Hi folks, welcome to another episode of Who Said What? I’m your host, Krishna. For those of you who are new here, let me quickly set the context for what this show is about.

The idea is that we will pick the most interesting and juiciest comments from business leaders, fund managers, and the like, and contextualize things around them. Now, some of these names might not be familiar, but trust me, they’re influential people, and what they say matters a lot because of their experience and background.

So I’ll make sure to bring a mix—some names you’ll know, some you’ll discover—and hopefully, it’ll give you a wide and useful perspective.

For all the sources mentioned in this video, don’t forget to check out our newsletter; the link is in the description.

With that out of the way, let me get started.

Ola says the market is flat - Everyone else says it’s flying

Ola’s latest results had a line that changes the way you read everything that follows. The company said the electric two-wheeler industry has been “largely flat for the last two to three quarters,” and used that to explain why it hasn’t been chasing volume. Instead, they said, they’ve taken “the opposite approach,” focusing on cost discipline and margin improvement.

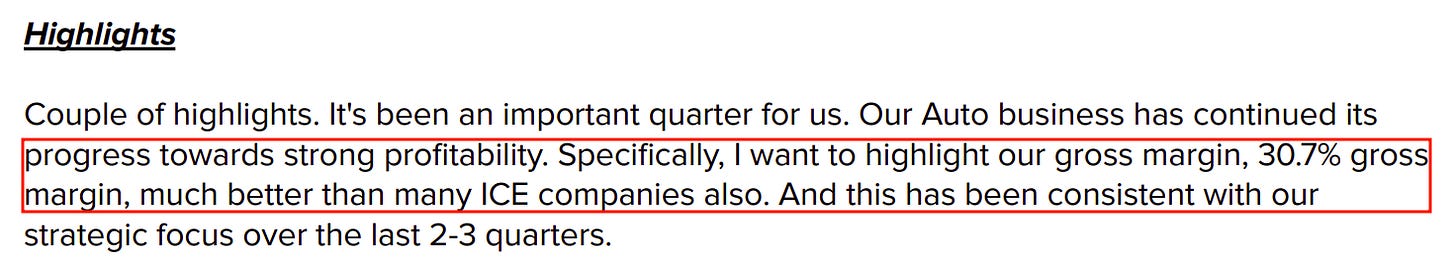

On paper, the margin story looks strong. Ola reported a 30.7% gross margin — and even added that this is “much better than many internal combustion engine companies.” But a margin number never speaks for itself. You have to place it next to what the company is doing with volumes, how it is revising expectations, and what competitors in the same market are experiencing.

