill-finish → device → marketing/distribution).

Why India’s curve hinges on price collapse, delivery comfort, and supply capacity—with a watchlist you can track.

What’s next: oral candidates, pipeline upgrades, and how they could rebalance the model.

Why everyone calls it a “miracle”—and what it actually does

When we say “GLP-1,” we’re really talking about a class of drugs that mimic a natural hormone which helps you feel full and supports insulin release. In plain English: you feel satiated sooner, eat fewer calories, and see better glucose control. That combination explains the hype in diabetes and obesity care.

We put it this way in the episode:

“There’s a magic pill vibe, but that’s an oversimplification.”

The benefits cascade—weight loss, improved cholesterol, and even kidney-related endpoints under study—but they’re not magic; they’re a physiological nudge that compounds over daily choices.

The catch: side-effects, behavior, and second-order effects

We asked the obvious question: Is there a catch? Yes—mostly tolerability and how people change their habits on the drug. We talked about the usual stuff: nausea, “fishy” breath, fatigue, and skin sagging when weight falls fast. None of this kills the thesis. But it does decide who sticks with therapy after month three.

The part people underplay: you can start to dislike food. Not just “I’m less hungry,” but a genuine aversion. Meals get skipped. Snacks disappear. Calorie intake can dip below your BMR (what your body burns at rest). Do that for long, and the body starts conserving energy, undereating creeps in, and nutrient gaps open up. It’s not just about weight; it’s recovery, mood, immunity—basic function.

There’s also muscle loss. Fast weight loss isn’t all fat. Without enough protein and some form of resistance work, you risk losing lean mass. That matters because muscle is your metabolic engine. Less muscle → lower resting burn → easier regain later (and more of that regain tends to be fat). Long-term outcomes depend on what you lose, not just how much you lose.

Zooming out, there’s the economy-wide ripple:

“An average person on GLP-1 sees their monthly grocery bill fall.”

Makes sense if total calories drop. At the same time, gym sign-ups are ticking up as people try to protect muscle and deal with skin tone—classic second-order behavior change.

Bottom line for investors: don’t model GLP-1 in isolation. It touches consumer staples (less bulk calories), alcohol (lower discretionary consumption), cosmetics/derm/dental (appearance spend), and fitness (muscle-preserving behavior). The right mental model is: less bulk calories, more appearance/health spending — with adherence wobble if aversion to food and muscle loss aren’t managed well.

How the money flows (today): injectables first

Right now, injectables dominate because peptides get chewed up in the gut. Pens deliver reliable exposure, so the first big wave scaled around injections, not pills.

