NSDL's IPO: Understanding the depository duopoly

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how, too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

You can listen to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and watch the videos on YouTube. You can also watch The Daily Brief in Hindi.

In today’s edition of The Daily Brief:

Who wins the depository wars?

Market coupling enters electricity trading

Who wins the depository wars?

If you’re reading this, chances are you’ve at least dabbled in the stock market — and that means you’ve benefited from India's capital market institutions, even if you didn't realise it.

Every time you effortlessly buy or sell shares with just a few taps on your phone, you're experiencing their quiet magic. Ask someone who invested before this digital era — about chasing paper certificates, verifying ownership, or anxiously waiting days for trades to settle — and you'll quickly grasp just how good you have it today.

A big part of this convenience is thanks to India’s depositories. Think of a depository as a digital bank vault, but for your securities. Instead of you having to hold paper certificates, which are prone to getting lost or damaged, a depository safely stores your investments on your behalf. In effect, then, you own shares in digital form with the depository — much like you own money in digital form with a bank. Your “demat account”, in fact, isn’t actually held with a broker. It’s held with a depository. Brokers like us are just intermediaries that give instructions to the depository on your behalf.

The real convenience of this system comes through when you trade. This system allows you to “fire-and-forget” an order. You don’t, for instance, have to courier your share certificates after you sell them. This is possible because of depositories; it is they that move securities from one investor to another in the background, without friction. Nobody has to touch the security, or check after it. It all just works.

The older of India’s two depositories — NSDL — will soon list its own shares on the market. Their offer document gives us a window into a business without which we wouldn’t exist. Let’s dive in.

Betting on India’s capital markets

A bet on a depository, broadly, is a bet on India’s capital markets as a whole.

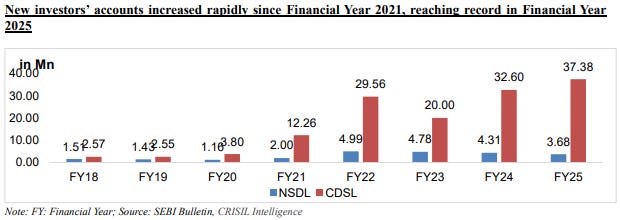

If the last few years are anything to go by, that’s a solid bet to make. In FY 2020, 4.96 million new investors opened demat accounts. By FY 2025, that number had ballooned to over 41.06 million — nearly eight times as much. With that, the markets have practically doubled in size. Back in FY 2019, companies had raised a total of ₹919.5 billion from India’s capital markets. In FY 20205, that number had grown by ₹2,181.2 billion.

This was, of course, a remarkable period. We might never repeat this rate of growth again. But at least directionally, India’s capital markets are slated to only get more active over time. And if more Indians invest than ever before, their business necessarily goes to a depository.

As exciting as India’s capital markets are, however, the depository business is a stable, sedate one.

India’s market for depositories is a duopoly. On one hand, there’s CDSL, a company backed by BSE. On the other hand, there’s NSDL, backed by NSE. All depository business in India — and by extension, all of India’s capital markets — is handled by one of those two entities. It’s unlikely that any other entity will shake up this market any time soon.

This is also a business that’s heavily constrained by regulation. Everything from the role a depository plays, to the prices it charges, to the procedures it follows are governed by SEBI. Changing things is difficult.

Accordingly, this isn’t a business where you should expect much excitement. Depositories earn most of their money from three things: (a) charging for transactions, (b) charging fixed amounts for taking custody of a security, and (c) annual charges. This model is, by and large, set in stone. If you want to evaluate one of the two depositories, you need to understand how it fares on these fronts when compared to its rival.

To be fair, depositories also provide some other value-added services. For instance, NSDL runs tools that let companies host their AGMs online, and accept e-votes on company resolutions. One of its subsidiaries is also running a payments bank. These are, however, relatively small sources of revenue — and chances are that it’ll stay the same way.

If you’re assessing such a company, you’re only looking within a small range of possibilities.

Two depositories, two trajectories

The fact that the depository market is relatively quiet doesn’t mean there’s nothing setting India’s two depositories apart. The two have, in fact, seen wildly different trajectories over the years.