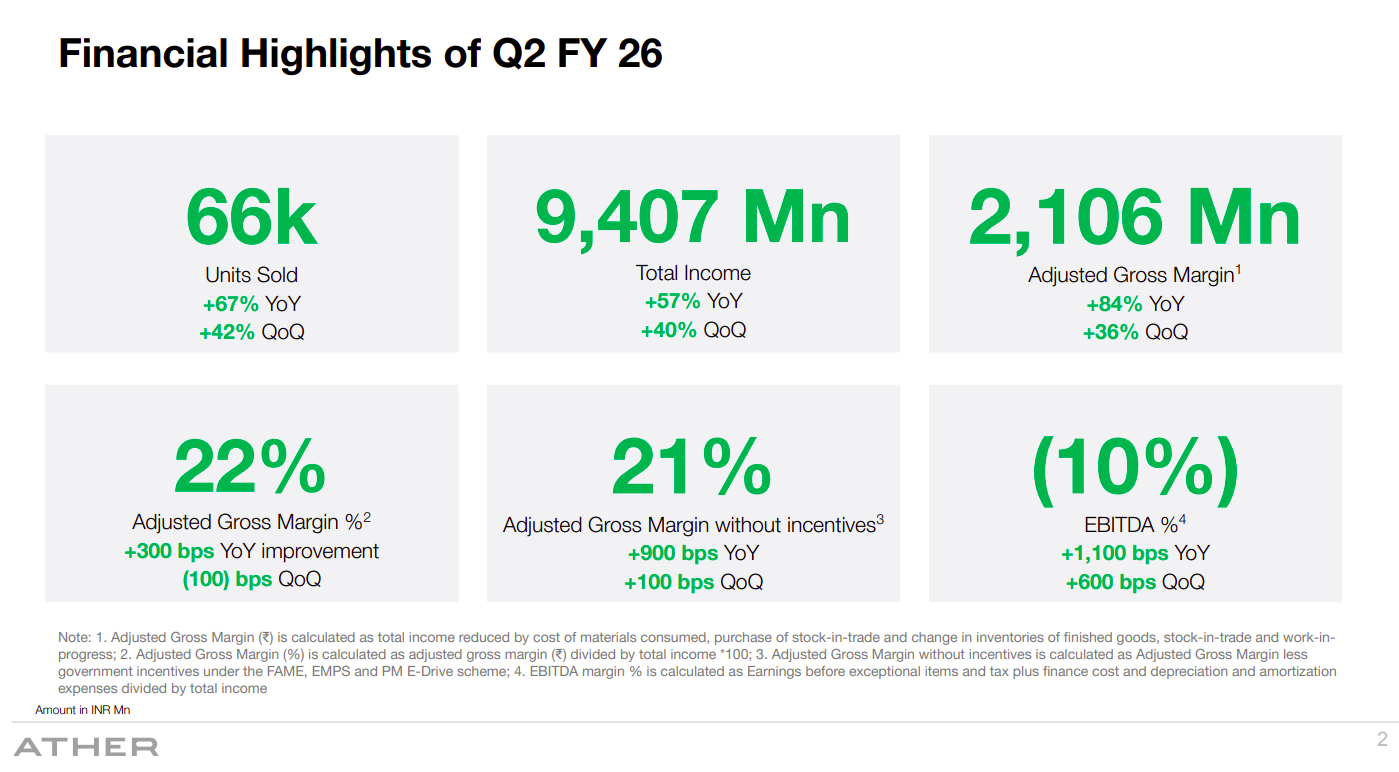

Because in the same quarter, Ola calls the industry flat, Ather described its own performance as one of its strongest ever. They sold around 66,000 vehicles in Q2, a 67% jump year-on-year and 42% quarter-on-quarter. October registrations were nearly 50% higher than last year.

Ather said they were stocked out in several markets. Nothing about this resembles a flat industry.

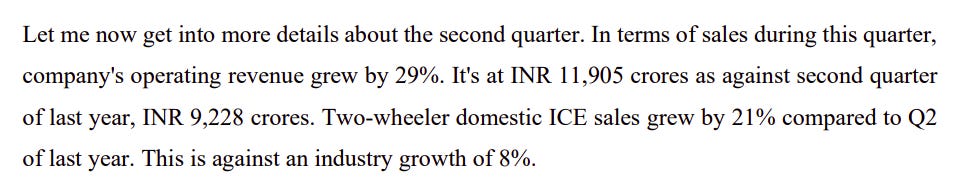

And the divergence doesn’t stop at pure EVs. TVS said domestic ICE two-wheeler sales grew 21% for them, against industry growth of 8%.

Scooters are growing faster than the broader market. Bajaj said October was an all-time high for its Pulsar portfolio, and that exports have reached a new peak after months of volatility. Both companies are pointing to momentum — steady, broad-based, and visible across segments. If Ola is describing the market as flat, it is the only one seeing it that way.

Part of the answer sits in the details Ola didn’t emphasise. Back in July, the company publicly guided for 3.25–3.75 lakh vehicles in FY26, anchored on the festive season and the rollout of its Gen 3 platform.

But in the latest call, that guidance quietly fell away. Instead, the company said it expects to deliver just 1,00,000 units in the second half. Even if you add the first half, the full-year number comes in far below the earlier target. A reset of that scale doesn’t appear out of nowhere.

