Narrative vs Reality ft. microfinance

Our goal with The Daily Brief is to simplify the biggest stories in the Indian markets and help you understand what they mean. We won’t just tell you what happened, but why and how too. We do this show in both formats: video and audio. This piece curates the stories that we talk about.

Check out the audio here:

And the video is here.

In today’s episode, we look at 4 big stories:

The skies are cloudy for Indian solar

Narrative vs Reality ft. microfinance

Fear the taxman

China is sneezing and this time it caught a cold

The skies are cloudy for Indian solar

China and India have a complex relationship—one moment they’re clashing at the border, and the next, they’re shaking hands on trade deals. While there’s been a lot of talk about decoupling, diversifying supply chains, and the whole China+1 strategy, the reality is that neither India nor the rest of the world can just cut ties with China overnight.

Nowhere is this more evident than in the solar panel industry. China is the world’s largest manufacturer of solar panels and their components. Despite the global desire to move away from relying on China, it’s not that simple. The planet is still grappling with rising carbon emissions, and we’ve got a short window to ramp up decarbonization efforts. This means countries like India need to invest heavily in renewable energy sources like solar, wind, and nuclear.

Source: Our World in Data

Source: Statista

China dominates the solar industry across the board, from raw materials to finished products.

Source: Statista

Sure, there’s been a lot of chatter about India ramping up domestic production, but the numbers tell a different story. From 2020 to 2025, India’s solar imports from China have been a bit of a rollercoaster. Imports dipped during the COVID-19 pandemic, then skyrocketed to $4.5 billion in 2022, with over 90% coming from China. Even in 2023, China’s share of India’s solar imports was still above 90%. In 2024, this figure dropped to 56% for solar cells and 66% for modules as India increased its own production. But just as quickly, these numbers are creeping back up in the new financial year.

Source: Ember

By the way, India is the third-largest consumer of solar energy globally, which adds even more pressure to get this right.

Source: Statista

So, why are we still so reliant on China? It boils down to one thing—cost. Chinese solar panels are dirt cheap. China poured massive investments into solar manufacturing and now has an overcapacity issue. With too much inventory on hand, they’re dumping solar panels worldwide at prices that are hard to compete with.

The Indian government has been trying to curb this reliance by imposing import restrictions and pushing for more local production. They’ve mandated that government solar projects must use products from approved Indian manufacturers. This rule was briefly relaxed last year but is being reintroduced as India’s solar manufacturing capabilities improve.

There’s a silver lining, though. According to the think tank ORF, India has the potential to become an alternative supplier of solar panels to China. We’ve even started exporting solar products, particularly to the U.S., which is a promising sign, even if the numbers are still small.

But let’s not get ahead of ourselves. India still has a long way to go. For starters, we don’t produce key raw materials like polysilicon and wafers, which are essential for solar manufacturing. Making these materials is expensive and requires technical know-how that India is still developing.

Oh, and here’s a quirky tidbit: Europe is so flooded with cheap Chinese solar panels due to China’s overcapacity that people are using them as garden fences. Imagine that—solar panels as garden decor!

Narrative vs Reality ft. microfinance

We keep talking about loans, and you’re probably tired of it by now, but bear with us—there’s a lot going on in the lending space that we just can’t ignore.

Let’s quickly set the stage: Last Friday, Anurag mentioned how the RBI is growing concerned about the rapid rise in unsecured and personal loans. What’s worrying is that some people are taking out loans just to cover basic necessities like food, energy, and shelter. The RBI governor pointed out that while overall credit growth has slowed, certain types of personal loans are still climbing fast, and that needs close watching. Some banks are already seeing a rise in bad loans within their retail lending portfolios.

And it’s not just personal loans. Microfinance is facing its own set of challenges, with bad loans on the rise in states like Tamil Nadu and West Bengal. RBL Bank and Kotak Mahindra Bank, both of which recently reported their earnings, highlighted this issue.