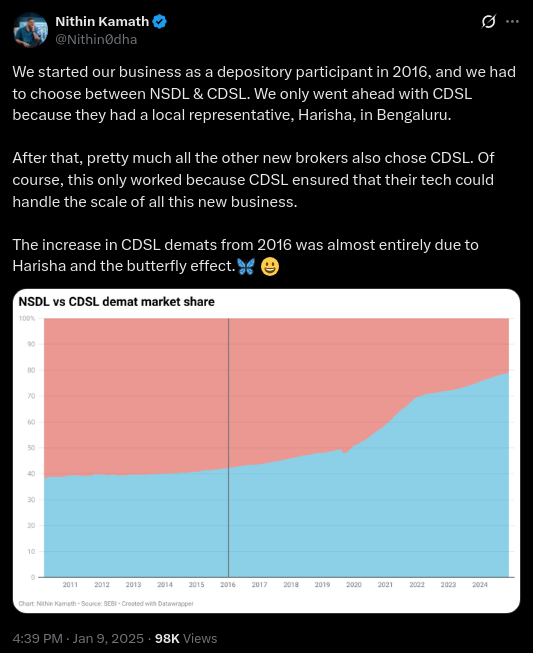

When India’s capital markets saw their recent once-in-a-lifetime lift-off (something we’ve written a detailed blog post on, in case you want to really picture what happened), a lot of that recent rush of new investors was, in fact, channeled towards CDSL, and not NSDL:

This was when many of India’s new-age discount brokers took to CDSL. It was these companies that seeded India’s capital markets lift-off. As they grew, their legions of retail investors all had their accounts made with CDSL. At Zerodha, we perhaps wrote one chapter of this story:

Over time, the effects of this shift have become evident. Right now, CDSL has around 15.86 crore accounts. NSDL, in contrast, has a little over 4 crore.

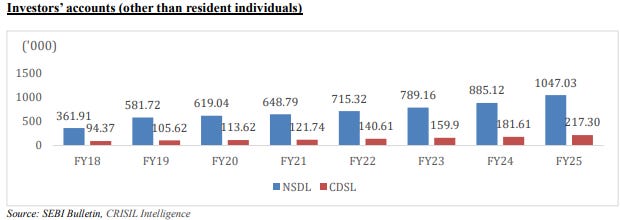

NSDL’s, in contrast, has by-and-large gone for the business of non-retail clients. Think of big banks, foreign investors, legacy full-service brokers, and the like. If you take retail customers away from the picture, in fact, NSDL utterly dwarfs CDSL in the number of accounts it has.

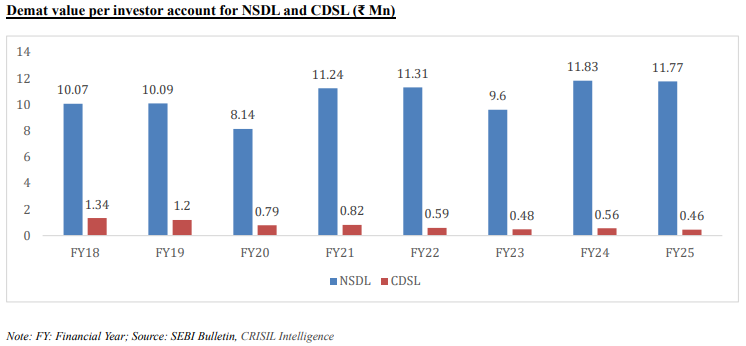

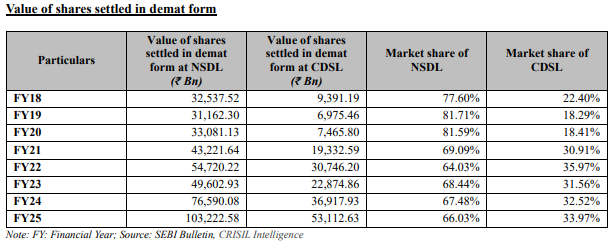

Since the biggest players of the market all keep their business with NSDL, naturally, NSDL holds a lot more securities by value, even if CDSL has more accounts. Nearly 87% of all of India’s dematerialised securities by value sit with NSDL. The average NSDL investor holds almost ₹1.2 crore worth of securities in their account. The average CDSL investor? ₹4.6 lakh.

The big question, though, is how much does that matter?

Earning from holdings

One way to look at this question is to ask: is there a way in which a depository earns money for the number of shares it holds?

Well, sort of. Depositories charge companies “annual custodial fees” for all their securities that they keep with them. But there’s a catch: they don’t charge them according to the number of securities they hold. They charge by the number of folios. That is, they charge by the number of accounts holding a security — not by how much each account holds.

If one depository stores 10,000 shares of a company, held across 10 demat accounts, while the other has just 500 shares of the same company — but held across 50 different demat accounts, it’s the latter that the company will pay more.