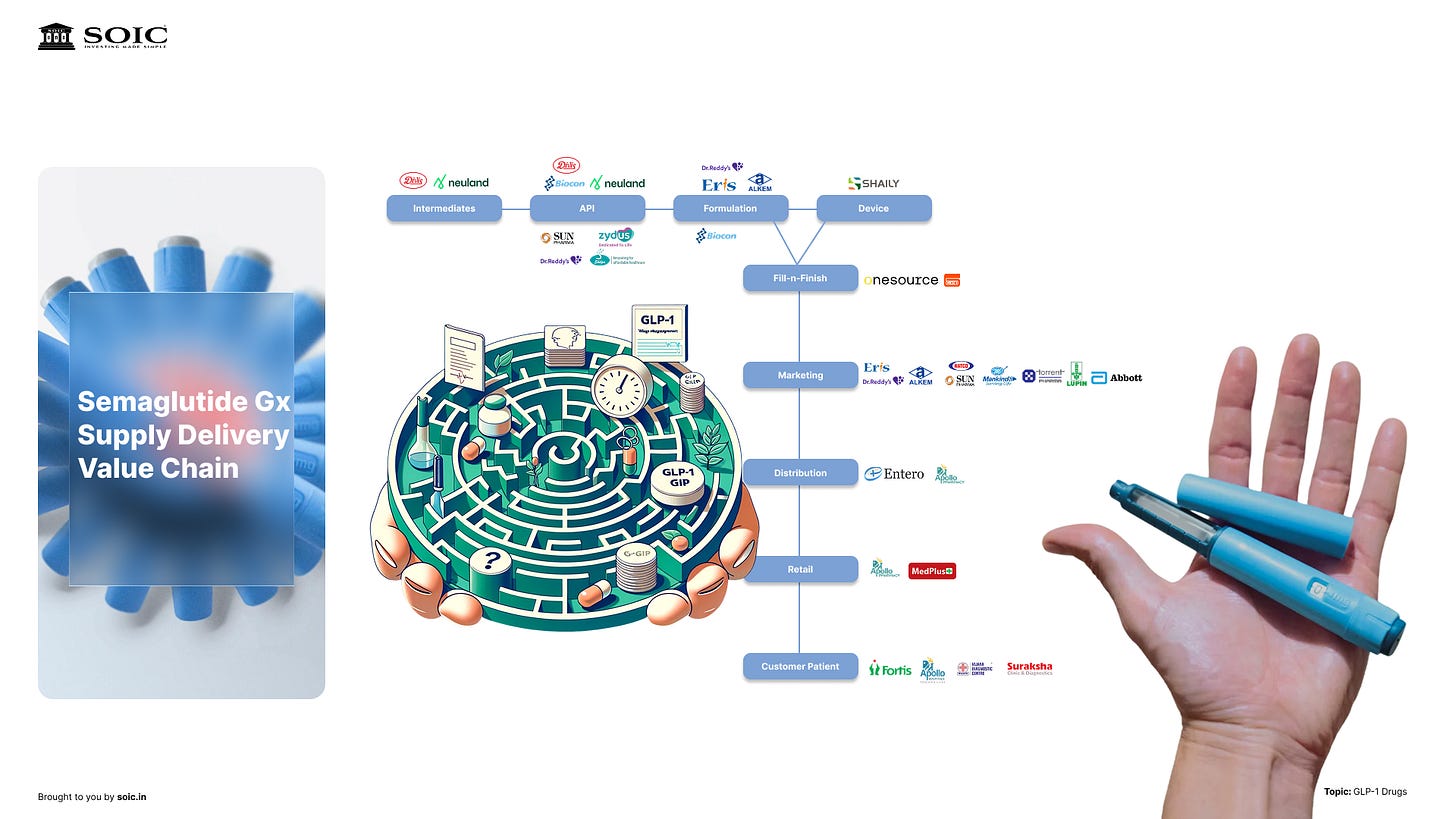

Here’s the investor map—with what each node actually does, where the bottlenecks are, and what to watch.

So where does the money actually get made?