Now, IIFL has come out with an interesting report on microfinance, and there are a few things that really stood out.

First off, stress levels are rising across various segments, with more borrowers struggling to pay back their loans. The situation has been gradually worsening, and this isn’t just a problem for a few lenders—it seems to be affecting the entire sector.

Source: Motilal

Another thing that caught my attention is that regular group meetings, a staple in microfinance, haven’t fully resumed. These meetings are crucial because they help keep borrowers accountable. Without them, it’s been tougher for microfinance institutions (MFIs) to collect payments and ensure borrowers stay on track.

Some microfinance lenders are blaming external factors like heatwaves and elections for the increase in bad loans.

But according to IIFL, these reasons don’t really hold up. The real problem is overleveraging—borrowers are taking out loans from multiple lenders, sometimes more than five, and that’s where things start to go south. As we mentioned in Friday’s episode, this isn’t just a microfinance issue; it’s also happening with personal loans and other consumer loans.

So, what’s really going on here? Is this just a temporary bump in asset quality for microfinance, or are we seeing the start of something bigger? Only time will tell, but it’s definitely something to keep an eye on.

Fear the taxman

Yesterday, Bajaj Finance, one of India’s leading NBFCs, found itself in hot water after receiving a notice from the Directorate General of GST Intelligence (DGGI). The DGGI claims that Bajaj Finance evaded taxes to the tune of ₹341 crore between June 2022 and March 2024. Here’s a quick breakdown of what happened:

The issue revolves around how Bajaj Finance categorized a certain charge. According to the DGGI, Bajaj Finance labeled a service charge as an interest charge. The key thing to understand here is that interest is exempt from GST, so by classifying this charge as interest, Bajaj Finance avoided paying the tax.

But the potential liability isn’t just ₹341 crore. The notice also includes a 100% penalty, ₹150 crore in interest, and a daily interest of ₹16 lakh until the payment is made. So, this could end up being a much bigger financial hit.

Now, let’s break down how this works:

Imagine you want to borrow ₹100 from a lender. The lender charges an upfront fee of 5% of the loan amount, which means your total loan amount becomes ₹105. In this scenario, the ₹5 upfront fee is added to the loan amount, so you’re actually borrowing ₹105 instead of ₹100 and paying interest on the full amount over the life of the loan. The DGGI is arguing that Bajaj Finance has been including a service fee in that ₹5 but labeling it as interest to avoid GST, since service fees attract GST while interest does not.

If the DGGI’s interpretation is correct, their argument seems fair. However, the bigger issue here is India’s complicated GST system, which can make it challenging for businesses to navigate smoothly.

There are two ways to look at this:

India’s GST system is so complicated that loopholes can always be found and exploited.

India’s GST system needs to be complex because we’re a diverse country with varying needs.

Regardless of which perspective you lean toward, incidents like this one with Bajaj Finance send a negative signal to international investors about the ease of doing business in India.

We actually covered this topic in detail on our July 3rd episode, but let me quickly recap in case you missed it:

India’s foreign direct investments (FDIs) have taken a significant hit, dropping almost 43% in 2023. Despite being the world’s fifth-largest economy, we rank only 15th in terms of FDIs. In fact, more money has been leaving the country than coming in. This is a serious issue because, without these investments, we can’t scale up manufacturing the way we need to. In FY24, manufacturing was just 12.84% of our GDP, the lowest it’s been in a decade.

One of the main reasons for this decline is that foreign investors are losing confidence in India. They’re worried about the risk of policies changing overnight and having retrospective implications. In simpler terms, investors fear sudden rule or tax law changes that could not only impact them in the future but also penalize them for the past—similar to what happened with Vodafone a few years back.

A recent example of this uncertainty is the notice received by Mahindra & Mahindra. The government questioned the use of the 'Mahindra' brand name by its various group companies. The tax authorities argue that different subsidiaries of M&M should pay the main entity for using the brand name and logo, and that GST should be paid on these transactions.