Here, CDSL has a clear advantage. With nearly four times the number of accounts, CDSL just has more folios on its books.

Earning from transactions

A depository doesn’t just earn money for holding a share. Much more of its revenue comes from activity; from when securities are traded and transferred between different people.

Every time the depository is asked to process a trade — whether that trade is for one security or for a thousand — it charges a fixed fee. Those fees make up the biggest chunk of a depository’s revenue.

Now, NSDL’s clients are much bigger than those with CDSL. They trade more securities by value.

But once again, that isn’t the deciding factor. The real question is: who processes more orders?

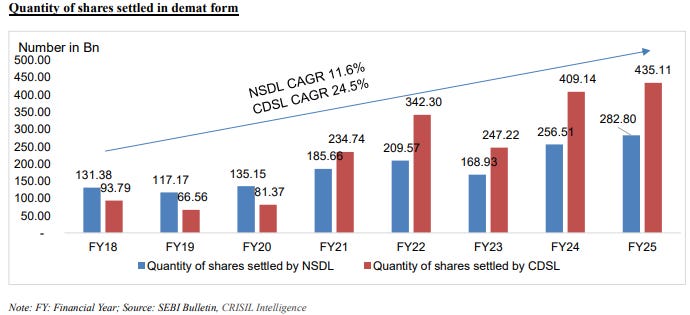

Here, again, CDSL wins out. We don’t have a clean data source for the number of transactions either processes. But if you look at the number of shares as a quick-and-dirty stand-in, CDSL processes far more orders for shares than NSDL.

Charging per security

When companies dematerialise their securities for the first time, they pay a depository a small sum. And then, they pay one of the two depositories an annual fee for monitoring who invests in the company.

This, for both depositories, could be a massive business opportunity.

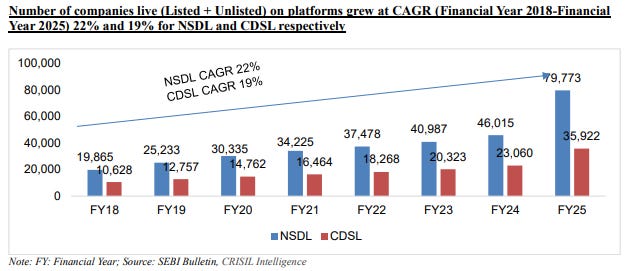

See, all listed companies already have their shares dematerialised. But increasingly, most unlisted companies are getting their shares dematerialised as well. The government has asked all companies above a certain size to only issue shares in dematerialised form. That means each of India’s 18+ lakh active companies — once they turn a certain size — will have to head to one of the two depositories for the service. For context, there are currently just over 1.15 lakh companies, listed and unlisted, that actually have dematerialised shares.

So far, this is one place where NSDL has a clear lead. It has more than twice the companies that CDSL does:

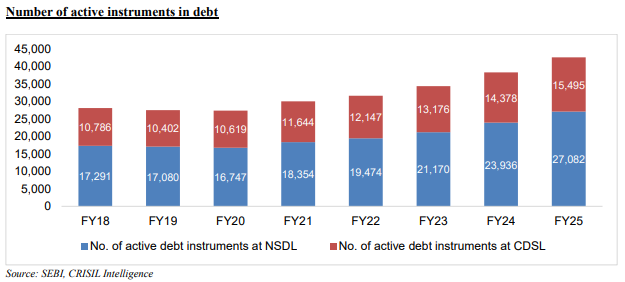

Equity shares, of course, aren’t the only ‘security’ there is. From debt instruments, to warrants, to mutual fund units, to an assortment of other securities — each has to be registered with a depository. And a depository earns money each time that happens.

Take the corporate bond market. Unlike equity shares — which, for any company, usually come in just one variety — each bond issuance by a company could be unique, with entirely different terms. Each one, then, must be registered separately. Which earns a depository a fee.

Here, too, NSDL has a lead. Nearly two-thirds of India’s active, dematerialised debt instruments sit with NSDL.

Who comes out ahead?

All of this brings us to the bottomline — who earns more money: NSDL or CDSL? NSDL has more companies, it registers more securities, and it houses the accounts of bigger investors. CDSL has more accounts — many of which are from retail investors. So, what’s the better business?