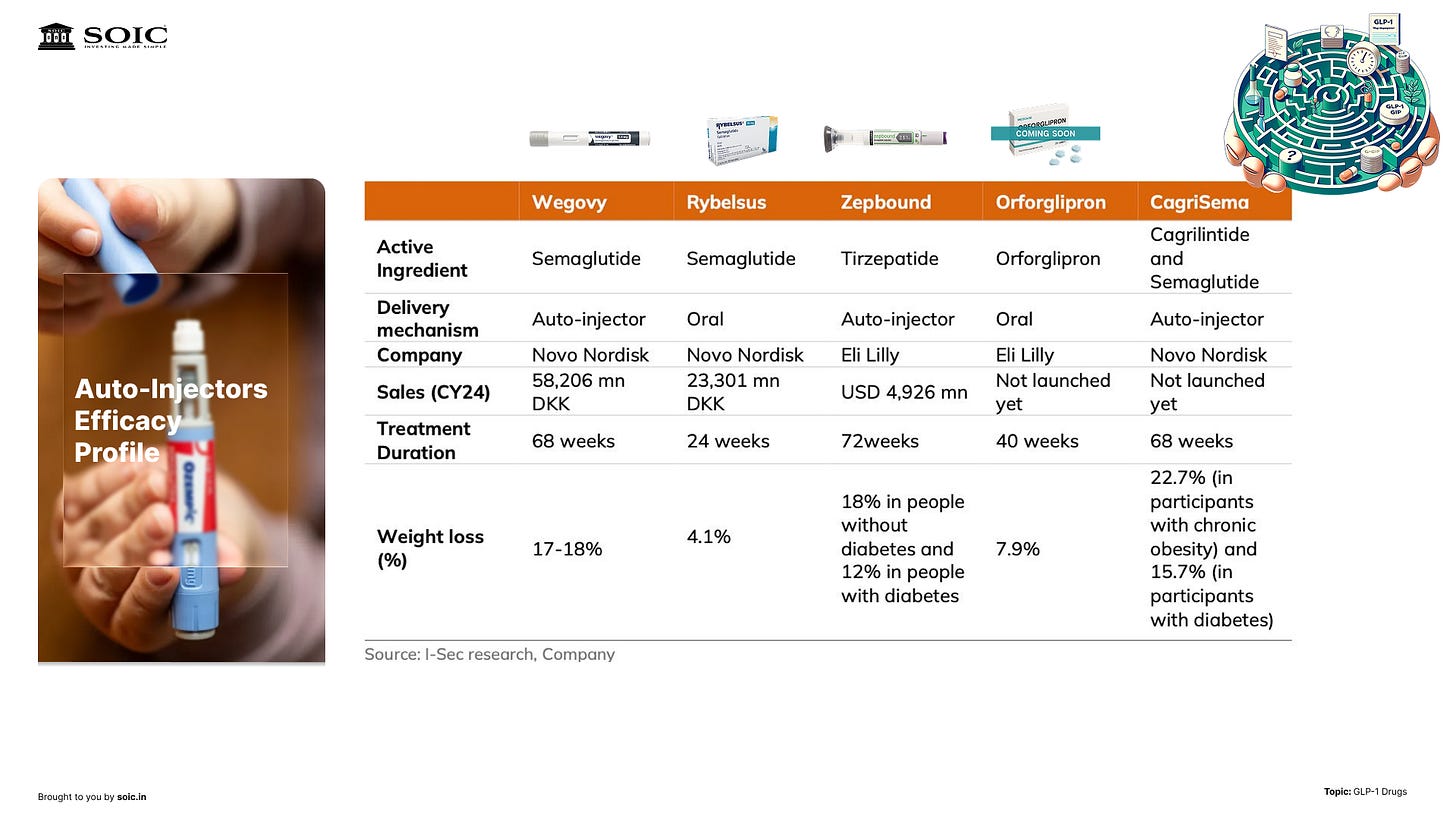

It begins with the innovators. They discover the molecule, run the trials, and getting it approved as treatment — first diabetes, then obesity, and maybe add-on indications over time. What I’m watching here: any safety flags, how many patients stick past month three, and whether payers start leaning harder on price as volumes explode.

Next comes the peptide itself—the API. These are long, fussy molecules. Making them at scale without ruining yield is… hard. You need specialized reactors, purification, and quality control that doesn’t blink. When it works, it’s a craft business with real moat: know-how + validated manufacturing lines. When it doesn’t, one bad batch ripples through the whole chain. So the signals we care about are capacity adds (new lines), yield improvements, and any supply shock that hints at fragility.

Then the real choke point: formulation and fill-finish. This is where bulk drug becomes a sterile, stable product—often cartridges that slot into pens. And it’s exactly why early global rollout was concentrated in a few markets: you can’t just flip a switch and add capacity, and the talent pool isn’t endless. We talked on the podcast about the headline deal—Novo Nordisk buying Catalent—not for gossip, but for the signal it sent: fill-finish was tight enough to justify buying the tap. When capacity, not demand, is your constraint, owning the bottleneck is strategy.

Layer on the pen itself—the delivery device. It’s not just plastic and a spring. It’s human-factors design, dose accuracy, assembly, and a zero-tolerance attitude to failures. Device reliability quietly becomes a brand moat: if the pen’s easy, people stay; if it misfires, they churn. What we can track: new pen lines coming online, cartridge/glass availability, and any device recalls that hint at stress in the system.