And there’s a missing piece here that the company didn’t highlight directly, but you can see when you compare it with competitor commentary. If Ather is growing 40–60% in multiple markets, and TVS and Bajaj are seeing multi-year highs across premium and scooter categories, then someone’s share is shifting. The simplest reading is also the most likely one: Ola didn’t just see a flat market. It saw its own share being chipped away by competitors who are growing into the space it once dominated. The “industry flatness” line hides that possibility, but doesn’t remove it.

Meanwhile, something else happened around the same time: Bhavish Aggarwal pledged an additional portion of his Ola Electric shares, raising the pledged stake from 8.09% in June to 10.11% in September.

If you put all four calls side by side, the contrast is sharp. Ola is tightening. Ather is accelerating. TVS and Bajaj are enjoying a different cycle. And somewhere between these stories is the real state of the 2-wheeler market.

Tata Steel promises green steel… But Europe isn’t making it easy

Tata Steel released its second-quarter results of this year, and they were stellar. Its profit-after-tax more than tripled compared to last year. In the face of global headwinds — be it Chinese steel exports surging, US tariffs or shrinking steel demand in Europe — the business has largely improved. We will be breaking down these results in our coverage of Indian steel’s results soon.

But in this episode, we’ll be covering an interesting quote — and trend — that we spotted in the concall. Tata Steel is working with the Netherlands government to decarbonize the steel plants they own in the country.

If you’ve read our Daily Brief piece on Jindal potentially buying Thyssenkrupp — one of Europe’s largest steel players — you might remember a similar thing playing out. A huge consideration in the deal is whether Jindal will decarbonize their biggest plant.

Now, why is that?

Well, Europe has a policy called Carbon Border Adjustment Mechanism (CBAM), which aims to reduce emissions significantly. CBAM effectively adds a tax on carbon-heavy goods imported into the EU.

It just so happens that making steel carbon-less is really hard. It requires burning a lot of coke, which is made from coal, /and therefore will release plenty of emissions. The alternative is using a clean fuel such as hydrogen. But generating hydrogen uses a lot of electricity, and potentially makes the cost of steel ~50% higher.

Which makes the nature of Tata Steel’s quote interesting. They say they have signed a letter of intent with the government of the Netherlands, and earlier, they also indicated their confidence that they’ll do it on time:

“...we remain confident that the transition to green steel making in the UK and the Netherlands will happen as per our plans, in the next few years.”

But in practice, Tata Steel hasn’t really taken the full plunge. For one, the letter of intent is non-binding. And so far, there is no sign of any financial commitment made. Talks between both parties have been going on for at least a year, if not more.

That’s not to say they won’t do it — in fact, they don’t really have much of a choice. At over ₹15,700 crores of revenue this quarter, The Netherlands makes up over 20% of Tata Steel’s business. And it does seem like a necessary precondition for doing business in Europe profitably.

But across Europe, steel decarbonization projects have turned out to be really hard to execute, with multiple announcements of postponements and cancellations made this year. For instance, German steel producer Salzgitter postponed its next phase of its greening project by 3 years. Even ArcelorMittal postponed greening two of its plants in Germany, despite receiving state aid over a billion dollars. In fact, earlier this year, even Thyssenkrupp postponed a tender for green hydrogen because the fuel was too costly.

It also doesn’t help that it’s hard to make money in Europe anyway. Demand has been flat there over years. It has been a devastatingly difficult market to crack for Indian steelmakers, as they’ve faced multiple high-profile failures.

While on paper, the optimism for European steel going green seems high, reading between the lines tempers those expectations.

That’s it for this edition. Thank you for reading. Do let us know your feedback in the comments.

Introducing In The Money by Zerodha

The newsletter and YouTube channel aren’t about hot tips or chasing the next big trade. It’s about understanding the markets, what’s happening, why it’s happening, and how to sidestep the mistakes that derail most traders. Clear explanations, practical insights, and a simple goal: to help you navigate the markets smarter.