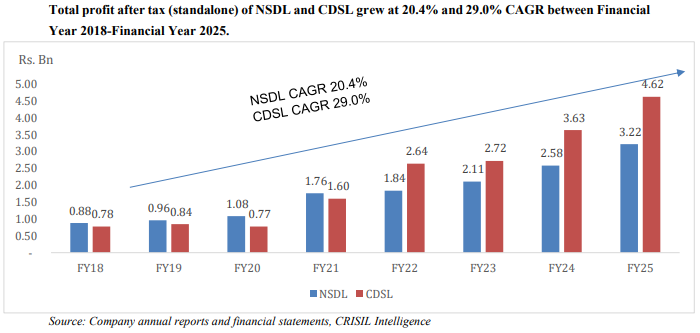

Well, right now, CDSL beats NSDL handsomely.

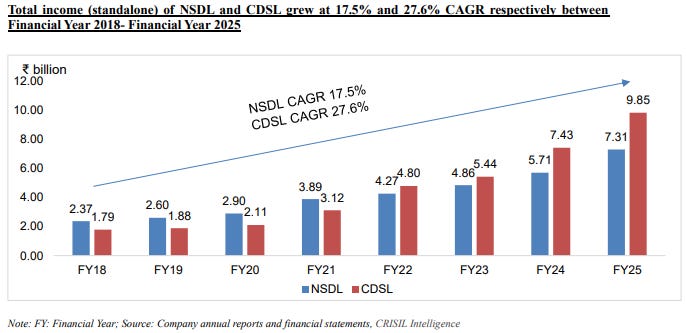

This is a new phenomenon. As recently as FY 2021, NSDL was earning much more than CDSL. But in the retail investing boom of the last few years, CDSL took a handsome lead — coasting on the back of millions of new retail accounts, and billions of transactions. Today, CDSL beats NSDL out, both in revenue and profits.

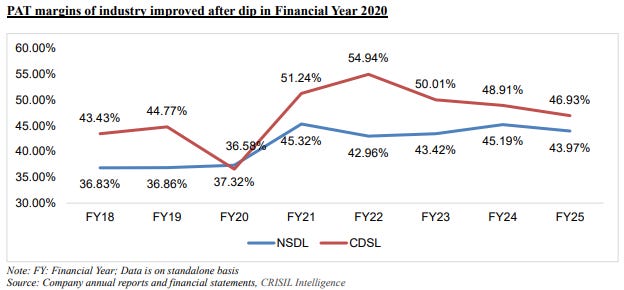

Not only is CDSL making higher profits, in fact, it is also more profitable, with consistently higher margins:

But there’s a caveat here. A significant portion of a depository’s earnings depends on how much market activity there is. When markets run hot, the sheer volume of transactions can turn a depository into a huge cash machine.

The last few years saw the mother-of-all-bullruns. Retail investors were more active than they have ever been. That’s why the business of both depositories has been growing at such a wild pace.

What happens if things turn for the worse? We’re not sure.

NSDL claims that they have one key advantage here: stability. While CDSL has earned higher revenues in the recent past, NSDL has larger, more established customers. It also has a larger share of recurring revenues, like annual fees from companies. If India ever enters a terrible bear market — one where retail investors exit the market in droves — NSDL believes it will find it easier to survive the purge. Its customers will continue to invest more than those of CDSL.

Is that true? We hope we never find out.

A structurally stable business

For all that catastrophising, however, it’s important to remember one thing: the business of a depository is a remarkably stable one.

NSDL isn’t really like a regular, for-profit business. It’s an institution which is run as a private company. It’s baked into the very heart of India’s capital markets, creating some of the core plumbing it needs to run. For that reason, NSDL will always have a role to play. If India’s capital markets are alive, at least in the near future, NSDL will be so as well.

Functionally, there are just two things that could really threaten a business like this: (a) that there is, at some point, a structural change that transforms how the markets work, and unseats NSDL from its position, or (b) that NSDL goes through some sort of catastrophic failure — say, its IT systems fall apart — which makes major players in the market lose trust in the company. Both are remote, tail risks.

It’s much more likely, at least to us, that NSDL shall stay locked in a slow, grinding battle for relevance with CDSL. Both will try eking out minor competitive advantages — that gives them a lead for a while. For now, it seems to us that CDSL has the upper hand.

But who knows how that picture changes tomorrow.

Market coupling enters electricity trading

India is about to witness a significant transformation in how electricity is bought and sold.

On July 23, 2025, the Central Electricity Regulatory Commission (CERC) announced that, beginning in January 2026, electricity trading would soon see ‘market coupling’. This is a move that promises to bring alive the promise of electricity trading. It could create a single electricity price across exchanges, make better use of power lines, and ensure both buyers and sellers get the best possible prices.