Finally, marketing and distribution. This is the unglamorous part that actually decides adoption curves. You need prescriber education, patient programs, and a cold-chain that can push chronic volumes into clinics and retail. Watch for the moment scripts shift from specialists to primary care, and for retail readiness—when you can walk into more pharmacies and reliably find pens, the S-curve is real.

If you zoom out, the picture is simple:

API → fill-finish → pen assembly → distribution has to move in lockstep.

If any gear slips, shelves go empty. That’s why capacity—more than demand—has set the pace so far. And it’s why the smart money has chased control over the tight nodes first (again, the Catalent deal is the tell).

What could change this map? Orals. If oral candidates clear the bar on efficacy and tolerability, you’ll get a different set of bottlenecks and a wider top-of-funnel through primary care. That’s also true because of the hesitancy that Indian customers may have in consuming any drug through an injection, than more common method of pills. But until then, the operational edge—and most of the economics—live in injectables, fill-finish, and pens.

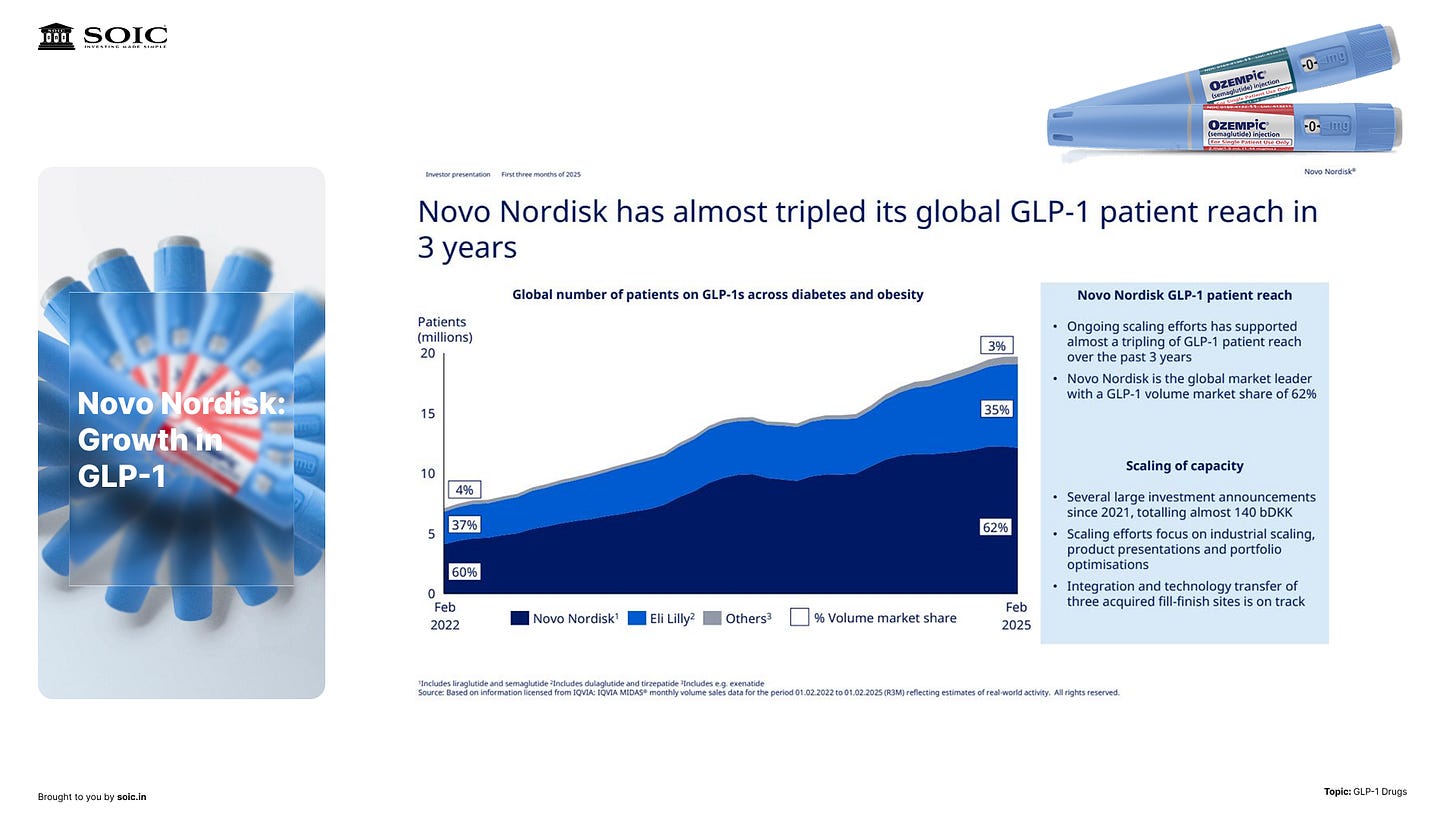

How big is this, really?

We walked through a quick market snapshot: this category has jumped to roughly ~$45B in just a few years, driven by two headline molecules. The bulk of current demand sits in the U.S./Europe, with Canada and Brazil also strong—unsurprising where BMI>25 prevalence is high.

The key is not the static number but the S-curve dynamics: injectables lead now; orals may expand the addressable base (daily pill = new adherence trade-offs), but the near-term remains pen-driven.

India: the real adoption drivers

Will India see GLP-1 “go mainstream”? We broke it down to three drivers:

1) Price. For many geographies outside the U.S./EU, it’s about when patents roll off and generics rush in. We called out a live example to watch: post-patent price compression in one North American market where early signals point to ~70% price drops—useful for handicapping what could follow elsewhere.

2) Capacity and channels. Injectables need fill-finish, cartridges, and device supply. If generic capacity scales, prices follow down, and distribution breadth widens. That’s how you convert from specialist to more routine chronic care in clinics and retail.

3) Indication order. Ishmohit expects India to mirror the global pattern: diabetes and obesity first, lifestyle/vanity usage later (if at all). As we said on the pod:

“First two lines of treatment will always be diabetes and obesity; lifestyle may follow if culture and pricing allow.”

On size, even a modest adoption curve can nudge domestic pharma growth above trend if GLP-1 becomes a steady chronic therapy line item. That’s the quiet compounding story here.

What to watch (next 12–36 months)