While this might seem reasonable in theory, it makes doing business in India more complicated. Companies and investors have to constantly worry about unexpected challenges that could arise. This uncertainty is one of the key reasons why FDIs in India have been declining, even though the country is often touted as the next big investment destination.

If India wants to attract global capital, we need to assure investors of policy stability. If rules keep changing and there’s a constant fear of regulatory actions, investors will think twice before putting their money here.

China is sneezing and this time it caught a cold

The Chinese economy is facing some serious challenges, and we’ve touched on a lot of them before on this podcast. One of the biggest issues is the struggling real estate sector.

For years, the Chinese went all-in on real estate. People kept buying houses, thinking prices would just keep going up. In response, property developers kept building more and more, often taking on massive debt to do so. A huge bubble formed, and when COVID-19 hit, that bubble burst, plunging the country into a crisis. This could be the largest housing market crash the world has ever seen, even bigger than the one during the 2008 Global Financial Crisis.

But bad times don’t last forever, right? Eventually, things should get better. So, are we there yet? Well, a new report from Nomura suggests that China’s housing sector is still in deep trouble.

Most indicators are down compared to last year. Prices are falling month by month—June’s prices were 0.85% lower than May’s. The number of new houses sold in June was down almost 15% compared to last year, and one-fifth fewer houses began construction.

China’s stuck in a vicious cycle. People aren’t buying houses, and there are a few reasons for that:

Falling Prices: Prices are steadily dropping, and no one wants to buy something today that will be cheaper tomorrow.

Undelivered Houses: A lot of houses in China were pre-sold, meaning people paid for them before they were built. But in many cases, those houses were never actually delivered. In fact, the delivery of 20 million pre-sold houses has been delayed.

Cash-Strapped Local Governments: Since the crisis, local governments have been short on cash, and they’ve cut back on how people pay, making them hesitant to invest in a house.

Because people aren’t buying, prices keep falling. As prices drop, builders are struggling to find the money they need to complete their projects, which leads to even more delays in delivering pre-sold houses. This is hurting local governments too since a lot of their revenue comes from private property developers who are now stuck with unfinished projects.

And round and round it goes, pushing people even further away from buying houses.

This is a huge problem for China, and the government is scrambling to fix it. Their main focus right now is on getting all those pre-sold houses delivered, which makes sense. But it’s going to take a lot of patience to solve this mess.

And it’s not just the housing market that’s in trouble. There are other problems that could throw a wrench in China’s recovery efforts:

Large investors are pulling back from China’s capital markets. Many companies are voluntarily withdrawing their IPO applications due to regulatory issues, so equity financing has taken a huge hit. On-shore equity financing dropped by more than 75% year-on-year between January and May this year.

A lot of Chinese finance professionals have been laid off or have seen their salaries slashed, which only makes the housing problem worse.

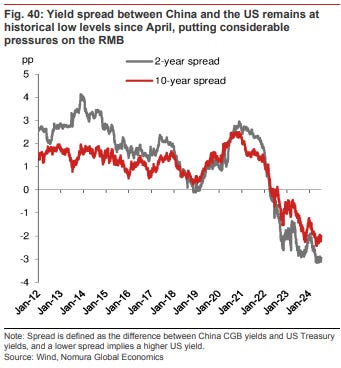

With IPOs drying up, money that would’ve gone into them is now flowing into Chinese government bonds. This has caused bond yields to crash, signaling that people aren’t too optimistic about China’s future. And as Chinese government bonds become more expensive, a lot of investors are shifting their money to American bonds, which are yielding more. This is China’s version of the carry trade.

Local governments are hiking taxes and fees and getting more aggressive in enforcing tax laws. Unfortunately, this money is coming out of the pockets of ordinary Chinese people, making them even less likely to make big investments, like buying a house.

All these factors together paint a pretty bleak picture for China’s real estate sector and the broader economy. The road to recovery is going to be long and bumpy.

Hi Team.. Are our Indian Banks exposed to China’s realty sector by any chance?