But… what does market coupling even mean? What will it do, and who shall it affect?

Let’s jump into all of that.

Understanding India's electricity exchanges

Most of India's electricity is covered by long-term contracts, called Power Purchase Agreements (PPAs). Someone that generates electricity enters a 10-25 year long deal with a state-owned distribution company (or someone else that consumes or sells that electricity), setting out everything from how much electricity they shall supply, how much they shall charge, and so on. These deals are rigid and inflexible, but they give a sense of certainty to everyone involved.

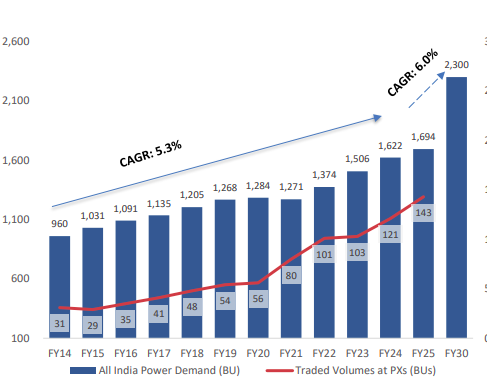

Lately, however, there's also a short-term market. This operates more like a regular market, where prices are based on supply and demand. About 15% of all electricity consumed in India goes through this short-term market, with the spot market accounting for 8% of total consumption. This spot market currently represents about 143 billion units of electricity — something worth thousands of crores in trading value.

This spot market is what we, and the CERC, is looking at.

What does a market for electricity even look like? Well, a lot of it takes the form of electricity exchanges. Here, a business can sell surplus electricity to anyone who needs it — distribution companies, large industrial consumers, or other power generators that are struggling to meet their long term commitments. Without these exchanges, buyers and sellers of electricity would have to hunt urgently for counterparties, and neither would have a reference point for a good price to trade on.

Currently, there are largely three such power exchanges in India:

Indian Energy Exchange (IEX), which dominates the landscape with a near monopolistic 85% market share. It is also the only publicly listed power exchange.

Power Exchange India Limited (PXIL) — a joint venture between NSE and NCDEX, the NSE-backed commodities exchange — that runs 8% of the market.

Hindustan Power Exchange (HPX), the newest player, with around 7% market share.

These exchanges all have several markets that run concurrently:

The Day-Ahead Market (DAM) runs like a forward market, where electricity is traded for delivery the next day.

The Real-Time Market (RTM) is more urgent, facilitating electricity trading for delivery within the next 30 minutes — helping entities tide over unexpected shortages or surpluses.

The Term-Ahead Market (TAM) allows trading for longer periods, from one day to several months ahead.

Although any two units of electricity behave alike, there are differences in what it costs people to make it. There are also differences in how much people need it, and what they’re willing to pay. So how do you find the correct price?

Well, here’s what happens; everyone that wants to buy or sell electricity puts up a bid with whatever price they have in mind. The exchange then starts matching supply and demand. It starts with the cheapest available electricity first, moving up the price ladder until anyone who wants electricity finds a supplier. The price at which this balance happens is called the Market Clearing Price (MCP). This is essentially the most expensive unit of electricity needed to fulfil all demand.

The MCP becomes the price of electricity. Every seller is paid this same price. Every buyer pays it — regardless of the individual prices they offer.

Currently, each power exchange operates independently with their own MCPs. But that’s inefficient.

Each exchange has its own pool of buyers and sellers, its own auction system, and its own pricing — completely cut off from the others. This essentially dilutes the biggest advantage of using an exchange. Individual exchanges match the supply and demand on their platforms, but these might be completely unconnected to the wider conditions outside. You may, for instance, try buying electricity on an exchange with very few suppliers that day, even while others are full of cheap electricity.

This is what market coupling is trying to solve.

What is Market Coupling?

Market coupling is like creating pipes across these three separate exchanges, so that it behaves like one giant, unified marketplace.