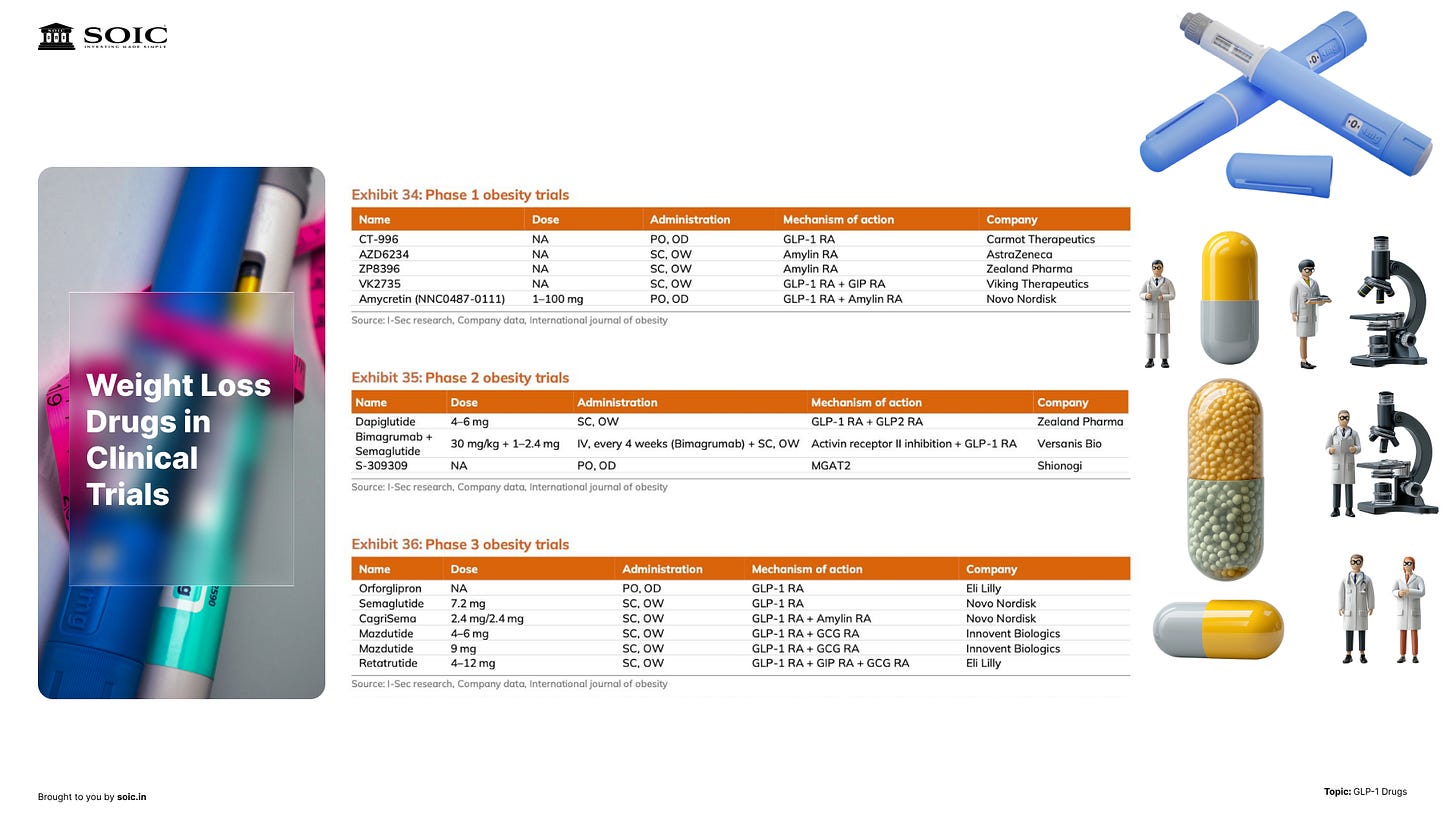

1) Orals getting through later-stage trials. The first oral candidate(s) could be approved on weight-loss efficacy below pens but with convenience and adherence upside. If that happens, expect a wider top-of-funnel and more primary-care touchpoints.

2) Pipeline broadening within the class. Think of GLP-1 as a “family” with sub-branches; we’re likely at year 5–6 of a decade-plus evolution. New variants can tweak efficacy/tolerability and shift share between injectables and orals.

3) Generic timing outside the U.S./EU. As patents lapse in parts of the world earlier than in the U.S./EU, reference pricing from those markets will inform Indian affordability. Track the early movers in API, fill-finish, cartridges, and pen manufacturing—category level not stock picking.

A few lines to remember

“It’s not magic—it’s physiology at scale.” (Satiety + insulin support → lower calories, better glucose.)

“There is a catch.” Tolerability and lifestyle side-effects shape who persists beyond month three.

“Watch price and capacity, not just headlines.” India’s adoption is a function of post-patent pricing and whether the ecosystem can move pens at scale.

If you want the full story

This post is the tight investor version. We go deeper on the science, second-order sector impacts, and the manufacturing puzzle in the video.

Hi, I'm a regular reader of your newsletter. I learn a lot from it every day.

But I found myself getting annoyed at this one because the obvious chatgpt language made it frustrating to read.

I'd prefer just a plain transcript of the interview or some post generation editing to this. Would make it much more palatable.

I do understand if it's too time consuming to do that though.

Thank you!

I think copy pasting the plain transcript would be much helpful than this ChatGPT crap