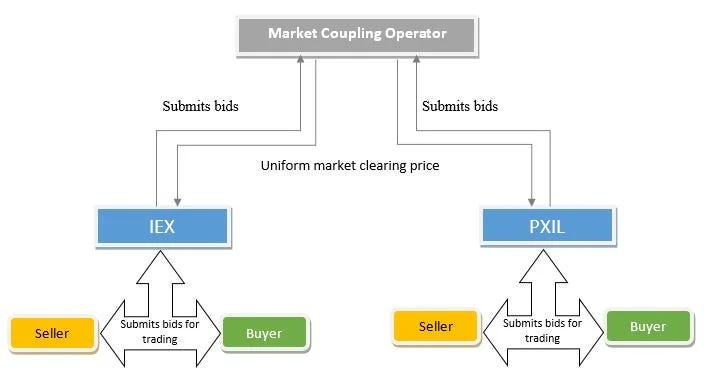

Here's how it shall work: all ‘buy’ and ‘sell’ orders from any exchange get pooled into a central platform, operated by a Market Coupling Operator (MCO). Instead of three separate order books, these shall come together to make one national order book, capturing the entire country's electricity supply and demand.

For each time slot, this shall create a single, uniform market clearing price. This single price shall be reflected across all participating exchanges.

In effect, even though there are multiple exchanges, with market coupling, they’ll have a unified order book. All buyers and sellers across the exchanges shall be pooled into a single, virtual marketplace. There shall just be a single combined auction between the three.

Before considering whether to implement coupling in the system, CERC wanted to ensure it would actually benefit the market. In February 2024, they ordered Grid-India — India's national grid operator — to conduct a "shadow pilot". This was essentially a test run that used real market data without affecting actual trading.

The pilot tested three types of coupling across different market segments:

Day-Ahead Market Coupling, which stitched together the day-ahead markets. This emerged as the most promising segment during testing. It created notable cost savings and improved economic efficiency. The market saw “welfare gains” (essentially, the amount that everyone in the system was better off by) of ₹38 crores (0.3%), while trading volumes were boosted by 52 Million Units — a 0.2% rise.

Real-Time Market Coupling, which stitched together real-time markets. This showed smaller gains, with welfare gains of ₹72 lakhs (0.01%) and volume growth of 1.54 MU (0.01%). The more modest gains, here, reflect how much harder it gets to find advantages within shorter timeframes.

Aside from these, they tried RTM-SCED Coupling (Real-Time Market with Security Constrained Economic Dispatch). This combined two important functions: real-time electricity trading and smart grid management. Not only will this plug the exchanges together, it would also ensure that the traded electricity would flow without overwhelming any powerlines. This showed the most substantial daily operational benefits. It generated net savings of ₹1.4 crores per day, despite raising the average cost by ₹1/MWh.

Fundamentally, the hypothesis was proven. Coupling worked. By bringing together different markets, trades that would never happen otherwise could suddenly go through, leaving everyone happier.

Based on these results, CERC has decided to implement market coupling gradually:

Phase 1: Day-Ahead Market Coupling (January 2026): This is where the journey shall begin. All three power exchanges will take turns acting as the Market Coupling Operator (MCO) in a round-robin system, while Grid-India shall be the backup and auditor.

Phase 2: Real-Time Market Coupling: This will be implemented later, taking in the experience from DAM coupling, so that we find ways of dealing with technical challenges which come with shorter bidding times.

Phase 3: RTM-SCED Coupling: This advanced system is still under review. It still needs some work before we’re confident of bringing it into operation.

Phase 4: Term-Ahead Market Coupling: This is still an unproven idea. Grid-India must first develop the necessary software and run a 3-month shadow pilot before this can be implemented.

IEX in trouble?

Under the current system, IEX controls the largest pool of buyers and sellers, giving it the most liquidity. With liquidity, it can set competitive prices — attracting even more participants. It’s where the action is.

But could market coupling wreck this lead?

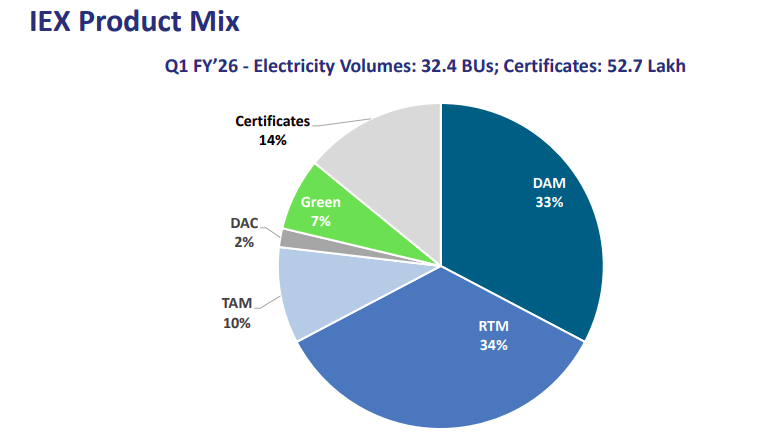

The fundamental advantage of being a market leader — the network effect that keeps bringing everyone to your system, could suddenly dissolve. In a coupled market, players will see no reason to choose one exchange over the other. IEX's massive market share might slowly dissipate to all three exchanges, reducing the number of transactions on IEX and impacting its revenue. That could become a problem.

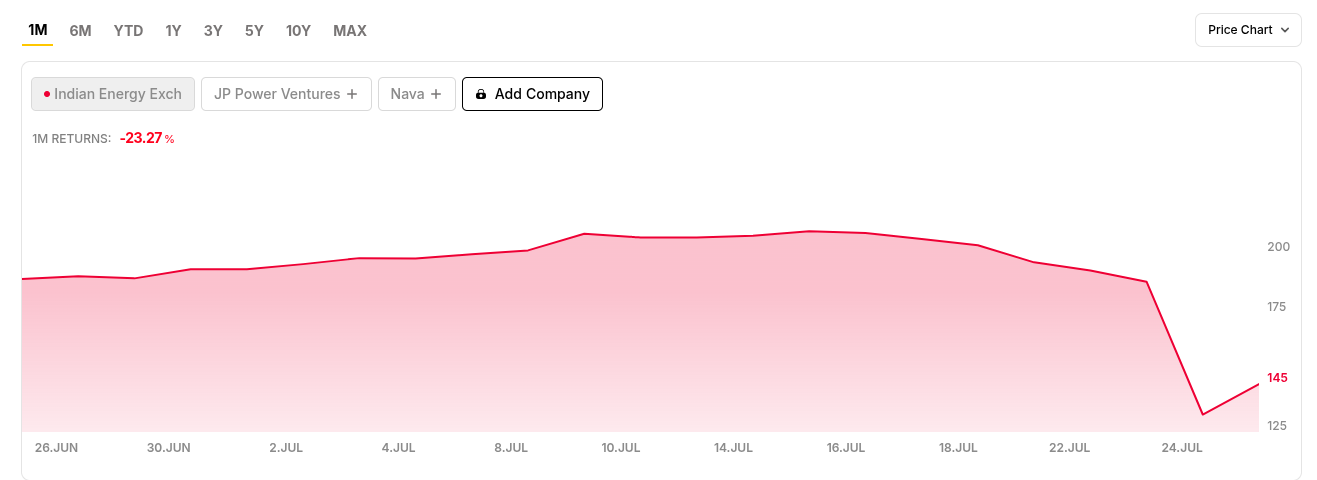

The markets seem to believe so. IEX shares crashed by around 30% on July 24, the day after CERC announced the market coupling decision. This was its worst intraday single-day performance since listing in 2017. Meanwhile, PTC India — the promoter of HPX — saw its share price rally nearly 9% on the same day.

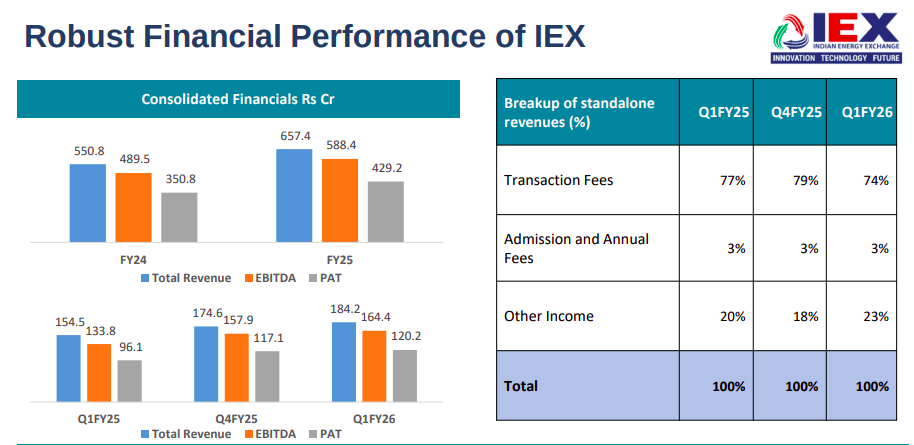

IEX’s stock did see some recovery once the company announced its Q1FY26 results — featuring a 19% revenue growth year-on-year, with a 25% rise in net profit. However, only future results will tell us exactly how IEX will fare once the new coupling system kicks in.

The company remains positive, though. Here’s what the management said in their latest concall:

“The present order is for coupling of DAM market. DAM market constitutes only about 35-40% of our total volume. So we still have almost about 60-65% volume coming from the other products. So we will continue to maintain that technology platform and continue to do upgradation of that.

And even in case of DAM market also, except for the price discovery, there are other part of the technology platform, technology services, customer services, market development activities, which we will continue to do that. And I'm sure that all will basically ensure that we retain the position.”

Bottom line

CERC's decision to implement market coupling now isn't coincidental.

India is undergoing a massive energy transition, with electricity demand growing rapidly. The need for more efficient power markets is becoming critical. Reforming our power sector, as a whole, is a tall task. But it’s important to weed out any inefficiencies we can.

The current, fragmented system, where each exchange operates independently with different prices for the same electricity, creates some such inefficiencies. These could become more problematic as the electricity market grows. Market coupling nips this problem in the bud, by creating a single national electricity marketplace that matches supply with demand to the greatest possible extent.

The immediate benefits might seem modest, based on the pilot results. But the long-term implications could be substantial. It might just ensure a more reliable and cost-effective power supply, in the long run, for India's growing economy.

Tidbits

PMAY 2.0 Gets a Data Upgrade

India’s affordable housing push just got smarter. The government will now set up a dedicated research centre under PMAY–Urban 2.0, with a strong focus on data analytics and global partnerships. The aim? Build smarter policies using real-time insights, not just subsidies.

This comes as urban housing demand rises, and affordable housing lenders like Aavas, Aadhar, PNB Housing, and Bajaj Housing are scaling rapidly. The centre will analyze demand patterns, housing gaps, and urban migration trends — drawing from international experiences in France, Singapore, and the Netherlands, with guidance from UN-Habitat.

It’s not just a policy tweak — it’s a move to align housing interventions with the “Viksit Bharat 2047” vision, using data to ensure schemes like PMAY 2.0 are more targeted, scalable, and future-ready. For India’s housing finance ecosystem, this signals a more analytical, proactive approach to urban housing challenges.

Source: Mint

TCS Layoffs Signal Tough Times for Indian IT

TCS will lay off 12,000 employees—about 2% of its global workforce—over the next year, mainly impacting middle and senior managers. The move comes as the IT giant faces weak client spending, AI-led disruptions, and internal pushback on its stricter bench policy (minimum 225 billable days/year).

This follows a broader slowdown across Indian IT: Infosys and Wipro have issued cautious growth guidance, hiring has slowed, and utilisation rates are rising. TCS has delayed onboarding for 600 lateral hires, and wage hikes have been deferred.

Globally, over 80,000 tech jobs have been cut in 2025, with Microsoft alone shedding 15,000. While AI promises long-term efficiency, for now, it’s accelerating cost cuts and role redundancy.

Indian IT isn’t collapsing—but the playbook is changing fast.

Source: TOI

- This edition of the newsletter was written by Pranav and Prerana

📚Join our book club

We've started a book club where we meet each week in JP Nagar, Bangalore to read and talk about books we find fascinating.

If you think you’d be serious about this and would like to join us, we'd love to have you along! Join in here.

🧑🏻💻Have you checked out The Chatter?

Every week we listen to the big Indian earnings calls—Reliance, HDFC Bank, even the smaller logistics firms—and copy the full transcripts. Then we bin the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

Subscribe to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Thank you for reading. Do share this with your friends and make them as smart as you are 😉

Today’s edition of The Daily Brief while exploring NSDL IPO ,also explains the Depository industry as a whole.

I recap a recent article by Mr.Nitin Kamath where he explained about the difference in Investor accounts and demat accounts and I had given feedback as requested (tho.no reply recd.)

Well,the fundamental of equity' is to keep pace with economic development and inflation. But these days IPOs have become casinos’.It defies logic why a company which doesn’t have any capex etc planned,raises funds more than its annual turnover.Looking at their existing profits,the funds raised if kept in Bank FDs will bring more interest.Every time someone buys in IPO, someone else is looking to cash out. We are not investing in real businesses. We’re playing a game of musical chairs where the only way you can get rich is if you sell at the peak.I request ZERODHA VARSITY to analyse this.

The other topic—Market coupling enters electricity trading— is very educational for ordinary investors like me.

I’m Grateful for your sharing knowledge that I can use .

Thank you for the wonderful explanation about depository business and relative strengths of two depositories.

Somewhere above it is mentioned that the subsidiary of NSDL, the managing payment bank has minuscule revenue, which is not really the case. As per the RHP, the payment bank has close to 50% of the consolidated revenue, which may provide NSDL some kind of a buffer against any downside in capital markets.